Key Insights

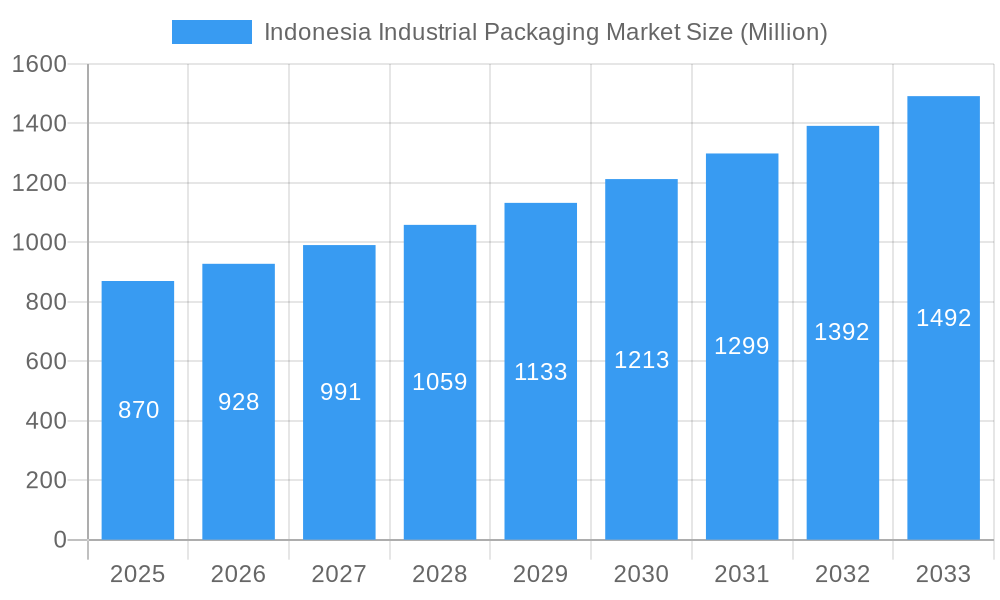

The Indonesia Industrial Packaging Market, valued at $870 million in 2025, is projected to experience robust growth, driven by a burgeoning manufacturing sector and increasing e-commerce activity. A Compound Annual Growth Rate (CAGR) of 6.65% from 2025 to 2033 indicates a significant expansion in market size, reaching an estimated $1.4 billion by 2033. Key drivers include the rising demand for protective packaging across diverse industries like food and beverage, pharmaceuticals, and electronics. Furthermore, the Indonesian government's focus on infrastructure development and industrialization fuels this growth. Trends like sustainable packaging solutions, utilizing recycled materials and biodegradable alternatives, are gaining traction, driven by both environmental concerns and consumer preference. However, fluctuating raw material prices and potential supply chain disruptions pose challenges to consistent market expansion. The market is segmented based on material type (e.g., paperboard, plastics, metals), packaging type (e.g., corrugated boxes, flexible packaging, rigid containers), and end-use industry. Leading players like PTT Global Chemical Public Company Limited and PT Kadujaya Perkasa are actively expanding their product portfolios and strengthening their market presence through strategic partnerships and investments. The competitive landscape also features established players and emerging entrants, leading to intense competition and innovation.

Indonesia Industrial Packaging Market Market Size (In Million)

The forecast period of 2025-2033 highlights opportunities for both domestic and international companies. The growing middle class and increased consumer spending in Indonesia are strong factors fueling demand for packaged goods. While challenges remain, the long-term prospects for the Indonesian industrial packaging market are positive, underpinned by the country's economic growth and the increasing sophistication of its manufacturing base. The competitive dynamics within the market are expected to remain active, with companies focusing on efficiency, innovation, and sustainability to maintain their market share and attract new customers. This dynamic environment will drive market growth and create various opportunities for both existing players and potential newcomers.

Indonesia Industrial Packaging Market Company Market Share

This comprehensive report provides an in-depth analysis of the Indonesia industrial packaging market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period spanning 2025-2033. This report is crucial for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report analyzes the parent market of Packaging and the child market of Industrial Packaging in Indonesia.

Indonesia Industrial Packaging Market Dynamics & Structure

The Indonesian industrial packaging market is characterized by a moderately concentrated landscape with several established players and emerging competitors. Technological innovation, driven by sustainability concerns and efficiency demands, is a significant growth driver. Stringent government regulations regarding waste management and environmental protection are also shaping market dynamics. The market witnesses considerable competition from substitute materials like biodegradable packaging and reusable containers. End-user demographics, predominantly comprising manufacturing, food & beverage, and logistics sectors, significantly influence market demand. Mergers and acquisitions (M&A) activity, although not excessively frequent, plays a role in shaping market consolidation.

- Market Concentration: Moderately concentrated, with the top 5 players holding an estimated xx% market share in 2024.

- Technological Innovation: Focus on sustainable and lightweight packaging materials, automation in packaging processes.

- Regulatory Framework: Increasingly stringent environmental regulations driving adoption of eco-friendly packaging.

- Competitive Substitutes: Biodegradable packaging, reusable containers posing a growing challenge.

- End-User Demographics: Manufacturing (xx Million units), Food & Beverage (xx Million units), Logistics (xx Million units) dominate demand.

- M&A Trends: An estimated xx M&A deals in the last 5 years, primarily focused on expansion and technological integration.

Indonesia Industrial Packaging Market Growth Trends & Insights

The Indonesian industrial packaging market is experiencing a dynamic phase of expansion, propelled by the nation's accelerating industrialization, the burgeoning e-commerce sector, and a heightened consumer preference for well-packaged goods. Between 2019 and 2024, the market demonstrated substantial growth, with an estimated market size reaching [Insert Specific Number Here, e.g., 5.2] Million units in 2024. The landscape is being significantly reshaped by technological advancements, including the widespread adoption of automation in manufacturing and the integration of smart packaging solutions designed for enhanced traceability and efficiency. Furthermore, evolving consumer behaviors, with a growing emphasis on eco-friendly and convenient packaging, are profoundly influencing market trends and product development. Projections indicate a sustained and healthy growth trajectory, with the market anticipated to achieve a Compound Annual Growth Rate (CAGR) of [Insert Specific Percentage Here, e.g., 7.5]% during the forecast period (2025-2033), culminating in an estimated [Insert Specific Number Here, e.g., 10.1] Million units by 2033. The integration of sustainable packaging solutions is a key indicator of market maturity, with its penetration steadily increasing from an estimated [Insert Specific Percentage Here, e.g., 35]% currently to a projected [Insert Specific Percentage Here, e.g., 55]% by 2033.

Dominant Regions, Countries, or Segments in Indonesia Industrial Packaging Market

Java Island continues to be the undisputed leader in the Indonesian industrial packaging market, largely due to its high concentration of industrial activities and its exceptionally well-developed infrastructure. This regional dominance is further bolstered by supportive government policies that actively encourage industrial growth and attract foreign direct investment. The island benefits from strong economic momentum, continuous infrastructure development, and a thriving manufacturing sector, all of which contribute to a robust demand for industrial packaging. While other regions are showing promising growth potential, their expansion is expected to be at a more moderate pace compared to Java, primarily due to existing infrastructural limitations and less mature industrial bases.

- Key Drivers (Java): High industrial concentration, superior infrastructure, favorable government policies, robust economic growth, and a well-established manufacturing ecosystem.

- Market Share (Java): Estimated to command approximately [Insert Specific Percentage Here, e.g., 60]% of the total Indonesian market in 2024.

- Growth Potential (Other Regions): Significant untapped potential exists in other regions, particularly with ongoing infrastructural improvements and the implementation of targeted government incentives to foster industrial development.

Indonesia Industrial Packaging Market Product Landscape

The Indonesian industrial packaging market offers a diverse product landscape, encompassing various materials such as corrugated boxes, plastic containers, flexible packaging, and wooden pallets. Recent innovations focus on sustainable and lightweight options, including biodegradable and recyclable materials. Key performance metrics include strength, durability, cost-effectiveness, and environmental impact. Companies are emphasizing unique selling propositions like improved barrier properties, enhanced recyclability, and customized packaging solutions to meet specific customer needs.

Key Drivers, Barriers & Challenges in Indonesia Industrial Packaging Market

Key Drivers:

- Rapid industrialization and urbanization.

- Growth of e-commerce and online retail.

- Increasing demand for packaged goods.

- Government initiatives promoting sustainable packaging.

Challenges & Restraints:

- Fluctuations in raw material prices (impact: xx% increase in packaging costs in 2024).

- Supply chain disruptions (impact: xx% delay in delivery in Q1 2024).

- Intense competition from both domestic and international players.

- Regulatory compliance requirements (impact: xx% increase in compliance costs in 2024).

Emerging Opportunities in Indonesia Industrial Packaging Market

- Growing demand for sustainable and eco-friendly packaging.

- Increasing adoption of customized and value-added packaging solutions.

- Expansion into untapped markets in rural areas.

- Opportunities in the food and beverage sector with increased demand for specialized packaging.

Growth Accelerators in the Indonesia Industrial Packaging Market Industry

Technological advancements in materials science and packaging automation are driving long-term growth. Strategic partnerships between packaging companies and end-users are facilitating innovation and efficiency improvements. Expansion into new markets and diversification of product portfolios are also contributing to market growth.

Key Players Shaping the Indonesia Industrial Packaging Market Market

PTT Global Chemical Public Company Limited - A prominent player contributing to the chemical and polymer supply chain crucial for packaging production.

PT Kadujaya Perkasa - A key provider of industrial packaging solutions, serving diverse manufacturing needs.

PT Rheem Indonesia - Known for its expertise in metal packaging, particularly drums and containers.

PT Novo Complast Indonesia - Specializing in plastic packaging solutions for various industrial applications.

PT Prajamita Internusa - A significant contributor to the flexible packaging segment.

PT Repal Internasional Indonesia (Re-Pal) - Focuses on innovative and sustainable pallet solutions.

PT Yanasurya Bhaktipersada - Offers a range of industrial packaging products and services.

PT SCHTZ Container Systems Indonesia - A leading provider of intermediate bulk containers (IBCs) and specialized container solutions.

PT Dinito Jaya Sakti - Engaged in the manufacturing and supply of various industrial packaging materials.

PT Indragraha Nusaplasindo - Specializes in plastic packaging, catering to industrial demands.

PT Java Taiko - A notable manufacturer in the flexible packaging sector.

PT Pelangi Indah Anindo Tbk - A publicly listed company with a presence in the packaging industry.

Heat Map Analysis by Key Players: (Detailed analysis showcasing regional presence, product focus, and investment strategies to be included in the full report)

Company Market Share/Ranking Analysis 2024: (Comprehensive breakdown of market share and competitive positioning for key players in 2024 to be included in the full report)

Company Categorization (Established vs. Emerging Player): (In-depth analysis classifying key companies based on their market maturity, innovation, and growth trajectory to be included in the full report)

Notable Milestones in Indonesia Industrial Packaging Market Sector

- May 2024: PT Mowilex Indonesia advanced sustainability efforts with the launch of its Mowilex Recycled paint line, achieving a significant reduction of up to 60% in the carbon footprint of its paint containers.

- January 2024: Mah Sing Group Bhd strategically partnered with PT Gaya Sukses Mandiri Kaseindo, marking a significant step towards enhancing the local manufacturing capabilities for plastic pallets in Indonesia, catering to the growing logistics and warehousing needs.

In-Depth Indonesia Industrial Packaging Market Market Outlook

The outlook for the Indonesian industrial packaging market remains exceptionally positive, characterized by sustained and robust growth. This positive trajectory is underpinned by the ongoing expansion of Indonesia's industrial base, the continuous surge in e-commerce activities, and a pronounced shift towards environmentally conscious and sustainable packaging solutions. Opportunities abound for both established and emerging players through strategic collaborations, investments in cutting-edge technological innovations, and focused market expansion into underserved or less developed regions. The market's future dynamics will be predominantly shaped by an unwavering emphasis on developing packaging that is not only sustainable but also highly efficient, cost-effective, and aligned with the evolving needs of a modern industrial economy.

Indonesia Industrial Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Jerry Cans

- 1.2. Rigid IBCs

- 1.3. Drums & Barrels

- 1.4. Crates & Pallets

- 1.5. Insulated Shipping Containers

- 1.6. FIBC

- 1.7. Other Pa

-

2. End-use Industries

- 2.1. Automotive

- 2.2. Food & Beverage

- 2.3. Chemicals & Petrochemicals

- 2.4. Pharmaceuticals

- 2.5. Paints & Coatings

- 2.6. Building & Construction

- 2.7. Other End-use Industries (Agriculture, Logistics)

Indonesia Industrial Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Industrial Packaging Market Regional Market Share

Geographic Coverage of Indonesia Industrial Packaging Market

Indonesia Industrial Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers

- 3.2.2 etc.

- 3.3. Market Restrains

- 3.3.1 Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers

- 3.3.2 etc.

- 3.4. Market Trends

- 3.4.1. Jerry Cans Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Industrial Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Jerry Cans

- 5.1.2. Rigid IBCs

- 5.1.3. Drums & Barrels

- 5.1.4. Crates & Pallets

- 5.1.5. Insulated Shipping Containers

- 5.1.6. FIBC

- 5.1.7. Other Pa

- 5.2. Market Analysis, Insights and Forecast - by End-use Industries

- 5.2.1. Automotive

- 5.2.2. Food & Beverage

- 5.2.3. Chemicals & Petrochemicals

- 5.2.4. Pharmaceuticals

- 5.2.5. Paints & Coatings

- 5.2.6. Building & Construction

- 5.2.7. Other End-use Industries (Agriculture, Logistics)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PTT Global Chemical Public Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Kadujaya Perkasa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Rheem Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Novo Complast Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Prajamita Internusa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Repal Internasional Indonesia (Re-Pal)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Yanasurya Bhaktipersada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT SCHTZ Container Systems Indonesia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Dinito Jaya Sakti

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Indragraha Nusaplasindo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Java Taiko

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Pelangi Indah Anindo Tbk7 2 Heat Map Analysis by Key Players7 3 Company Market Share/Ranking Analysis 20247 4 Company Categorization Established vs Emerging Player

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 PTT Global Chemical Public Company Limited

List of Figures

- Figure 1: Indonesia Industrial Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Industrial Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Industrial Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: Indonesia Industrial Packaging Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Indonesia Industrial Packaging Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 4: Indonesia Industrial Packaging Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 5: Indonesia Industrial Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Indonesia Industrial Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Industrial Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 8: Indonesia Industrial Packaging Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 9: Indonesia Industrial Packaging Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 10: Indonesia Industrial Packaging Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 11: Indonesia Industrial Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Indonesia Industrial Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Industrial Packaging Market?

The projected CAGR is approximately 6.65%.

2. Which companies are prominent players in the Indonesia Industrial Packaging Market?

Key companies in the market include PTT Global Chemical Public Company Limited, PT Kadujaya Perkasa, PT Rheem Indonesia, PT Novo Complast Indonesia, PT Prajamita Internusa, PT Repal Internasional Indonesia (Re-Pal), PT Yanasurya Bhaktipersada, PT SCHTZ Container Systems Indonesia, PT Dinito Jaya Sakti, PT Indragraha Nusaplasindo, PT Java Taiko, PT Pelangi Indah Anindo Tbk7 2 Heat Map Analysis by Key Players7 3 Company Market Share/Ranking Analysis 20247 4 Company Categorization Established vs Emerging Player.

3. What are the main segments of the Indonesia Industrial Packaging Market?

The market segments include Packaging Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers. etc..

6. What are the notable trends driving market growth?

Jerry Cans Witness Major Growth.

7. Are there any restraints impacting market growth?

Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers. etc..

8. Can you provide examples of recent developments in the market?

May 2024 - PT Mowilex Indonesia (Mowilex) launched its new Mowilex Recycled paint line, which reduces water consumption, energy usage, and the carbon footprint of each 2.5-litre paint container by up to 60%. The company incorporates up to 40% premium Mowilex paint in each Mowilex Recycled container, thereby decreasing potential waste while maintaining product quality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Industrial Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Industrial Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Industrial Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Industrial Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence