Key Insights

The Japan Plastic Packaging market is projected for substantial growth, expected to reach 17.2 million units by 2025. The market anticipates a Compound Annual Growth Rate (CAGR) of 2.53% through 2033. This expansion is driven by increasing consumer demand for convenient and portable packaging, especially in the food and beverage sectors. The inherent versatility and cost-effectiveness of plastic packaging continue to make it a preferred choice for manufacturers seeking to maintain product freshness, extend shelf life, and enhance consumer appeal. Furthermore, advancements in material science are facilitating the development of more sustainable and eco-friendly plastic packaging solutions, effectively addressing growing environmental concerns and regulatory requirements. The evolving landscape of packaging types, marked by a significant shift towards flexible options like pouches and bags, aligns with consumer preferences for lighter, more manageable, and resource-efficient products. Rigid plastic packaging, encompassing bottles, jars, and trays, maintains a strong presence, particularly within the healthcare and personal care industries, where product integrity and protection are paramount.

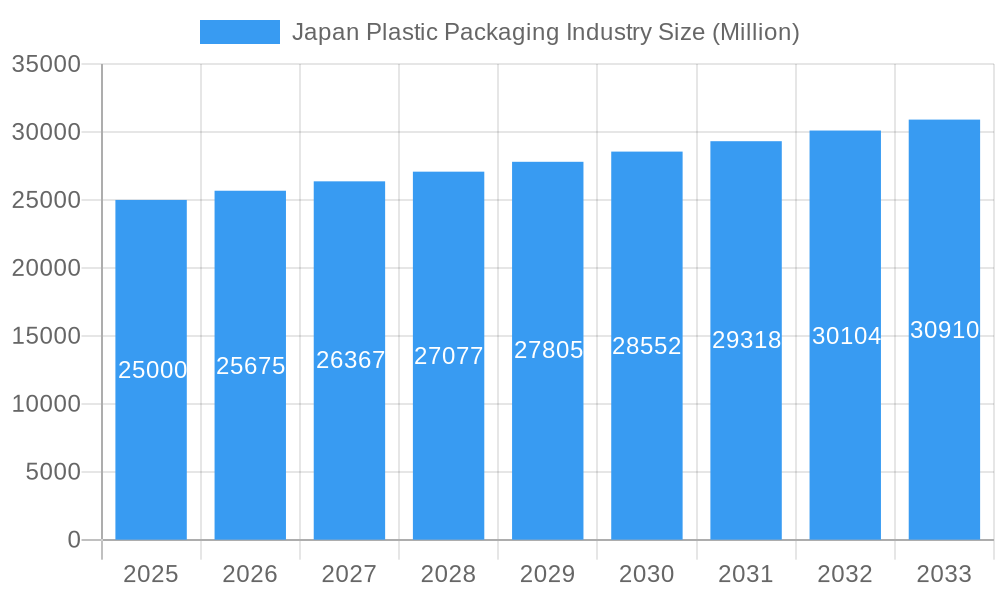

Japan Plastic Packaging Industry Market Size (In Million)

The market is shaped by dynamic trends and a competitive environment featuring key players such as Amcor Japan, Toyo Seikan Group Holdings Ltd., and Toppan Inc. These industry leaders are actively investing in innovation, prioritizing lightweighting, recyclability, and the integration of post-consumer recycled (PCR) content to support circular economy principles. However, the industry faces certain challenges. Heightened consumer and regulatory scrutiny concerning plastic waste and its environmental implications presents a significant obstacle, driving the adoption of alternative materials and improved recycling infrastructure. Volatility in raw material prices, largely influenced by crude oil derivatives, can also impact profitability and operational expenditures. Despite these hurdles, continuous innovation in product types, including specialized films and wraps offering enhanced barrier properties and extended shelf life, alongside expanding applications across diverse end-user verticals, ensures a positive outlook for the Japan Plastic Packaging industry. The healthcare sector, with its stringent packaging mandates, and the expanding personal care market are anticipated to be key drivers of growth.

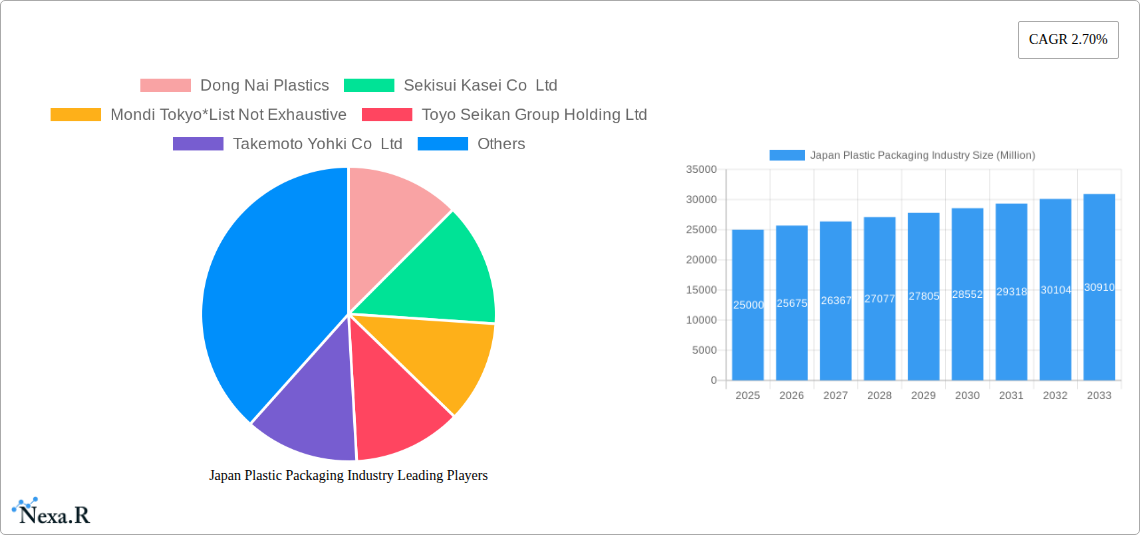

Japan Plastic Packaging Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the Japan plastic packaging industry, meticulously examining market dynamics, growth catalysts, prominent players, and future prospects. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025, and a robust forecast period from 2025 to 2033, this report provides unparalleled insights into a rapidly evolving sector. We present detailed analysis of parent and child market structures, with all values denominated in Million units for enhanced clarity and actionable intelligence.

Japan Plastic Packaging Industry Market Dynamics & Structure

The Japan plastic packaging market exhibits a moderate concentration, characterized by the presence of both large, established conglomerates and agile, specialized manufacturers. Technological innovation is a pivotal driver, with ongoing advancements in material science, barrier properties, and sustainable processing methods shaping product development. The regulatory framework, particularly concerning environmental sustainability and food safety, plays a significant role in dictating market trends and investment priorities. Competitive product substitutes, such as paper-based packaging and glass, present ongoing challenges, necessitating continuous innovation in plastic packaging solutions. End-user demographics, driven by an aging population and a demand for convenience, influence product design and consumption patterns. Mergers and acquisitions (M&A) activity, while not overtly dominant, signifies strategic consolidation and expansion by key industry players. For instance, the acquisition of Berry Global Group Inc. by Graham Partners, combining it with Advanced Barrier Extrusions LLC (ABX), signals a strategic move towards advanced manufacturing capabilities in flexible packaging.

- Market Concentration: Moderate, with a mix of large corporations and specialized SMEs.

- Technological Innovation: Driven by sustainable materials, enhanced barrier properties, and efficient manufacturing processes.

- Regulatory Framework: Emphasis on environmental regulations, food safety standards, and recycling initiatives.

- Competitive Landscape: Competition from paper, glass, and alternative sustainable materials.

- End-User Demographics: Influenced by aging population, urbanization, and demand for convenience.

- M&A Trends: Strategic acquisitions focused on enhancing technological capabilities and market reach.

Japan Plastic Packaging Industry Growth Trends & Insights

The Japan plastic packaging industry is poised for sustained growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. The market size, estimated at $xx,xxx million units in 2025, is expected to reach $xx,xxx million units by 2033. This expansion is fueled by increasing adoption rates of advanced packaging solutions across various end-user verticals, driven by evolving consumer preferences and the relentless pursuit of product safety and shelf-life extension. Technological disruptions, including the development of biodegradable and compostable plastics, as well as advancements in intelligent packaging, are reshaping market dynamics. Consumer behavior shifts towards sustainability, convenience, and premiumization are directly impacting demand for specific packaging types and functionalities. The historical data from 2019-2024 indicates a steady upward trajectory, with a slight moderation during periods of global economic uncertainty, underscoring the resilience of this essential industry. The increasing emphasis on lightweighting and material reduction further contributes to market volume, even as innovation drives higher-value applications.

Dominant Regions, Countries, or Segments in Japan Plastic Packaging Industry

Within the Japan plastic packaging industry, Flexible Plastic Packaging emerges as the dominant packaging type, accounting for an estimated xx% of the total market share in 2025. This segment is propelled by its versatility, cost-effectiveness, and superior protective qualities, making it indispensable for a wide array of products. The Food end-user vertical stands out as the largest consumer of plastic packaging, driven by the nation's robust food processing industry, high demand for convenience foods, and the critical need for extended shelf-life and food safety. Within the product types, Films and Wraps represent a significant sub-segment within flexible packaging, essential for everything from fresh produce to processed goods.

- Dominant Packaging Type: Flexible Plastic Packaging (estimated xx% market share in 2025).

- Key Drivers: Versatility, cost-effectiveness, superior barrier properties, lightweight nature.

- Sub-segments: Films and wraps, pouches, bags playing crucial roles in product protection and presentation.

- Dominant End-user Vertical: Food (estimated xx% market share in 2025).

- Key Drivers: Large food processing industry, demand for convenience, extended shelf-life requirements, stringent food safety regulations.

- Applications: Primary packaging for a wide range of food products, from fresh to processed.

- Dominant Product Type: Films and Wraps (within flexible packaging).

- Key Drivers: Broad applicability across food, personal care, and healthcare sectors.

- Innovation: Focus on multi-layer films for enhanced barrier properties and sustainability.

The Beverage sector also commands a substantial share, with significant demand for Bottles and Jars and other rigid plastic packaging solutions. The increasing preference for single-serve beverage options and the growing market for functional drinks contribute to this segment's expansion. In terms of regional dominance, the Kanto region, encompassing Tokyo, represents the economic heartland and a major hub for both manufacturing and consumption of plastic packaging. Its dense population, concentration of end-user industries, and advanced logistics infrastructure contribute to its leading position. Economic policies supporting manufacturing and consumption, coupled with robust infrastructure, are key factors underpinning the dominance of these segments and regions.

Japan Plastic Packaging Industry Product Landscape

The Japan plastic packaging product landscape is characterized by a strong emphasis on high-performance films and wraps offering superior barrier properties against moisture, oxygen, and light, thereby extending product shelf life. Innovations in trays and containers are focused on lightweighting, tamper-evidence, and microwave-safe capabilities, catering to the convenience food sector. The development of advanced pouches with re-sealable features and sophisticated printing technologies enhances consumer appeal and functionality. Beyond conventional applications, the industry is increasingly exploring other product types such as specialized medical packaging, agricultural films, and industrial protective wraps, demonstrating a commitment to diversified market penetration and technological advancement.

Key Drivers, Barriers & Challenges in Japan Plastic Packaging Industry

Key Drivers:

- Growing Demand from End-User Verticals: Sustained demand from food, beverage, healthcare, and personal care sectors.

- Technological Advancements: Development of innovative materials, smart packaging, and sustainable solutions.

- Consumer Convenience and Shelf-Life Extension: Need for packaging that preserves freshness and offers user-friendly features.

- Lightweighting Initiatives: Reducing material usage for cost and environmental benefits.

- Aging Population: Driving demand for smaller, single-serve, and easy-to-open packaging.

Barriers & Challenges:

- Environmental Concerns and Regulations: Increasing pressure for sustainable and recyclable packaging solutions.

- Fluctuating Raw Material Prices: Volatility in the cost of petrochemicals, the primary feedstock for plastics.

- Competition from Alternative Materials: Growing adoption of paper, glass, and bio-based alternatives.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges impacting material availability.

- Public Perception: Negative sentiment surrounding plastic waste and its environmental impact.

Emerging Opportunities in Japan Plastic Packaging Industry

Emerging opportunities in the Japan plastic packaging industry lie in the continued development and adoption of sustainable packaging solutions. This includes a focus on advanced recycling technologies, the increased use of recycled content (r-PET, r-PE), and the exploration of bio-based and biodegradable plastics, particularly for single-use applications. The "smart packaging" segment, incorporating features like traceability, spoilage indicators, and anti-counterfeiting measures, presents significant growth potential. Furthermore, the expansion of e-commerce necessitates innovative and protective packaging solutions for a wider range of products, creating new avenues for specialized plastic packaging. The healthcare sector's demand for sterile, tamper-evident, and child-resistant packaging also offers a robust growth area.

Growth Accelerators in the Japan Plastic Packaging Industry Industry

Several catalysts are accelerating growth in the Japan plastic packaging industry. Technological breakthroughs in polymer science, enabling the creation of higher-barrier, lighter, and more recyclable plastics, are a primary driver. Strategic partnerships and collaborations between packaging manufacturers, material suppliers, and end-users are fostering innovation and streamlining the adoption of new solutions. Market expansion strategies, including increased investment in research and development and the pursuit of export markets for specialized packaging technologies, are also contributing significantly to the industry's upward trajectory. The government's initiatives and incentives promoting a circular economy for plastics further act as significant growth accelerators.

Key Players Shaping the Japan Plastic Packaging Industry Market

- Dong Nai Plastics

- Sekisui Kasei Co Ltd

- Mondi Tokyo

- Toyo Seikan Group Holding Ltd

- Takemoto Yohki Co Ltd

- Hosokawa Yoko Co Ltd

- Takigawa Corporation

- Rengo Co Ltd

- Amcor Japan

- Gunze Limited

- Cosmo Films Japan LLC

- Toppan Inc

- Toyobo Co Ltd

- JSP Corporation Japan

- Sealed Air Japan

- Sonoco Japan

Notable Milestones in Japan Plastic Packaging Industry Sector

- Dec 2020: Private investment firm Graham Partners continues its targeted investments in technology-driven advanced manufacturing companies and has acquired Berry Global Group Inc. The business will be combined with Graham Partners' flexible packaging portfolio company, Advanced Barrier Extrusions LLC (ABX), which Graham Partners acquired in August 2018. The business will operate under the ABX name in the future.

- March 2021: Greiner Packaging announced that it has expanded its range of sanitizer bottles to meet the increased demand. The new product range includes 16 bottles, including sanitizers, and comes in different sizes and shapes with capacities ranging between 100 and 1000 milliliters. These bottles are all produced using the ISBM process and have round bodies, which can be made from up to 100% r-PET.

In-Depth Japan Plastic Packaging Industry Market Outlook

The future outlook for the Japan plastic packaging industry is exceptionally promising, driven by a confluence of factors that enhance its strategic importance. Sustained demand from critical sectors like food and healthcare, coupled with relentless innovation in sustainable and functional packaging, will propel market expansion. The industry is poised to capitalize on the growing consumer preference for convenience and extended shelf-life, while simultaneously addressing environmental imperatives through advanced recycling and bio-based material development. Strategic investments in R&D, coupled with supportive government policies aimed at fostering a circular economy, will act as powerful growth accelerators, solidifying Japan's position as a leader in advanced plastic packaging solutions. The evolving needs of a modernizing society and a focus on resource efficiency will continue to shape a dynamic and resilient market.

Japan Plastic Packaging Industry Segmentation

-

1. Packaging Type

- 1.1. Flexible Plastic Packaging

- 1.2. Rigid Plastic Packaging

-

2. Product Type

- 2.1. Bottles and Jars

- 2.2. Trays and containers

- 2.3. Pouches

- 2.4. Bags

- 2.5. Films and Wraps

- 2.6. Other Product Types

-

3. End-user Vertical

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Personal care and Household

- 3.5. Other End-user Verticals

Japan Plastic Packaging Industry Segmentation By Geography

- 1. Japan

Japan Plastic Packaging Industry Regional Market Share

Geographic Coverage of Japan Plastic Packaging Industry

Japan Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight-packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic

- 3.3. Market Restrains

- 3.3.1. Monitoring issues and lack of standardization

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of Light-Weight Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Plastic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Flexible Plastic Packaging

- 5.1.2. Rigid Plastic Packaging

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Jars

- 5.2.2. Trays and containers

- 5.2.3. Pouches

- 5.2.4. Bags

- 5.2.5. Films and Wraps

- 5.2.6. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Personal care and Household

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dong Nai Plastics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sekisui Kasei Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi Tokyo*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyo Seikan Group Holding Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Takemoto Yohki Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hosokawa Yoko Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Takigawa Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rengo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amcor Japan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gunze Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cosmo Films Japan LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Toppan Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Toyobo Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JSP Corporation Japan

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sealed Air Japan

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Sonoco Japan

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Dong Nai Plastics

List of Figures

- Figure 1: Japan Plastic Packaging Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Japan Plastic Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Plastic Packaging Industry Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 2: Japan Plastic Packaging Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Japan Plastic Packaging Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Japan Plastic Packaging Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Japan Plastic Packaging Industry Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 6: Japan Plastic Packaging Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Japan Plastic Packaging Industry Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Japan Plastic Packaging Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Plastic Packaging Industry?

The projected CAGR is approximately 2.53%.

2. Which companies are prominent players in the Japan Plastic Packaging Industry?

Key companies in the market include Dong Nai Plastics, Sekisui Kasei Co Ltd, Mondi Tokyo*List Not Exhaustive, Toyo Seikan Group Holding Ltd, Takemoto Yohki Co Ltd, Hosokawa Yoko Co Ltd, Takigawa Corporation, Rengo Co Ltd, Amcor Japan, Gunze Limited, Cosmo Films Japan LLC, Toppan Inc, Toyobo Co Ltd, JSP Corporation Japan, Sealed Air Japan, Sonoco Japan.

3. What are the main segments of the Japan Plastic Packaging Industry?

The market segments include Packaging Type, Product Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.2 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight-packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic.

6. What are the notable trends driving market growth?

Increase in Adoption of Light-Weight Packaging.

7. Are there any restraints impacting market growth?

Monitoring issues and lack of standardization.

8. Can you provide examples of recent developments in the market?

Dec 2020- Private investment firm Graham Partners continues its targeted investments in technology-driven advanced manufacturing companies and has acquired Berry Global Group Inc. The business will be combined with Graham Partners' flexible packaging portfolio company, Advanced Barrier Extrusions LLC (ABX), which Graham Partners acquired in August 2018. The business will operate under the ABX name in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Japan Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence