Key Insights

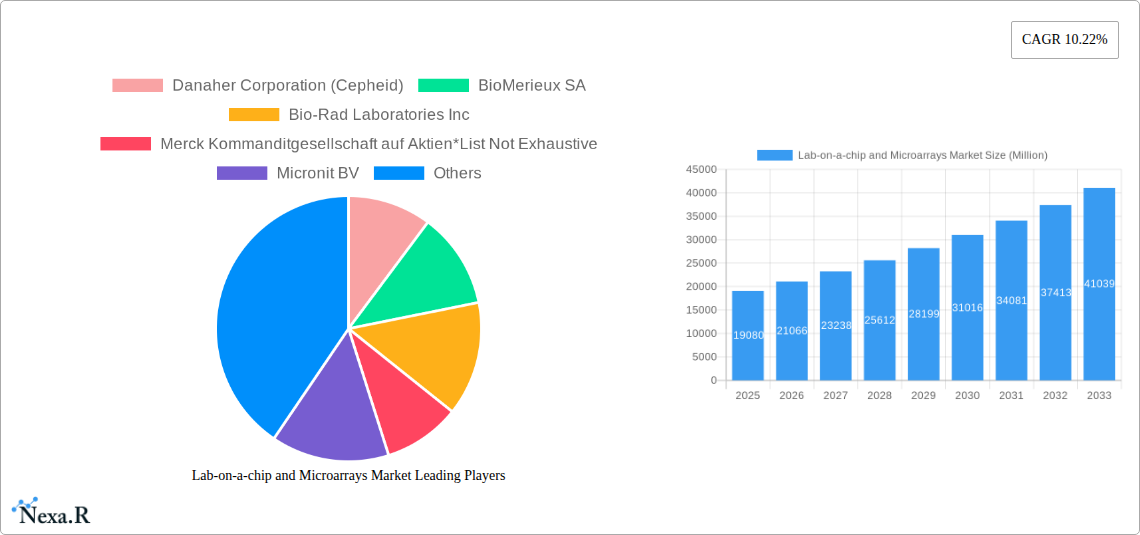

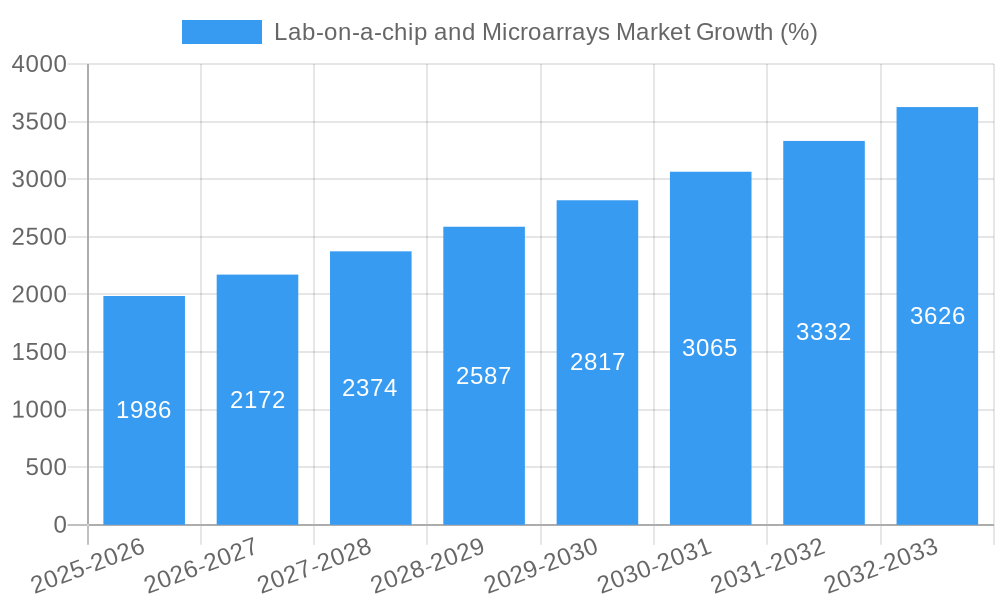

The global lab-on-a-chip and microarrays market, valued at $19.08 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing prevalence of chronic diseases necessitates advanced diagnostic tools, fueling demand for faster, more efficient, and cost-effective technologies like lab-on-a-chip devices and microarrays. These technologies offer miniaturization, automation, and high-throughput capabilities, making them ideal for various applications, including clinical diagnostics (particularly in point-of-care testing), drug discovery (high-throughput screening), and genomics and proteomics research. Furthermore, advancements in nanotechnology and microfluidics are constantly improving the sensitivity, specificity, and functionality of these platforms, further stimulating market growth. The significant investments in R&D by both established players and emerging biotech companies are also contributing to market expansion. While regulatory hurdles and high initial investment costs pose some challenges, the overall market outlook remains positive, driven by the continuous need for improved healthcare solutions and scientific advancements.

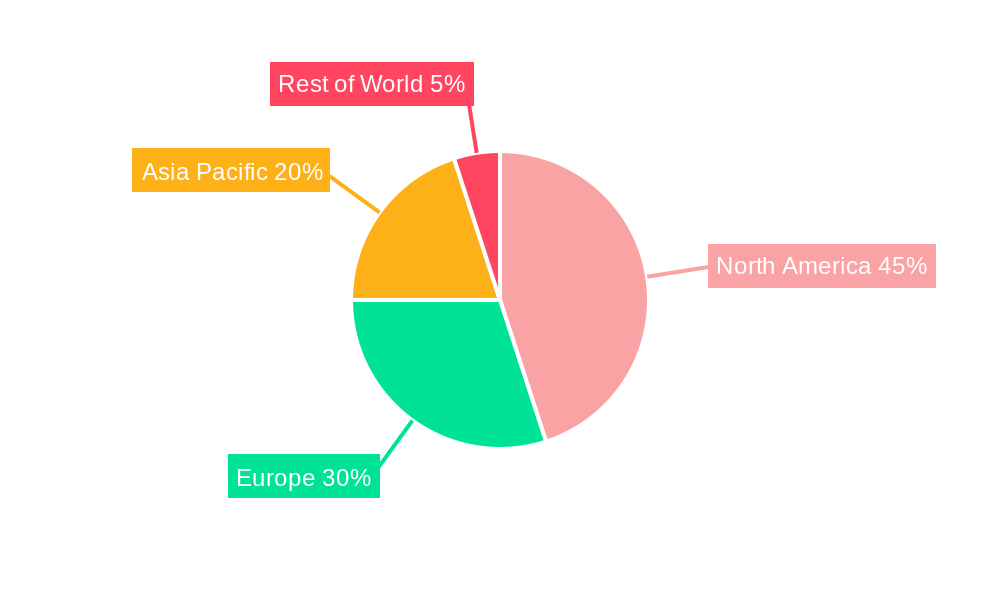

The market segmentation reveals significant opportunities across various product categories. Instruments, reagents, and consumables constitute a major portion of the market, followed by software and services that support data analysis and workflow management. Within applications, clinical diagnostics holds the largest share, reflecting the widespread adoption of lab-on-a-chip and microarray technologies for rapid and accurate disease detection. Biotechnology and pharmaceutical companies are the dominant end-users, leveraging these technologies for drug development and research. The geographic landscape shows North America leading the market, followed by Europe and Asia-Pacific. However, rapidly developing economies in Asia-Pacific are expected to witness significant growth in the coming years, driven by rising healthcare expenditure and increasing adoption of advanced diagnostic technologies. The competitive landscape is characterized by the presence of both large multinational corporations and smaller specialized companies, resulting in continuous innovation and competitive pricing. A projected CAGR of 10.22% indicates substantial growth potential until 2033.

Lab-on-a-Chip and Microarrays Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Lab-on-a-chip and Microarrays market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for businesses and stakeholders across the parent market (In-vitro Diagnostics) and child market (molecular diagnostics). The market size is projected to reach xx Million by 2033.

Lab-on-a-chip and Microarrays Market Market Dynamics & Structure

The Lab-on-a-chip and Microarrays market is characterized by a moderately consolidated structure, with several key players holding significant market share. Technological innovation, particularly in miniaturization, automation, and integration of multiple functionalities, is a major growth driver. Stringent regulatory frameworks governing medical devices and diagnostic tests influence market access and adoption. Competitive pressure from substitute technologies and the increasing demand for point-of-care diagnostics shape market dynamics. The end-user demographic is diverse, comprising biotechnology and pharmaceutical companies, hospitals, diagnostic centers, and academic research institutions. M&A activity within the sector has been relatively frequent, demonstrating consolidation and the pursuit of technological advancements.

- Market Concentration: Moderately consolidated, with top 10 players holding approximately 60% market share in 2024.

- Technological Innovation: Focus on miniaturization, automation, improved sensitivity, and integration of multiple assays.

- Regulatory Framework: Stringent regulations for medical devices and diagnostic tests vary by region, impacting market entry.

- Competitive Substitutes: PCR-based techniques and traditional laboratory methods present competition.

- End-User Demographics: Biotech/Pharma companies, hospitals, diagnostic centers, and academic institutions drive demand.

- M&A Trends: Significant M&A activity observed in recent years, driven by technological advancements and market expansion strategies. Approximately 20 M&A deals were recorded between 2019 and 2024.

Lab-on-a-chip and Microarrays Market Growth Trends & Insights

The Lab-on-a-chip and Microarrays market exhibits a robust growth trajectory, driven by the increasing prevalence of chronic diseases, advancements in genomics and proteomics research, and the growing demand for rapid and accurate diagnostics. The market has witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). The adoption rate of these technologies is increasing rapidly, particularly in clinical diagnostics and drug discovery, driven by factors such as reduced assay time, improved efficiency, and cost-effectiveness. Technological disruptions, such as the development of advanced microfluidic devices and high-throughput microarray platforms, contribute to market expansion. Consumer behavior is shifting towards personalized medicine and point-of-care diagnostics, further fueling market growth. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Lab-on-a-chip and Microarrays Market

North America currently holds the largest market share, followed by Europe, owing to the well-established healthcare infrastructure, high adoption rates of advanced technologies, and substantial funding for research and development in these regions. Within the segments, the clinical diagnostics application segment is the most dominant, followed by drug discovery. The Instruments segment holds the largest share among product categories. Growth is fueled by factors like increasing healthcare expenditure, growing awareness of various diseases, and technological advancements leading to improved diagnosis and treatment.

- North America: Strong healthcare infrastructure, high R&D spending, early adoption of new technologies.

- Europe: High healthcare standards, growing prevalence of chronic diseases, increasing focus on personalized medicine.

- Asia-Pacific: Rapidly expanding healthcare sector, rising disposable incomes, increasing investments in healthcare infrastructure.

- Clinical Diagnostics: High demand driven by increasing disease prevalence and need for rapid diagnostics.

- Instruments: Large market share due to high initial investment required for equipment purchase.

Lab-on-a-chip and Microarrays Market Product Landscape

The market offers a diverse range of products, including microfluidic chips, microarray platforms, reagents, consumables, and related software and services. Innovations focus on enhancing sensitivity, reducing assay time, and integrating multiple functionalities onto a single platform. Products are designed to meet the specific needs of various applications, such as clinical diagnostics, drug discovery, genomics, and proteomics research. Key performance metrics include sensitivity, specificity, throughput, and cost-effectiveness. The unique selling propositions of various products often hinge on ease of use, speed of results, and data analysis capabilities.

Key Drivers, Barriers & Challenges in Lab-on-a-chip and Microarrays Market

Key Drivers:

- Increasing demand for rapid and point-of-care diagnostics.

- Advancements in miniaturization and automation technologies.

- Growing investments in genomics and proteomics research.

- Rising prevalence of chronic diseases globally.

Challenges and Restraints:

- High initial investment costs for equipment and infrastructure.

- Stringent regulatory approvals and compliance requirements.

- Limited skilled personnel to operate and maintain sophisticated instruments.

- Potential for data security and privacy concerns, especially for personalized medicine applications. Market size impacted by approximately 5% due to regulatory hurdles between 2021 and 2024.

Emerging Opportunities in Lab-on-a-chip and Microarrays Market

- Expansion into emerging markets with growing healthcare infrastructure.

- Development of point-of-care diagnostic devices for remote areas.

- Integration of AI and machine learning for advanced data analysis.

- Application in personalized medicine and companion diagnostics.

Growth Accelerators in the Lab-on-a-chip and Microarrays Market Industry

Long-term growth will be fueled by technological advancements leading to more sophisticated and integrated platforms. Strategic partnerships between technology providers and healthcare organizations will also be crucial. Market expansion into emerging economies with a growing healthcare sector will significantly contribute to growth.

Key Players Shaping the Lab-on-a-chip and Microarrays Market Market

- Danaher Corporation (Cepheid)

- BioMerieux SA

- Bio-Rad Laboratories Inc

- Merck Kommanditgesellschaft auf Aktien

- Micronit BV

- Phalanx Biotech Group Inc

- Thermo Fisher Scientific Inc

- Abbott Laboratories

- Agilent Technologies Inc

- PerkinElmer Inc

- Qiagen NV

- Illumina Inc

- Fluidigm Corporation

Notable Milestones in Lab-on-a-chip and Microarrays Market Sector

- October 2022: MicrobioSeq (CD Genomics) launched Phage Whole-Genome Sequencing, advancing biomarker discovery and non-antibiotic treatment development.

- October 2022: Thermo Fisher Scientific Inc. upgraded its Applied Biosystems Chromosome Analysis Suite (ChAS) software through a collaboration with Genoox, enhancing cytogenetic analysis workflow.

In-Depth Lab-on-a-chip and Microarrays Market Market Outlook

The Lab-on-a-chip and Microarrays market holds significant future potential, driven by ongoing technological innovation, expanding applications in personalized medicine, and increasing demand for rapid and accurate diagnostics. Strategic partnerships and market expansion into untapped regions will further propel market growth. The integration of artificial intelligence and machine learning will offer substantial opportunities for enhanced data analysis and improved diagnostic capabilities. The market is poised for sustained growth, offering lucrative opportunities for businesses operating within this sector.

Lab-on-a-chip and Microarrays Market Segmentation

-

1. Type

- 1.1. Lab-on-a-chip

- 1.2. Microarray

-

2. Products

- 2.1. Instruments

- 2.2. Reagents and Consumables

- 2.3. Software and Services

-

3. Application

- 3.1. Clinical Diagnostics

- 3.2. Drug Discovery

- 3.3. Genomics and Proteomics

- 3.4. Other Applications

-

4. End User

- 4.1. Biotechnology and Pharmaceutical Companies

- 4.2. Hospitals and Diagnostic Centers

- 4.3. Academic and Research Institutes

Lab-on-a-chip and Microarrays Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Lab-on-a-chip and Microarrays Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Point-of-care Testing; Increasing Incidences of Chronic Diseases; Increasing Application of Proteomics and Genomics in Cancer Research

- 3.3. Market Restrains

- 3.3.1. Design Constraints of Lab-on-chip Technology; Availability of Alternative Technologies

- 3.4. Market Trends

- 3.4.1. Lab-on-a-chip Segment Expected to Witness Significant Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lab-on-a-chip

- 5.1.2. Microarray

- 5.2. Market Analysis, Insights and Forecast - by Products

- 5.2.1. Instruments

- 5.2.2. Reagents and Consumables

- 5.2.3. Software and Services

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Clinical Diagnostics

- 5.3.2. Drug Discovery

- 5.3.3. Genomics and Proteomics

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Biotechnology and Pharmaceutical Companies

- 5.4.2. Hospitals and Diagnostic Centers

- 5.4.3. Academic and Research Institutes

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lab-on-a-chip

- 6.1.2. Microarray

- 6.2. Market Analysis, Insights and Forecast - by Products

- 6.2.1. Instruments

- 6.2.2. Reagents and Consumables

- 6.2.3. Software and Services

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Clinical Diagnostics

- 6.3.2. Drug Discovery

- 6.3.3. Genomics and Proteomics

- 6.3.4. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Biotechnology and Pharmaceutical Companies

- 6.4.2. Hospitals and Diagnostic Centers

- 6.4.3. Academic and Research Institutes

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lab-on-a-chip

- 7.1.2. Microarray

- 7.2. Market Analysis, Insights and Forecast - by Products

- 7.2.1. Instruments

- 7.2.2. Reagents and Consumables

- 7.2.3. Software and Services

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Clinical Diagnostics

- 7.3.2. Drug Discovery

- 7.3.3. Genomics and Proteomics

- 7.3.4. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Biotechnology and Pharmaceutical Companies

- 7.4.2. Hospitals and Diagnostic Centers

- 7.4.3. Academic and Research Institutes

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lab-on-a-chip

- 8.1.2. Microarray

- 8.2. Market Analysis, Insights and Forecast - by Products

- 8.2.1. Instruments

- 8.2.2. Reagents and Consumables

- 8.2.3. Software and Services

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Clinical Diagnostics

- 8.3.2. Drug Discovery

- 8.3.3. Genomics and Proteomics

- 8.3.4. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Biotechnology and Pharmaceutical Companies

- 8.4.2. Hospitals and Diagnostic Centers

- 8.4.3. Academic and Research Institutes

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lab-on-a-chip

- 9.1.2. Microarray

- 9.2. Market Analysis, Insights and Forecast - by Products

- 9.2.1. Instruments

- 9.2.2. Reagents and Consumables

- 9.2.3. Software and Services

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Clinical Diagnostics

- 9.3.2. Drug Discovery

- 9.3.3. Genomics and Proteomics

- 9.3.4. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Biotechnology and Pharmaceutical Companies

- 9.4.2. Hospitals and Diagnostic Centers

- 9.4.3. Academic and Research Institutes

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lab-on-a-chip

- 10.1.2. Microarray

- 10.2. Market Analysis, Insights and Forecast - by Products

- 10.2.1. Instruments

- 10.2.2. Reagents and Consumables

- 10.2.3. Software and Services

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Clinical Diagnostics

- 10.3.2. Drug Discovery

- 10.3.3. Genomics and Proteomics

- 10.3.4. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Biotechnology and Pharmaceutical Companies

- 10.4.2. Hospitals and Diagnostic Centers

- 10.4.3. Academic and Research Institutes

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North Americ Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. South America Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Mexico

- 12.1.3 Rest of South America

- 13. Europe Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Rest of Europe

- 14. Asia Pacific Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Taiwan

- 14.1.6 Australia

- 14.1.7 Rest of Asia-Pacific

- 15. MEA Lab-on-a-chip and Microarrays Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Middle East

- 15.1.2 Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Danaher Corporation (Cepheid)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 BioMerieux SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bio-Rad Laboratories Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Merck Kommanditgesellschaft auf Aktien*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Micronit BV

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Phalanx Biotech Group Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Thermo Fisher Scientific Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Abbott Laboratories

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Agilent Technologies Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 PerkinElmer Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Qiagen NV

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Illumina Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Fluidigm Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Danaher Corporation (Cepheid)

List of Figures

- Figure 1: Global Lab-on-a-chip and Microarrays Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North Americ Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North Americ Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 5: South America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Lab-on-a-chip and Microarrays Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Lab-on-a-chip and Microarrays Market Revenue (Million), by Products 2024 & 2032

- Figure 15: North America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Products 2024 & 2032

- Figure 16: North America Lab-on-a-chip and Microarrays Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Lab-on-a-chip and Microarrays Market Revenue (Million), by End User 2024 & 2032

- Figure 19: North America Lab-on-a-chip and Microarrays Market Revenue Share (%), by End User 2024 & 2032

- Figure 20: North America Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Lab-on-a-chip and Microarrays Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Lab-on-a-chip and Microarrays Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Lab-on-a-chip and Microarrays Market Revenue (Million), by Products 2024 & 2032

- Figure 25: Europe Lab-on-a-chip and Microarrays Market Revenue Share (%), by Products 2024 & 2032

- Figure 26: Europe Lab-on-a-chip and Microarrays Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Europe Lab-on-a-chip and Microarrays Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe Lab-on-a-chip and Microarrays Market Revenue (Million), by End User 2024 & 2032

- Figure 29: Europe Lab-on-a-chip and Microarrays Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue (Million), by Products 2024 & 2032

- Figure 35: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue Share (%), by Products 2024 & 2032

- Figure 36: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue (Million), by End User 2024 & 2032

- Figure 39: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue Share (%), by End User 2024 & 2032

- Figure 40: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue (Million), by Type 2024 & 2032

- Figure 43: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue Share (%), by Type 2024 & 2032

- Figure 44: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue (Million), by Products 2024 & 2032

- Figure 45: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue Share (%), by Products 2024 & 2032

- Figure 46: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue (Million), by End User 2024 & 2032

- Figure 49: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue Share (%), by End User 2024 & 2032

- Figure 50: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: South America Lab-on-a-chip and Microarrays Market Revenue (Million), by Type 2024 & 2032

- Figure 53: South America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: South America Lab-on-a-chip and Microarrays Market Revenue (Million), by Products 2024 & 2032

- Figure 55: South America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Products 2024 & 2032

- Figure 56: South America Lab-on-a-chip and Microarrays Market Revenue (Million), by Application 2024 & 2032

- Figure 57: South America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: South America Lab-on-a-chip and Microarrays Market Revenue (Million), by End User 2024 & 2032

- Figure 59: South America Lab-on-a-chip and Microarrays Market Revenue Share (%), by End User 2024 & 2032

- Figure 60: South America Lab-on-a-chip and Microarrays Market Revenue (Million), by Country 2024 & 2032

- Figure 61: South America Lab-on-a-chip and Microarrays Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Products 2019 & 2032

- Table 4: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: China Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Japan Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Korea Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Taiwan Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Middle East Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Africa Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Products 2019 & 2032

- Table 35: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by End User 2019 & 2032

- Table 37: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Canada Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Mexico Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Products 2019 & 2032

- Table 43: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by End User 2019 & 2032

- Table 45: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Type 2019 & 2032

- Table 53: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Products 2019 & 2032

- Table 54: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by End User 2019 & 2032

- Table 56: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Australia Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Type 2019 & 2032

- Table 64: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Products 2019 & 2032

- Table 65: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Application 2019 & 2032

- Table 66: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by End User 2019 & 2032

- Table 67: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: GCC Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Africa Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Middle East and Africa Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Type 2019 & 2032

- Table 72: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Products 2019 & 2032

- Table 73: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Application 2019 & 2032

- Table 74: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by End User 2019 & 2032

- Table 75: Global Lab-on-a-chip and Microarrays Market Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Brazil Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Argentina Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Lab-on-a-chip and Microarrays Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lab-on-a-chip and Microarrays Market?

The projected CAGR is approximately 10.22%.

2. Which companies are prominent players in the Lab-on-a-chip and Microarrays Market?

Key companies in the market include Danaher Corporation (Cepheid), BioMerieux SA, Bio-Rad Laboratories Inc, Merck Kommanditgesellschaft auf Aktien*List Not Exhaustive, Micronit BV, Phalanx Biotech Group Inc, Thermo Fisher Scientific Inc, Abbott Laboratories, Agilent Technologies Inc, PerkinElmer Inc, Qiagen NV, Illumina Inc, Fluidigm Corporation.

3. What are the main segments of the Lab-on-a-chip and Microarrays Market?

The market segments include Type, Products, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Point-of-care Testing; Increasing Incidences of Chronic Diseases; Increasing Application of Proteomics and Genomics in Cancer Research.

6. What are the notable trends driving market growth?

Lab-on-a-chip Segment Expected to Witness Significant Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

Design Constraints of Lab-on-chip Technology; Availability of Alternative Technologies.

8. Can you provide examples of recent developments in the market?

Oct 2022: MicrobioSeq (CD Genomics) launched the Phage Whole-Genome Sequencing to help discover biomarkers and develop non-antibiotic treatment methods. CD Genomics uses next-generation sequencing and long-read sequencing technologies (mainly Illumina HiSeq, Nanopore, and PacBio SMRT sequencing) to provide virus/phage sequencing services and help in-depth studies of structural genomics and comparative genomics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lab-on-a-chip and Microarrays Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lab-on-a-chip and Microarrays Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lab-on-a-chip and Microarrays Market?

To stay informed about further developments, trends, and reports in the Lab-on-a-chip and Microarrays Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence