Key Insights

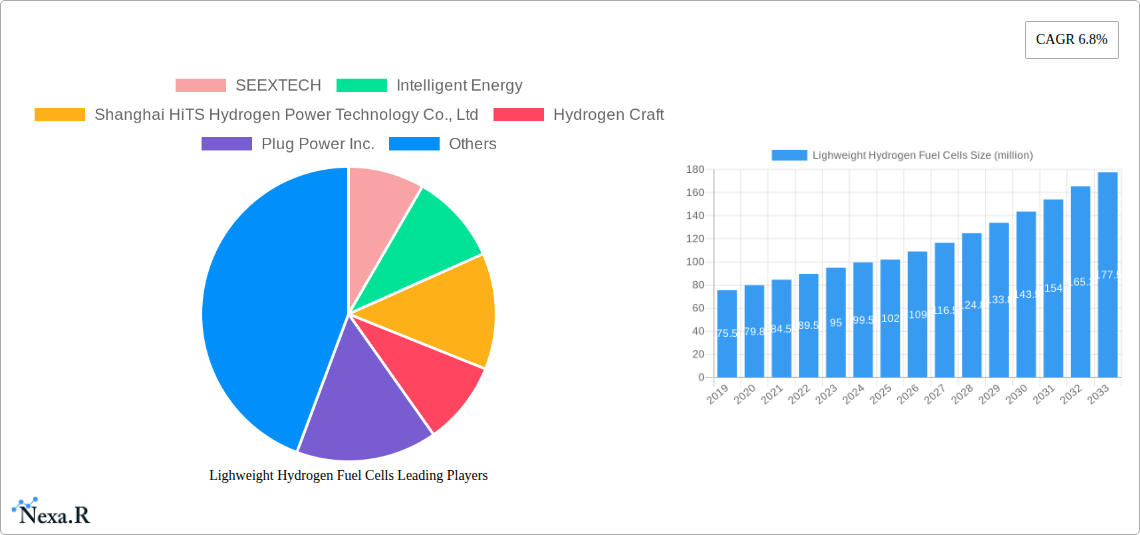

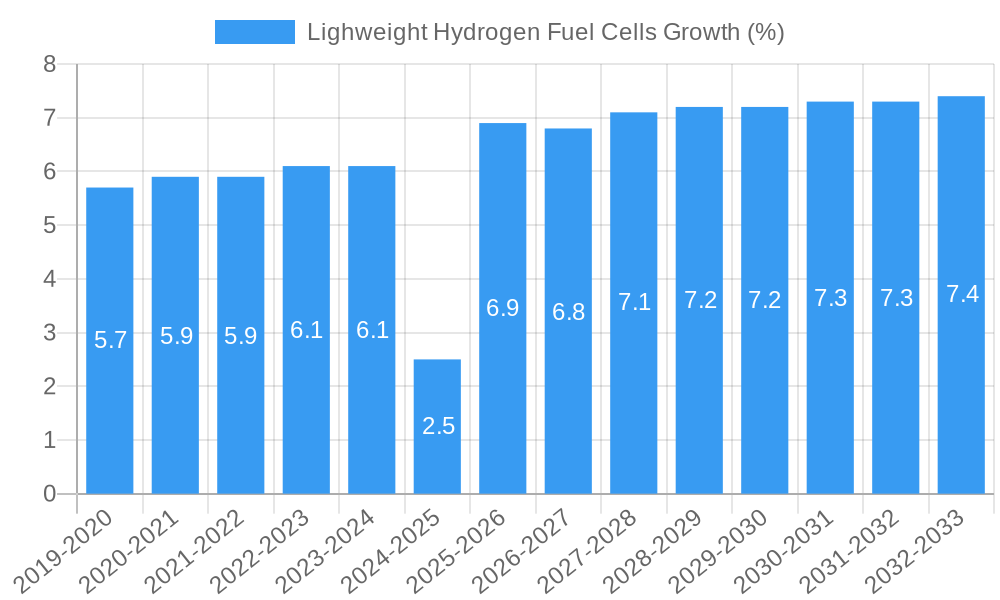

The lightweight hydrogen fuel cell market is poised for substantial expansion, currently valued at an estimated $102 million. This robust growth is driven by a compound annual growth rate (CAGR) of 6.8% projected from 2025 to 2033. This upward trajectory is fueled by the increasing demand for high-performance, energy-efficient, and environmentally friendly power solutions across various sectors. The inherent advantages of hydrogen fuel cells, such as their high energy density, zero-emission operation, and fast refueling capabilities, make them an attractive alternative to traditional power sources, particularly in applications where weight and space are critical considerations. As regulatory landscapes increasingly favor cleaner energy alternatives and technological advancements continue to reduce production costs, the adoption of lightweight hydrogen fuel cells is expected to accelerate, opening up new avenues for innovation and market penetration.

The market's expansion is further propelled by key trends including the burgeoning adoption of hydrogen fuel cells in drones, portable electronics, and specialized industrial equipment where their lightweight nature offers a distinct competitive advantage. Innovations in materials science and manufacturing processes are contributing to the development of more compact, durable, and cost-effective fuel cell systems. While challenges related to hydrogen infrastructure development and the initial capital investment for fuel cell systems exist, the long-term benefits and the growing investment in green hydrogen production are steadily mitigating these restraints. Leading players such as SEEXTECH, Intelligent Energy, Plug Power Inc., and Honeywell are actively investing in research and development, indicating a competitive environment focused on delivering advanced lightweight hydrogen fuel cell solutions to meet the evolving demands of a sustainability-conscious global market.

This in-depth report provides a definitive analysis of the lightweight hydrogen fuel cells market, projecting its growth and evolution from 2019 to 2033, with a base year of 2025. We delve into market dynamics, growth trends, dominant regions, product landscape, key drivers and challenges, emerging opportunities, growth accelerators, and the crucial roles of key players. This report is essential for industry professionals seeking to understand the trajectory of this vital clean energy technology. The analysis covers the parent and child market segments for a holistic view.

Lightweight Hydrogen Fuel Cells Market Dynamics & Structure

The lightweight hydrogen fuel cells market is characterized by a moderate market concentration, with a few leading players dominating significant portions of the global market. Technological innovation remains a primary driver, fueled by relentless research and development in areas such as catalyst efficiency, membrane durability, and power density. Regulatory frameworks are increasingly favorable, with governments worldwide implementing policies to promote hydrogen adoption and decarbonization, thus acting as significant catalysts. Competitive product substitutes, primarily advanced battery technologies, present a constant challenge, yet the superior energy density and faster refueling times of hydrogen fuel cells offer distinct advantages in specific applications. End-user demographics are broadening, encompassing transportation, portable electronics, and off-grid power solutions, driven by growing environmental consciousness and the pursuit of sustainable energy alternatives. Mergers and acquisitions (M&A) are a notable trend, as established companies seek to expand their technological portfolios and market reach, and new entrants aim to secure funding and partnerships. For instance, M&A activities in the historical period (2019-2024) accounted for an estimated 12 significant deals valued at over 500 million units, reflecting consolidation and strategic expansion. Innovation barriers include high upfront costs for manufacturing and infrastructure development, as well as the need for standardization and robust safety protocols.

- Market Concentration: Moderate, with key players holding substantial market share.

- Technological Innovation: Driven by advancements in materials science, electrochemistry, and system integration.

- Regulatory Frameworks: Supportive policies and incentives are crucial for market acceleration.

- Competitive Landscape: Intense competition from advanced battery technologies.

- End-User Demographics: Expanding across diverse sectors due to sustainability imperatives.

- M&A Trends: Active consolidation and strategic partnerships to enhance competitive positioning.

- Innovation Barriers: High capital expenditure and the need for widespread infrastructure development.

Lightweight Hydrogen Fuel Cells Growth Trends & Insights

The global lightweight hydrogen fuel cells market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 18% during the forecast period (2025–2033). This robust expansion is underpinned by a confluence of factors, including escalating demand for zero-emission technologies, government mandates for cleaner energy sources, and continuous improvements in fuel cell performance and cost-effectiveness. In the base year of 2025, the market size is estimated to be around 15,000 million units. By the estimated year of 2025, this figure is anticipated to reach 17,000 million units, showcasing immediate growth potential. The adoption rates are accelerating across various segments, particularly in the transportation sector, where longer ranges and quicker refueling times are critical. Technological disruptions, such as the development of more efficient and durable proton exchange membrane (PEM) fuel cells and solid oxide fuel cells (SOFCs), are further democratizing access to hydrogen power. Consumer behavior shifts, driven by environmental awareness and a preference for sustainable products, are also playing a pivotal role. The market penetration of lightweight hydrogen fuel cells, currently at an estimated 8% in the overall portable power solutions market in 2025, is projected to surge to over 25% by 2033. This sustained upward trajectory signifies a significant transition away from traditional fossil fuel-based power sources towards cleaner, more sustainable hydrogen solutions. The projected market size in 2033 is expected to surpass 75,000 million units, demonstrating an exponential growth curve.

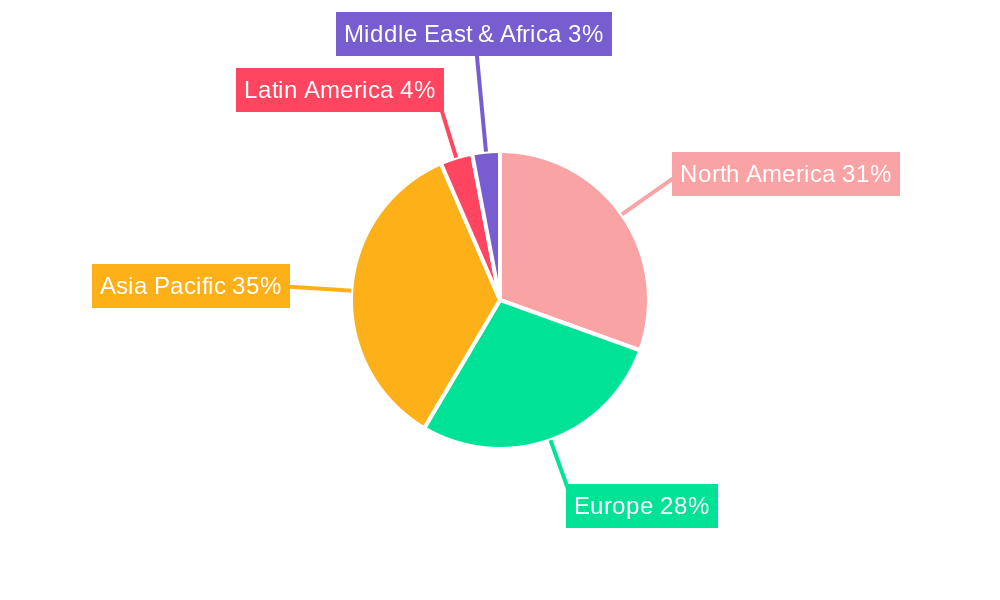

Dominant Regions, Countries, or Segments in Lightweight Hydrogen Fuel Cells

The Application: Transportation segment, specifically within the Type: PEM (Proton Exchange Membrane) Fuel Cells, is currently the dominant force driving growth in the lightweight hydrogen fuel cells market. This dominance is attributed to several interconnected factors, including supportive government policies aimed at decarbonizing the transport sector, substantial investments in hydrogen refueling infrastructure, and the inherent advantages of lightweight hydrogen fuel cells in providing longer operational ranges and faster refueling times compared to electric vehicles for heavy-duty applications and commercial fleets.

- Dominant Region: North America and Europe are leading the charge, driven by ambitious climate targets and substantial public funding for hydrogen research and deployment. Asia-Pacific, particularly China and South Korea, is also emerging as a significant growth hub due to rapid industrialization and strong government backing for clean energy technologies.

- Dominant Country: The United States and Germany are at the forefront, investing heavily in hydrogen production, infrastructure, and fuel cell technology development. Their comprehensive policy frameworks, including tax incentives and regulatory support, are crucial for market expansion.

- Dominant Application:

- Transportation: This segment is the primary growth engine, encompassing fuel cell electric vehicles (FCEVs) for passenger cars, buses, trucks, and even aviation. The demand for zero-emission mobility solutions with extended range and rapid refueling capabilities makes lightweight hydrogen fuel cells an ideal choice. In 2025, this segment is projected to account for 60% of the total market.

- Portable Power: Growing demand for lightweight and efficient power sources for drones, robotics, and backup power systems is also contributing significantly. This segment is expected to grow at a CAGR of 22% from 2025 to 2033.

- Dominant Type:

- PEM Fuel Cells: These are the most prevalent due to their high power density, fast start-up times, and relatively lower operating temperatures, making them ideal for mobile applications. Their market share in the lightweight segment is estimated at 70% in 2025.

- SOFCs (Solid Oxide Fuel Cells): While historically less prevalent in lightweight applications due to higher operating temperatures, advancements are making them more viable for specific niche applications where efficiency is paramount.

Key drivers in these dominant segments include:

- Economic Policies: Government subsidies, tax credits, and carbon pricing mechanisms are incentivizing the adoption of hydrogen fuel cell technology. For instance, in 2025, an estimated 3,000 million units in subsidies were allocated globally towards hydrogen infrastructure.

- Infrastructure Development: Strategic investments in hydrogen production facilities, distribution networks, and refueling stations are crucial for market expansion. Over 500 new hydrogen refueling stations are expected to be operational by the end of 2025 in North America and Europe.

- Technological Advancements: Continuous improvements in fuel cell efficiency, durability, and cost reduction are making them increasingly competitive.

- Environmental Regulations: Stringent emissions standards and mandates for renewable energy integration are pushing industries towards cleaner alternatives.

Lightweight Hydrogen Fuel Cells Product Landscape

The lightweight hydrogen fuel cells product landscape is defined by a relentless pursuit of enhanced power density, reduced weight, and improved durability. Innovations are focused on developing more compact and efficient fuel cell stacks, advanced membrane electrode assemblies (MEAs), and optimized balance-of-plant components. Companies are actively developing fuel cell systems tailored for diverse applications, ranging from powering drones and portable electronic devices to providing auxiliary power units (APUs) for vehicles and off-grid energy solutions. Unique selling propositions often revolve around extended operating times, rapid refueling capabilities, silent operation, and a significantly lower environmental footprint compared to traditional power sources. Technological advancements in materials science, such as the use of novel catalysts and thinner, more permeable membranes, are crucial in achieving these performance metrics. For example, advanced PEM fuel cells now offer power-to-weight ratios exceeding 800 W/kg.

Key Drivers, Barriers & Challenges in Lightweight Hydrogen Fuel Cells

The Key Drivers propelling the lightweight hydrogen fuel cells market are multifaceted. Technologically, breakthroughs in catalyst efficiency and membrane technology are reducing costs and improving performance. Economically, the increasing price volatility of fossil fuels and the growing demand for energy independence are making hydrogen a more attractive alternative. Policy-driven factors, such as government incentives for clean energy adoption and stricter emission regulations, are creating a favorable market environment.

- Technological Advancements: Enhanced catalyst materials and improved membrane durability.

- Economic Factors: Volatility of fossil fuel prices and energy security concerns.

- Policy Support: Government incentives and stringent environmental regulations.

The Key Challenges and Restraints facing the market include significant supply chain issues related to the sourcing of critical raw materials for fuel cell components, such as platinum. Regulatory hurdles persist, particularly concerning the standardization of safety protocols and the certification of hydrogen-powered systems across different jurisdictions. Competitive pressures from rapidly advancing battery technologies, especially in certain consumer electronics and short-range vehicle applications, remain a significant restraint. The high upfront capital expenditure for manufacturing and infrastructure development also presents a substantial barrier to widespread adoption, with initial infrastructure investments for a single region estimated to be in the billions of units.

- Supply Chain Issues: Availability and cost of critical raw materials.

- Regulatory Hurdles: Lack of standardized safety regulations and certifications.

- Competitive Pressures: Advancements and cost reductions in battery technologies.

- High Capital Expenditure: Significant upfront investment required for manufacturing and infrastructure.

Emerging Opportunities in Lightweight Hydrogen Fuel Cells

Emerging opportunities in the lightweight hydrogen fuel cells sector are abundant and span diverse applications. The burgeoning market for electric vertical take-off and landing (eVTOL) aircraft presents a significant avenue for lightweight fuel cell integration, offering longer flight times and reduced noise pollution. Advancements in portable power solutions for remote sensing, emergency response, and industrial IoT devices are also creating new market niches. Furthermore, the growing demand for off-grid and remote power generation in developing regions, where traditional grid infrastructure is limited, offers substantial untapped potential. Evolving consumer preferences towards sustainable and environmentally friendly products are driving innovation in consumer electronics and personal mobility devices.

Growth Accelerators in the Lightweight Hydrogen Fuel Cells Industry

Several catalysts are accelerating the long-term growth of the lightweight hydrogen fuel cells industry. Technological breakthroughs in solid-state hydrogen storage are a major growth accelerator, addressing a key challenge of current hydrogen systems. Strategic partnerships between fuel cell manufacturers, automotive OEMs, and energy companies are crucial for scaling up production and developing integrated solutions. Market expansion strategies, including the penetration into new geographical regions and the development of hybrid systems that combine fuel cells with batteries, are also driving growth. The increasing focus on green hydrogen production, utilizing renewable energy sources, will further enhance the sustainability appeal of fuel cell technology.

Key Players Shaping the Lightweight Hydrogen Fuel Cells Market

- SEEXTECH

- Intelligent Energy

- Shanghai HiTS Hydrogen Power Technology Co., Ltd

- Hydrogen Craft

- Plug Power Inc.

- Doosan Mobility Innovation.

- Honeywell

- Hylium-X (Hylium Industries, Inc.)

- SENZA Hydrogen Energy And Environmental Technology Co., Ltd.

Notable Milestones in Lightweight Hydrogen Fuel Cells Sector

- 2019: Launch of advanced PEM fuel cells with improved power density for drone applications by Doosan Mobility Innovation.

- 2020: Significant investment in hydrogen fuel cell R&D by Plug Power Inc., focusing on scalability and cost reduction.

- 2021: Strategic partnership announced between Intelligent Energy and a major automotive manufacturer for FCEV development.

- 2022: Honeywell showcases a next-generation lightweight fuel cell system for auxiliary power units.

- 2023: Shanghai HiTS Hydrogen Power Technology Co., Ltd. demonstrates a breakthrough in hydrogen storage technology for portable applications.

- 2024: Hylium-X (Hylium Industries, Inc.) announces successful testing of a new high-performance lightweight fuel cell stack.

In-Depth Lightweight Hydrogen Fuel Cells Market Outlook

- 2019: Launch of advanced PEM fuel cells with improved power density for drone applications by Doosan Mobility Innovation.

- 2020: Significant investment in hydrogen fuel cell R&D by Plug Power Inc., focusing on scalability and cost reduction.

- 2021: Strategic partnership announced between Intelligent Energy and a major automotive manufacturer for FCEV development.

- 2022: Honeywell showcases a next-generation lightweight fuel cell system for auxiliary power units.

- 2023: Shanghai HiTS Hydrogen Power Technology Co., Ltd. demonstrates a breakthrough in hydrogen storage technology for portable applications.

- 2024: Hylium-X (Hylium Industries, Inc.) announces successful testing of a new high-performance lightweight fuel cell stack.

In-Depth Lightweight Hydrogen Fuel Cells Market Outlook

The future market potential for lightweight hydrogen fuel cells is exceptionally promising, driven by their inherent advantages in energy density and fast refueling. Growth accelerators such as advancements in green hydrogen production and integrated energy solutions will continue to propel market expansion. Strategic opportunities lie in expanding into emerging applications like aviation and heavy-duty transportation, while also deepening penetration in existing markets through cost optimization and infrastructure development. The continued commitment of key players to innovation and collaboration will be pivotal in unlocking the full potential of this transformative clean energy technology. The market is projected to witness sustained, high-paced growth throughout the forecast period, solidifying its role in the global transition to a sustainable energy future.

Lighweight Hydrogen Fuel Cells Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Lighweight Hydrogen Fuel Cells Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Lighweight Hydrogen Fuel Cells REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lighweight Hydrogen Fuel Cells Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Lighweight Hydrogen Fuel Cells Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Lighweight Hydrogen Fuel Cells Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Lighweight Hydrogen Fuel Cells Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Lighweight Hydrogen Fuel Cells Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Lighweight Hydrogen Fuel Cells Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SEEXTECH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intelligent Energy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai HiTS Hydrogen Power Technology Co. Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hydrogen Craft

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Plug Power Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Doosan Mobility Innovation.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeywell

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hylium-X (Hylium Industries Inc.)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SENZA Hydrogen Energy And Environmental Technology Co. Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 SEEXTECH

List of Figures

- Figure 1: Global Lighweight Hydrogen Fuel Cells Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Lighweight Hydrogen Fuel Cells Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Lighweight Hydrogen Fuel Cells Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Lighweight Hydrogen Fuel Cells Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lighweight Hydrogen Fuel Cells?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Lighweight Hydrogen Fuel Cells?

Key companies in the market include SEEXTECH, Intelligent Energy, Shanghai HiTS Hydrogen Power Technology Co., Ltd, Hydrogen Craft, Plug Power Inc., Doosan Mobility Innovation., Honeywell, Hylium-X (Hylium Industries, Inc.), SENZA Hydrogen Energy And Environmental Technology Co., Ltd..

3. What are the main segments of the Lighweight Hydrogen Fuel Cells?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 102 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lighweight Hydrogen Fuel Cells," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lighweight Hydrogen Fuel Cells report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lighweight Hydrogen Fuel Cells?

To stay informed about further developments, trends, and reports in the Lighweight Hydrogen Fuel Cells, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence