Key Insights

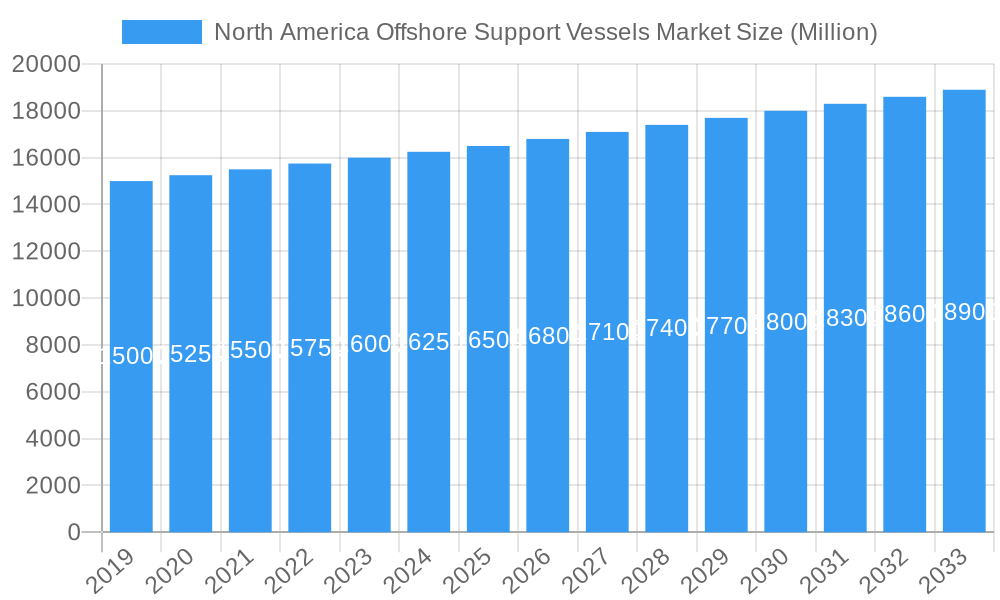

The North America Offshore Support Vessels (OSV) Market is poised for robust growth, driven by significant investments in both traditional oil and gas exploration and the burgeoning renewable energy sector. With a market size estimated to be in the billions of USD and a projected Compound Annual Growth Rate (CAGR) exceeding 2.00% from 2019 to 2033, the demand for specialized vessels remains strong. Key drivers include the ongoing need for offshore exploration and production activities, particularly in deepwater reserves, and the expanding infrastructure for offshore wind farms. The increasing complexity of subsea construction projects and the critical role of OSVs in offshore maintenance and repair further bolster market expansion. Vessel types such as supply vessels, anchor handling tugs, platform supply vessels, multi-purpose support vessels, and dive support vessels are all crucial components of this ecosystem, catering to the diverse needs of oil and gas companies, renewable energy firms, and marine contractors.

North America Offshore Support Vessels Market Market Size (In Billion)

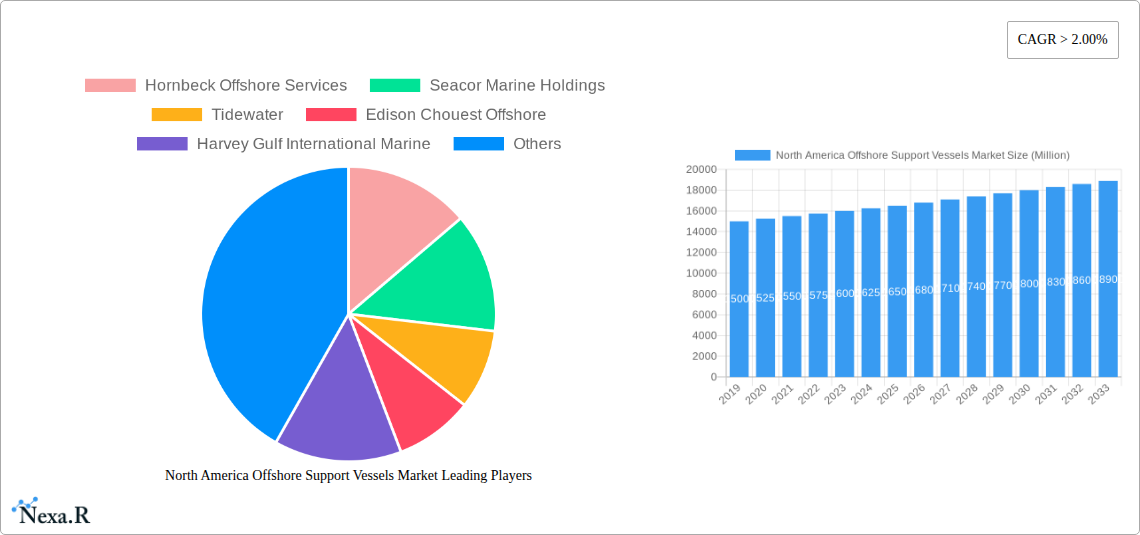

The market's trajectory is significantly influenced by technological advancements in propulsion systems, with diesel-electric, hybrid, and gas-electric solutions gaining traction due to their improved efficiency and environmental benefits. While the market benefits from strong demand, it also faces restraints such as fluctuating crude oil prices, stringent environmental regulations, and the high capital expenditure associated with acquiring and maintaining advanced OSVs. Geographically, the United States, Canada, and Mexico represent the core of the North American OSV market, each with unique operational landscapes and development priorities. Leading companies like Hornbeck Offshore Services, Seacor Marine Holdings, Tidewater, Edison Chouest Offshore, and Harvey Gulf International Marine are actively shaping the market through fleet modernization, strategic partnerships, and expansion into new geographical areas and service offerings. The forecast period from 2025 to 2033 anticipates continued evolution, with a strong emphasis on sustainable operations and integrated service solutions.

North America Offshore Support Vessels Market Company Market Share

This report delivers an in-depth analysis of the North America Offshore Support Vessels (OSV) Market, a critical sector supporting vital offshore energy operations and emerging renewable energy initiatives. Leveraging high-traffic keywords and a granular approach to market segmentation, this study provides actionable insights for industry stakeholders, investors, and decision-makers. The analysis covers the historical performance, current dynamics, and future trajectory of the OSV market, with a focus on key vessel types, end-user industries, applications, and propulsion systems.

North America Offshore Support Vessels Market Market Dynamics & Structure

The North America Offshore Support Vessels (OSV) Market is characterized by a moderate market concentration, with a few key players dominating a significant portion of the market share. However, the growing emphasis on technological innovation is fostering a more dynamic landscape, driven by the need for enhanced efficiency, safety, and environmental compliance. Regulatory frameworks, particularly concerning environmental protection and offshore safety standards, play a crucial role in shaping market entry and operational strategies. Competitive product substitutes, while present in certain niche applications, are largely overshadowed by the specialized nature of OSVs required for complex offshore operations. The demographics of end-users are shifting, with traditional oil and gas companies continuing to be major consumers, while renewable energy companies (e.g., offshore wind developers) are emerging as significant growth drivers. Mergers & Acquisitions (M&A) trends indicate a strategic consolidation among established players to gain scale, optimize operational efficiency, and expand service portfolios.

- Market Concentration: Dominated by a few large operators, but with potential for new entrants in niche segments.

- Technological Innovation Drivers: Demand for fuel-efficient vessels, advanced navigation systems, autonomous operations, and eco-friendly propulsion.

- Regulatory Frameworks: Strict adherence to environmental regulations (e.g., emissions standards) and safety protocols is paramount.

- Competitive Product Substitutes: Limited direct substitutes for specialized OSV functions.

- End-User Demographics: Increasing demand from offshore wind sector complementing sustained oil and gas activity.

- M&A Trends: Strategic acquisitions to enhance fleet size, technological capabilities, and geographic reach.

North America Offshore Support Vessels Market Growth Trends & Insights

The North America Offshore Support Vessels (OSV) Market is poised for robust growth, driven by a confluence of factors including the sustained demand from the oil and gas sector, the burgeoning offshore renewable energy industry, and technological advancements. The market size evolution is projected to witness a healthy Compound Annual Growth Rate (CAGR) over the forecast period. Adoption rates for advanced OSV technologies, such as hybrid and diesel-electric propulsion systems, are steadily increasing as companies prioritize operational efficiency and reduced environmental impact. Technological disruptions, including the integration of AI for vessel management and the development of more specialized vessels for complex subsea operations, are reshaping the industry. Consumer behavior shifts are evident in the growing preference for integrated service solutions and vessels with enhanced sustainability features. The market penetration of specialized vessels for deepwater exploration and production remains high, while newer segments like offshore wind farm installation and maintenance are experiencing rapid expansion.

The market size of the North America Offshore Support Vessels (OSV) Market is projected to reach approximately $15,500 Million units in 2025, with a projected growth to $22,000 Million units by 2033. This represents a CAGR of approximately 4.8% during the forecast period of 2025-2033. The historical period of 2019-2024 saw a market size of roughly $12,000 Million units in 2019, experiencing fluctuating demand due to global energy price volatility and the impact of the COVID-19 pandemic, but recovering steadily.

Key growth trends shaping the market include:

- Increased offshore oil and gas exploration and production activities, particularly in the Gulf of Mexico, are driving demand for a wide range of OSVs.

- The rapid expansion of the offshore wind energy sector across North America necessitates specialized vessels for construction, installation, and maintenance of wind turbines and associated infrastructure.

- Technological advancements in vessel design, propulsion systems (e.g., hybrid, electric), and automation are leading to the adoption of more efficient and environmentally friendly OSVs.

- The growing complexity of offshore operations, including deepwater exploration and subsea construction, requires highly specialized and advanced OSV capabilities.

- Government initiatives and incentives supporting offshore energy development, both fossil fuels and renewables, are a significant catalyst for market growth.

- Stricter environmental regulations are pushing for the adoption of cleaner propulsion technologies and sustainable operational practices, creating opportunities for innovative vessel designs.

- The need for offshore maintenance and repair services for aging offshore infrastructure and new renewable energy installations is contributing to consistent demand for OSVs.

The adoption rate of advanced propulsion systems, such as diesel-electric and hybrid systems, is expected to accelerate, driven by both regulatory pressures and operational cost savings. Consumer behavior is also evolving, with offshore operators increasingly looking for comprehensive service packages rather than standalone vessel charters, fostering strategic partnerships and integrated service providers. Market penetration of dedicated vessels for subsea construction and maintenance is deepening as these applications become more sophisticated and critical for project success. The overall market trajectory indicates a period of sustained expansion, fueled by both traditional and emerging offshore energy sectors.

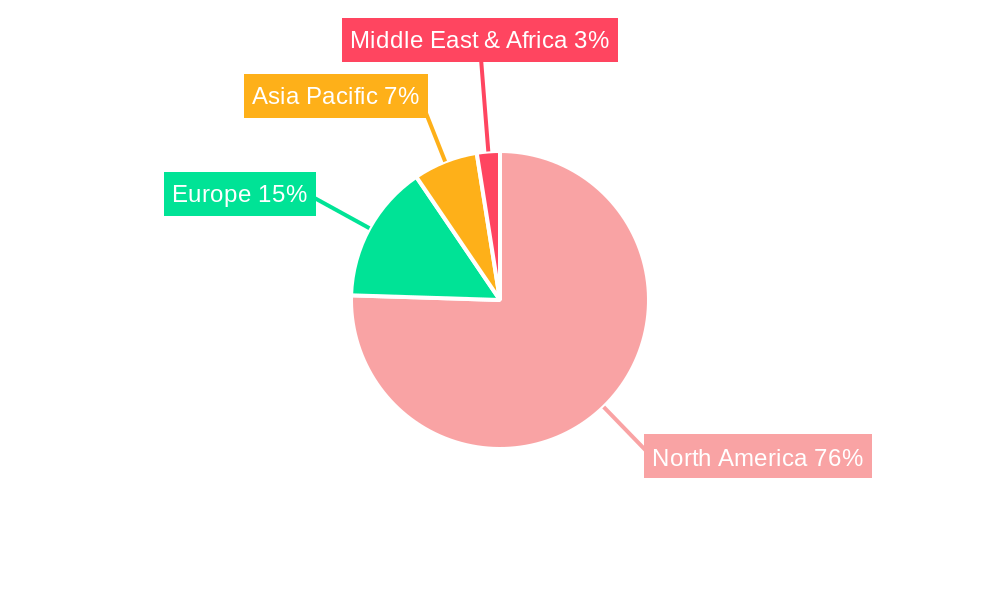

Dominant Regions, Countries, or Segments in North America Offshore Support Vessels Market

The North America Offshore Support Vessels (OSV) Market is significantly influenced by the United States as the dominant country, primarily due to its extensive offshore oil and gas reserves in the Gulf of Mexico and its rapidly expanding offshore wind development initiatives along the Atlantic coast. Within the Vessel Type segment, Platform Supply Vessels (PSVs) and Anchor Handling Tugs (AHTs) continue to be the workhorses, crucial for logistics and anchoring in oil and gas operations. However, Multi-purpose Support Vessels (MPSVs) and Dive Support Vessels (DSVs) are witnessing increasing demand due to the complexity of subsea construction and maintenance. For End Users, oil and gas companies remain the largest consumers, but renewable energy companies are rapidly gaining traction, particularly for offshore wind farm construction and maintenance. In terms of Application, offshore production and offshore exploration are long-standing drivers, while subsea construction and offshore maintenance and repair are experiencing accelerated growth. The Propulsion System landscape is evolving, with Diesel-electric and hybrid systems gaining market share over traditional diesel engines due to their fuel efficiency and reduced emissions, while gas-electric systems are gaining traction in specific regions.

- Dominant Country: United States, driven by the Gulf of Mexico oil and gas sector and burgeoning Atlantic offshore wind projects.

- Leading Vessel Types: Platform Supply Vessels (PSVs) and Anchor Handling Tugs (AHTs) for traditional operations; Multi-purpose Support Vessels (MPSVs) and Dive Support Vessels (DSVs) for complex tasks.

- Key End Users: Oil and Gas Companies continue to be dominant, with Renewable Energy Companies emerging as significant growth drivers.

- Primary Applications: Offshore Production and Offshore Exploration remain vital, with substantial growth in Subsea Construction and Offshore Maintenance and Repair.

- Emerging Propulsion Systems: Diesel-electric and Hybrid systems are increasingly adopted for their efficiency and environmental benefits; Gas-electric systems are gaining niche adoption.

Factors contributing to the dominance of these regions and segments include favorable economic policies supporting offshore energy development, significant existing infrastructure for oil and gas, and ambitious government targets for renewable energy deployment. The sheer scale of operations in the Gulf of Mexico, coupled with the strategic expansion of offshore wind farms along the East Coast, creates a substantial and sustained demand for a diverse fleet of OSVs. Market share within these dominant segments is driven by fleet size, technological capabilities, operational expertise, and the ability to offer integrated services. The growth potential in the renewable energy segment is particularly high, signaling a transformative shift in the OSV market landscape.

North America Offshore Support Vessels Market Product Landscape

The North America Offshore Support Vessels (OSV) Market product landscape is defined by continuous innovation aimed at enhancing operational efficiency, safety, and environmental sustainability. Vessel designs are becoming more specialized, catering to specific offshore applications such as deepwater exploration, complex subsea construction, and the installation and maintenance of offshore wind turbines. Key product innovations include the integration of advanced dynamic positioning systems, fuel-efficient hybrid and diesel-electric propulsion, and sophisticated deck equipment for handling heavy loads and subsea equipment. Performance metrics are increasingly focused on fuel consumption reduction, emissions control, and uptime reliability. Unique selling propositions often revolve around a vessel's ability to operate in challenging weather conditions, its payload capacity, and the integration of cutting-edge technology for remote operations and data acquisition.

Key Drivers, Barriers & Challenges in North America Offshore Support Vessels Market

The North America Offshore Support Vessels (OSV) Market is propelled by several key drivers. The ongoing demand from the oil and gas sector for exploration, production, and maintenance remains a fundamental growth catalyst. Furthermore, the rapid expansion of the offshore wind energy industry presents a significant opportunity, requiring specialized vessels for construction, installation, and ongoing maintenance. Technological advancements in vessel design and propulsion systems are driving the adoption of more efficient and environmentally friendly OSVs. Government policies and incentives aimed at bolstering domestic energy production and renewable energy targets also play a crucial role.

However, the market faces considerable barriers and challenges. Volatile oil and gas prices can significantly impact investment decisions and charter rates, creating market uncertainty. Stringent environmental regulations and the increasing pressure for decarbonization necessitate substantial investments in cleaner technologies, posing a financial challenge for some operators. Supply chain disruptions for specialized components and skilled labor shortages can impede new vessel construction and timely maintenance. Intense competition among OSV operators, particularly for standard vessel types, can lead to pressure on pricing and profitability. The high capital expenditure required for acquiring and maintaining modern OSV fleets is another significant barrier.

Emerging Opportunities in North America Offshore Support Vessels Market

Emerging opportunities in the North America Offshore Support Vessels (OSV) Market are largely centered around the burgeoning renewable energy sector and the increasing demand for specialized subsea services. The rapid growth of offshore wind farms across the East Coast and potentially the West Coast of the United States and Canada presents a substantial and growing market for construction support vessels, cable-laying vessels, and specialized maintenance vessels. Furthermore, the advancements in subsea technology, including the development of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs), are creating opportunities for OSVs equipped to support these sophisticated operations for both oil and gas and offshore renewable projects. There is also a growing demand for decommissioning services for aging offshore oil and gas infrastructure, requiring specialized OSVs for dismantling and removal operations.

Growth Accelerators in the North America Offshore Support Vessels Market Industry

Several catalysts are accelerating growth in the North America Offshore Support Vessels (OSV) Market. The unwavering commitment to renewable energy targets by North American governments, particularly for offshore wind, is a primary growth accelerator, driving investment in new vessel construction and chartering. Technological breakthroughs in vessel design and propulsion, such as the widespread adoption of hybrid and electric systems, are not only meeting environmental demands but also improving operational efficiency and reducing costs, making OSVs more attractive. Strategic partnerships and collaborations between OSV operators and renewable energy developers or major oil and gas companies are streamlining project execution and expanding service offerings. The increasing complexity of subsea operations, requiring highly specialized vessels and integrated solutions, also acts as a significant growth accelerator.

Key Players Shaping the North America Offshore Support Vessels Market Market

- Hornbeck Offshore Services

- Seacor Marine Holdings

- Tidewater

- Edison Chouest Offshore

- Harvey Gulf International Marine

Notable Milestones in North America Offshore Support Vessels Market Sector

- 2023/Ongoing: Significant increase in newbuild orders for offshore wind installation and maintenance vessels.

- 2022: Accelerated adoption of hybrid propulsion systems in new OSV deliveries to meet emission reduction targets.

- 2021: Resumption of robust offshore exploration activities in the Gulf of Mexico, boosting demand for traditional OSVs.

- 2020: Consolidation efforts and fleet rationalization by major players in response to market volatility.

- 2019: Increased investment in multi-purpose offshore support vessels capable of diverse applications.

In-Depth North America Offshore Support Vessels Market Market Outlook

The North America Offshore Support Vessels (OSV) Market outlook is characterized by sustained growth, driven by the dual engines of conventional offshore oil and gas activity and the burgeoning renewable energy sector. Strategic opportunities lie in catering to the specialized needs of offshore wind farm construction and maintenance, as well as providing advanced subsea support services. The increasing demand for eco-friendly and technologically advanced vessels, coupled with government support for both fossil fuel and renewable energy development, positions the market for continued expansion. Companies that can offer integrated solutions, demonstrate operational excellence, and embrace sustainable technologies are poised to capitalize on the evolving market dynamics.

North America Offshore Support Vessels Market Segmentation

-

1. Vessel Type

- 1.1. Supply vessels

- 1.2. Anchor handling tugs

- 1.3. Platform supply vessels

- 1.4. Multi-purpose support vessels

- 1.5. Dive support vessels

-

2. End User

- 2.1. Oil and gas companies

- 2.2. renewable energy companies

- 2.3. marine contractors

-

3. Application

- 3.1. Offshore exploration

- 3.2. offshore production

- 3.3. offshore maintenance and repair

- 3.4. subsea construction

-

4. Propulsion System

- 4.1. Diesel-electric, hybrid

- 4.2. gas-electric, steam

North America Offshore Support Vessels Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Offshore Support Vessels Market Regional Market Share

Geographic Coverage of North America Offshore Support Vessels Market

North America Offshore Support Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices

- 3.3. Market Restrains

- 3.3.1. 4.; The Country's Inefficient Electricity Grid Infrastructure

- 3.4. Market Trends

- 3.4.1. Platform Supply Vessels (PSVs) Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Supply vessels

- 5.1.2. Anchor handling tugs

- 5.1.3. Platform supply vessels

- 5.1.4. Multi-purpose support vessels

- 5.1.5. Dive support vessels

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Oil and gas companies

- 5.2.2. renewable energy companies

- 5.2.3. marine contractors

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Offshore exploration

- 5.3.2. offshore production

- 5.3.3. offshore maintenance and repair

- 5.3.4. subsea construction

- 5.4. Market Analysis, Insights and Forecast - by Propulsion System

- 5.4.1. Diesel-electric, hybrid

- 5.4.2. gas-electric, steam

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. United States North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6.1.1. Supply vessels

- 6.1.2. Anchor handling tugs

- 6.1.3. Platform supply vessels

- 6.1.4. Multi-purpose support vessels

- 6.1.5. Dive support vessels

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Oil and gas companies

- 6.2.2. renewable energy companies

- 6.2.3. marine contractors

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Offshore exploration

- 6.3.2. offshore production

- 6.3.3. offshore maintenance and repair

- 6.3.4. subsea construction

- 6.4. Market Analysis, Insights and Forecast - by Propulsion System

- 6.4.1. Diesel-electric, hybrid

- 6.4.2. gas-electric, steam

- 6.1. Market Analysis, Insights and Forecast - by Vessel Type

- 7. Canada North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vessel Type

- 7.1.1. Supply vessels

- 7.1.2. Anchor handling tugs

- 7.1.3. Platform supply vessels

- 7.1.4. Multi-purpose support vessels

- 7.1.5. Dive support vessels

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Oil and gas companies

- 7.2.2. renewable energy companies

- 7.2.3. marine contractors

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Offshore exploration

- 7.3.2. offshore production

- 7.3.3. offshore maintenance and repair

- 7.3.4. subsea construction

- 7.4. Market Analysis, Insights and Forecast - by Propulsion System

- 7.4.1. Diesel-electric, hybrid

- 7.4.2. gas-electric, steam

- 7.1. Market Analysis, Insights and Forecast - by Vessel Type

- 8. Mexico North America Offshore Support Vessels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vessel Type

- 8.1.1. Supply vessels

- 8.1.2. Anchor handling tugs

- 8.1.3. Platform supply vessels

- 8.1.4. Multi-purpose support vessels

- 8.1.5. Dive support vessels

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Oil and gas companies

- 8.2.2. renewable energy companies

- 8.2.3. marine contractors

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Offshore exploration

- 8.3.2. offshore production

- 8.3.3. offshore maintenance and repair

- 8.3.4. subsea construction

- 8.4. Market Analysis, Insights and Forecast - by Propulsion System

- 8.4.1. Diesel-electric, hybrid

- 8.4.2. gas-electric, steam

- 8.1. Market Analysis, Insights and Forecast - by Vessel Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Hornbeck Offshore Services

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Seacor Marine Holdings

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Tidewater

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Edison Chouest Offshore

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Harvey Gulf International Marine

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.1 Hornbeck Offshore Services

List of Figures

- Figure 1: North America Offshore Support Vessels Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Offshore Support Vessels Market Share (%) by Company 2025

List of Tables

- Table 1: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 2: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 5: North America Offshore Support Vessels Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 7: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 10: North America Offshore Support Vessels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 12: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 13: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 15: North America Offshore Support Vessels Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Offshore Support Vessels Market Revenue undefined Forecast, by Vessel Type 2020 & 2033

- Table 17: North America Offshore Support Vessels Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: North America Offshore Support Vessels Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: North America Offshore Support Vessels Market Revenue undefined Forecast, by Propulsion System 2020 & 2033

- Table 20: North America Offshore Support Vessels Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Offshore Support Vessels Market?

The projected CAGR is approximately 7.94%.

2. Which companies are prominent players in the North America Offshore Support Vessels Market?

Key companies in the market include Hornbeck Offshore Services , Seacor Marine Holdings , Tidewater , Edison Chouest Offshore, Harvey Gulf International Marine .

3. What are the main segments of the North America Offshore Support Vessels Market?

The market segments include Vessel Type , End User , Application , Propulsion System .

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices.

6. What are the notable trends driving market growth?

Platform Supply Vessels (PSVs) Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Country's Inefficient Electricity Grid Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Offshore Support Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Offshore Support Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Offshore Support Vessels Market?

To stay informed about further developments, trends, and reports in the North America Offshore Support Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence