Key Insights

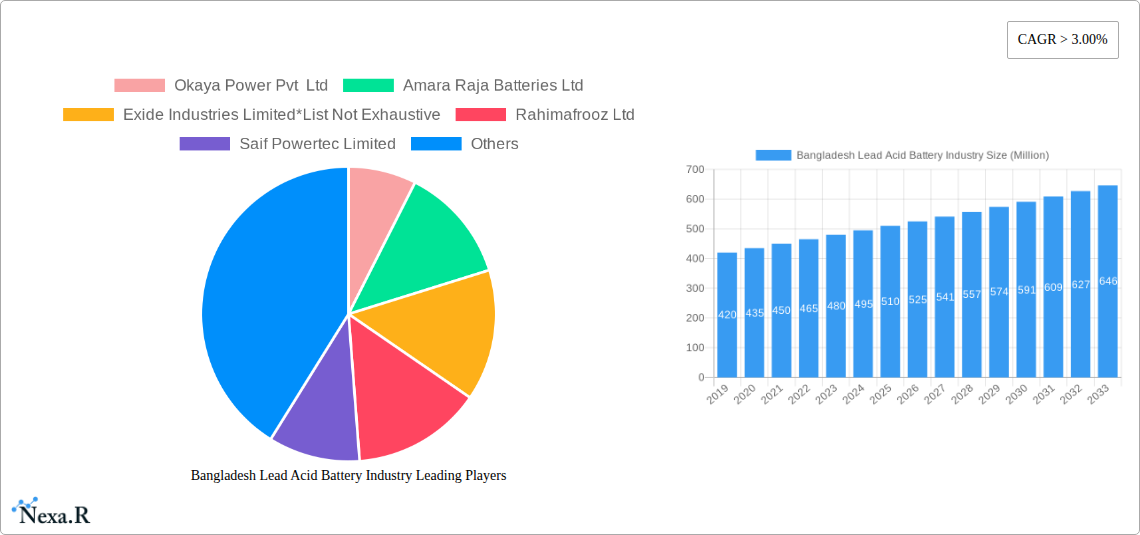

The Bangladesh Lead Acid Battery industry is poised for robust growth, projecting a market size of approximately USD 500 million in 2025, with a Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This expansion is primarily fueled by the increasing demand for reliable power solutions across various sectors, including automotive, telecommunications, and renewable energy storage. The automotive sector, driven by a growing vehicle parc and the sustained popularity of SLI (Starting, Lighting, and Ignition) batteries, remains a cornerstone of the market. Furthermore, the burgeoning telecommunications infrastructure and the increasing adoption of solar energy systems for both residential and commercial use are significant growth drivers, demanding dependable stationary lead-acid battery solutions. The market's value, denominated in millions, reflects the substantial and consistent demand for these essential power storage devices.

Bangladesh Lead Acid Battery Industry Market Size (In Million)

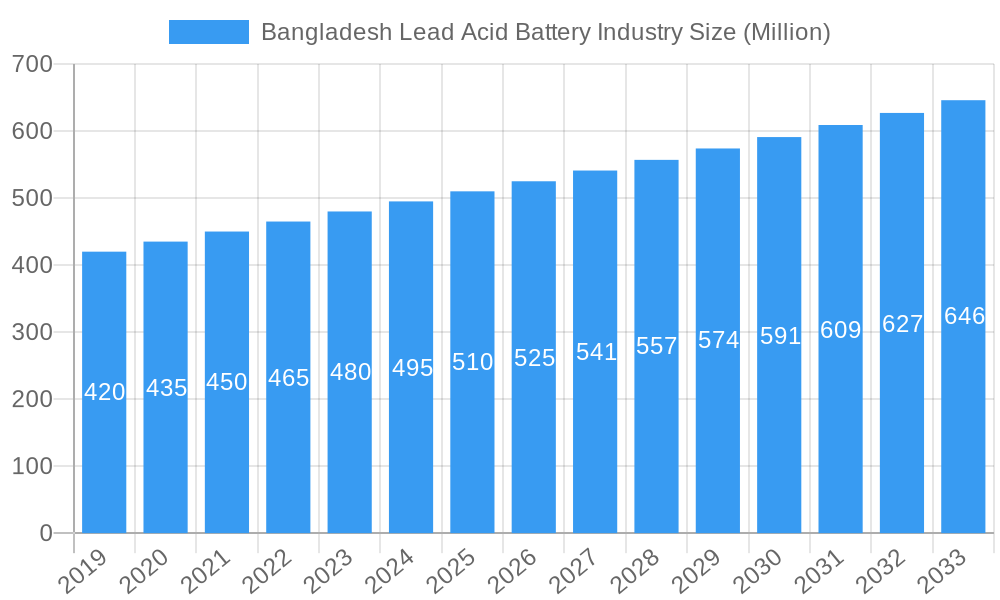

The market is segmented by battery type, with SLI batteries holding a dominant share due to their widespread use in vehicles. However, stationary and portable batteries are exhibiting strong growth trajectories, fueled by the expanding need for backup power in critical infrastructure and the proliferation of consumer electronics. Technologically, flooded lead-acid batteries continue to be prevalent due to their cost-effectiveness, while valve-regulated lead-acid (VRLA) batteries are gaining traction for their maintenance-free operation and enhanced safety features, particularly in sensitive applications. Key industry players such as Okaya Power Pvt Ltd, Amara Raja Batteries Ltd, and Exide Industries Limited are actively shaping the competitive landscape through innovation and strategic expansions, ensuring a dynamic and evolving market environment in Bangladesh.

Bangladesh Lead Acid Battery Industry Company Market Share

Bangladesh Lead Acid Battery Industry: Market Analysis, Trends & Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Bangladesh lead acid battery market, offering critical insights into its structure, growth trajectory, and future potential. Covering a study period from 2019 to 2033, with a base year of 2025, this report delves into key market dynamics, dominant segments, product landscapes, and influential industry players. It leverages detailed quantitative data and qualitative analysis to equip industry professionals, investors, and stakeholders with actionable intelligence for strategic decision-making in this vital sector.

Bangladesh Lead Acid Battery Industry Market Dynamics & Structure

The Bangladesh lead acid battery industry is characterized by a moderately concentrated market structure, with a few dominant players controlling a significant share. Technological innovation is primarily driven by the need for improved energy density, longer lifespan, and enhanced safety features. Regulatory frameworks, particularly those concerning battery recycling and environmental compliance, are increasingly shaping market dynamics. Competition from alternative battery technologies poses a continuous challenge, though the cost-effectiveness and established infrastructure of lead-acid batteries maintain their dominance in many applications. End-user demographics are diverse, spanning automotive, industrial backup power, and consumer electronics. Mergers and acquisitions (M&A) activity, while not overtly high, plays a role in market consolidation and strategic expansion.

- Market Concentration: Dominated by a few key manufacturers, contributing to a moderate level of market concentration.

- Technological Innovation: Focus on performance enhancement (e.g., deeper discharge capabilities) and environmental impact reduction.

- Regulatory Impact: Strict adherence to environmental regulations is becoming a significant factor for market entry and operations, especially concerning lead acid battery recycling in Bangladesh.

- Competitive Landscape: Intense competition from lithium-ion and other advanced battery technologies, necessitating continuous improvement in lead-acid battery offerings.

- End-User Demand: Strong demand from the automotive sector (SLI batteries) and the growing need for reliable backup power solutions in industrial and residential segments.

- M&A Trends: Opportunities for strategic consolidation to enhance market reach and technological capabilities.

Bangladesh Lead Acid Battery Industry Growth Trends & Insights

The Bangladesh lead acid battery market is projected to experience robust growth, driven by a confluence of factors including the expanding automotive fleet, increasing demand for uninterrupted power supply in the industrial and commercial sectors, and the burgeoning consumer electronics market. The adoption rate of lead-acid batteries remains high due to their proven reliability and cost-effectiveness. However, technological disruptions from alternative battery chemistries are steadily influencing market evolution. Consumer behavior is shifting towards seeking more sustainable and longer-lasting power solutions, prompting manufacturers to invest in product improvements and recycling initiatives. The overall market size is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period, indicating a healthy expansion trajectory. Market penetration for specialized lead-acid battery applications is also on an upward trend, reflecting the sustained demand across various end-use industries.

The Bangladesh lead acid battery industry is witnessing a significant upswing, fueled by the nation's rapid economic development and industrial expansion. The automotive sector, a primary consumer of Starting, Lighting, and Ignition (SLI) batteries, continues to grow with an increasing number of vehicle registrations, thereby driving substantial demand. Simultaneously, the increasing reliance on electricity for industrial operations, telecommunications, and even residential power backup in the face of grid instability necessitates a strong market for stationary lead-acid batteries. This demand is further amplified by the growing penetration of consumer electronics, which utilize portable lead-acid batteries for various devices.

The market's growth is further underpinned by the inherent advantages of lead-acid batteries: their mature technology, established recycling infrastructure, and cost-competitiveness compared to newer alternatives. While lithium-ion batteries are gaining traction in specific niche applications, the sheer volume and economic viability of lead-acid batteries ensure their continued dominance across the broader market spectrum. The average lifespan of industrial lead-acid batteries, for instance, is being extended through technological advancements in plate design and electrolyte management, enhancing their value proposition for end-users. Consumer behavior is also evolving, with a growing awareness of the environmental impact of battery disposal leading to increased demand for batteries from manufacturers who actively participate in recycling programs. This trend is particularly evident in urban centers where environmental consciousness is on the rise. The projected market size for lead-acid batteries in Bangladesh is estimated to reach XXX million units by 2033, a testament to its sustained demand and growth potential.

Dominant Regions, Countries, or Segments in Bangladesh Lead Acid Battery Industry

Within the Bangladesh lead acid battery industry, the SLI Batteries (Starting, Lighting, and Ignition) segment stands out as the dominant force driving market growth. This dominance is primarily attributed to the continuously expanding automotive sector in Bangladesh. With increasing disposable incomes, urbanization, and government initiatives promoting vehicle ownership, the demand for new vehicles, and consequently, replacement SLI batteries, remains exceptionally high. The country's burgeoning automotive repair and maintenance ecosystem further solidifies the market for SLI batteries.

SLI Batteries (Starting, Lighting, and Ignition):

- Key Drivers: Rapidly growing automotive parc, increasing vehicle sales (both new and used), and a robust aftermarket for replacements.

- Market Share: Consistently holds over 60% of the total lead-acid battery market in Bangladesh.

- Growth Potential: Sustained demand due to ongoing vehicle registration and the lifespan of existing vehicles necessitating periodic battery replacements.

- Economic Policies: Government policies encouraging automotive manufacturing and import of vehicles directly impact SLI battery demand.

- Consumer Behavior: Reliance on traditional, cost-effective battery solutions for everyday vehicle needs.

Stationary Batteries:

- Key Drivers: Increasing demand for reliable backup power in industrial facilities, telecommunication towers, data centers, and residential power backup systems, especially in areas prone to power outages.

- Market Share: Significant and growing segment, estimated to be around 25% of the market.

- Growth Potential: Driven by infrastructure development, digitalization, and the need for uninterrupted operations.

Portable Batteries (Consumer Electronics):

- Key Drivers: Growing use of portable electronic devices like UPS systems, emergency lights, and smaller electronic gadgets.

- Market Share: A smaller but growing segment, approximately 10%.

- Growth Potential: Linked to the increasing adoption of consumer electronics and demand for off-grid power solutions.

Other Types:

- Key Drivers: Niche applications such as solar energy storage and specialized industrial equipment.

- Market Share: Represents the remaining percentage, subject to specific project-based demands.

The dominance of SLI batteries is further reinforced by the established distribution networks and the familiarity of consumers and mechanics with this type of battery. While stationary batteries are witnessing rapid growth due to infrastructural needs, the sheer volume of vehicles on the road ensures the continued leadership of SLI batteries in the Bangladesh lead acid battery market.

Bangladesh Lead Acid Battery Industry Product Landscape

The Bangladesh lead acid battery industry features a diverse product landscape catering to a wide array of applications. Key product innovations focus on enhancing the performance and lifespan of traditional lead-acid batteries. This includes advancements in plate manufacturing technologies, the use of specialized alloys for improved corrosion resistance, and enhanced separator materials for better conductivity and reduced internal resistance. For SLI batteries, the emphasis is on providing reliable starting power, longer shelf life, and resistance to vibrations encountered in automotive use. Stationary batteries are designed for deep-cycle applications, offering consistent power delivery for extended periods and robustness against frequent discharge-recharge cycles, crucial for backup power and renewable energy systems. Portable batteries are optimized for lighter weight and higher energy density within the lead-acid chemistry's constraints.

Key Drivers, Barriers & Challenges in Bangladesh Lead Acid Battery Industry

Key Drivers:

- Automotive Sector Growth: Expanding vehicle population and aftermarket demand for SLI batteries.

- Infrastructure Development: Increased need for reliable backup power in industrial, commercial, and telecommunication sectors driving demand for stationary batteries.

- Cost-Effectiveness: Lead-acid batteries remain an economically viable power storage solution for a vast majority of applications.

- Established Recycling Infrastructure: Growing emphasis on battery recycling supports a circular economy and reduces raw material costs.

Barriers & Challenges:

- Environmental Concerns: Toxicity of lead and sulfuric acid requires stringent handling and disposal protocols.

- Technological Competition: Rise of lithium-ion and other advanced battery technologies offering higher energy density and longer lifespans, especially in premium segments.

- Import Dependence: Reliance on imported raw materials like lead, influencing cost and supply chain stability.

- Regulatory Compliance: Adhering to evolving environmental regulations and recycling mandates can increase operational costs.

- Supply Chain Disruptions: Vulnerability to global price fluctuations of lead and other key components.

Emerging Opportunities in Bangladesh Lead Acid Battery Industry

Emerging opportunities in the Bangladesh lead acid battery industry lie in the increasing demand for robust and affordable energy storage solutions for off-grid and semi-grid applications. The growing adoption of solar power systems in rural and peri-urban areas presents a significant avenue for stationary lead-acid batteries, especially those designed for deep-cycle performance. Furthermore, the push towards improved waste management and recycling initiatives opens doors for companies focused on developing and implementing efficient lead-acid battery recycling processes, creating a sustainable business model. The expansion of e-mobility in specific segments, while dominated by other chemistries, may still present niche opportunities for specialized lead-acid battery applications where cost is a paramount factor.

Growth Accelerators in the Bangladesh Lead Acid Battery Industry Industry

Several catalysts are accelerating the growth of the Bangladesh lead acid battery industry. Foremost is the nation's robust economic growth, which directly fuels demand across key sectors like automotive and industrial applications. Government initiatives supporting infrastructure development and renewable energy adoption are significant growth accelerators, particularly for stationary battery solutions. Technological advancements in lead-acid battery manufacturing, leading to improved efficiency and lifespan, are further enhancing their competitiveness. Strategic partnerships between local manufacturers and international technology providers can also foster innovation and market expansion. Finally, the increasing focus on battery recycling, driven by both environmental concerns and regulatory mandates, is creating a more sustainable and cost-effective supply chain, thereby supporting long-term growth.

Key Players Shaping the Bangladesh Lead Acid Battery Industry Market

- Okaya Power Pvt Ltd

- Amara Raja Batteries Ltd

- Exide Industries Limited

- Rahimafrooz Ltd

- Saif Powertec Limited

- Panna Group

Notable Milestones in Bangladesh Lead Acid Battery Industry Sector

- February 2021: The Ministry of Environment, Forest and Climate Change (MoEF) of Bangladesh declared an order (S.R.O No. 45-Act/2021) on battery recycling under the Bangladesh Environment Conservation Act, 1995.

- Impact: Mandates companies involved in the manufacture and recycling of lead-acid batteries to appoint dealers and agents for used battery collection.

- Impact: Requires companies to obtain a Non-objection Certificate (NOC) from the Department of Environment (DoE) for importing lead-acid batteries.

- Impact: Importers are now obligated to sign contracts with battery recycling companies, significantly enhancing the focus on end-of-life management and environmental responsibility within the industry.

In-Depth Bangladesh Lead Acid Battery Industry Market Outlook

The Bangladesh lead acid battery industry is poised for sustained growth, driven by a combination of fundamental economic drivers and evolving market dynamics. The increasing demand for reliable power storage, fueled by the expanding automotive sector and the nation's industrialization efforts, will continue to be a primary growth accelerator. Furthermore, the increasing adoption of renewable energy sources, particularly solar power, will create significant opportunities for stationary lead-acid battery solutions. The regulatory push towards enhanced battery recycling, exemplified by the S.R.O No. 45-Act/2021, is fostering a more sustainable ecosystem and encouraging investment in environmentally responsible practices. Strategic collaborations and technological enhancements aimed at improving the performance and lifespan of lead-acid batteries will further solidify their market position. Overall, the outlook suggests a vibrant and expanding market, with significant potential for both established players and new entrants focused on innovation and sustainability.

Bangladesh Lead Acid Battery Industry Segmentation

-

1. Type

- 1.1. SLI Batteries (Starting, Lighting, and Ignition)

- 1.2. Stationa

- 1.3. Portable Batteries (Consumer Electronics)

- 1.4. Other Types

-

2. Technology

- 2.1. Flooded

- 2.2. Valve Regulated Battery

Bangladesh Lead Acid Battery Industry Segmentation By Geography

- 1. Bangladesh

Bangladesh Lead Acid Battery Industry Regional Market Share

Geographic Coverage of Bangladesh Lead Acid Battery Industry

Bangladesh Lead Acid Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1 SLI Batteries (Starting

- 3.4.2 Lighting

- 3.4.3 and Ignition) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Lead Acid Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. SLI Batteries (Starting, Lighting, and Ignition)

- 5.1.2. Stationa

- 5.1.3. Portable Batteries (Consumer Electronics)

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Flooded

- 5.2.2. Valve Regulated Battery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Okaya Power Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amara Raja Batteries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exide Industries Limited*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rahimafrooz Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saif Powertec Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Panna Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Okaya Power Pvt Ltd

List of Figures

- Figure 1: Bangladesh Lead Acid Battery Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Bangladesh Lead Acid Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Lead Acid Battery Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Bangladesh Lead Acid Battery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Bangladesh Lead Acid Battery Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Bangladesh Lead Acid Battery Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Bangladesh Lead Acid Battery Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Bangladesh Lead Acid Battery Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Lead Acid Battery Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Bangladesh Lead Acid Battery Industry?

Key companies in the market include Okaya Power Pvt Ltd, Amara Raja Batteries Ltd, Exide Industries Limited*List Not Exhaustive, Rahimafrooz Ltd, Saif Powertec Limited, Panna Group.

3. What are the main segments of the Bangladesh Lead Acid Battery Industry?

The market segments include Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants.

6. What are the notable trends driving market growth?

SLI Batteries (Starting. Lighting. and Ignition) to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In February 2021, The Ministry of Environment, Forest and Climate Change (MoEF) of Bangladesh declared an order (S.R.O No. 45-Act/2021) on battery recycling under the Bangladesh Environment Conservation Act, 1995. The main provisions of this order include the companies involved in the manufacture and recycling of lead-acid batteries shall appoint dealers and agents to collect used batteries. Also, companies shall obtain a Non-objection Certificate (NOC) from the DoE to obtain a license to import lead-acid batteries. The importer shall sign a contract with a battery recycling company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Lead Acid Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Lead Acid Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Lead Acid Battery Industry?

To stay informed about further developments, trends, and reports in the Bangladesh Lead Acid Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence