Key Insights

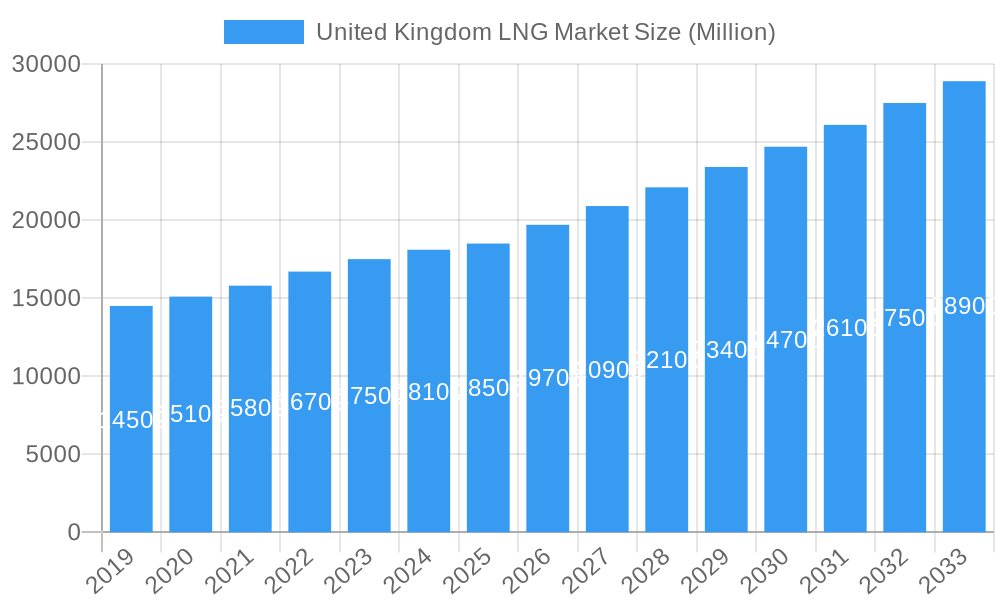

The United Kingdom's Liquefied Natural Gas (LNG) market is projected for substantial expansion, driven by its vital role in national energy security and the transition to cleaner energy sources. With an estimated market size of 462.69 million in the base year 2024, the sector is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 5.1%. Key growth drivers include the imperative to diversify energy imports amidst evolving geopolitical landscapes, enhancing the strategic importance of LNG for a stable and flexible natural gas supply. The increasing adoption of LNG as a cleaner alternative across transportation sectors, including heavy-duty vehicles and maritime shipping, and within industrial processes, further fuels market expansion. Investments in LNG import terminals and distribution infrastructure are critical for meeting rising demand and improving market accessibility. The market's historical performance from 2019 to 2024 has likely established a strong foundation for this projected growth, influenced by dynamic energy policies and global gas market trends.

United Kingdom LNG Market Market Size (In Million)

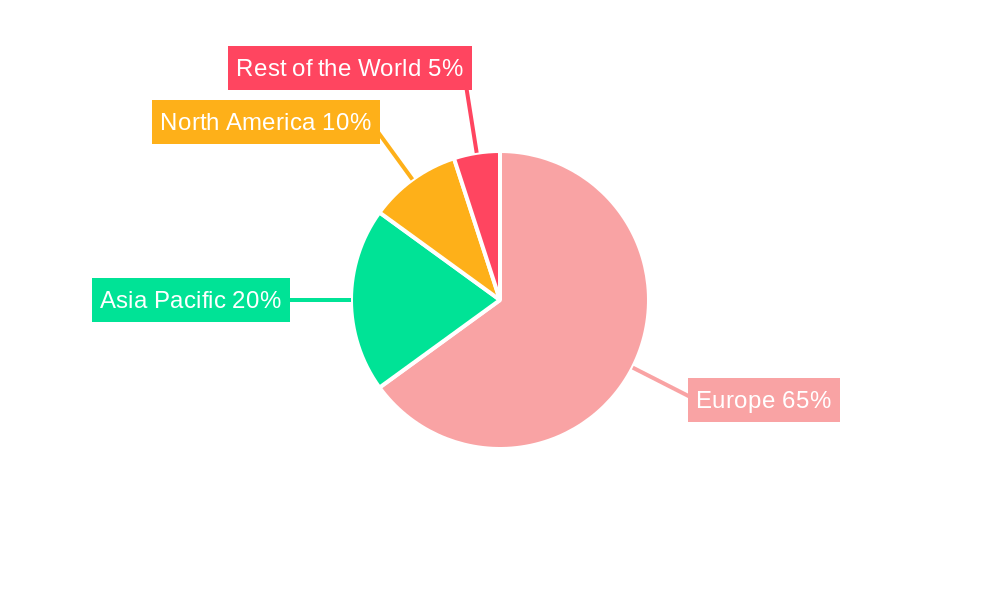

Sustained demand for reliable energy and ongoing decarbonization initiatives will propel the UK LNG market forward. The forecast period anticipates a significant increase in market value, supported by the development of new LNG regasification capacities and the optimization of existing infrastructure to enhance efficient import and distribution. Government initiatives promoting cleaner fuel adoption and carbon emission reduction will be instrumental in driving LNG utilization across diverse industries. While specific regional market share data for the UK is not detailed, its significant contribution to the European energy market underscores its importance. The market's resilience and adaptability to global supply fluctuations and price volatility will be crucial for its long-term success and sustained growth.

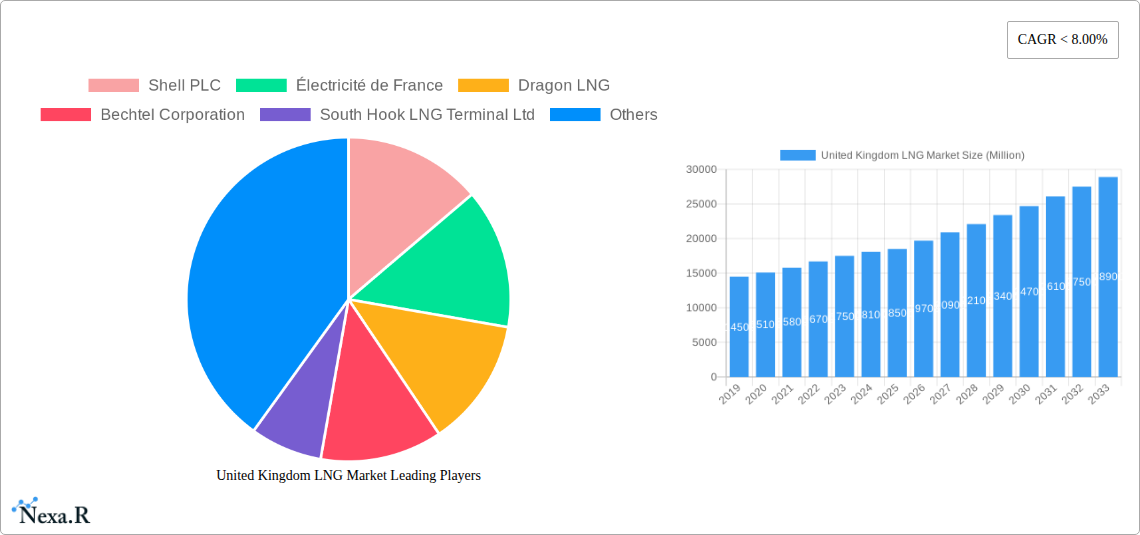

United Kingdom LNG Market Company Market Share

United Kingdom LNG Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the United Kingdom Liquefied Natural Gas (LNG) market, offering critical insights into its dynamics, growth trajectories, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report leverages high-traffic keywords and a detailed breakdown of parent and child markets to ensure maximum search engine visibility and deliver actionable intelligence to industry professionals.

United Kingdom LNG Market Market Dynamics & Structure

The United Kingdom LNG market exhibits a moderately concentrated structure, with key players like Shell PLC and Électricité de France (EDF) holding significant influence. Technological innovation is a crucial driver, particularly in areas such as liquefaction, regasification, and LNG bunkering technologies, enhancing efficiency and reducing operational costs. Regulatory frameworks, including government policies on energy security, decarbonization targets, and import/export regulations, play a pivotal role in shaping market entry and expansion strategies. The availability of competitive product substitutes, such as pipeline natural gas and renewable energy sources, presents a constant challenge, necessitating strategic pricing and supply chain optimization for LNG. End-user demographics are shifting, with growing demand from the power generation sector for grid stability and flexibility, alongside increasing adoption in the transportation sector for cleaner fuel alternatives. Merger and acquisition (M&A) trends are indicative of strategic consolidation and investment in infrastructure, with companies seeking to secure supply chains and expand their market reach.

- Market Concentration: Dominated by a few major energy corporations and infrastructure providers.

- Technological Innovation Drivers: Advancements in liquefaction, regasification efficiency, and LNG fueling technologies.

- Regulatory Frameworks: Energy security policies, net-zero targets, and import/export compliance.

- Competitive Product Substitutes: Pipeline natural gas, renewable energy sources, and alternative fuels.

- End-User Demographics: Increasing demand from power generation and transportation sectors.

- M&A Trends: Strategic consolidation and infrastructure investment shaping the competitive landscape.

United Kingdom LNG Market Growth Trends & Insights

The United Kingdom LNG market is projected to experience robust growth driven by escalating energy demands and a strategic imperative to diversify energy sources. The market size evolution is anticipated to reflect increased import volumes and enhanced regasification capacities. Adoption rates for LNG as a fuel in heavy-duty transport, shipping, and power generation are on an upward trajectory, fueled by stringent emission regulations and the pursuit of cleaner energy alternatives. Technological disruptions, including innovations in small-scale LNG infrastructure and advanced liquefaction technologies, are unlocking new market segments and applications. Consumer behavior shifts are evident, with industries prioritizing energy security and seeking reliable, flexible fuel options amidst volatile global energy markets. The forecast period from 2025 to 2033 is expected to witness a significant Compound Annual Growth Rate (CAGR), driven by a combination of these factors. The market penetration of LNG is set to increase as infrastructure development accelerates and the economic viability of LNG as a fuel source becomes more pronounced. This growth is underpinned by substantial investments in import terminals, storage facilities, and distribution networks.

Dominant Regions, Countries, or Segments in United Kingdom LNG Market

The Power Generation segment is a dominant force driving the United Kingdom LNG market. This dominance stems from the critical role LNG plays in ensuring energy security and grid stability, especially during periods of peak demand and when renewable energy sources are intermittent. The UK's commitment to reducing carbon emissions while maintaining a reliable energy supply makes LNG an attractive transitional fuel, capable of rapidly responding to fluctuating electricity needs. Infrastructure investments in regasification terminals and storage facilities, strategically located to serve major industrial hubs and power plants, further solidify this segment's leading position.

- Power Generation Dominance: LNG provides essential flexibility and reliability for the UK's electricity grid, complementing renewable energy sources and ensuring energy security.

- Infrastructure Investments: Development and expansion of regasification terminals and storage facilities, often in key coastal regions, directly support power generation needs.

- Economic Policies: Government incentives and policies aimed at decarbonizing the power sector indirectly favor LNG as a cleaner alternative to coal and oil.

- Growth Potential: Continued reliance on flexible generation sources will maintain strong demand for LNG in this segment.

The Transportation segment is also a significant growth area, with increasing adoption of LNG as a fuel for heavy-duty trucks, buses, and maritime vessels. This is propelled by:

- Environmental Regulations: Increasingly stringent emissions standards for transportation necessitate the adoption of cleaner fuels like LNG.

- Cost-Effectiveness: For long-haul transportation, LNG offers competitive fuel costs compared to diesel.

- Infrastructure Development: The growing network of LNG refueling stations is making LNG a more viable option for fleet operators.

While Other Applications, including industrial heating and feedstock, represent smaller but growing segments, the overall market growth is primarily propelled by the indispensable role of LNG in the Power Generation sector.

United Kingdom LNG Market Product Landscape

The United Kingdom LNG market is characterized by a spectrum of innovative products and applications designed to enhance efficiency and sustainability. Key product developments focus on optimizing liquefaction and regasification processes, leading to reduced energy consumption and lower operational costs. Advancements in small-scale LNG (ssLNG) infrastructure are enabling broader distribution and accessibility, catering to niche markets and remote locations. Furthermore, the performance metrics of LNG as a fuel, particularly its lower carbon emissions compared to traditional fossil fuels, are a significant selling point across all applications. Unique selling propositions revolve around reliability, price competitiveness, and adherence to evolving environmental standards, making LNG a crucial component of the UK's energy transition strategy. Technological advancements are also being made in the development of advanced LNG carriers and specialized storage solutions, ensuring safe and efficient transportation and handling of the commodity.

Key Drivers, Barriers & Challenges in United Kingdom LNG Market

The United Kingdom LNG market is propelled by several key drivers: a strong impetus for energy security and diversification away from single-source suppliers, increasing demand from the power generation sector for flexible and cleaner energy, and supportive government policies aimed at achieving net-zero emissions targets. Technological advancements in liquefaction, regasification, and transportation further enhance the market's attractiveness.

- Drivers:

- Energy Security & Diversification

- Growing Power Generation Demand

- Government Decarbonization Policies

- Technological Advancements

However, the market faces significant barriers and challenges. Supply chain disruptions and price volatility in the global LNG market pose considerable risks. The substantial capital investment required for LNG infrastructure development, including terminals and distribution networks, can be a deterrent. Furthermore, the competition from established renewable energy sources and the ongoing development of alternative fuels present a continuous challenge.

- Barriers & Challenges:

- Global Supply Chain Volatility & Price Fluctuations

- High Capital Investment for Infrastructure

- Competition from Renewable Energy Sources

- Regulatory Hurdles for New Project Approvals

Emerging Opportunities in United Kingdom LNG Market

Emerging opportunities within the United Kingdom LNG market are centered on the expansion of small-scale LNG (ssLNG) applications and the development of integrated energy solutions. Untapped markets include increased LNG adoption for maritime bunkering in major ports and the provision of off-grid energy solutions for industrial clusters. Innovative applications in the chemical industry as a feedstock also present growth potential. Evolving consumer preferences towards cleaner and more reliable energy sources further create avenues for market expansion, particularly in industrial and commercial sectors seeking to decarbonize their operations while ensuring energy resilience. The development of liquefaction capabilities for domestic gas resources, though limited, could also unlock niche opportunities.

Growth Accelerators in the United Kingdom LNG Market Industry

Several catalysts are driving long-term growth in the United Kingdom LNG market industry. Technological breakthroughs in floating liquefaction and regasification units (FLNG/FRU) are set to enhance flexibility and reduce the need for extensive land-based infrastructure. Strategic partnerships between energy companies, terminal operators, and end-users are crucial for securing long-term supply agreements and optimizing distribution networks. Market expansion strategies, including the development of new import routes and the increased use of LNG in sectors beyond power generation, will also accelerate growth. The ongoing global energy transition, with its emphasis on reducing carbon footprints, positions LNG as a vital transitional fuel, creating sustained demand.

Key Players Shaping the United Kingdom LNG Market Market

- Shell PLC

- Électricité de France

- Dragon LNG

- Bechtel Corporation

- South Hook LNG Terminal Ltd

- Ramboll Group A/S

- Fluor Corporation

- Npower Limited

Notable Milestones in United Kingdom LNG Market Sector

- August 2022: Houston-based Delfin LNG signed a deal to supply LNG to a United Kingdom energy company that plans to construct a floating LNG export terminal off Louisiana's coast. This agreement involves Delfin LNG providing 1 million metric tons of LNG annually to Centrica, an energy company located in Windsor, England, which owns British Gas and Bord Gais Energy.

In-Depth United Kingdom LNG Market Market Outlook

The future outlook for the United Kingdom LNG market is exceptionally promising, driven by robust growth accelerators and strategic opportunities. The continued emphasis on energy security, coupled with stringent decarbonization goals, will ensure sustained demand for LNG as a flexible and cleaner transitional fuel. Investments in advanced regasification infrastructure, alongside the expansion of small-scale LNG networks, will unlock new market segments and applications. Strategic partnerships and technological innovations in areas such as floating LNG solutions are poised to further enhance market efficiency and accessibility. The UK's commitment to a diversified energy portfolio positions LNG as a critical component, offering both reliability and a pathway towards lower carbon emissions, thus securing its vital role in the nation's energy landscape for the foreseeable future.

United Kingdom LNG Market Segmentation

-

1. Application

- 1.1. Power Generation

- 1.2. Transportation

- 1.3. Other Applications

United Kingdom LNG Market Segmentation By Geography

- 1. United Kingdom

United Kingdom LNG Market Regional Market Share

Geographic Coverage of United Kingdom LNG Market

United Kingdom LNG Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Drivers; Restraints

- 3.3. Market Restrains

- 3.3.1. 4.; Political Instability and Militant Attacks on Pipeline Infrastructure

- 3.4. Market Trends

- 3.4.1. Transportation Segment to dominate the market during the forecast period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom LNG Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation

- 5.1.2. Transportation

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Électricité de France

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dragon LNG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bechtel Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 South Hook LNG Terminal Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ramboll Group A/S

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fluor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Npower Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: United Kingdom LNG Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United Kingdom LNG Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom LNG Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: United Kingdom LNG Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: United Kingdom LNG Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: United Kingdom LNG Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom LNG Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the United Kingdom LNG Market?

Key companies in the market include Shell PLC, Électricité de France, Dragon LNG, Bechtel Corporation, South Hook LNG Terminal Ltd, Ramboll Group A/S, Fluor Corporation, Npower Limited.

3. What are the main segments of the United Kingdom LNG Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 462.69 million as of 2022.

5. What are some drivers contributing to market growth?

Drivers; Restraints.

6. What are the notable trends driving market growth?

Transportation Segment to dominate the market during the forecast period..

7. Are there any restraints impacting market growth?

4.; Political Instability and Militant Attacks on Pipeline Infrastructure.

8. Can you provide examples of recent developments in the market?

In August 2022, Houston-based Delfin LNG signed a deal to supply LNG to a United Kingdom energy company that plans to construct a floating LNG export terminal off Louisiana's coast. This agreement involves Delfin LNG providing 1 million metric tons of LNG annually to Centrica, an energy company located in Windsor, England, which owns British Gas and Bord Gais Energy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom LNG Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom LNG Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom LNG Market?

To stay informed about further developments, trends, and reports in the United Kingdom LNG Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence