Key Insights

The Swedish renewable energy sector is projected for substantial growth, with an estimated market size of $2 billion by 2024. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 11.29% through 2033. This expansion is propelled by robust government initiatives supporting decarbonization, significant investments in wind and solar power, and increasing corporate demand for green energy. Key drivers include ambitious climate targets, the ongoing fossil fuel phase-out, and technological advancements enhancing efficiency and reducing costs. Sweden's commitment to carbon neutrality by 2045 further solidifies its leadership in the global sustainable energy transition. The market prominently features wind energy (onshore and offshore), with a growing emphasis on solar photovoltaic (PV) and bioenergy. Investment is focused on capacity expansion and new project development.

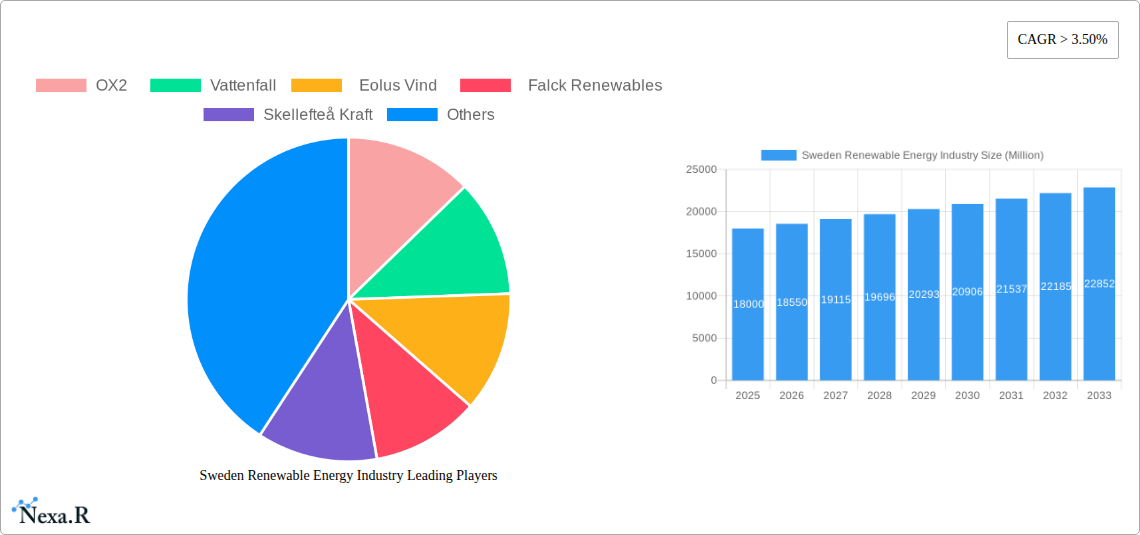

Sweden Renewable Energy Industry Market Size (In Billion)

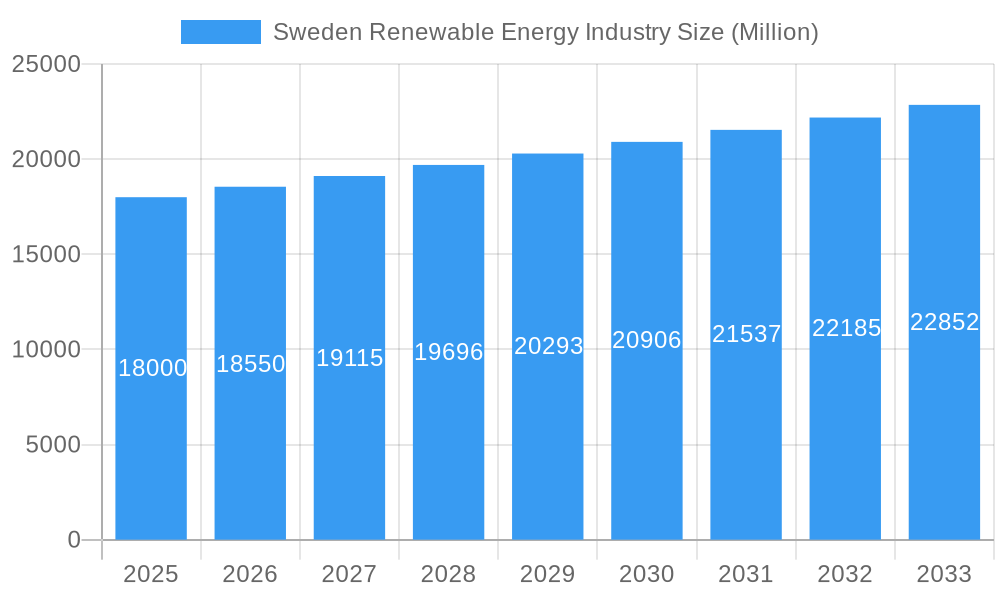

Transformative industry trends include the integration of energy storage for intermittency management, smart grid development for optimized energy distribution, and the rise of corporate Power Purchase Agreements (PPAs) offering stable revenue for developers. Leading companies like OX2, Vattenfall, Eolus Vind, Falck Renewables, and Skellefteå Kraft are instrumental in project development and operation. While challenges such as grid connection issues, permitting delays, and the need for continuous innovation exist, the overall outlook is positive, driven by a clear policy framework and a forward-looking energy generation strategy.

Sweden Renewable Energy Industry Company Market Share

This report provides an in-depth analysis of the Swedish renewable energy industry, a vital sector for national sustainability and economic growth. Covering the period from 2019 to 2033, with a base year of 2024, it offers comprehensive insights into market dynamics, growth trends, dominant regions, product landscape, key players, and emerging opportunities. Optimized for search engines with keywords like "Sweden renewable energy," "onshore wind Sweden," "solar energy Sweden," "biogas Sweden," and "green energy market," this analysis engages industry professionals, investors, and policymakers. We examine both parent and child markets for a holistic view of the evolving renewable energy ecosystem. All monetary values are presented in billions of units.

Sweden Renewable Energy Industry Market Dynamics & Structure

The Swedish renewable energy industry is characterized by a dynamic and evolving market structure, driven by a strong commitment to decarbonization and energy independence. Market concentration is moderately fragmented, with established players like Vattenfall and OX2 dominating large-scale projects, while emerging companies are carving out niches in specialized segments like biogas and distributed solar. Technological innovation remains a key driver, particularly in the advancement of wind turbine efficiency, battery storage solutions, and grid integration technologies for intermittent sources. Regulatory frameworks, including long-term power purchase agreements (PPAs) and tax incentives, are crucial in de-risking investments and fostering growth. Competitive product substitutes are primarily limited to fossil fuels, with a growing focus on electrification and hydrogen as alternative energy carriers. End-user demographics are shifting towards industrial and commercial sectors actively seeking to reduce their carbon footprint through renewable energy procurement. Mergers and acquisitions (M&A) are on an upward trend as companies seek to consolidate portfolios, acquire new technologies, or expand market reach.

- Market Concentration: Moderately fragmented with a mix of large utility-scale developers and smaller specialized firms.

- Technological Innovation Drivers: Increased efficiency in wind turbines, advancements in solar PV technology, development of energy storage solutions, and smart grid technologies.

- Regulatory Frameworks: Supportive government policies, carbon pricing mechanisms, and the EU's renewable energy directives.

- Competitive Product Substitutes: Primarily fossil fuels, with increasing interest in electrification and green hydrogen.

- End-User Demographics: Growing demand from industrial and commercial sectors for sustainable energy solutions, alongside continued residential adoption.

- M&A Trends: Consolidation of market players and acquisition of renewable energy assets to expand portfolios and technological capabilities.

Sweden Renewable Energy Industry Growth Trends & Insights

The Swedish renewable energy industry is poised for significant expansion, driven by ambitious national climate targets and a robust policy environment. The market size is projected to grow substantially over the forecast period, fueled by increasing investments in onshore wind, solar photovoltaic (PV), and bioenergy. Adoption rates for renewable energy technologies are consistently high, with Sweden often leading European counterparts in per capita renewable energy generation. Technological disruptions, such as the increasing efficiency and decreasing costs of solar panels and wind turbines, are accelerating the transition away from fossil fuels. Consumer behavior is shifting towards a greater demand for clean energy, with both individuals and corporations actively seeking sustainable energy sources and participating in distributed generation initiatives. The compound annual growth rate (CAGR) is expected to be robust, reflecting the ongoing expansion of existing capacities and the development of new renewable energy projects. Market penetration of renewable sources in the overall energy mix is continuously increasing, solidifying Sweden's position as a global leader in clean energy.

Market Size Evolution: The market is witnessing substantial growth driven by policy support and technological advancements. The total installed capacity for renewable energy sources is expected to continue its upward trajectory throughout the forecast period.

Adoption Rates: Sweden demonstrates a strong adoption rate for renewable energy technologies, particularly in onshore wind and solar PV, reflecting a high level of public and private sector commitment.

Technological Disruptions: Innovations in turbine technology, battery storage, and grid management are enhancing the reliability and cost-effectiveness of renewable energy sources.

Consumer Behavior Shifts: An increasing awareness of climate change and a desire for energy independence are driving demand for renewable energy solutions among both households and businesses.

Compound Annual Growth Rate (CAGR): The Swedish renewable energy market is anticipated to experience a healthy CAGR, underscoring its dynamic growth potential.

Market Penetration: The share of renewable energy in Sweden's total energy consumption is projected to rise significantly, contributing to the country's ambitious climate goals.

Dominant Regions, Countries, or Segments in Sweden Renewable Energy Industry

Within the Swedish renewable energy landscape, the Production Analysis segment emerges as the most dominant driver of market growth. This is largely attributable to the nation's vast natural resources, particularly for wind and hydropower, coupled with proactive government policies and significant private sector investment. The onshore wind energy sector, a key component of production, is experiencing unparalleled expansion, with regions in northern Sweden being particularly prominent due to favorable wind conditions and available land.

- Dominant Segment: Production Analysis

- Key Drivers: Abundant natural resources, favorable wind speeds in certain regions, supportive government incentives (e.g., the Swedish Environmental Protection Agency's Klimatklivet program), and significant private investment in large-scale projects.

- Market Share: Onshore wind and hydropower collectively hold the largest share of renewable energy production in Sweden.

- Growth Potential: Continued expansion of wind farms and ongoing optimization of hydropower facilities present substantial growth opportunities.

The Consumption Analysis segment also plays a crucial role, with increasing demand from industrial and commercial sectors aiming to decarbonize their operations. This is evident in the growing number of Power Purchase Agreements (PPAs) being signed, securing clean energy supplies. The Import Market Analysis (Value & Volume) for renewable energy technologies, such as solar panels and specialized wind turbine components, remains significant as Sweden continues to scale its renewable infrastructure. Conversely, the Export Market Analysis (Value & Volume) is primarily driven by electricity generated from renewable sources, particularly hydropower, which can be transmitted to neighboring Nordic countries. The Price Trend Analysis for renewable energy is influenced by global commodity prices, technological advancements, and the cost of grid integration, with a general trend towards decreasing costs for wind and solar energy over the long term.

- Consumption Analysis:

- Drivers: Industrial demand for sustainable energy, corporate climate targets, and increasing electrification of transport and heating.

- Key Industries: Manufacturing, forestry, and data centers are key consumers of renewable energy.

- Import Market Analysis (Value & Volume):

- Key Imports: Solar PV modules, specialized wind turbine components, and energy storage solutions.

- Value: Estimated to be in the hundreds of millions of units annually.

- Volume: Significant, reflecting the rapid deployment of renewable energy infrastructure.

- Export Market Analysis (Value & Volume):

- Key Exports: Electricity from hydropower and wind power to neighboring Nordic countries.

- Value: Contributes significantly to the national economy.

- Volume: Varies based on seasonal availability and demand from importing countries.

- Price Trend Analysis:

- Key Factors: Technological advancements, global supply chain dynamics, and government subsidies.

- Trend: Declining costs for wind and solar technologies, making them increasingly competitive.

Sweden Renewable Energy Industry Product Landscape

The product landscape within the Swedish renewable energy industry is diverse and rapidly evolving, with a strong focus on efficiency, scalability, and sustainability. Key products include advanced wind turbines designed for varying wind conditions, high-efficiency solar photovoltaic (PV) modules for both utility-scale farms and distributed rooftop installations, and sophisticated battery energy storage systems that enhance grid stability and reliability. Furthermore, the bioenergy sector is characterized by innovative solutions for biogas production from waste streams, offering a valuable source of renewable fuel and heat. Performance metrics are continuously improving, with higher capacity factors for wind and solar, longer lifespans for components, and reduced environmental footprints across the product lifecycle. Unique selling propositions often lie in the integration of smart technologies, predictive maintenance capabilities, and tailored solutions for specific industrial or commercial applications, all contributing to Sweden's green energy transition.

Key Drivers, Barriers & Challenges in Sweden Renewable Energy Industry

The Swedish renewable energy industry is propelled by several key drivers. Strong government commitment to achieving carbon neutrality by 2045, coupled with favorable policy incentives and a stable regulatory environment, provides a fertile ground for investment. Technological advancements in wind, solar, and battery storage are making these sources increasingly cost-competitive. Furthermore, growing public awareness and demand for sustainable energy solutions are creating a strong market pull.

- Key Drivers:

- Ambitious national climate targets (carbon neutrality by 2045).

- Supportive government policies and financial incentives.

- Technological innovation driving cost reductions and efficiency improvements.

- Increasing corporate and public demand for clean energy.

- Energy security concerns enhancing the appeal of domestic renewable sources.

However, the industry faces significant barriers and challenges. The intermittent nature of wind and solar power necessitates substantial investment in grid infrastructure upgrades and energy storage solutions. Securing adequate grid connection capacity and navigating complex permitting processes can cause project delays. Supply chain vulnerabilities for critical components and the availability of skilled labor also pose potential constraints. Furthermore, ensuring the long-term economic viability of projects amidst fluctuating energy prices and evolving market dynamics requires careful planning and robust business models.

- Barriers & Challenges:

- Intermittency of renewable sources requiring grid modernization and storage.

- Permitting complexities and lengthy approval processes.

- Grid connection capacity limitations.

- Supply chain disruptions and reliance on imported components.

- Availability of skilled workforce for installation and maintenance.

- Ensuring long-term economic viability and price stability.

Emerging Opportunities in Sweden Renewable Energy Industry

Emerging opportunities in the Swedish renewable energy sector are abundant and span across various technological and market segments. The expansion of offshore wind power presents a significant untapped market, with Sweden's extensive coastline offering considerable potential. Advancements in green hydrogen production, powered by renewable electricity, are opening new avenues for decarbonizing heavy industry and transportation. Furthermore, the development of smart grid technologies and integrated energy systems offers opportunities for enhanced efficiency and flexibility. Evolving consumer preferences are also driving demand for innovative energy-as-a-service models and community-based renewable energy projects, fostering greater citizen engagement and local benefits. The circular economy principles are increasingly being integrated, creating opportunities in waste-to-energy solutions and the recycling of renewable energy components.

Growth Accelerators in the Sweden Renewable Energy Industry Industry

Several catalysts are driving the long-term growth of the Swedish renewable energy industry. Continued technological breakthroughs, particularly in areas such as advanced battery chemistries for energy storage, more efficient solar cells, and next-generation wind turbine designs, will further reduce costs and improve performance. Strategic partnerships between energy developers, technology providers, and industrial off-takers are crucial for de-risking large-scale projects and ensuring market access. Market expansion strategies, including exploring new geographical areas within Sweden for renewable deployment and fostering cross-border energy cooperation, will also play a vital role. The ongoing push towards electrification across multiple sectors, from transport to heating, will create sustained demand for clean electricity.

Key Players Shaping the Sweden Renewable Energy Industry Market

- OX2

- Vattenfall

- Eolus Vind

- Falck Renewables

- Skellefteå Kraft

- Cloudberry Clean Energy

- Scandinavian Biogas

- Alight

Notable Milestones in Sweden Renewable Energy Industry Sector

- February 2022: Cloudberry Clean Energy secured the 18 MW Munkhyttan Vindkraft onshore wind project in Lindesberg, Sweden, in its late stage of development, negotiating with Eno-Energy for three 6 MW turbines, with commercial operation expected by 2023/2024. Cloudberry also initiated permit applications for a second phase, the 18 MW Munkhyttan 2 project.

- December 2021: Scandinavian Biogas announced plans to build a biogas plant in Grimhult, Sweden, with an investment of EUR 48.6 million, supported by EUR 14.9 million from Klimatklivet. The project will process 300,000 tons of agricultural waste annually to produce approximately 120 GWh of bio-LNG.

- October 2021: Alight announced the development of three solar farms totaling 90 MW. Commercial PPAs were signed with Martin and Servera for an 18 MW project (expected Q2 2022), Axfood for a 40 MW park (expected H1 2023), and Axel Johnson AB for a 30 MW park (expected H1 2023).

In-Depth Sweden Renewable Energy Industry Market Outlook

The future outlook for the Swedish renewable energy industry is exceptionally bright, driven by a confluence of supportive governmental policies, technological advancements, and growing environmental consciousness. The market is expected to experience robust growth in both onshore wind and solar PV capacity, with a significant increase in investment anticipated over the next decade. The development of green hydrogen infrastructure, powered by abundant renewable electricity, presents a transformative opportunity for decarbonizing hard-to-abate sectors and positioning Sweden as a leader in sustainable fuels. Furthermore, the ongoing modernization of the grid and the integration of advanced energy storage solutions will enhance the reliability and flexibility of the renewable energy system. Strategic collaborations and innovative business models will be crucial in unlocking the full potential of this dynamic sector, contributing significantly to Sweden's sustainability goals and economic prosperity.

Sweden Renewable Energy Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

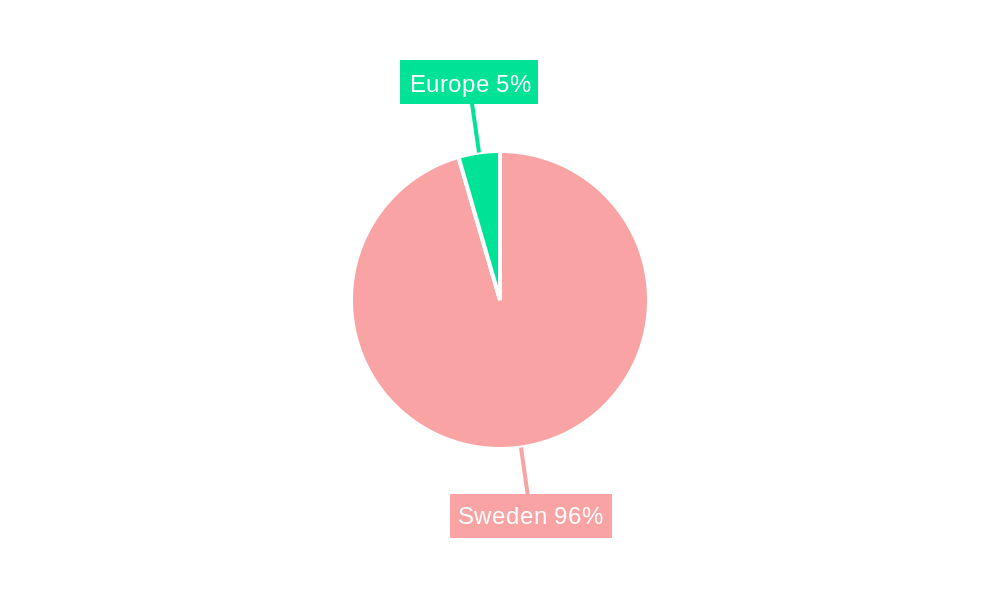

Sweden Renewable Energy Industry Segmentation By Geography

- 1. Sweden

Sweden Renewable Energy Industry Regional Market Share

Geographic Coverage of Sweden Renewable Energy Industry

Sweden Renewable Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrial Operations

- 3.3. Market Restrains

- 3.3.1. 4.; Advancement in Technology such as Photovoltic (PV)Cell

- 3.4. Market Trends

- 3.4.1. Hydro Energy is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Renewable Energy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OX2

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vattenfall

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eolus Vind

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Falck Renewables

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skellefteå Kraft

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 OX2

List of Figures

- Figure 1: Sweden Renewable Energy Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden Renewable Energy Industry Share (%) by Company 2025

List of Tables

- Table 1: Sweden Renewable Energy Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Production Analysis 2020 & 2033

- Table 3: Sweden Renewable Energy Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Sweden Renewable Energy Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Sweden Renewable Energy Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Sweden Renewable Energy Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Sweden Renewable Energy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Region 2020 & 2033

- Table 13: Sweden Renewable Energy Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Production Analysis 2020 & 2033

- Table 15: Sweden Renewable Energy Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Sweden Renewable Energy Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Sweden Renewable Energy Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Sweden Renewable Energy Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Sweden Renewable Energy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Sweden Renewable Energy Industry Volume watt-hours per liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Renewable Energy Industry?

The projected CAGR is approximately 11.29%.

2. Which companies are prominent players in the Sweden Renewable Energy Industry?

Key companies in the market include OX2 , Vattenfall, Eolus Vind , Falck Renewables, Skellefteå Kraft.

3. What are the main segments of the Sweden Renewable Energy Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrial Operations.

6. What are the notable trends driving market growth?

Hydro Energy is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Advancement in Technology such as Photovoltic (PV)Cell.

8. Can you provide examples of recent developments in the market?

In February 2022, Cloudberry Clean Energy secured the 18 MW Munkhyttan Vindkraft onshore wind in Lindesberg, Sweden, which is in the late stage of development. The company announced that it was in the final stage of negotiations with the German turbine supplier Eno-Energy for three 6 MW turbines for the project, and the project is expected to commence commercial operation by 2023/2024. Cloudberry has also secured options under the same terms to develop a second phase, the 18MW Munkhyttan 2 project, and has already started the permit application process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in watt-hours per liter.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Renewable Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Renewable Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Renewable Energy Industry?

To stay informed about further developments, trends, and reports in the Sweden Renewable Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence