Key Insights

The South & Central America Smart Grid Industry is projected for substantial growth, anticipated to reach approximately $66.1 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 9%. This expansion is fueled by significant investments in modernizing aging electrical infrastructure, the critical need for enhanced grid reliability, and the increasing integration of renewable energy sources. Key growth drivers include government initiatives promoting energy efficiency, rising demand for dependable power in underserved areas, and the imperative to reduce transmission and distribution losses. The accelerated adoption of Advanced Metering Infrastructure (AMI) enables real-time data, empowering utilities to optimize operations, manage demand, and prevent outages. Demand Response programs are also vital for balancing supply and demand, particularly with renewable energy intermittency, fostering a stable and resilient power ecosystem.

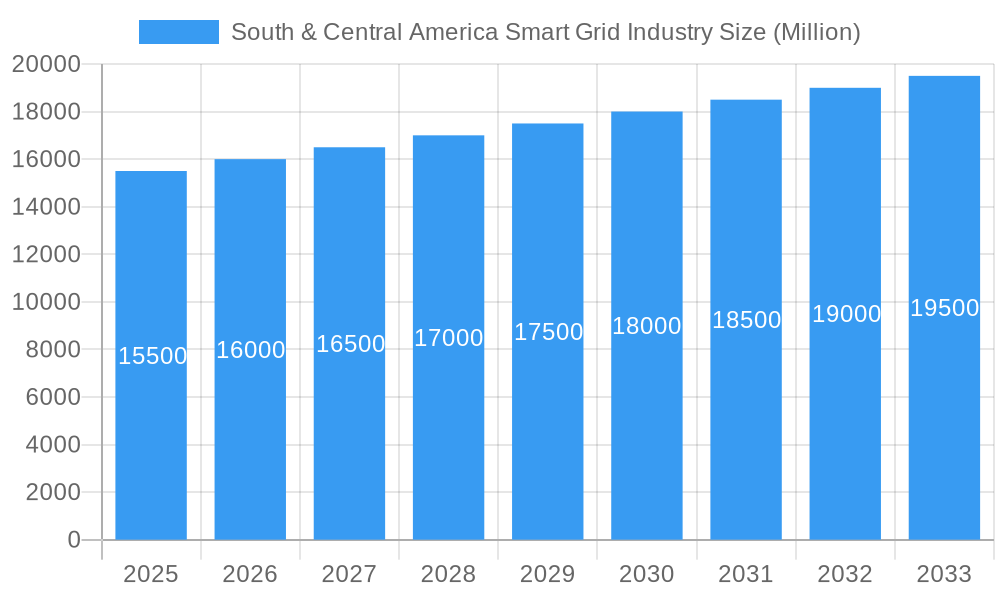

South & Central America Smart Grid Industry Market Size (In Billion)

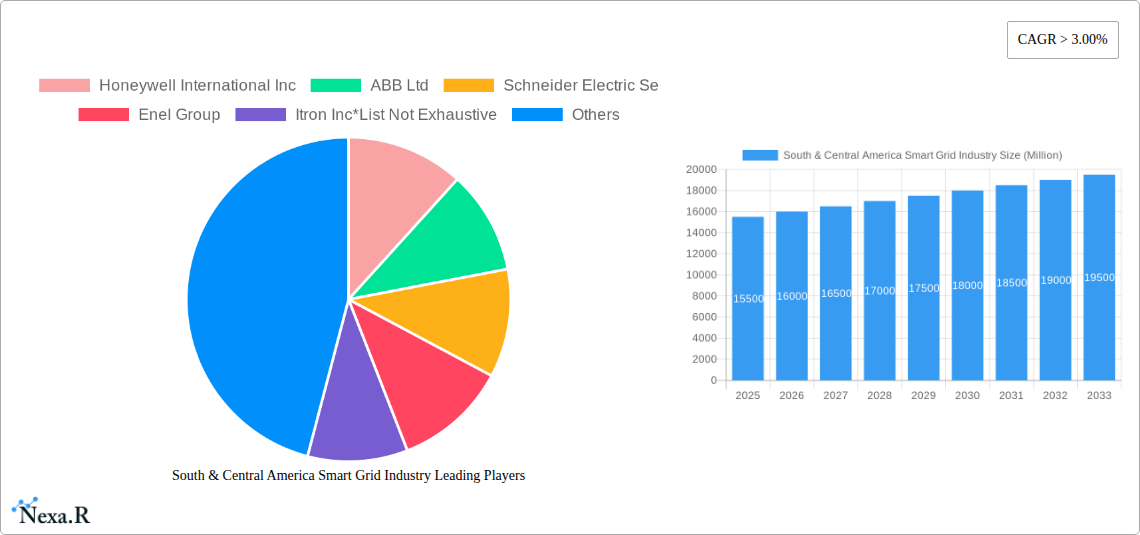

The market is shaped by technological advancements and evolving regulatory frameworks. Leading global companies such as Honeywell International Inc., ABB Ltd, Schneider Electric SE, Siemens AG, and General Electric Company are actively deploying smart grid solutions across South and Central America. While Brazil and Argentina are mature markets, Chile and the broader "Rest of South and Central America" are emerging as high-growth regions due to supportive government policies and infrastructure needs. Challenges such as high upfront investment, cybersecurity concerns, and the need for skilled workforce development are being addressed through strategic partnerships and capacity-building initiatives. The ongoing digital transformation in the energy sector, coupled with a growing emphasis on sustainability, will continue to drive demand for innovative smart grid solutions in the region.

South & Central America Smart Grid Industry Company Market Share

South & Central America Smart Grid Industry Market Dynamics & Structure

The South & Central America smart grid industry is characterized by a moderately consolidated market structure, with major players like Honeywell International Inc, ABB Ltd, Schneider Electric Se, and Siemens AG holding significant influence. Technological innovation is primarily driven by the increasing demand for grid modernization, renewable energy integration, and enhanced grid reliability. Regulatory frameworks are gradually evolving, with governments in key markets like Brazil and Chile implementing policies to encourage smart grid adoption and investment. Competitive product substitutes include traditional grid infrastructure, but the inherent benefits of smart grids – efficiency, resilience, and data-driven decision-making – are rapidly outpacing these alternatives. End-user demographics are shifting towards a more digitally connected populace, demanding reliable and sustainable energy solutions. Mergers and acquisitions (M&A) activity is present, albeit at a moderate pace, as larger companies seek to expand their portfolios and market reach. For instance, a recent M&A deal in 2023 saw a regional utility acquire a smart meter provider to bolster its AMI capabilities, indicating a trend towards vertical integration. Barriers to innovation include the high upfront cost of smart grid deployment and the need for standardized interoperability across diverse legacy systems.

- Market Concentration: Moderately consolidated with a few dominant players.

- Technological Innovation Drivers: Renewable energy integration, grid modernization, energy efficiency.

- Regulatory Frameworks: Evolving government policies supporting smart grid development.

- Competitive Substitutes: Traditional grid infrastructure, but with diminishing relevance.

- End-User Demographics: Growing demand for reliable, sustainable, and digitally-enabled energy services.

- M&A Trends: Moderate activity focused on portfolio expansion and capability enhancement.

- Innovation Barriers: High initial investment, system interoperability challenges.

South & Central America Smart Grid Industry Growth Trends & Insights

The South & Central America smart grid industry is poised for robust expansion, driven by a confluence of factors that are reshaping the energy landscape. The market size is projected to grow from an estimated $15,500 million in the base year of 2025 to a substantial $45,000 million by the end of the forecast period in 2033, exhibiting a compound annual growth rate (CAGR) of approximately 10.5%. This significant uplift is fueled by increasing investments in grid modernization initiatives across the region. Adoption rates for smart grid technologies are accelerating, particularly in Advanced Metering Infrastructure (AMI) and transmission upgrades, as utilities strive to improve operational efficiency and reduce non-technical losses. Technological disruptions, such as the integration of AI and IoT in grid management systems, are enabling predictive maintenance and real-time anomaly detection, thereby enhancing grid resilience. Consumer behavior shifts are also playing a crucial role, with a growing demand for real-time energy consumption data, demand response programs, and integration of distributed energy resources (DERs). The push towards cleaner energy sources and the need to manage the intermittency of renewables are further compelling utilities to invest in smarter, more flexible grids. For example, the penetration of smart meters, a key component of AMI, is expected to rise from 40% in 2025 to over 75% by 2033, reflecting the rapid adoption of these technologies. Furthermore, the increasing frequency of extreme weather events is highlighting the importance of a resilient and responsive grid infrastructure, leading to greater investment in smart grid solutions that can mitigate disruptions and restore power more quickly. This evolving ecosystem presents a dynamic growth trajectory for the South & Central American smart grid market.

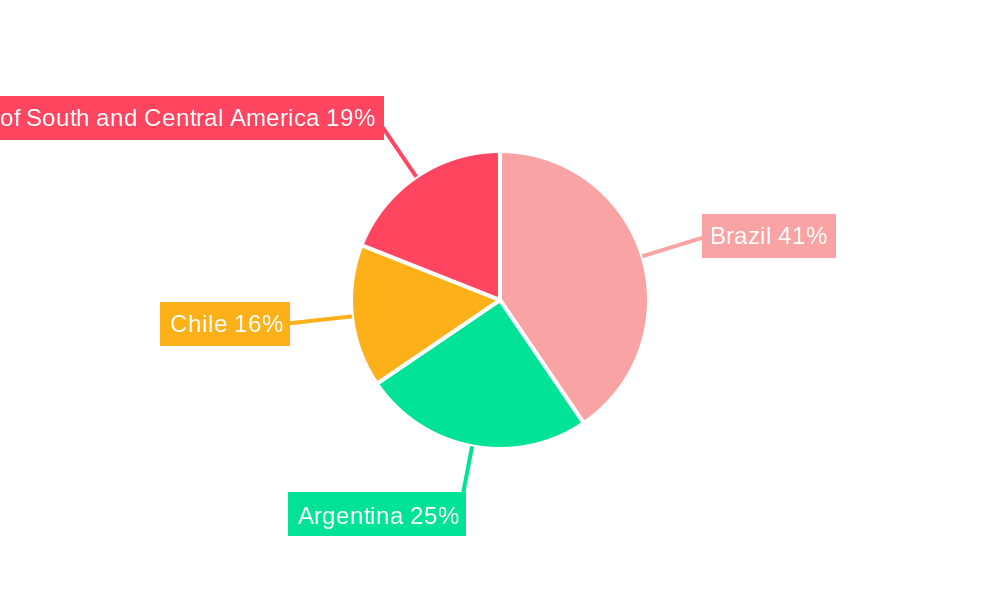

Dominant Regions, Countries, or Segments in South & Central America Smart Grid Industry

Brazil unequivocally stands as the dominant force within the South & Central America smart grid industry, driven by its sheer market size, proactive policy initiatives, and substantial investments in grid modernization. The country’s vast energy consumption and its commitment to integrating a growing share of renewable energy sources necessitate a highly sophisticated and resilient grid infrastructure. Brazil's smart grid market is projected to command a significant portion, estimated at 35% of the total regional market share in 2025, with continued strong growth expected throughout the forecast period. This dominance is further bolstered by large-scale pilot projects and widespread deployment of Advanced Metering Infrastructure (AMI), aimed at improving billing accuracy and reducing energy losses.

- Brazil: Leads due to market size, renewable energy integration goals, and government support for smart grid initiatives. Its extensive transmission and distribution network requires significant upgrades, making it a prime market for smart grid technologies.

- Key Drivers: National energy plans promoting renewables, large-scale AMI deployments, significant utility investment in grid modernization, favorable regulatory incentives for smart grid adoption.

- Market Share Projection (2025): Approximately 35% of the South & Central America smart grid market.

- Growth Potential: High, driven by ongoing modernization projects and increasing demand for grid reliability.

Chile, another significant player, is characterized by its progressive stance on renewable energy, particularly solar and wind power. The country’s geographically dispersed population and the need to manage decentralized energy generation make smart grid technologies essential for efficient grid operation. Chile’s smart grid market is anticipated to hold a 18% market share in 2025, with its focus on grid stability and demand-side management contributing to its growth.

- Chile: Strong focus on renewable energy integration and grid stability, coupled with a proactive regulatory environment.

- Key Drivers: Ambitious renewable energy targets, need for advanced grid management for intermittent sources, government support for smart grid innovation, and a mature regulatory framework.

- Market Share Projection (2025): Approximately 18% of the South & Central America smart grid market.

- Growth Potential: Moderate to high, fueled by ongoing decarbonization efforts and smart grid technology adoption.

Argentina, while facing economic complexities, is also demonstrating a growing commitment to smart grid development, particularly in enhancing transmission capabilities and reducing energy losses. The country is projected to account for roughly 12% of the regional market share in 2025.

- Argentina: Increasing investment in grid modernization and transmission upgrades, with a growing emphasis on smart grid solutions to address energy efficiency challenges.

- Key Drivers: Efforts to improve energy efficiency and reduce losses, modernization of aging infrastructure, and a gradual adoption of smart grid technologies in key urban centers.

- Market Share Projection (2025): Approximately 12% of the South & Central America smart grid market.

- Growth Potential: Moderate, contingent on economic stability and consistent policy implementation.

The "Rest of South and Central America" segment, encompassing countries like Colombia, Peru, Mexico, and Central American nations, collectively represents a substantial and growing market. While individual country contributions may be smaller, the aggregate potential is significant, driven by similar trends of renewable energy integration and grid modernization. This segment is expected to hold the remaining 35% of the market share in 2025.

- Rest of South and Central America: Diverse market with growing adoption across multiple countries, driven by a collective push for modernization and renewable energy.

- Key Drivers: Increasing awareness of smart grid benefits, growing demand for reliable power, and targeted investments in specific technology applications like AMI and grid automation.

- Market Share Projection (2025): Approximately 35% of the South & Central America smart grid market.

- Growth Potential: Strong and diversified, with emerging opportunities in various nations as their energy sectors evolve.

Among the technology application areas, Advanced Metering Infrastructure (AMI) is emerging as the primary growth engine, with its widespread deployment contributing significantly to the overall market expansion. Transmission upgrades and demand response solutions also represent key segments driving innovation and investment in the region.

South & Central America Smart Grid Industry Product Landscape

The product landscape for the South & Central America smart grid industry is characterized by a robust suite of interconnected solutions designed to enhance grid efficiency, reliability, and sustainability. Key offerings include advanced smart meters, which provide real-time data on energy consumption, enabling better demand management and reducing utility operational costs. Grid automation systems, incorporating intelligent electronic devices (IEDs) and substation automation technologies, are crucial for optimizing power flow and enabling rapid fault detection and isolation. Communication networks, leveraging fiber optics, cellular, and radio frequency technologies, form the backbone for seamless data exchange between grid components and control centers. Software solutions encompassing grid management platforms, energy analytics, and customer engagement portals are also vital for leveraging the data generated by smart grid devices. The performance metrics of these products are increasingly focused on improved uptime, reduced energy losses (estimated to be reduced by 5-10% through AMI), faster restoration times after outages (potentially by 20-30%), and enhanced cybersecurity. Unique selling propositions often revolve around interoperability, scalability, and advanced analytics capabilities that empower utilities with actionable insights.

Key Drivers, Barriers & Challenges in South & Central America Smart Grid Industry

Key Drivers: The South & Central America smart grid industry is propelled by a strong imperative to modernize aging grid infrastructure, facilitate the integration of growing renewable energy sources like solar and wind power, and enhance overall grid reliability and resilience. Government policies and regulatory mandates promoting energy efficiency and smart grid adoption are critical catalysts. Furthermore, the increasing demand for reliable and sustainable energy solutions from a growing and increasingly urbanized population, coupled with the desire to reduce non-technical energy losses, are significant drivers. The need to improve the efficiency of transmission and distribution networks, particularly in large and geographically diverse countries, also fuels investment.

Key Barriers & Challenges: Despite promising growth, the industry faces significant hurdles. High upfront capital expenditure for deploying smart grid technologies remains a primary barrier, especially for utilities with limited financial resources. Regulatory uncertainty and slow-moving policy reforms in some countries can hinder investment. The lack of standardized communication protocols and interoperability issues between different vendors' equipment can lead to complex integration challenges and increased costs. Cybersecurity threats to smart grid infrastructure are a growing concern, requiring substantial investment in robust security measures. Workforce skills gaps in areas like data analytics and cybersecurity also pose a challenge, necessitating investment in training and development. Supply chain disruptions, particularly for specialized components, can also impact project timelines and costs. For example, a delay in the supply of advanced microprocessors could push back the deployment of smart meters by 6-12 months, impacting the overall market growth trajectory.

Emerging Opportunities in South & Central America Smart Grid Industry

Emerging opportunities in the South & Central America smart grid industry lie in the burgeoning demand for grid-edge intelligence and distributed energy resource (DER) management. The increasing adoption of electric vehicles (EVs) and the development of smart charging infrastructure present a significant opportunity for utilities to integrate these assets into the grid for load balancing and grid support. Furthermore, the development of microgrids for remote communities and critical infrastructure offers a pathway to enhanced energy resilience and access. The growing focus on energy efficiency programs, leveraging smart grid data for targeted interventions, is another promising avenue. Opportunities also exist in leveraging advanced analytics and artificial intelligence for predictive maintenance, grid optimization, and enhanced customer engagement. The potential for expanding smart grid solutions to smaller utilities and municipal power providers, offering tailored and cost-effective solutions, represents a largely untapped market segment.

Growth Accelerators in the South & Central America Smart Grid Industry Industry

Several catalysts are accelerating long-term growth in the South & Central America smart grid industry. Technological breakthroughs in areas like artificial intelligence for grid optimization, advanced sensor technologies for real-time monitoring, and more robust cybersecurity solutions are continuously enhancing the capabilities and attractiveness of smart grids. Strategic partnerships between technology providers, utilities, and government agencies are crucial for fostering innovation and facilitating large-scale deployments. Market expansion strategies, including the development of innovative financing models and public-private partnerships, are helping to overcome financial barriers. The increasing global emphasis on decarbonization and the transition to a cleaner energy future will continue to drive demand for the flexible and efficient grids that smart grid technologies enable. Furthermore, the growing understanding of the economic benefits derived from reduced energy losses, improved operational efficiency, and enhanced grid reliability is spurring further investment and adoption.

Key Players Shaping the South & Central America Smart Grid Industry Market

- Honeywell International Inc

- ABB Ltd

- Schneider Electric Se

- Enel Group

- Itron Inc

- Cisco Systems Inc

- Siemens AG

- General Electric Company

Notable Milestones in South & Central America Smart Grid Industry Sector

- 2023: Several countries in the region announced ambitious targets for renewable energy integration, necessitating significant smart grid investments.

- 2022: Major utilities in Brazil and Chile initiated large-scale rollouts of Advanced Metering Infrastructure (AMI) systems, significantly increasing smart meter penetration.

- 2021: Regional governments introduced new regulations and incentive programs to encourage private sector investment in smart grid technologies.

- 2020: Several pilot projects focusing on grid modernization and demand response management were successfully completed, demonstrating the effectiveness of smart grid solutions.

- 2019: The market saw increased M&A activity as larger technology providers acquired specialized smart grid solution companies to expand their regional presence and offerings.

In-Depth South & Central America Smart Grid Industry Market Outlook

The South & Central America smart grid industry is on an upward trajectory, driven by a clear need for modernized, resilient, and sustainable energy infrastructure. Growth accelerators, including technological advancements in AI and IoT, strategic collaborations, and innovative financing models, are poised to propel the market forward. The increasing global commitment to decarbonization and the successful demonstration of smart grid benefits in pilot projects are instilling greater confidence and encouraging substantial investments. Future market potential is immense, particularly in leveraging smart grid capabilities to manage the increasing influx of renewable energy and to build more resilient energy systems capable of withstanding climate-related challenges. Strategic opportunities lie in focusing on comprehensive grid modernization, developing advanced solutions for DER integration, and expanding smart grid adoption across a wider range of countries and utility types within the region. The industry is expected to witness continued expansion and innovation in the coming years.

South & Central America Smart Grid Industry Segmentation

-

1. Technology Application Area

- 1.1. Transmission

- 1.2. Demand Response

- 1.3. Advanced Metering Infrastructure (AMI)

- 1.4. Other Technology Application Areas

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Chile

- 2.4. Rest of South and Central America

South & Central America Smart Grid Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Chile

- 4. Rest of South and Central America

South & Central America Smart Grid Industry Regional Market Share

Geographic Coverage of South & Central America Smart Grid Industry

South & Central America Smart Grid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuation in Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Advanced Metering Infrastructure to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South & Central America Smart Grid Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 5.1.1. Transmission

- 5.1.2. Demand Response

- 5.1.3. Advanced Metering Infrastructure (AMI)

- 5.1.4. Other Technology Application Areas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Chile

- 5.2.4. Rest of South and Central America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Chile

- 5.3.4. Rest of South and Central America

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 6. Brazil South & Central America Smart Grid Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 6.1.1. Transmission

- 6.1.2. Demand Response

- 6.1.3. Advanced Metering Infrastructure (AMI)

- 6.1.4. Other Technology Application Areas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Chile

- 6.2.4. Rest of South and Central America

- 6.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 7. Argentina South & Central America Smart Grid Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 7.1.1. Transmission

- 7.1.2. Demand Response

- 7.1.3. Advanced Metering Infrastructure (AMI)

- 7.1.4. Other Technology Application Areas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Chile

- 7.2.4. Rest of South and Central America

- 7.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 8. Chile South & Central America Smart Grid Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 8.1.1. Transmission

- 8.1.2. Demand Response

- 8.1.3. Advanced Metering Infrastructure (AMI)

- 8.1.4. Other Technology Application Areas

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Chile

- 8.2.4. Rest of South and Central America

- 8.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 9. Rest of South and Central America South & Central America Smart Grid Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 9.1.1. Transmission

- 9.1.2. Demand Response

- 9.1.3. Advanced Metering Infrastructure (AMI)

- 9.1.4. Other Technology Application Areas

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Chile

- 9.2.4. Rest of South and Central America

- 9.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Schneider Electric Se

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Enel Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Itron Inc*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cisco Systems Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Siemens AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 General Electric Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: South & Central America Smart Grid Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South & Central America Smart Grid Industry Share (%) by Company 2025

List of Tables

- Table 1: South & Central America Smart Grid Industry Revenue billion Forecast, by Technology Application Area 2020 & 2033

- Table 2: South & Central America Smart Grid Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: South & Central America Smart Grid Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South & Central America Smart Grid Industry Revenue billion Forecast, by Technology Application Area 2020 & 2033

- Table 5: South & Central America Smart Grid Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South & Central America Smart Grid Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: South & Central America Smart Grid Industry Revenue billion Forecast, by Technology Application Area 2020 & 2033

- Table 8: South & Central America Smart Grid Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: South & Central America Smart Grid Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: South & Central America Smart Grid Industry Revenue billion Forecast, by Technology Application Area 2020 & 2033

- Table 11: South & Central America Smart Grid Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South & Central America Smart Grid Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South & Central America Smart Grid Industry Revenue billion Forecast, by Technology Application Area 2020 & 2033

- Table 14: South & Central America Smart Grid Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: South & Central America Smart Grid Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South & Central America Smart Grid Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the South & Central America Smart Grid Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Schneider Electric Se, Enel Group, Itron Inc*List Not Exhaustive, Cisco Systems Inc, Siemens AG, General Electric Company.

3. What are the main segments of the South & Central America Smart Grid Industry?

The market segments include Technology Application Area, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Oil and Gas Industry4.; Rapid Growth in the Industrial Sector.

6. What are the notable trends driving market growth?

Advanced Metering Infrastructure to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Fluctuation in Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South & Central America Smart Grid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South & Central America Smart Grid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South & Central America Smart Grid Industry?

To stay informed about further developments, trends, and reports in the South & Central America Smart Grid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence