Key Insights

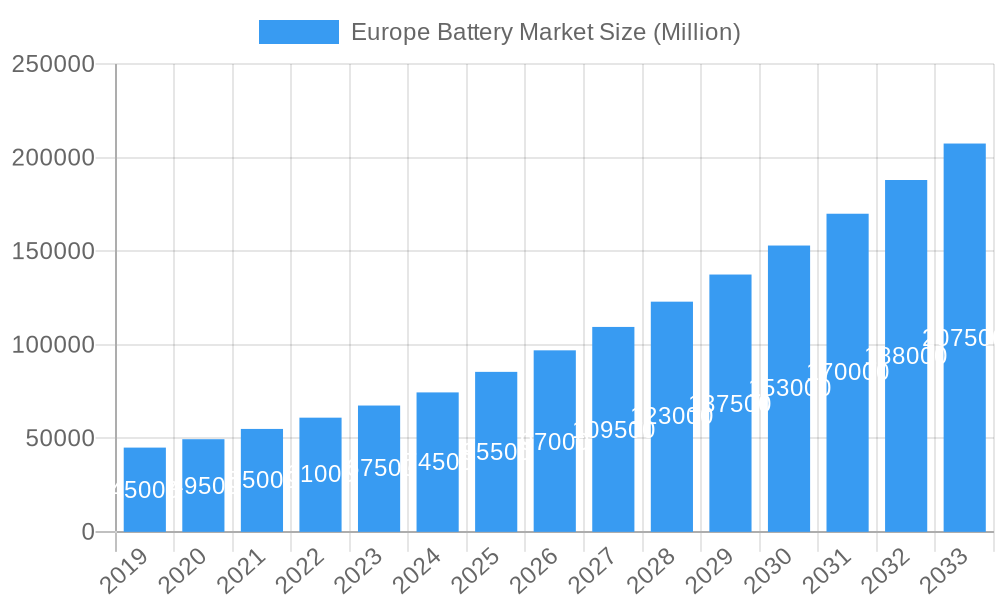

The European battery market is projected for substantial growth, anticipating a market size of $30.4 billion by 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 10.28%, forecasting a robust trajectory through 2033. Key growth drivers include the increasing adoption of electric vehicles (EVs), hybrid (HEV), and plug-in hybrid (PHEV) models. Supportive government policies promoting sustainable transport and rising consumer environmental awareness are significant catalysts. Beyond automotive applications, advancements in consumer electronics and critical industrial energy storage solutions are further stimulating market demand.

Europe Battery Market Market Size (In Billion)

Market segmentation highlights the dominance of lithium-ion batteries, attributed to their high energy density and performance, particularly in EVs and portable electronics. While lead-acid batteries maintain a presence in specific industrial and automotive backup applications, newer technologies are gaining traction. Emerging solutions, such as solid-state batteries, are expected to drive long-term innovation and adoption. Geographically, Europe exhibits a concentrated manufacturing and consumption base, with Germany, France, and the United Kingdom anticipated to lead in the production and uptake of advanced battery technologies.

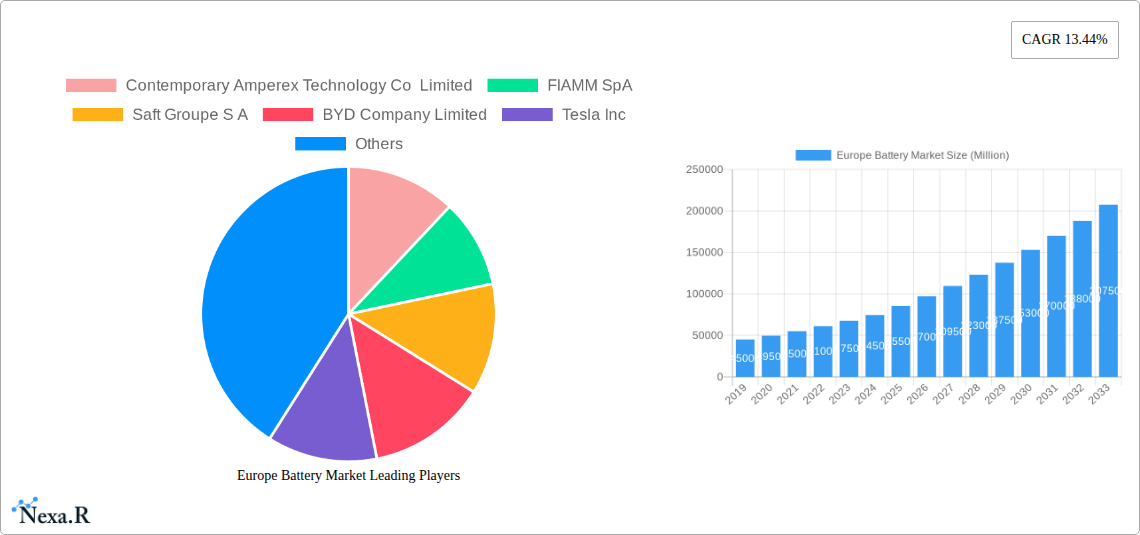

Europe Battery Market Company Market Share

Europe Battery Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Europe battery market, encompassing primary batteries, secondary batteries, and their diverse applications across automotive (HEV, PHEV, and EV), industrial, and consumer electronics sectors. Leveraging extensive data and expert insights, we dissect market dynamics, growth trends, regional dominance, product landscapes, and the strategic implications of key players for the 2019-2033 period, with a base and estimated year of 2025 and a forecast period of 2025-2033. Gain a competitive edge with crucial intelligence on lithium-ion batteries, lead-acid batteries, and emerging technologies.

Europe Battery Market Market Dynamics & Structure

The Europe battery market exhibits a moderately concentrated structure, driven by significant investments and strategic partnerships within the electric vehicle (EV) battery sector. Technological innovation remains a paramount driver, particularly in enhancing energy density, charging speed, and lifespan for lithium-ion batteries. Regulatory frameworks, such as the European Green Deal, are increasingly shaping market dynamics by promoting sustainable battery manufacturing and battery recycling. Competitive product substitutes exist, with advancements in solid-state batteries posing a long-term challenge to current lithium-ion dominance. End-user demographics are shifting towards environmentally conscious consumers and industries seeking cleaner energy solutions. Mergers and acquisitions (M&A) activity is on the rise as established players aim to secure market share and acquire innovative technologies.

- Market Concentration: Dominated by a few key global players, with increasing fragmentation due to new entrants focusing on niche applications and sustainable solutions.

- Technological Innovation Drivers: Focus on high energy density, faster charging capabilities, improved safety, and longer cycle life for secondary batteries.

- Regulatory Frameworks: EU directives on emissions reduction, battery passports, and battery recycling are crucial influencing factors.

- Competitive Product Substitutes: Emerging technologies like solid-state batteries and alternative chemistries for lithium-ion batteries.

- End-User Demographics: Growing demand from the automotive sector, driven by EV adoption, and increasing reliance on portable electronics.

- M&A Trends: Strategic acquisitions and joint ventures to gain access to manufacturing capacity, raw materials, and advanced battery technologies.

Europe Battery Market Growth Trends & Insights

The Europe battery market is poised for substantial expansion, propelled by a confluence of factors including the accelerating adoption of electric vehicles (EVs), stringent environmental regulations, and significant government incentives aimed at fostering a domestic battery manufacturing ecosystem. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is underpinned by an increasing penetration rate of secondary batteries, particularly lithium-ion batteries, across various applications. Technological disruptions, such as advancements in battery management systems and novel cell chemistries, are enhancing performance and reducing costs, further fueling demand. Consumer behavior is shifting towards sustainable and electrified mobility options, directly impacting the automotive battery market. The push for energy independence and a circular economy is also driving innovation in battery recycling and the utilization of recycled materials, contributing to a more sustainable market trajectory. The development of Gigafactories across the continent signifies a pivotal shift in the manufacturing landscape, aiming to reduce reliance on external supply chains and bolster regional competitiveness in energy storage solutions. Furthermore, the growing demand for efficient power storage in renewable energy integration and industrial applications will also contribute significantly to market expansion.

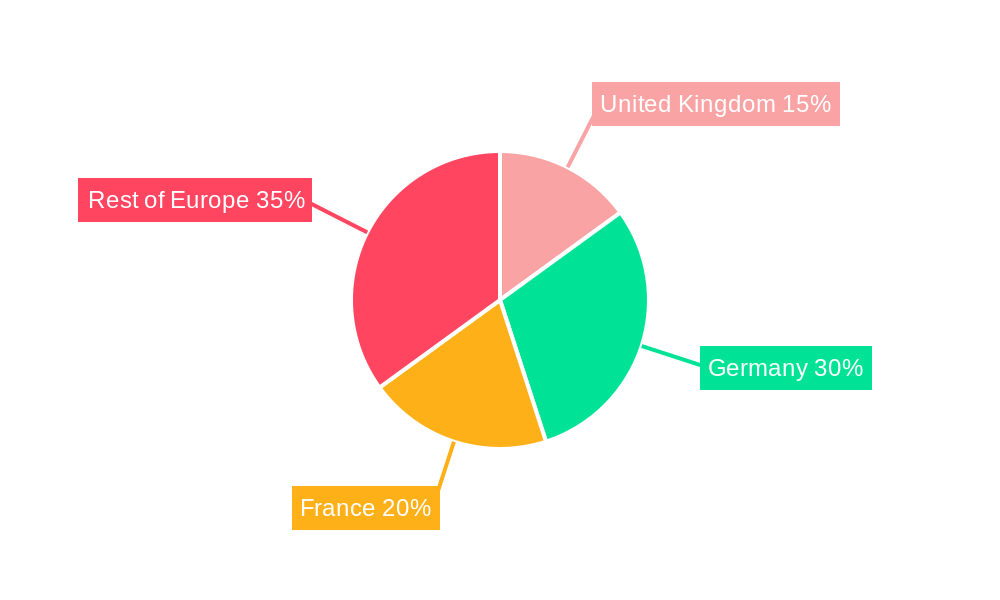

Dominant Regions, Countries, or Segments in Europe Battery Market

The Europe battery market is experiencing robust growth, with a clear dominance emerging from specific segments and geographical regions. Among the type segments, Secondary Battery is the leading contributor, driven by the exponential growth in the automotive (HEV, PHEV, and EV) application, which is projected to account for xx% of the total market revenue by 2033. Within the technology landscape, Lithium-Ion Battery technology is unequivocally the frontrunner, capturing an estimated xx% market share in 2025 and projected to expand further. This dominance is attributable to its superior energy density, longer lifespan, and versatility across various demanding applications compared to Lead-Acid Battery and other emerging technologies.

Geographically, Germany stands out as the most dominant country in the Europe battery market. This leadership is attributed to its strong automotive industry, which is aggressively transitioning towards electric mobility, coupled with substantial government support for battery manufacturing and research and development. The presence of leading automotive manufacturers and a burgeoning ecosystem of EV battery producers and suppliers in Germany creates a powerful demand pull and a robust supply chain. Furthermore, regulatory frameworks within Germany and the broader EU, such as stringent emission standards and incentives for electric vehicles, directly stimulate the demand for advanced secondary batteries.

- Leading Segment by Type: Secondary Battery

- Key Drivers: High demand from the automotive sector (HEV, PHEV, and EV), growth in consumer electronics, and industrial energy storage.

- Market Share Projection (2033): xx%

- Leading Technology: Lithium-Ion Battery

- Key Drivers: Superior performance characteristics (energy density, cycle life), rapid advancements, and widespread adoption in EVs and portable electronics.

- Market Share Projection (2025): xx%

- Dominant Country: Germany

- Key Drivers: Strong automotive industry leadership in EV transition, significant government incentives for battery production and EV adoption, presence of major battery manufacturers and R&D centers.

- Economic Impact: Germany's focus on creating a localized battery supply chain and manufacturing capacity is a significant market accelerator.

- Dominant Application: Automotive (HEV, PHEV, and EV)

- Key Drivers: Global shift towards decarbonized transportation, government mandates on EV sales, and decreasing battery costs.

- Growth Potential: Continued rapid expansion driven by new model introductions and increasing consumer acceptance of electric mobility.

Europe Battery Market Product Landscape

The Europe battery market product landscape is characterized by continuous innovation aimed at enhancing performance, safety, and sustainability. Lithium-ion batteries remain at the forefront, with ongoing advancements in cathode and anode materials leading to higher energy densities and faster charging capabilities, crucial for the burgeoning EV market. Manufacturers are increasingly focusing on NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate) chemistries to balance cost, performance, and safety profiles. Primary batteries continue to serve niche applications requiring long shelf life and consistent power output, such as in medical devices and remote sensing equipment. The development of more robust and efficient battery management systems (BMS) is a critical product innovation, ensuring optimal performance and extending the lifespan of secondary batteries. Furthermore, the focus on battery recycling is driving the development of battery designs that facilitate easier disassembly and material recovery.

Key Drivers, Barriers & Challenges in Europe Battery Market

The Europe battery market is propelled by powerful drivers, including the accelerating transition to electric mobility driven by stringent emission regulations and government incentives, particularly for EVs. The growing demand for renewable energy storage solutions to ensure grid stability and the increasing reliance on portable consumer electronics also contribute significantly. Technological advancements in lithium-ion battery chemistry and manufacturing processes are enhancing performance and reducing costs, making batteries more accessible and competitive.

- Key Drivers:

- Strong policy support and incentives for EV adoption and battery manufacturing.

- Technological breakthroughs in lithium-ion battery energy density, safety, and charging speed.

- Growing demand for energy storage solutions for renewable energy integration.

- Increasing consumer preference for sustainable and electrified products.

However, the market faces notable barriers and challenges. The dependence on imported raw materials, particularly lithium, cobalt, and nickel, creates significant supply chain vulnerabilities and price volatility. The high upfront cost of establishing Gigafactories and the complex regulatory landscape for battery production and disposal also pose hurdles. Fierce competition from established global players and emerging Asian manufacturers exerts significant price pressure.

- Key Barriers & Challenges:

- Supply chain disruptions and reliance on critical raw material imports (e.g., lithium, cobalt).

- High capital expenditure required for Gigafactory construction and technology development.

- Complex and evolving regulatory frameworks for battery production, safety, and recycling.

- Intense global competition leading to price pressures.

- Need for skilled workforce development in battery manufacturing.

Emerging Opportunities in Europe Battery Market

Emerging opportunities in the Europe battery market lie in the development of next-generation battery technologies, such as solid-state batteries, which promise enhanced safety and energy density. The significant drive towards a circular economy is creating substantial opportunities in battery recycling and the recovery of critical raw materials, reducing reliance on primary extraction. The expansion of charging infrastructure for electric vehicles presents a direct growth avenue for EV battery manufacturers. Furthermore, the integration of batteries into smart grids and decentralized energy storage systems for both industrial and residential applications offers vast untapped potential. There is also a growing demand for specialized battery solutions for niche applications like drones, medical devices, and advanced robotics.

Growth Accelerators in the Europe Battery Market Industry

The Europe battery market is experiencing significant growth acceleration driven by a confluence of strategic initiatives and technological advancements. The European Union's ambitious targets for reducing carbon emissions and promoting electromobility are acting as a powerful catalyst, fostering substantial investment in battery manufacturing facilities (Gigafactories) across the continent. Breakthroughs in lithium-ion battery technology, leading to higher energy density, faster charging times, and improved safety, are making electric vehicles and other battery-powered devices more attractive and practical for consumers and industries alike. Strategic partnerships and collaborations between automotive manufacturers, battery producers, and raw material suppliers are crucial for securing supply chains and driving innovation. The increasing focus on battery recycling and the development of a circular economy are not only addressing sustainability concerns but also creating new revenue streams and reducing the overall cost of battery production.

Key Players Shaping the Europe Battery Market Market

- Contemporary Amperex Technology Co Limited

- FIAMM SpA

- Saft Groupe S A

- BYD Company Limited

- Tesla Inc

- GS Yuasa Corporation

- Duracell Inc

- LG Energy Solutions Ltd

Notable Milestones in Europe Battery Market Sector

- May 2023: Two major electric vehicle battery manufacturers announced ambitious plans to invest approximately EUR 10 billion in constructing new factories within Europe. These state-of-the-art facilities are slated to commence production within two years, significantly bolstering the continent's EV battery supply chain and catering to the growing demand from European car producers.

- May 2023: Li-Cycle Holdings Corp., a leading battery recycling company, and Glencore International AG, a global natural resource company, announced the signing of a letter of intent to jointly explore the feasibility of establishing a large-scale hub facility in Italy. The proposed Portovesme Hub aims to produce critical battery materials, including nickel, cobalt, and lithium, by processing recycled battery content, marking a significant step towards a circular economy for batteries in Europe.

In-Depth Europe Battery Market Market Outlook

The Europe battery market is set for an unprecedented period of growth, fueled by a synergistic combination of supportive policies, rapid technological innovation, and shifting consumer preferences. The ongoing expansion of electric vehicle adoption, coupled with significant investments in domestic Gigafactory capacity, will continue to be the primary growth engine. Emerging opportunities in grid-scale energy storage and the burgeoning battery recycling sector will further accelerate market expansion. Strategic collaborations and advancements in battery chemistries, including the potential of solid-state batteries, will enhance performance and unlock new applications. The market is strategically positioned to become a global leader in sustainable battery innovation and production, driving both economic growth and environmental progress across the continent.

Europe Battery Market Segmentation

-

1. Type

- 1.1. Primary Battery

- 1.2. Secondary Battery

-

2. Technology

- 2.1. Lead-Acid Battery

- 2.2. Lithium-Ion Battery

- 2.3. Other Technologies

-

3. Application

- 3.1. Automotive (HEV, PHEV, and EV)

- 3.2. Industri

- 3.3. Consumer Electronics

- 3.4. Other Applications

Europe Battery Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Rest of Europe

Europe Battery Market Regional Market Share

Geographic Coverage of Europe Battery Market

Europe Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices4.; Rapid Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; The Demand-Supply Mismatch of Raw Materials

- 3.4. Market Trends

- 3.4.1. Automotive Segment Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Battery

- 5.1.2. Secondary Battery

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Lead-Acid Battery

- 5.2.2. Lithium-Ion Battery

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive (HEV, PHEV, and EV)

- 5.3.2. Industri

- 5.3.3. Consumer Electronics

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Kingdom Europe Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Primary Battery

- 6.1.2. Secondary Battery

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Lead-Acid Battery

- 6.2.2. Lithium-Ion Battery

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Automotive (HEV, PHEV, and EV)

- 6.3.2. Industri

- 6.3.3. Consumer Electronics

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Germany Europe Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Primary Battery

- 7.1.2. Secondary Battery

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Lead-Acid Battery

- 7.2.2. Lithium-Ion Battery

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Automotive (HEV, PHEV, and EV)

- 7.3.2. Industri

- 7.3.3. Consumer Electronics

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Primary Battery

- 8.1.2. Secondary Battery

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Lead-Acid Battery

- 8.2.2. Lithium-Ion Battery

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Automotive (HEV, PHEV, and EV)

- 8.3.2. Industri

- 8.3.3. Consumer Electronics

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Primary Battery

- 9.1.2. Secondary Battery

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Lead-Acid Battery

- 9.2.2. Lithium-Ion Battery

- 9.2.3. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Automotive (HEV, PHEV, and EV)

- 9.3.2. Industri

- 9.3.3. Consumer Electronics

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Contemporary Amperex Technology Co Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 FIAMM SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saft Groupe S A

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BYD Company Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tesla Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GS Yuasa Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Duracell Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 LG Energy Solutions Ltd *List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Contemporary Amperex Technology Co Limited

List of Figures

- Figure 1: Europe Battery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Battery Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Europe Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Europe Battery Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 5: Europe Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Europe Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: Europe Battery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Europe Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Europe Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Battery Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: Europe Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 12: Europe Battery Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 13: Europe Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Europe Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 15: Europe Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Battery Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Battery Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: Europe Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Europe Battery Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 21: Europe Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Europe Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 23: Europe Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Battery Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Battery Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Europe Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 28: Europe Battery Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 29: Europe Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Europe Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 31: Europe Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Europe Battery Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Europe Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Europe Battery Market Volume K Units Forecast, by Type 2020 & 2033

- Table 35: Europe Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 36: Europe Battery Market Volume K Units Forecast, by Technology 2020 & 2033

- Table 37: Europe Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Europe Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 39: Europe Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Europe Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Battery Market?

The projected CAGR is approximately 10.28%.

2. Which companies are prominent players in the Europe Battery Market?

Key companies in the market include Contemporary Amperex Technology Co Limited, FIAMM SpA, Saft Groupe S A, BYD Company Limited, Tesla Inc, GS Yuasa Corporation, Duracell Inc, LG Energy Solutions Ltd *List Not Exhaustive.

3. What are the main segments of the Europe Battery Market?

The market segments include Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 30.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices4.; Rapid Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

Automotive Segment Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

4.; The Demand-Supply Mismatch of Raw Materials.

8. Can you provide examples of recent developments in the market?

May 2023: Two electric vehicle battery manufacturers announced plans to spend around EUR 10 billion on factories in Europe. Both plants are expected to start production in after two years and supply batteries to European car producers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Battery Market?

To stay informed about further developments, trends, and reports in the Europe Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence