Key Insights

The Middle East and Africa (MEA) Compressed Natural Gas (CNG) dispenser market is set for significant expansion. Projections indicate a market size of 219.63 billion by 2033, growing at a CAGR of 8.54% from a base year of 2024. This growth is propelled by the increasing adoption of natural gas as a cleaner and more economical alternative to traditional fuels in transportation. Government initiatives promoting fuel diversification and carbon emission reduction are key drivers. The region's substantial natural gas reserves, especially in Saudi Arabia and the UAE, foster favorable conditions for CNG infrastructure development. Growing demand for fuel-efficient vehicles and heightened environmental awareness among consumers and corporations also accelerate market growth. MEA's commitment to sustainable energy solutions underpins this upward trend.

MEA Compressed Natural Gas Dispenser Market Market Size (In Billion)

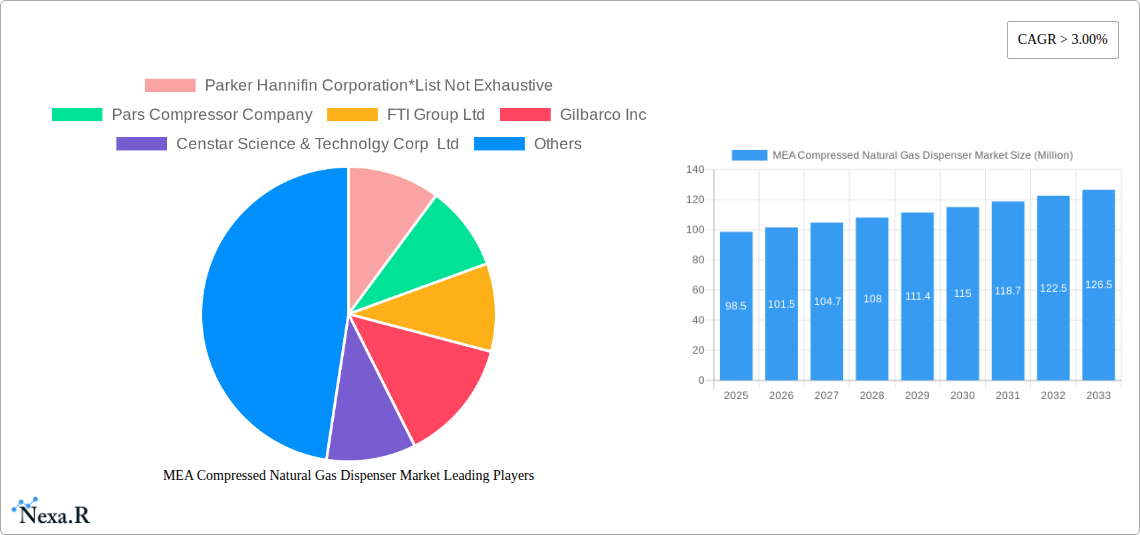

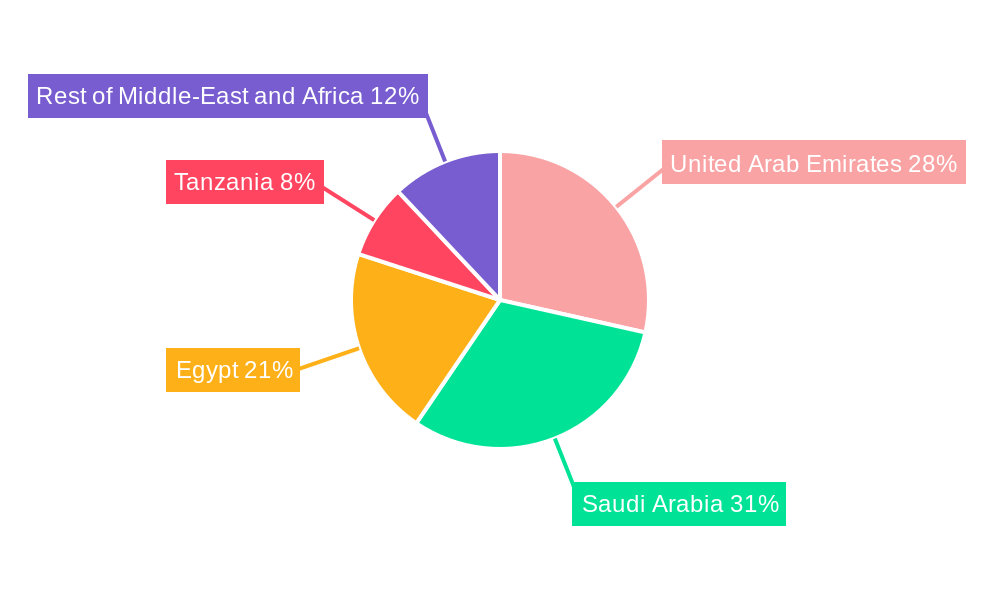

Market segmentation highlights dynamic growth across key geographies. The UAE and Saudi Arabia are projected to lead CNG dispenser adoption, supported by proactive energy policies and significant infrastructure investments. Egypt offers substantial growth potential due to its large population and increasing focus on cleaner fuels. Tanzania and the broader Rest of MEA are emerging markets expected to experience steady growth as CNG adoption increases. Leading industry players, including Parker Hannifin Corporation, Gilbarco Inc., and Dover Fuelling Solutions, are expanding their market presence through technological innovation, strategic partnerships, and product portfolio enhancements. These companies are crucial in advancing the market by offering sophisticated dispensing solutions that improve efficiency, safety, and user experience, meeting the evolving demands of the expanding CNG refueling network in MEA.

MEA Compressed Natural Gas Dispenser Market Company Market Share

MEA Compressed Natural Gas Dispenser Market Report: Unlocking Growth in a Dynamic Region

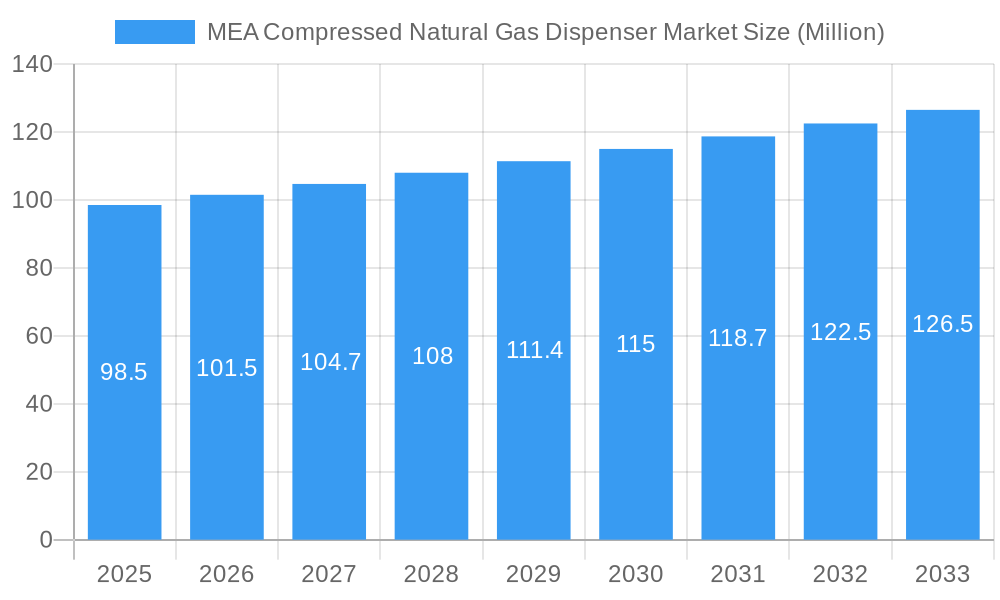

This comprehensive report delivers a deep dive into the MEA Compressed Natural Gas (CNG) Dispenser Market, analyzing its current trajectory and forecasting future expansion. With a meticulous study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this research provides unparalleled insights into this crucial segment of the alternative fuel infrastructure. We offer detailed analyses of market dynamics, growth trends, regional dominance, product landscapes, and key players, equipping industry stakeholders with the knowledge to navigate and capitalize on this evolving market. All values are presented in Million units for clarity and comparability.

MEA Compressed Natural Gas Dispenser Market Market Dynamics & Structure

The MEA Compressed Natural Gas Dispenser Market is characterized by a moderately consolidated structure, with key players actively investing in technological advancements and expanding their geographical reach. Technological innovation drivers, particularly in improving dispenser efficiency, safety features, and connectivity, are paramount. Regulatory frameworks surrounding fuel quality, safety standards, and environmental compliance play a significant role in shaping market entry and product development. Competitive product substitutes, such as diesel and gasoline dispensers, remain a consideration, but the growing demand for cleaner energy solutions is bolstering CNG adoption. End-user demographics are shifting towards fleet operators, public transportation services, and commercial vehicle owners seeking cost-effective and environmentally friendly fuel options. Mergers and acquisitions (M&A) trends are observed as companies aim to broaden their product portfolios and gain a larger market share. For instance, the M&A volume in the historical period (2019-2024) is estimated at xx million units, reflecting strategic consolidation. Innovation barriers include the high initial cost of CNG infrastructure and the need for specialized maintenance expertise.

- Market Concentration: Moderately consolidated with significant players investing in innovation.

- Technological Innovation Drivers: Focus on dispenser efficiency, safety, smart features, and IoT integration.

- Regulatory Frameworks: Stringent safety and environmental standards are critical for market access.

- Competitive Product Substitutes: Diesel and gasoline dispensers, though facing pressure from cleaner alternatives.

- End-User Demographics: Growing adoption by fleet operators, public transport, and commercial vehicles.

- M&A Trends: Strategic consolidation for portfolio expansion and market share growth.

- Innovation Barriers: High infrastructure costs and specialized maintenance requirements.

MEA Compressed Natural Gas Dispenser Market Growth Trends & Insights

The MEA Compressed Natural Gas Dispenser Market is poised for robust growth, driven by a confluence of economic, environmental, and technological factors. The market size is projected to witness a significant expansion from its estimated value of $xxx million in 2025 to $yyy million by 2033, exhibiting a compound annual growth rate (CAGR) of xx%. This upward trajectory is fueled by increasing government initiatives promoting natural gas as a cleaner alternative fuel, coupled with rising fuel prices for conventional energy sources. The adoption rates of CNG dispensers are accelerating across various sectors, particularly in transportation and commercial applications, as businesses and governments prioritize sustainability and cost savings. Technological disruptions, such as the integration of smart metering, remote diagnostics, and enhanced safety features in dispensers, are further enhancing their appeal and efficiency. Consumer behavior shifts are evident, with a growing preference for vehicles and infrastructure that align with environmental consciousness and operational cost reduction. Market penetration is expected to deepen, moving beyond early adopters to broader market segments. The evolving landscape is also witnessing increased investment in refueling infrastructure, directly correlating with the demand for advanced CNG dispensers. The forecast period (2025–2033) anticipates a steady increase in the deployment of CNG dispensers, supported by supportive policies and growing fleet conversions.

Dominant Regions, Countries, or Segments in MEA Compressed Natural Gas Dispenser Market

The United Arab Emirates is emerging as a dominant force within the MEA Compressed Natural Gas Dispenser Market, spearheading growth through a combination of proactive government policies, substantial investments in infrastructure, and a burgeoning demand for alternative fuels. The country's commitment to diversifying its energy mix and reducing carbon emissions is creating a fertile ground for CNG adoption. Significant market share is attributed to the UAE's strategic focus on developing robust CNG refueling networks to support its growing transportation sector, including public buses, taxis, and commercial fleets.

- United Arab Emirates: Leads market growth due to strong government support for alternative fuels and significant infrastructure development.

- Economic Policies: Favorable incentives and subsidies for CNG vehicle conversion and infrastructure deployment.

- Infrastructure Development: Extensive network expansion of CNG refueling stations to cater to increasing demand.

- Fleet Modernization: Government and private sector initiatives to transition public and commercial fleets to CNG.

- Technological Adoption: Early adoption of advanced CNG dispenser technologies for enhanced efficiency and safety.

- Market Share: Estimated to hold xx% of the MEA CNG dispenser market by 2025.

Saudi Arabia also presents a significant growth opportunity, driven by its own environmental sustainability goals and the economic benefits of utilizing its abundant natural gas reserves. The country is actively promoting the use of CNG in its transportation sector, particularly for heavy-duty vehicles and public transportation.

- Saudi Arabia: A key growth driver, focusing on utilizing natural gas resources for transportation and achieving environmental targets.

- Resource Abundance: Leveraging vast natural gas reserves to promote domestic fuel consumption.

- Emission Reduction Targets: Ambitious national goals for reducing air pollution and greenhouse gas emissions.

- Industrial Growth: Expansion of industrial sectors requiring reliable and cost-effective fuel solutions.

Egypt is witnessing a substantial surge in the adoption of CNG as a primary fuel for vehicles, propelled by supportive government policies aimed at reducing reliance on imported fossil fuels and mitigating fuel subsidies. The country’s extensive conversion program for existing vehicles has created a substantial demand for CNG dispensers.

- Egypt: Experiencing rapid growth driven by extensive vehicle conversion programs and government support for CNG.

- Vehicle Conversion Programs: Large-scale government-led initiatives to convert petrol vehicles to CNG.

- Fuel Subsidy Reduction: Economic incentives to shift towards domestically available and cheaper CNG.

- Growing Vehicle Par: Increasing number of CNG-powered vehicles creating demand for refueling infrastructure.

Tanzania represents an emerging market with considerable potential, fueled by increasing awareness of the benefits of CNG and a nascent but growing investment in infrastructure. While still in its early stages, the country's commitment to expanding its energy options positions it for future growth.

- Tanzania: An emerging market with significant untapped potential and a growing focus on alternative fuels.

- Infrastructure Investment: Gradual development of CNG refueling stations to support initial demand.

- Growing Awareness: Increasing understanding of CNG's economic and environmental advantages.

The Rest of Middle-East and Africa segment encompasses a diverse range of markets, each with its unique drivers and challenges. However, the overarching trend of seeking cleaner, more cost-effective energy solutions is fostering a gradual but consistent expansion of the CNG dispenser market across these regions.

MEA Compressed Natural Gas Dispenser Market Product Landscape

The MEA Compressed Natural Gas Dispenser Market is characterized by a diverse product landscape focused on enhanced safety, efficiency, and user-friendliness. Innovations include multi-nozzle dispensers for faster refueling, advanced metering systems for accurate dispensing, and robust construction materials for durability in various environmental conditions. Applications range from large-scale public refueling stations to smaller, dedicated fleet depots. Performance metrics such as flow rate, pressure regulation, and electronic transaction capabilities are key differentiators. Unique selling propositions often lie in the integration of smart technologies for remote monitoring, diagnostics, and integration with broader fleet management systems. Technological advancements are also prioritizing user interface design and compliance with international safety standards.

Key Drivers, Barriers & Challenges in MEA Compressed Natural Gas Dispenser Market

Key Drivers:

- Government Initiatives & Policies: Supportive regulations, subsidies, and targets for natural gas as a transportation fuel.

- Economic Benefits: Lower operating costs compared to gasoline and diesel, particularly for high-mileage fleets.

- Environmental Concerns: Growing awareness and mandates for reducing emissions and improving air quality.

- Energy Security: Diversification of energy sources away from reliance on imported liquid fuels.

- Technological Advancements: Improved dispenser efficiency, safety features, and integration capabilities.

Barriers & Challenges:

- High Upfront Infrastructure Costs: Significant investment required for building refueling stations and distribution networks.

- Limited CNG Vehicle Availability: A smaller range of CNG-powered vehicles compared to traditional options in some markets.

- Technical Expertise and Maintenance: Need for specialized training and skilled personnel for installation and upkeep.

- Safety Perceptions: Overcoming public perception challenges related to the safe handling of compressed gas.

- Intermittency of Supply (in some regions): Ensuring a consistent and reliable supply of natural gas for refueling.

Emerging Opportunities in MEA Compressed Natural Gas Dispenser Market

Emerging opportunities within the MEA Compressed Natural Gas Dispenser Market are abundant, particularly in the expansion of refueling infrastructure in underserved regions and the development of specialized dispensers for niche applications. The growing trend of natural gas vehicles (NGVs) in public transportation, including buses and waste management fleets, presents a significant opportunity for high-volume dispenser sales. Furthermore, the integration of smart technologies, such as IoT-enabled dispensers for real-time data analytics and predictive maintenance, offers a pathway for enhanced operational efficiency and new revenue streams. Untapped markets within certain African nations, with increasing economic development and a desire for cleaner energy, also represent significant future growth potential. The evolving consumer preference for sustainable transportation solutions will continue to drive demand for advanced and reliable CNG dispensing solutions.

Growth Accelerators in the MEA Compressed Natural Gas Dispenser Market Industry

Long-term growth in the MEA Compressed Natural Gas Dispenser Market is being significantly accelerated by a combination of strategic catalysts. Technological breakthroughs in dispenser design, such as faster refueling times and enhanced safety mechanisms, are crucial. Strategic partnerships between dispenser manufacturers, energy providers, and vehicle manufacturers are fostering ecosystem development and driving market adoption. Furthermore, aggressive market expansion strategies by key players, including the establishment of new manufacturing facilities and distribution networks across the region, are vital. The increasing global focus on decarbonization and the adoption of circular economy principles will also propel the demand for cleaner fuels like CNG, thereby accelerating the growth of the dispenser market.

Key Players Shaping the MEA Compressed Natural Gas Dispenser Market Market

- Parker Hannifin Corporation

- Pars Compressor Company

- FTI Group Ltd

- Gilbarco Inc

- Censtar Science & Technology Corp Ltd

- Compressor Sazi Tabriz

- Galileo Technologies SA

- Dover Fuelling Solutions

Notable Milestones in MEA Compressed Natural Gas Dispenser Market Sector

- July 2022: Dover Fuelling Solutions (DFS), the global provider of technologies and services for the fuel industry, announced the launch of a new technologically advanced four-nozzle Wayne Helix CNG dispenser and hydrogen dispenser for EMEA (Europe, Middle-East, and Africa) region.

In-Depth MEA Compressed Natural Gas Dispenser Market Market Outlook

The MEA Compressed Natural Gas Dispenser Market is on a robust growth trajectory, propelled by a clear trend towards cleaner energy solutions and supportive government policies. Key growth accelerators, including technological innovations in dispenser design, strategic partnerships across the value chain, and ambitious market expansion initiatives, are poised to further solidify this expansion. The increasing demand for cost-effective and environmentally friendly transportation fuels, coupled with the ongoing development of refueling infrastructure, will continue to drive market penetration across the region. Future outlook indicates a sustained increase in the deployment of advanced CNG dispensers, offering significant opportunities for stakeholders to capitalize on the evolving energy landscape in the Middle East and Africa.

MEA Compressed Natural Gas Dispenser Market Segmentation

-

1. Geography

- 1.1. United Arab Emirates

- 1.2. Saudi Arabia

- 1.3. Egypt

- 1.4. Tanzania

- 1.5. Rest of Middle-East and Africa

MEA Compressed Natural Gas Dispenser Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Egypt

- 4. Tanzania

- 5. Rest of Middle East and Africa

MEA Compressed Natural Gas Dispenser Market Regional Market Share

Geographic Coverage of MEA Compressed Natural Gas Dispenser Market

MEA Compressed Natural Gas Dispenser Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Offshore Oil and Gas Exploration and Production Activities4.; Growing Demand for Energy

- 3.3. Market Restrains

- 3.3.1. High Upfront Costs

- 3.4. Market Trends

- 3.4.1. Growing Demand of CNG vehicles Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Compressed Natural Gas Dispenser Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. United Arab Emirates

- 5.1.2. Saudi Arabia

- 5.1.3. Egypt

- 5.1.4. Tanzania

- 5.1.5. Rest of Middle-East and Africa

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. Egypt

- 5.2.4. Tanzania

- 5.2.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. United Arab Emirates MEA Compressed Natural Gas Dispenser Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. United Arab Emirates

- 6.1.2. Saudi Arabia

- 6.1.3. Egypt

- 6.1.4. Tanzania

- 6.1.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Saudi Arabia MEA Compressed Natural Gas Dispenser Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. United Arab Emirates

- 7.1.2. Saudi Arabia

- 7.1.3. Egypt

- 7.1.4. Tanzania

- 7.1.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Egypt MEA Compressed Natural Gas Dispenser Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. United Arab Emirates

- 8.1.2. Saudi Arabia

- 8.1.3. Egypt

- 8.1.4. Tanzania

- 8.1.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Tanzania MEA Compressed Natural Gas Dispenser Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. United Arab Emirates

- 9.1.2. Saudi Arabia

- 9.1.3. Egypt

- 9.1.4. Tanzania

- 9.1.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. United Arab Emirates

- 10.1.2. Saudi Arabia

- 10.1.3. Egypt

- 10.1.4. Tanzania

- 10.1.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Parker Hannifin Corporation*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pars Compressor Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FTI Group Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gilbarco Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Censtar Science & Technolgy Corp Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Compressor Sazi Tabriz

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Galileo Technologies SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dover Fuelling Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Parker Hannifin Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global MEA Compressed Natural Gas Dispenser Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global MEA Compressed Natural Gas Dispenser Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Geography 2025 & 2033

- Figure 4: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Geography 2025 & 2033

- Figure 5: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Geography 2025 & 2033

- Figure 7: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Country 2025 & 2033

- Figure 8: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Arab Emirates MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Geography 2025 & 2033

- Figure 12: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Geography 2025 & 2033

- Figure 13: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Saudi Arabia MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Egypt MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Geography 2025 & 2033

- Figure 20: Egypt MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Geography 2025 & 2033

- Figure 21: Egypt MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Geography 2025 & 2033

- Figure 22: Egypt MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Geography 2025 & 2033

- Figure 23: Egypt MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Egypt MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Egypt MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Egypt MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Tanzania MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Geography 2025 & 2033

- Figure 28: Tanzania MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Geography 2025 & 2033

- Figure 29: Tanzania MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Tanzania MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: Tanzania MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Tanzania MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Tanzania MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Tanzania MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Geography 2025 & 2033

- Figure 36: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Geography 2025 & 2033

- Figure 37: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Geography 2025 & 2033

- Figure 38: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Geography 2025 & 2033

- Figure 39: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Middle East and Africa MEA Compressed Natural Gas Dispenser Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 2: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 3: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Global MEA Compressed Natural Gas Dispenser Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global MEA Compressed Natural Gas Dispenser Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Compressed Natural Gas Dispenser Market?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the MEA Compressed Natural Gas Dispenser Market?

Key companies in the market include Parker Hannifin Corporation*List Not Exhaustive, Pars Compressor Company, FTI Group Ltd, Gilbarco Inc, Censtar Science & Technolgy Corp Ltd, Compressor Sazi Tabriz, Galileo Technologies SA, Dover Fuelling Solutions.

3. What are the main segments of the MEA Compressed Natural Gas Dispenser Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 219.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Offshore Oil and Gas Exploration and Production Activities4.; Growing Demand for Energy.

6. What are the notable trends driving market growth?

Growing Demand of CNG vehicles Expected to Drive the Market.

7. Are there any restraints impacting market growth?

High Upfront Costs.

8. Can you provide examples of recent developments in the market?

July 2022: Dover Fuelling Solutions (DFS), the global provider of technologies and services for the fuel industry, announced the launch of a new technologically advanced four-nozzle Wayne Helix CNG dispenser and hydrogen dispenser for EMEA (Europe, Middle-East, and Africa) region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Compressed Natural Gas Dispenser Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Compressed Natural Gas Dispenser Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Compressed Natural Gas Dispenser Market?

To stay informed about further developments, trends, and reports in the MEA Compressed Natural Gas Dispenser Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence