Key Insights

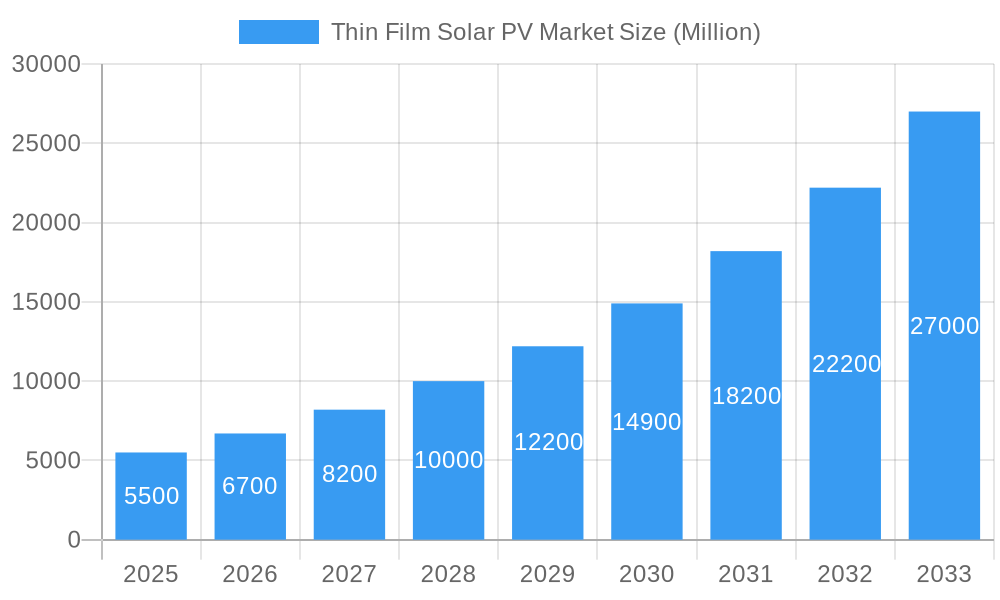

The global Thin Film Solar Photovoltaic (PV) Market is poised for explosive growth, projected to reach an estimated $XX million by 2025 and continue its upward trajectory through 2033. Driven by an impressive Compound Annual Growth Rate (CAGR) of 23.02%, this market signifies a significant shift towards advanced solar technologies. Key market drivers include escalating demand for renewable energy sources to combat climate change, coupled with substantial government incentives and favorable policies supporting solar installations worldwide. Technological advancements in thin-film materials, leading to improved efficiency and reduced manufacturing costs, are further fueling this expansion. Industries are increasingly adopting thin-film solar PV for their flexibility, lightweight nature, and suitability for diverse applications, from building-integrated photovoltaics (BIPV) to portable electronics. The growing awareness of energy security and the need for decentralized power generation also contribute to the market's robust expansion.

Thin Film Solar PV Market Market Size (In Billion)

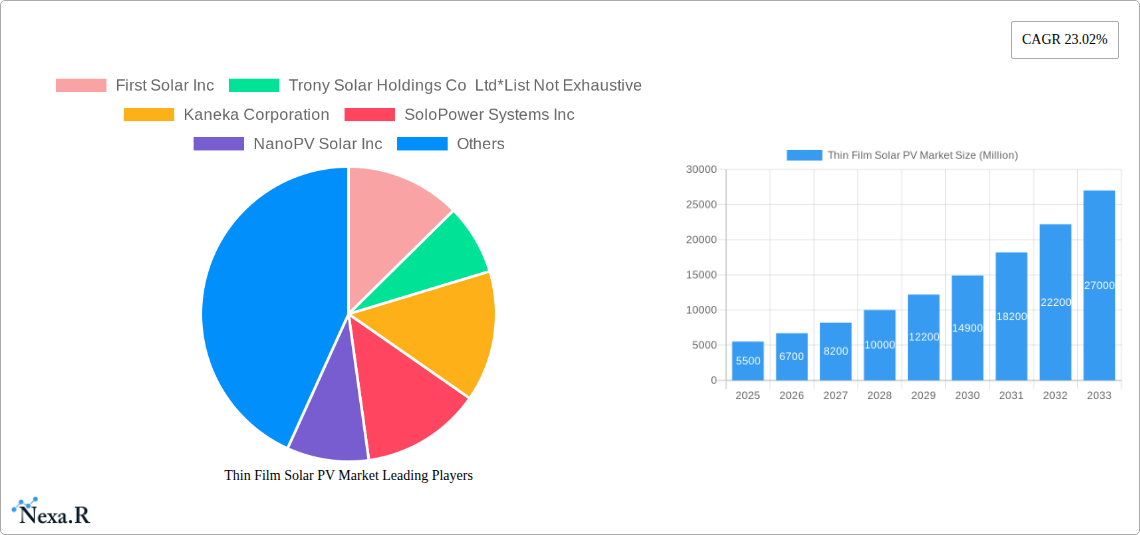

The competitive landscape of the Thin Film Solar PV Market is characterized by innovation and strategic expansions from leading players like First Solar Inc. and Hanergy Thin Film Power Group Ltd. Prominent segments within this market include Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), and Amorphous Silicon (a-Si), each offering unique advantages and catering to specific application needs. While the market demonstrates immense potential, certain restraints such as the initial capital investment for manufacturing facilities and the ongoing need for further efficiency improvements compared to traditional silicon-based solar panels present challenges. However, ongoing research and development efforts are actively addressing these limitations. Geographically, the Asia Pacific region is expected to lead market growth due to strong government support, a large manufacturing base, and increasing energy demands. North America and Europe are also significant contributors, driven by ambitious renewable energy targets and technological advancements. The market's dynamism is underscored by its transition from 2019-2024 historical data to a projected forecast period of 2025-2033, with 2025 serving as a pivotal base and estimated year.

Thin Film Solar PV Market Company Market Share

Explore the dynamic Thin Film Solar PV Market, a crucial segment of the renewable energy sector. This in-depth report provides a forward-looking analysis of market trends, growth drivers, and competitive landscapes from 2019 to 2033, with a base year of 2025. Uncover critical insights into market concentration, technological advancements, regulatory impacts, and emerging opportunities within the thin-film solar photovoltaic market. Gain a competitive edge with detailed forecasts and strategic intelligence on parent and child markets, essential for stakeholders in the global solar energy industry.

Thin Film Solar PV Market Dynamics & Structure

The Thin Film Solar PV Market is characterized by a moderately consolidated structure, with key players like First Solar Inc., Trony Solar Holdings Co Ltd, Kaneka Corporation, SoloPower Systems Inc., NanoPV Solar Inc., Hanergy Thin Film Power Group Ltd, Solar Frontier K K, and Ascent Solar Technologies Inc. driving innovation and market expansion. Technological innovation, particularly in enhancing the efficiency and cost-effectiveness of Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), and Amorphous Silicon (a-Si) technologies, is a primary driver. Stringent regulatory frameworks promoting renewable energy adoption and supportive government incentives, such as tax credits and feed-in tariffs, significantly influence market growth. Competitive product substitutes, including crystalline silicon solar panels, pose a constant challenge, driving the need for continuous product differentiation and cost reduction in the thin-film segment. End-user demographics are shifting towards larger-scale utility projects and specialized applications where thin-film's flexibility and lightweight properties offer distinct advantages. Merger and acquisition (M&A) trends, though less frequent than in broader renewable energy markets, are strategic maneuvers to acquire new technologies or expand market reach. For instance, historical M&A activity indicates a focus on integrating upstream material production or downstream project development capabilities. Innovation barriers include the high initial investment in research and development and the need for scaling up manufacturing processes to achieve cost parity with established technologies.

- Market Concentration: Moderately consolidated with a few dominant players.

- Technological Innovation Drivers: Efficiency improvements in CdTe, CIGS, and a-Si.

- Regulatory Frameworks: Government incentives and renewable energy mandates.

- Competitive Product Substitutes: Crystalline silicon solar panels.

- End-User Demographics: Shift towards utility-scale and niche applications.

- M&A Trends: Strategic acquisitions for technology and market access.

- Innovation Barriers: High R&D costs and scaling challenges.

Thin Film Solar PV Market Growth Trends & Insights

The Thin Film Solar PV Market is projected to experience robust growth, driven by a combination of increasing global demand for renewable energy, advancements in thin-film solar cell technologies, and supportive government policies. The market size is expected to evolve from approximately USD XXX million in 2024 to USD XXX million by 2033, demonstrating a significant expansion. Adoption rates are accelerating, particularly in regions with high solar irradiance and strong political will for decarbonization. Technological disruptions, such as the development of perovskite-based thin-film technologies and tandem solar cells, are poised to further enhance efficiency and reduce manufacturing costs, thereby increasing market penetration. Consumer behavior shifts are evident, with a growing preference for aesthetically pleasing and flexible solar solutions, areas where thin-film technology excels. The compound annual growth rate (CAGR) for the forecast period (2025–2033) is estimated at XX.X%, underscoring the market's strong upward trajectory. Historical data from 2019–2024 shows a steady increase in deployment, laying a solid foundation for future expansion. The increasing integration of thin-film solar PV into building-integrated photovoltaics (BIPV) and portable electronic devices also contributes to diversified market penetration. Furthermore, the declining levelized cost of electricity (LCOE) for thin-film solar solutions is making them increasingly competitive against traditional energy sources. The research and development efforts are focused on improving the long-term stability and durability of thin-film modules, addressing a key concern for widespread adoption. The global push towards net-zero emissions targets is a significant tailwind, encouraging substantial investments in solar energy technologies, including thin-film PV.

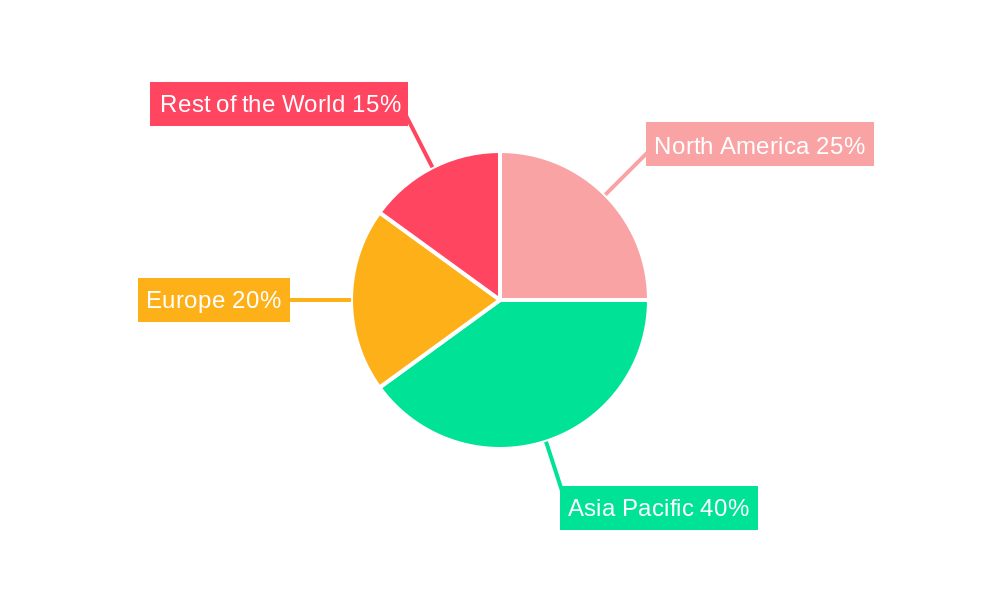

Dominant Regions, Countries, or Segments in Thin Film Solar PV Market

The Thin Film Solar PV Market is witnessing dominant growth driven by specific regions and segments. Among the types, Cadmium Telluride (CdTe) currently holds a significant market share due to its established manufacturing base, cost-effectiveness, and continuous efficiency improvements, particularly championed by key players in North America and Europe. Copper Indium Gallium Selenide (CIGS) technology, while historically facing production challenges, is experiencing a resurgence with advancements in manufacturing processes, especially in Asia, where countries like China and Japan are at the forefront of innovation and large-scale deployment. Amorphous Silicon (a-Si) technology, known for its flexibility and performance in low-light conditions, finds niche applications and sees steady adoption, particularly in consumer electronics and specialized architectural integrations across various regions.

- North America: A dominant region, particularly driven by the United States' strong policy support and the presence of leading CdTe manufacturers like First Solar. Economic policies focusing on energy independence and climate change mitigation are key drivers. The large-scale utility solar projects are a significant contributor to market share in this region.

- Asia Pacific: Emerging as a powerhouse for CIGS and a-Si technologies, with China leading in manufacturing capacity and Japan pioneering in advanced CIGS research and development. Favorable government policies, a rapidly growing economy, and increasing demand for renewable energy sources fuel this dominance. Infrastructure development for solar farms and grid integration are key factors.

- Europe: Continues to be a significant market for thin-film solar PV, driven by ambitious renewable energy targets and strong R&D initiatives, particularly in CIGS and emerging technologies. Regulatory frameworks supporting solar installations and a focus on sustainable building practices contribute to its market share and growth potential.

The growth potential is further amplified by the decreasing manufacturing costs and increasing efficiency of these thin-film technologies, making them increasingly competitive. The economic policies in these leading regions are designed to incentivize solar adoption, creating a favorable environment for market expansion.

Thin Film Solar PV Market Product Landscape

The product landscape of the Thin Film Solar PV Market is characterized by continuous innovation focused on enhancing energy conversion efficiency, durability, and application versatility. Companies are developing thin-film modules with improved performance metrics, such as higher power output per unit area and enhanced energy generation in diffuse light conditions. Key technological advancements include the refinement of manufacturing processes for Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), and Amorphous Silicon (a-Si) to reduce production costs and increase scalability. Unique selling propositions for thin-film solar PV include its lightweight nature, flexibility, and aesthetically pleasing design, making it ideal for building-integrated photovoltaics (BIPV), portable electronics, and specialized industrial applications. Research into novel materials and device architectures, such as perovskite-silicon tandem cells, promises to further revolutionize the market by pushing the boundaries of solar energy conversion.

Key Drivers, Barriers & Challenges in Thin Film Solar PV Market

Key Drivers: The Thin Film Solar PV Market is propelled by several key drivers. The escalating global demand for clean and sustainable energy sources, coupled with ambitious government targets for renewable energy adoption, provides a strong impetus for market growth. Technological advancements leading to improved efficiency and reduced manufacturing costs of thin-film solar cells, particularly CdTe and CIGS, make them increasingly competitive. Supportive government policies, including subsidies, tax incentives, and favorable feed-in tariffs, significantly encourage investment and deployment. The unique advantages of thin-film technology, such as flexibility, lightweight design, and superior performance in low-light conditions, open up niche and specialized application markets.

Barriers & Challenges: Despite the positive outlook, the market faces several barriers and challenges. The primary challenge remains the efficiency gap compared to crystalline silicon solar panels, although this is narrowing with ongoing R&D. High initial capital investment for setting up manufacturing facilities and scaling up production can be a significant hurdle. Supply chain disruptions for critical raw materials and volatile pricing can impact manufacturing costs and project timelines. Regulatory hurdles and complex permitting processes in some regions can slow down project development and deployment. Intense competition from established crystalline silicon manufacturers and emerging solar technologies also presents a competitive pressure.

Emerging Opportunities in Thin Film Solar PV Market

Emerging opportunities in the Thin Film Solar PV Market are diverse and promising. The growing demand for building-integrated photovoltaics (BIPV) presents a significant avenue, as thin-film's flexibility and aesthetic appeal are ideal for seamlessly integrating solar power generation into architectural designs. The expansion of solar energy into developing nations, where cost-effectiveness and ease of installation are paramount, offers untapped market potential. Innovations in tandem solar cells, combining thin-film technologies with other photovoltaic materials, are poised to break efficiency records and create new market segments. The increasing interest in portable and flexible electronics, powered by small-scale thin-film solar chargers, represents another burgeoning niche. Evolving consumer preferences for sustainable and visually appealing energy solutions further fuel demand for innovative thin-film applications.

Growth Accelerators in the Thin Film Solar PV Market Industry

Several key catalysts are accelerating the growth of the Thin Film Solar PV Market. Technological breakthroughs in materials science and manufacturing processes are continuously improving the efficiency and reducing the cost of thin-film solar cells, making them more accessible and competitive. Strategic partnerships between research institutions, technology developers, and large-scale manufacturers are crucial for fast-tracking innovation and commercialization. Market expansion strategies, including the penetration into emerging economies and the development of specialized applications, are driving increased demand. The ongoing global commitment to decarbonization and the transition to renewable energy sources provide a macro-economic tailwind, encouraging substantial investments in solar energy technologies like thin-film PV.

Key Players Shaping the Thin Film Solar PV Market Market

- First Solar Inc.

- Trony Solar Holdings Co Ltd

- Kaneka Corporation

- SoloPower Systems Inc.

- NanoPV Solar Inc.

- Hanergy Thin Film Power Group Ltd

- Solar Frontier K K

- Ascent Solar Technologies Inc.

Notable Milestones in Thin Film Solar PV Market Sector

- 2019: Significant advancements in CIGS cell efficiency reported, exceeding 23% in laboratory settings.

- 2020: Increased adoption of thin-film solar in utility-scale projects due to cost reductions and improved performance.

- 2021: Launch of new generation CdTe modules with enhanced durability and longer warranty periods.

- 2022: Growing interest in perovskite-based thin-film solar cell research and pilot production.

- 2023: Expansion of BIPV applications, with thin-film integrated into façade and roofing materials.

- 2024: Further improvements in manufacturing scalability for CIGS technology, leading to potential cost parity in certain markets.

In-Depth Thin Film Solar PV Market Market Outlook

The future outlook for the Thin Film Solar PV Market is exceptionally bright, fueled by sustained technological innovation and a global imperative for clean energy. Growth accelerators, including ongoing R&D into higher efficiency thin-film technologies like perovskites and tandem cells, are set to redefine the market's capabilities. Strategic partnerships and collaborations among industry leaders will further bolster innovation and accelerate commercialization. Market expansion into underserved regions and the increasing demand for flexible, aesthetically pleasing solar solutions in architectural and consumer electronics applications represent significant growth avenues. The overarching commitment to climate goals and energy independence will continue to drive substantial investment in renewable energy, positioning thin-film solar PV as a critical component of the future energy landscape.

Thin Film Solar PV Market Segmentation

-

1. Type

- 1.1. Cadmium Telluride (CdTe)

- 1.2. Copper Indium Gallium Selenide (CIGS)

- 1.3. Amorphous Silicon (a-Si)

Thin Film Solar PV Market Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Rest of the World

Thin Film Solar PV Market Regional Market Share

Geographic Coverage of Thin Film Solar PV Market

Thin Film Solar PV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Government Policies and Increasing Adoption of Solar PV Systems; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption

- 3.3. Market Restrains

- 3.3.1. The Growth of Other Renewable Technologies Such as Wind and Bioenergy

- 3.4. Market Trends

- 3.4.1. Cadmium-Telluride (CdTe) Thin Film Solar Cells to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cadmium Telluride (CdTe)

- 5.1.2. Copper Indium Gallium Selenide (CIGS)

- 5.1.3. Amorphous Silicon (a-Si)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cadmium Telluride (CdTe)

- 6.1.2. Copper Indium Gallium Selenide (CIGS)

- 6.1.3. Amorphous Silicon (a-Si)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cadmium Telluride (CdTe)

- 7.1.2. Copper Indium Gallium Selenide (CIGS)

- 7.1.3. Amorphous Silicon (a-Si)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cadmium Telluride (CdTe)

- 8.1.2. Copper Indium Gallium Selenide (CIGS)

- 8.1.3. Amorphous Silicon (a-Si)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Thin Film Solar PV Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cadmium Telluride (CdTe)

- 9.1.2. Copper Indium Gallium Selenide (CIGS)

- 9.1.3. Amorphous Silicon (a-Si)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 First Solar Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trony Solar Holdings Co Ltd*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kaneka Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SoloPower Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 NanoPV Solar Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hanergy Thin Film Power Group Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Solar Frontier K K

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ascent Solar Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 First Solar Inc

List of Figures

- Figure 1: Global Thin Film Solar PV Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Thin Film Solar PV Market Volume Breakdown (Gigawatt, %) by Region 2025 & 2033

- Figure 3: North America Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 5: North America Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 9: North America Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Asia Pacific Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 12: Asia Pacific Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 13: Asia Pacific Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Asia Pacific Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 15: Asia Pacific Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: Asia Pacific Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 17: Asia Pacific Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 20: Europe Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 21: Europe Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 25: Europe Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Rest of the World Thin Film Solar PV Market Revenue (undefined), by Type 2025 & 2033

- Figure 28: Rest of the World Thin Film Solar PV Market Volume (Gigawatt), by Type 2025 & 2033

- Figure 29: Rest of the World Thin Film Solar PV Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Rest of the World Thin Film Solar PV Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Rest of the World Thin Film Solar PV Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: Rest of the World Thin Film Solar PV Market Volume (Gigawatt), by Country 2025 & 2033

- Figure 33: Rest of the World Thin Film Solar PV Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of the World Thin Film Solar PV Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: Global Thin Film Solar PV Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 7: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 9: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 11: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 15: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: Global Thin Film Solar PV Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 19: Global Thin Film Solar PV Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Global Thin Film Solar PV Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thin Film Solar PV Market?

The projected CAGR is approximately 7.05%.

2. Which companies are prominent players in the Thin Film Solar PV Market?

Key companies in the market include First Solar Inc, Trony Solar Holdings Co Ltd*List Not Exhaustive, Kaneka Corporation, SoloPower Systems Inc, NanoPV Solar Inc, Hanergy Thin Film Power Group Ltd, Solar Frontier K K, Ascent Solar Technologies Inc.

3. What are the main segments of the Thin Film Solar PV Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Favorable Government Policies and Increasing Adoption of Solar PV Systems; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption.

6. What are the notable trends driving market growth?

Cadmium-Telluride (CdTe) Thin Film Solar Cells to Dominate the Market.

7. Are there any restraints impacting market growth?

The Growth of Other Renewable Technologies Such as Wind and Bioenergy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thin Film Solar PV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thin Film Solar PV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thin Film Solar PV Market?

To stay informed about further developments, trends, and reports in the Thin Film Solar PV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence