Key Insights

The North America Oil Country Tubular Goods (OCTG) market is set for substantial growth, projected to reach over USD 10.87 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 11.74% through 2033. This expansion is driven by robust oil and gas exploration and production (E&P) activities across the United States and Canada. Key growth catalysts include advancements in drilling technologies, the exploitation of unconventional reserves like shale, and significant investments in energy infrastructure. The increasing adoption of premium OCTG grades, offering enhanced performance in demanding downhole conditions, is a notable trend. While seamless OCTG continues to lead due to its superior strength and reliability, Electric Resistance Welded (ERW) pipes are gaining market share in cost-sensitive applications.

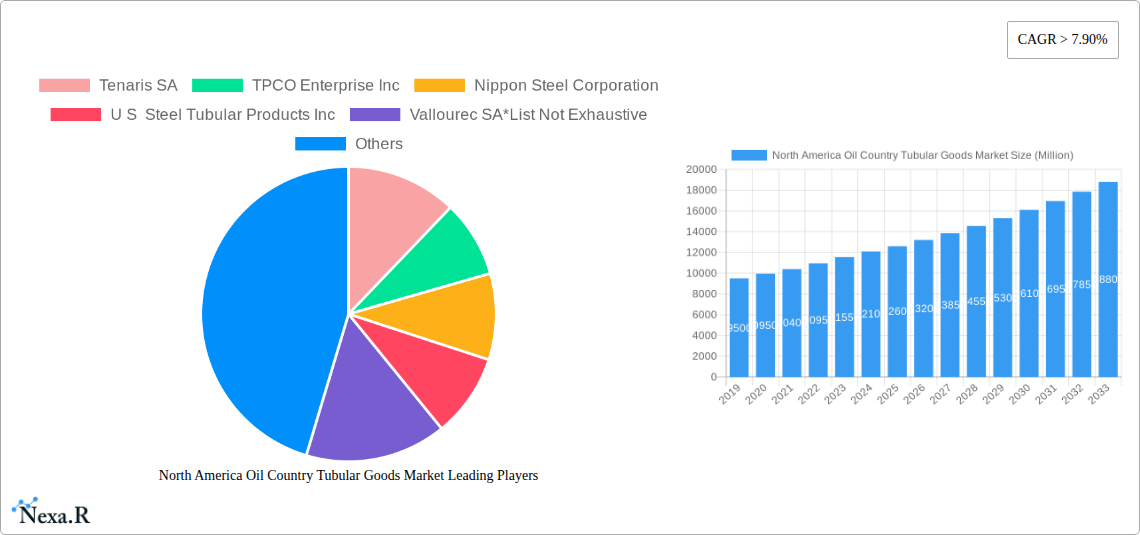

North America Oil Country Tubular Goods Market Market Size (In Billion)

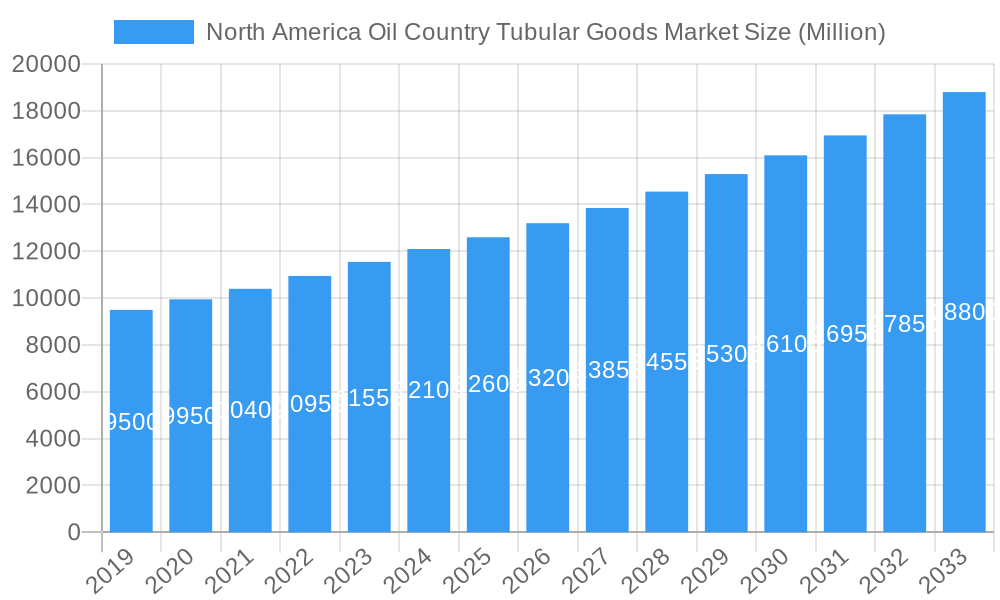

Challenges such as volatile crude oil prices, which influence E&P capital expenditure, and stringent environmental regulations, alongside the global energy transition towards renewables, pose potential market restraints. However, the continued global reliance on oil and gas for energy, coupled with innovations enhancing extraction efficiency and mitigating environmental impact, are expected to offset these concerns. Leading OCTG manufacturers such as Tenaris SA, TPCO Enterprise Inc, and Nippon Steel Corporation are focused on innovation and portfolio expansion, delivering high-performance and specialized OCTG solutions to meet evolving industry demands. The North American region, boasting extensive reserves and mature energy infrastructure, is anticipated to remain the primary market for OCTG products.

North America Oil Country Tubular Goods Market Company Market Share

North America Oil Country Tubular Goods Market: Comprehensive Analysis and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the North America Oil Country Tubular Goods (OCTG) market, providing critical insights for industry stakeholders. Covering the historical period from 2019-2024, base year 2025, and a forecast period extending to 2033, this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the competitive strategies of leading players. We meticulously examine market size evolution, technological advancements, regulatory influences, and end-user demographics, presenting a holistic view of the OCTG sector. All quantitative data is presented in Million units for clarity and precision.

North America Oil Country Tubular Goods Market Market Dynamics & Structure

The North America Oil Country Tubular Goods (OCTG) market is characterized by a moderately consolidated structure, with a few key players dominating the production landscape. Technological innovation is a significant driver, particularly in the development of premium grades with enhanced corrosion resistance and higher strength-to-weight ratios, crucial for increasingly demanding exploration and production (E&P) operations. Regulatory frameworks, including stringent environmental standards and API (American Petroleum Institute) certifications, profoundly influence product development and market entry. Competitive product substitutes, while limited for core OCTG applications, emerge in specialized scenarios and for lower-tier projects. End-user demographics are shifting, with a growing demand for OCTG solutions that support deepwater exploration, unconventional resource development (shale oil and gas), and extended reach drilling. Mergers and acquisitions (M&A) trends are active, aimed at consolidating market share, acquiring advanced technologies, and expanding geographical reach.

- Market Concentration: The market exhibits a moderate concentration, with the top 5-7 companies holding a significant market share.

- Technological Innovation Drivers: Demand for OCTG capable of withstanding extreme pressures, temperatures, and corrosive environments, particularly in offshore and unconventional plays.

- Regulatory Frameworks: Stringent safety, environmental, and quality standards (e.g., API specifications) are paramount, impacting manufacturing processes and material selection.

- Competitive Product Substitutes: While direct substitutes are scarce for primary OCTG applications, advancements in alternative materials or trenchless technologies can pose indirect competition in niche areas.

- End-User Demographics: Shift towards unconventional drilling requiring specialized OCTG, increasing demand for seamless pipes and premium connections.

- M&A Trends: Strategic acquisitions and partnerships aimed at vertical integration and technological enhancement are observed. For instance, a projected 15-20 M&A deals within the historical period, involving both large manufacturers and specialized service providers.

North America Oil Country Tubular Goods Market Growth Trends & Insights

The North America Oil Country Tubular Goods (OCTG) market is projected to witness robust growth, driven by a dynamic interplay of economic factors, technological advancements, and evolving energy policies. The market size is expected to expand significantly from an estimated USD 15,500 million in 2025 to USD 20,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 3.2% during the forecast period. This growth trajectory is underpinned by the sustained demand for oil and gas exploration and production activities across the continent, particularly in regions with substantial unconventional reserves. Adoption rates for advanced OCTG solutions, such as those with superior metallurgical properties and innovative connection designs, are steadily increasing. Technological disruptions, including advancements in material science and manufacturing processes, are enabling the production of OCTG that can withstand increasingly harsh operating conditions, thereby unlocking new exploration frontiers. Consumer behavior shifts are evident, with oil and gas operators prioritizing reliability, longevity, and reduced total cost of ownership, favoring premium OCTG products. The increasing focus on optimizing production efficiency and minimizing operational downtime further fuels the demand for high-performance OCTG. The market penetration of seamless OCTG, known for its superior strength and integrity, is expected to grow, catering to the demands of deep-well drilling and high-pressure applications. Electric Resistance Welded (ERW) OCTG will continue to hold a significant share, particularly for shallower wells and less demanding environments, offering a cost-effective solution. The sustained investment in infrastructure development and the ongoing need to replenish reserves will act as consistent growth accelerators. The adoption of digital technologies in OCTG manufacturing and supply chain management is also expected to improve efficiency and reduce lead times, further stimulating market expansion. The increasing exploration in offshore regions and the continued development of shale plays in the United States and Canada will be pivotal in shaping the market's future landscape.

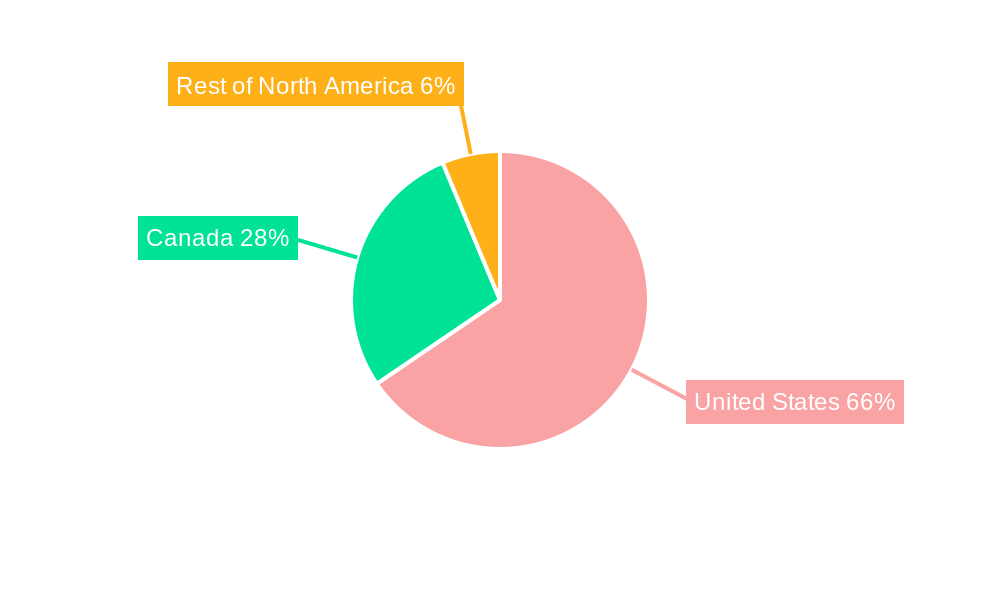

Dominant Regions, Countries, or Segments in North America Oil Country Tubular Goods Market

The United States is poised to remain the dominant force within the North America Oil Country Tubular Goods (OCTG) market, primarily driven by its vast reserves of unconventional oil and gas, particularly in shale formations. This dominance is further bolstered by a robust upstream oil and gas industry with continuous investment in exploration and production activities. The United States segment is estimated to account for over 70% of the total North American OCTG market share in 2025. Key drivers for this dominance include a favorable regulatory environment for domestic energy production, significant technological advancements in horizontal drilling and hydraulic fracturing, and an extensive existing infrastructure for oil and gas transportation. The demand for both seamless and API grade OCTG in the United States is exceptionally high, catering to a wide spectrum of drilling requirements, from shallow conventional wells to complex deep and unconventional plays.

Dominant Segment: United States

- Market Share (Estimated 2025): Over 70% of North American OCTG market.

- Key Drivers:

- Vast Unconventional Reserves: Significant shale oil and gas plays (e.g., Permian Basin, Eagle Ford, Bakken) necessitate substantial OCTG volumes.

- Technological Leadership: Advanced drilling techniques like horizontal drilling and hydraulic fracturing are predominantly developed and deployed here, requiring specialized OCTG.

- Investment Climate: Strong domestic and international investment in the US oil and gas sector fuels exploration and production.

- Infrastructure: Well-established midstream and downstream infrastructure supports continued upstream development.

- Regulatory Support: Policies generally favor domestic energy production and innovation.

- Growth Potential: Continued investment in developing mature fields and exploring new frontiers, especially in deep offshore and complex unconventional plays, ensures sustained demand.

Manufacturing Process Dominance: The Seamless manufacturing process is expected to witness higher growth in value due to its superior strength and integrity for demanding applications, while ERW will maintain a significant volume share for standard requirements.

Grade Dominance: API grades remain the industry standard, but the demand for Premium grades is escalating rapidly, driven by the need for enhanced performance in challenging environments.

North America Oil Country Tubular Goods Market Product Landscape

The product landscape of the North America Oil Country Tubular Goods (OCTG) market is characterized by a relentless pursuit of enhanced performance and reliability. Innovations focus on developing OCTG with superior corrosion resistance, higher tensile strength, and improved fatigue life to withstand extreme pressures and corrosive downhole environments. Premium OCTG products, featuring proprietary thread designs and advanced metallurgy, offer leak-free connections and greater operational integrity, crucial for deep, high-pressure, and sour gas wells. Applications span across conventional oil and gas extraction, unconventional resource development (shale gas and oil), and offshore exploration. Unique selling propositions often revolve around specialized coatings, advanced heat treatments, and superior material composition that extend product lifespan and reduce the risk of costly failures. Technological advancements are continuously pushing the boundaries of OCTG capabilities, enabling operators to reach more challenging reservoirs and optimize production efficiency.

Key Drivers, Barriers & Challenges in North America Oil Country Tubular Goods Market

Key Drivers:

- Sustained Global Energy Demand: The ongoing need for oil and natural gas, particularly in North America, directly fuels OCTG demand for exploration and production.

- Technological Advancements in Drilling: Innovations like horizontal drilling and hydraulic fracturing open up previously inaccessible reserves, requiring specialized OCTG.

- Aging Infrastructure & Reserve Replenishment: The need to maintain and expand existing oil and gas fields necessitates ongoing OCTG replacement and new well construction.

- Growth in Unconventional Resources: The significant shale oil and gas plays in the US and Canada represent a major demand driver.

Barriers & Challenges:

- Price Volatility of Crude Oil and Natural Gas: Fluctuations in commodity prices can significantly impact E&P budgets, leading to reduced OCTG orders.

- Stringent Environmental Regulations: Increasingly strict environmental standards can increase compliance costs and potentially slow down project approvals.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and logistical challenges can disrupt the availability of raw materials and finished products.

- Intense Competition and Price Pressure: A competitive market environment can lead to price erosion, impacting profitability for manufacturers.

- Skilled Labor Shortages: A lack of skilled labor in manufacturing and field operations can affect production and installation efficiency.

Emerging Opportunities in North America Oil Country Tubular Goods Market

Emerging opportunities in the North America OCTG market lie in the increasing demand for high-performance OCTG designed for deepwater exploration and the development of challenging unconventional reservoirs. The focus on sustainability and emission reduction is also creating opportunities for OCTG manufacturers offering solutions with reduced environmental impact, such as specialized coatings that prevent leaks or materials that enable longer service life. Furthermore, the growing adoption of digitalization and IoT solutions within the oil and gas industry presents opportunities for integrated OCTG services, including smart monitoring and predictive maintenance, offering value-added solutions beyond just the physical product. The ongoing transition towards cleaner energy sources, while a long-term shift, still requires substantial investment in traditional energy infrastructure in the interim, presenting short to medium-term opportunities for OCTG.

Growth Accelerators in the North America Oil Country Tubular Goods Market Industry

Several key factors are accelerating growth in the North America OCTG industry. Technological breakthroughs in metallurgy and manufacturing processes are enabling the production of OCTG capable of withstanding increasingly extreme downhole conditions, thus unlocking new exploration potential. Strategic partnerships between OCTG manufacturers and oilfield service companies are fostering innovation and improving supply chain efficiency. Market expansion strategies, including the development of new product lines tailored to specific regional demands and applications, are also crucial. Furthermore, sustained government support for domestic energy production in key North American markets continues to provide a stable environment for investment in exploration and development, directly benefiting the OCTG sector. The ongoing demand for natural gas as a transition fuel also acts as a significant growth catalyst.

Key Players Shaping the North America Oil Country Tubular Goods Market Market

- Tenaris SA

- TPCO Enterprise Inc

- Nippon Steel Corporation

- U S Steel Tubular Products Inc

- Vallourec SA

- National-Oilwell Varco Inc

- ILJIN Steel Co

- ArcelorMittal SA

- TMK PAO

Notable Milestones in North America Oil Country Tubular Goods Market Sector

- 2021: Tenaris SA launched a new high-strength OCTG product line designed for challenging shale plays.

- 2022: Vallourec SA announced significant investments in upgrading its manufacturing facilities to enhance premium connection production.

- 2023: TPCO Enterprise Inc expanded its presence in the North American market through strategic distribution agreements.

- 2023: Nippon Steel Corporation received new API certifications for its advanced OCTG offerings.

- 2024: U S Steel Tubular Products Inc focused on enhancing its seamless OCTG production capacity to meet growing demand.

In-Depth North America Oil Country Tubular Goods Market Market Outlook

The future outlook for the North America Oil Country Tubular Goods (OCTG) market is characterized by sustained growth, driven by innovation and strategic market positioning. Growth accelerators such as ongoing technological advancements in high-performance OCTG for extreme environments, coupled with strategic alliances and expanding market footprints of key players, will continue to propel the industry forward. The increasing emphasis on efficient and reliable energy production, alongside the continued importance of North America's vast unconventional resources, ensures a robust demand for OCTG solutions. Future market potential lies in the development of smart OCTG with integrated monitoring capabilities and the adoption of sustainable manufacturing practices. Strategic opportunities include catering to the evolving needs of operators seeking longer service life, reduced operational risks, and optimized total cost of ownership in their exploration and production endeavors.

North America Oil Country Tubular Goods Market Segmentation

-

1. Manufacturing Process

- 1.1. Seamless

- 1.2. Electric Resistance Welded

-

2. Grade

- 2.1. Premium

- 2.2. API

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Oil Country Tubular Goods Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Oil Country Tubular Goods Market Regional Market Share

Geographic Coverage of North America Oil Country Tubular Goods Market

North America Oil Country Tubular Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing

- 3.3. Market Restrains

- 3.3.1. 4.; High Exploration Cost

- 3.4. Market Trends

- 3.4.1. Premium Grade Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Oil Country Tubular Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.1.1. Seamless

- 5.1.2. Electric Resistance Welded

- 5.2. Market Analysis, Insights and Forecast - by Grade

- 5.2.1. Premium

- 5.2.2. API

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 6. United States North America Oil Country Tubular Goods Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 6.1.1. Seamless

- 6.1.2. Electric Resistance Welded

- 6.2. Market Analysis, Insights and Forecast - by Grade

- 6.2.1. Premium

- 6.2.2. API

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 7. Canada North America Oil Country Tubular Goods Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 7.1.1. Seamless

- 7.1.2. Electric Resistance Welded

- 7.2. Market Analysis, Insights and Forecast - by Grade

- 7.2.1. Premium

- 7.2.2. API

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 8. Rest of North America North America Oil Country Tubular Goods Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 8.1.1. Seamless

- 8.1.2. Electric Resistance Welded

- 8.2. Market Analysis, Insights and Forecast - by Grade

- 8.2.1. Premium

- 8.2.2. API

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Tenaris SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 TPCO Enterprise Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nippon Steel Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 U S Steel Tubular Products Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Vallourec SA*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 National-Oilwell Varco Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 ILJIN Steel Co

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 ArcelorMittal SA

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 TMK PAO

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Tenaris SA

List of Figures

- Figure 1: North America Oil Country Tubular Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Oil Country Tubular Goods Market Share (%) by Company 2025

List of Tables

- Table 1: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Manufacturing Process 2020 & 2033

- Table 2: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 3: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Manufacturing Process 2020 & 2033

- Table 6: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 7: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Manufacturing Process 2020 & 2033

- Table 10: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 11: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Manufacturing Process 2020 & 2033

- Table 14: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Grade 2020 & 2033

- Table 15: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Oil Country Tubular Goods Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Oil Country Tubular Goods Market?

The projected CAGR is approximately 11.74%.

2. Which companies are prominent players in the North America Oil Country Tubular Goods Market?

Key companies in the market include Tenaris SA, TPCO Enterprise Inc, Nippon Steel Corporation, U S Steel Tubular Products Inc, Vallourec SA*List Not Exhaustive, National-Oilwell Varco Inc, ILJIN Steel Co, ArcelorMittal SA, TMK PAO.

3. What are the main segments of the North America Oil Country Tubular Goods Market?

The market segments include Manufacturing Process, Grade, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.87 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Proven Shale Gas Reserves 4.; Technological Advancement in Horizontal Drilling and Hydraulic Fracturing.

6. What are the notable trends driving market growth?

Premium Grade Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Exploration Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Oil Country Tubular Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Oil Country Tubular Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Oil Country Tubular Goods Market?

To stay informed about further developments, trends, and reports in the North America Oil Country Tubular Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence