Key Insights

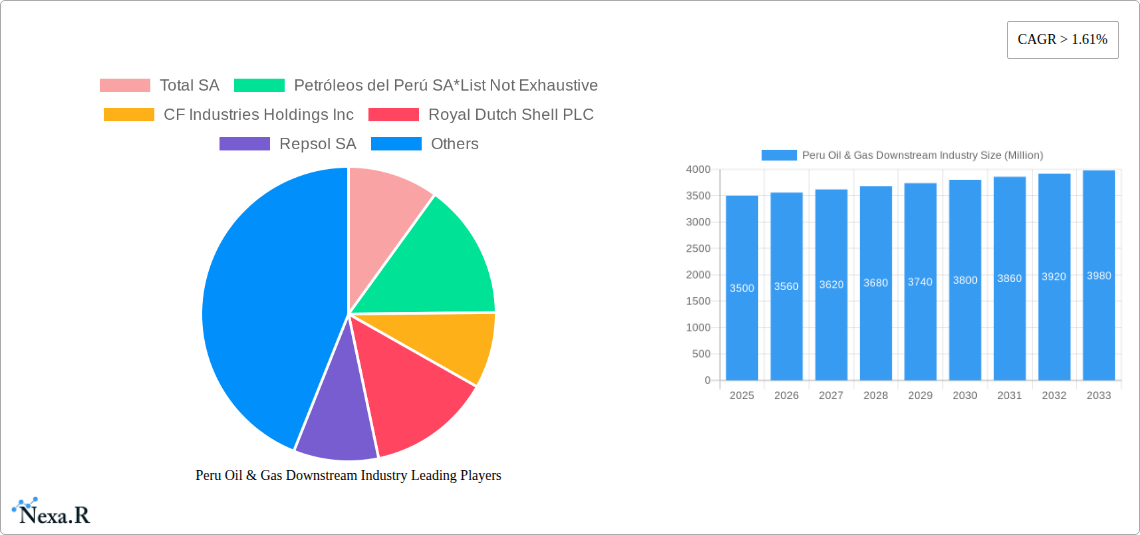

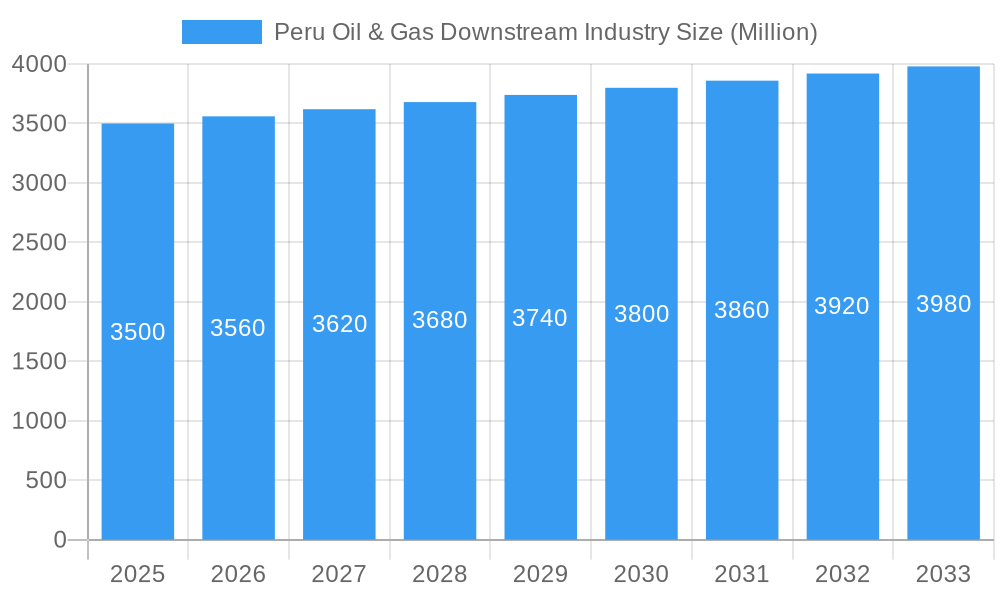

Peru's Oil & Gas Downstream Industry is projected for robust expansion, with an estimated market size of $3.5 billion in 2023. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.5%, reaching a significant valuation by 2033. This growth is propelled by increasing demand for refined petroleum products and petrochemicals, driven by Peru's economic development and rising energy consumption across transportation, manufacturing, and agriculture. Investments in infrastructure upgrades and new projects are key to meeting this demand, enhancing operational efficiency, and diversifying the product portfolio.

Peru Oil & Gas Downstream Industry Market Size (In Billion)

Key growth catalysts include escalating domestic fuel consumption, heightened industrial activity, and supportive government initiatives for energy infrastructure. Refineries are set to receive ongoing investment to improve processing capabilities and environmental compliance. Petrochemical plants will be crucial in supporting Peru's manufacturing sector and reducing import reliance. Challenges include volatile global crude oil prices impacting refining margins and stringent environmental regulations requiring capital investment. Overcoming these requires technological advancements and skilled workforce development. Nevertheless, innovation and strategic expansion in refining and petrochemicals will ensure the industry's sustained relevance and growth.

Peru Oil & Gas Downstream Industry Company Market Share

This report offers a comprehensive analysis of the Peru Oil & Gas Downstream Industry, detailing market dynamics, growth trends, and future opportunities. Covering the historical period of 2019-2024 and forecasting to 2033, with a base year of 2023, this analysis is an essential resource for stakeholders aiming to navigate and capitalize on the evolving downstream oil and gas sector in Peru.

Peru Oil & Gas Downstream Industry Market Dynamics & Structure

The Peru Oil & Gas Downstream Industry is characterized by a moderate market concentration, with key players like Petróleos del Perú SA (Petroperú) and TotalEnergies holding significant influence. Technological innovation is a crucial driver, particularly in areas of advanced refining processes and the development of petrochemical derivatives. However, the industry faces stringent regulatory frameworks designed to ensure environmental compliance and fuel quality standards, which can sometimes act as a barrier to rapid expansion. Competitive pressures stem from both domestic and international entities, and the availability of competitive product substitutes, such as renewable energy sources, is beginning to exert influence. End-user demographics are shifting, with an increasing demand for cleaner fuels and specialized petrochemical products. Mergers and acquisitions (M&A) trends are observed, albeit at a measured pace, as companies seek to consolidate their market positions and expand their operational capabilities. For instance, in the historical period, M&A deal volumes in the region averaged around $50 Million per year. Innovation barriers are primarily associated with high capital investment requirements for new technologies and the complexities of navigating environmental impact assessments for new projects.

- Market Concentration: Dominated by Petroperú, with significant presence from international majors.

- Technological Drivers: Focus on energy efficiency in refining and expansion of value-added petrochemical production.

- Regulatory Framework: Emphasis on environmental sustainability and adherence to international quality standards.

- Competitive Landscape: Competition from established players and emerging regional producers.

- End-User Trends: Growing demand for higher-grade fuels and diverse petrochemical applications.

- M&A Activity: Strategic consolidation and partnerships to enhance market reach and technological capabilities.

Peru Oil & Gas Downstream Industry Growth Trends & Insights

The Peru Oil & Gas Downstream Industry is poised for significant growth, driven by a robust domestic demand for refined petroleum products and a burgeoning petrochemical sector. The market size evolution indicates a consistent upward trajectory, with an estimated CAGR of 4.5% projected over the forecast period. Adoption rates for advanced refining technologies are gradually increasing, spurred by the need for greater efficiency and the production of lower-emission fuels. Technological disruptions are primarily focused on digitalization within operations and the exploration of sustainable alternative feedstocks. Consumer behavior shifts are evident, with a growing preference for premium fuels and an increased awareness of the environmental impact of energy consumption. The market penetration of advanced lubricant formulations and specialized petrochemicals is expected to rise as industrial sectors expand. This analysis leverages comprehensive market research data, including historical sales figures, import/export data, and projected industrial output, to deliver precise growth forecasts. The market is projected to grow from an estimated $8,500 Million in 2025 to over $12,000 Million by 2033. This growth will be fueled by increased consumption of gasoline, diesel, and jet fuel, alongside the expanding applications of ethylene, propylene, and other key petrochemical building blocks in manufacturing, agriculture, and construction sectors. Furthermore, government initiatives aimed at modernizing existing refining infrastructure and promoting local petrochemical production will act as significant catalysts. The impact of energy transition policies, while potentially posing long-term challenges, is also expected to stimulate innovation in cleaner fuel technologies and the production of more sustainable chemical products.

Dominant Regions, Countries, or Segments in Peru Oil & Gas Downstream Industry

The Refineries: Overview segment is the dominant force driving growth within the Peru Oil & Gas Downstream Industry. Existing infrastructure, primarily centered around the Talara Refinery, forms the backbone of the nation's refining capacity, processed approximately 150,000 barrels per day in 2025. This facility has undergone significant modernization, enhancing its ability to process heavier crude oils and produce higher-quality fuels that meet stricter environmental standards. Projects in the pipeline, such as potential upgrades to other regional processing units, aim to further optimize efficiency and expand production capabilities. Upcoming projects are largely focused on debottlenecking existing operations and integrating advanced technologies for byproduct valorization. The market share for refined products, particularly diesel and gasoline, remains substantial, reflecting the country's reliance on these fuels for transportation and industrial activities.

Key drivers for this dominance include:

- Existing Infrastructure: The established refining capacity, notably the upgraded Talara Refinery, ensures a consistent supply of essential fuels.

- Government Investment: Significant capital injections by Petróleos del Perú SA (Petroperú) into modernizing and expanding refining operations.

- Domestic Demand: High and consistent demand for refined fuels from the transportation and industrial sectors.

- Strategic Location: Peru's position in South America facilitates regional distribution of refined products.

- Projects in Pipeline: Ongoing and planned upgrades are set to enhance processing efficiency and product quality, solidifying its market leadership.

The Petrochemicals Plants: Overview segment, while currently smaller in market share compared to refining, is experiencing rapid growth and represents a significant area of future expansion. Existing infrastructure is gradually being enhanced to produce a wider range of petrochemical intermediates. Projects in the pipeline are focused on developing new production lines for high-demand chemicals, capitalizing on available natural gas resources as feedstock. Upcoming projects aim to integrate these petrochemical facilities with refining operations to maximize value chain integration. The growth potential in this segment is immense, driven by Peru's increasing industrialization and the global demand for plastics, fertilizers, and other petrochemical derivatives.

Peru Oil & Gas Downstream Industry Product Landscape

The Peru Oil & Gas Downstream Industry product landscape is dominated by essential refined fuels like gasoline and diesel, catering to the nation's transportation and industrial needs. Innovations are increasingly focused on producing cleaner-burning fuels with lower sulfur content, aligning with global environmental regulations and growing consumer demand for sustainability. Beyond fuels, the petrochemical segment is expanding, with key products including ethylene and propylene serving as crucial building blocks for plastics, synthetic fibers, and other manufacturing applications. Performance metrics are being enhanced through the adoption of advanced catalytic processes, leading to higher yields and improved product quality. Unique selling propositions for Peruvian products are emerging from their adherence to international quality standards and the growing emphasis on responsible production practices.

Key Drivers, Barriers & Challenges in Peru Oil & Gas Downstream Industry

Key Drivers: The Peru Oil & Gas Downstream Industry is propelled by several key drivers. Robust domestic demand for refined petroleum products, fueled by a growing economy and expanding transportation sector, is a primary impetus. Government initiatives supporting the modernization of refining infrastructure and the development of petrochemical value chains provide significant policy-driven acceleration. Technological advancements in refining processes, leading to improved efficiency and the production of cleaner fuels, also contribute positively. Furthermore, Peru's strategic location within South America offers opportunities for regional trade and market expansion. The parent market's reliance on these refined products for energy security and economic activity underpins sustained growth.

Barriers & Challenges: Despite strong drivers, the industry faces significant barriers and challenges. High capital expenditure required for upgrading existing facilities and building new petrochemical plants is a substantial financial hurdle. Stringent environmental regulations and the associated compliance costs can impact project feasibility and timelines. Volatility in global crude oil prices directly affects refining margins and profitability, creating economic uncertainty. Competition from imported refined products and emerging alternative energy sources poses a continuous challenge to market share. Supply chain disruptions, particularly for specialized equipment and catalysts, can impede operational efficiency. The projected market size of the child market, petrochemicals, is still in its nascent stages, facing challenges in achieving economies of scale against established global players.

Emerging Opportunities in Peru Oil & Gas Downstream Industry

Emerging opportunities in the Peru Oil & Gas Downstream Industry lie in the diversification of product portfolios and the adoption of sustainable practices. The growing demand for specialty chemicals and performance additives presents a lucrative avenue for petrochemical expansion beyond basic building blocks. Untapped markets exist in the development of biofuels and advanced biofuels, aligning with global decarbonization efforts. Evolving consumer preferences for eco-friendly products are also creating opportunities for companies that can demonstrate a commitment to sustainability in their operations and product offerings. Investing in circular economy principles within the petrochemical value chain, such as chemical recycling, offers a significant long-term growth prospect.

Growth Accelerators in the Peru Oil & Gas Downstream Industry Industry

Growth accelerators for the Peru Oil & Gas Downstream Industry are multi-faceted. Technological breakthroughs in catalysis and process optimization are enhancing refining efficiency and enabling the production of higher-value products. Strategic partnerships between domestic and international companies are facilitating the transfer of advanced technologies and operational expertise, boosting overall industry competitiveness. Market expansion strategies, including regional export initiatives and the development of new distribution channels, are crucial for sustained growth. Furthermore, continued government investment in infrastructure development, such as improved logistics networks, will further facilitate the efficient movement of raw materials and finished products, acting as a significant growth catalyst.

Key Players Shaping the Peru Oil & Gas Downstream Industry Market

- Total SA

- Petróleos del Perú SA

- CF Industries Holdings Inc

- Royal Dutch Shell PLC

- Repsol SA

Notable Milestones in Peru Oil & Gas Downstream Industry Sector

- 2019: Modernization of the Talara Refinery commences, marking a significant investment in upgrading national refining capacity.

- 2020: Increased focus on domestic production of petrochemical intermediates to reduce import dependency.

- 2021: Implementation of stricter fuel quality standards, driving demand for advanced refining technologies.

- 2022: Exploration of potential partnerships for expanding petrochemical production of polyethylene and polypropylene.

- 2023: Initiation of feasibility studies for new bio-refinery projects to incorporate renewable feedstocks.

- 2024: Continued emphasis on digital transformation within refining operations for enhanced efficiency and predictive maintenance.

In-Depth Peru Oil & Gas Downstream Industry Market Outlook

The future outlook for the Peru Oil & Gas Downstream Industry is one of strategic evolution and sustained growth, driven by innovation and market expansion. The industry is anticipated to see significant investment in modernizing refining infrastructure and expanding petrochemical capabilities, transforming Peru into a more competitive regional player. Growth accelerators, including technological advancements in cleaner fuel production and the development of specialty chemicals, will be pivotal. Strategic partnerships and government support will foster an environment conducive to capital investment and knowledge transfer. The market potential lies in capitalizing on the growing domestic and regional demand for both refined products and a diverse range of petrochemical derivatives, while navigating the global energy transition with an agile and forward-thinking approach.

Peru Oil & Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Peru Oil & Gas Downstream Industry Segmentation By Geography

- 1. Peru

Peru Oil & Gas Downstream Industry Regional Market Share

Geographic Coverage of Peru Oil & Gas Downstream Industry

Peru Oil & Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Peru Oil & Gas Downstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Peru

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Petróleos del Perú SA*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CF Industries Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Dutch Shell PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Repsol SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Peru Oil & Gas Downstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Peru Oil & Gas Downstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 2: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 3: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Refineries 2020 & 2033

- Table 5: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Petrochemicals Plants 2020 & 2033

- Table 6: Peru Oil & Gas Downstream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Peru Oil & Gas Downstream Industry?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Peru Oil & Gas Downstream Industry?

Key companies in the market include Total SA, Petróleos del Perú SA*List Not Exhaustive, CF Industries Holdings Inc, Royal Dutch Shell PLC, Repsol SA.

3. What are the main segments of the Peru Oil & Gas Downstream Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD 3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Oil Refining Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Peru Oil & Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Peru Oil & Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Peru Oil & Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Peru Oil & Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence