Key Insights

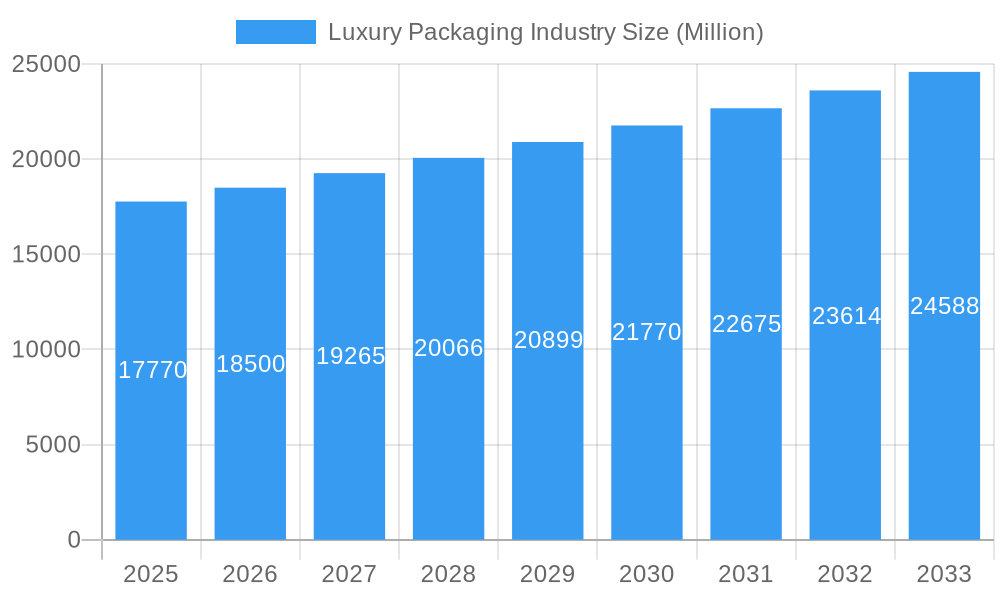

The luxury packaging market, valued at $17.77 billion in 2025, is projected to experience robust growth, driven by escalating demand for premium products across various sectors. The Compound Annual Growth Rate (CAGR) of 4.20% from 2025 to 2033 indicates a significant expansion, fueled by several key factors. The rising disposable incomes in developing economies, coupled with a growing preference for personalized and sustainable packaging solutions, are major contributors to this growth. The cosmetics and fragrances sector, followed closely by confectionery and premium beverages, represents significant end-user industries, demanding sophisticated and aesthetically pleasing packaging to enhance brand image and product appeal. Material choices like paperboard, glass, and metal dominate the market, reflecting the need for both luxury aesthetics and functionality. Furthermore, the increasing adoption of e-commerce and the consequent need for protective and attractive packaging for online deliveries further propels market growth. Competition among established players like Amcor Plc, Crown Holdings Inc, and WestRock Company is intense, leading to continuous innovation in packaging design and material utilization.

Luxury Packaging Industry Market Size (In Billion)

The market segmentation reveals diverse opportunities. While paperboard offers cost-effectiveness and recyclability, glass and metal provide premium aesthetics and durability. Geographical distribution suggests strong growth potential in the Asia-Pacific region, driven by rising consumer spending and economic growth in countries like China and India. However, fluctuating raw material prices and stringent environmental regulations pose challenges to the industry. Companies are increasingly focusing on sustainable and eco-friendly packaging solutions, incorporating recycled materials and minimizing environmental impact to meet evolving consumer preferences and regulatory compliance. This focus on sustainability is expected to be a key differentiator and growth driver in the years to come. The forecast period (2025-2033) suggests a continued upward trend, with significant expansion potential across all major segments and regions.

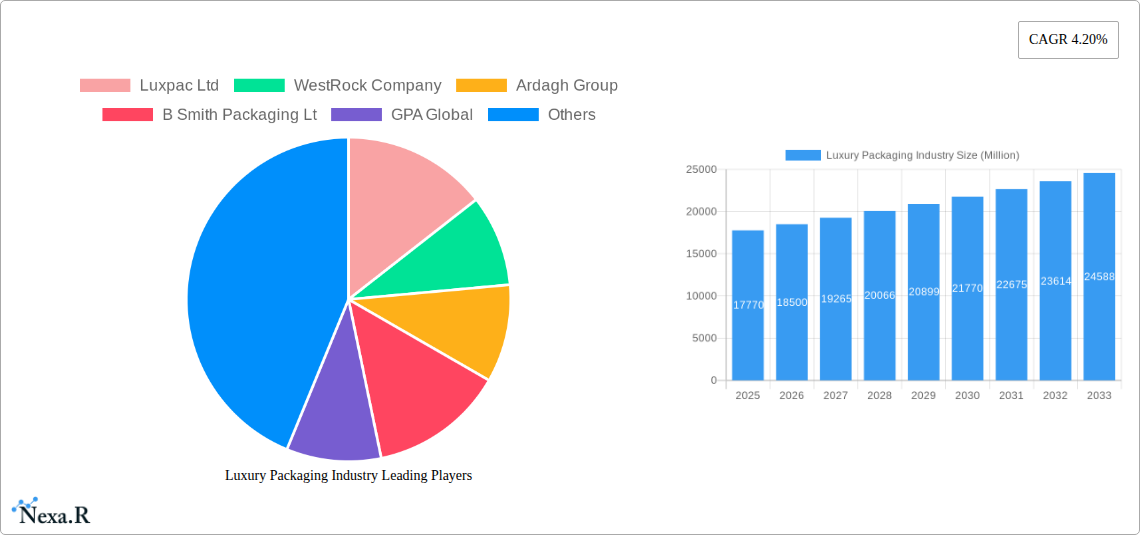

Luxury Packaging Industry Company Market Share

Luxury Packaging Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the luxury packaging industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by end-user industry (Cosmetics & Fragrances, Confectionery, Watches & Jewelry, Premium Beverages, Other) and material (Paperboard, Glass, Metal, Other), offering a granular view of this high-value sector. The report value is in Million Units.

Luxury Packaging Industry Market Dynamics & Structure

The luxury packaging market is characterized by a moderately concentrated structure, with key players like Amcor Plc, WestRock Company, and Ardagh Group holding significant market share (estimated at xx% collectively in 2025). Technological innovation, particularly in sustainable materials and advanced printing techniques, is a major driver, alongside increasing demand for bespoke, personalized packaging. Stringent regulatory frameworks concerning sustainability and materials compliance present both challenges and opportunities. The rise of e-commerce necessitates packaging solutions that prioritize both aesthetics and secure delivery. Competitive substitutes exist in the form of less expensive packaging options, impacting the market's premium positioning. M&A activity is significant, with several acquisitions in recent years aiming to expand product portfolios and market reach (e.g., Fedrigoni's acquisition of Guarro Casas).

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation Drivers: Sustainable materials, advanced printing, personalization.

- Regulatory Landscape: Stringent sustainability and compliance regulations.

- Competitive Substitutes: Lower-cost packaging options.

- M&A Trends: Significant activity, driven by portfolio expansion and market access.

- End-User Demographics: Growing affluent consumer base driving demand for premium packaging.

Luxury Packaging Industry Growth Trends & Insights

The luxury packaging market witnessed robust growth during the historical period (2019-2024), driven by rising disposable incomes in emerging markets and a growing preference for premium products across various sectors. The market size is estimated at xx million units in 2025 and is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by several factors, including increasing adoption of sustainable packaging solutions, technological advancements such as augmented reality and smart packaging, and changing consumer behavior towards experiences over mere products. The market penetration of sustainable packaging is also increasing, expected to reach xx% by 2033. Luxury brands are increasingly integrating digital technologies into their packaging, enhancing the customer experience. This trend is projected to further drive market growth in the coming years.

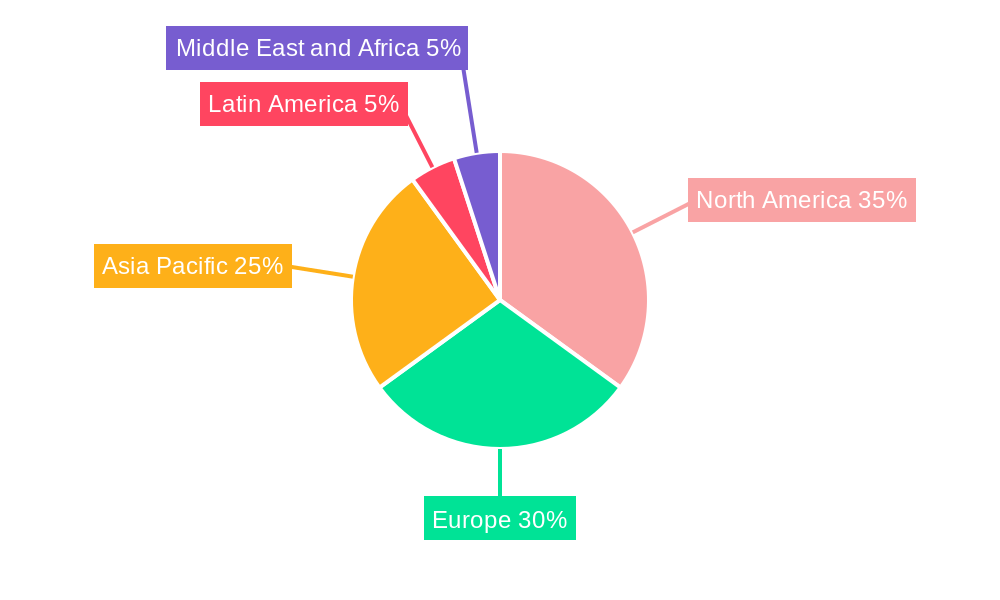

Dominant Regions, Countries, or Segments in Luxury Packaging Industry

The Cosmetics and Fragrances segment dominates the luxury packaging market, followed by Watches & Jewelry and Premium Beverages. In terms of materials, Paperboard maintains the largest market share due to its versatility and cost-effectiveness for various luxury applications. North America and Europe remain the leading regions, propelled by established luxury brands and high consumer spending. However, the Asia-Pacific region showcases significant growth potential owing to the expanding middle class and rising demand for premium goods.

- Dominant End-User Segment: Cosmetics & Fragrances, followed by Watches & Jewelry and Premium Beverages.

- Dominant Material: Paperboard, owing to its versatility and cost-effectiveness.

- Leading Regions: North America and Europe, with significant growth potential in Asia-Pacific.

- Key Growth Drivers (Region-Specific):

- North America: High consumer spending, established luxury brands.

- Europe: Similar to North America, with a strong focus on sustainability.

- Asia-Pacific: Expanding middle class, rising disposable incomes.

Luxury Packaging Industry Product Landscape

The luxury packaging landscape is marked by innovative product designs, incorporating sustainable materials and advanced printing techniques. Products are increasingly personalized, offering unique features such as augmented reality experiences or embedded sensors. Key performance metrics focus on sustainability certifications, product durability, and the overall brand enhancement provided by the packaging. Unique selling propositions frequently highlight eco-friendly materials, bespoke designs, and personalized touches that resonate with high-net-worth consumers.

Key Drivers, Barriers & Challenges in Luxury Packaging Industry

Key Drivers:

- Rising disposable incomes and increased demand for premium products.

- Growing adoption of sustainable packaging solutions.

- Technological advancements in printing, materials, and personalization.

- Increasing emphasis on brand storytelling and experience.

Key Challenges:

- Fluctuating raw material prices, impacting cost and profitability.

- Supply chain disruptions, leading to delays and increased costs.

- Stringent environmental regulations, requiring innovation in sustainable materials.

- Intense competition from established and emerging players. Estimated impact: xx% reduction in profit margins in 2025.

Emerging Opportunities in Luxury Packaging Industry

- Untapped markets in emerging economies with rising purchasing power.

- Growing demand for sustainable and eco-friendly packaging options.

- Increased adoption of personalized and customized packaging.

- Opportunities in integrating digital technologies such as AR and smart packaging.

Growth Accelerators in the Luxury Packaging Industry

Technological advancements in materials science, sustainable packaging solutions, and digital printing are key drivers. Strategic partnerships between luxury brands and packaging suppliers foster innovation and ensure alignment with branding strategies. Market expansion into emerging economies through targeted marketing and distribution channels unlocks significant growth potential.

Key Players Shaping the Luxury Packaging Industry Market

- Luxpac Ltd

- WestRock Company

- Ardagh Group

- B Smith Packaging Ltd

- GPA Global

- Lucas Luxury Packaging

- Stolzle Glass Group

- Elegant Packaging

- Amcor Plc

- HH Deluxe Packaging

- Crown Holdings Inc

- McLaren Packaging Ltd

- Prestige Packaging Industries

- International Paper Company

- DS Smith Plc

- Keenpac

- Pendragon Presentation Packaging

- Delta Global

- Owens-Illinois Inc

Notable Milestones in Luxury Packaging Industry Sector

- October 2022: Fedrigoni acquires Guarro Casas, strengthening its position in specialty papers for luxury packaging.

- August 2022: Delta Global receives a Gold Award from EcoVadis for sustainability performance.

- January 2022: Groupe Caisserie Bordelaise acquires Wildcat Packaging, entering the luxury packaging market.

In-Depth Luxury Packaging Industry Market Outlook

The luxury packaging market is poised for sustained growth, driven by technological innovation, a focus on sustainability, and increasing consumer demand for premium experiences. Strategic partnerships and market expansion into high-growth regions present significant opportunities for players in this sector. The future potential is substantial, with continued growth in personalized and sustainable luxury packaging expected to shape market dynamics over the next decade.

Luxury Packaging Industry Segmentation

-

1. Material

- 1.1. Paperboard

- 1.2. Glass

- 1.3. Metal

- 1.4. Other Material Types

-

2. End User

- 2.1. Cosmetics and Fragrances

- 2.2. Confectionery

- 2.3. Watches and Jewelry

- 2.4. Premium Beverages

- 2.5. Other End Users

Luxury Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Luxury Packaging Industry Regional Market Share

Geographic Coverage of Luxury Packaging Industry

Luxury Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism

- 3.3. Market Restrains

- 3.3.1. Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries

- 3.4. Market Trends

- 3.4.1. Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard may Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paperboard

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Cosmetics and Fragrances

- 5.2.2. Confectionery

- 5.2.3. Watches and Jewelry

- 5.2.4. Premium Beverages

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Luxury Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Paperboard

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Cosmetics and Fragrances

- 6.2.2. Confectionery

- 6.2.3. Watches and Jewelry

- 6.2.4. Premium Beverages

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Luxury Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Paperboard

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Cosmetics and Fragrances

- 7.2.2. Confectionery

- 7.2.3. Watches and Jewelry

- 7.2.4. Premium Beverages

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Luxury Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Paperboard

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Cosmetics and Fragrances

- 8.2.2. Confectionery

- 8.2.3. Watches and Jewelry

- 8.2.4. Premium Beverages

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Luxury Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Paperboard

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Cosmetics and Fragrances

- 9.2.2. Confectionery

- 9.2.3. Watches and Jewelry

- 9.2.4. Premium Beverages

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Luxury Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Paperboard

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Cosmetics and Fragrances

- 10.2.2. Confectionery

- 10.2.3. Watches and Jewelry

- 10.2.4. Premium Beverages

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Luxpac Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WestRock Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ardagh Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 B Smith Packaging Lt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GPA Global

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lucas Luxury Packaging

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stolzle Glass Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Elegant Packaging

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amcor Plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HH Deluxe Packaging

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Crown Holdings Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 McLaren Packaging Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Prestige Packaging Industries

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 International Paper Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DS Smith Plc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Keenpac

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Pendragon Presentation Packaging

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Delta Global

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Owens-Illinois Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Luxpac Ltd

List of Figures

- Figure 1: Global Luxury Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Luxury Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Luxury Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Luxury Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Luxury Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Luxury Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Luxury Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 9: Europe Luxury Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe Luxury Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Luxury Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Luxury Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Luxury Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Luxury Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 15: Asia Pacific Luxury Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific Luxury Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific Luxury Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Luxury Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Luxury Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Luxury Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 21: Latin America Luxury Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Latin America Luxury Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Latin America Luxury Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Luxury Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Luxury Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Luxury Packaging Industry Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East and Africa Luxury Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa Luxury Packaging Industry Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Luxury Packaging Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Luxury Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Luxury Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Luxury Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 5: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 18: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Luxury Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 25: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Luxury Packaging Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 28: Global Luxury Packaging Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 29: Global Luxury Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Packaging Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Luxury Packaging Industry?

Key companies in the market include Luxpac Ltd, WestRock Company, Ardagh Group, B Smith Packaging Lt, GPA Global, Lucas Luxury Packaging, Stolzle Glass Group, Elegant Packaging, Amcor Plc, HH Deluxe Packaging, Crown Holdings Inc, McLaren Packaging Ltd, Prestige Packaging Industries, International Paper Company, DS Smith Plc, Keenpac, Pendragon Presentation Packaging, Delta Global, Owens-Illinois Inc.

3. What are the main segments of the Luxury Packaging Industry?

The market segments include Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism.

6. What are the notable trends driving market growth?

Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard may Drive the Market Growth.

7. Are there any restraints impacting market growth?

Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries.

8. Can you provide examples of recent developments in the market?

October 2022: Fedrigoni, a prominent paper manufacturer, acquires Guarro Casas, enhancing its selection of specialty papers for high-end printing, packaging, and other creative uses. Guarro Casas specializes in producing fine papers for innovative and binding applications. It is a market player in high-added-value finishing for luxury packaging, fine book covering, and security applications. This acquisition strengthens Fedrigoni's proposal in the specialty papers business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Packaging Industry?

To stay informed about further developments, trends, and reports in the Luxury Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence