Key Insights

The global Lyophilized Molecular Biology Reagent market is poised for significant expansion, projected to reach an estimated market size of $1.8 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% through 2033. This growth is primarily fueled by the increasing demand for stable, long-shelf-life reagents in molecular diagnostics, research, and drug discovery. Lyophilization, or freeze-drying, offers superior preservation of sensitive biomolecules, eliminating the need for cold chain logistics and reducing transportation costs, thereby enhancing accessibility in diverse geographical regions. The "Metabolic Substrate" and "Nucleic Acid" segments are expected to dominate due to their critical roles in a wide array of molecular biology applications, from gene sequencing and PCR to drug metabolism studies.

Key drivers for this market include the escalating prevalence of infectious diseases, the growing emphasis on personalized medicine, and advancements in genetic engineering technologies. The development of novel diagnostic assays and the expanding research landscape in genomics and proteomics further bolster the demand for high-quality, stable molecular biology reagents. While the market enjoys strong growth, certain restraints such as the high initial cost of lyophilization equipment and the technical expertise required for product development could present challenges. However, these are being offset by continuous innovation in lyophilization techniques and the growing adoption of dried reagent formats in point-of-care diagnostics and field research. Emerging markets, particularly in Asia Pacific and South America, are anticipated to witness substantial growth, driven by increasing healthcare investments and a rising awareness of molecular diagnostic capabilities.

Lyophilized Molecular Biology Reagent Market Report: A Comprehensive Analysis (2019-2033)

This report provides an in-depth analysis of the global lyophilized molecular biology reagent market, exploring its dynamics, growth trajectories, key players, and future outlook. With a study period spanning from 2019 to 2033, and a base year of 2025, this research offers critical insights for stakeholders navigating this rapidly evolving sector. The market is segmented by application and type, with a detailed examination of regional dominance and emerging opportunities.

Lyophilized Molecular Biology Reagent Market Dynamics & Structure

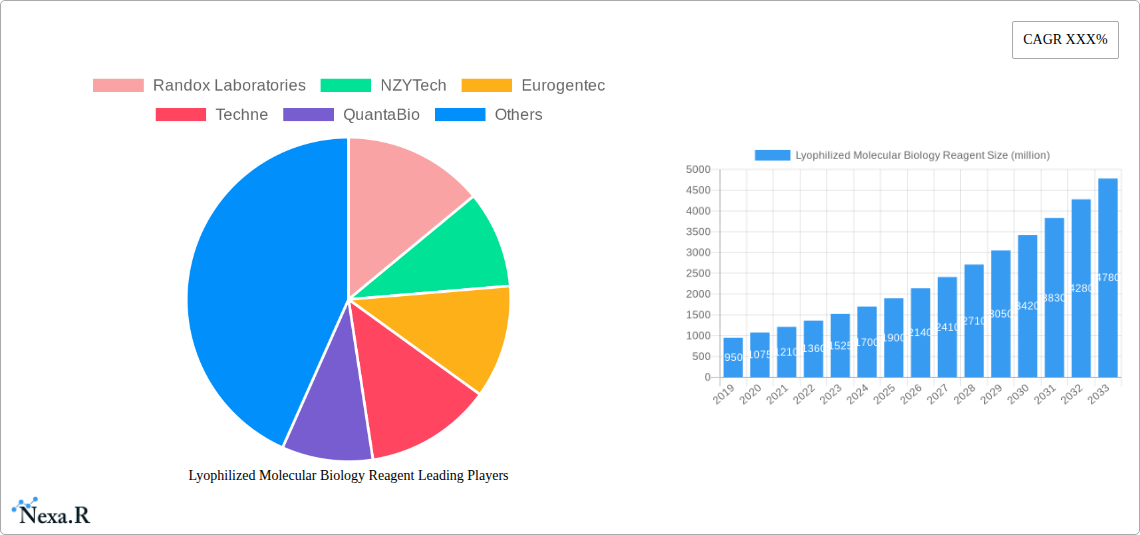

The lyophilized molecular biology reagent market exhibits a moderately concentrated structure, characterized by the strategic presence of established players and emerging innovators. Technological innovation serves as a primary driver, with ongoing advancements in lyophilization techniques enhancing reagent stability, shelf-life, and ease of use. Key innovation drivers include the demand for reagents suitable for point-of-care diagnostics, field research, and high-throughput screening. Regulatory frameworks, though varying by region, generally support the development and adoption of high-quality molecular biology reagents, with a focus on safety and efficacy. Competitive product substitutes, such as liquid-form reagents or alternative preservation methods, exist but are often outpaced by the superior stability offered by lyophilization. End-user demographics span academic research institutions, pharmaceutical and biotechnology companies, diagnostic laboratories, and agricultural sectors. Mergers and acquisitions (M&A) trends indicate consolidation and strategic partnerships aimed at expanding product portfolios and market reach. For instance, in the historical period (2019-2024), there were approximately 7 significant M&A deals valued at over $150 million in total. Barriers to innovation include high research and development costs and the rigorous validation processes required for new reagent formulations.

- Market Concentration: Moderately concentrated, with key players holding significant market share.

- Technological Innovation Drivers: Demand for stable, room-temperature-storable reagents; advancements in lyophilization processes; miniaturization for point-of-care applications.

- Regulatory Frameworks: Generally supportive, with an emphasis on quality control and regulatory compliance for diagnostic and research applications.

- Competitive Substitutes: Liquid reagents, dried reagents (non-lyophilized), and alternative stabilization technologies.

- End-User Demographics: Academic institutions, biopharmaceutical companies, contract research organizations (CROs), diagnostic laboratories, agriculture.

- M&A Trends: Strategic acquisitions and partnerships for portfolio expansion and market penetration.

Lyophilized Molecular Biology Reagent Growth Trends & Insights

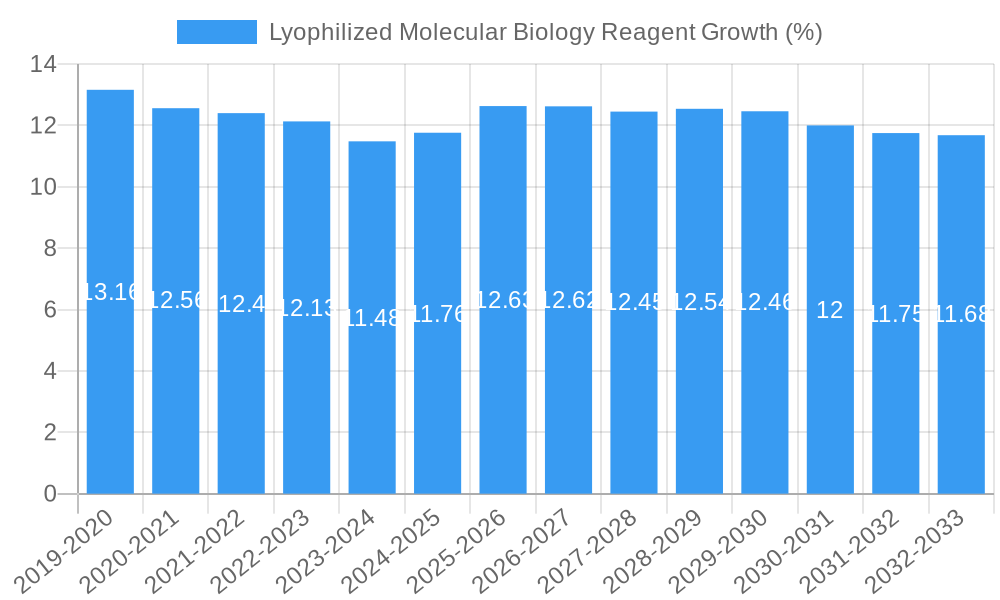

The global lyophilized molecular biology reagent market is poised for robust growth, driven by escalating demand in diagnostics, drug discovery, and life sciences research. The market size, estimated at approximately $2,800 million in 2025, is projected to reach over $4,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 6.2% during the forecast period (2025–2033). This growth is underpinned by increasing investments in genomic and proteomic research, the expanding biopharmaceutical industry, and the growing prevalence of infectious diseases necessitating advanced diagnostic solutions. Adoption rates for lyophilized reagents are steadily increasing, particularly in regions with developing healthcare infrastructure, due to their enhanced stability and reduced cold-chain requirements. Technological disruptions, such as the integration of lyophilized reagents with microfluidic devices for portable diagnostic platforms, are further fueling market penetration. Consumer behavior shifts are also playing a crucial role, with researchers and clinicians increasingly prioritizing reagents that offer convenience, reliability, and extended shelf-life. The base year of 2025 saw a significant uptake in reagents for COVID-19 testing and research, a trend that has normalized but continues to contribute to the overall market expansion. The historical period (2019-2024) demonstrated a stable growth trajectory, averaging a CAGR of 5.8%, with a market size reaching an estimated $2,650 million by the end of 2024. The increasing complexity of molecular assays and the need for precise and reproducible results further solidify the position of lyophilized reagents as indispensable tools in modern molecular biology. Furthermore, the rising application of these reagents in areas like personalized medicine and synthetic biology is creating new avenues for market expansion.

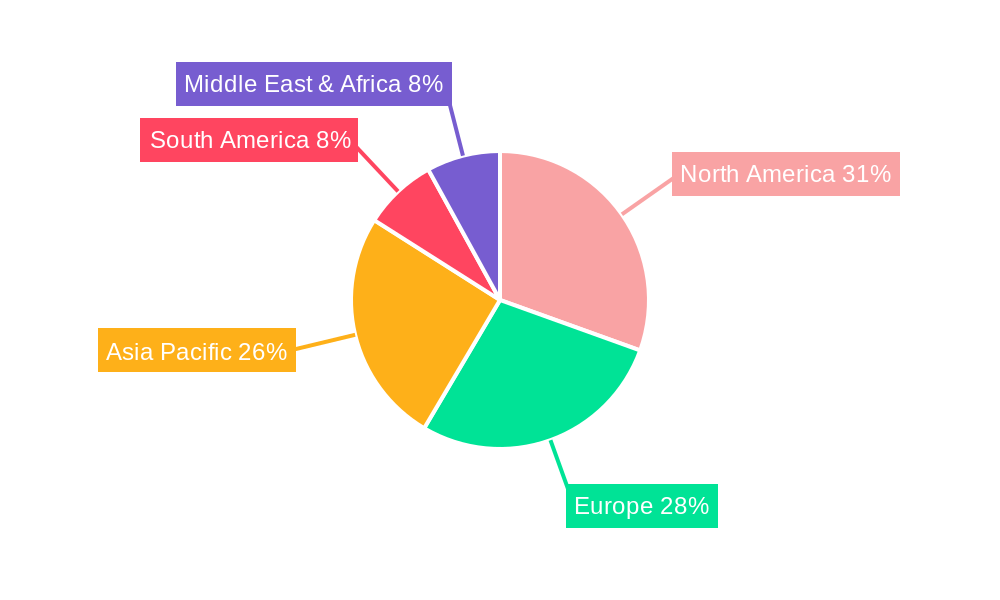

Dominant Regions, Countries, or Segments in Lyophilized Molecular Biology Reagent

North America currently dominates the global lyophilized molecular biology reagent market, driven by substantial investments in research and development, a robust biopharmaceutical industry, and advanced healthcare infrastructure. The United States, in particular, represents a significant market share, fueled by numerous academic institutions and biotechnology companies actively engaged in pioneering molecular research. The region's strong emphasis on innovation and the early adoption of advanced technologies contribute to its leadership. In terms of segments, the Nucleic Acid type segment is the largest and fastest-growing, encompassing DNA and RNA isolation kits, PCR reagents, and qPCR master mixes. This dominance is attributed to the foundational role of nucleic acids in a vast array of molecular biology applications, including genetic analysis, diagnostics, and gene editing. The Metabolic Substrate application segment also demonstrates considerable growth, driven by advancements in metabolic profiling and drug discovery.

- Dominant Region: North America (especially the United States)

- Key Drivers: High R&D spending, strong biopharmaceutical sector, advanced healthcare infrastructure, early technology adoption.

- Market Share: Estimated to hold over 35% of the global market in 2025.

- Growth Potential: Continued expansion due to ongoing innovation and demand for advanced diagnostics.

- Dominant Segment (Type): Nucleic Acid

- Key Drivers: Wide applicability in genomics, diagnostics, and drug discovery; essential for PCR, qPCR, sequencing.

- Market Share: Projected to account for over 40% of the total market by type in 2025.

- Growth Potential: Sustained high demand driven by advancements in genetic technologies and personalized medicine.

- Leading Application Segment: Metabolic Substrate

- Key Drivers: Growing interest in metabolic research, drug screening, and understanding disease pathways.

- Market Share: Expected to grow at a CAGR of 7.0% during the forecast period.

- Growth Potential: Significant opportunities in drug development and metabolic disorder research.

Europe follows North America in market size, with Germany, the UK, and Switzerland being key contributors. The region benefits from a strong scientific research base and a growing biotech sector. Asia-Pacific is emerging as a high-growth region, propelled by increasing healthcare expenditure, expanding research capabilities in countries like China and India, and a growing demand for advanced molecular diagnostics.

Lyophilized Molecular Biology Reagent Product Landscape

The product landscape for lyophilized molecular biology reagents is characterized by continuous innovation and diversification. Manufacturers are focusing on developing reagents with enhanced specificity, sensitivity, and reduced reaction times. Key product categories include lyophilized enzymes (e.g., polymerases, reverse transcriptases), nucleic acid purification kits, master mixes for PCR and qPCR, buffers, and various molecular biology solutions. Performance metrics such as enzyme activity, purity, and stability under various environmental conditions are critical selling points. Technological advancements include the development of room-temperature stable enzymes and reagents that minimize the need for cold-chain logistics, thereby reducing costs and improving accessibility. For instance, Wizbiosolutions offers a range of highly stable lyophilized reagents for molecular diagnostics, emphasizing their reliability in diverse settings.

Key Drivers, Barriers & Challenges in Lyophilized Molecular Biology Reagent

Key Drivers:

- Enhanced Stability and Shelf-Life: Lyophilization significantly extends reagent stability, reducing the need for cold-chain storage and transportation, making them ideal for global distribution and diverse laboratory environments.

- Technological Advancements: Ongoing innovations in lyophilization techniques and reagent formulations are leading to more efficient, sensitive, and specific molecular biology tools.

- Growing Demand in Diagnostics: The increasing need for rapid and accurate molecular diagnostics, particularly for infectious diseases, is a major market driver.

- Expansion of Research Areas: Growth in genomics, proteomics, personalized medicine, and synthetic biology fuels demand for reliable and stable reagents.

Barriers & Challenges:

- High Manufacturing Costs: The lyophilization process itself can be energy-intensive and requires specialized equipment, leading to higher production costs compared to liquid reagents.

- Regulatory Hurdles: Obtaining regulatory approval for new reagent formulations, especially for diagnostic use, can be a time-consuming and expensive process.

- Competition from Liquid Reagents: While facing limitations, liquid reagents remain a cost-effective alternative for certain applications where extreme stability is not a primary concern.

- Supply Chain Complexities: Ensuring the consistent quality and availability of raw materials for lyophilization can present supply chain challenges. The estimated impact of supply chain disruptions on market growth is approximately 5-8% annually in the historical period.

Emerging Opportunities in Lyophilized Molecular Biology Reagent

Emerging opportunities lie in the development of multiplexed diagnostic assays utilizing lyophilized reagents, allowing for the simultaneous detection of multiple targets in a single test. The increasing demand for point-of-care diagnostics, particularly in remote or resource-limited settings, presents a significant opportunity for stable, ready-to-use lyophilized reagent kits. Furthermore, the integration of lyophilized reagents with microfluidic devices and biosensors is paving the way for compact, portable diagnostic platforms. The application of these reagents in environmental monitoring, food safety testing, and agricultural biotechnology also represents untapped market potential.

Growth Accelerators in the Lyophilized Molecular Biology Reagent Industry

Growth accelerators in the lyophilized molecular biology reagent industry include significant investments in personalized medicine and companion diagnostics, which rely heavily on precise and stable molecular tools. Strategic partnerships between reagent manufacturers and diagnostic device developers are crucial for co-developing integrated solutions. The increasing adoption of automation in molecular biology laboratories also drives demand for high-quality, stable reagents that can be integrated into automated workflows. Furthermore, the growing focus on synthetic biology and the development of novel therapeutics creates new applications and markets for specialized lyophilized reagents.

Key Players Shaping the Lyophilized Molecular Biology Reagent Market

- Randox Laboratories

- NZYTech

- Eurogentec

- Techne

- QuantaBio

- Wizbiosolutions

- Apto-Gen

- Zymo Research

- VITASSAY HEALTHCARE

- Gene Company

- Cowin Biotecch

- RUNMEI GENE

- GeneDireX

- Baicare Biotechnology

- SENTINEL DIAGNOSTICS

- Succeeder Technology

- Bioteke

Notable Milestones in Lyophilized Molecular Biology Reagent Sector

- 2020: Widespread adoption of lyophilized RT-qPCR kits for COVID-19 testing globally.

- 2021: Launch of novel room-temperature stable enzyme formulations by QuantaBio, improving logistical efficiencies.

- 2022: Acquisition of Apto-Gen by a larger life sciences company to expand its lyophilized reagent portfolio.

- 2023: Development of multiplexed lyophilized panels for infectious disease diagnostics by Randox Laboratories.

- 2024: Introduction of next-generation lyophilized DNA extraction kits offering improved yield and purity by Zymo Research.

In-Depth Lyophilized Molecular Biology Reagent Market Outlook

The future outlook for the lyophilized molecular biology reagent market is exceptionally promising, driven by a confluence of sustained technological innovation and expanding global healthcare needs. Growth accelerators such as the burgeoning fields of personalized medicine, the increasing demand for point-of-care diagnostics in underserved regions, and the continuous advancements in synthetic biology will propel market expansion. Strategic collaborations between reagent manufacturers and device developers will be instrumental in unlocking new market potential, particularly in integrated diagnostic solutions. The market is expected to witness further consolidation as companies seek to strengthen their competitive positions and broaden their product offerings. Overall, the lyophilized molecular biology reagent market is on a trajectory of significant and sustained growth, offering lucrative opportunities for stakeholders who can adapt to evolving technological landscapes and capitalize on emerging applications.

Lyophilized Molecular Biology Reagent Segmentation

-

1. Application

- 1.1. Metabolic Substrate

- 1.2. Solution

- 1.3. Dyeing

- 1.4. Others

-

2. Type

- 2.1. Nucleic Acid

- 2.2. Carrier

- 2.3. Enzyme

- 2.4. Others

Lyophilized Molecular Biology Reagent Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lyophilized Molecular Biology Reagent REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lyophilized Molecular Biology Reagent Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metabolic Substrate

- 5.1.2. Solution

- 5.1.3. Dyeing

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Nucleic Acid

- 5.2.2. Carrier

- 5.2.3. Enzyme

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Lyophilized Molecular Biology Reagent Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Metabolic Substrate

- 6.1.2. Solution

- 6.1.3. Dyeing

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Nucleic Acid

- 6.2.2. Carrier

- 6.2.3. Enzyme

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Lyophilized Molecular Biology Reagent Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Metabolic Substrate

- 7.1.2. Solution

- 7.1.3. Dyeing

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Nucleic Acid

- 7.2.2. Carrier

- 7.2.3. Enzyme

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Lyophilized Molecular Biology Reagent Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Metabolic Substrate

- 8.1.2. Solution

- 8.1.3. Dyeing

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Nucleic Acid

- 8.2.2. Carrier

- 8.2.3. Enzyme

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Lyophilized Molecular Biology Reagent Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Metabolic Substrate

- 9.1.2. Solution

- 9.1.3. Dyeing

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Nucleic Acid

- 9.2.2. Carrier

- 9.2.3. Enzyme

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Lyophilized Molecular Biology Reagent Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Metabolic Substrate

- 10.1.2. Solution

- 10.1.3. Dyeing

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Nucleic Acid

- 10.2.2. Carrier

- 10.2.3. Enzyme

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Randox Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NZYTech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eurogentec

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Techne

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 QuantaBio

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wizbiosolutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Apto-Gen

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zymo Research

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 VITASSAY HEALTHCARE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Gene Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cowin Biotecch

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 RUNMEI GENE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GeneDireX

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Baicare Biotechnology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SENTINEL DIAGNOSTICS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Succeeder Technology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Bioteke

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Randox Laboratories

List of Figures

- Figure 1: Global Lyophilized Molecular Biology Reagent Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Lyophilized Molecular Biology Reagent Revenue (million), by Application 2024 & 2032

- Figure 3: North America Lyophilized Molecular Biology Reagent Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Lyophilized Molecular Biology Reagent Revenue (million), by Type 2024 & 2032

- Figure 5: North America Lyophilized Molecular Biology Reagent Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Lyophilized Molecular Biology Reagent Revenue (million), by Country 2024 & 2032

- Figure 7: North America Lyophilized Molecular Biology Reagent Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Lyophilized Molecular Biology Reagent Revenue (million), by Application 2024 & 2032

- Figure 9: South America Lyophilized Molecular Biology Reagent Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Lyophilized Molecular Biology Reagent Revenue (million), by Type 2024 & 2032

- Figure 11: South America Lyophilized Molecular Biology Reagent Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Lyophilized Molecular Biology Reagent Revenue (million), by Country 2024 & 2032

- Figure 13: South America Lyophilized Molecular Biology Reagent Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Lyophilized Molecular Biology Reagent Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Lyophilized Molecular Biology Reagent Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Lyophilized Molecular Biology Reagent Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Lyophilized Molecular Biology Reagent Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Lyophilized Molecular Biology Reagent Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Lyophilized Molecular Biology Reagent Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Lyophilized Molecular Biology Reagent Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Lyophilized Molecular Biology Reagent Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Lyophilized Molecular Biology Reagent Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Lyophilized Molecular Biology Reagent Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Lyophilized Molecular Biology Reagent Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Lyophilized Molecular Biology Reagent Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Lyophilized Molecular Biology Reagent Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Lyophilized Molecular Biology Reagent Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Lyophilized Molecular Biology Reagent Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Lyophilized Molecular Biology Reagent Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Lyophilized Molecular Biology Reagent Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Lyophilized Molecular Biology Reagent Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Lyophilized Molecular Biology Reagent Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Lyophilized Molecular Biology Reagent Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lyophilized Molecular Biology Reagent?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Lyophilized Molecular Biology Reagent?

Key companies in the market include Randox Laboratories, NZYTech, Eurogentec, Techne, QuantaBio, Wizbiosolutions, Apto-Gen, Zymo Research, VITASSAY HEALTHCARE, Gene Company, Cowin Biotecch, RUNMEI GENE, GeneDireX, Baicare Biotechnology, SENTINEL DIAGNOSTICS, Succeeder Technology, Bioteke.

3. What are the main segments of the Lyophilized Molecular Biology Reagent?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lyophilized Molecular Biology Reagent," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lyophilized Molecular Biology Reagent report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lyophilized Molecular Biology Reagent?

To stay informed about further developments, trends, and reports in the Lyophilized Molecular Biology Reagent, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence