Key Insights

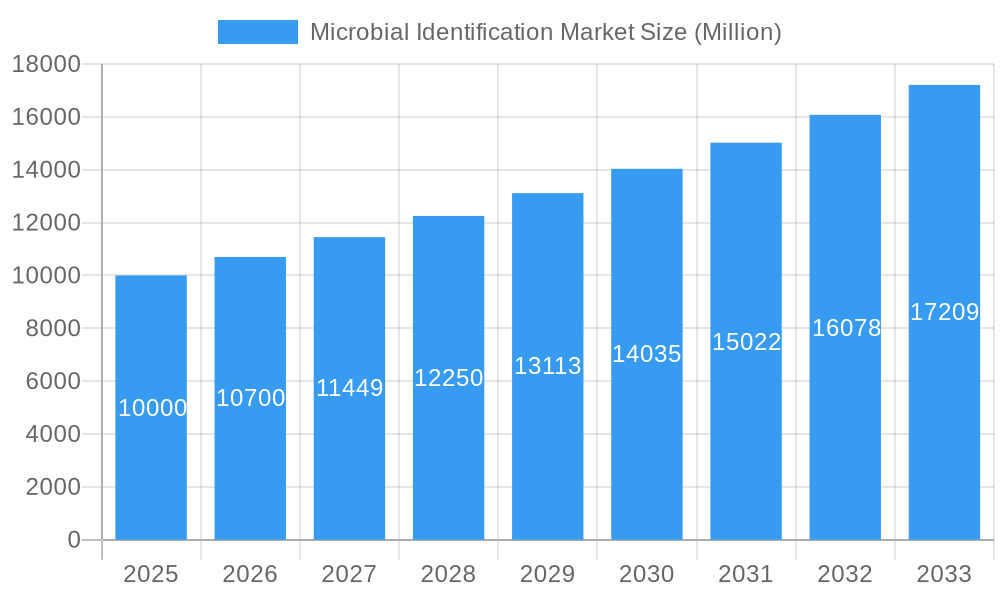

The global Microbial Identification Market is poised for significant expansion, projected to reach an estimated market size of approximately $10,000 million by 2025. This robust growth is fueled by a Compound Annual Growth Rate (CAGR) of 7.00%, indicating a dynamic and evolving industry. A primary driver for this expansion is the increasing demand for accurate and rapid identification of microorganisms across diverse sectors, most notably in diagnostics and pharmaceutical quality control. The escalating prevalence of infectious diseases, coupled with stringent regulatory requirements for food safety and drug efficacy, necessitates advanced microbial identification solutions. Furthermore, the continuous innovation in technologies, such as the development of faster and more sensitive genotypic and proteomics-based methods, is augmenting the market's growth trajectory. These advancements offer improved accuracy and efficiency compared to traditional phenotypic methods, driving adoption rates among research institutions and commercial laboratories.

Microbial Identification Market Market Size (In Billion)

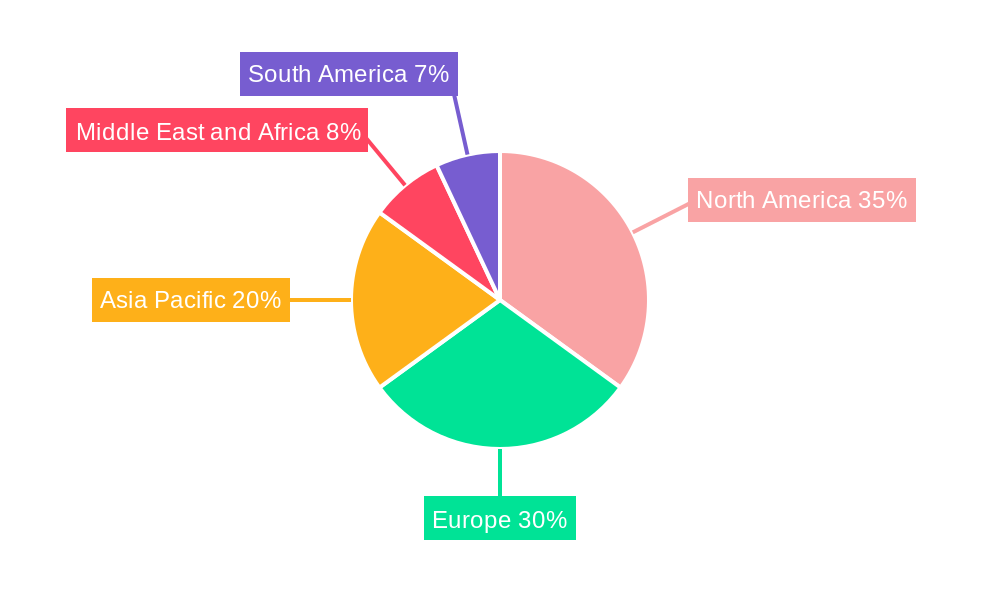

The market is further segmented into key product and service categories, with instruments and consumables representing substantial segments. In terms of methodologies, phenotypic methods, while established, are increasingly being complemented and sometimes supplanted by more sophisticated genotypic and proteomics-based approaches, which offer higher specificity and speed. The application landscape is broad, encompassing critical areas like diagnostics, where timely identification is crucial for effective patient treatment, and food and beverage testing, where ensuring product safety and quality is paramount. The pharmaceutical industry relies heavily on these technologies for drug development and quality assurance, while the cosmetics and personal care sectors also utilize microbial identification to ensure product integrity. Geographically, North America and Europe currently hold significant market shares due to established healthcare infrastructure and advanced research capabilities. However, the Asia Pacific region, driven by rapidly developing economies and increasing investments in healthcare and biotechnology, is expected to witness the fastest growth in the coming years, presenting substantial opportunities for market players.

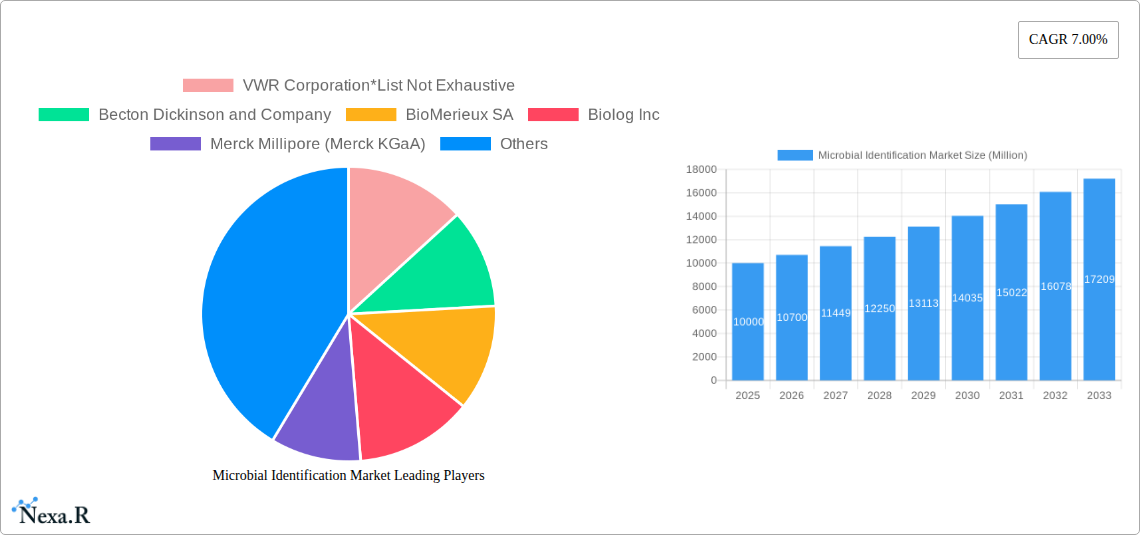

Microbial Identification Market Company Market Share

This in-depth report provides a detailed examination of the global microbial identification market, a critical sector encompassing diagnostics, food safety, pharmaceuticals, and beyond. With a comprehensive study period from 2019 to 2033, this analysis offers unparalleled insights into market dynamics, growth trajectories, and strategic imperatives for industry stakeholders. We leverage advanced analytical frameworks to dissect the microbial identification market size, CAGR, and market penetration, focusing on the base year 2025 and a robust forecast period of 2025–2033, building upon a thorough historical period of 2019–2024. This report is optimized with high-traffic keywords to ensure maximum visibility for industry professionals seeking advanced microbial testing solutions, pathogen detection technologies, and rapid identification systems.

Microbial Identification Market Market Dynamics & Structure

The microbial identification market is characterized by dynamic shifts driven by escalating global health concerns, stringent regulatory mandates, and rapid technological advancements. Market concentration is moderately fragmented, with a few key players holding significant shares while a growing number of innovative startups contribute to the competitive landscape. Technological innovation is a primary driver, with continuous development in genotypic methods and proteomics-based methods offering faster, more accurate, and comprehensive microbial identification. Regulatory frameworks, particularly those governing food safety and healthcare diagnostics, impose strict standards that necessitate reliable and validated microbial identification systems. Competitive product substitutes, while present, are increasingly being outpaced by the precision and speed of molecular and proteomic approaches. End-user demographics are expanding beyond traditional clinical laboratories to include broader applications in environmental monitoring, industrial microbiology, and agricultural sectors. Mergers and acquisitions (M&A) trends are prevalent as larger entities seek to acquire innovative technologies or expand their market reach, leading to strategic consolidations.

- Market Concentration: Moderately fragmented with a blend of established giants and agile innovators.

- Technological Innovation Drivers: Advancements in PCR, NGS, MALDI-TOF MS, and AI-driven data analysis.

- Regulatory Frameworks: FDA, EMA, ISO standards driving demand for validated microbial identification solutions.

- Competitive Product Substitutes: Traditional culture-based methods being replaced by molecular and rapid techniques.

- End-User Demographics: Expansion into environmental, industrial, and agricultural applications alongside core healthcare and food sectors.

- M&A Trends: Strategic acquisitions to enhance technological portfolios and market penetration.

Microbial Identification Market Growth Trends & Insights

The microbial identification market is poised for substantial growth, projected to expand significantly from its current valuation. The increasing prevalence of infectious diseases, coupled with growing awareness of antimicrobial resistance (AMR), is a primary catalyst, driving demand for rapid microbial identification and antibiotic susceptibility testing. The evolution of healthcare, particularly the rise of personalized medicine and precision diagnostics, further fuels the adoption of advanced microbial identification technologies. Furthermore, stringent food safety regulations worldwide necessitate robust microbial testing protocols throughout the food supply chain, from farm to fork, contributing to sustained market expansion. Technological disruptions are at the forefront, with innovations in genotypic methods like next-generation sequencing (NGS) and multiplex PCR assays offering unprecedented speed and specificity in identifying a wide range of pathogens. The adoption rates of these advanced microbial identification systems are accelerating as their cost-effectiveness and superior performance become more apparent. Consumer behavior shifts, particularly a growing demand for safe food products and effective healthcare interventions, indirectly bolster the microbial identification market. The integration of artificial intelligence (AI) and machine learning (ML) in data analysis is further enhancing the interpretative capabilities of microbial identification platforms, promising more actionable insights and predictive diagnostics.

Dominant Regions, Countries, or Segments in Microbial Identification Market

The North America region currently dominates the global microbial identification market, driven by its advanced healthcare infrastructure, significant investments in R&D, and stringent regulatory oversight. The United States, in particular, boasts a high concentration of leading pharmaceutical and biotechnology companies, academic research institutions, and a well-established diagnostics market. This robust ecosystem fosters the adoption of cutting-edge microbial identification technologies.

Key Drivers of Dominance in North America:

- Advanced Healthcare Infrastructure: Widespread availability of sophisticated diagnostic laboratories and hospitals equipped for advanced microbial testing.

- High R&D Investment: Substantial funding from government agencies and private enterprises fuels innovation in pathogen detection and microbial profiling.

- Stringent Regulatory Standards: FDA mandates for accurate and rapid microbial identification in clinical settings and food products.

- Prevalence of Infectious Diseases: A significant burden of various infectious diseases necessitates continuous development and deployment of microbial identification solutions.

Within the Products and Services segment, Consumables represent a substantial market share due to their recurring purchase nature in routine microbial identification workflows. However, the Instruments segment, particularly genotypic and proteomics-based instruments, is exhibiting higher growth rates as labs invest in advanced technologies. In terms of Methods, Genotypic Methods, including PCR and sequencing, are experiencing rapid adoption due to their speed and accuracy, often surpassing traditional Phenotypic Methods. However, Phenotypic Methods continue to hold relevance in certain applications. Looking at Applications, Diagnostics is the largest segment, driven by the critical need for accurate identification of pathogens in patient samples to guide treatment decisions. Food and Beverage Testing is another significant and growing application area, driven by consumer demand for safe food and regulatory requirements for microbial contamination control.

Microbial Identification Market Product Landscape

The microbial identification market is characterized by a dynamic product landscape driven by innovation in rapid identification systems and enhanced assay development. Companies are focusing on developing instruments that offer faster turnaround times, higher multiplexing capabilities, and improved sensitivity for detecting a broader spectrum of microorganisms. Innovations in consumables, such as advanced reagents and sample preparation kits, are enhancing the efficiency and accuracy of microbial testing. The integration of data analytics and artificial intelligence into microbial identification platforms is a significant trend, enabling more sophisticated interpretation of results and predictive insights into microbial behavior. Unique selling propositions often revolve around ease of use, cost-effectiveness, and the ability to integrate with existing laboratory workflows.

Key Drivers, Barriers & Challenges in Microbial Identification Market

The microbial identification market is propelled by several key drivers, including the escalating global burden of infectious diseases, the growing threat of antimicrobial resistance, and increasing regulatory pressure for robust food safety and clinical diagnostics. Technological advancements in genotypic methods, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), offer unparalleled speed and accuracy, driving market growth. The expanding applications in environmental monitoring and industrial biotechnology also contribute to market expansion.

- Technological Advancements: Innovations in molecular diagnostics, bioinformatics, and AI.

- Rising Infectious Disease Incidence: Increased focus on rapid and accurate pathogen identification.

- Antimicrobial Resistance (AMR) Concerns: Need for rapid diagnostics to guide appropriate antibiotic therapy.

- Stringent Regulations: Growing emphasis on food safety and clinical diagnostic accuracy.

- Expanding Applications: Utilization in environmental, industrial, and agricultural sectors.

However, the market faces significant barriers and challenges. The high initial cost of advanced microbial identification instruments, particularly for smaller laboratories or in emerging economies, can be a restraint. The need for specialized training and expertise to operate and interpret results from complex molecular identification systems also presents a hurdle. Stringent regulatory approval processes for new microbial identification assays and devices can lead to prolonged time-to-market. Furthermore, the prevalence of counterfeit products and the potential for data breaches in digital microbial identification platforms pose risks. Supply chain disruptions for critical reagents and components can also impact market availability and pricing.

Emerging Opportunities in Microbial Identification Market

Emerging opportunities in the microbial identification market lie in the expansion of point-of-care diagnostics, enabling rapid microbial testing at the patient's bedside or in remote settings. The growing demand for personalized medicine creates a niche for microbial identification solutions that can precisely characterize an individual's microbiome. Untapped markets in developing countries, with increasing healthcare investments and a rising incidence of infectious diseases, present significant growth potential. Innovative applications in agriculture, such as soil microbiome analysis for crop improvement and disease prevention, are also on the rise. Furthermore, the increasing focus on the human microbiome and its link to various diseases opens avenues for novel microbial identification and analysis tools.

Growth Accelerators in the Microbial Identification Market Industry

The long-term growth of the microbial identification market is significantly accelerated by continuous technological breakthroughs, strategic partnerships, and proactive market expansion strategies. The ongoing refinement of genotypic methods, such as advancements in CRISPR-based diagnostics and single-cell sequencing, promises even greater precision and speed in pathogen detection. Strategic collaborations between instrument manufacturers, reagent suppliers, and data analytics companies are fostering integrated solutions that enhance workflow efficiency and diagnostic capabilities. Market expansion strategies focused on underserved regions and novel application areas, like environmental pathogen surveillance and industrial bioprocess monitoring, are also critical growth catalysts. The increasing adoption of cloud-based platforms for data management and sharing further facilitates research and development, driving innovation and market penetration.

Key Players Shaping the Microbial Identification Market Market

- VWR Corporation

- Becton Dickinson and Company

- BioMerieux SA

- Biolog Inc

- Merck Millipore (Merck KGaA)

- Charles River Laboratories International Inc

- Thermo Fisher Scientific Inc

- Eurofins Scientific SE

- Bruker Corporation

- Danaher Corporation (Beckman Coulter Inc )

- Shimadzu Corporation

Notable Milestones in Microbial Identification Market Sector

- April 2022: Bruker Corporation advanced its new multiplex PCR infectious disease assays based on its proprietary LiquidArray technology. The company also expanded its mycobacteria portfolio with the FluoroType Mycobacteria PCR assay, launched on the high-precision FluoroCycler XT thermocycler, which uses powerful LiquidArray technology to differentiate 31 clinically relevant non-tuberculous mycobacteria and the M. tuberculosis complex from cultures in a single test.

- March 2022: Accelerate Diagnostics, Inc. launched Accelerate Arc system, comprised of the Arc Module and BC Kit, an automated path to rapid and accurate microbial identification for positive blood cultures. The system is designed to eliminate the need for overnight culture incubation while reducing cross-reactivity and potentially false positive results that come with rapid multi-targeted molecular tests.

In-Depth Microbial Identification Market Market Outlook

The microbial identification market is projected for robust future growth, driven by an interplay of technological innovation, increasing healthcare demands, and expanding applications. Growth accelerators such as the development of advanced genotypic and proteomic methods, alongside the integration of AI and machine learning, will continue to enhance the speed, accuracy, and comprehensiveness of microbial testing. Strategic partnerships and a focus on developing integrated solutions will further solidify market positions. Emerging opportunities in point-of-care diagnostics, microbiome analysis, and environmental monitoring will open new revenue streams. The ongoing global emphasis on infectious disease surveillance and the management of antimicrobial resistance ensures a sustained demand for cutting-edge microbial identification systems, making this a pivotal market for future advancements in public health and scientific discovery.

Microbial Identification Market Segmentation

-

1. Products and Services

- 1.1. Instruments

- 1.2. Consumables

-

2. Method

- 2.1. Phenotypic Methods

- 2.2. Genotypic Methods

- 2.3. Proteomics-based Methods

-

3. Application

- 3.1. Diagnostics

- 3.2. Food and Beverage Testing

- 3.3. Pharmaceuticals

- 3.4. Cosmetics and Personal Care Products Testing

- 3.5. Other Applications

Microbial Identification Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Microbial Identification Market Regional Market Share

Geographic Coverage of Microbial Identification Market

Microbial Identification Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Infectious Diseases; Technological Advancements in Microbial Identification; Increasing Food Safety Concerns; Government Initiatives and Funding for Promoting Microbial Identification

- 3.3. Market Restrains

- 3.3.1. High Cost of Automated Microbial Identification Systems

- 3.4. Market Trends

- 3.4.1. The Instruments Segment is Anticipated to Witness a Growth in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microbial Identification Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products and Services

- 5.1.1. Instruments

- 5.1.2. Consumables

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Phenotypic Methods

- 5.2.2. Genotypic Methods

- 5.2.3. Proteomics-based Methods

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Diagnostics

- 5.3.2. Food and Beverage Testing

- 5.3.3. Pharmaceuticals

- 5.3.4. Cosmetics and Personal Care Products Testing

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Products and Services

- 6. North America Microbial Identification Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Products and Services

- 6.1.1. Instruments

- 6.1.2. Consumables

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Phenotypic Methods

- 6.2.2. Genotypic Methods

- 6.2.3. Proteomics-based Methods

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Diagnostics

- 6.3.2. Food and Beverage Testing

- 6.3.3. Pharmaceuticals

- 6.3.4. Cosmetics and Personal Care Products Testing

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Products and Services

- 7. Europe Microbial Identification Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Products and Services

- 7.1.1. Instruments

- 7.1.2. Consumables

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Phenotypic Methods

- 7.2.2. Genotypic Methods

- 7.2.3. Proteomics-based Methods

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Diagnostics

- 7.3.2. Food and Beverage Testing

- 7.3.3. Pharmaceuticals

- 7.3.4. Cosmetics and Personal Care Products Testing

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Products and Services

- 8. Asia Pacific Microbial Identification Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Products and Services

- 8.1.1. Instruments

- 8.1.2. Consumables

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Phenotypic Methods

- 8.2.2. Genotypic Methods

- 8.2.3. Proteomics-based Methods

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Diagnostics

- 8.3.2. Food and Beverage Testing

- 8.3.3. Pharmaceuticals

- 8.3.4. Cosmetics and Personal Care Products Testing

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Products and Services

- 9. Middle East and Africa Microbial Identification Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Products and Services

- 9.1.1. Instruments

- 9.1.2. Consumables

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Phenotypic Methods

- 9.2.2. Genotypic Methods

- 9.2.3. Proteomics-based Methods

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Diagnostics

- 9.3.2. Food and Beverage Testing

- 9.3.3. Pharmaceuticals

- 9.3.4. Cosmetics and Personal Care Products Testing

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Products and Services

- 10. South America Microbial Identification Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Products and Services

- 10.1.1. Instruments

- 10.1.2. Consumables

- 10.2. Market Analysis, Insights and Forecast - by Method

- 10.2.1. Phenotypic Methods

- 10.2.2. Genotypic Methods

- 10.2.3. Proteomics-based Methods

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Diagnostics

- 10.3.2. Food and Beverage Testing

- 10.3.3. Pharmaceuticals

- 10.3.4. Cosmetics and Personal Care Products Testing

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Products and Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 VWR Corporation*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Becton Dickinson and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BioMerieux SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Biolog Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merck Millipore (Merck KGaA)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Charles River Laboratories International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thermo Fisher Scientific Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Eurofins Scientific SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bruker Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Danaher Corporation (Beckman Coulter Inc )

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shimadzu Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 VWR Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global Microbial Identification Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Microbial Identification Market Revenue (undefined), by Products and Services 2025 & 2033

- Figure 3: North America Microbial Identification Market Revenue Share (%), by Products and Services 2025 & 2033

- Figure 4: North America Microbial Identification Market Revenue (undefined), by Method 2025 & 2033

- Figure 5: North America Microbial Identification Market Revenue Share (%), by Method 2025 & 2033

- Figure 6: North America Microbial Identification Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Microbial Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Microbial Identification Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Microbial Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Microbial Identification Market Revenue (undefined), by Products and Services 2025 & 2033

- Figure 11: Europe Microbial Identification Market Revenue Share (%), by Products and Services 2025 & 2033

- Figure 12: Europe Microbial Identification Market Revenue (undefined), by Method 2025 & 2033

- Figure 13: Europe Microbial Identification Market Revenue Share (%), by Method 2025 & 2033

- Figure 14: Europe Microbial Identification Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Microbial Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Microbial Identification Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Microbial Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Microbial Identification Market Revenue (undefined), by Products and Services 2025 & 2033

- Figure 19: Asia Pacific Microbial Identification Market Revenue Share (%), by Products and Services 2025 & 2033

- Figure 20: Asia Pacific Microbial Identification Market Revenue (undefined), by Method 2025 & 2033

- Figure 21: Asia Pacific Microbial Identification Market Revenue Share (%), by Method 2025 & 2033

- Figure 22: Asia Pacific Microbial Identification Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Microbial Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Microbial Identification Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Microbial Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Microbial Identification Market Revenue (undefined), by Products and Services 2025 & 2033

- Figure 27: Middle East and Africa Microbial Identification Market Revenue Share (%), by Products and Services 2025 & 2033

- Figure 28: Middle East and Africa Microbial Identification Market Revenue (undefined), by Method 2025 & 2033

- Figure 29: Middle East and Africa Microbial Identification Market Revenue Share (%), by Method 2025 & 2033

- Figure 30: Middle East and Africa Microbial Identification Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East and Africa Microbial Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Microbial Identification Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Microbial Identification Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Microbial Identification Market Revenue (undefined), by Products and Services 2025 & 2033

- Figure 35: South America Microbial Identification Market Revenue Share (%), by Products and Services 2025 & 2033

- Figure 36: South America Microbial Identification Market Revenue (undefined), by Method 2025 & 2033

- Figure 37: South America Microbial Identification Market Revenue Share (%), by Method 2025 & 2033

- Figure 38: South America Microbial Identification Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: South America Microbial Identification Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Microbial Identification Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Microbial Identification Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Microbial Identification Market Revenue undefined Forecast, by Products and Services 2020 & 2033

- Table 2: Global Microbial Identification Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 3: Global Microbial Identification Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Microbial Identification Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Microbial Identification Market Revenue undefined Forecast, by Products and Services 2020 & 2033

- Table 6: Global Microbial Identification Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 7: Global Microbial Identification Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Microbial Identification Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Microbial Identification Market Revenue undefined Forecast, by Products and Services 2020 & 2033

- Table 13: Global Microbial Identification Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 14: Global Microbial Identification Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Microbial Identification Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Microbial Identification Market Revenue undefined Forecast, by Products and Services 2020 & 2033

- Table 23: Global Microbial Identification Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 24: Global Microbial Identification Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Microbial Identification Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Microbial Identification Market Revenue undefined Forecast, by Products and Services 2020 & 2033

- Table 33: Global Microbial Identification Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 34: Global Microbial Identification Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global Microbial Identification Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Microbial Identification Market Revenue undefined Forecast, by Products and Services 2020 & 2033

- Table 40: Global Microbial Identification Market Revenue undefined Forecast, by Method 2020 & 2033

- Table 41: Global Microbial Identification Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 42: Global Microbial Identification Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Microbial Identification Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microbial Identification Market?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the Microbial Identification Market?

Key companies in the market include VWR Corporation*List Not Exhaustive, Becton Dickinson and Company, BioMerieux SA, Biolog Inc, Merck Millipore (Merck KGaA), Charles River Laboratories International Inc, Thermo Fisher Scientific Inc, Eurofins Scientific SE, Bruker Corporation, Danaher Corporation (Beckman Coulter Inc ), Shimadzu Corporation.

3. What are the main segments of the Microbial Identification Market?

The market segments include Products and Services, Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Infectious Diseases; Technological Advancements in Microbial Identification; Increasing Food Safety Concerns; Government Initiatives and Funding for Promoting Microbial Identification.

6. What are the notable trends driving market growth?

The Instruments Segment is Anticipated to Witness a Growth in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Automated Microbial Identification Systems.

8. Can you provide examples of recent developments in the market?

In April 2022, Bruker Corporation advanced its new multiplex PCR infectious disease assays based on its proprietary LiquidArray technology. The company also expanded its mycobacteria portfolio with the FluoroType Mycobacteria PCR assay, launched on the high-precision FluoroCycler XT thermocycler, which uses powerful LiquidArray technology to differentiate 31 clinically relevant non-tuberculous mycobacteria and the M. tuberculosis complex from cultures in a single test.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microbial Identification Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microbial Identification Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microbial Identification Market?

To stay informed about further developments, trends, and reports in the Microbial Identification Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence