Key Insights

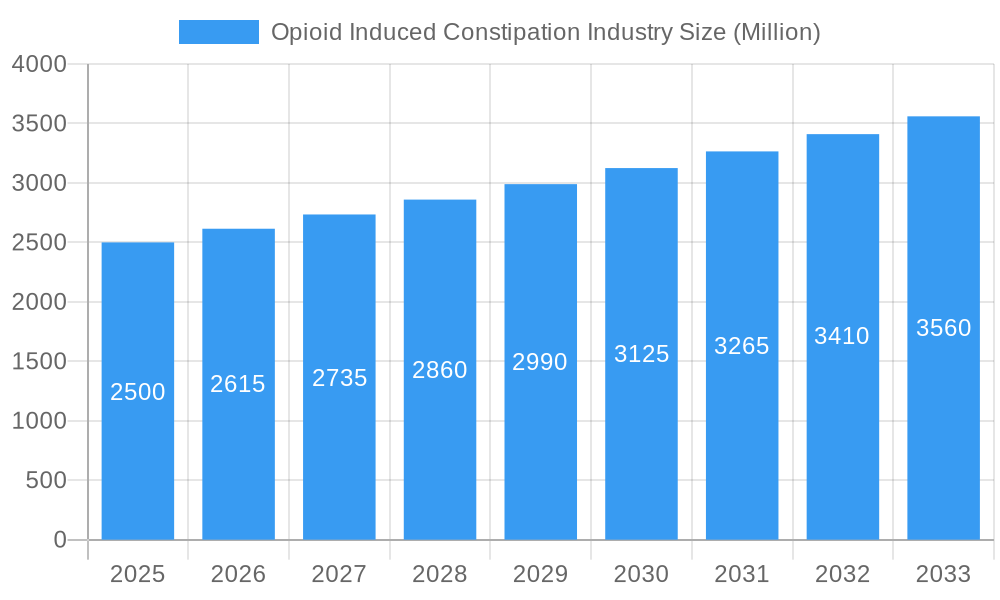

The Opioid-Induced Constipation (OIC) market is projected for significant expansion, forecast to grow from an estimated market size of $9.68 billion in the base year 2025, with a compound annual growth rate (CAGR) of 12.93% through 2033. This growth is driven by the increasing global prevalence of chronic pain management and associated opioid prescriptions, coupled with an aging population requiring pain relief. Advancements in OIC therapeutics, including novel mu-opioid receptor antagonists and chloride channel-2 activators, are also key contributors. Enhanced awareness among healthcare professionals and patients regarding OIC's impact and available treatments further supports market expansion.

Opioid Induced Constipation Industry Market Size (In Billion)

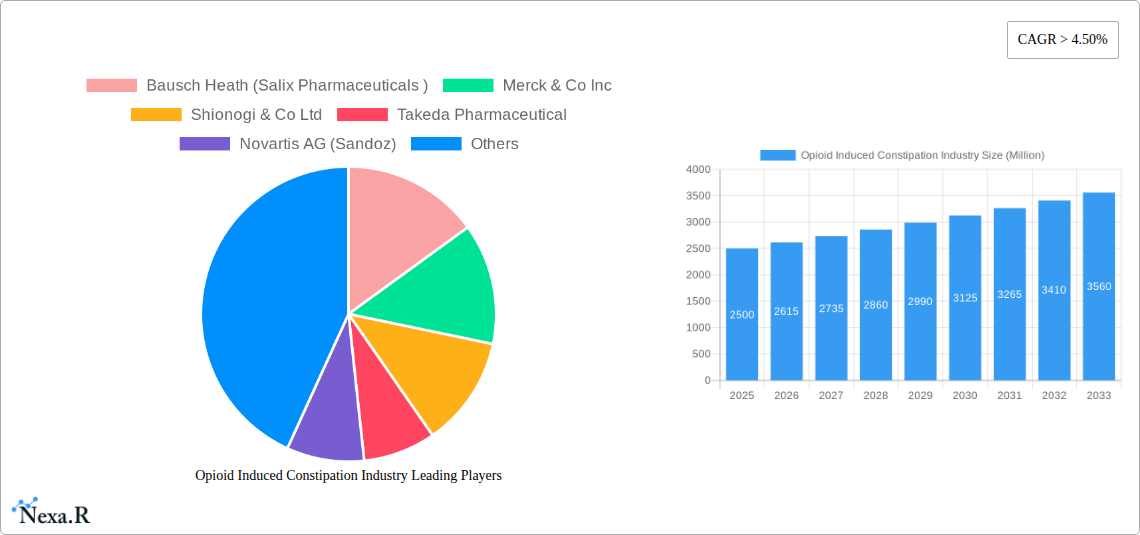

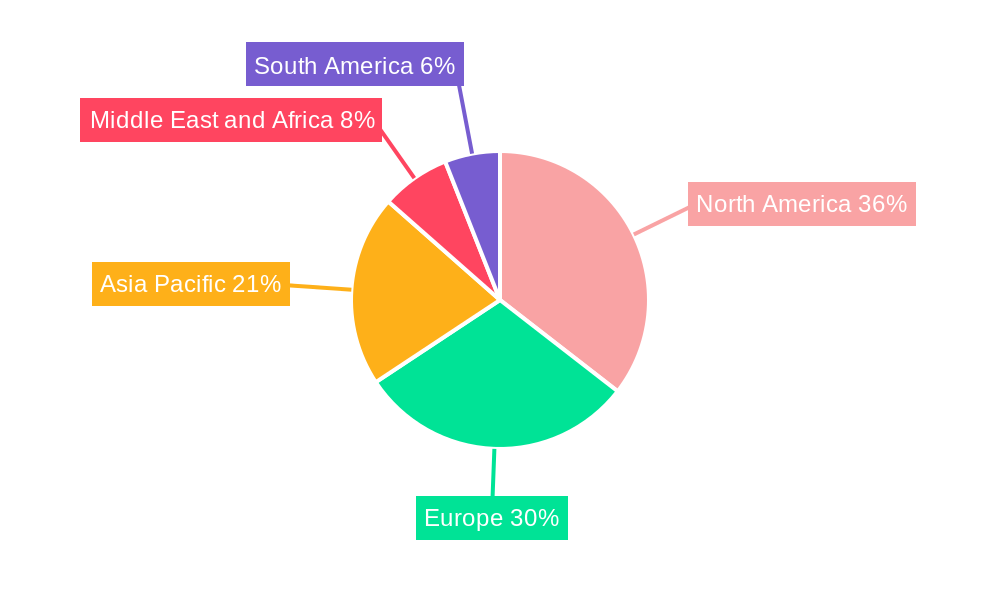

The OIC market features competition between established pharmaceutical companies and emerging biopharmaceutical firms. Key players are investing in R&D for next-generation therapies. The market is segmented by drug class, with mu-opioid receptor antagonists currently leading, while chloride channel-2 activators are gaining traction. Segmentation by prescription type includes both Over-The-Counter (OTC) and prescription medications. End-users span hospital, retail, and online pharmacies. North America and Europe currently dominate, but the Asia Pacific region is anticipated to experience substantial growth due to rising chronic disease rates and improving healthcare infrastructure.

Opioid Induced Constipation Industry Company Market Share

This report provides an in-depth analysis of the Opioid-Induced Constipation (OIC) market, a dynamic segment within the pharmaceutical industry. Driven by the global opioid crisis and the rising incidence of chronic pain, the OIC market is experiencing robust growth. This analysis offers critical insights for pharmaceutical manufacturers, healthcare providers, investors, and regulatory bodies. We meticulously examine market dynamics, growth trends, regional performance, product offerings, key drivers, challenges, and emerging opportunities, with projections extending through 2033. Leveraging high-impact keywords such as opioid-induced constipation treatment, OIC drugs, mu-opioid receptor antagonists, prescription OIC medication, chronic pain management, gastrointestinal disorders, pharmaceutical market analysis, and global drug market, this report ensures optimal search engine visibility for industry professionals.

The analysis encompasses a detailed Historical Period (2019–2024), a Base Year (2025), and an extensive Forecast Period (2025–2033), with an emphasis on the Estimated Year (2025) for immediate strategic planning. Market segmentation includes Drug Class (Mu-opioid Receptor Antagonists, Chloride Channel-2 Activators, Others), Prescription Type (Over The Counter, Prescription), and End-User (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies). Quantitative data is presented in Million units, providing a clear financial perspective on market valuations and trends.

Opioid Induced Constipation Industry Market Dynamics & Structure

The Opioid Induced Constipation (OIC) market is characterized by a moderate to high level of market concentration, with established pharmaceutical giants dominating the prescription segment. Technological innovation is a primary driver, focusing on novel drug delivery systems and improved efficacy with reduced side effects for OIC treatments. Regulatory frameworks, particularly stringent FDA approvals in major markets, significantly influence market entry and product development. Competitive product substitutes, primarily from other OIC therapies and over-the-counter (OTC) laxatives, exert pressure on market share, necessitating continuous innovation. End-user demographics are shifting, with an aging population and increased awareness of OIC management contributing to demand. Mergers & Acquisitions (M&A) trends are prevalent as larger companies seek to acquire innovative pipelines or expand their OIC portfolios.

- Market Concentration: Dominated by key players with established OIC therapeutics.

- Technological Innovation: Focus on enhanced opioid antagonist efficacy and patient convenience.

- Regulatory Influence: FDA and other health authority approvals are critical for market access.

- Competitive Landscape: Presence of multiple drug classes and OTC alternatives.

- End-User Evolution: Growing demand from chronic pain patients and healthcare facilities.

- M&A Activity: Strategic acquisitions to bolster OIC product offerings and market presence.

Opioid Induced Constipation Industry Growth Trends & Insights

The Opioid Induced Constipation (OIC) market is poised for substantial growth, projected to witness a robust CAGR of approximately 6.8% from 2025 to 2033. This expansion is fueled by the escalating global incidence of chronic pain requiring long-term opioid analgesia, directly correlating with a higher prevalence of OIC. The increasing awareness among both patients and healthcare providers regarding the debilitating effects of OIC and the availability of effective prescription medications is a significant adoption driver. Technological disruptions are centered on developing targeted therapies that specifically counteract opioid-induced gut dysfunction without compromising pain relief. Consumer behavior is shifting towards seeking proactive management of OIC, moving beyond symptomatic relief to preventative strategies. Market penetration of advanced OIC treatments is expected to rise as clinical evidence supporting their efficacy and cost-effectiveness in reducing hospitalizations and improving quality of life becomes more widely disseminated. The estimated market size in 2025 is projected to be approximately $4,500 Million units, with a forecast to reach over $7,800 Million units by 2033.

Dominant Regions, Countries, or Segments in Opioid Induced Constipation Industry

North America, particularly the United States, is currently the dominant region in the Opioid Induced Constipation (OIC) market, driven by its extensive healthcare infrastructure, high opioid prescription rates for chronic pain management, and advanced pharmaceutical research and development capabilities. The Mu-opioid Receptor Antagonists drug class holds the largest market share within the OIC landscape due to its targeted mechanism of action in counteracting opioid effects on the gut. Within the Prescription Type segment, Prescription drugs represent the lion's share, reflecting the need for specialized therapies to manage OIC effectively, though Over The Counter (OTC) options are gaining traction for milder cases. The Hospital Pharmacies end-user segment plays a crucial role, particularly for patients requiring in-patient care and for the initial management of severe OIC.

- Dominant Region: North America, led by the United States, due to high opioid usage and robust healthcare systems.

- Leading Drug Class: Mu-opioid Receptor Antagonists, offering targeted relief.

- Primary Prescription Type: Prescription medications are essential for effective OIC management.

- Key End-User Segment: Hospital Pharmacies cater to a significant patient population requiring acute care.

- Growth Drivers: Increasing chronic pain prevalence, growing awareness of OIC, and advancements in therapeutic options.

- Market Share Potential: Significant growth expected in Asia-Pacific due to expanding healthcare access and rising opioid use.

Opioid Induced Constipation Industry Product Landscape

The Opioid Induced Constipation (OIC) product landscape is marked by continuous innovation aimed at improving efficacy and patient compliance. Leading products, such as Relistor (methylnaltrexone bromide) and Movantik (naloxegol oxalate), represent the forefront of Mu-opioid Receptor Antagonist therapies, offering targeted relief from OIC without affecting central opioid analgesia. Emerging therapies are exploring novel mechanisms of action and delivery methods to address unmet needs. The performance metrics for these drugs are evaluated based on their ability to restore bowel function, reduce abdominal pain, and improve the quality of life for patients dependent on opioid therapy. Unique selling propositions often lie in the rapid onset of action, favorable safety profiles, and convenient dosing regimens, differentiating them in a competitive market.

Key Drivers, Barriers & Challenges in Opioid Induced Constipation Industry

Key Drivers:

- Rising Opioid Prescriptions: The pervasive use of opioids for chronic pain management directly fuels the demand for OIC treatments.

- Increasing Awareness: Growing recognition of OIC as a significant adverse effect of opioid therapy among patients and healthcare professionals.

- Technological Advancements: Development of more effective and targeted OIC medications with improved safety profiles.

- Aging Population: A larger elderly demographic susceptible to both chronic pain and constipation issues.

- Focus on Quality of Life: Patient and physician emphasis on mitigating discomfort and improving well-being associated with OIC.

Barriers & Challenges:

- Regulatory Hurdles: Stringent approval processes for new OIC drugs can delay market entry.

- High Development Costs: Significant investment is required for research, clinical trials, and regulatory submissions.

- Competition from OTC Laxatives: Over-the-counter alternatives, though less targeted, pose a competitive threat.

- Misdiagnosis and Underdiagnosis: OIC can be overlooked or attributed to other gastrointestinal issues.

- Reimbursement Challenges: Securing favorable insurance coverage for advanced OIC therapies can be complex.

- Supply Chain Disruptions: Potential for disruptions in the manufacturing and distribution of OIC medications.

Emerging Opportunities in Opioid Induced Constipation Industry

Emerging opportunities in the Opioid Induced Constipation (OIC) market lie in the development of novel therapeutic targets beyond current mu-opioid receptor antagonists, such as therapies addressing gut motility disorders or the microbiome. The expansion of OIC treatment into the Over The Counter (OTC) segment with pharmacist-recommended solutions presents a significant untapped market. Furthermore, the growing adoption of Online Pharmacies for prescription fulfillment creates new distribution channels. Personalized medicine approaches, tailoring OIC treatment based on individual patient profiles and genetic predispositions, represent a future growth avenue. Increased focus on patient education and adherence programs can also unlock further market potential.

Growth Accelerators in Opioid Induced Constipation Industry Industry

Several catalysts are accelerating the growth of the Opioid Induced Constipation (OIC) market. Technological breakthroughs in drug discovery, particularly in understanding the complex gut-opioid interaction, are leading to the development of more sophisticated and effective OIC therapies. Strategic partnerships between pharmaceutical companies and academic institutions are fostering innovation and accelerating clinical development timelines. Market expansion strategies targeting underserved patient populations and geographical regions with rising opioid use are also key growth drivers. The increasing integration of OIC management within broader pain management protocols is creating a more comprehensive approach, boosting demand for dedicated OIC treatments.

Key Players Shaping the Opioid Induced Constipation Industry Market

- Bausch Health (Salix Pharmaceuticals)

- Merck & Co Inc

- Shionogi & Co Ltd

- Takeda Pharmaceutical

- Novartis AG (Sandoz)

- RedHill Biopharma

- AstraZeneca plc

- GlaxoSmithKline (Theravance Biopharma Inc)

- Mallinckrodt Pharmaceuticals

Notable Milestones in Opioid Induced Constipation Industry Sector

- March 2022: Bausch Health Companies Inc. and Salix Pharmaceuticals announced research findings indicating that patients receiving FDA-approved OIC-Rx medications, including RELISTOR subcutaneous injection (SC) (methylnaltrexone bromide), in the emergency department (ED) experienced reduced hospitalization rates and shorter lengths of stay, highlighting RELISTOR SC's potential.

- January 2022: BioGaia Pharma reported the enrollment of the first patient in a Phase II clinical study evaluating BGP345A for the treatment of opioid-induced constipation (OIC-1).

In-Depth Opioid Induced Constipation Industry Market Outlook

The Opioid Induced Constipation (OIC) market is poised for sustained growth, driven by the persistent challenge of managing opioid-induced gastrointestinal side effects. Future market potential is significant, with an increasing focus on developing multi-targeted therapies and understanding the gut microbiome's role in OIC. Strategic opportunities include expanding into emerging markets with growing opioid consumption, leveraging digital health platforms for patient monitoring and adherence, and forging collaborations to expedite the development of next-generation OIC treatments. The evolving regulatory landscape and increasing emphasis on patient-centric care will continue to shape market dynamics, creating a favorable environment for innovative pharmaceutical companies.

Opioid Induced Constipation Industry Segmentation

-

1. Drug Class

- 1.1. Mu-opioid Receptor Antagonists

- 1.2. Chloride Channel-2 Activators

- 1.3. Others

-

2. Prescription Type

- 2.1. Over The Counter

-

3. End-User

- 3.1. Hospital Pharmacies

- 3.2. Retail Pharmacies

- 3.3. Online Pharmacies

Opioid Induced Constipation Industry Segmentation By Geography

-

1. North America

- 1.1. United states

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Opioid Induced Constipation Industry Regional Market Share

Geographic Coverage of Opioid Induced Constipation Industry

Opioid Induced Constipation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Availability of Effective OIC Drugs Along with Growing Prevalence of Chronic Idiopathic Pains; Increasing Use of Opioid Analgesic Prescriptions Along with Growing Geriatric Population in Developed Nations

- 3.3. Market Restrains

- 3.3.1. Clinical Trials on Next Generation Analgesics as an Alternative to Opioid Analgesics; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of OIC Drugs

- 3.4. Market Trends

- 3.4.1. The Mu-opioid Receptor Antagonists in Drug Class Segment are Expected to Hold the Large Market Share in the Opioid-Induced Constipation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Opioid Induced Constipation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Mu-opioid Receptor Antagonists

- 5.1.2. Chloride Channel-2 Activators

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Prescription Type

- 5.2.1. Over The Counter

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospital Pharmacies

- 5.3.2. Retail Pharmacies

- 5.3.3. Online Pharmacies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Opioid Induced Constipation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Mu-opioid Receptor Antagonists

- 6.1.2. Chloride Channel-2 Activators

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Prescription Type

- 6.2.1. Over The Counter

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Hospital Pharmacies

- 6.3.2. Retail Pharmacies

- 6.3.3. Online Pharmacies

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Opioid Induced Constipation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Mu-opioid Receptor Antagonists

- 7.1.2. Chloride Channel-2 Activators

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Prescription Type

- 7.2.1. Over The Counter

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Hospital Pharmacies

- 7.3.2. Retail Pharmacies

- 7.3.3. Online Pharmacies

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Opioid Induced Constipation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Mu-opioid Receptor Antagonists

- 8.1.2. Chloride Channel-2 Activators

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Prescription Type

- 8.2.1. Over The Counter

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Hospital Pharmacies

- 8.3.2. Retail Pharmacies

- 8.3.3. Online Pharmacies

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Opioid Induced Constipation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Mu-opioid Receptor Antagonists

- 9.1.2. Chloride Channel-2 Activators

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Prescription Type

- 9.2.1. Over The Counter

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Hospital Pharmacies

- 9.3.2. Retail Pharmacies

- 9.3.3. Online Pharmacies

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Opioid Induced Constipation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Mu-opioid Receptor Antagonists

- 10.1.2. Chloride Channel-2 Activators

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Prescription Type

- 10.2.1. Over The Counter

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Hospital Pharmacies

- 10.3.2. Retail Pharmacies

- 10.3.3. Online Pharmacies

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bausch Heath (Salix Pharmaceuticals )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck & Co Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shionogi & Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Takeda Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Novartis AG (Sandoz)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RedHill Biopharma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AstraZeneca plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GlaxoSmithKline (Theravance Biopharma Inc)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mallinckrodt Pharmaceuticals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Bausch Heath (Salix Pharmaceuticals )

List of Figures

- Figure 1: Global Opioid Induced Constipation Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Opioid Induced Constipation Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Opioid Induced Constipation Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 4: North America Opioid Induced Constipation Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 5: North America Opioid Induced Constipation Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 6: North America Opioid Induced Constipation Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 7: North America Opioid Induced Constipation Industry Revenue (billion), by Prescription Type 2025 & 2033

- Figure 8: North America Opioid Induced Constipation Industry Volume (K Unit), by Prescription Type 2025 & 2033

- Figure 9: North America Opioid Induced Constipation Industry Revenue Share (%), by Prescription Type 2025 & 2033

- Figure 10: North America Opioid Induced Constipation Industry Volume Share (%), by Prescription Type 2025 & 2033

- Figure 11: North America Opioid Induced Constipation Industry Revenue (billion), by End-User 2025 & 2033

- Figure 12: North America Opioid Induced Constipation Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 13: North America Opioid Induced Constipation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Opioid Induced Constipation Industry Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America Opioid Induced Constipation Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Opioid Induced Constipation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Opioid Induced Constipation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Opioid Induced Constipation Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Opioid Induced Constipation Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 20: Europe Opioid Induced Constipation Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 21: Europe Opioid Induced Constipation Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 22: Europe Opioid Induced Constipation Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 23: Europe Opioid Induced Constipation Industry Revenue (billion), by Prescription Type 2025 & 2033

- Figure 24: Europe Opioid Induced Constipation Industry Volume (K Unit), by Prescription Type 2025 & 2033

- Figure 25: Europe Opioid Induced Constipation Industry Revenue Share (%), by Prescription Type 2025 & 2033

- Figure 26: Europe Opioid Induced Constipation Industry Volume Share (%), by Prescription Type 2025 & 2033

- Figure 27: Europe Opioid Induced Constipation Industry Revenue (billion), by End-User 2025 & 2033

- Figure 28: Europe Opioid Induced Constipation Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 29: Europe Opioid Induced Constipation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Opioid Induced Constipation Industry Volume Share (%), by End-User 2025 & 2033

- Figure 31: Europe Opioid Induced Constipation Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Opioid Induced Constipation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Opioid Induced Constipation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Opioid Induced Constipation Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Opioid Induced Constipation Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 36: Asia Pacific Opioid Induced Constipation Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 37: Asia Pacific Opioid Induced Constipation Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 38: Asia Pacific Opioid Induced Constipation Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 39: Asia Pacific Opioid Induced Constipation Industry Revenue (billion), by Prescription Type 2025 & 2033

- Figure 40: Asia Pacific Opioid Induced Constipation Industry Volume (K Unit), by Prescription Type 2025 & 2033

- Figure 41: Asia Pacific Opioid Induced Constipation Industry Revenue Share (%), by Prescription Type 2025 & 2033

- Figure 42: Asia Pacific Opioid Induced Constipation Industry Volume Share (%), by Prescription Type 2025 & 2033

- Figure 43: Asia Pacific Opioid Induced Constipation Industry Revenue (billion), by End-User 2025 & 2033

- Figure 44: Asia Pacific Opioid Induced Constipation Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 45: Asia Pacific Opioid Induced Constipation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Asia Pacific Opioid Induced Constipation Industry Volume Share (%), by End-User 2025 & 2033

- Figure 47: Asia Pacific Opioid Induced Constipation Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Opioid Induced Constipation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Opioid Induced Constipation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Opioid Induced Constipation Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Opioid Induced Constipation Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 52: Middle East and Africa Opioid Induced Constipation Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 53: Middle East and Africa Opioid Induced Constipation Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 54: Middle East and Africa Opioid Induced Constipation Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 55: Middle East and Africa Opioid Induced Constipation Industry Revenue (billion), by Prescription Type 2025 & 2033

- Figure 56: Middle East and Africa Opioid Induced Constipation Industry Volume (K Unit), by Prescription Type 2025 & 2033

- Figure 57: Middle East and Africa Opioid Induced Constipation Industry Revenue Share (%), by Prescription Type 2025 & 2033

- Figure 58: Middle East and Africa Opioid Induced Constipation Industry Volume Share (%), by Prescription Type 2025 & 2033

- Figure 59: Middle East and Africa Opioid Induced Constipation Industry Revenue (billion), by End-User 2025 & 2033

- Figure 60: Middle East and Africa Opioid Induced Constipation Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 61: Middle East and Africa Opioid Induced Constipation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 62: Middle East and Africa Opioid Induced Constipation Industry Volume Share (%), by End-User 2025 & 2033

- Figure 63: Middle East and Africa Opioid Induced Constipation Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East and Africa Opioid Induced Constipation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Opioid Induced Constipation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Opioid Induced Constipation Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Opioid Induced Constipation Industry Revenue (billion), by Drug Class 2025 & 2033

- Figure 68: South America Opioid Induced Constipation Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 69: South America Opioid Induced Constipation Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 70: South America Opioid Induced Constipation Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 71: South America Opioid Induced Constipation Industry Revenue (billion), by Prescription Type 2025 & 2033

- Figure 72: South America Opioid Induced Constipation Industry Volume (K Unit), by Prescription Type 2025 & 2033

- Figure 73: South America Opioid Induced Constipation Industry Revenue Share (%), by Prescription Type 2025 & 2033

- Figure 74: South America Opioid Induced Constipation Industry Volume Share (%), by Prescription Type 2025 & 2033

- Figure 75: South America Opioid Induced Constipation Industry Revenue (billion), by End-User 2025 & 2033

- Figure 76: South America Opioid Induced Constipation Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 77: South America Opioid Induced Constipation Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 78: South America Opioid Induced Constipation Industry Volume Share (%), by End-User 2025 & 2033

- Figure 79: South America Opioid Induced Constipation Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: South America Opioid Induced Constipation Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Opioid Induced Constipation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Opioid Induced Constipation Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 2: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 3: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 4: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 5: Global Opioid Induced Constipation Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 7: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 10: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 11: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 12: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 13: Global Opioid Induced Constipation Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 15: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United states Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United states Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 24: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 25: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 26: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 27: Global Opioid Induced Constipation Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 28: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 29: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: France Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Spain Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 44: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 45: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 46: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 47: Global Opioid Induced Constipation Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 48: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 49: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: China Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: India Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Australia Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 64: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 65: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 66: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 67: Global Opioid Induced Constipation Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 68: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 69: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: GCC Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 78: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 79: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Prescription Type 2020 & 2033

- Table 80: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Prescription Type 2020 & 2033

- Table 81: Global Opioid Induced Constipation Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 82: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 83: Global Opioid Induced Constipation Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 84: Global Opioid Induced Constipation Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Brazil Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: Argentina Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Opioid Induced Constipation Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Opioid Induced Constipation Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Opioid Induced Constipation Industry?

The projected CAGR is approximately 12.93%.

2. Which companies are prominent players in the Opioid Induced Constipation Industry?

Key companies in the market include Bausch Heath (Salix Pharmaceuticals ), Merck & Co Inc, Shionogi & Co Ltd, Takeda Pharmaceutical, Novartis AG (Sandoz), RedHill Biopharma, AstraZeneca plc, GlaxoSmithKline (Theravance Biopharma Inc), Mallinckrodt Pharmaceuticals.

3. What are the main segments of the Opioid Induced Constipation Industry?

The market segments include Drug Class, Prescription Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Availability of Effective OIC Drugs Along with Growing Prevalence of Chronic Idiopathic Pains; Increasing Use of Opioid Analgesic Prescriptions Along with Growing Geriatric Population in Developed Nations.

6. What are the notable trends driving market growth?

The Mu-opioid Receptor Antagonists in Drug Class Segment are Expected to Hold the Large Market Share in the Opioid-Induced Constipation Market.

7. Are there any restraints impacting market growth?

Clinical Trials on Next Generation Analgesics as an Alternative to Opioid Analgesics; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of OIC Drugs.

8. Can you provide examples of recent developments in the market?

In March 2022, Bausch Health Companies Inc. and its gastroenterology business, Salix Pharmaceuticals reported that research revealed that patients who received prescription medications approved by the United States Food and Drug Administration (FDA) for opioid-induced constipation (OIC-Rx), including RELISTOR subcutaneous injection (SC) (methylnaltrexone bromide), in the emergency department (ED) were less likely to be hospitalized, and when hospitalized, had a shorter length of stay than patients who did not receive an OIC-Rx in the ED. These findings highlight the potential for RELISTOR SC to provide relief for patients with OIC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Opioid Induced Constipation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Opioid Induced Constipation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Opioid Induced Constipation Industry?

To stay informed about further developments, trends, and reports in the Opioid Induced Constipation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence