Key Insights

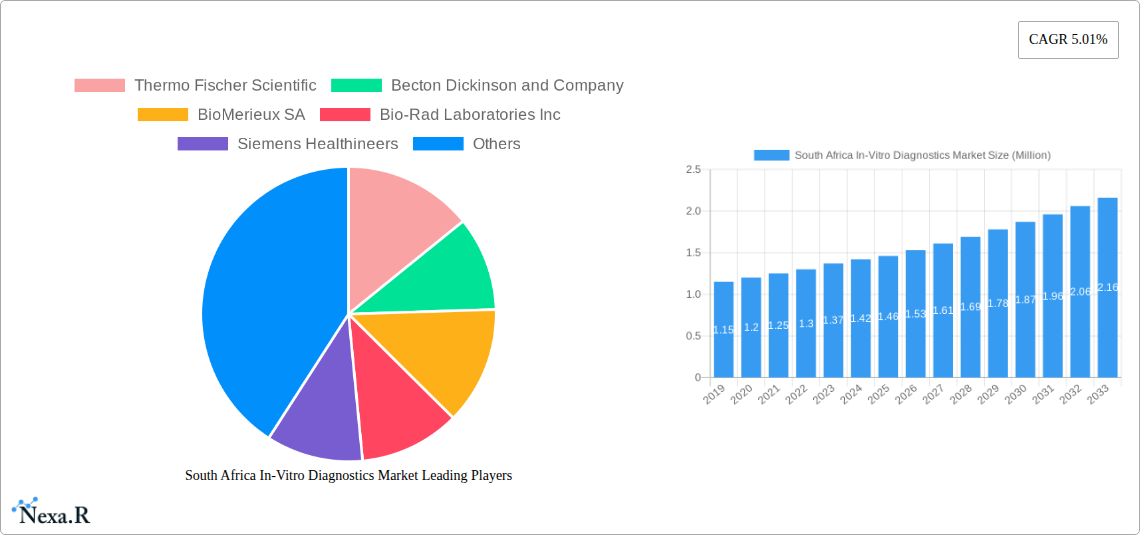

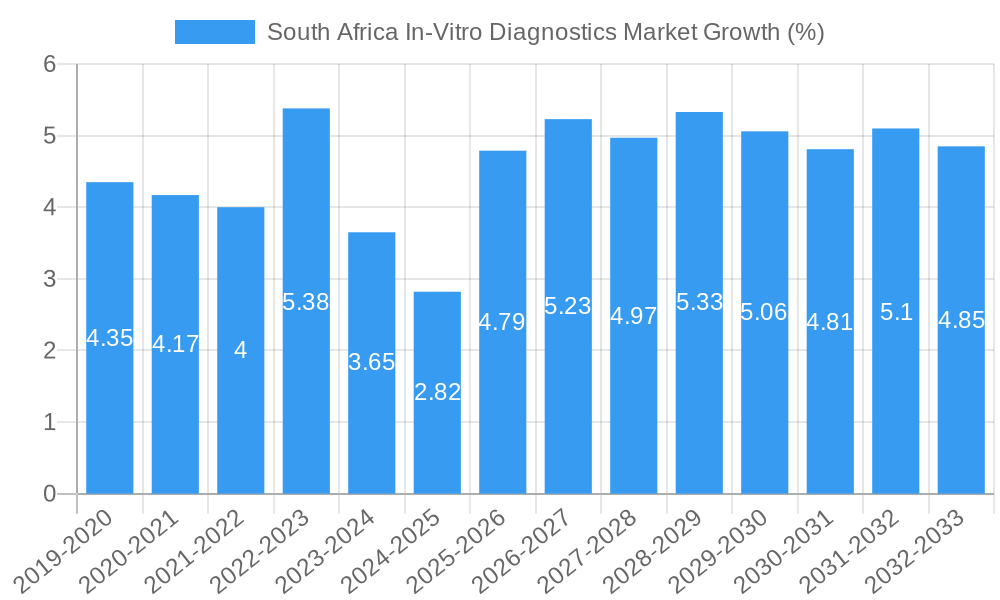

The South African In-Vitro Diagnostics (IVD) market is poised for robust growth, projected to reach approximately $1.46 billion by 2025, driven by an estimated CAGR of 5.01% over the forecast period. This expansion is fueled by increasing healthcare expenditure, a rising prevalence of chronic diseases such as diabetes and cancer, and a growing awareness of the importance of early disease detection. The market is segmented across various test types, including Molecular Diagnostics, Clinical Chemistry, and Immuno Diagnostics, all of which are witnessing significant demand due to their critical role in accurate patient diagnosis and management. Furthermore, the demand for advanced instruments and reagents underscores the technological advancements and increasing sophistication of diagnostic processes within the region. The growing adoption of disposable IVD devices, particularly in point-of-care settings and for infectious disease testing, also contributes significantly to market expansion.

The market's growth trajectory is further bolstered by the expanding applications in areas like infectious diseases, cancer/oncology, and cardiology, reflecting the evolving healthcare needs of South Africa. Diagnostic laboratories and hospitals and clinics represent the primary end-users, consistently investing in IVD technologies to enhance their diagnostic capabilities. While the market benefits from these drivers, it also faces certain restraints, such as the high cost of advanced IVD equipment and reagents, and challenges in equitable access to these technologies across different socio-economic strata. However, government initiatives aimed at improving healthcare infrastructure and public health programs are expected to mitigate these restraints. Key companies such as Thermo Fisher Scientific, Abbott Laboratories, and Siemens Healthineers are actively participating in this market, introducing innovative solutions and expanding their presence to cater to the growing demand.

Here is a compelling, SEO-optimized report description for the South Africa In-Vitro Diagnostics Market:

South Africa In-Vitro Diagnostics Market: Growth, Trends, and Future Outlook (2019–2033)

Gain unparalleled insights into the dynamic South Africa In-Vitro Diagnostics (IVD) market. This comprehensive report provides an in-depth analysis of current market dynamics, growth trends, key players, and future opportunities within the South African IVD landscape. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers strategic intelligence for stakeholders navigating the evolving diagnostic sector. Explore the market breakdown by Test Type (Clinical Chemistry, Molecular Diagnostics, Immuno Diagnostics, Haematology), Product (Instrument, Reagent), Usability (Disposable IVD Device, Reusable IVD Device), Application (Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology), and End-User (Diagnostic Laboratories, Hospitals and Clinics). All values are presented in Million units for clear quantitative understanding.

South Africa In-Vitro Diagnostics Market Market Dynamics & Structure

The South Africa In-Vitro Diagnostics market is characterized by a moderate level of concentration, with a few global giants holding significant market share while a growing number of local players are emerging. Technological innovation is a primary driver, fueled by the increasing demand for rapid and accurate diagnostic solutions, particularly in response to public health challenges like infectious diseases and the rising burden of chronic conditions. The regulatory framework, while evolving, plays a crucial role in ensuring the quality and safety of IVD products, impacting market entry and product development. Competitive product substitutes are present, especially in areas like point-of-care testing, offering alternative diagnostic pathways. End-user demographics are shifting, with a growing awareness of preventative healthcare and a demand for personalized diagnostics. Mergers and acquisitions (M&A) activity is a significant trend as larger companies seek to expand their portfolios and geographical reach within the African continent.

- Market Concentration: Dominated by a few multinational corporations, with increasing local participation.

- Technological Innovation: Driven by demand for rapid diagnostics, AI integration, and molecular testing.

- Regulatory Framework: Evolving standards for product approval and market access.

- Competitive Landscape: Presence of established players and emerging local manufacturers.

- End-User Demographics: Growing demand for chronic disease screening and infectious disease detection.

- M&A Trends: Strategic acquisitions to enhance market presence and product offerings.

South Africa In-Vitro Diagnostics Market Growth Trends & Insights

The South Africa In-Vitro Diagnostics market is poised for robust growth, driven by several converging factors. The increasing prevalence of lifestyle diseases such as diabetes and cardiovascular conditions, coupled with the persistent threat of infectious diseases, is significantly boosting the demand for diagnostic testing. The government's focus on improving healthcare infrastructure and access, especially in underserved areas, further accelerates the adoption of IVD solutions. Technological advancements, including the rise of molecular diagnostics and point-of-care testing (POCT), are transforming the diagnostic landscape, offering faster and more accessible results. The growing disposable income and rising health awareness among the South African population are also contributing to increased healthcare expenditure, directly benefiting the IVD market. Furthermore, the increasing integration of digital health solutions and data analytics in diagnostics is enhancing efficiency and accuracy, paving the way for personalized medicine. This evolution is evident in the rising market penetration of advanced diagnostic instruments and sophisticated reagent kits designed for specific disease biomarkers. The shift towards home-based and decentralized testing models, facilitated by user-friendly disposable IVD devices, represents a significant consumer behavior shift, indicating a greater patient-centric approach to healthcare. The overall market size is projected to experience a healthy CAGR, reflecting the strong underlying demand and the continuous innovation within the sector.

- Market Size Evolution: Projected substantial growth driven by healthcare demand.

- Adoption Rates: Increasing uptake of advanced diagnostic technologies and POCT.

- Technological Disruptions: Impact of molecular diagnostics, AI, and digital health integration.

- Consumer Behavior Shifts: Growing preference for convenient, decentralized, and personalized testing.

- Market Penetration: Expansion of diagnostic services across urban and rural areas.

- CAGR: Forecasted [xx.x]% CAGR during the forecast period.

Dominant Regions, Countries, or Segments in South Africa In-Vitro Diagnostics Market

The South Africa In-Vitro Diagnostics market demonstrates significant dominance across several key segments. In terms of Test Type, Molecular Diagnostics is emerging as a frontrunner, driven by its crucial role in identifying infectious diseases like COVID-19, HIV, and tuberculosis, and its growing application in oncology and genetic testing. The demand for molecular diagnostic solutions is further amplified by advancements in PCR and next-generation sequencing technologies. Within the Product segment, Reagents consistently lead due to their high consumption volume and their essential role in every diagnostic test performed. The continuous need for specific reagents for various assays, from routine clinical chemistry to specialized immunoassays, ensures their sustained market dominance. For Usability, Disposable IVD Devices are experiencing rapid growth. This trend is propelled by the need for convenience, reduced risk of contamination, and the expansion of point-of-care testing, making diagnostics more accessible and efficient. The Application segment sees Infectious Disease diagnostics as a dominant force, historically and currently, due to its public health significance in South Africa. However, Cancer/Oncology is rapidly gaining prominence with the increasing incidence of various cancers and the development of targeted therapies requiring precise diagnostic support. Among End-Users, Diagnostic Laboratories are the largest segment, forming the backbone of the IVD ecosystem, performing a vast array of tests. Hospitals and Clinics are also significant consumers, with an increasing number adopting in-house diagnostic capabilities.

- Test Type Dominance: Molecular Diagnostics, fueled by infectious disease and oncology applications.

- Product Leadership: Reagents, essential for all diagnostic procedures.

- Usability Growth: Disposable IVD Devices, enabling POCT and convenience.

- Application Strength: Infectious Disease, with Cancer/Oncology showing significant upward trajectory.

- End-User Influence: Diagnostic Laboratories as primary consumers, followed by Hospitals and Clinics.

South Africa In-Vitro Diagnostics Market Product Landscape

The South Africa In-Vitro Diagnostics market is witnessing a surge in product innovation focused on enhancing speed, accuracy, and accessibility. Key advancements include the development of highly sensitive immunoassay kits for early disease detection, next-generation molecular diagnostic platforms for rapid pathogen identification, and automated clinical chemistry analyzers designed for high throughput and reduced error rates. The integration of artificial intelligence (AI) into diagnostic instruments is emerging, promising improved data analysis and predictive capabilities. Point-of-care testing devices, particularly disposable IVD kits, are gaining traction for their ability to deliver results at the patient's bedside, revolutionizing patient care and disease management.

Key Drivers, Barriers & Challenges in South Africa In-Vitro Diagnostics Market

Key Drivers: The South Africa In-Vitro Diagnostics market is propelled by a growing burden of chronic and infectious diseases, driving demand for accurate and timely diagnostic solutions. Government initiatives aimed at strengthening healthcare infrastructure and expanding access to diagnostics, coupled with increasing health awareness and disposable income, further fuel market growth. Technological advancements, such as the development of more sensitive and specific assays, alongside the increasing adoption of molecular diagnostics and point-of-care testing, are significant growth accelerators.

Barriers & Challenges: High import duties on specialized medical equipment and reagents can pose a significant barrier, increasing operational costs for diagnostic providers. The scarcity of skilled laboratory personnel and technicians can limit the widespread adoption and effective utilization of advanced diagnostic technologies. Furthermore, price sensitivity among a segment of the population and competition from informal or substandard diagnostic providers present challenges to market growth and standardization. Supply chain disruptions, particularly for imported components and reagents, can also impact the availability and cost of essential diagnostic tools.

Emerging Opportunities in South Africa In-Vitro Diagnostics Market

Emerging opportunities in the South Africa In-Vitro Diagnostics market lie in the burgeoning demand for personalized medicine, driven by advancements in genetic testing and companion diagnostics. The increasing prevalence of non-communicable diseases like diabetes and cancer presents a vast untapped market for specialized diagnostic solutions and screening programs. Furthermore, the expansion of telehealth and remote patient monitoring creates opportunities for the development of user-friendly, connected diagnostic devices that can facilitate at-home testing and data transmission. The potential for novel applications in areas such as infectious disease surveillance and early detection of emerging pathogens offers significant growth prospects.

Growth Accelerators in the South Africa In-Vitro Diagnostics Market Industry

Several catalysts are accelerating growth in the South Africa In-Vitro Diagnostics market. Technological breakthroughs, such as the miniaturization of diagnostic devices and the development of AI-powered diagnostic platforms, are enhancing efficiency and accessibility. Strategic partnerships between global IVD manufacturers and local distributors or healthcare providers are crucial for expanding market reach and tailoring solutions to local needs. Market expansion strategies focusing on underserved rural areas, coupled with government support for local manufacturing and research and development, will play a pivotal role in sustained growth.

Key Players Shaping the South Africa In-Vitro Diagnostics Market Market

- Thermo Fischer Scientific

- Becton Dickinson and Company

- BioMerieux SA

- Bio-Rad Laboratories Inc

- Siemens Healthineers

- F Hoffmann-La Roche Ltd

- DiaSorin SpA

- Abbott Laboratories

- Danaher Corporation

- Nihon Kohden Corporation

Notable Milestones in South Africa In-Vitro Diagnostics Market Sector

- March 2022: Audere partnered with Medical Diagnostech (South Africa) to integrate Medical Diagnostech's MD SARS-nCoV-2 Antigen Device with Audere's HealthPulse digital companion app.

- February 2022: Datar Cancer Genetics launched its Blood-based Trucheck cancer screening test in South Africa.

In-Depth South Africa In-Vitro Diagnostics Market Market Outlook

The future outlook for the South Africa In-Vitro Diagnostics market is exceptionally promising, driven by a confluence of factors that are poised to reshape the healthcare landscape. Growth accelerators such as the continuous innovation in molecular diagnostics, enabling precise identification of infectious agents and genetic predispositions, will underpin market expansion. The increasing investment in healthcare infrastructure, particularly in expanding access to diagnostic services in rural and peri-urban areas, presents a significant opportunity. Strategic collaborations between technology providers, local healthcare institutions, and government bodies are expected to foster the development and adoption of cutting-edge IVD solutions. Furthermore, the growing demand for personalized medicine, driven by advances in genomics and targeted therapies, will propel the market towards more sophisticated and individualized diagnostic approaches. The market is set for sustained growth, with an emphasis on accessibility, affordability, and technological advancement.

South Africa In-Vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Haematology

- 1.5. Other Test Types

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Device

- 3.2. Reusable IVD Device

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End-User

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End-users

South Africa In-Vitro Diagnostics Market Segmentation By Geography

- 1. South Africa

South Africa In-Vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.01% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Point-of-Care (POC) Diagnostics; Growing Burden of Chronic and Infectious Diseases; Technological Advancements in the Diagnostics

- 3.3. Market Restrains

- 3.3.1. Reimbursement Issues; High Cost of Advanced IVD Devices

- 3.4. Market Trends

- 3.4.1. Reagents are Expected to hold a Significant Market Share in the Product Segment Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Haematology

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Device

- 5.3.2. Reusable IVD Device

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End-User

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End-users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. South Africa South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Thermo Fischer Scientific

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Becton Dickinson and Company

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 BioMerieux SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bio-Rad Laboratories Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens Healthineers

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 F Hoffmann-La Roche Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 DiaSorin SpA

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Abbott Laboratories

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Danaher Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Nihon Kohden Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Thermo Fischer Scientific

List of Figures

- Figure 1: South Africa In-Vitro Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa In-Vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 5: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 7: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa South Africa In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 16: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 17: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 18: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: South Africa In-Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa In-Vitro Diagnostics Market?

The projected CAGR is approximately 5.01%.

2. Which companies are prominent players in the South Africa In-Vitro Diagnostics Market?

Key companies in the market include Thermo Fischer Scientific, Becton Dickinson and Company, BioMerieux SA, Bio-Rad Laboratories Inc, Siemens Healthineers, F Hoffmann-La Roche Ltd, DiaSorin SpA, Abbott Laboratories, Danaher Corporation, Nihon Kohden Corporation.

3. What are the main segments of the South Africa In-Vitro Diagnostics Market?

The market segments include Test Type, Product, Usability, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Point-of-Care (POC) Diagnostics; Growing Burden of Chronic and Infectious Diseases; Technological Advancements in the Diagnostics.

6. What are the notable trends driving market growth?

Reagents are Expected to hold a Significant Market Share in the Product Segment Over the Forecast Period.

7. Are there any restraints impacting market growth?

Reimbursement Issues; High Cost of Advanced IVD Devices.

8. Can you provide examples of recent developments in the market?

March 2022: Audere entered into a partnership with Medical Diagnostech, headquartered in South Africa, a developer, and manufacturer of lateral flow rapid diagnostic test kits. This partnership will pair Medical Diagnostech's MD SARS-nCoV-2 Antigen Device with Audere's HealthPulse digital companion app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa In-Vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa In-Vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa In-Vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the South Africa In-Vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence