Key Insights

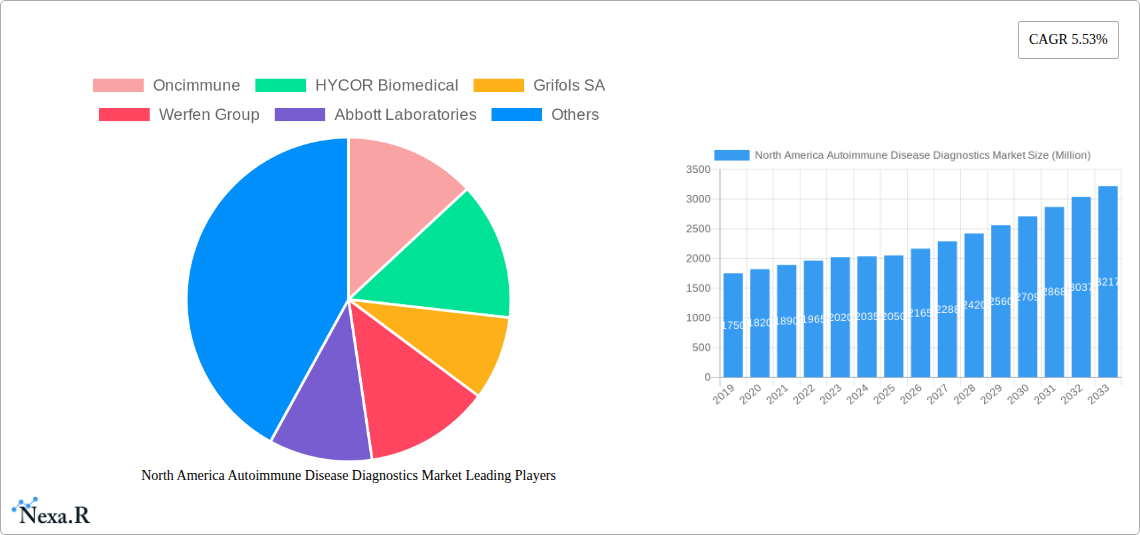

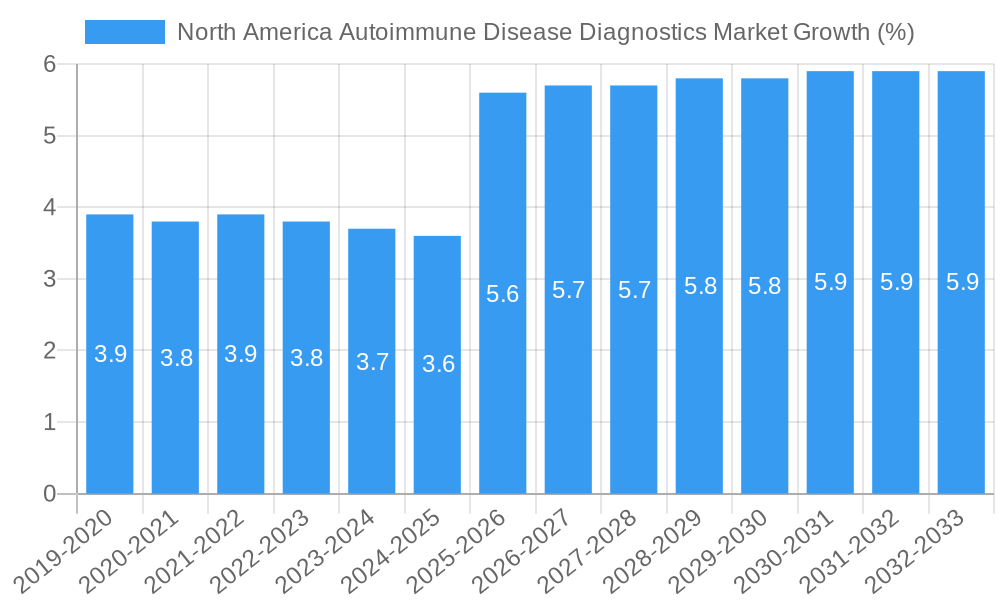

The North America Autoimmune Disease Diagnostics Market is poised for substantial growth, projected to reach a market size of approximately $2,050 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.53% expected through 2033. This expansion is driven by several key factors. The increasing prevalence of autoimmune diseases across North America, coupled with growing awareness among both patients and healthcare professionals, is a primary catalyst. Advancements in diagnostic technologies, including highly sensitive immunologic assays and antibody tests, are enabling earlier and more accurate detection of these complex conditions. Furthermore, a heightened focus on personalized medicine and precision diagnostics is encouraging greater investment in sophisticated diagnostic tools. The market segments for systemic autoimmune diseases, such as Rheumatoid Arthritis and Systemic Lupus Erythematosus (SLE), are expected to lead the growth due to their widespread impact. Diagnostic test segments, particularly inflammatory markers and antibody tests, will also witness significant uptake as they become more integrated into routine healthcare.

The North American landscape, encompassing the United States, Canada, and Mexico, presents a dynamic environment for autoimmune disease diagnostics. While the United States is anticipated to remain the dominant market owing to its advanced healthcare infrastructure, higher healthcare spending, and a larger patient population, Canada and Mexico are showing promising growth trajectories. This is attributed to expanding healthcare access, increasing adoption of new diagnostic technologies, and rising incidences of autoimmune conditions. However, certain restraints might influence the market's pace. These include the high cost of advanced diagnostic tests, reimbursement challenges in some regions, and the need for skilled personnel to operate and interpret complex diagnostic platforms. Nonetheless, ongoing research and development efforts aimed at creating more accessible and cost-effective diagnostic solutions, alongside strategic collaborations among key market players, are expected to mitigate these challenges and sustain the market's upward trajectory.

North America Autoimmune Disease Diagnostics Market: Comprehensive Insights and Future Outlook (2019-2033)

This report provides an in-depth analysis of the North America Autoimmune Disease Diagnostics Market, covering critical market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and a detailed outlook. The study period spans from 2019 to 2033, with a base year of 2025. Leverage cutting-edge analytics to understand the market's evolution, driven by increasing prevalence of autoimmune disorders, technological advancements in diagnostic tools, and a growing emphasis on early disease detection. This report is an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning opportunities within the North America autoimmune disease diagnostics sector.

North America Autoimmune Disease Diagnostics Market Market Dynamics & Structure

The North America Autoimmune Disease Diagnostics Market exhibits a moderately concentrated structure, with several large multinational corporations holding significant market share. However, the presence of specialized diagnostic companies and a steady stream of new entrants driven by technological innovation prevents complete market saturation. Technological innovation is a primary driver, fueled by advancements in molecular diagnostics, immunoassay techniques, and the integration of artificial intelligence in diagnostic platforms. Regulatory frameworks, particularly those established by the FDA in the United States and Health Canada, play a crucial role in dictating product approval pathways, safety standards, and market access. Competitive product substitutes, while present in terms of diagnostic methodologies, are often differentiated by sensitivity, specificity, turnaround time, and cost-effectiveness, leading to a dynamic competitive landscape. End-user demographics are shifting, with an aging population and increased awareness of autoimmune diseases contributing to higher demand. Mergers and Acquisitions (M&A) trends indicate a strategic consolidation of capabilities, with larger players acquiring innovative startups or complementary technology providers to expand their portfolios and market reach.

- Market Concentration: Moderately concentrated with a mix of large and niche players.

- Technological Innovation Drivers: Advancements in molecular diagnostics, AI in diagnostics, multiplex assays.

- Regulatory Frameworks: FDA, Health Canada approvals critical for market entry and product lifecycle.

- Competitive Product Substitutes: Differentiated by performance metrics like sensitivity, specificity, and cost.

- End-User Demographics: Aging population, increased disease awareness driving demand.

- M&A Trends: Strategic acquisitions to broaden product portfolios and technological capabilities.

North America Autoimmune Disease Diagnostics Market Growth Trends & Insights

The North America Autoimmune Disease Diagnostics Market is poised for significant expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033. This growth is underpinned by an escalating prevalence of various autoimmune conditions, including Systemic Lupus Erythematosus (SLE), Rheumatoid Arthritis, Multiple Sclerosis, and Inflammatory Bowel Disease, which directly fuels the demand for accurate and timely diagnostic solutions. The market size is expected to reach an estimated value of $12,500 million units in 2025 and is projected to grow substantially by the end of the forecast period. Adoption rates for advanced diagnostic technologies are on an upward trajectory, driven by their enhanced precision and ability to detect diseases at earlier, more manageable stages. Technological disruptions, such as the development of novel biomarker identification techniques and the refinement of antibody detection assays, are continually reshaping the diagnostic landscape, offering improved patient outcomes. Consumer behavior is also evolving, with a greater emphasis on proactive health management and personalized medicine leading patients to seek earlier and more comprehensive diagnostic assessments. The increasing investment in research and development by key players, coupled with favorable reimbursement policies for diagnostic procedures, further bolsters market penetration.

The market's robust growth is also attributed to the rising incidence of autoimmune diseases, influenced by a complex interplay of genetic predispositions, environmental factors, and lifestyle changes. For instance, the growing understanding of the genetic links to diseases like Type 1 Diabetes and Thyroid disorders is prompting wider adoption of genetic screening and early diagnostic testing. Furthermore, the development of point-of-care diagnostic devices and home-testing kits is enhancing accessibility and convenience for patients, thereby accelerating adoption rates. The integration of digital health solutions and big data analytics is revolutionizing how diagnostic information is processed and utilized, leading to more efficient disease management pathways. The increasing focus on precision medicine, where treatment is tailored to an individual's genetic and molecular profile, is creating a demand for sophisticated diagnostic tools that can provide detailed insights into disease mechanisms. This, in turn, fosters innovation and drives market growth. The healthcare infrastructure in North America, characterized by well-equipped laboratories and a skilled workforce, is also instrumental in supporting the widespread adoption of advanced diagnostic technologies. The proactive government initiatives aimed at improving public health and disease surveillance further contribute to a conducive market environment.

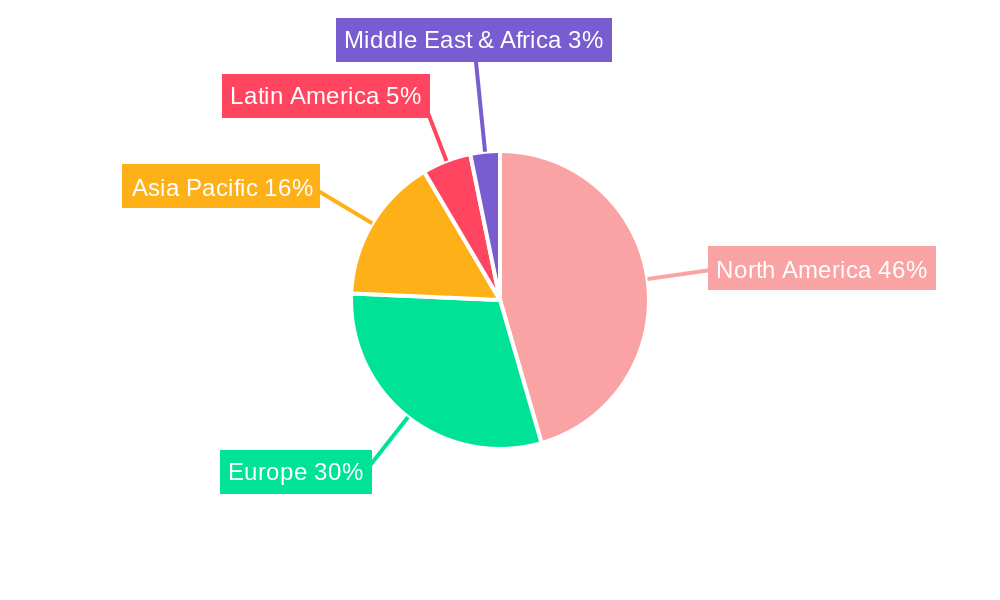

Dominant Regions, Countries, or Segments in North America Autoimmune Disease Diagnostics Market

The United States stands as the dominant region within the North America Autoimmune Disease Diagnostics Market, commanding a significant market share estimated at 78% in 2025, contributing over $9,750 million units to the overall market value. This regional dominance is propelled by several key factors, including a highly advanced healthcare infrastructure, substantial investments in research and development, and a robust regulatory framework that encourages innovation while ensuring patient safety. The high prevalence of autoimmune diseases in the United States, coupled with a large and aging population, creates a consistent and substantial demand for diagnostic solutions. Furthermore, the presence of leading pharmaceutical and biotechnology companies, alongside academic research institutions, fosters a dynamic environment for the development and adoption of cutting-edge diagnostic technologies.

Within the Disease Type segment, Systemic Autoimmune Diseases are the primary growth drivers, accounting for an estimated 65% of the market share. Rheumatoid Arthritis and Systemic Lupus Erythematosus (SLE) are particularly significant contributors due to their high prevalence and the ongoing development of targeted diagnostic tests. The demand for early and accurate diagnosis of these conditions drives the adoption of advanced immunologic assays and antibody tests.

The Diagnostic Test segment is led by Antibody Tests, which are crucial for identifying autoantibodies specific to various autoimmune diseases, holding an estimated 40% market share. These tests, particularly for conditions like SLE and systemic sclerosis, are continuously being refined for improved sensitivity and specificity. Regular Laboratory Tests and Inflammatory Markers collectively represent another substantial portion, providing foundational diagnostic information.

Geographically, beyond the United States, Canada and Mexico represent emerging markets with significant growth potential. Canada, with its universal healthcare system, demonstrates strong demand for cost-effective and reliable diagnostic solutions. Mexico, while facing some infrastructure challenges, is experiencing an increasing focus on healthcare modernization and a growing awareness of autoimmune disorders, leading to expanding market opportunities. The presence of specialized diagnostic laboratories and a growing number of clinical trials in these regions further support market expansion.

North America Autoimmune Disease Diagnostics Market Product Landscape

The product landscape of the North America Autoimmune Disease Diagnostics Market is characterized by a continuous influx of innovative diagnostic kits and platforms. Key advancements include the development of multiplex assays capable of detecting multiple autoantibodies simultaneously, significantly reducing testing time and improving diagnostic efficiency. High-throughput immunoassay systems and molecular diagnostic tools, such as PCR-based tests, are gaining traction for their precision and speed in identifying specific disease markers. The focus is increasingly on developing more sensitive and specific antibody tests for early disease detection and prognosis, including tests for novel biomarkers associated with conditions like Multiple Sclerosis and Inflammatory Bowel Disease. Furthermore, the integration of automation and artificial intelligence in laboratory workflows is enhancing diagnostic accuracy and reducing human error.

Key Drivers, Barriers & Challenges in North America Autoimmune Disease Diagnostics Market

Key Drivers:

- Rising Prevalence of Autoimmune Diseases: An increasing incidence of conditions like Rheumatoid Arthritis, SLE, and Multiple Sclerosis is the primary growth catalyst.

- Technological Advancements: Innovations in immunoassay technology, molecular diagnostics, and biomarker discovery are enhancing diagnostic capabilities.

- Growing Awareness and Early Diagnosis Focus: Increased patient and physician awareness drives demand for earlier and more accurate diagnostic testing.

- Favorable Reimbursement Policies: Expanding insurance coverage and reimbursement for autoimmune disease diagnostics in North America supports market growth.

- Increased R&D Investments: Significant investment by market players in developing novel diagnostic solutions fuels innovation.

Barriers & Challenges:

- High Cost of Advanced Diagnostics: The expense associated with sophisticated diagnostic tests can limit accessibility for certain patient populations.

- Regulatory Hurdles: Stringent regulatory approval processes for new diagnostic tests can be time-consuming and costly.

- Diagnostic Complexity: The overlapping symptoms of various autoimmune diseases can make differential diagnosis challenging.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of essential reagents and components for diagnostic kits.

- Reimbursement Gaps: Inconsistent reimbursement policies across different healthcare systems and payers can pose challenges.

Emerging Opportunities in North America Autoimmune Disease Diagnostics Market

Emerging opportunities in the North America Autoimmune Disease Diagnostics Market lie in the development of more personalized and predictive diagnostic approaches. The exploration of novel biomarkers, including genetic markers and advanced protein panels, offers potential for even earlier disease detection and risk stratification. The expansion of point-of-care diagnostic solutions for autoimmune diseases presents a significant opportunity to improve patient access and reduce healthcare costs. Furthermore, the growing interest in liquid biopsy techniques for non-invasive diagnostic assessments and disease monitoring holds immense promise. Strategic collaborations between diagnostic manufacturers and pharmaceutical companies are also creating avenues for companion diagnostics, facilitating targeted therapies for autoimmune conditions.

Growth Accelerators in the North America Autoimmune Disease Diagnostics Market Industry

Long-term growth in the North America Autoimmune Disease Diagnostics Market is being accelerated by several key catalysts. Breakthroughs in understanding the complex pathogenesis of autoimmune diseases are leading to the identification of new diagnostic targets and therapeutic strategies. Strategic partnerships between established diagnostic companies and innovative biotech startups are fostering the rapid development and commercialization of next-generation diagnostic tools. Market expansion strategies are focusing on underserved patient populations and geographical regions with a growing demand for specialized diagnostics. The increasing adoption of artificial intelligence and machine learning in diagnostic interpretation and data analysis is further enhancing efficiency and accuracy, driving sustained market growth.

Key Players Shaping the North America Autoimmune Disease Diagnostics Market Market

- Oncimmune

- HYCOR Biomedical

- Grifols SA

- Werfen Group

- Abbott Laboratories

- Siemens Healthineers Inc

- Bio-rad Laboratories

- Myriad Genetics

- Euroimmun AG (Perkinelmer Inc)

- F Hoffmann-la Roche

- Thermo Fisher Scientific

- Trinity Biotech

Notable Milestones in North America Autoimmune Disease Diagnostics Market Sector

- February 2023: Edesa Biotech received approval from Health Canada for a phase II clinical trial of its EB06 monoclonal antibody candidate to treat vitiligo, a life-altering autoimmune disease.

- June 2022: Thermo Scientific received United States FDA clearance for the EliA RNA Pol III and EliA Rib-P tests for aiding in the diagnosis of systemic sclerosis and systemic lupus erythematosus (SLE).

In-Depth North America Autoimmune Disease Diagnostics Market Market Outlook

The future outlook for the North America Autoimmune Disease Diagnostics Market is exceptionally promising, driven by a confluence of accelerating growth factors. The continuous evolution of diagnostic technologies, including advancements in genomics, proteomics, and high-sensitivity immunoassay platforms, will enable earlier, more accurate, and personalized diagnoses. Strategic partnerships and collaborations will play a pivotal role in bringing innovative solutions to market swiftly and efficiently. Moreover, the expanding focus on preventative healthcare and precision medicine will further amplify the demand for sophisticated diagnostic tools. The market is set to witness significant growth in areas such as companion diagnostics and the development of novel biomarkers for a wider spectrum of autoimmune conditions, solidifying its trajectory towards substantial expansion and improved patient outcomes.

North America Autoimmune Disease Diagnostics Market Segmentation

-

1. Disease Type

-

1.1. Systemic Autoimmune Disease

- 1.1.1. Rheumatoid Arthritis

- 1.1.2. Psoriasis

- 1.1.3. Systemic Lupus Erythematosus (SLE)

- 1.1.4. Multiple Sclerosis

- 1.1.5. Other Disease Types

-

1.2. Localized Autoimmune Disease

- 1.2.1. Inflammatory Bowel disease

- 1.2.2. Type 1 Diabetes

- 1.2.3. Thyroid

- 1.2.4. Other Localized Autoimmune Diseases

-

1.1. Systemic Autoimmune Disease

-

2. Diagnostic Test

- 2.1. Regular Laboratory Tests

- 2.2. Inflammatory Markers

- 2.3. Immunologic Assays

- 2.4. Antibody Tests

- 2.5. Other Tests

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Autoimmune Disease Diagnostics Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Autoimmune Disease Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence and Growing Public Awareness of Autoimmune Diseases; Technological Advancements in Autoimmune Disease Diagnostics

- 3.3. Market Restrains

- 3.3.1. Slow Turnaround Time for Autoimmune Disease Diagnostic Test Results; High Frequency of False Positive Result

- 3.4. Market Trends

- 3.4.1. Immunologic Assays Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Systemic Autoimmune Disease

- 5.1.1.1. Rheumatoid Arthritis

- 5.1.1.2. Psoriasis

- 5.1.1.3. Systemic Lupus Erythematosus (SLE)

- 5.1.1.4. Multiple Sclerosis

- 5.1.1.5. Other Disease Types

- 5.1.2. Localized Autoimmune Disease

- 5.1.2.1. Inflammatory Bowel disease

- 5.1.2.2. Type 1 Diabetes

- 5.1.2.3. Thyroid

- 5.1.2.4. Other Localized Autoimmune Diseases

- 5.1.1. Systemic Autoimmune Disease

- 5.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 5.2.1. Regular Laboratory Tests

- 5.2.2. Inflammatory Markers

- 5.2.3. Immunologic Assays

- 5.2.4. Antibody Tests

- 5.2.5. Other Tests

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. United States North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 6.1.1. Systemic Autoimmune Disease

- 6.1.1.1. Rheumatoid Arthritis

- 6.1.1.2. Psoriasis

- 6.1.1.3. Systemic Lupus Erythematosus (SLE)

- 6.1.1.4. Multiple Sclerosis

- 6.1.1.5. Other Disease Types

- 6.1.2. Localized Autoimmune Disease

- 6.1.2.1. Inflammatory Bowel disease

- 6.1.2.2. Type 1 Diabetes

- 6.1.2.3. Thyroid

- 6.1.2.4. Other Localized Autoimmune Diseases

- 6.1.1. Systemic Autoimmune Disease

- 6.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 6.2.1. Regular Laboratory Tests

- 6.2.2. Inflammatory Markers

- 6.2.3. Immunologic Assays

- 6.2.4. Antibody Tests

- 6.2.5. Other Tests

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 7. Canada North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 7.1.1. Systemic Autoimmune Disease

- 7.1.1.1. Rheumatoid Arthritis

- 7.1.1.2. Psoriasis

- 7.1.1.3. Systemic Lupus Erythematosus (SLE)

- 7.1.1.4. Multiple Sclerosis

- 7.1.1.5. Other Disease Types

- 7.1.2. Localized Autoimmune Disease

- 7.1.2.1. Inflammatory Bowel disease

- 7.1.2.2. Type 1 Diabetes

- 7.1.2.3. Thyroid

- 7.1.2.4. Other Localized Autoimmune Diseases

- 7.1.1. Systemic Autoimmune Disease

- 7.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 7.2.1. Regular Laboratory Tests

- 7.2.2. Inflammatory Markers

- 7.2.3. Immunologic Assays

- 7.2.4. Antibody Tests

- 7.2.5. Other Tests

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 8. Mexico North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 8.1.1. Systemic Autoimmune Disease

- 8.1.1.1. Rheumatoid Arthritis

- 8.1.1.2. Psoriasis

- 8.1.1.3. Systemic Lupus Erythematosus (SLE)

- 8.1.1.4. Multiple Sclerosis

- 8.1.1.5. Other Disease Types

- 8.1.2. Localized Autoimmune Disease

- 8.1.2.1. Inflammatory Bowel disease

- 8.1.2.2. Type 1 Diabetes

- 8.1.2.3. Thyroid

- 8.1.2.4. Other Localized Autoimmune Diseases

- 8.1.1. Systemic Autoimmune Disease

- 8.2. Market Analysis, Insights and Forecast - by Diagnostic Test

- 8.2.1. Regular Laboratory Tests

- 8.2.2. Inflammatory Markers

- 8.2.3. Immunologic Assays

- 8.2.4. Antibody Tests

- 8.2.5. Other Tests

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 9. United States North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Autoimmune Disease Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Oncimmune

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 HYCOR Biomedical

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Grifols SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Werfen Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Abbott Laboratories

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Siemens Healthineers Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Bio-rad Laboratories

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Myriad Genetics

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Euroimmun AG (Perkinelmer Inc )

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 F Hoffmann-la Roche

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Thermo Fisher Scientific

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Trinity Biotech

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Oncimmune

List of Figures

- Figure 1: North America Autoimmune Disease Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Autoimmune Disease Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 4: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2019 & 2032

- Table 5: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2019 & 2032

- Table 6: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2019 & 2032

- Table 7: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States North America Autoimmune Disease Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Autoimmune Disease Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Autoimmune Disease Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Autoimmune Disease Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Autoimmune Disease Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Autoimmune Disease Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Autoimmune Disease Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Autoimmune Disease Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 22: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2019 & 2032

- Table 23: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2019 & 2032

- Table 24: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2019 & 2032

- Table 25: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 30: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2019 & 2032

- Table 31: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2019 & 2032

- Table 32: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2019 & 2032

- Table 33: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Disease Type 2019 & 2032

- Table 38: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Disease Type 2019 & 2032

- Table 39: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Diagnostic Test 2019 & 2032

- Table 40: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Diagnostic Test 2019 & 2032

- Table 41: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 43: North America Autoimmune Disease Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Autoimmune Disease Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Autoimmune Disease Diagnostics Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the North America Autoimmune Disease Diagnostics Market?

Key companies in the market include Oncimmune, HYCOR Biomedical, Grifols SA, Werfen Group, Abbott Laboratories, Siemens Healthineers Inc, Bio-rad Laboratories, Myriad Genetics, Euroimmun AG (Perkinelmer Inc ), F Hoffmann-la Roche, Thermo Fisher Scientific, Trinity Biotech.

3. What are the main segments of the North America Autoimmune Disease Diagnostics Market?

The market segments include Disease Type, Diagnostic Test, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence and Growing Public Awareness of Autoimmune Diseases; Technological Advancements in Autoimmune Disease Diagnostics.

6. What are the notable trends driving market growth?

Immunologic Assays Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Slow Turnaround Time for Autoimmune Disease Diagnostic Test Results; High Frequency of False Positive Result.

8. Can you provide examples of recent developments in the market?

February 2023: Edesa Biotech received approval from Health Canada for a phase II clinical trial of its EB06 monoclonal antibody candidate to treat vitiligo, a life-altering autoimmune disease.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Autoimmune Disease Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Autoimmune Disease Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Autoimmune Disease Diagnostics Market?

To stay informed about further developments, trends, and reports in the North America Autoimmune Disease Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence