Key Insights

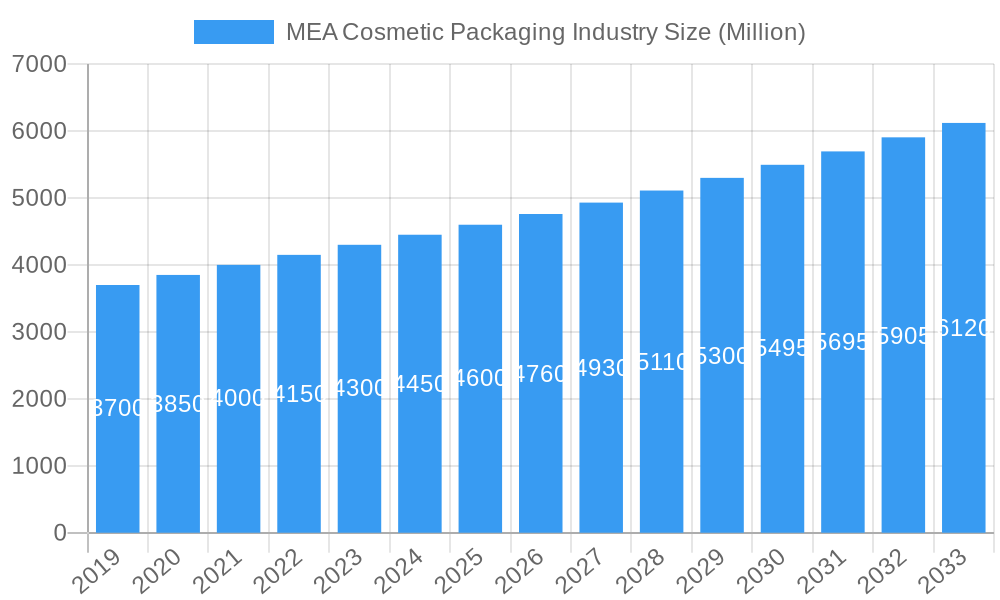

The Middle East & Africa (MEA) cosmetic packaging market is projected for substantial growth, anticipating a market size of $2.1 billion by 2025. The market is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.05% from 2025 through 2033. This expansion is driven by increasing disposable incomes, a growing demand for premium and innovative beauty products, and the recognition of sophisticated packaging as a key brand differentiator. A young demographic, coupled with the influence of social media beauty trends, is boosting consumption across diverse cosmetic categories including hair care, color cosmetics, advanced skincare, and men's grooming. Packaging innovations prioritizing safety, convenience, and sustainability are significantly influencing consumer purchasing decisions.

MEA Cosmetic Packaging Industry Market Size (In Billion)

Key market segments like plastic bottles, metal containers, and flexible plastic packaging are experiencing strong demand due to their versatility, cost-effectiveness, and product adaptability. Caps, closures, pumps, and dispensers are also in high demand for user-friendly application. Emerging trends such as the adoption of eco-friendly and recyclable materials, alongside personalized and minimalist packaging designs, are shaping the competitive landscape. While fluctuating raw material costs and diverse regulatory environments present challenges, strategic investments in localized manufacturing, sustainable practices, and customized packaging solutions are expected to drive market advancement, particularly catering to consumer preferences in the GCC, North Africa, and South Africa.

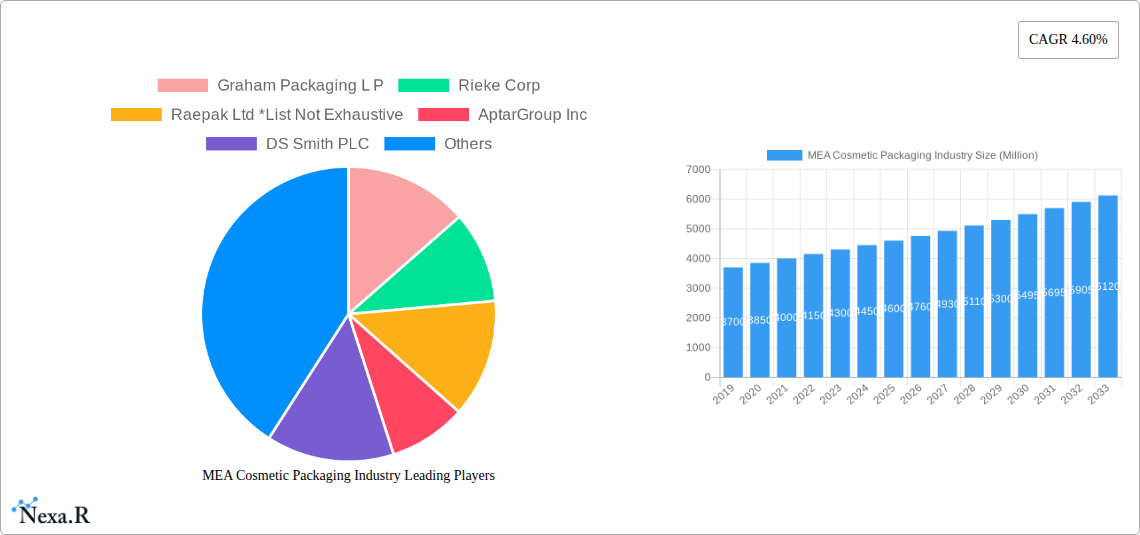

MEA Cosmetic Packaging Industry Company Market Share

MEA Cosmetic Packaging Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the multifaceted MEA Cosmetic Packaging Industry, offering an in-depth analysis of market dynamics, growth drivers, regional dominance, product landscape, and future opportunities. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report provides critical insights for industry stakeholders. It meticulously examines segments including material types (Plastic, Glass, Metal, Paper), product types (Plastic Bottles and Containers, Glass Bottles and Containers, Metal Containers, Folding Cartons, Corrugated Boxes, Tubes and Sticks, Caps and Closures, Pump and Dispenser, Droppers, Ampoules, Flexible Plastic Packaging), and cosmetic types (Hair Care, Color Cosmetics, Skin Care, Men's Grooming, Deodorants, Other Cosmetics). Valuable data points are presented in Million units.

MEA Cosmetic Packaging Industry Market Dynamics & Structure

The MEA cosmetic packaging market is characterized by a moderate to high degree of concentration, with a few key players holding significant market shares. Technological innovation is a primary driver, with companies continually investing in sustainable materials, advanced dispensing mechanisms, and smart packaging solutions to cater to evolving consumer demands for eco-friendly and convenient products. Regulatory frameworks, particularly concerning material safety and recyclability, are becoming increasingly stringent, influencing packaging design and material selection. Competitive product substitutes are emerging, especially in the realm of sustainable alternatives to traditional plastics. End-user demographics in the MEA region are diverse, with a growing middle class and an increasing demand for premium and personalized cosmetic products, particularly from younger demographics. Merger and acquisition (M&A) trends are evident as larger companies seek to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Key players like Amcor PLC, AptarGroup Inc., and Berry Global Group (RPC Group PLC) dominate a significant portion of the market.

- Technological Innovation: Focus on bioplastics, recycled PET (rPET), and novel barrier properties for extended shelf life.

- Regulatory Frameworks: Increasing emphasis on Extended Producer Responsibility (EPR) and reduction of single-use plastics.

- Competitive Substitutes: Growth in paper-based packaging and reusable container systems.

- End-User Demographics: Rising disposable incomes and a strong preference for aesthetically pleasing and functional packaging.

- M&A Trends: Strategic acquisitions aimed at vertical integration and market expansion.

MEA Cosmetic Packaging Industry Growth Trends & Insights

The MEA cosmetic packaging industry is poised for robust growth, driven by a confluence of escalating consumer demand for beauty and personal care products, a burgeoning middle class with increased disposable income, and a growing awareness of sustainable packaging solutions. The market size evolution is projected to witness a steady upward trajectory, fueled by the expansion of both domestic and international cosmetic brands within the region. Adoption rates of innovative packaging technologies, such as airless pumps and tamper-evident seals, are on the rise, enhancing product integrity and user experience. Technological disruptions, including advancements in materials science for enhanced recyclability and biodegradability, are significantly reshaping the industry landscape. Furthermore, significant shifts in consumer behavior, characterized by a preference for e-commerce channels and a keen interest in brands that demonstrate environmental responsibility, are acting as powerful catalysts for growth. The increasing penetration of luxury and premium cosmetic brands also necessitates sophisticated and high-quality packaging, further stimulating market expansion.

- Market Size Evolution: Projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period.

- Adoption Rates: High adoption of innovative features like pump dispensers and sustainable materials.

- Technological Disruptions: Integration of smart packaging and advanced printing techniques.

- Consumer Behavior Shifts: Growing demand for eco-friendly, personalized, and online-purchased cosmetic products.

- Market Penetration: Increased presence of multinational cosmetic brands and expansion of local players.

Dominant Regions, Countries, or Segments in MEA Cosmetic Packaging Industry

Within the MEA cosmetic packaging industry, the Plastic material segment, specifically Plastic Bottles and Containers, is demonstrating exceptional dominance. This supremacy is driven by the inherent versatility, cost-effectiveness, and vast application range of plastics in packaging a wide array of cosmetic products, from skincare lotions and shampoos to makeup foundations. The growing preference for lightweight and durable packaging solutions further bolsters the position of plastic.

In terms of geographical dominance, Saudi Arabia and the United Arab Emirates (UAE) are emerging as key growth hubs. These countries boast a rapidly expanding consumer base with a high propensity to spend on beauty and personal care products, fueled by a young demographic and increasing disposable incomes. Significant investments in retail infrastructure, including sophisticated malls and thriving e-commerce platforms, create a conducive environment for the cosmetic industry and, consequently, its packaging. Economic policies that encourage foreign investment and support the growth of manufacturing sectors also play a crucial role in attracting packaging manufacturers and brands.

- Dominant Material Type: Plastic, due to its adaptability, affordability, and extensive use across various cosmetic categories.

- Key Sub-segment: Plastic Bottles and Containers, offering a wide range of shapes, sizes, and functionalities.

- Dominant Product Types:

- Plastic Bottles and Containers: Leading in volume and value due to broad applicability.

- Caps and Closures: Essential components, driving demand in conjunction with primary packaging.

- Pump and Dispenser: Increasing adoption for hygienic and controlled product dispensing.

- Dominant Cosmetic Types:

- Skin Care: The largest segment, driving demand for a diverse range of packaging solutions.

- Hair Care: Continues to be a strong performer, requiring specialized bottle and closure designs.

- Dominant Regions/Countries:

- United Arab Emirates (UAE): A regional hub for luxury cosmetics and a strong market for innovative packaging.

- Key Drivers: High consumer spending, robust retail and e-commerce infrastructure, tourism-driven demand.

- Saudi Arabia: Rapidly growing market with increasing demand for both mass-market and premium beauty products.

- Key Drivers: Young demographic, rising disposable incomes, government initiatives to diversify the economy.

- United Arab Emirates (UAE): A regional hub for luxury cosmetics and a strong market for innovative packaging.

- Market Share (Plastic Bottles & Containers): Estimated to hold XX% of the total MEA cosmetic packaging market.

- Growth Potential (UAE & Saudi Arabia): Projected CAGR of XX% and XX% respectively for cosmetic packaging demand.

MEA Cosmetic Packaging Industry Product Landscape

The MEA cosmetic packaging product landscape is characterized by a strong emphasis on both aesthetic appeal and functional superiority. Innovations are prevalent across all product types, ranging from the development of lightweight yet durable plastic bottles and containers with advanced barrier properties to the intricate designs of dropper bottles for precise serum application. Metal containers are gaining traction for luxury fragrance and skincare lines, offering a premium feel. Folding cartons and corrugated boxes are increasingly incorporating sustainable materials and sophisticated printing techniques for enhanced brand storytelling and visual impact. Tubes and sticks are seeing advancements in user-friendly dispensing mechanisms, while caps and closures are evolving with tamper-evident features and child-resistant designs. The integration of pump and dispenser technologies continues to drive convenience and hygiene, with a growing demand for airless pump systems.

Key Drivers, Barriers & Challenges in MEA Cosmetic Packaging Industry

Key Drivers:

- Growing Consumer Demand: An expanding middle class and increasing disposable incomes in the MEA region are fueling the demand for beauty and personal care products, directly impacting the cosmetic packaging industry.

- E-commerce Growth: The rapid expansion of online retail channels necessitates robust, protective, and visually appealing packaging for direct-to-consumer shipments.

- Technological Advancements: Innovations in materials, printing, and dispensing technologies are creating new opportunities and enhancing product appeal.

- Sustainability Initiatives: Increasing consumer and regulatory pressure for eco-friendly packaging solutions is driving the adoption of recycled, recyclable, and biodegradable materials.

Barriers & Challenges:

- Supply Chain Volatility: Geopolitical factors and global logistical challenges can disrupt the supply of raw materials and finished packaging products.

- Regulatory Compliance: Navigating diverse and evolving regulations across different MEA countries regarding material safety, labeling, and environmental impact can be complex.

- Cost Sensitivity: While premium packaging is desired, a significant segment of the market remains price-sensitive, creating a balance between innovation and affordability.

- Competition: Intense competition from both established global players and emerging local manufacturers puts pressure on pricing and innovation timelines.

- Infrastructure Limitations: In certain sub-regions, underdeveloped logistics and waste management infrastructure can pose challenges for the adoption of certain packaging formats and recycling initiatives.

Emerging Opportunities in MEA Cosmetic Packaging Industry

Emerging opportunities in the MEA cosmetic packaging industry lie in the burgeoning demand for sustainable and eco-friendly packaging solutions, particularly bioplastics and those made from recycled content. The growing trend of personalization and customization in cosmetics presents an avenue for innovative packaging designs and smaller batch production capabilities. Furthermore, the increasing popularity of "clean beauty" and natural ingredients is driving demand for packaging that reflects these values through minimalist designs and transparent materials. The untapped potential in emerging markets within the MEA region, coupled with the rise of niche cosmetic brands, offers significant growth prospects for agile and innovative packaging suppliers. The integration of smart packaging features for enhanced consumer engagement and traceability also represents a promising frontier.

Growth Accelerators in the MEA Cosmetic Packaging Industry Industry

Several key catalysts are accelerating the growth of the MEA cosmetic packaging industry. Technological breakthroughs in material science, leading to the development of more sustainable and functional packaging options, are a primary driver. Strategic partnerships between cosmetic brands and packaging manufacturers are fostering co-creation and faster innovation cycles. Market expansion strategies, including the penetration of new geographical areas within the MEA region and the catering to specific demographic needs, are also contributing significantly. The increasing focus on premiumization and the rising demand for luxury cosmetic products are pushing the boundaries of design and material quality. Moreover, a growing awareness and adoption of e-commerce logistics require packaging that ensures product safety and enhances the unboxing experience, further stimulating growth.

Key Players Shaping the MEA Cosmetic Packaging Industry Market

- Graham Packaging L P

- Rieke Corp

- Raepak Ltd

- AptarGroup Inc

- DS Smith PLC

- Amcor PLC

- Cosmopak Ltd

- Albea SA

- RPC Group PLC (Berry Global Group)

- Silgan Holdings Inc

- Gerresheimer AG

Notable Milestones in MEA Cosmetic Packaging Industry Sector

- 2019: Increased investment in PET recycling infrastructure across several MEA countries, driving demand for rPET in cosmetic bottles.

- 2020: Surge in demand for e-commerce-ready packaging solutions due to the global pandemic.

- 2021: Launch of new sustainable bioplastic packaging options by key players, gaining traction among eco-conscious brands.

- 2022: Significant M&A activity, with larger conglomerates acquiring smaller specialized packaging firms to expand their regional presence.

- 2023: Growing emphasis on innovative dispensing systems, such as airless pumps and precise applicators, for skincare and color cosmetics.

- 2024: Increased adoption of smart packaging features, including QR codes for product authentication and ingredient transparency.

In-Depth MEA Cosmetic Packaging Industry Market Outlook

The MEA cosmetic packaging industry is set for sustained and accelerated growth. The ongoing focus on sustainability will continue to be a paramount growth accelerator, driving innovation in recycled, recyclable, and biodegradable materials, with an estimated market share expansion in these categories. Technological advancements in intelligent packaging and advanced dispensing systems will further enhance product value and consumer experience. Strategic market expansion into underserved territories within the MEA region, alongside the continuous growth of e-commerce, will provide substantial opportunities. The increasing demand for premium and personalized cosmetic products will fuel investments in high-quality, aesthetically pleasing, and functional packaging. This dynamic landscape presents lucrative prospects for companies that can adapt to evolving consumer preferences and regulatory demands.

MEA Cosmetic Packaging Industry Segmentation

-

1. Material type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper

-

2. Product Type

- 2.1. Plastic Bottles and Containers

- 2.2. Glass Bottles and Containers

- 2.3. Metal Containers

- 2.4. Folding Cartons

- 2.5. Corrugated Boxes

- 2.6. Tubes and Sticks

- 2.7. Caps and Closures

- 2.8. Pump and Dispenser

- 2.9. Droppers

- 2.10. Ampoules

- 2.11. Flexible Plastic Packaging

-

3. Cosmetic Type

- 3.1. Hair Care

- 3.2. Color Cosmetics

- 3.3. Skin Care

- 3.4. Men's Grooming

- 3.5. Deodorants

- 3.6. Other Co

MEA Cosmetic Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

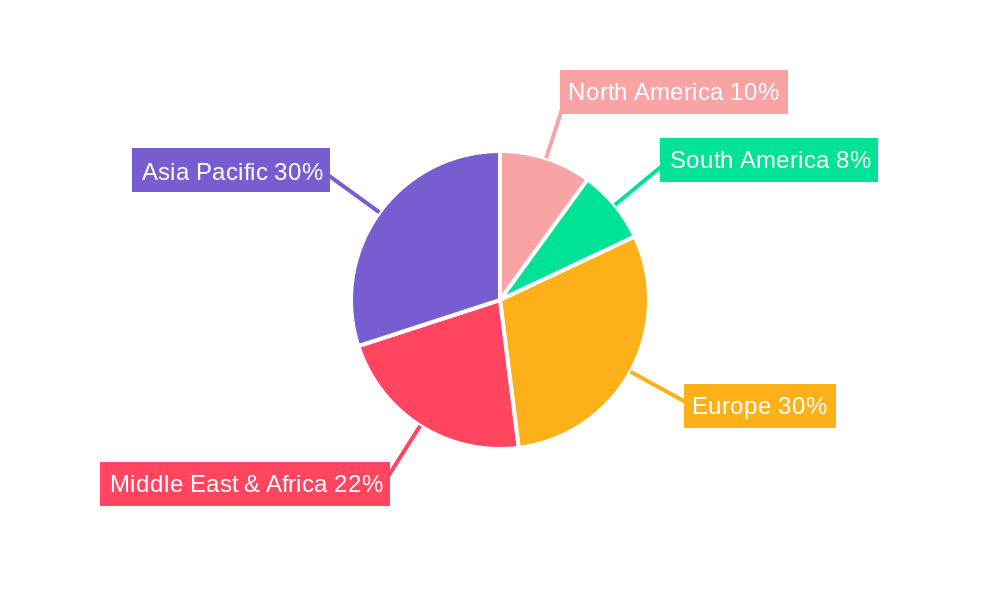

MEA Cosmetic Packaging Industry Regional Market Share

Geographic Coverage of MEA Cosmetic Packaging Industry

MEA Cosmetic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Focus on Innovation and Attractive Packaging

- 3.3. Market Restrains

- 3.3.1. ; Growing Sustainability Concerns

- 3.4. Market Trends

- 3.4.1. Sustainable Packaging to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles and Containers

- 5.2.2. Glass Bottles and Containers

- 5.2.3. Metal Containers

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated Boxes

- 5.2.6. Tubes and Sticks

- 5.2.7. Caps and Closures

- 5.2.8. Pump and Dispenser

- 5.2.9. Droppers

- 5.2.10. Ampoules

- 5.2.11. Flexible Plastic Packaging

- 5.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 5.3.1. Hair Care

- 5.3.2. Color Cosmetics

- 5.3.3. Skin Care

- 5.3.4. Men's Grooming

- 5.3.5. Deodorants

- 5.3.6. Other Co

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material type

- 6. North America MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material type

- 6.1.1. Plastic

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Paper

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Plastic Bottles and Containers

- 6.2.2. Glass Bottles and Containers

- 6.2.3. Metal Containers

- 6.2.4. Folding Cartons

- 6.2.5. Corrugated Boxes

- 6.2.6. Tubes and Sticks

- 6.2.7. Caps and Closures

- 6.2.8. Pump and Dispenser

- 6.2.9. Droppers

- 6.2.10. Ampoules

- 6.2.11. Flexible Plastic Packaging

- 6.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 6.3.1. Hair Care

- 6.3.2. Color Cosmetics

- 6.3.3. Skin Care

- 6.3.4. Men's Grooming

- 6.3.5. Deodorants

- 6.3.6. Other Co

- 6.1. Market Analysis, Insights and Forecast - by Material type

- 7. South America MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material type

- 7.1.1. Plastic

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Paper

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Plastic Bottles and Containers

- 7.2.2. Glass Bottles and Containers

- 7.2.3. Metal Containers

- 7.2.4. Folding Cartons

- 7.2.5. Corrugated Boxes

- 7.2.6. Tubes and Sticks

- 7.2.7. Caps and Closures

- 7.2.8. Pump and Dispenser

- 7.2.9. Droppers

- 7.2.10. Ampoules

- 7.2.11. Flexible Plastic Packaging

- 7.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 7.3.1. Hair Care

- 7.3.2. Color Cosmetics

- 7.3.3. Skin Care

- 7.3.4. Men's Grooming

- 7.3.5. Deodorants

- 7.3.6. Other Co

- 7.1. Market Analysis, Insights and Forecast - by Material type

- 8. Europe MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material type

- 8.1.1. Plastic

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Paper

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Plastic Bottles and Containers

- 8.2.2. Glass Bottles and Containers

- 8.2.3. Metal Containers

- 8.2.4. Folding Cartons

- 8.2.5. Corrugated Boxes

- 8.2.6. Tubes and Sticks

- 8.2.7. Caps and Closures

- 8.2.8. Pump and Dispenser

- 8.2.9. Droppers

- 8.2.10. Ampoules

- 8.2.11. Flexible Plastic Packaging

- 8.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 8.3.1. Hair Care

- 8.3.2. Color Cosmetics

- 8.3.3. Skin Care

- 8.3.4. Men's Grooming

- 8.3.5. Deodorants

- 8.3.6. Other Co

- 8.1. Market Analysis, Insights and Forecast - by Material type

- 9. Middle East & Africa MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material type

- 9.1.1. Plastic

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Paper

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Plastic Bottles and Containers

- 9.2.2. Glass Bottles and Containers

- 9.2.3. Metal Containers

- 9.2.4. Folding Cartons

- 9.2.5. Corrugated Boxes

- 9.2.6. Tubes and Sticks

- 9.2.7. Caps and Closures

- 9.2.8. Pump and Dispenser

- 9.2.9. Droppers

- 9.2.10. Ampoules

- 9.2.11. Flexible Plastic Packaging

- 9.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 9.3.1. Hair Care

- 9.3.2. Color Cosmetics

- 9.3.3. Skin Care

- 9.3.4. Men's Grooming

- 9.3.5. Deodorants

- 9.3.6. Other Co

- 9.1. Market Analysis, Insights and Forecast - by Material type

- 10. Asia Pacific MEA Cosmetic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material type

- 10.1.1. Plastic

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Paper

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Plastic Bottles and Containers

- 10.2.2. Glass Bottles and Containers

- 10.2.3. Metal Containers

- 10.2.4. Folding Cartons

- 10.2.5. Corrugated Boxes

- 10.2.6. Tubes and Sticks

- 10.2.7. Caps and Closures

- 10.2.8. Pump and Dispenser

- 10.2.9. Droppers

- 10.2.10. Ampoules

- 10.2.11. Flexible Plastic Packaging

- 10.3. Market Analysis, Insights and Forecast - by Cosmetic Type

- 10.3.1. Hair Care

- 10.3.2. Color Cosmetics

- 10.3.3. Skin Care

- 10.3.4. Men's Grooming

- 10.3.5. Deodorants

- 10.3.6. Other Co

- 10.1. Market Analysis, Insights and Forecast - by Material type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Graham Packaging L P

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rieke Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Raepak Ltd *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AptarGroup Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DS Smith PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amcor PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cosmopak Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Albea SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 RPC Group PLC (Berry Global Group)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Silgan Holdings Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gerresheimer AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Graham Packaging L P

List of Figures

- Figure 1: Global MEA Cosmetic Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America MEA Cosmetic Packaging Industry Revenue (billion), by Material type 2025 & 2033

- Figure 3: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2025 & 2033

- Figure 4: North America MEA Cosmetic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America MEA Cosmetic Packaging Industry Revenue (billion), by Cosmetic Type 2025 & 2033

- Figure 7: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2025 & 2033

- Figure 8: North America MEA Cosmetic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America MEA Cosmetic Packaging Industry Revenue (billion), by Material type 2025 & 2033

- Figure 11: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2025 & 2033

- Figure 12: South America MEA Cosmetic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America MEA Cosmetic Packaging Industry Revenue (billion), by Cosmetic Type 2025 & 2033

- Figure 15: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2025 & 2033

- Figure 16: South America MEA Cosmetic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: South America MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe MEA Cosmetic Packaging Industry Revenue (billion), by Material type 2025 & 2033

- Figure 19: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2025 & 2033

- Figure 20: Europe MEA Cosmetic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe MEA Cosmetic Packaging Industry Revenue (billion), by Cosmetic Type 2025 & 2033

- Figure 23: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2025 & 2033

- Figure 24: Europe MEA Cosmetic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (billion), by Material type 2025 & 2033

- Figure 27: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2025 & 2033

- Figure 28: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (billion), by Cosmetic Type 2025 & 2033

- Figure 31: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2025 & 2033

- Figure 32: Middle East & Africa MEA Cosmetic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific MEA Cosmetic Packaging Industry Revenue (billion), by Material type 2025 & 2033

- Figure 35: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Material type 2025 & 2033

- Figure 36: Asia Pacific MEA Cosmetic Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific MEA Cosmetic Packaging Industry Revenue (billion), by Cosmetic Type 2025 & 2033

- Figure 39: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Cosmetic Type 2025 & 2033

- Figure 40: Asia Pacific MEA Cosmetic Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific MEA Cosmetic Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Material type 2020 & 2033

- Table 2: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 4: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Material type 2020 & 2033

- Table 6: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 8: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Material type 2020 & 2033

- Table 13: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 15: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Material type 2020 & 2033

- Table 20: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 21: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 22: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Material type 2020 & 2033

- Table 33: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 35: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Material type 2020 & 2033

- Table 43: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Cosmetic Type 2020 & 2033

- Table 45: Global MEA Cosmetic Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific MEA Cosmetic Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Cosmetic Packaging Industry?

The projected CAGR is approximately 5.05%.

2. Which companies are prominent players in the MEA Cosmetic Packaging Industry?

Key companies in the market include Graham Packaging L P, Rieke Corp, Raepak Ltd *List Not Exhaustive, AptarGroup Inc, DS Smith PLC, Amcor PLC, Cosmopak Ltd, Albea SA, RPC Group PLC (Berry Global Group), Silgan Holdings Inc, Gerresheimer AG.

3. What are the main segments of the MEA Cosmetic Packaging Industry?

The market segments include Material type, Product Type, Cosmetic Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Focus on Innovation and Attractive Packaging.

6. What are the notable trends driving market growth?

Sustainable Packaging to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Growing Sustainability Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Cosmetic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Cosmetic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Cosmetic Packaging Industry?

To stay informed about further developments, trends, and reports in the MEA Cosmetic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence