Key Insights

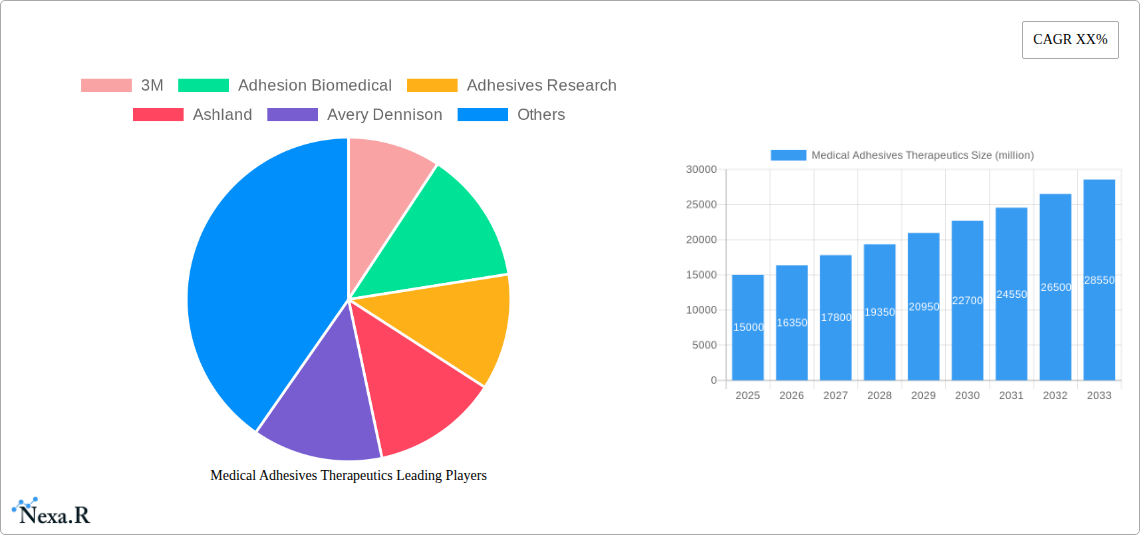

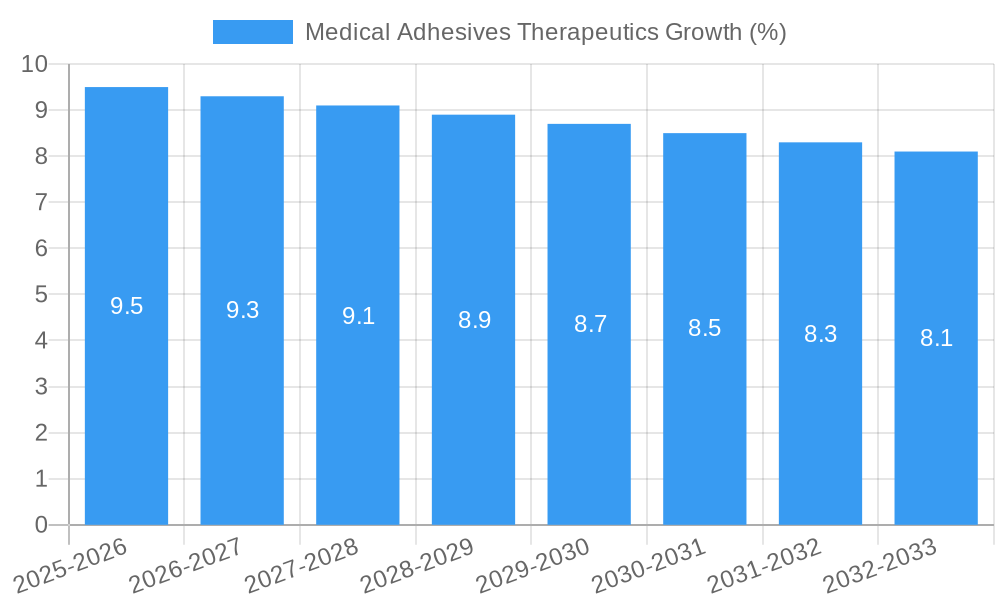

The global Medical Adhesives Therapeutics market is poised for robust growth, projected to reach a significant market size of approximately $15,000 million by 2025. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of around 9.5% over the forecast period of 2025-2033. This sustained momentum is primarily driven by the increasing prevalence of chronic diseases, a growing demand for minimally invasive surgical procedures, and continuous advancements in adhesive technology for improved biocompatibility and efficacy. The market is broadly segmented into natural and synthetic resins, with synthetic resins dominating due to their superior performance characteristics and wider applicability in complex medical interventions. Key applications span dental procedures, external wound management, internal surgical site closures, and the manufacturing of advanced medical devices and equipment. The rising adoption of these advanced materials in sophisticated healthcare settings underscores their critical role in enhancing patient outcomes and reducing healthcare burdens.

The market's trajectory is further shaped by several influential trends and strategic initiatives by leading companies. An increasing focus on developing biodegradable and bioresorbable adhesives is a significant trend, addressing the need for materials that integrate seamlessly with body tissues and dissolve over time, eliminating the need for secondary removal procedures. Furthermore, the integration of smart technologies, such as drug-eluting adhesives, is emerging, offering localized delivery of therapeutic agents directly at the site of application. While the market exhibits substantial growth potential, certain restraints, such as stringent regulatory approvals and the high cost associated with advanced adhesive formulations, need to be navigated. However, the expanding healthcare infrastructure, particularly in the Asia Pacific region, coupled with significant investments in research and development by prominent players like Johnson & Johnson, Medtronic, and 3M, are expected to propel the market forward, solidifying its importance in modern therapeutics.

This comprehensive report provides an in-depth analysis of the Medical Adhesives Therapeutics market, encompassing historical trends, current dynamics, and future projections. With a study period from 2019 to 2033 and a base year of 2025, this report offers critical insights for stakeholders seeking to navigate this rapidly evolving sector. We examine market segmentation by application and type, explore key industry developments, and identify the leading companies shaping the future of medical adhesives.

Medical Adhesives Therapeutics Market Dynamics & Structure

The Medical Adhesives Therapeutics market is characterized by a moderately consolidated structure, with a few major players holding significant market share. 3M, Johnson & Johnson, and B. Braun are prominent entities, actively investing in research and development to maintain their competitive edge. Technological innovation is the primary driver of market growth, fueled by advancements in biomaterials and drug delivery systems. The development of bio-compatible and bio-resorbable adhesives is a key area of focus, offering enhanced patient outcomes and reduced side effects.

- Market Concentration: Moderate to high, with leading players dominating specific application segments.

- Technological Innovation Drivers:

- Development of advanced polymer science for enhanced adhesion and biocompatibility.

- Integration of drug delivery functionalities within adhesives.

- Miniaturization and precision application techniques.

- Regulatory Frameworks: Stringent regulatory approvals (e.g., FDA, EMA) are crucial for market entry and product commercialization. Compliance with ISO standards is a prerequisite for all manufacturers.

- Competitive Product Substitutes: While direct substitutes are limited, advancements in traditional suturing techniques and novel wound closure devices present indirect competition.

- End-User Demographics: An aging global population and a rising prevalence of chronic diseases are increasing the demand for advanced wound care and minimally invasive surgical procedures, directly impacting the need for medical adhesives.

- M&A Trends: Strategic acquisitions and collaborations are prevalent as companies seek to expand their product portfolios, gain access to new technologies, and strengthen their market presence. Recent years have seen several key acquisitions aimed at consolidating market share and acquiring specialized adhesive technologies.

Medical Adhesives Therapeutics Growth Trends & Insights

The Medical Adhesives Therapeutics market is poised for robust growth, driven by increasing adoption across various healthcare applications. The global market size for medical adhesives is projected to expand significantly, fueled by a combination of factors including an aging population, a growing demand for minimally invasive procedures, and continuous technological advancements. In 2025, the global market is estimated to reach approximately $12,500 million units. This growth is further propelled by the increasing integration of therapeutic agents within adhesive formulations, transforming them into advanced drug delivery systems.

The CAGR for the forecast period (2025-2033) is estimated at a strong xx%, indicating a sustained upward trajectory. Adoption rates for advanced medical adhesives are accelerating as healthcare providers recognize their benefits in terms of reduced procedure times, improved patient comfort, and enhanced healing outcomes compared to traditional methods. The shift towards internal medical applications and specialized medical devices and equipment is a particularly dynamic segment, witnessing substantial investment and innovation.

Technological disruptions, such as the development of novel adhesive chemistries and smart adhesives with embedded sensors, are continuously enhancing product efficacy and expanding application scope. Consumer behavior shifts, including a greater preference for less invasive treatments and faster recovery times, are also playing a pivotal role in driving market demand. The increasing awareness among healthcare professionals and patients about the advantages of medical adhesives over conventional closure methods is a significant market penetration driver.

Dominant Regions, Countries, or Segments in Medical Adhesives Therapeutics

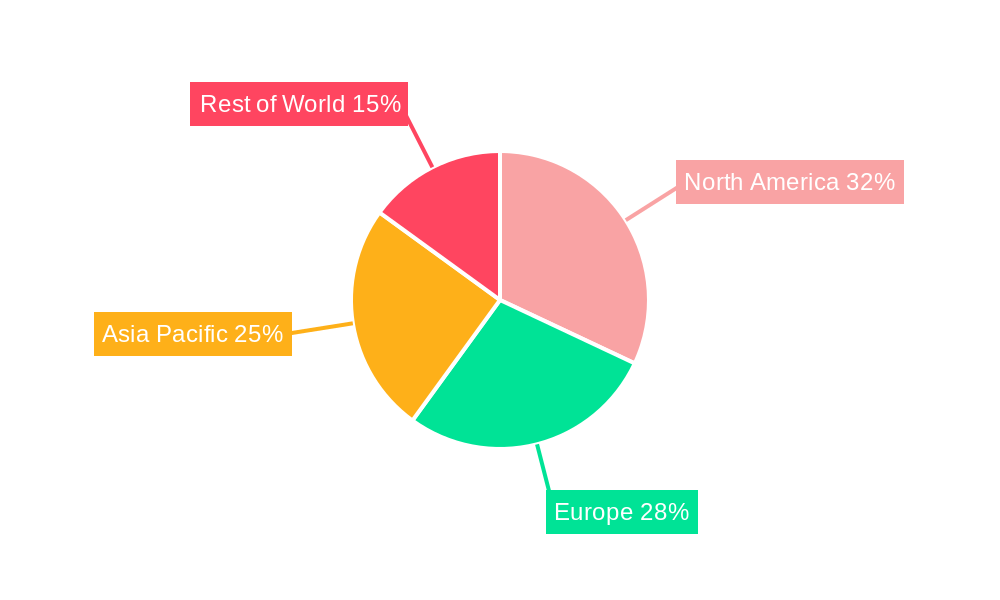

The North America region stands out as a dominant force in the Medical Adhesives Therapeutics market, driven by a confluence of factors including a highly developed healthcare infrastructure, substantial investment in research and development, and a strong regulatory framework that encourages innovation. The United States, in particular, is a key contributor, with a high prevalence of chronic diseases and an aging population that necessitates advanced medical treatments, including sophisticated wound closure and tissue sealing solutions.

Key drivers for North America's dominance include:

- Economic Policies: Favorable reimbursement policies and significant private and public funding for healthcare innovation.

- Infrastructure: Advanced hospital networks and a well-established supply chain for medical devices and pharmaceuticals.

- Technological Advancements: A robust ecosystem of research institutions and private companies at the forefront of biomaterial science and medical technology development.

Within the application segments, Internal Medical Applications are exhibiting the most significant growth potential. This segment encompasses a wide range of uses, from surgical wound closure and tissue repair during complex procedures to drug delivery systems for chronic conditions. The increasing preference for minimally invasive surgeries, which heavily rely on advanced adhesives for internal sealing and bonding, is a primary catalyst. The market share for internal medical applications is projected to reach approximately 40% of the total market by 2033.

Synthetic Resins dominate the 'Types' segment, accounting for over 70% of the market share. This dominance is attributed to their superior performance characteristics, including enhanced biocompatibility, tunable mechanical properties, and the ability to be engineered for specific medical applications. Advances in polymer chemistry continue to yield novel synthetic resins with improved efficacy and reduced allergenic potential.

- Market Share (Internal Medical Applications): Estimated to reach 40% by 2033.

- Growth Potential (Internal Medical Applications): High, driven by minimally invasive surgery trends and chronic disease management.

- Market Share (Synthetic Resins): Over 70%.

- Dominance Factors (Synthetic Resins): Superior performance, customization, and ongoing R&D.

Medical Adhesives Therapeutics Product Landscape

The product landscape for Medical Adhesives Therapeutics is characterized by continuous innovation focused on enhancing biocompatibility, biodegradability, and targeted therapeutic delivery. Innovations include cyanoacrylate-based adhesives for rapid wound closure, fibrin sealants for delicate tissue applications, and hydrogel adhesives offering sustained drug release. Bio-resorbable polymers are increasingly being incorporated to ensure seamless integration and elimination post-healing. The development of specialized adhesives for specific surgical procedures, such as cardiovascular or neurological interventions, underscores the trend towards highly customized and application-specific solutions.

Key Drivers, Barriers & Challenges in Medical Adhesives Therapeutics

Key Drivers:

- Technological Advancements: Development of novel bio-compatible and bio-resorbable adhesives with enhanced properties.

- Minimally Invasive Surgery: Growing preference for procedures that reduce patient trauma and recovery time.

- Aging Population & Chronic Diseases: Increased demand for advanced wound care and therapeutic solutions.

- Product Innovation: Integration of drug delivery capabilities within adhesives for targeted treatment.

Key Barriers & Challenges:

- Regulatory Hurdles: Stringent and time-consuming approval processes for new medical devices and adhesives.

- High R&D Costs: Significant investment required for developing and validating advanced adhesive technologies.

- Competitive Pressures: Intense competition from established players and emerging innovators.

- Supply Chain Disruptions: Potential challenges in sourcing raw materials and ensuring consistent product availability.

- Adoption Rates: Overcoming physician inertia and established procedural practices can be a challenge in certain segments.

Emerging Opportunities in Medical Adhesives Therapeutics

Emerging opportunities lie in the development of smart adhesives capable of monitoring wound healing or delivering therapeutic agents in response to physiological cues. The untapped potential in regenerative medicine, where adhesives can act as scaffolds for tissue engineering, presents a significant growth avenue. Furthermore, the expansion of home healthcare solutions creates a demand for advanced, user-friendly adhesives for post-operative wound management and chronic wound care. The increasing global demand for dental applications, particularly in restorative dentistry and orthodontics, also represents a substantial, albeit developing, opportunity.

Growth Accelerators in the Medical Adhesives Therapeutics Industry

Growth accelerators in the Medical Adhesives Therapeutics industry are primarily driven by significant investments in research and development, leading to the introduction of novel drug-eluting adhesives that combine wound closure with localized therapeutic delivery. Strategic partnerships and collaborations between adhesive manufacturers and pharmaceutical companies are further propelling innovation. The increasing adoption of these advanced adhesives in emerging economies, as healthcare infrastructure improves, also serves as a major growth catalyst. Furthermore, the continuous development of biodegradable and bio-compatible materials is expanding their therapeutic utility and patient acceptance.

Key Players Shaping the Medical Adhesives Therapeutics Market

- 3M

- Adhesion Biomedical

- Adhesives Research

- Ashland

- Avery Dennison

- B. Braun

- Bostik

- Chemence

- Cohera Medical

- Johnson & Johnson

- Cyberbond

- Dentsply Sirona

- Medtronic Diabetes

- GluStitch

- H.B. Fuller

- Henkel

- Pinnacle Technologies

- Baxter

Notable Milestones in Medical Adhesives Therapeutics Sector

- 2019: Launch of advanced bio-resorbable adhesives for complex surgical closures.

- 2020: Increased focus on antimicrobial adhesives to prevent surgical site infections.

- 2021: Significant advancements in hydrogel-based adhesives for sustained drug release.

- 2022: Emergence of smart adhesives with integrated sensing capabilities.

- 2023: FDA approval for novel cyanoacrylate formulations with enhanced elasticity.

- 2024: Increased M&A activity targeting companies with specialized bio-adhesive technologies.

In-Depth Medical Adhesives Therapeutics Market Outlook

The future of the Medical Adhesives Therapeutics market is exceptionally promising, driven by ongoing technological breakthroughs that are continually expanding the capabilities and applications of these critical medical tools. The market is set to witness a significant surge in the development and adoption of personalized adhesive solutions, tailored to specific patient needs and surgical requirements. Strategic initiatives, including increased investment in regenerative medicine applications and the integration of AI for predictive wound care, will further amplify growth. Expansion into underserved geographical markets and a focus on patient-centric innovations will be paramount for sustained success in this dynamic and expanding sector.

Medical Adhesives Therapeutics Segmentation

-

1. Application

- 1.1. Dental applications

- 1.2. External medical applications

- 1.3. Internal medical applications

- 1.4. Medical devices and equipment

-

2. Types

- 2.1. Natural Resins

- 2.2. Synthetic Resins

Medical Adhesives Therapeutics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Adhesives Therapeutics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Adhesives Therapeutics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dental applications

- 5.1.2. External medical applications

- 5.1.3. Internal medical applications

- 5.1.4. Medical devices and equipment

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Natural Resins

- 5.2.2. Synthetic Resins

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Adhesives Therapeutics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dental applications

- 6.1.2. External medical applications

- 6.1.3. Internal medical applications

- 6.1.4. Medical devices and equipment

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Natural Resins

- 6.2.2. Synthetic Resins

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Adhesives Therapeutics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dental applications

- 7.1.2. External medical applications

- 7.1.3. Internal medical applications

- 7.1.4. Medical devices and equipment

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Natural Resins

- 7.2.2. Synthetic Resins

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Adhesives Therapeutics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dental applications

- 8.1.2. External medical applications

- 8.1.3. Internal medical applications

- 8.1.4. Medical devices and equipment

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Natural Resins

- 8.2.2. Synthetic Resins

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Adhesives Therapeutics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dental applications

- 9.1.2. External medical applications

- 9.1.3. Internal medical applications

- 9.1.4. Medical devices and equipment

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Natural Resins

- 9.2.2. Synthetic Resins

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Adhesives Therapeutics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dental applications

- 10.1.2. External medical applications

- 10.1.3. Internal medical applications

- 10.1.4. Medical devices and equipment

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Natural Resins

- 10.2.2. Synthetic Resins

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adhesion Biomedical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adhesives Research

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ashland

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avery Dennison

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 B. Braun

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bostik

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chemence

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cohera Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Johnson & Johnson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cyberbond

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dentsply Sirona

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Medtronic Diabetes

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GluStitch

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 H.B. Fuller

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Henkel

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Pinnacle Technologies

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Baxter

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Medical Adhesives Therapeutics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Medical Adhesives Therapeutics Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Medical Adhesives Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 4: North America Medical Adhesives Therapeutics Volume (K), by Application 2024 & 2032

- Figure 5: North America Medical Adhesives Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Medical Adhesives Therapeutics Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Medical Adhesives Therapeutics Revenue (million), by Types 2024 & 2032

- Figure 8: North America Medical Adhesives Therapeutics Volume (K), by Types 2024 & 2032

- Figure 9: North America Medical Adhesives Therapeutics Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Medical Adhesives Therapeutics Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Medical Adhesives Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 12: North America Medical Adhesives Therapeutics Volume (K), by Country 2024 & 2032

- Figure 13: North America Medical Adhesives Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Medical Adhesives Therapeutics Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Medical Adhesives Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 16: South America Medical Adhesives Therapeutics Volume (K), by Application 2024 & 2032

- Figure 17: South America Medical Adhesives Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Medical Adhesives Therapeutics Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Medical Adhesives Therapeutics Revenue (million), by Types 2024 & 2032

- Figure 20: South America Medical Adhesives Therapeutics Volume (K), by Types 2024 & 2032

- Figure 21: South America Medical Adhesives Therapeutics Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Medical Adhesives Therapeutics Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Medical Adhesives Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 24: South America Medical Adhesives Therapeutics Volume (K), by Country 2024 & 2032

- Figure 25: South America Medical Adhesives Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Medical Adhesives Therapeutics Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Medical Adhesives Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Medical Adhesives Therapeutics Volume (K), by Application 2024 & 2032

- Figure 29: Europe Medical Adhesives Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Medical Adhesives Therapeutics Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Medical Adhesives Therapeutics Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Medical Adhesives Therapeutics Volume (K), by Types 2024 & 2032

- Figure 33: Europe Medical Adhesives Therapeutics Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Medical Adhesives Therapeutics Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Medical Adhesives Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Medical Adhesives Therapeutics Volume (K), by Country 2024 & 2032

- Figure 37: Europe Medical Adhesives Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Medical Adhesives Therapeutics Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Medical Adhesives Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Medical Adhesives Therapeutics Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Medical Adhesives Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Medical Adhesives Therapeutics Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Medical Adhesives Therapeutics Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Medical Adhesives Therapeutics Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Medical Adhesives Therapeutics Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Medical Adhesives Therapeutics Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Medical Adhesives Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Medical Adhesives Therapeutics Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Medical Adhesives Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Medical Adhesives Therapeutics Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Medical Adhesives Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Medical Adhesives Therapeutics Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Medical Adhesives Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Medical Adhesives Therapeutics Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Medical Adhesives Therapeutics Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Medical Adhesives Therapeutics Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Medical Adhesives Therapeutics Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Medical Adhesives Therapeutics Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Medical Adhesives Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Medical Adhesives Therapeutics Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Medical Adhesives Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Medical Adhesives Therapeutics Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Adhesives Therapeutics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Adhesives Therapeutics Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Medical Adhesives Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Medical Adhesives Therapeutics Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Medical Adhesives Therapeutics Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Medical Adhesives Therapeutics Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Medical Adhesives Therapeutics Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Medical Adhesives Therapeutics Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Medical Adhesives Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Medical Adhesives Therapeutics Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Medical Adhesives Therapeutics Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Medical Adhesives Therapeutics Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Medical Adhesives Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Medical Adhesives Therapeutics Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Medical Adhesives Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Medical Adhesives Therapeutics Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Medical Adhesives Therapeutics Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Medical Adhesives Therapeutics Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Medical Adhesives Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Medical Adhesives Therapeutics Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Medical Adhesives Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Medical Adhesives Therapeutics Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Medical Adhesives Therapeutics Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Medical Adhesives Therapeutics Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Medical Adhesives Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Medical Adhesives Therapeutics Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Medical Adhesives Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Medical Adhesives Therapeutics Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Medical Adhesives Therapeutics Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Medical Adhesives Therapeutics Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Medical Adhesives Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Medical Adhesives Therapeutics Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Medical Adhesives Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Medical Adhesives Therapeutics Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Medical Adhesives Therapeutics Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Medical Adhesives Therapeutics Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Medical Adhesives Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Medical Adhesives Therapeutics Volume K Forecast, by Country 2019 & 2032

- Table 81: China Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Medical Adhesives Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Medical Adhesives Therapeutics Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Adhesives Therapeutics?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Medical Adhesives Therapeutics?

Key companies in the market include 3M, Adhesion Biomedical, Adhesives Research, Ashland, Avery Dennison, B. Braun, Bostik, Chemence, Cohera Medical, Johnson & Johnson, Cyberbond, Dentsply Sirona, Medtronic Diabetes, GluStitch, H.B. Fuller, Henkel, Pinnacle Technologies, Baxter.

3. What are the main segments of the Medical Adhesives Therapeutics?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Adhesives Therapeutics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Adhesives Therapeutics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Adhesives Therapeutics?

To stay informed about further developments, trends, and reports in the Medical Adhesives Therapeutics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence