Key Insights

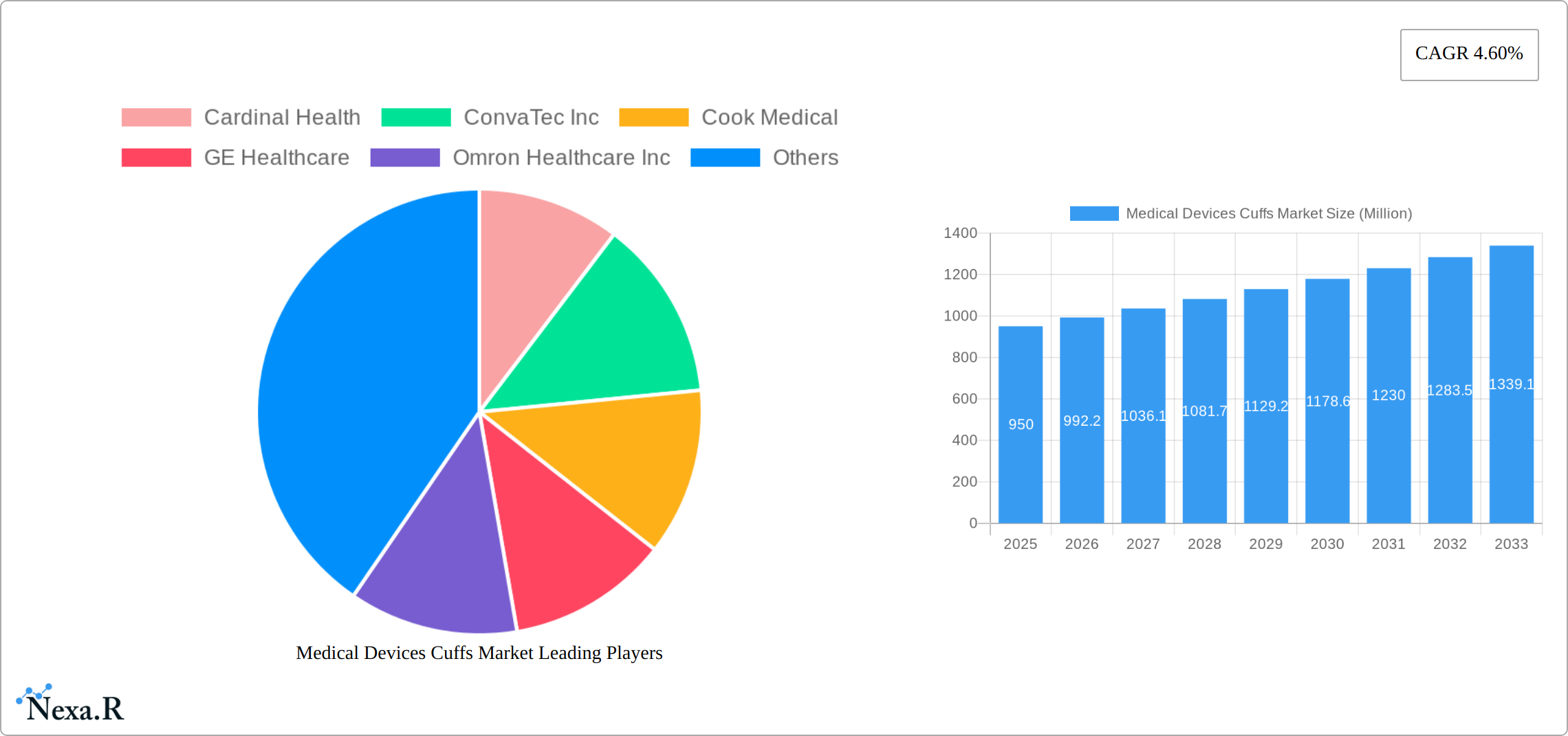

The Medical Devices Cuffs market, valued at $0.95 billion in 2025, is projected to experience steady growth, driven by factors such as the rising prevalence of chronic diseases requiring frequent blood pressure monitoring and increasing demand for technologically advanced cuffs offering improved accuracy and patient comfort. The market's Compound Annual Growth Rate (CAGR) of 4.60% from 2025 to 2033 indicates a consistent expansion, fueled by advancements in cuff design, materials, and integration with digital health technologies. This includes the development of smaller, more comfortable cuffs suitable for diverse patient populations, as well as wireless and reusable options that contribute to cost-effectiveness and enhanced patient experience. Furthermore, the aging global population and increasing healthcare expenditure are significant contributors to market growth. However, challenges such as stringent regulatory approvals and the potential for pricing pressure from generic competitors might slightly restrain market expansion. Major players like Cardinal Health, ConvaTec Inc., and Smiths Medical are leading the market innovation through continuous product development and strategic acquisitions.

The segmentation of the Medical Devices Cuffs market, while not explicitly provided, can be reasonably inferred based on typical industry categorizations. This likely includes segmentation by cuff type (e.g., adult, pediatric, neonatal), application (e.g., blood pressure monitoring, anesthesia), material (e.g., latex-free, reusable), and end-user (e.g., hospitals, clinics, home care). Regional variations in market growth will likely be influenced by differences in healthcare infrastructure, prevalence of chronic diseases, and adoption rates of new technologies. North America and Europe are expected to hold significant market shares due to higher healthcare spending and technological advancements, while emerging markets in Asia-Pacific are anticipated to exhibit faster growth rates. Competitive intensity is moderate, driven primarily by innovation, product differentiation, and strategic partnerships.

Medical Devices Cuffs Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Medical Devices Cuffs Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The market is segmented by type (blood pressure cuffs, tourniquet cuffs, etc.) and application (hospitals, clinics, home healthcare, etc.). This report is invaluable for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market. The total market size is projected to reach xx Million units by 2033.

Medical Devices Cuffs Market Market Dynamics & Structure

The Medical Devices Cuffs market presents a dynamic and evolving landscape characterized by a moderately fragmented competitive environment. Several established and emerging players are actively vying for market share, with a strategic emphasis on innovation, regulatory compliance, and market expansion. While current market concentration is relatively stable, the potential for strategic mergers and acquisitions (M&As) remains a significant factor, poised to drive future consolidation and reshape the competitive terrain. Technological innovation serves as a pivotal catalyst, with ongoing advancements in materials science, miniaturized sensor technology, and seamless connectivity actively influencing the development of next-generation cuffs. Navigating stringent regulatory frameworks, particularly those pertaining to patient safety, product efficacy, and data privacy, is paramount for market access and successful product approvals. The market also contends with competitive pressures from evolving non-invasive monitoring techniques. However, the fundamental drivers of market expansion remain robust, primarily propelled by the expanding global aging population and the escalating prevalence of chronic conditions that necessitate continuous and reliable physiological monitoring.

- Market Concentration: Moderately fragmented, with the top 10 players collectively holding an estimated [Insert specific percentage here, e.g., 55-65%] market share in 2024. This indicates a competitive yet consolidated segment.

- Technological Innovation: A relentless focus on miniaturization, enhanced wireless connectivity (e.g., Bluetooth, Wi-Fi), and superior accuracy in measurements is shaping product development and consumer appeal. Innovations are also geared towards improved user comfort and data integration capabilities.

- Regulatory Framework: Stringent and evolving regulatory standards, including those set by the FDA, EMA, and other global health authorities, significantly influence product design, testing protocols, and market entry strategies, prioritizing patient safety and device reliability.

- Competitive Substitutes: While established, non-invasive blood pressure monitoring technologies and alternative diagnostic tools present ongoing competitive considerations, the demand for dedicated cuff-based monitoring remains strong due to their established clinical utility and perceived accuracy.

- M&A Activity: A moderate and strategic level of M&A activity is observed. Acquisitions are primarily driven by the desire to expand product portfolios, gain access to new technologies or intellectual property, and enhance overall market reach. Approximately [Insert specific number here, e.g., 15-25] M&A deals were recorded between 2019 and 2024, reflecting strategic consolidation efforts.

- End-User Demographics: The burgeoning aging population, coupled with the persistent rise in the prevalence of chronic diseases such as hypertension, cardiovascular disorders, and diabetes, serves as a foundational demand driver for medical device cuffs, ensuring sustained market growth.

Medical Devices Cuffs Market Growth Trends & Insights

The Medical Devices Cuffs market is poised for substantial and sustained growth, underpinned by a confluence of powerful market drivers and evolving healthcare trends. The market size has witnessed considerable expansion in recent years, demonstrating a robust Compound Annual Growth Rate (CAGR) of approximately [Insert specific percentage here, e.g., 7-9%] during the historical period spanning 2019-2024. This upward trajectory is projected to continue, with forecasts indicating a significant CAGR of [Insert specific percentage here, e.g., 8-10%] for the forecast period of 2025-2033. A key contributor to this growth is the rapid pace of technological advancements, particularly in the realm of wireless connectivity and the integration of smart device functionalities. Consumers are increasingly embracing user-friendly and convenient home healthcare solutions, which is directly fueling the demand for sophisticated at-home blood pressure monitoring devices and other cuff-based health monitoring systems. Consequently, the market penetration rate of technologically advanced and connected cuffs is steadily increasing, signaling a significant shift in user preference and adoption patterns.

(Note: Detailed quantitative analysis, including specific figures for market size evolution in Million units, adoption rates, quantifiable technological disruptions, and shifts in consumer behavior, supported by empirical evidence and illustrative charts, will be provided in the comprehensive market research report. This section is currently a qualitative overview based on foundational market intelligence, leveraging insights from reputable market research firms, industry reports, and company financial statements.)

Dominant Regions, Countries, or Segments in Medical Devices Cuffs Market

North America currently holds the largest market share in the Medical Devices Cuffs market, followed by Europe and Asia-Pacific. This dominance is attributed to several factors, including high healthcare expenditure, advanced healthcare infrastructure, and a large aging population in these regions. However, the Asia-Pacific region is anticipated to experience the fastest growth rate during the forecast period, driven by rising healthcare awareness, increasing disposable incomes, and government initiatives to improve healthcare access.

- North America: High healthcare expenditure, advanced infrastructure, and large aging population drive market dominance.

- Europe: Established healthcare systems and significant demand for advanced medical devices contribute to market growth.

- Asia-Pacific: Rapid economic growth, rising healthcare awareness, and expanding healthcare infrastructure fuel significant growth potential.

- Other Regions: Latin America and the Middle East and Africa show promising but less developed market potential.

Medical Devices Cuffs Market Product Landscape

The Medical Devices Cuffs market is characterized by a diverse and innovative product portfolio designed to cater to a wide spectrum of medical needs and user preferences. Key product categories include an extensive range of blood pressure cuffs, encompassing traditional manual sphygmomanometers, advanced automatic digital monitors, and increasingly popular wireless and smart cuff solutions. The market also features a variety of tourniquet cuffs, available in both single-use and reusable formats, essential for surgical procedures and emergency care. Furthermore, specialized cuffs are developed for niche applications, such as neonatal cuffs designed for the delicate physiology of infants, and cuffs for specific therapeutic interventions. Product development is heavily influenced by a continuous drive for enhanced measurement accuracy, improved patient comfort during prolonged use, and simplified user operation. The integration of wireless connectivity, enabling seamless data synchronization with smartphones and electronic health records (EHRs), along with advanced data analytics capabilities, are becoming crucial differentiators. Emerging unique selling propositions (USPs) include innovative features such as self-calibration functionalities, effortless magnetic charging mechanisms, and the utilization of advanced, hypoallergenic materials designed to minimize skin irritation and enhance user compliance.

Key Drivers, Barriers & Challenges in Medical Devices Cuffs Market

Key Drivers:

- Increasing prevalence of chronic diseases requiring regular monitoring.

- Growing adoption of home healthcare solutions.

- Technological advancements leading to improved accuracy and convenience.

- Rising healthcare expenditure in developed and developing economies.

Key Challenges & Restraints:

- Stringent regulatory requirements for medical device approvals.

- High manufacturing costs and potential supply chain disruptions.

- Competition from substitute technologies and non-invasive monitoring methods.

- Price sensitivity in certain market segments.

Emerging Opportunities in Medical Devices Cuffs Market

- Expansion into untapped markets in developing economies.

- Development of innovative applications for specialized patient populations.

- Integration with telehealth platforms and remote patient monitoring systems.

- Growing demand for disposable and single-use cuffs to minimize infection risk.

Growth Accelerators in the Medical Devices Cuffs Market Industry

The Medical Devices Cuffs market is experiencing significant acceleration due to several converging factors. Groundbreaking advancements in sensor technology, enabling more precise and real-time physiological data capture, coupled with sophisticated wireless communication protocols, are acting as powerful growth catalysts. Strategic partnerships and collaborations between leading medical device manufacturers, healthcare providers, and technology companies are instrumental in expanding market reach, fostering interoperability, and improving patient access to essential monitoring tools. Moreover, supportive government initiatives aimed at promoting preventative healthcare strategies, encouraging the adoption of remote patient monitoring (RPM) technologies, and investing in healthcare infrastructure development are creating substantial new opportunities for market expansion and innovation.

Key Players Shaping the Medical Devices Cuffs Market Market

- Cardinal Health

- ConvaTec Inc

- Cook Medical

- GE Healthcare

- Omron Healthcare Inc

- Pulmodyne Inc

- Smiths Medical

- SunTech Medical Inc

- Teleflex Incorporated

- Welch Allyn Inc

- *List Not Exhaustive

Notable Milestones in Medical Devices Cuffs Market Sector

- June 2023: SourceMark Medical launched single-use tourniquet cuffs, enhancing hygiene and reducing costs.

- April 2023: Hingmed introduced the V03D at-home BP monitor with magnetic charging and self-check features, improving convenience and accuracy.

In-Depth Medical Devices Cuffs Market Market Outlook

The Medical Devices Cuffs market is projected to exhibit strong and sustained growth in the foreseeable future, propelled by a synergistic combination of continuous technological evolution, the expansion of global healthcare infrastructure, and the persistent increase in the prevalence of chronic diseases worldwide. Key strategic collaborations, proactive market expansion initiatives by key players, and relentless innovation in sensor technology and data integration will play a pivotal role in shaping the future market landscape. The market is anticipated to witness an escalating adoption of smart, connected cuffs, which will not only drive long-term market growth but also generate significant and lucrative opportunities for manufacturers and innovators adept at capitalizing on these emerging trends.

Medical Devices Cuffs Market Segmentation

-

1. Product Type

- 1.1. Blood Pressure Cuffs

- 1.2. Cuffed Endotracheal Tube

- 1.3. Tracheostomy Tube

-

2. End User

- 2.1. Hospitals

- 2.2. Clinics

- 2.3. Ambulatory Surgery Centers

- 2.4. Other End Users

Medical Devices Cuffs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Medical Devices Cuffs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prevalence of Cardiovascular Diseases Coupled with Rising Geriatric Population; Increasing Demand for Home Care Services

- 3.3. Market Restrains

- 3.3.1. Growing Prevalence of Cardiovascular Diseases Coupled with Rising Geriatric Population; Increasing Demand for Home Care Services

- 3.4. Market Trends

- 3.4.1. The Blood Pressure Cuffs Segment to Register Significant Growth in the Medical Devices Cuffs Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Devices Cuffs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Blood Pressure Cuffs

- 5.1.2. Cuffed Endotracheal Tube

- 5.1.3. Tracheostomy Tube

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Clinics

- 5.2.3. Ambulatory Surgery Centers

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Medical Devices Cuffs Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Blood Pressure Cuffs

- 6.1.2. Cuffed Endotracheal Tube

- 6.1.3. Tracheostomy Tube

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Clinics

- 6.2.3. Ambulatory Surgery Centers

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Medical Devices Cuffs Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Blood Pressure Cuffs

- 7.1.2. Cuffed Endotracheal Tube

- 7.1.3. Tracheostomy Tube

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Clinics

- 7.2.3. Ambulatory Surgery Centers

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Medical Devices Cuffs Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Blood Pressure Cuffs

- 8.1.2. Cuffed Endotracheal Tube

- 8.1.3. Tracheostomy Tube

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Clinics

- 8.2.3. Ambulatory Surgery Centers

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Medical Devices Cuffs Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Blood Pressure Cuffs

- 9.1.2. Cuffed Endotracheal Tube

- 9.1.3. Tracheostomy Tube

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Clinics

- 9.2.3. Ambulatory Surgery Centers

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Cardinal Health

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ConvaTec Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cook Medical

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GE Healthcare

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Omron Healthcare Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Pulmodyne Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Smiths Medical

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SunTech Medical Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Teleflex Incorporated

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Welch Allyn Inc *List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cardinal Health

List of Figures

- Figure 1: Global Medical Devices Cuffs Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Medical Devices Cuffs Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Medical Devices Cuffs Market Revenue (Million), by Product Type 2024 & 2032

- Figure 4: North America Medical Devices Cuffs Market Volume (Billion), by Product Type 2024 & 2032

- Figure 5: North America Medical Devices Cuffs Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Medical Devices Cuffs Market Volume Share (%), by Product Type 2024 & 2032

- Figure 7: North America Medical Devices Cuffs Market Revenue (Million), by End User 2024 & 2032

- Figure 8: North America Medical Devices Cuffs Market Volume (Billion), by End User 2024 & 2032

- Figure 9: North America Medical Devices Cuffs Market Revenue Share (%), by End User 2024 & 2032

- Figure 10: North America Medical Devices Cuffs Market Volume Share (%), by End User 2024 & 2032

- Figure 11: North America Medical Devices Cuffs Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Medical Devices Cuffs Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Medical Devices Cuffs Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Medical Devices Cuffs Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Medical Devices Cuffs Market Revenue (Million), by Product Type 2024 & 2032

- Figure 16: Europe Medical Devices Cuffs Market Volume (Billion), by Product Type 2024 & 2032

- Figure 17: Europe Medical Devices Cuffs Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Medical Devices Cuffs Market Volume Share (%), by Product Type 2024 & 2032

- Figure 19: Europe Medical Devices Cuffs Market Revenue (Million), by End User 2024 & 2032

- Figure 20: Europe Medical Devices Cuffs Market Volume (Billion), by End User 2024 & 2032

- Figure 21: Europe Medical Devices Cuffs Market Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Medical Devices Cuffs Market Volume Share (%), by End User 2024 & 2032

- Figure 23: Europe Medical Devices Cuffs Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Medical Devices Cuffs Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Medical Devices Cuffs Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Medical Devices Cuffs Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Pacific Medical Devices Cuffs Market Revenue (Million), by Product Type 2024 & 2032

- Figure 28: Asia Pacific Medical Devices Cuffs Market Volume (Billion), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Medical Devices Cuffs Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Medical Devices Cuffs Market Volume Share (%), by Product Type 2024 & 2032

- Figure 31: Asia Pacific Medical Devices Cuffs Market Revenue (Million), by End User 2024 & 2032

- Figure 32: Asia Pacific Medical Devices Cuffs Market Volume (Billion), by End User 2024 & 2032

- Figure 33: Asia Pacific Medical Devices Cuffs Market Revenue Share (%), by End User 2024 & 2032

- Figure 34: Asia Pacific Medical Devices Cuffs Market Volume Share (%), by End User 2024 & 2032

- Figure 35: Asia Pacific Medical Devices Cuffs Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Pacific Medical Devices Cuffs Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Pacific Medical Devices Cuffs Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Medical Devices Cuffs Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Rest of the World Medical Devices Cuffs Market Revenue (Million), by Product Type 2024 & 2032

- Figure 40: Rest of the World Medical Devices Cuffs Market Volume (Billion), by Product Type 2024 & 2032

- Figure 41: Rest of the World Medical Devices Cuffs Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 42: Rest of the World Medical Devices Cuffs Market Volume Share (%), by Product Type 2024 & 2032

- Figure 43: Rest of the World Medical Devices Cuffs Market Revenue (Million), by End User 2024 & 2032

- Figure 44: Rest of the World Medical Devices Cuffs Market Volume (Billion), by End User 2024 & 2032

- Figure 45: Rest of the World Medical Devices Cuffs Market Revenue Share (%), by End User 2024 & 2032

- Figure 46: Rest of the World Medical Devices Cuffs Market Volume Share (%), by End User 2024 & 2032

- Figure 47: Rest of the World Medical Devices Cuffs Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Rest of the World Medical Devices Cuffs Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Rest of the World Medical Devices Cuffs Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Rest of the World Medical Devices Cuffs Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Devices Cuffs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Devices Cuffs Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Medical Devices Cuffs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Medical Devices Cuffs Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Global Medical Devices Cuffs Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global Medical Devices Cuffs Market Volume Billion Forecast, by End User 2019 & 2032

- Table 7: Global Medical Devices Cuffs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Medical Devices Cuffs Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Medical Devices Cuffs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Global Medical Devices Cuffs Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Global Medical Devices Cuffs Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Global Medical Devices Cuffs Market Volume Billion Forecast, by End User 2019 & 2032

- Table 13: Global Medical Devices Cuffs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Medical Devices Cuffs Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United States Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Canada Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Mexico Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Global Medical Devices Cuffs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Medical Devices Cuffs Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 23: Global Medical Devices Cuffs Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Global Medical Devices Cuffs Market Volume Billion Forecast, by End User 2019 & 2032

- Table 25: Global Medical Devices Cuffs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Medical Devices Cuffs Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: United Kingdom Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United Kingdom Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Germany Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: France Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Italy Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Italy Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Spain Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Global Medical Devices Cuffs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Medical Devices Cuffs Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 41: Global Medical Devices Cuffs Market Revenue Million Forecast, by End User 2019 & 2032

- Table 42: Global Medical Devices Cuffs Market Volume Billion Forecast, by End User 2019 & 2032

- Table 43: Global Medical Devices Cuffs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Medical Devices Cuffs Market Volume Billion Forecast, by Country 2019 & 2032

- Table 45: China Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 47: Japan Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 49: India Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 51: Australia Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 53: South Korea Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Korea Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Medical Devices Cuffs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Medical Devices Cuffs Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: Global Medical Devices Cuffs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global Medical Devices Cuffs Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 59: Global Medical Devices Cuffs Market Revenue Million Forecast, by End User 2019 & 2032

- Table 60: Global Medical Devices Cuffs Market Volume Billion Forecast, by End User 2019 & 2032

- Table 61: Global Medical Devices Cuffs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Medical Devices Cuffs Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Devices Cuffs Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Medical Devices Cuffs Market?

Key companies in the market include Cardinal Health, ConvaTec Inc, Cook Medical, GE Healthcare, Omron Healthcare Inc, Pulmodyne Inc, Smiths Medical, SunTech Medical Inc, Teleflex Incorporated, Welch Allyn Inc *List Not Exhaustive.

3. What are the main segments of the Medical Devices Cuffs Market?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Prevalence of Cardiovascular Diseases Coupled with Rising Geriatric Population; Increasing Demand for Home Care Services.

6. What are the notable trends driving market growth?

The Blood Pressure Cuffs Segment to Register Significant Growth in the Medical Devices Cuffs Market.

7. Are there any restraints impacting market growth?

Growing Prevalence of Cardiovascular Diseases Coupled with Rising Geriatric Population; Increasing Demand for Home Care Services.

8. Can you provide examples of recent developments in the market?

June 2023: SourceMark Medical launched single-use tourniquet cuffs. These cuffs not only reduce handling costs but also minimize the risk of infections and protect against bacterial transference.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Devices Cuffs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Devices Cuffs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Devices Cuffs Market?

To stay informed about further developments, trends, and reports in the Medical Devices Cuffs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence