Key Insights

The Middle East and Africa (MEA) flexible packaging market is poised for significant expansion, driven by escalating demand in the packaged food and beverage, healthcare, and personal care sectors. With a projected Compound Annual Growth Rate (CAGR) of 4.2%, the market is anticipated to reach a substantial size of 301.2 billion by 2025. Key growth catalysts include the inherent cost-effectiveness, lightweight properties, and superior barrier protection offered by flexible packaging over rigid alternatives. Shifting consumer lifestyles favoring convenient, on-the-go consumption formats further accelerate market penetration. The food segment, led by pouches and bags, represents the largest share, followed by beverages and healthcare. While polyethylene (PE) and bi-oriented polypropylene (BOPP) dominate resin usage, a notable trend towards sustainable and eco-friendly materials is emerging. Leading markets include the UAE, Saudi Arabia, and South Africa, supported by higher disposable incomes and robust manufacturing bases. Emerging African nations present considerable untapped potential for future growth.

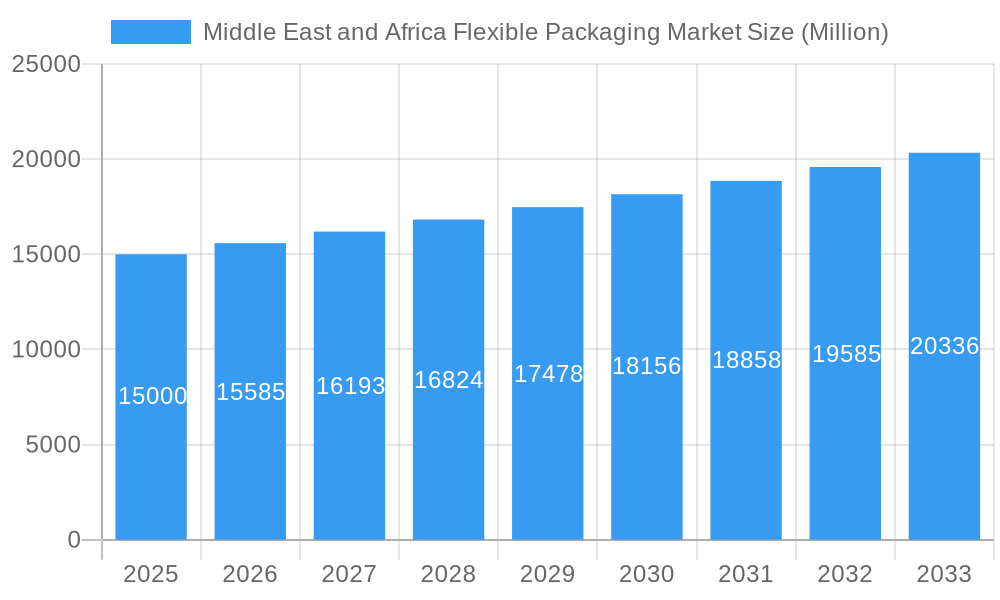

Middle East and Africa Flexible Packaging Market Market Size (In Billion)

Strategic initiatives focusing on innovation, sustainability, and consumer-centric solutions are paramount for stakeholders in the MEA flexible packaging market. Investments in research and development for advanced and eco-friendly packaging will be critical differentiators. Tailored market approaches are essential to address the region's diversity, with specific strategies adapted to the unique needs of individual nations. Overcoming infrastructural limitations and navigating complex regulatory environments will require meticulous planning and agile adaptation. Expansion into nascent African markets offers substantial long-term growth prospects, necessitating localized market intelligence and a deep understanding of consumer behavior and purchasing power. The sustained rise in demand for packaged goods, coupled with ongoing technological advancements in materials and production, positions the MEA flexible packaging market for continued robust growth.

Middle East and Africa Flexible Packaging Market Company Market Share

Middle East & Africa Flexible Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) flexible packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, and utilizes 2025 as the base year. The report segments the market by resin type, product type, end-user, and country, providing a granular understanding of growth drivers, challenges, and emerging opportunities across the MEA region. Market size is presented in million units.

Keywords: Middle East and Africa Flexible Packaging Market, Flexible Packaging, MEA Packaging Market, Polyethylene Packaging, BOPP Films, CPP Films, Pouch Packaging, Food Packaging, Beverage Packaging, Healthcare Packaging, Cosmetics Packaging, Amcor, Uflex Limited, Coveris, Treofan, BASF, Huhtamaki, Napco Group, Gulf Packaging, Mondi, DowDuPont, Market Size, Market Share, Growth Rate, CAGR, Market Trends, Market Analysis, Market Forecast

Middle East and Africa Flexible Packaging Market Dynamics & Structure

The MEA flexible packaging market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Technological innovation, driven by the demand for sustainable and high-performance packaging solutions, is a key dynamic. Stringent regulatory frameworks concerning food safety and environmental regulations are shaping industry practices. Competition from rigid packaging alternatives, such as glass and metal cans, presents a challenge. End-user demographics, with a growing middle class and changing consumer preferences, significantly influence market growth. Mergers and acquisitions (M&A) activity is relatively moderate, but strategic acquisitions like Huhtamaki’s acquisition of Elif in September 2021 are reshaping the competitive landscape.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on sustainable materials (e.g., biodegradable films), improved barrier properties, and advanced printing techniques.

- Regulatory Framework: Emphasis on food safety standards and environmental regulations impacting material selection and waste management.

- Competitive Substitutes: Rigid packaging (glass, metal) poses a challenge, particularly in certain segments.

- End-User Demographics: Growing population and rising disposable incomes are driving demand across various end-use sectors.

- M&A Trends: Moderate activity, with strategic acquisitions aiming to expand product portfolios and geographical reach. The number of M&A deals between 2019 and 2024 was xx.

Middle East and Africa Flexible Packaging Market Growth Trends & Insights

The MEA flexible packaging market experienced robust growth during the historical period (2019-2024), driven by factors such as rising food consumption, increasing demand for convenience foods, and the growth of the e-commerce sector. The market is expected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, particularly in sustainable packaging materials and advanced printing technologies, are further accelerating market expansion. A shift towards eco-friendly packaging is influencing consumer preferences, compelling manufacturers to develop more sustainable solutions. The market penetration rate for sustainable flexible packaging is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Middle East and Africa Flexible Packaging Market

The UAE and Saudi Arabia are currently the largest markets within the MEA region, driven by robust economic growth and significant investments in the food and beverage sector. Within the segment breakdown, the food industry, particularly beverages, remains the dominant end-user segment, followed by healthcare and personal care. Polyethylene (PE) remains the most widely used resin type due to its cost-effectiveness and versatility. Pouches (retort and stand-up) are the leading product type, driven by their convenience and adaptability to various applications.

- Leading Regions: UAE and Saudi Arabia contribute the largest market share due to higher per capita consumption and advanced infrastructure.

- Leading Countries: UAE and Saudi Arabia, followed by South Africa and Egypt. Nigeria shows significant growth potential.

- Leading Segments: Food (especially beverages), followed by healthcare and personal care. PE resin type and pouches (retort & stand-up) dominate the product landscape.

- Growth Drivers: Rising disposable incomes, expanding retail channels, and government initiatives promoting food processing and packaging industries in target countries.

Middle East and Africa Flexible Packaging Market Product Landscape

The MEA flexible packaging market exhibits a diverse product landscape, encompassing pouches (retort and stand-up), bags (gusseted and wicketed), and packaging films. Innovation focuses on improved barrier properties, enhanced printability, and the use of sustainable materials. Retort pouches are gaining popularity for their ability to withstand high-temperature sterilization. Stand-up pouches offer improved shelf appeal and consumer convenience. Technological advancements such as flexographic printing and the incorporation of features like zippers and tear notches are enhancing product functionality and user experience.

Key Drivers, Barriers & Challenges in Middle East and Africa Flexible Packaging Market

Key Drivers: The Middle East and Africa (MEA) flexible packaging market is experiencing robust growth fueled by several key factors. A burgeoning population, rapid urbanization, and a rise in disposable incomes are significantly increasing consumer spending on packaged goods. The expansion of organized retail channels provides wider distribution networks, further stimulating demand. Government initiatives supporting the food processing and packaging industries are also providing crucial impetus. Furthermore, the increasing preference for convenient and shelf-stable food products directly translates into heightened demand for flexible packaging solutions.

Key Challenges: Despite the considerable growth opportunities, the MEA flexible packaging market faces several challenges. Volatile raw material prices, particularly for polymers, present a significant risk to profitability. Stringent environmental regulations, promoting sustainable packaging solutions, require manufacturers to invest in eco-friendly alternatives. Keeping pace with evolving consumer preferences, such as a demand for enhanced aesthetics and functionality, necessitates continuous innovation. Intense competition from both established multinational corporations and emerging local players demands a strategic approach to differentiation and market positioning. Supply chain disruptions, including logistical hurdles and geopolitical instability, can significantly impact the timely delivery of products and materials.

Emerging Opportunities in Middle East and Africa Flexible Packaging Market

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging solutions. The rise of e-commerce is creating new opportunities for innovative packaging formats designed for online delivery. Untapped markets in sub-Saharan Africa offer substantial growth potential. There is a need for packaging tailored to specific regional needs, such as temperature control for sensitive products or solutions designed to address unique logistical challenges.

Growth Accelerators in the Middle East and Africa Flexible Packaging Market Industry

Several factors are accelerating growth within the MEA flexible packaging market. Technological advancements, particularly in sustainable packaging materials like biodegradable and compostable films, and advanced printing techniques like flexography and rotogravure, are enhancing product appeal and efficiency. Strategic partnerships and collaborations between packaging manufacturers and brand owners are fostering innovation and driving the development of customized solutions. Investments in state-of-the-art infrastructure and supply chain optimization are streamlining operations and reducing costs. A growing emphasis on food safety and hygiene is driving the demand for high-barrier and tamper-evident packaging solutions, ensuring product integrity and consumer confidence. The rise of e-commerce is also creating new opportunities for flexible packaging, particularly for convenient and protective packaging for online deliveries.

Key Players Shaping the Middle East and Africa Flexible Packaging Market Market

- Amcor

- Uflex Limited

- Coveris Management GmbH

- Treofan Films

- BASF SE

- Huhtamaki Group

- Napco Group

- Gulf Packaging Industries Limited

- Mondi Plc

- Dow Inc.

- DuPont de Nemours Inc.

- List Not Exhaustive

Notable Milestones in Middle East and Africa Flexible Packaging Market Sector

- September 2021: Huhtamaki acquired Elif, significantly expanding its flexible packaging portfolio and capabilities in the MEA region. This acquisition highlights a trend towards consolidation and the importance of sustainability in the market.

In-Depth Middle East and Africa Flexible Packaging Market Market Outlook

The MEA flexible packaging market exhibits strong potential for sustained growth, driven by a combination of factors. The region's expanding consumer base, coupled with increasing urbanization and a shift towards modern retail formats, creates a fertile ground for market expansion. The integration of sustainable and innovative packaging materials and technologies will be crucial in shaping future market trends. Strategic partnerships and collaborations, along with substantial investments in research and development, will play a pivotal role in driving long-term growth. Companies that successfully adapt to evolving consumer preferences, stringent regulatory landscapes, and embrace sustainable practices are best positioned to capitalize on this dynamic market's significant growth potential. Furthermore, the increasing focus on e-commerce and the associated need for efficient and protective packaging will present further opportunities for expansion.

Middle East and Africa Flexible Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Polypropylene (PP)

- 1.1.3. Polyethylene Terephthalate (PET )

- 1.1.4. Other Plastics (PVC, PA, etc.)

- 1.2. Paper

- 1.3. Aluminum

- 1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches And Bags

-

2.2. Films And Wraps

- 2.2.1. Thermoforming Film

- 2.2.2. Stretch Films

- 2.2.3. Shrink Film

- 2.2.4. Cling Film

- 2.3. Labels And Sleeves

- 2.4. Lidding And Liners

- 2.5. Blister Packaging

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverages

- 3.3. Pharmaceuticals

- 3.4. Cosmetics And Personal Care

- 3.5. Household Care

- 3.6. Pet Care

- 3.7. Tobacco

- 3.8. Other En

Middle East and Africa Flexible Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Flexible Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Flexible Packaging Market

Middle East and Africa Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand

- 3.3. Market Restrains

- 3.3.1. Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Polypropylene (PP)

- 5.1.1.3. Polyethylene Terephthalate (PET )

- 5.1.1.4. Other Plastics (PVC, PA, etc.)

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.4. Compostable Materials (PLA, PBS, PHA, PBAT, etc.)

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches And Bags

- 5.2.2. Films And Wraps

- 5.2.2.1. Thermoforming Film

- 5.2.2.2. Stretch Films

- 5.2.2.3. Shrink Film

- 5.2.2.4. Cling Film

- 5.2.3. Labels And Sleeves

- 5.2.4. Lidding And Liners

- 5.2.5. Blister Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Pharmaceuticals

- 5.3.4. Cosmetics And Personal Care

- 5.3.5. Household Care

- 5.3.6. Pet Care

- 5.3.7. Tobacco

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uflex Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Management GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Treofan Films

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BASF SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huhtamaki Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Napco Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gulf Pakcaging Industries Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondi Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DowDuPont*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amcor

List of Figures

- Figure 1: Middle East and Africa Flexible Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Middle East and Africa Flexible Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East and Africa Flexible Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Flexible Packaging Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Middle East and Africa Flexible Packaging Market?

Key companies in the market include Amcor, Uflex Limited, Coveris Management GmbH, Treofan Films, BASF SE, Huhtamaki Group, Napco Group, Gulf Pakcaging Industries Limited, Mondi Plc, DowDuPont*List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Flexible Packaging Market?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Steady Rise in Demand for Processing Food; Move Towards Light Weighting Expected to Spur Volume Demand.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Flexible Packaging is Increasingly Turning into a Competitive Market Place Which Could Impact the Growth Products of New Entrants; Environmental Challenges Related to Recycling Although There are Expected to be Offset by Move Towards Bio-Based Products.

8. Can you provide examples of recent developments in the market?

September 2021-Huhtamaki acquired Elif, a flexible packaging company with nearly recyclable products. Flexo printing and polyethylene (PE) film production technologies round out the company portfolio across Europe, the Middle East, and Africa. The acquisition aligned with the company's goals of promoting talent and sustainability and aided the company's growth and competitiveness plan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence