Key Insights

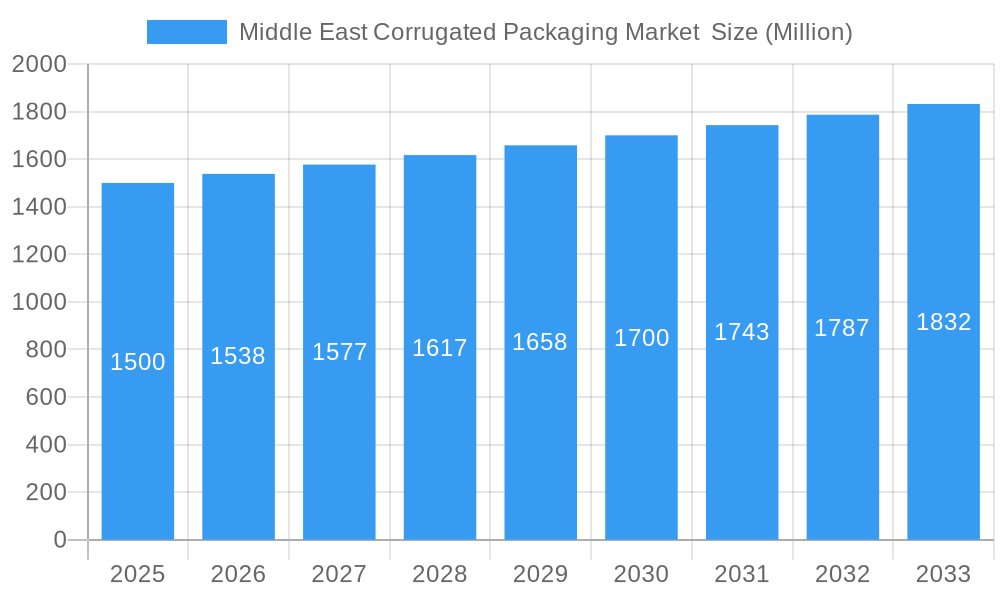

The Middle East corrugated packaging market, valued at approximately $X million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.58% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning food and beverage sector, coupled with increasing e-commerce activity across the region, significantly boosts demand for efficient and protective packaging solutions. Furthermore, the expanding construction and industrial sectors contribute to the market's positive trajectory. Growth in the personal care and household care sectors also contributes to the overall demand. The increasing adoption of sustainable packaging practices, including the use of recycled materials and eco-friendly designs, presents a significant opportunity for market players. While fluctuations in raw material prices and economic conditions might pose challenges, the overall outlook for the Middle East corrugated packaging market remains optimistic due to consistent infrastructural development and rising consumer spending.

Middle East Corrugated Packaging Market Market Size (In Billion)

Segmentation reveals a diverse landscape. Slotted containers, die-cut containers, and five-panel folder boxes constitute the major types, while the food and beverage sector dominates end-user applications. Geographically, Saudi Arabia and the United Arab Emirates represent significant market shares, driven by their robust economies and relatively advanced packaging industries. However, other countries such as Iraq, Jordan, and the broader "Rest of Middle East" region also show promising growth potential, fueled by expanding consumer markets and industrialization. The competitive landscape is characterized by both local and international players, leading to intense competition focused on product innovation, cost optimization, and service excellence. This competition should further drive market efficiency and innovation.

Middle East Corrugated Packaging Market Company Market Share

Middle East Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East corrugated packaging market, encompassing market dynamics, growth trends, dominant segments, competitive landscape, and future outlook. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. The report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. It values the market in Million units.

Middle East Corrugated Packaging Market Dynamics & Structure

The Middle East corrugated packaging market is characterized by moderate concentration, with several key players dominating the landscape. Technological innovation, driven by automation and digitalization, is a key driver, alongside evolving regulatory frameworks promoting sustainability. The market faces competition from alternative packaging materials, while end-user demographics, particularly the growth of e-commerce, influence demand. M&A activity, as evidenced by recent acquisitions like Hotpack Global's purchase of Al Huraiz Packaging, shapes the market structure and competitive dynamics.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on automation, digital printing, and sustainable materials (e.g., recycled content).

- Regulatory Framework: Growing emphasis on sustainability and food safety regulations impacts packaging choices.

- Competitive Substitutes: Plastic, paperboard, and other packaging types pose a competitive challenge.

- End-User Demographics: Growth in e-commerce, food & beverage, and personal care sectors fuels demand.

- M&A Trends: Consolidation through acquisitions and mergers is reshaping the competitive landscape (e.g., Hotpack Global's acquisition of Al Huraiz Packaging). An estimated xx M&A deals occurred in the historical period.

Middle East Corrugated Packaging Market Growth Trends & Insights

The Middle East corrugated packaging market experienced significant growth during the historical period (2019-2024), driven by factors such as expanding industrialization, urbanization, and rising consumer spending. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million units by 2033. Technological disruptions, including the adoption of automation and digital printing technologies, are boosting efficiency and customization options. Consumer behavior shifts towards sustainable and convenient packaging also impact market growth. Market penetration of advanced packaging solutions is currently at xx% and is expected to rise to xx% by 2033.

Dominant Regions, Countries, or Segments in Middle East Corrugated Packaging Market

Saudi Arabia and the UAE are the dominant markets within the Middle East, driven by robust economic growth, expanding industrial sectors, and significant investments in infrastructure. The food and beverage segment represents the largest end-user application, followed by the electrical goods and personal care sectors. Slotted containers constitute the most significant product type.

- Dominant Country: Saudi Arabia and the UAE hold the largest market share, accounting for xx% and xx% respectively in 2024.

- Dominant End-User Segment: The Food & Beverage sector leads with xx Million units in 2024, due to growing demand for packaged food products.

- Dominant Product Type: Slotted containers dominate the market, accounting for approximately xx% of total volume in 2024. This is driven by their cost-effectiveness and versatility.

- Key Drivers: Rapid urbanization, expanding retail sector, and rising disposable incomes are key drivers in Saudi Arabia and the UAE. Government initiatives supporting industrial growth and infrastructure development also contribute significantly.

Middle East Corrugated Packaging Market Product Landscape

The Middle East corrugated packaging market showcases diverse products, including slotted containers, die-cut containers, five-panel folder boxes, and other specialized types. Innovations focus on enhancing functionality, durability, and sustainability through the use of recycled materials and eco-friendly coatings. Unique selling propositions include customized designs, improved printing capabilities, and increased stackability for efficient logistics. Technological advancements are leading to lighter, stronger, and more cost-effective packaging solutions.

Key Drivers, Barriers & Challenges in Middle East Corrugated Packaging Market

Key Drivers: The growth of the e-commerce sector, increasing demand for packaged goods, and government initiatives to improve supply chain efficiency. Furthermore, increasing focus on branding and customized packaging solutions adds to the demand.

Key Challenges: Fluctuations in raw material prices, intense competition, and the need to meet stringent sustainability regulations pose significant challenges. Supply chain disruptions can lead to production delays and increased costs, estimated to impact around xx% of production in 2024.

Emerging Opportunities in Middle East Corrugated Packaging Market

The market presents significant opportunities in sustainable packaging solutions, innovative designs for e-commerce, and specialized packaging for niche sectors (e.g., pharmaceuticals). Untapped markets in less developed areas within the Middle East also present potential for growth. Demand for customized packaging and eco-friendly options offers attractive avenues for businesses.

Growth Accelerators in the Middle East Corrugated Packaging Market Industry

Technological advancements, particularly in automation and digital printing, are driving efficiency and customization. Strategic partnerships between packaging manufacturers and brand owners enhance product development and market reach. Expanding into new markets and offering value-added services further fuels growth.

Key Players Shaping the Middle East Corrugated Packaging Market Market

- Cepack Group

- Al Rumanah Packaging

- Falcon Pack

- Napco National

- United Carton Industries Company (UCIC)

- Unipack Containers & Carton Products LLC

- Universal Carton Industries Group

- Tarboosh Packaging Co LLC

- World Pack Industries LLC

- Green Packaging Boxes Ind LLC

- Arabian Packaging Co LLC

- Queenex Corrugated Carton Factory

Notable Milestones in Middle East Corrugated Packaging Market Sector

- October 2022: Hotpack Global acquires Al Huraiz Packaging Industry, expanding its market share in the UAE.

- June 2023: BOBST's acquisition of Dücker Robotics accelerates automation and digitalization in the corrugated packaging sector.

In-Depth Middle East Corrugated Packaging Market Market Outlook

The Middle East corrugated packaging market is poised for robust growth, fueled by strong economic growth, increasing consumer spending, and technological advancements. Strategic partnerships, investments in automation, and a focus on sustainable solutions will be key to success in this dynamic market. The continued expansion of e-commerce and the food and beverage sectors will drive future demand. The market exhibits strong growth potential, projected to reach xx Million units by 2033.

Middle East Corrugated Packaging Market Segmentation

-

1. Type

- 1.1. Slotted Containers

- 1.2. Die Cut Containers

- 1.3. Five Panel Folder Boxes

- 1.4. Other Types

-

2. End User

- 2.1. Food

- 2.2. Beverages

- 2.3. Electrical Goods

- 2.4. Personal Care and Household Care

- 2.5. Other End Users

Middle East Corrugated Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Corrugated Packaging Market Regional Market Share

Geographic Coverage of Middle East Corrugated Packaging Market

Middle East Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-User Segments

- 3.3. Market Restrains

- 3.3.1. Concerns About Material Availability and Durability of Corrugated-Based Products

- 3.4. Market Trends

- 3.4.1. Food Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Corrugated Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Slotted Containers

- 5.1.2. Die Cut Containers

- 5.1.3. Five Panel Folder Boxes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Electrical Goods

- 5.2.4. Personal Care and Household Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cepack Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Al Rumanah Packagin

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Falcon Pack

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Napco National

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Carton Industries Company (UCIC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unipack Containers & Carton Products LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Universal Carton Industries Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tarboosh Packaging Co LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 World Pack Industries LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Green Packaging Boxes Ind LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Arabian Packaging Co LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Queenex Corrugated Carton Factory

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Cepack Group

List of Figures

- Figure 1: Middle East Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Corrugated Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle East Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Middle East Corrugated Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Middle East Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Middle East Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Middle East Corrugated Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Corrugated Packaging Market ?

The projected CAGR is approximately 2.58%.

2. Which companies are prominent players in the Middle East Corrugated Packaging Market ?

Key companies in the market include Cepack Group, Al Rumanah Packagin, Falcon Pack, Napco National, United Carton Industries Company (UCIC), Unipack Containers & Carton Products LLC, Universal Carton Industries Group, Tarboosh Packaging Co LLC, World Pack Industries LLC, Green Packaging Boxes Ind LLC, Arabian Packaging Co LLC, Queenex Corrugated Carton Factory.

3. What are the main segments of the Middle East Corrugated Packaging Market ?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-User Segments.

6. What are the notable trends driving market growth?

Food Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Concerns About Material Availability and Durability of Corrugated-Based Products.

8. Can you provide examples of recent developments in the market?

June 2023 - BOBST announced its latest innovations to help converters and brand owners take a big step toward digitalizing the packaging supply chain. BOBST has strengthened its automation and connectivity streams by acquiring 70% of the equity of Dücker Robotics, one of the leaders in using robots in the corrugated board sector, while offering opportunities in the folding carton industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Corrugated Packaging Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Corrugated Packaging Market ?

To stay informed about further developments, trends, and reports in the Middle East Corrugated Packaging Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence