Key Insights

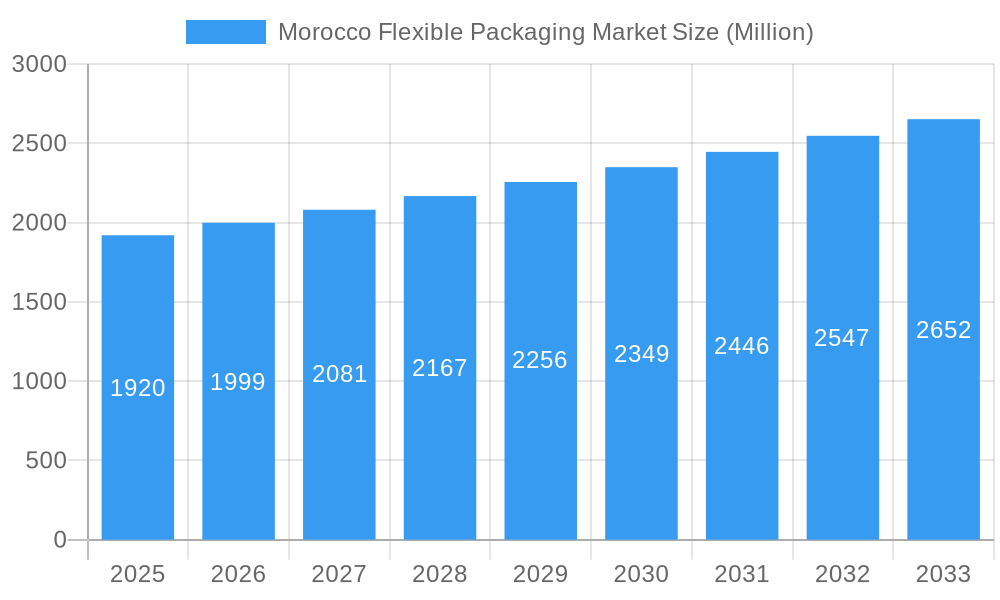

The Morocco flexible packaging market, valued at $1.92 billion in 2025, is projected to experience robust growth, driven by the expanding food and beverage sector, rising consumer demand for convenient packaging, and increasing adoption of flexible packaging in the household and personal care industries. The market's Compound Annual Growth Rate (CAGR) of 4.17% from 2025 to 2033 indicates a steady upward trajectory. Key growth drivers include the increasing preference for lightweight and cost-effective packaging solutions, the growing popularity of e-commerce and its associated need for efficient packaging, and a shift towards sustainable and eco-friendly packaging materials. Growth is further fueled by the government's initiatives to promote industrial development and attract foreign investment in the manufacturing sector, stimulating the packaging industry's growth. While the market is poised for expansion, challenges remain, such as fluctuations in raw material prices and stringent regulations regarding packaging materials. The market is segmented by product type (pouches, bags, films and wraps, others), end-user industry (food, beverages, household and personal care, others), and material (paper, plastic, aluminum foil). Major players like Unibag Maghreb, Compagnie Industrielle Des Fibres, and Mondi Pap Sac Maghreb SA are shaping the competitive landscape, with ongoing innovation and mergers & acquisitions further influencing market dynamics.

Morocco Flexible Packaging Market Market Size (In Billion)

The segment analysis reveals that the food and beverage sector is the largest contributor to market revenue, owing to the high demand for packaged food products. Plastic remains the dominant material due to its versatility and cost-effectiveness, although the growing awareness of environmental concerns is driving increased adoption of sustainable alternatives such as paper-based packaging. The increasing use of pouches, bags and films reflects consumer preference for convenience and product preservation. Future growth will likely be influenced by advancements in packaging technology, increased focus on sustainability, and the emergence of innovative solutions that meet the evolving needs of both manufacturers and consumers in Morocco. The forecast period of 2025-2033 promises continued expansion for the Moroccan flexible packaging market, driven by a confluence of factors, despite potential challenges related to resource availability and environmental regulations.

Morocco Flexible Packaging Market Company Market Share

Morocco Flexible Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Morocco flexible packaging market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with 2025 serving as the base year and estimated year. It meticulously analyzes market dynamics, growth trends, key players, and future opportunities within the Moroccan flexible packaging landscape. The market is segmented by product type (pouches, bags, films and wraps, other product types), end-user industry (food, beverages, household and personal care, other end-user industries), and material (paper, plastic, aluminum foil). The market value is presented in million units.

Morocco Flexible Packaging Market Dynamics & Structure

This section examines the competitive landscape of the Moroccan flexible packaging market, exploring market concentration, technological advancements, regulatory factors, and industry trends. The market is characterized by a mix of multinational corporations and local players. Market concentration is moderate, with several key players holding significant market share. Technological innovations, particularly in sustainable packaging solutions, are major drivers. Stringent regulatory frameworks concerning food safety and environmental standards influence packaging choices. The increasing prevalence of e-commerce is creating demand for flexible packaging suitable for online deliveries. Substitutes such as rigid packaging pose a competitive challenge. The market has seen a moderate number of M&A activities in recent years, primarily focused on expanding market reach and product portfolios.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2025).

- Technological Innovation: Focus on sustainable materials (e.g., biodegradable plastics) and improved barrier properties.

- Regulatory Framework: Stringent food safety and environmental regulations driving demand for compliant packaging.

- Competitive Substitutes: Rigid packaging presents a competitive challenge, especially for certain product categories.

- M&A Activity: xx deals recorded between 2019 and 2024, primarily driven by expansion strategies.

- End-User Demographics: Growing urban population and rising disposable incomes are boosting demand.

Morocco Flexible Packaging Market Growth Trends & Insights

The Moroccan flexible packaging market exhibits robust growth, driven by factors such as increasing consumer spending, changing consumption patterns, and growth in diverse end-use sectors. The market size is estimated at xx million units in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx million units by 2033. This growth is fueled by the expansion of the food and beverage industry, increasing demand for convenient packaging, and the rising adoption of e-commerce. Technological advancements are playing a key role in shaping the market, with a growing emphasis on sustainable packaging solutions and improved barrier properties. Shifting consumer preferences toward convenience and on-the-go consumption patterns are also contributing to market expansion. Market penetration for flexible packaging in various end-use sectors remains relatively high, indicating significant potential for further growth.

Dominant Regions, Countries, or Segments in Morocco Flexible Packaging Market

The urban centers of Casablanca, Rabat, and Marrakech are the leading regions driving market growth. The food and beverage sector is the dominant end-user industry, driven by high demand for packaged food and beverages. Within product types, pouches and bags dominate due to their versatility and cost-effectiveness. Plastic is the most widely used material due to its properties and cost-effectiveness.

- Key Drivers:

- Growing urban population and rising disposable incomes.

- Expansion of the food and beverage, household, and personal care sectors.

- Increasing adoption of flexible packaging in e-commerce.

- Government initiatives promoting local industries and sustainable packaging.

- Dominant Segments:

- Product Type: Pouches and bags (xx% market share in 2025)

- End-user Industry: Food and beverages (xx% market share in 2025)

- Material: Plastic (xx% market share in 2025)

Morocco Flexible Packaging Market Product Landscape

The Moroccan flexible packaging market offers a diverse range of products, catering to various needs and applications. Innovations focus on enhanced barrier properties, improved sustainability, and ease of use. Product differentiation is achieved through customized designs, enhanced functionalities (e.g., reclosable features), and eco-friendly materials. Technological advancements include the use of advanced printing techniques for eye-catching graphics and the development of specialized barrier films to prolong shelf life. Unique selling propositions often focus on product safety, environmental responsibility, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Morocco Flexible Packaging Market

Key Drivers: Rising disposable incomes, urbanization, growth of organized retail, and favorable government policies supporting local industries are propelling market growth. The increasing adoption of e-commerce further fuels demand for convenient packaging solutions. Technological advancements, particularly in sustainable packaging, present opportunities for innovation.

Key Barriers and Challenges: Fluctuations in raw material prices, competition from imports, and challenges associated with implementing sustainable packaging solutions are key obstacles. Supply chain disruptions can affect product availability and costs. Regulatory complexities and enforcement can create compliance burdens for businesses. Competition from established players and the emergence of new entrants can intensify market pressures.

Emerging Opportunities in Morocco Flexible Packaging Market

Untapped opportunities exist in the expansion of the e-commerce sector, requiring specialized flexible packaging solutions. Demand for sustainable and eco-friendly packaging is growing, presenting opportunities for companies offering biodegradable and compostable options. Rising consumer preferences for convenience and on-the-go products necessitate innovative packaging formats. The healthcare and pharmaceuticals sector offers potential for specialized flexible packaging applications.

Growth Accelerators in the Morocco Flexible Packaging Market Industry

Technological innovation in sustainable packaging materials and printing methods will play a critical role in driving market growth. Strategic partnerships between packaging companies and brand owners can facilitate product development and market access. Expansion into new markets within Morocco and across African regions will further accelerate market growth.

Key Players Shaping the Morocco Flexible Packaging Market Market

Notable Milestones in Morocco Flexible Packaging Market Sector

- July 2023: Smurfit Kappa's EUR 35 million (USD 38.51 million) investment in a new plant in Rabat, significantly expands flexible packaging capacity in Morocco.

- October 2023: ITC Packaging and Erum Group's collaboration (ITCErum Packaging) broadens the product portfolio and customer base within the Moroccan market, potentially influencing market competitiveness.

In-Depth Morocco Flexible Packaging Market Market Outlook

The Moroccan flexible packaging market is poised for significant growth driven by the factors mentioned earlier, including increasing consumer spending, adoption of sustainable packaging, and expansion of key end-user industries. Strategic partnerships, investments in innovative technologies, and the exploration of untapped market segments will be key to realizing this potential. The market's future prospects are positive, indicating attractive opportunities for both established and emerging players.

Morocco Flexible Packaging Market Segmentation

-

1. Material

- 1.1. Paper

- 1.2. Plastic

- 1.3. Aluminum Foil

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverages

- 3.3. Household and Personal Care

- 3.4. Other End-User Industries

Morocco Flexible Packaging Market Segmentation By Geography

- 1. Morocco

Morocco Flexible Packaging Market Regional Market Share

Geographic Coverage of Morocco Flexible Packaging Market

Morocco Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Convenient Packaging Solution; Growing Demand for Sustainable Packaging Solution

- 3.3. Market Restrains

- 3.3.1. Fluctuation in the Prices of Raw Materials

- 3.4. Market Trends

- 3.4.1. Plastic is Expected to Dominate the Material Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper

- 5.1.2. Plastic

- 5.1.3. Aluminum Foil

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Household and Personal Care

- 5.3.4. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Unibag Maghreb

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Industrielle Des Fibres

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi Pap Sac Maghreb SA (Mondi PLC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hotpack Packaging Industries LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alpla Werke Alwin Lehner GmbH & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Almapack

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Afrimag Glue

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor Group GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Atlantic Packaging SA (Diana Holding)*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Societe Nouvelle Des Etablissements Manusac

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Unibag Maghreb

List of Figures

- Figure 1: Morocco Flexible Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Morocco Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Morocco Flexible Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Morocco Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Morocco Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Morocco Flexible Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Morocco Flexible Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Morocco Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Morocco Flexible Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Morocco Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Flexible Packaging Market?

The projected CAGR is approximately 4.17%.

2. Which companies are prominent players in the Morocco Flexible Packaging Market?

Key companies in the market include Unibag Maghreb, Compagnie Industrielle Des Fibres, Mondi Pap Sac Maghreb SA (Mondi PLC), Hotpack Packaging Industries LLC, Alpla Werke Alwin Lehner GmbH & Co KG, Almapack, Afrimag Glue, Amcor Group GmbH, Atlantic Packaging SA (Diana Holding)*List Not Exhaustive, Societe Nouvelle Des Etablissements Manusac.

3. What are the main segments of the Morocco Flexible Packaging Market?

The market segments include Material, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Convenient Packaging Solution; Growing Demand for Sustainable Packaging Solution.

6. What are the notable trends driving market growth?

Plastic is Expected to Dominate the Material Segment.

7. Are there any restraints impacting market growth?

Fluctuation in the Prices of Raw Materials.

8. Can you provide examples of recent developments in the market?

July 2023: Smurfit Kappa made a substantial investment of approximately EUR 4.7 billion (USD 5.17 billion) to support its global customer base. The company inaugurated its site in North Africa, a state-of-the-art integrated plant in Rabat, Morocco. Smurfit Kappa's strategic positioning in Morocco allows it to efficiently serve the local market and the broader African regions across various sectors, including industrial, agriculture, automotive, consumer products, and pharmaceutical. Notably, the group invested more than EUR 35 million (USD 38.51 million) in this expansive 25,000 m2 facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Morocco Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence