Key Insights

The Nordic Rigid Plastic Packaging Market is projected to experience moderate growth, with an estimated Compound Annual Growth Rate (CAGR) of 3.6%. The market was valued at approximately 220.2 billion in the base year 2025. Key growth drivers include sustained demand from the food and beverage industry, fueled by consumer preferences for convenience, single-serving formats, and shelf-stable products. Stringent regulations promoting sustainable packaging solutions and advancements in material science, yielding lighter, more durable, and recyclable options, are also significant catalysts. The expanding foodservice sector, particularly quick-service restaurants and retail, along with the healthcare industry's need for sterile and secure packaging for pharmaceuticals and medical devices, further contribute to consistent demand.

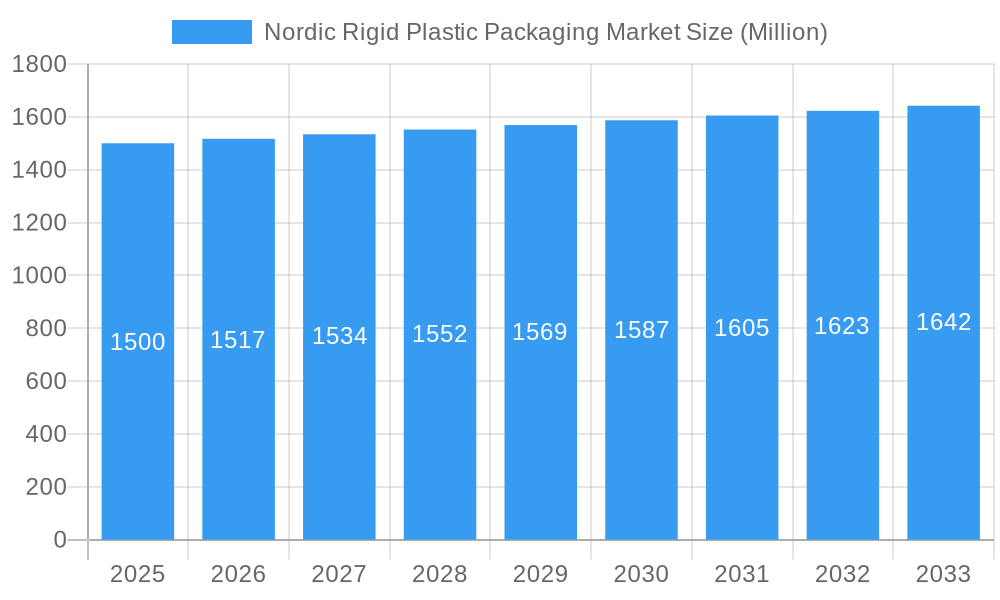

Nordic Rigid Plastic Packaging Market Market Size (In Billion)

Challenges for the market include volatility in raw material prices for essential polymers such as Polyethylene (PE) and Polypropylene (PP), potentially impacting profitability. Growing environmental concerns and regulatory pressure to minimize plastic waste and embrace circular economy principles are driving a transition towards sustainable alternatives, including recycled and bio-based materials. While this presents a long-term opportunity, it may introduce short-term challenges related to production costs and infrastructure adaptation. The competitive landscape features both global enterprises and specialized regional manufacturers, with key players actively pursuing product innovation, sustainability initiatives, and strategic alliances. The market is segmented by product type, with bottles and jars, trays and containers, and caps and closures representing the leading segments.

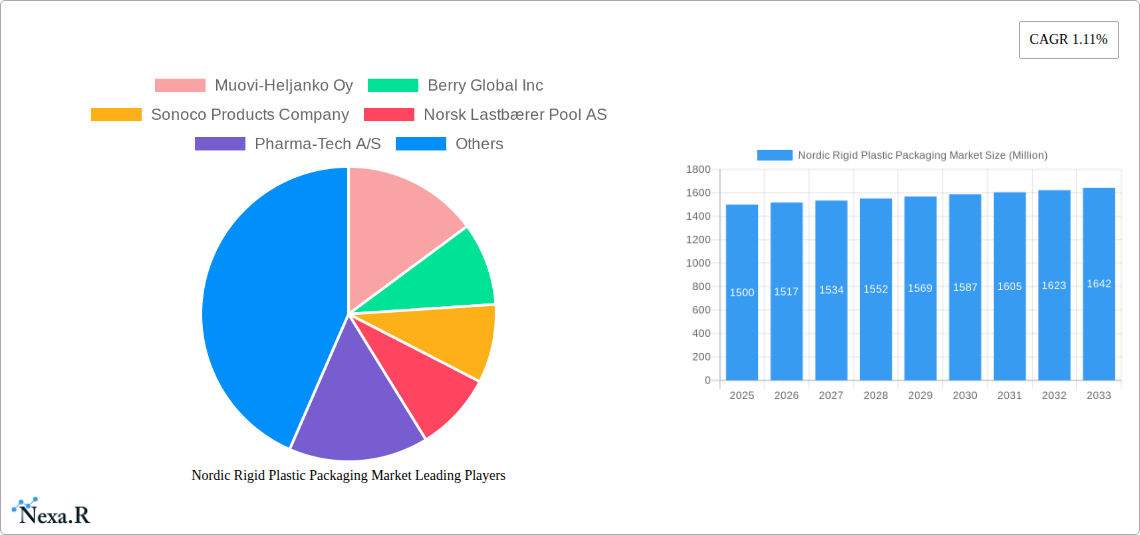

Nordic Rigid Plastic Packaging Market Company Market Share

Comprehensive Report: Nordic Rigid Plastic Packaging Market Analysis 2025-2033

Unlock the Future of Nordic Rigid Plastic Packaging: Market Dynamics, Growth Trends, and Strategic Opportunities.

This in-depth report provides an exhaustive analysis of the Nordic Rigid Plastic Packaging Market, offering unparalleled insights into its growth trajectory, key market drivers, emerging opportunities, and competitive landscape. With a meticulous Study Period of 2019–2033, a Base Year of 2025, and a detailed Forecast Period from 2025–2033, this report leverages critical data to empower stakeholders. We delve into the nuances of parent and child markets, providing a holistic view of this dynamic sector. Explore detailed segmentations including Product Type (Bottles and Jars, Trays and Containers, Caps and Closures, Intermediate Bulk Containers (IBCs), Drums, Pallets, Other Product Types), Material (Polyethylene (PE) (LDPE & LLDPE, HDPE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS) and Expanded Polystyrene (EPS), Polyvinyl Chloride (PVC), Other Rigid Plastic Packaging Materials), and End-Use Industries (Food, Foodservice, Beverage, Healthcare, Cosmetics and Personal Care, Industrial, Building and Construction, Automotive, Other). This report is optimized with high-traffic keywords such as rigid plastic packaging Nordics, plastic containers Nordic countries, PET packaging Scandinavia, HDPE bottles Northern Europe, PP trays Europe, food packaging solutions Nordic, beverage packaging industry, healthcare packaging solutions, cosmetic packaging Nordic, industrial packaging Nordic, sustainable plastic packaging, recycled plastic packaging Nordics, and circular economy packaging.

Nordic Rigid Plastic Packaging Market Market Dynamics & Structure

The Nordic Rigid Plastic Packaging Market exhibits a moderately concentrated structure, with key players like Berry Global Inc, Sonoco Products Company, and Muovi-Heljanko Oy holding significant market shares. Technological innovation is primarily driven by the increasing demand for sustainable packaging solutions, pushing advancements in lightweighting, barrier properties, and the incorporation of recycled content. Regulatory frameworks, particularly those focused on waste management and extended producer responsibility (EPR), are shaping market strategies and influencing material choices. Competitive product substitutes, such as glass and paperboard, pose a continuous challenge, but rigid plastics offer advantages in durability, cost-effectiveness, and design flexibility. End-user demographics are shifting towards greater environmental consciousness, demanding eco-friendly packaging options. Merger and acquisition (M&A) trends are observed as companies seek to consolidate market positions, expand their product portfolios, and enhance their sustainability credentials. For instance, recent investments in advanced recycling technologies signal a proactive approach to addressing environmental concerns and securing future material supply. The market is characterized by a balance between established players and emerging innovators vying for market dominance.

- Market Concentration: Moderately concentrated with a few dominant global and regional players.

- Technological Drivers: Sustainability, lightweighting, enhanced barrier properties, advanced recycling.

- Regulatory Influence: EPR schemes, recycling mandates, single-use plastic bans are key influencers.

- Competitive Landscape: Continuous pressure from glass, metal, and paperboard alternatives.

- End-User Demand: Growing preference for convenience, safety, and environmentally responsible packaging.

- M&A Activity: Strategic acquisitions focused on capacity expansion and sustainability capabilities.

Nordic Rigid Plastic Packaging Market Growth Trends & Insights

The Nordic Rigid Plastic Packaging Market is poised for robust growth, projected to witness a significant CAGR of approximately 6.2% during the forecast period. This expansion is underpinned by several key trends. The escalating demand from the Food and Beverage sectors, driven by an increasing population and evolving dietary habits, forms a foundational growth pillar. Consumers’ preference for convenience and ready-to-eat meals further fuels the demand for trays, containers, and bottles. The Healthcare sector's consistent need for sterile, protective, and tamper-evident packaging for pharmaceuticals and medical devices is another critical growth accelerator. Furthermore, the burgeoning e-commerce industry is creating a substantial uplift in the demand for robust and protective secondary packaging solutions, including Intermediate Bulk Containers (IBCs) and specialized drums.

Technological advancements in material science are enabling the development of lighter yet stronger rigid plastic packaging, leading to reduced material consumption and transportation costs. The increasing adoption of Polyethylene Terephthalate (PET) for beverage bottles and Polypropylene (PP) for food trays highlights a shift towards materials offering superior clarity, chemical resistance, and recyclability. Consumer behavior is also playing a pivotal role, with a growing awareness and preference for brands demonstrating environmental responsibility. This is translating into a higher demand for recycled rigid plastic packaging and packaging solutions designed for circularity. The Nordic countries are at the forefront of embracing sustainable practices, with strong government support for recycling initiatives and the adoption of advanced recycling technologies, such as alkaline hydrolysis. This commitment to a circular economy is not only meeting regulatory demands but also resonating with environmentally conscious consumers.

The market penetration of rigid plastic packaging is expected to deepen across various end-use industries, driven by its inherent advantages in product protection, shelf-life extension, and cost-effectiveness compared to traditional materials. Innovations in design, such as nested stacking and integrated dispensing features, are further enhancing the efficiency and consumer appeal of rigid plastic packaging. The integration of smart technologies, like QR codes for traceability and augmented reality for enhanced consumer engagement, is also an emerging trend that will contribute to market expansion. The overall market size is expected to evolve from approximately USD 15.2 Billion units in 2025 to over USD 27.5 Billion units by 2033, showcasing a strong upward trajectory fueled by innovation, consumer demand, and a growing commitment to sustainability.

Dominant Regions, Countries, or Segments in Nordic Rigid Plastic Packaging Market

The Nordic Rigid Plastic Packaging Market is characterized by a robust and multifaceted demand across various segments. Among the Product Types, Bottles and Jars are anticipated to maintain their dominance, driven by extensive use in the Beverage, Food, and Healthcare sectors. These products offer excellent barrier properties, recyclability, and cost-effectiveness, making them a preferred choice for a wide array of liquid and semi-liquid products. The Food end-use industry, in particular, is a significant growth engine for rigid plastic packaging. Within the Food segment, Fresh Produce, Dairy Products, and Frozen Foods are leading sub-segments due to the requirement for protective, shelf-life extending packaging that ensures food safety and quality. The convenience and portability offered by rigid plastic packaging solutions for these product categories are highly valued by consumers.

In terms of Materials, Polyethylene (PE), encompassing both LDPE & LLDPE and HDPE, holds a leading position. HDPE's rigidity, chemical resistance, and excellent barrier properties make it ideal for bottles, drums, and containers. LDPE and LLDPE are also crucial for flexible film layers within some rigid packaging structures and for certain types of closures. Polypropylene (PP) is rapidly gaining traction, especially for trays and containers used in food packaging, owing to its high melting point, good chemical resistance, and recyclability. Polyethylene Terephthalate (PET) remains a dominant material for beverage bottles, valued for its clarity, strength, and recyclability. The growing emphasis on sustainability is also driving the demand for rPET (recycled PET).

The Foodservice sector, encompassing Quick Service Restaurants (QSRs) and Full-Service Restaurants (FSRs), is a substantial contributor to the market's growth, demanding durable and hygienic containers for takeout and dine-in services. The Healthcare industry's stringent requirements for sterile, tamper-evident, and chemically inert packaging solutions for pharmaceuticals and medical devices ensures consistent demand for specialized rigid plastic packaging. Geographically, Sweden and Norway are emerging as the dominant countries driving market growth within the Nordics, supported by strong industrial bases, high consumer spending power, and progressive environmental policies encouraging sustainable packaging adoption. Economic policies promoting circular economy principles and investments in advanced recycling infrastructure are key drivers of this dominance, fostering innovation and the widespread use of rigid plastic packaging solutions.

Nordic Rigid Plastic Packaging Market Product Landscape

The Nordic Rigid Plastic Packaging Market is witnessing continuous product innovation focused on enhancing functionality, sustainability, and consumer appeal. Key advancements include the development of multi-layer rigid plastic packaging offering superior barrier properties to extend product shelf-life, particularly for sensitive food items and pharmaceuticals. Lightweighting initiatives are paramount, with manufacturers optimizing designs to reduce material usage without compromising structural integrity, thereby lowering costs and environmental impact. The integration of advanced features such as child-resistant closures, tamper-evident seals, and easy-open mechanisms are enhancing consumer safety and convenience. Furthermore, the incorporation of recycled content, particularly rPET and rPP, into virgin-grade packaging is a significant product innovation driven by regulatory pressures and growing consumer demand for sustainable options. The performance metrics being prioritized include enhanced durability, chemical inertness, resistance to temperature fluctuations, and optimized stacking capabilities for efficient logistics. Unique selling propositions often revolve around recyclability, the use of post-consumer recycled (PCR) materials, and innovative design elements that simplify product usage and disposal.

Key Drivers, Barriers & Challenges in Nordic Rigid Plastic Packaging Market

Key Drivers:

- Growing Demand from Food & Beverage Sector: The largest end-use industry, driven by convenience, safety, and extended shelf-life requirements.

- Increasing Healthcare Industry Needs: Stringent regulations and the demand for sterile, tamper-evident packaging for pharmaceuticals and medical devices.

- E-commerce Growth: Increased demand for protective and robust packaging for shipped goods.

- Sustainability Initiatives & Regulations: Government mandates for recycling, use of recycled content, and extended producer responsibility (EPR) are propelling innovation.

- Technological Advancements: Lightweighting, improved barrier properties, and advanced recycling technologies enhance material performance and recyclability.

- Consumer Preference for Convenience: Demand for easy-to-use, portable, and single-serve packaging solutions.

Barriers & Challenges:

- Perception of Plastic Waste & Environmental Concerns: Negative public perception and concerns about plastic pollution continue to pose a challenge.

- Fluctuating Raw Material Prices: Volatility in the cost of crude oil and natural gas impacts the price of virgin plastic resins.

- Availability and Quality of Recycled Materials: Ensuring a consistent supply of high-quality recycled plastic feedstocks for advanced recycling processes.

- Competition from Alternative Materials: Sustained competition from glass, metal, and paperboard packaging solutions.

- Complex Recycling Infrastructure: The need for enhanced and harmonized collection and sorting infrastructure across the Nordic region to improve recycling rates.

- Regulatory Uncertainty: Evolving and sometimes inconsistent regulations across different Nordic countries can create compliance challenges for manufacturers.

Emerging Opportunities in Nordic Rigid Plastic Packaging Market

The Nordic Rigid Plastic Packaging Market is ripe with emerging opportunities. A significant area of growth lies in the expansion of advanced recycling technologies, such as chemical recycling (e.g., alkaline hydrolysis), which can process mixed plastic waste and produce virgin-quality recycled materials. This opens avenues for a truly circular economy for plastics, addressing the limitations of mechanical recycling. The increasing demand for bio-based and biodegradable rigid plastics presents another promising avenue, catering to environmentally conscious consumers and brands seeking alternatives to fossil-fuel-based plastics. Furthermore, the burgeoning cosmetics and personal care sector in the Nordics, with its focus on premium and sustainable products, offers substantial potential for innovative and aesthetically pleasing rigid plastic packaging. The growth of the pet food market also presents opportunities for specialized, functional, and sustainable rigid packaging solutions. Finally, the development of smart packaging, incorporating features like traceability, authentication, and temperature monitoring, will unlock new value propositions and market segments.

Growth Accelerators in the Nordic Rigid Plastic Packaging Market Industry

Several catalysts are accelerating the growth within the Nordic Rigid Plastic Packaging Market. Technological breakthroughs in polymer science are enabling the creation of more durable, lighter, and higher-performing packaging materials, often with improved recyclability. Strategic partnerships between packaging manufacturers, raw material suppliers, and recycling companies are crucial for fostering innovation and establishing robust supply chains for recycled content. For example, collaborations focused on advanced recycling initiatives are proving to be significant growth accelerators. Furthermore, market expansion strategies, including entering new sub-segments within existing end-use industries and exploring untapped geographical niches within the broader European market, are driving growth. Investments in capacity expansion by key players, coupled with a focus on product differentiation through design and functionality, are also contributing significantly to the market's upward trajectory.

Key Players Shaping the Nordic Rigid Plastic Packaging Market Market

- Muovi-Heljanko Oy

- Berry Global Inc

- Sonoco Products Company

- Norsk Lastbærer Pool AS

- Pharma-Tech A/S

- Creopack AB

- Maro Fabriken AB

- Berling Packaging

- Europak Oy

Notable Milestones in Nordic Rigid Plastic Packaging Market Sector

- July 2024: Plast Nordic and Norner partnered to implement alkaline hydrolysis to recycle 97% of PET waste in the Nordics back into raw materials. Their target markets for the 'virgin-quality' rPET resin are the packaging and other industries. The partners are set to recycle around 97% of this waste into raw materials. It believes advanced recycling is the 'only' technology that can achieve circularity without compromising the quality of the recyclate. This initiative is poised to enhance access to recycled materials, reduce transportation needs, and generate new employment opportunities.

- June 2024: Nordic Plast SIA (LTD), a subsidiary of Eco Baltia AS (JSC) - the foremost environmental resource management group and a prominent player in polymer recycling in the region - is set to invest EUR 1.7 million (USD 1.83 million) in its development. This capital infusion aims to enhance the production capacity of recycled pellets, setting the stage for the company's future expansion. In tandem with this strategic investment and development initiative, Nordic Plast is rolling out a new corporate identity. Such investments would drive the demand for rigid plastic packaging in the region.

In-Depth Nordic Rigid Plastic Packaging Market Market Outlook

The Nordic Rigid Plastic Packaging Market is characterized by a highly positive future outlook, driven by an unwavering commitment to sustainability and circular economy principles. Growth accelerators such as continued investment in advanced recycling technologies, the increasing adoption of bio-based and recycled content, and innovations in lightweighting and product design will shape the market landscape. The expanding e-commerce sector and the persistent demand from essential industries like Food, Beverage, and Healthcare will provide a stable foundation for growth. Strategic partnerships and M&A activities are expected to continue, fostering consolidation and driving technological advancements. Stakeholders can anticipate a market that is increasingly defined by its ability to deliver high-performance, cost-effective, and environmentally responsible rigid plastic packaging solutions, meeting both regulatory mandates and evolving consumer expectations for a sustainable future.

Nordic Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-Use Industries

-

3.1. Food**

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

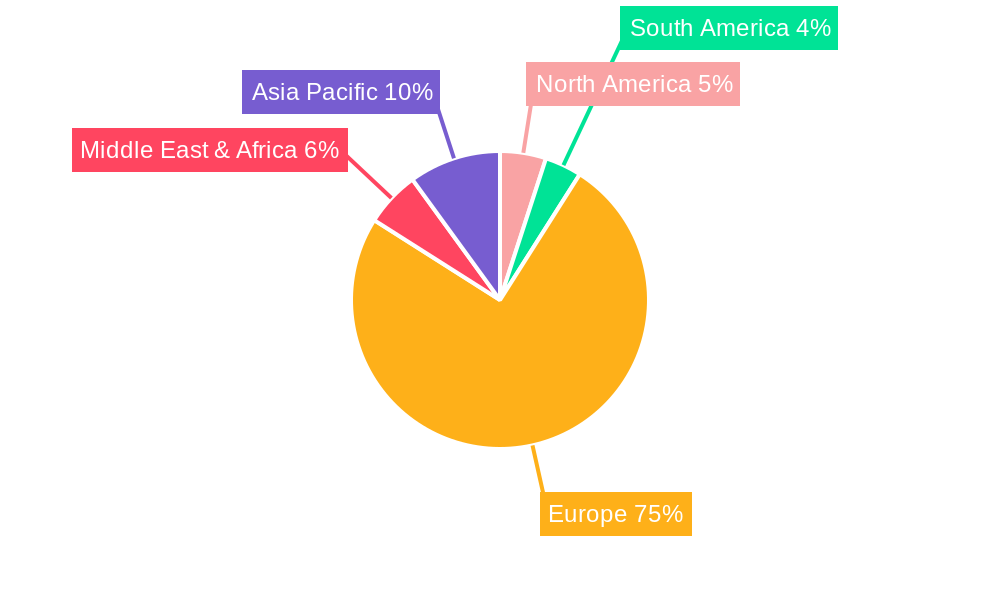

Nordic Rigid Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nordic Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Nordic Rigid Plastic Packaging Market

Nordic Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options

- 3.3. Market Restrains

- 3.3.1. Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) To Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bottles and Jars

- 6.1.2. Trays and Containers

- 6.1.3. Caps and Closures

- 6.1.4. Intermediate Bulk Containers (IBCs)

- 6.1.5. Drums

- 6.1.6. Pallets

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Polyethylene (PE)

- 6.2.1.1. LDPE & LLDPE

- 6.2.1.2. HDPE

- 6.2.2. Polyethylene Terephthalate (PET)

- 6.2.3. Polypropylene (PP)

- 6.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 6.2.5. Polyvinyl chloride (PVC)

- 6.2.6. Other Rigid Plastic Packaging Materials

- 6.2.1. Polyethylene (PE)

- 6.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 6.3.1. Food**

- 6.3.1.1. Candy & Confectionery

- 6.3.1.2. Frozen Foods

- 6.3.1.3. Fresh Produce

- 6.3.1.4. Dairy Products

- 6.3.1.5. Dry Foods

- 6.3.1.6. Meat, Poultry, And Seafood

- 6.3.1.7. Pet Food

- 6.3.1.8. Other Food Products

- 6.3.2. Foodservice**

- 6.3.2.1. Quick Service Restaurants (QSRs)

- 6.3.2.2. Full-Service Restaurants (FSRs)

- 6.3.2.3. Coffee and Snack Outlets

- 6.3.2.4. Retail Establishments

- 6.3.2.5. Institutional

- 6.3.2.6. Hospitality

- 6.3.2.7. Other Foodservice End-uses

- 6.3.3. Beverage

- 6.3.4. Healthcare

- 6.3.5. Cosmetics and Personal Care

- 6.3.6. Industrial

- 6.3.7. Building and Construction

- 6.3.8. Automotive

- 6.3.9. Other En

- 6.3.1. Food**

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bottles and Jars

- 7.1.2. Trays and Containers

- 7.1.3. Caps and Closures

- 7.1.4. Intermediate Bulk Containers (IBCs)

- 7.1.5. Drums

- 7.1.6. Pallets

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Polyethylene (PE)

- 7.2.1.1. LDPE & LLDPE

- 7.2.1.2. HDPE

- 7.2.2. Polyethylene Terephthalate (PET)

- 7.2.3. Polypropylene (PP)

- 7.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 7.2.5. Polyvinyl chloride (PVC)

- 7.2.6. Other Rigid Plastic Packaging Materials

- 7.2.1. Polyethylene (PE)

- 7.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 7.3.1. Food**

- 7.3.1.1. Candy & Confectionery

- 7.3.1.2. Frozen Foods

- 7.3.1.3. Fresh Produce

- 7.3.1.4. Dairy Products

- 7.3.1.5. Dry Foods

- 7.3.1.6. Meat, Poultry, And Seafood

- 7.3.1.7. Pet Food

- 7.3.1.8. Other Food Products

- 7.3.2. Foodservice**

- 7.3.2.1. Quick Service Restaurants (QSRs)

- 7.3.2.2. Full-Service Restaurants (FSRs)

- 7.3.2.3. Coffee and Snack Outlets

- 7.3.2.4. Retail Establishments

- 7.3.2.5. Institutional

- 7.3.2.6. Hospitality

- 7.3.2.7. Other Foodservice End-uses

- 7.3.3. Beverage

- 7.3.4. Healthcare

- 7.3.5. Cosmetics and Personal Care

- 7.3.6. Industrial

- 7.3.7. Building and Construction

- 7.3.8. Automotive

- 7.3.9. Other En

- 7.3.1. Food**

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bottles and Jars

- 8.1.2. Trays and Containers

- 8.1.3. Caps and Closures

- 8.1.4. Intermediate Bulk Containers (IBCs)

- 8.1.5. Drums

- 8.1.6. Pallets

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Polyethylene (PE)

- 8.2.1.1. LDPE & LLDPE

- 8.2.1.2. HDPE

- 8.2.2. Polyethylene Terephthalate (PET)

- 8.2.3. Polypropylene (PP)

- 8.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 8.2.5. Polyvinyl chloride (PVC)

- 8.2.6. Other Rigid Plastic Packaging Materials

- 8.2.1. Polyethylene (PE)

- 8.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 8.3.1. Food**

- 8.3.1.1. Candy & Confectionery

- 8.3.1.2. Frozen Foods

- 8.3.1.3. Fresh Produce

- 8.3.1.4. Dairy Products

- 8.3.1.5. Dry Foods

- 8.3.1.6. Meat, Poultry, And Seafood

- 8.3.1.7. Pet Food

- 8.3.1.8. Other Food Products

- 8.3.2. Foodservice**

- 8.3.2.1. Quick Service Restaurants (QSRs)

- 8.3.2.2. Full-Service Restaurants (FSRs)

- 8.3.2.3. Coffee and Snack Outlets

- 8.3.2.4. Retail Establishments

- 8.3.2.5. Institutional

- 8.3.2.6. Hospitality

- 8.3.2.7. Other Foodservice End-uses

- 8.3.3. Beverage

- 8.3.4. Healthcare

- 8.3.5. Cosmetics and Personal Care

- 8.3.6. Industrial

- 8.3.7. Building and Construction

- 8.3.8. Automotive

- 8.3.9. Other En

- 8.3.1. Food**

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bottles and Jars

- 9.1.2. Trays and Containers

- 9.1.3. Caps and Closures

- 9.1.4. Intermediate Bulk Containers (IBCs)

- 9.1.5. Drums

- 9.1.6. Pallets

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Polyethylene (PE)

- 9.2.1.1. LDPE & LLDPE

- 9.2.1.2. HDPE

- 9.2.2. Polyethylene Terephthalate (PET)

- 9.2.3. Polypropylene (PP)

- 9.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 9.2.5. Polyvinyl chloride (PVC)

- 9.2.6. Other Rigid Plastic Packaging Materials

- 9.2.1. Polyethylene (PE)

- 9.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 9.3.1. Food**

- 9.3.1.1. Candy & Confectionery

- 9.3.1.2. Frozen Foods

- 9.3.1.3. Fresh Produce

- 9.3.1.4. Dairy Products

- 9.3.1.5. Dry Foods

- 9.3.1.6. Meat, Poultry, And Seafood

- 9.3.1.7. Pet Food

- 9.3.1.8. Other Food Products

- 9.3.2. Foodservice**

- 9.3.2.1. Quick Service Restaurants (QSRs)

- 9.3.2.2. Full-Service Restaurants (FSRs)

- 9.3.2.3. Coffee and Snack Outlets

- 9.3.2.4. Retail Establishments

- 9.3.2.5. Institutional

- 9.3.2.6. Hospitality

- 9.3.2.7. Other Foodservice End-uses

- 9.3.3. Beverage

- 9.3.4. Healthcare

- 9.3.5. Cosmetics and Personal Care

- 9.3.6. Industrial

- 9.3.7. Building and Construction

- 9.3.8. Automotive

- 9.3.9. Other En

- 9.3.1. Food**

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bottles and Jars

- 10.1.2. Trays and Containers

- 10.1.3. Caps and Closures

- 10.1.4. Intermediate Bulk Containers (IBCs)

- 10.1.5. Drums

- 10.1.6. Pallets

- 10.1.7. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Polyethylene (PE)

- 10.2.1.1. LDPE & LLDPE

- 10.2.1.2. HDPE

- 10.2.2. Polyethylene Terephthalate (PET)

- 10.2.3. Polypropylene (PP)

- 10.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 10.2.5. Polyvinyl chloride (PVC)

- 10.2.6. Other Rigid Plastic Packaging Materials

- 10.2.1. Polyethylene (PE)

- 10.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 10.3.1. Food**

- 10.3.1.1. Candy & Confectionery

- 10.3.1.2. Frozen Foods

- 10.3.1.3. Fresh Produce

- 10.3.1.4. Dairy Products

- 10.3.1.5. Dry Foods

- 10.3.1.6. Meat, Poultry, And Seafood

- 10.3.1.7. Pet Food

- 10.3.1.8. Other Food Products

- 10.3.2. Foodservice**

- 10.3.2.1. Quick Service Restaurants (QSRs)

- 10.3.2.2. Full-Service Restaurants (FSRs)

- 10.3.2.3. Coffee and Snack Outlets

- 10.3.2.4. Retail Establishments

- 10.3.2.5. Institutional

- 10.3.2.6. Hospitality

- 10.3.2.7. Other Foodservice End-uses

- 10.3.3. Beverage

- 10.3.4. Healthcare

- 10.3.5. Cosmetics and Personal Care

- 10.3.6. Industrial

- 10.3.7. Building and Construction

- 10.3.8. Automotive

- 10.3.9. Other En

- 10.3.1. Food**

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Muovi-Heljanko Oy

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Berry Global Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonoco Products Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Norsk Lastbærer Pool AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pharma-Tech A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Creopack AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Maro Fabriken AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berling Packaging

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Europak Oy8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Muovi-Heljanko Oy

List of Figures

- Figure 1: Global Nordic Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 5: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 7: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 8: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 13: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 15: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 16: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 21: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 23: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 24: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 29: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 31: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 32: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 37: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 39: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 40: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 4: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 8: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 14: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 15: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 21: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 22: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 34: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 35: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 44: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 45: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nordic Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Nordic Rigid Plastic Packaging Market?

Key companies in the market include Muovi-Heljanko Oy, Berry Global Inc, Sonoco Products Company, Norsk Lastbærer Pool AS, Pharma-Tech A/S, Creopack AB, Maro Fabriken AB, Berling Packaging, Europak Oy8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Nordic Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) To Witness Growth.

7. Are there any restraints impacting market growth?

Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options.

8. Can you provide examples of recent developments in the market?

July 2024 - Plast Nordic and Norner partnered to implement alkaline hydrolysis to recycle 97% of PET waste in the Nordics back into raw materials. Their target markets for the 'virgin-quality' rPET resin are the packaging and other industries. The partners are set to recycle around 97% of this waste into raw materials. It believes advanced recycling is the 'only' technology that can achieve circularity without compromising the quality of the recyclate. This initiative is poised to enhance access to recycled materials, reduce transportation needs, and generate new employment opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nordic Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nordic Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nordic Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Nordic Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence