Key Insights

The North American beverage packaging market is poised for significant expansion, driven by escalating consumer demand across diverse beverage categories including bottled water, carbonated soft drinks, and functional beverages such as energy and sports drinks. The market size is projected at $168.08 billion, with an estimated Compound Annual Growth Rate (CAGR) of 5.05% from 2025 to 2033. Key growth catalysts include innovative packaging designs enhancing product appeal and convenience, alongside a strong consumer preference for sustainable packaging solutions. The burgeoning e-commerce and direct-to-consumer sales channels necessitate packaging that ensures product integrity during transit and delivers an engaging unboxing experience. Furthermore, evolving consumer lifestyles in North America, with an increased focus on health and wellness, are driving demand for beverage packaging formats aligning with these priorities, such as single-serve options and resealable containers.

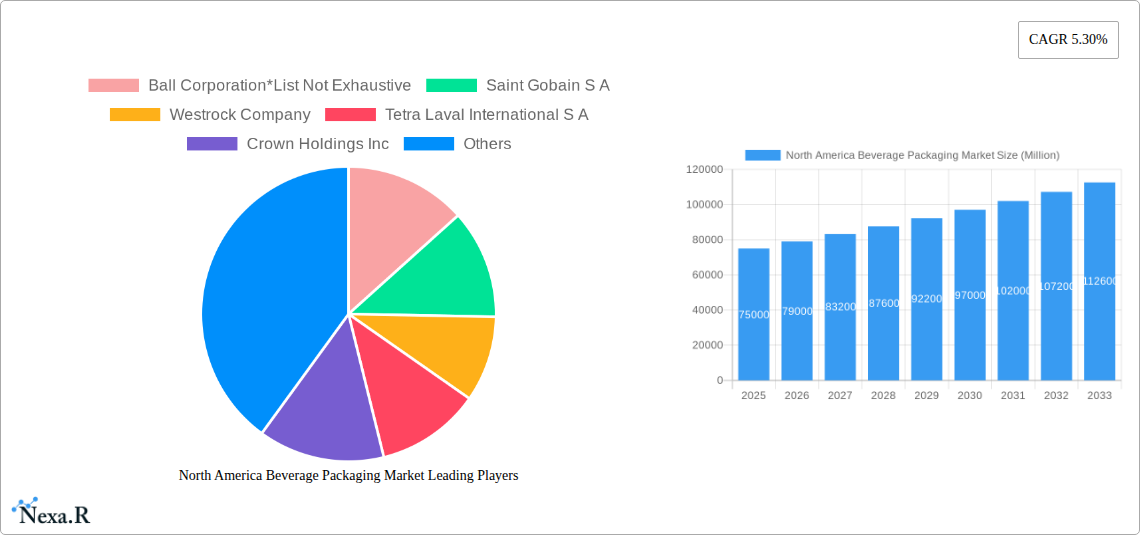

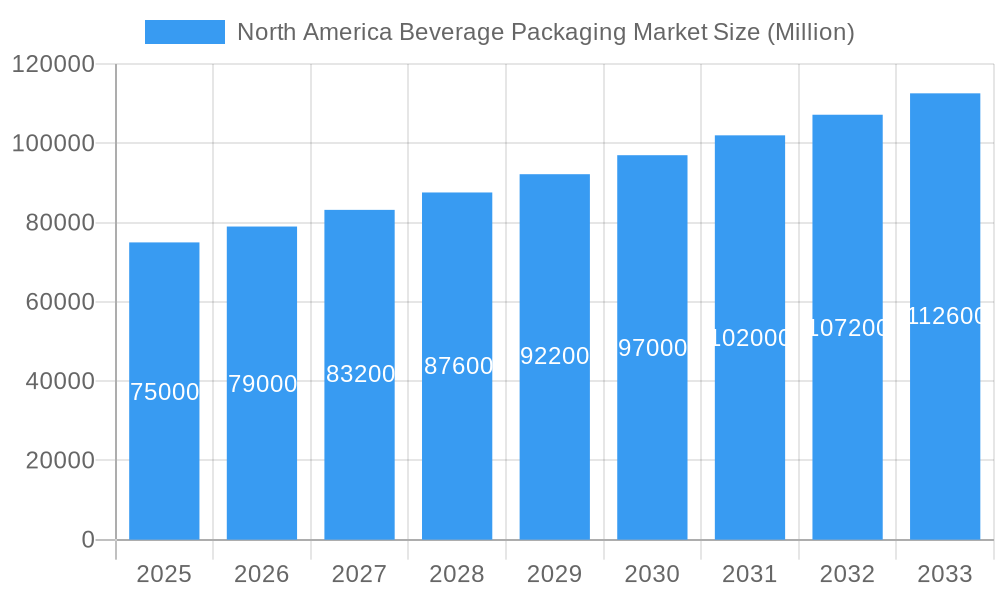

North America Beverage Packaging Market Market Size (In Billion)

Market growth is further propelled by advancements in materials science and manufacturing technologies, leading to more efficient, cost-effective, and environmentally responsible packaging alternatives. While glass, plastic, and metal remain dominant, a clear trend towards increased adoption of paperboard and advanced composite materials indicates a collective industry commitment to minimizing environmental impact. Challenges such as fluctuating raw material costs and stringent regulations on packaging waste are being mitigated through continuous research and development of sustainable alternatives and improved waste management infrastructure. Leading industry players like Ball Corporation, Westrock Company, and Amcor Limited are pioneering innovations that address both consumer preferences and regulatory requirements, solidifying North America's status as a dynamic and progressive beverage packaging market.

North America Beverage Packaging Market Company Market Share

North America Beverage Packaging Market: Comprehensive Analysis & Future Outlook (2019-2033)

This comprehensive report delivers critical insights into the North America Beverage Packaging Market, detailing market dynamics, growth trends, key players, and future opportunities. Spanning a study period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for industry professionals seeking to navigate the evolving beverage packaging landscape. All market size figures are presented in $168.08 billion for clarity.

North America Beverage Packaging Market Market Dynamics & Structure

The North America Beverage Packaging Market is characterized by a moderate concentration, with leading players actively engaged in strategic acquisitions and technological advancements. Market concentration is influenced by economies of scale, particularly in high-volume sectors like aluminum cans for carbonated soft drinks. Technological innovation is a significant driver, focusing on lightweighting, recyclability, and enhanced product shelf-life, all crucial for sustainable plastic bottles and glass bottles. Stringent regulatory frameworks, including those mandating recycled content and single-use plastic reduction, are reshaping material choices and driving the adoption of paperboard cartons and innovative metal solutions. Competitive product substitutes, such as the shift from glass to PET for certain beverages, constantly challenge market equilibrium. End-user demographics, including a growing demand for convenience and health-conscious options for bottled water and energy drinks, directly influence packaging design and functionality. Mergers and acquisitions (M&A) activity remains robust, with companies like Ball Corporation and Crown Holdings Inc. consolidating their positions through strategic buyouts to expand their product portfolios and geographical reach. The estimated M&A deal volume in the historical period (2019-2024) was approximately XX, indicating significant industry consolidation. Innovation barriers include the high cost of R&D for novel materials and the complexity of retooling existing manufacturing lines.

North America Beverage Packaging Market Growth Trends & Insights

The North America Beverage Packaging Market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This robust expansion is fueled by evolving consumer preferences, an increasing focus on sustainability, and continuous technological advancements in packaging materials and designs. The market size is estimated to reach XX million units by 2033, a significant increase from the XX million units in the base year 2025. Adoption rates for recyclable and biodegradable packaging solutions are rapidly accelerating, driven by heightened environmental consciousness and supportive government policies. For instance, the increasing penetration of rPET bottles for juice and other beverages highlights this trend. Technological disruptions, such as the development of intelligent packaging that monitors product freshness and tamper-evidence, are enhancing product safety and consumer trust. Consumer behavior shifts, including a growing demand for on-the-go consumption and single-serving packages, are driving the adoption of smaller-format bottles, cans, and pouches. The market penetration of sustainable packaging solutions is expected to exceed XX% by 2030. The demand for lightweight yet durable packaging materials, particularly for alcoholic beverages and energy drinks, will continue to be a key growth determinant.

Dominant Regions, Countries, or Segments in North America Beverage Packaging Market

Within the North America Beverage Packaging Market, the United States stands out as the dominant country, driven by its vast consumer base, strong economic performance, and sophisticated beverage industry. This dominance is further amplified by significant investments in packaging innovation and sustainability initiatives. The plastic segment, particularly PET bottles, commands the largest market share, owing to its versatility, cost-effectiveness, and suitability for a wide range of applications, including carbonated soft drinks, bottled water, and fruit juices.

Dominant Segments:

- Material: Plastic accounts for an estimated XX% of the market share due to its lightweight properties, durability, and affordability. Its widespread use in single-serving and larger format beverage containers is a key driver.

- Product Type: Bottles represent the most significant product type, with an estimated XX% market share. This is attributed to their adaptability across nearly all beverage categories, from water and soft drinks to dairy and alcoholic beverages.

- Application Type: Carbonated Soft Drinks & Fruit Beverages continue to be the largest application segment, consuming an estimated XX% of all beverage packaging. The high volume and widespread popularity of these beverages necessitate a robust packaging infrastructure.

Key Drivers in the Dominant Segment (Plastic Bottles for CSD & Fruit Beverages):

- Economic Policies: Favorable trade agreements and domestic manufacturing incentives in the United States bolster the production and consumption of plastic packaging.

- Infrastructure: A well-established recycling infrastructure, though facing continuous improvements, supports the use and end-of-life management of plastic bottles.

- Consumer Preferences: The demand for convenience, portability, and visually appealing packaging for CSDs and fruit juices strongly favors plastic bottles.

- Technological Advancements: Continuous innovation in PET resin technology, leading to lighter, stronger, and more recyclable bottles, further solidifies its position.

The growth potential for plastic packaging remains high, though increasingly influenced by evolving regulations around single-use plastics and a growing consumer preference for sustainable alternatives. The metal segment, particularly aluminum cans, is also witnessing robust growth, driven by its high recyclability and suitability for alcoholic beverages and energy drinks. The paperboard segment is gaining traction, especially in multi-packs and niche beverage categories, driven by its environmental credentials.

North America Beverage Packaging Market Product Landscape

The North America Beverage Packaging Market is witnessing a surge in product innovations focused on sustainability, convenience, and enhanced consumer experience. Lightweighting of plastic bottles and aluminum cans remains a key area of development, reducing material usage and transportation costs. Advancements in barrier technologies for paperboard cartons are extending shelf life for sensitive beverages like milk and juices. The introduction of smart packaging features, such as QR codes for product traceability and augmented reality experiences, is enhancing brand engagement. For example, the innovative pull-tab designs introduced by Crown Holdings, Inc. exemplify the trend towards functional aesthetics.

Key Drivers, Barriers & Challenges in North America Beverage Packaging Market

The North America Beverage Packaging Market is propelled by several key drivers. The increasing global demand for beverages, coupled with evolving consumer preferences for convenience and health-oriented drinks, is a primary economic driver. Technological advancements in materials science, leading to lighter, more durable, and recyclable packaging options like rPET bottles and advanced aluminum cans, are critical technological drivers. Furthermore, supportive government policies promoting recycling and waste reduction are significant policy-driven factors. The demand for sustainable packaging solutions, driven by consumer awareness and corporate social responsibility, is a powerful catalyst.

However, the market faces significant challenges and restraints. The rising cost of raw materials, particularly virgin plastic resins, poses an economic restraint. Stringent regulatory frameworks regarding the use of certain materials and packaging waste can create compliance hurdles. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, impact production and distribution timelines. Intense competition among packaging manufacturers, leading to price pressures, also presents a challenge. The environmental impact of single-use packaging and consumer demand for more sustainable alternatives continue to exert pressure on traditional packaging formats.

Emerging Opportunities in North America Beverage Packaging Market

Emerging opportunities in the North America Beverage Packaging Market are largely centered around sustainability and innovation. The growing demand for biodegradable and compostable packaging presents a significant untapped market, particularly for niche beverage segments. Innovative applications of recycled materials, such as closed-loop recycling initiatives for glass bottles and advanced chemical recycling for plastics, offer substantial growth potential. Evolving consumer preferences for personalized and functional packaging, including smart features for traceability and enhanced consumer engagement, also represent emerging avenues. The expansion of the plant-based beverage market is creating new demands for specialized packaging solutions that align with their natural and sustainable branding. The development of reusable packaging systems is another promising area, driven by a circular economy approach.

Growth Accelerators in the North America Beverage Packaging Market Industry

Several factors are accelerating long-term growth in the North America Beverage Packaging Market. Breakthroughs in material science, leading to the development of novel, sustainable, and high-performance packaging materials, are critical. Strategic partnerships between packaging manufacturers, beverage brands, and technology providers are fostering innovation and market penetration. For instance, collaborations focused on developing advanced recycling technologies for plastic bottles and aluminum cans are crucial. Market expansion strategies, including targeting emerging demographics and expanding into new beverage categories, will drive sustained growth. The increasing adoption of automation and digitalization in packaging manufacturing processes is enhancing efficiency and reducing costs, further fueling expansion. Investments in research and development for sustainable packaging solutions will continue to be a significant growth accelerator.

Key Players Shaping the North America Beverage Packaging Market Market

- Ball Corporation

- Saint Gobain S A

- Westrock Company

- Tetra Laval International S A

- Crown Holdings Inc

- Owens Illinois Inc

- Mondi Group

- Graham Packaging Company

- Reynolds Group Holdings Limited

- Amcor Limited

- Berry Global Inc

- Alcoa Inc

- Rexam PLC

Notable Milestones in North America Beverage Packaging Market Sector

- June 2021: Crown Holdings, Inc. expanded its functional pull-tab offerings to include options with enhanced visual appeal, such as brightly colored or laser-etched tabs, reinforcing brand identity and premium product perception.

- April 2021: Lassonde, a North American food and beverage company, launched juice bottles made from 25% post-consumer food-grade recycled polyethylene terephthalate (rPET) resin for its 300ml juice packages in Canada.

In-Depth North America Beverage Packaging Market Market Outlook

The future outlook for the North America Beverage Packaging Market is exceptionally promising, driven by an unwavering commitment to sustainability and continuous technological evolution. Growth accelerators such as the increasing demand for recycled content in plastic bottles and aluminum cans, coupled with the development of biodegradable alternatives, will shape market trajectory. Strategic partnerships aimed at advancing circular economy principles and investments in innovative packaging designs for energy drinks and alcoholic beverages will further propel market expansion. The market is poised to witness significant growth, offering lucrative opportunities for stakeholders focused on eco-friendly and consumer-centric packaging solutions. The continued emphasis on lightweighting and enhanced functionality will remain paramount.

North America Beverage Packaging Market Segmentation

-

1. Material

- 1.1. Glass

- 1.2. Plastic

- 1.3. Paperboard

- 1.4. Metal

-

2. Product Type

- 2.1. Cans

- 2.2. Bottles

- 2.3. Pouches

- 2.4. Cartons

- 2.5. Other Product Types

-

3. Application Type

- 3.1. Carbonated Soft Drinks & Fruit Beverages

- 3.2. Alcoholic (Beer, Wine & Distilled Spirits)

- 3.3. Bottled Water

- 3.4. Milk

- 3.5. Energy & Sport Drinks

- 3.6. Other Applications

North America Beverage Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Beverage Packaging Market Regional Market Share

Geographic Coverage of North America Beverage Packaging Market

North America Beverage Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing e-commerce industry

- 3.3. Market Restrains

- 3.3.1. Environmental concerns against plastic

- 3.4. Market Trends

- 3.4.1. E-commerce is Expected to Drive the Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Beverage Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Glass

- 5.1.2. Plastic

- 5.1.3. Paperboard

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Cans

- 5.2.2. Bottles

- 5.2.3. Pouches

- 5.2.4. Cartons

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Carbonated Soft Drinks & Fruit Beverages

- 5.3.2. Alcoholic (Beer, Wine & Distilled Spirits)

- 5.3.3. Bottled Water

- 5.3.4. Milk

- 5.3.5. Energy & Sport Drinks

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ball Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint Gobain S A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Westrock Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tetra Laval International S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Crown Holdings Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Owens Illinois Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Graham Packaging Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Reynolds Group Holdings Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Berry Global Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Alcoa Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Rexam PLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Ball Corporation*List Not Exhaustive

List of Figures

- Figure 1: North America Beverage Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Beverage Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Beverage Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: North America Beverage Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: North America Beverage Packaging Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 4: North America Beverage Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Beverage Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 6: North America Beverage Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: North America Beverage Packaging Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 8: North America Beverage Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Beverage Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Beverage Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Beverage Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Beverage Packaging Market?

The projected CAGR is approximately 5.05%.

2. Which companies are prominent players in the North America Beverage Packaging Market?

Key companies in the market include Ball Corporation*List Not Exhaustive, Saint Gobain S A, Westrock Company, Tetra Laval International S A, Crown Holdings Inc, Owens Illinois Inc, Mondi Group, Graham Packaging Company, Reynolds Group Holdings Limited, Amcor Limited, Berry Global Inc, Alcoa Inc, Rexam PLC.

3. What are the main segments of the North America Beverage Packaging Market?

The market segments include Material, Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 168.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing e-commerce industry.

6. What are the notable trends driving market growth?

E-commerce is Expected to Drive the Market Share.

7. Are there any restraints impacting market growth?

Environmental concerns against plastic.

8. Can you provide examples of recent developments in the market?

June 2021 - Crown Holdings, Inc. expanded from the functional pull-tab-the first easy-open beverage to include options that offer a source of extra flair. For example, brightly colored tabs can create a striking appearance and reinforce brand identity from all angles. In contrast, cut-out or laser-etch tabs can spotlight brand logos or imagery and lend a premium feel to products. These subtle yet thoughtful touches demonstrate attention to detail and quality as core brand values.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Beverage Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Beverage Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Beverage Packaging Market?

To stay informed about further developments, trends, and reports in the North America Beverage Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence