Key Insights

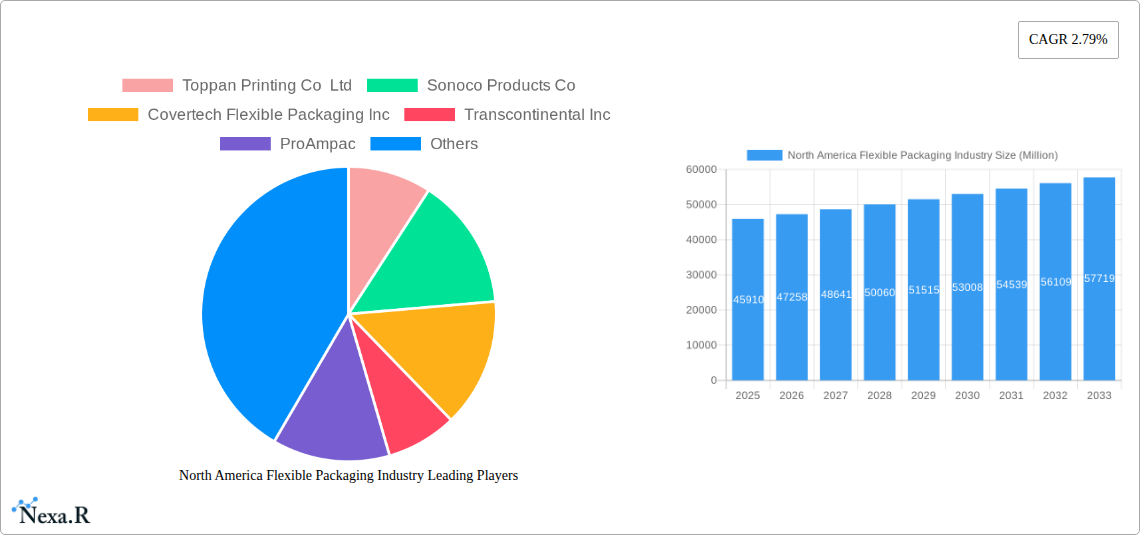

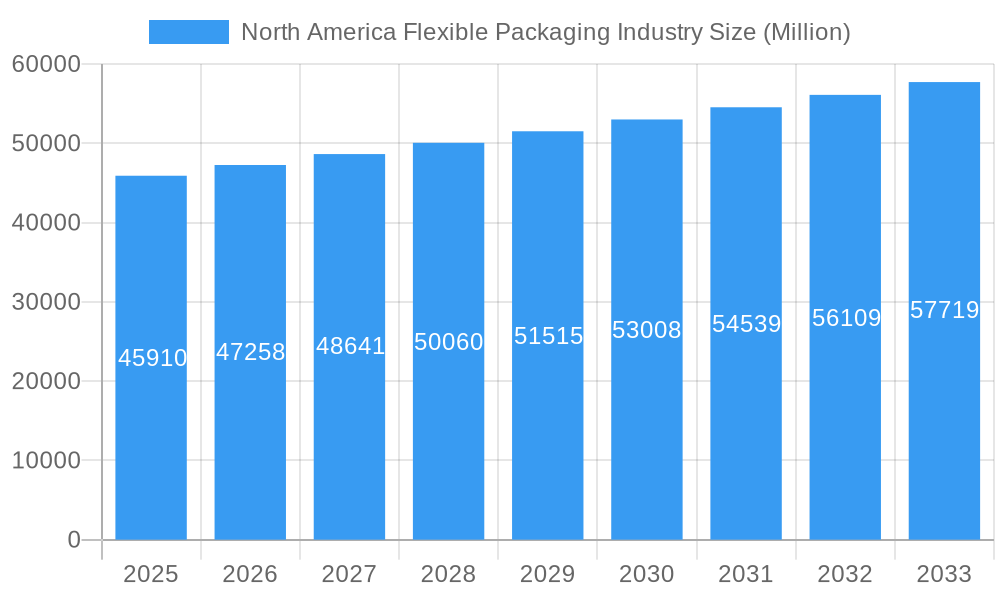

The North American flexible packaging market, valued at $45.91 billion in 2025, is projected to experience steady growth, driven by escalating demand across diverse end-use sectors like food, beverages, and personal care. The compound annual growth rate (CAGR) of 2.79% from 2025 to 2033 indicates a consistent, albeit moderate, expansion. This growth is fueled by several key factors. The rising popularity of convenient, ready-to-eat meals and single-serve portions directly boosts the demand for flexible packaging solutions. Furthermore, the increasing focus on sustainable and eco-friendly packaging options is influencing material selection, with a gradual shift towards biodegradable and recyclable alternatives like paper and bioplastics, despite plastics continuing to dominate market share. E-commerce growth also contributes significantly, necessitating robust and protective packaging for efficient shipping and handling. Geographic segmentation reveals strong performance within the United States and Canada, the two major contributors to the overall market size. Competitive dynamics are shaped by a mix of large multinational corporations and smaller regional players, constantly innovating to meet evolving consumer preferences and regulatory compliance requirements. Product diversification, including pouches, bags, films, and wraps, further caters to specific application needs.

North America Flexible Packaging Industry Market Size (In Billion)

However, challenges exist. Fluctuating raw material prices, especially for plastics, pose a significant concern for manufacturers, potentially impacting profitability and pricing strategies. Stringent environmental regulations regarding plastic waste management necessitate continuous investment in sustainable packaging technologies and waste reduction initiatives. Furthermore, consumer perception regarding the environmental impact of flexible packaging materials plays a key role in shaping market trends, placing pressure on manufacturers to adopt more environmentally conscious practices and transparent labeling. Despite these headwinds, the overall outlook for the North American flexible packaging industry remains positive, driven by strong end-user demand, ongoing product innovation, and the strategic adaptation to sustainability concerns. The market's continued evolution will be characterized by a balanced approach to growth, addressing both consumer needs and environmental responsibilities.

North America Flexible Packaging Industry Company Market Share

North America Flexible Packaging Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America flexible packaging industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. The market is segmented by country (United States, Canada), material type (Plastics, Paper, Aluminium Foil, Other Types (PVC, PA)), product type (Pouches, Bags, Films and Wraps, Other Product Types), and end-user industry (Food, Beverages, Household and Personal Care, Other End User Industries). The total market size is projected to reach xx Million units by 2033.

North America Flexible Packaging Industry Market Dynamics & Structure

The North American flexible packaging market is characterized by a dynamic landscape, exhibiting moderate concentration with a blend of influential multinational corporations and agile regional players. This market is significantly propelled by relentless technological innovation, largely spurred by a growing imperative for sustainability and the ever-evolving demands of discerning consumers. A robust framework of stringent regulations, particularly concerning food safety standards and environmental stewardship, profoundly shapes industry practices and operational strategies. The market's trajectory is also influenced by intense competitive pressures, not only from within the flexible packaging sector but also from alternative packaging formats. Furthermore, the accelerating adoption of eco-conscious and sustainable solutions is a pivotal force reshaping market dynamics. Mergers and acquisitions (M&A) remain a prevalent strategy, as established entities aim to fortify their market positions, expand their geographical reach, and diversify their product portfolios.

- Market Concentration: Moderately concentrated, with a few leading players commanding a significant market share (estimated at [Insert Percentage Here, e.g., 60-70%]).

- Technological Innovation: A strong emphasis on developing and implementing advanced sustainable materials, including high-performance recycled content, compostable, and biodegradable options. Innovations also focus on enhancing barrier properties for extended shelf life and superior product protection, alongside advancements in high-fidelity printing and customization capabilities.

- Regulatory Framework: Continually evolving and stringent regulations governing food contact safety, material composition (including minimum recycled content mandates), waste management, and recyclability standards.

- Competitive Substitutes: Ongoing competition from rigid packaging solutions (e.g., glass, metal, rigid plastics) and the emergence of novel, sustainable alternative materials.

- End-User Demographics: Rapidly shifting consumer preferences towards convenience, on-the-go solutions, a strong desire for sustainable and ethically sourced products, and heightened expectations for product freshness and extended shelf life.

- M&A Trends: Active consolidation through strategic acquisitions and mergers, aiming to achieve economies of scale, enhance innovation capabilities, expand product offerings, and secure broader market access (reportedly [Insert Number Here, e.g., 15-20] significant deals in the last 5 years).

North America Flexible Packaging Industry Growth Trends & Insights

The North American flexible packaging market has witnessed consistent growth throughout the historical period (2019-2024), driven by factors such as increasing demand from the food and beverage sector, rising consumer preference for convenient packaging formats, and the adoption of sustainable packaging solutions. The market is expected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Technological advancements, such as the introduction of innovative materials and improved printing technologies, are further accelerating market growth. However, factors such as fluctuations in raw material prices and environmental regulations may pose challenges to sustained expansion.

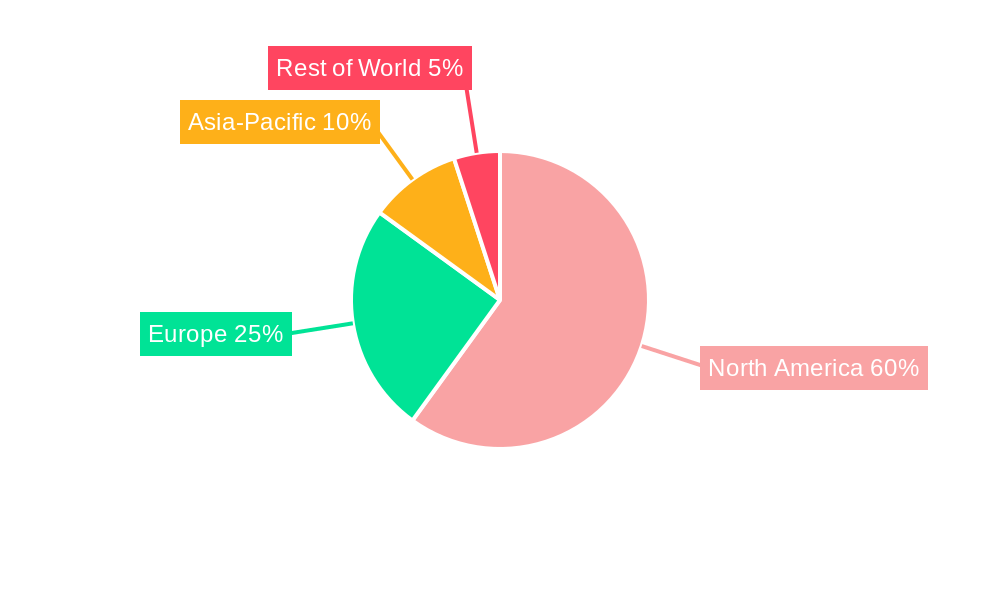

Dominant Regions, Countries, or Segments in North America Flexible Packaging Industry

The United States dominates the North American flexible packaging market, accounting for the largest market share (xx%) due to its large consumer base, robust food and beverage industry, and advanced packaging infrastructure. The plastics segment holds the largest market share (xx%) among material types, followed by paper and aluminum foil. The pouches segment dominates product types, while the food and beverage industry is the largest end-user segment.

- United States: Large consumer base, developed infrastructure, and strong food & beverage sector drive market dominance.

- Canada: Growing market with potential for future expansion, influenced by increasing consumer demand and government initiatives promoting sustainable packaging.

- Plastics: High demand due to versatility, cost-effectiveness, and barrier properties.

- Food & Beverage: Largest end-user segment due to high packaging requirements.

- Pouches: Convenient and cost-effective packaging format driving segment growth.

North America Flexible Packaging Industry Product Landscape

The North American flexible packaging landscape features a wide range of products, including pouches, bags, films, and wraps, each tailored to specific end-use applications. Recent innovations focus on enhanced barrier properties for extended shelf life, improved recyclability, and sustainable material composition. Manufacturers are increasingly incorporating features like resealable closures, tamper-evident seals, and customized printing options to meet consumer demands. Unique selling propositions often include improved sustainability, enhanced convenience, and superior product protection.

Key Drivers, Barriers & Challenges in North America Flexible Packaging Industry

Key Drivers: The robust growth of the food and beverage sector remains a primary driver, complemented by a surging consumer demand for convenient and portable packaging solutions. Significant advancements in the development and application of sustainable packaging materials, coupled with supportive government policies and initiatives that champion environmentally friendly packaging alternatives, are further propelling market expansion.

Key Challenges: Volatility in raw material prices, including petrochemicals and resins, presents a consistent challenge. Stringent and evolving environmental regulations, coupled with intense price competition among manufacturers, put pressure on profit margins. Furthermore, persistent supply chain disruptions, exacerbated by global events, can impact production schedules and delivery timelines, potentially hindering overall market growth by an estimated [Insert Percentage Here, e.g., 2-5%] in certain periods.

Emerging Opportunities in North America Flexible Packaging Industry

The North American flexible packaging market is brimming with opportunities. A significant avenue lies in the development and widespread adoption of truly circular and sustainable packaging solutions, including advanced recycling technologies and bio-based materials. Innovations in high-performance, specialized packaging tailored for the burgeoning e-commerce sector, ensuring product protection and shelf appeal during transit, represent another key growth area. Furthermore, the increasing demand for personalized and on-demand packaging, catering to specific consumer needs and brand messaging, offers substantial potential. Untapped market segments within emerging industries and strategic regional expansion also present considerable growth prospects.

Growth Accelerators in the North America Flexible Packaging Industry Industry

Strategic alliances and collaborative ventures focused on pioneering sustainable innovations, such as novel material science and enhanced recyclability, are potent growth accelerators. Significant investments in advanced manufacturing technologies, including automation and digital printing, are optimizing efficiency and enabling greater customization. Expansion into underserved market segments and geographic regions, coupled with a dedicated focus on developing bespoke and value-added packaging solutions that meet specific client requirements, are poised to drive substantial market expansion.

Key Players Shaping the North America Flexible Packaging Industry Market

- Toppan Printing Co Ltd

- Sonoco Products Co

- Covertech Flexible Packaging Inc

- Transcontinental Inc

- ProAmpac

- American Packaging Corporation

- Cascades Flexible Packaging

- St Johns Packaging

- Emmerson Packaging

- Amcor PLC

- Novolex Holdings Inc

- Mondi PLC

- Sealed Air Corp

- Constantia Flexibles

- Tetra Pak International SA

- Berry Global Inc

- Printpack Inc

- Winpak Limited

- Sigma Plastics Group Inc

- Sit Group SpA

Notable Milestones in North America Flexible Packaging Industry Sector

- December 2022: Amcor PLC's strategic, multi-year contract with ExxonMobil for certified-circular polyethylene marked a significant commitment to advancing sustainable packaging. This collaboration underscores a strong push towards increased utilization of recycled content and the broader adoption of circular economy principles within the industry.

- October 2022: The joint initiative by Berry Global and Printpack to launch the Preserve PE PCR (Post-Consumer Recycled) recyclable pouch highlighted a collaborative effort in sustainable packaging innovation. This launch demonstrated a tangible commitment to developing and commercializing high-performance packaging solutions that effectively integrate recycled materials, addressing market demand for eco-friendly options.

In-Depth North America Flexible Packaging Industry Market Outlook

The North American flexible packaging market exhibits promising growth potential driven by technological advancements, increasing demand for sustainable alternatives, and the expansion of e-commerce. Strategic partnerships, focused on innovation and sustainability, will play a vital role in shaping the market's trajectory. Companies that prioritize sustainable materials and solutions are expected to gain a competitive edge. The focus will continue to be on enhancing packaging performance, reducing environmental impact, and improving supply chain efficiency.

North America Flexible Packaging Industry Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Bi-orientated Polypropylene (BOPP)

- 1.1.3. Cast Polypropylene (CPP)

- 1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 1.1.5. Other Types (PVC, PA, Bioplastics)

- 1.2. Paper

- 1.3. Aluminium Foil

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Frozen & Chilled Food

- 3.1.2. Meat, Poultry & Fish

- 3.1.3. Fruits & Vegetables

- 3.1.4. Bakery & Confectionary

- 3.1.5. Dried & Ready Meals

- 3.1.6. Pet Food

- 3.1.7. Other Food Products

- 3.2. Beverages

- 3.3. Tobacco

- 3.4. Cosmetics & Personal Care

- 3.5. Other End-user Industries

-

3.1. Food

North America Flexible Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Flexible Packaging Industry Regional Market Share

Geographic Coverage of North America Flexible Packaging Industry

North America Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding the Environment and Recycling

- 3.4. Market Trends

- 3.4.1. The Increased Demand for Convenient Packaging to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Bi-orientated Polypropylene (BOPP)

- 5.1.1.3. Cast Polypropylene (CPP)

- 5.1.1.4. Ethylene Vinyl Alcohol (EVOH)

- 5.1.1.5. Other Types (PVC, PA, Bioplastics)

- 5.1.2. Paper

- 5.1.3. Aluminium Foil

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Frozen & Chilled Food

- 5.3.1.2. Meat, Poultry & Fish

- 5.3.1.3. Fruits & Vegetables

- 5.3.1.4. Bakery & Confectionary

- 5.3.1.5. Dried & Ready Meals

- 5.3.1.6. Pet Food

- 5.3.1.7. Other Food Products

- 5.3.2. Beverages

- 5.3.3. Tobacco

- 5.3.4. Cosmetics & Personal Care

- 5.3.5. Other End-user Industries

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toppan Printing Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Covertech Flexible Packaging Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Transcontinental Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ProAmpac

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Packaging Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cascades Flexible Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Johns Packaging*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emmerson Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Novolex Holdings Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mondi PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Sealed Air Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Constantia Flexibles

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tetra Pak International SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Berry Global Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Printpack Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Winpak Limited

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Sigma Plastics Group Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Sit Group SpA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Toppan Printing Co Ltd

List of Figures

- Figure 1: North America Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: North America Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: North America Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Flexible Packaging Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: North America Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexible Packaging Industry?

The projected CAGR is approximately 2.79%.

2. Which companies are prominent players in the North America Flexible Packaging Industry?

Key companies in the market include Toppan Printing Co Ltd, Sonoco Products Co, Covertech Flexible Packaging Inc, Transcontinental Inc, ProAmpac, American Packaging Corporation, Cascades Flexible Packaging, St Johns Packaging*List Not Exhaustive, Emmerson Packaging, Amcor PLC, Novolex Holdings Inc, Mondi PLC, Sealed Air Corp, Constantia Flexibles, Tetra Pak International SA, Berry Global Inc, Printpack Inc, Winpak Limited, Sigma Plastics Group Inc, Sit Group SpA.

3. What are the main segments of the North America Flexible Packaging Industry?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 45.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

The Increased Demand for Convenient Packaging to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Concerns Regarding the Environment and Recycling.

8. Can you provide examples of recent developments in the market?

December 2022: Amcor PLC, a global leader in developing and producing packaging solutions, has announced a five-year contract with ExxonMobil to purchase certified-circular polyethylene material in support of its target to achieve 30% recycled material across its portfolio by 2030. Amcor plans to leverage this material across its global portfolio, focusing on the healthcare and food industries, which are needed to meet stringent safety requirements for recycled plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence