Key Insights

The North American flexographic printing market is poised for significant expansion, propelled by escalating demand for flexible packaging solutions across key industries such as food & beverage, pharmaceuticals, and consumer goods. With a projected Compound Annual Growth Rate (CAGR) of 0.5%, the market is anticipated to reach 86.6 billion by 2025. Key growth drivers include the rising adoption of sustainable packaging, the increasing demand for premium print quality to elevate brand appeal, and continuous technological advancements in flexographic equipment that enhance efficiency and output quality. Major market segments encompass flexible packaging, labels, and folding cartons, with both wide-web and narrow-web equipment categories demonstrating robust growth in response to evolving packaging format requirements.

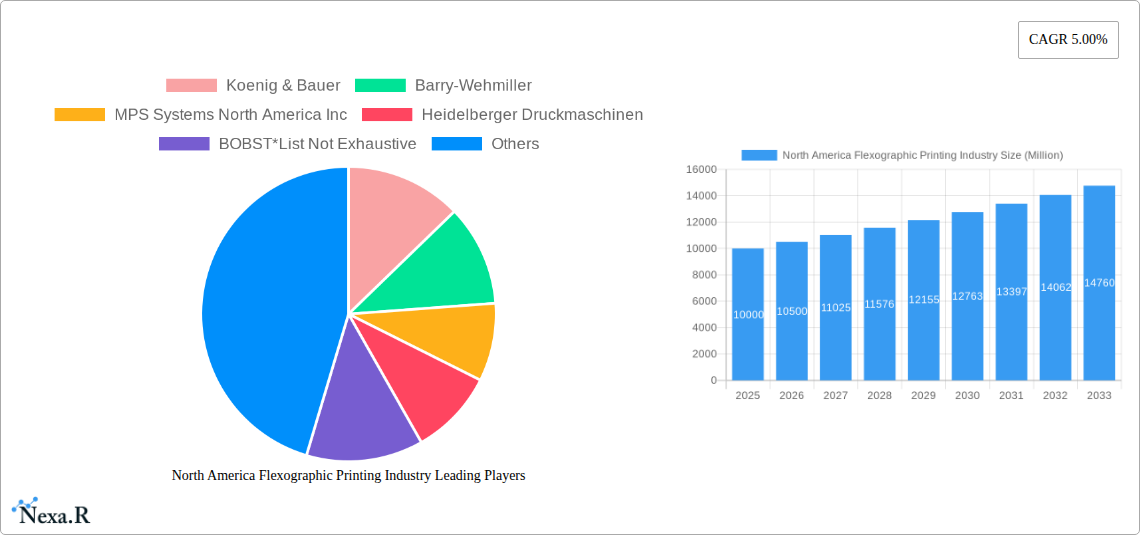

North America Flexographic Printing Industry Market Size (In Billion)

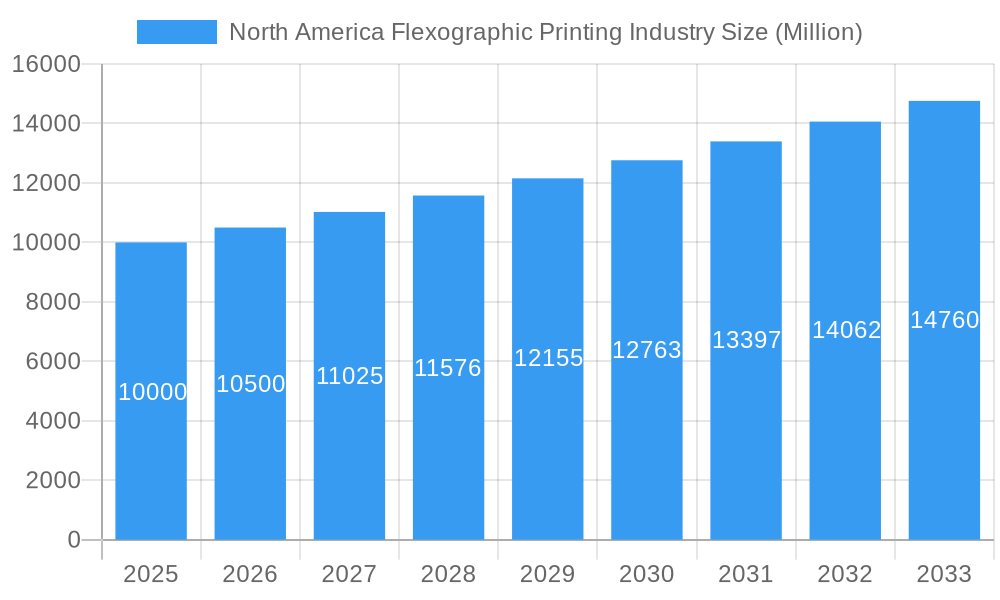

The competitive environment features a mix of established multinational corporations and specialized niche providers. Leading companies are actively investing in innovation and portfolio expansion to secure market dominance. Emerging players are also contributing to market dynamism through increased research and development, fostering advancements in speed, precision, and cost-effectiveness of flexographic printing processes. North America's strong economic foundation and substantial consumer market underpin its leadership position in the flexographic printing sector. An ongoing emphasis on aesthetic and functional packaging enhancements will continue to stimulate demand for high-quality flexographic printing services, reinforcing North America's prominence in the global market throughout the forecast period.

North America Flexographic Printing Industry Company Market Share

North America Flexographic Printing Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the North American flexographic printing industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis and expert insights to deliver actionable intelligence. The total market value is estimated at xx Million in 2025.

North America Flexographic Printing Industry Market Dynamics & Structure

This section delves into the intricate structure of the North American flexographic printing market, analyzing market concentration, technological advancements, regulatory landscapes, competitive substitutes, end-user demographics, and merger & acquisition (M&A) activities. The analysis incorporates both quantitative data (market share, M&A deal volume) and qualitative factors (innovation barriers).

- Market Concentration: The North American flexographic printing market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The top five players account for approximately xx% of the market in 2025.

- Technological Innovation: Advancements in digital printing technologies, automation, and sustainable inks are major drivers of innovation. However, high implementation costs and the need for skilled labor present significant barriers to entry for smaller players.

- Regulatory Framework: Environmental regulations concerning ink composition and waste management significantly influence industry practices. Compliance costs represent a notable operating expense for companies.

- Competitive Substitutes: Other printing methods, such as gravure and digital printing, compete for market share, particularly in specific segments. The choice between methods often depends on factors such as print quality, run length, and cost considerations.

- End-User Demographics: The primary end-users are diverse, encompassing sectors like flexible packaging, labels, and corrugated packaging. Market growth is strongly correlated with the growth of the consumer goods sector.

- M&A Trends: The industry has seen a moderate level of consolidation in recent years, with xx M&A deals recorded between 2019 and 2024. This trend is expected to continue, driven by the pursuit of economies of scale and technological synergies.

North America Flexographic Printing Industry Growth Trends & Insights

This section provides a detailed analysis of the North American flexographic printing market's growth trajectory, incorporating insights into market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior.

The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for flexible packaging, driven by factors such as rising e-commerce and convenience food consumption. Technological advancements, such as the adoption of high-definition flexography (HD Flexo), and the rise of sustainable inks are further bolstering market expansion. Changes in consumer preferences, favoring eco-friendly packaging solutions and personalized branding are creating opportunities for growth. Market penetration of HD Flexo technology is expected to reach xx% by 2033.

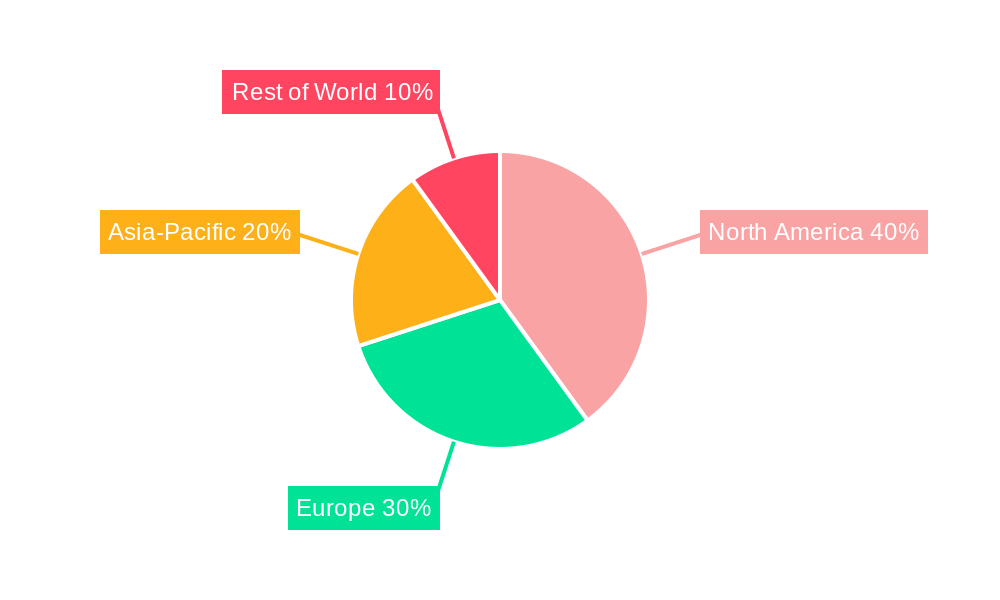

Dominant Regions, Countries, or Segments in North America Flexographic Printing Industry

This section identifies the leading regions, countries, and segments within the North American flexographic printing market driving market growth.

- Leading Segments: Flexible packaging continues to be the dominant segment, projected to capture approximately 65-70% of the total market value by 2028, with labels following closely at 20-25%. Within the equipment sector, wide-web presses are expected to maintain their leadership due to their unparalleled efficiency in high-volume, high-quality printing applications.

-

Key Drivers by Segment:

- Flexible Packaging: This segment's growth is intrinsically linked to the robust expansion of the food and beverage industry, consumer demand for convenience, and the need for innovative, shelf-appealing packaging.

- Labels: The increasing demand from the consumer goods, pharmaceutical, and nutraceutical industries, coupled with the rise of product differentiation and regulatory compliance requirements, are fueling growth in the label segment.

- Wide-Web Equipment: The continuous drive for higher productivity, improved print consistency, and reduced operational costs across various packaging formats solidifies the dominance of wide-web presses.

- Regional Dominance: The Midwest and Northeast regions of the United States are anticipated to retain their dominant positions. This is largely attributed to their established manufacturing infrastructure, a high concentration of major consumer goods companies, and a well-developed supply chain supporting the flexographic printing ecosystem.

North America Flexographic Printing Industry Product Landscape

The North American flexographic printing industry is characterized by a relentless pursuit of product innovation, with a sharp focus on elevating print quality, enhancing production speeds, and championing sustainability. Significant technological advancements, including the widespread adoption of energy-efficient UV-LED curing systems and the continuous refinement of anilox roll technologies, are instrumental in achieving superior print accuracy and substantially reducing material waste. Key features defining the current and future product landscape include advanced high-definition printing capabilities, sophisticated automated plate mounting systems, and seamlessly integrated color management tools. These innovations collectively deliver exceptional print quality, drive significant increases in production efficiency, and demonstrably reduce the environmental footprint, thereby amplifying the overall value proposition for end-users and stakeholders.

Key Drivers, Barriers & Challenges in North America Flexographic Printing Industry

Key Drivers:

- Increasing demand for flexible packaging and labels, fueled by growth in consumer goods and e-commerce sectors.

- Technological advancements offering enhanced print quality, speed, and sustainability.

- Growing adoption of eco-friendly inks and materials.

Key Challenges & Restraints:

- Rising raw material costs and fluctuating energy prices impacting profitability.

- Intense competition from alternative printing technologies like digital printing.

- Stringent environmental regulations requiring investment in compliance measures. This contributes to approximately xx million dollars of additional annual operating costs for the industry in 2025.

Emerging Opportunities in North America Flexographic Printing Industry

The North American flexographic printing industry is witnessing the emergence of compelling opportunities across several key areas. Sustainable packaging solutions, driven by consumer preference and regulatory mandates, represent a significant growth avenue. The demand for personalized and variable data printing is expanding, opening doors for innovative applications. Furthermore, the industry is exploring new frontiers, including advanced security printing solutions for brand protection and the integration of flexography in the production of flexible electronics. The synergistic adoption of digital printing technologies alongside advancements in eco-friendly ink formulations presents lucrative prospects for market expansion and differentiation. The burgeoning e-commerce sector and the escalating consumer desire for highly customized and engaging packaging solutions are powerful catalysts for these emerging opportunities.

Growth Accelerators in the North America Flexographic Printing Industry Industry

Long-term growth within the North American flexographic printing industry will be significantly propelled by ongoing technological breakthroughs in high-definition flexography, enabling finer details and enhanced visual appeal. The widespread adoption of Industry 4.0 principles, fostering greater automation, real-time data analytics, and predictive maintenance, will optimize operational efficiency and reduce downtime. Strategic partnerships and collaborations among stakeholders, aimed at co-developing cutting-edge solutions and expanding market reach, will be crucial. Furthermore, proactive expansion into underserved geographical markets and the exploration of novel applications beyond traditional packaging will unlock new revenue streams. A steadfast commitment to sustainability, including the development of recyclable and compostable materials and the reduction of energy consumption and waste, will be a pivotal factor in driving market expansion and enhancing brand reputation.

Key Players Shaping the North America Flexographic Printing Industry Market

Notable Milestones in North America Flexographic Printing Industry Sector

- 2020: Introduction of a new generation of UV-LED curing systems by several key players, resulting in faster curing times and reduced energy consumption.

- 2022: Significant investment in automation technologies, including robotic systems for plate mounting and cleaning.

- 2023: Launch of several sustainable ink formulations with lower VOCs and improved recyclability.

In-Depth North America Flexographic Printing Industry Market Outlook

The North American flexographic printing industry is strategically positioned for substantial and sustained growth over the next decade. This positive outlook is underpinned by a potent combination of relentless technological innovation, a rapidly increasing demand for environmentally responsible packaging solutions, and the strategic expansion into diverse new application areas. Key success factors for companies aiming to capitalize on this burgeoning market potential will include the formation of strategic alliances, significant investments in advanced automation technologies, and an unwavering commitment to minimizing environmental impact. The market is projected to reach an estimated value of $XX Billion by 2033, signifying substantial opportunities for strategic investment, capacity expansion, and the development of next-generation flexographic printing solutions.

North America Flexographic Printing Industry Segmentation

-

1. Equipment

- 1.1. Narrow Web

- 1.2. Wide Web

- 1.3. Sheetfed

- 1.4. Other Equipment

-

2. Application

- 2.1. Flexible Packaging

- 2.2. Bags and Sacks

- 2.3. Labels

- 2.4. Folding Cartons

- 2.5. Corrugated packaging

- 2.6. Other Applications

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

-

3.1. North America

North America Flexographic Printing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America Flexographic Printing Industry Regional Market Share

Geographic Coverage of North America Flexographic Printing Industry

North America Flexographic Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Development of Advanced Equipment that Offer Shorter Turnaround Time with Greater Accuracy; Rapid Growth of Consumer Goods

- 3.3. Market Restrains

- 3.3.1. ; Offset Printing can Hinder the Growth of Flexographic Printing

- 3.4. Market Trends

- 3.4.1. Flexible Packaging is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Narrow Web

- 5.1.2. Wide Web

- 5.1.3. Sheetfed

- 5.1.4. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Flexible Packaging

- 5.2.2. Bags and Sacks

- 5.2.3. Labels

- 5.2.4. Folding Cartons

- 5.2.5. Corrugated packaging

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koenig & Bauer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Barry-Wehmiller

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MPS Systems North America Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heidelberger Druckmaschinen

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BOBST*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Uteco North America

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mark Andy

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flint Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Koenig & Bauer

List of Figures

- Figure 1: North America Flexographic Printing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Flexographic Printing Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Flexographic Printing Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 2: North America Flexographic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Flexographic Printing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Flexographic Printing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Flexographic Printing Industry Revenue billion Forecast, by Equipment 2020 & 2033

- Table 6: North America Flexographic Printing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Flexographic Printing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Flexographic Printing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Flexographic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Flexographic Printing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flexographic Printing Industry?

The projected CAGR is approximately 0.5%.

2. Which companies are prominent players in the North America Flexographic Printing Industry?

Key companies in the market include Koenig & Bauer, Barry-Wehmiller, MPS Systems North America Inc, Heidelberger Druckmaschinen, BOBST*List Not Exhaustive, Uteco North America, Mark Andy, Flint Group.

3. What are the main segments of the North America Flexographic Printing Industry?

The market segments include Equipment, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 86.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Development of Advanced Equipment that Offer Shorter Turnaround Time with Greater Accuracy; Rapid Growth of Consumer Goods.

6. What are the notable trends driving market growth?

Flexible Packaging is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; Offset Printing can Hinder the Growth of Flexographic Printing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flexographic Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flexographic Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flexographic Printing Industry?

To stay informed about further developments, trends, and reports in the North America Flexographic Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence