Key Insights

The North America rigid plastic packaging market is projected to reach $15.51 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.13%. Growth is propelled by strong demand from the food & beverage, healthcare, and cosmetics & personal care sectors, driven by needs for convenience, shelf-stability, sterility, and aesthetic appeal. Innovations in material science are introducing lighter, more sustainable, and recyclable options, aligning with environmental concerns and regulatory trends. Key challenges include raw material price volatility and competition from alternative packaging materials. The market segmentation includes product type, material, end-user industry, and geography, with the United States leading market share, followed by Canada, and promising growth in Mexico.

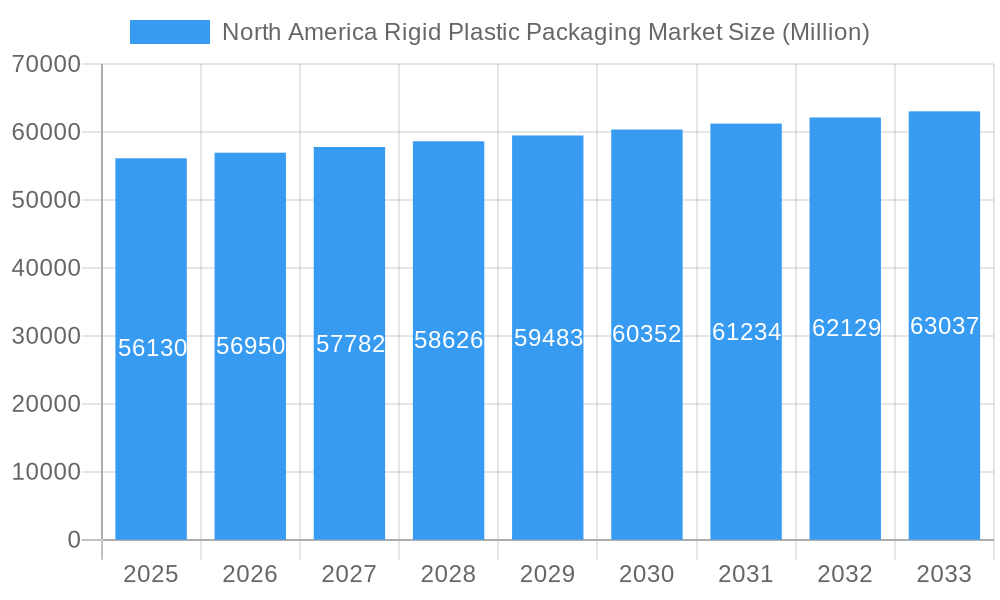

North America Rigid Plastic Packaging Market Market Size (In Million)

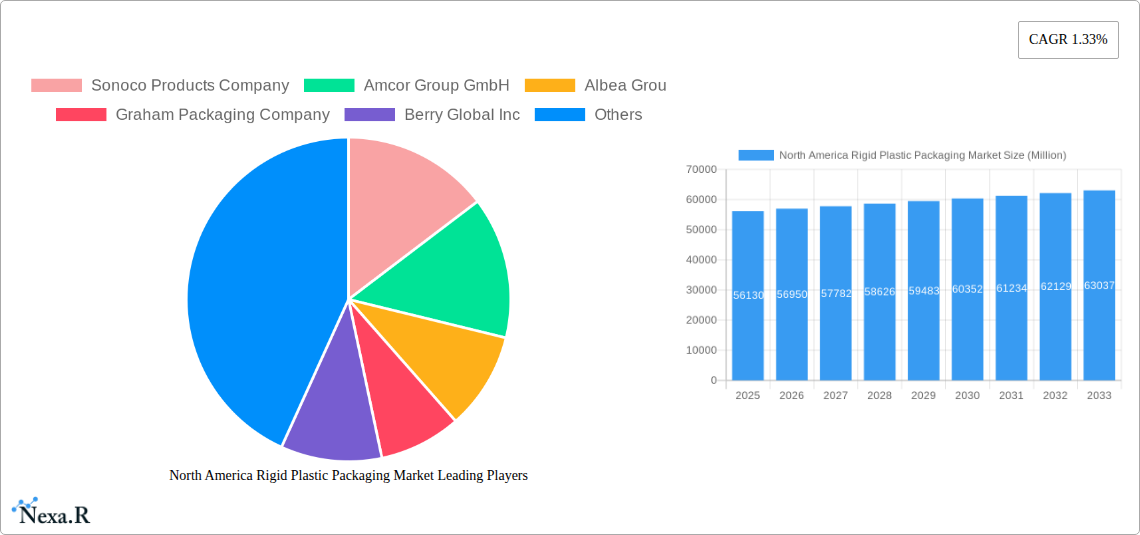

The competitive landscape features established multinational corporations and agile specialized firms. Leading companies such as Sonoco Products Company, Amcor, Berry Global, and Silgan Holdings Inc. dominate through manufacturing scale, distribution strength, and innovation. Smaller entities are focusing on niche markets and sustainable solutions. Future growth will be shaped by advancements in recyclability, bio-based plastics, and supportive regulations. Sustained demand, coupled with material and manufacturing innovations, will support steady market expansion throughout the forecast period. Adaptability to evolving consumer preferences and regulatory frameworks is critical for sustained success.

North America Rigid Plastic Packaging Market Company Market Share

North America Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America rigid plastic packaging market, encompassing market dynamics, growth trends, dominant segments, and key players. With a focus on the parent market (Packaging) and child market (Rigid Plastic Packaging), this report offers crucial insights for industry professionals, investors, and strategists seeking to navigate this dynamic landscape. The study period spans 2019-2033, with 2025 serving as the base and estimated year.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

North America Rigid Plastic Packaging Market Dynamics & Structure

The North American rigid plastic packaging market is characterized by a moderately consolidated structure, with key players like Sonoco Products Company, Amcor Group GmbH, Berry Global Inc., and Silgan Holdings Inc. holding significant market share. Market concentration is expected to remain relatively stable over the forecast period, although strategic mergers and acquisitions (M&A) will continue to reshape the competitive landscape. The market is driven by technological innovations in materials science (e.g., lighter-weight plastics, improved barrier properties) and sustainable packaging solutions. Stringent regulatory frameworks concerning plastic waste management and recyclability present both challenges and opportunities. Competition from alternative packaging materials (e.g., paperboard, glass, aluminum) necessitates continuous innovation and differentiation. End-user demographics, particularly the rise of e-commerce and changing consumer preferences towards convenience and sustainability, significantly influence market demand.

- Market Concentration: Moderately Consolidated (xx%)

- M&A Deal Volume (2019-2024): xx deals

- Key Innovation Drivers: Lightweighting, Barrier Improvement, Sustainability

- Regulatory Impact: Increasingly stringent regulations on plastic waste.

- Competitive Substitutes: Paperboard, Glass, Aluminum

North America Rigid Plastic Packaging Market Growth Trends & Insights

The North America rigid plastic packaging market experienced robust growth during the historical period (2019-2024), driven primarily by the expansion of the food and beverage, healthcare, and cosmetics and personal care industries. Market size is estimated at xx million units in 2025 and is projected to grow at a CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. This growth is fuelled by increasing demand for convenient and protective packaging, along with the rising adoption of sustainable and recyclable plastic packaging solutions. Technological disruptions, particularly advancements in automation and digital printing technologies, are improving efficiency and enhancing customization options. Consumer behavior shifts, emphasizing convenience, sustainability, and product safety, further shape market trends. The market penetration of recycled content in rigid plastic packaging is gradually increasing, driven by consumer and regulatory pressures.

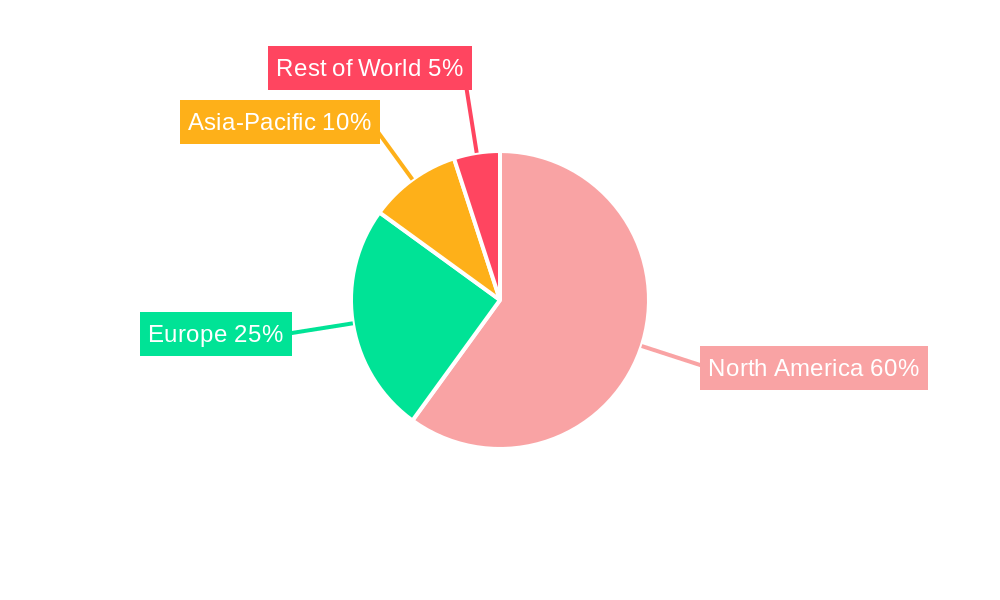

Dominant Regions, Countries, or Segments in North America Rigid Plastic Packaging Market

The United States dominates the North American rigid plastic packaging market, accounting for xx% of the total market value in 2025. This dominance stems from the country's large and diverse end-user industries, particularly food and beverage. The bottles and jars segment holds the largest market share among product types, followed closely by trays and containers. Within materials, polyethylene (PE) and polypropylene (PP) are the most widely used, driven by their cost-effectiveness and versatility. The food and beverage industry is the largest end-user sector, contributing significantly to market growth.

- Leading Region: United States

- Dominant Product Segment: Bottles and Jars

- Leading Material Segment: Polyethylene (PE)

- Largest End-User Industry: Food and Beverage

- Key Growth Drivers (US): Strong Consumer Spending, Robust Food & Beverage Industry, E-commerce Growth

North America Rigid Plastic Packaging Market Product Landscape

Product innovation focuses on enhancing barrier properties, improving recyclability, and reducing environmental impact. Advancements in lightweighting technologies are making rigid plastic packaging more sustainable. The incorporation of recycled content is becoming increasingly prevalent, responding to both consumer demand and environmental regulations. New applications are emerging in areas such as medical devices and electronics packaging. Unique selling propositions often center on improved functionality, enhanced aesthetics, and sustainable attributes.

Key Drivers, Barriers & Challenges in North America Rigid Plastic Packaging Market

Key Drivers:

- Growing demand from various end-use sectors.

- Technological advancements leading to improved product performance and sustainability.

- Favorable regulatory policies promoting recycling and sustainable packaging.

Key Challenges:

- Fluctuating raw material prices, impacting profitability.

- Stringent environmental regulations and growing consumer concerns about plastic waste.

- Competition from alternative packaging materials.

- Supply chain disruptions impacting production and delivery.

Emerging Opportunities in North America Rigid Plastic Packaging Market

- Bio-based plastics: Growing demand for environmentally friendly materials.

- Recycled content incorporation: Meeting sustainability goals and regulatory requirements.

- Smart packaging: Integration of technology for product traceability and consumer engagement.

- E-commerce packaging: Specialized solutions for online retail.

Growth Accelerators in the North America Rigid Plastic Packaging Market Industry

Technological advancements in material science, automation, and digital printing are enhancing manufacturing efficiency and creating new product opportunities. Strategic partnerships between packaging companies and brand owners are fostering innovation and driving market expansion. The growing focus on sustainability and circular economy principles is creating new opportunities for recycled content and bio-based plastics. Expansion into emerging markets and diversification into new product applications will drive long-term growth.

Key Players Shaping the North America Rigid Plastic Packaging Market Market

- Sonoco Products Company

- Amcor Group GmbH

- Albea Group

- Graham Packaging Company

- Berry Global Inc

- Silgan Holdings Inc

- Plastipak Holding Inc

- Sealed Air Corporation

- Alpla Werke Alwin Lehner GmbH & Co KG

- Huhtamaki Inc

Notable Milestones in North America Rigid Plastic Packaging Market Sector

- April 2023: Tesco and Faerch collaborate on a closed-loop recycling system for ready-meal trays, using recycled PET to create new food-grade trays. This signifies a significant advancement in sustainable packaging practices.

- February 2023: Ecolab and TotalEnergies partner to integrate post-consumer recycled plastic into heavy-duty cleaning product packaging, showcasing commitment to sustainable sourcing.

In-Depth North America Rigid Plastic Packaging Market Market Outlook

The North American rigid plastic packaging market is poised for continued growth, fueled by technological advancements, sustainable practices, and increasing demand from diverse end-use sectors. Strategic partnerships, investments in innovation, and the exploration of new applications (e.g., active and intelligent packaging) will shape future market dynamics. Companies focusing on circular economy solutions and environmentally friendly materials will be best positioned to capitalize on growth opportunities.

North America Rigid Plastic Packaging Market Segmentation

-

1. Resin Type

-

1.1. Polyethylene (PE)

- 1.1.1. Low-Dens

- 1.1.2. High Density Polyethylene (HDPE)

- 1.2. Polyethylene terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 1.5. Polyvinyl chloride (PVC)

- 1.6. Other Resin Types

-

1.1. Polyethylene (PE)

-

2. Product Type

- 2.1. Bottles and Jars

- 2.2. Trays and Containers

- 2.3. Caps and Closures

- 2.4. Intermediate Bulk Containers (IBCs)

- 2.5. Drums

- 2.6. Pallets

- 2.7. Other Product Types

-

3. End-use Industries

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Others Foodservice Sectors

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other End User Industries

-

3.1. Food

North America Rigid Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of North America Rigid Plastic Packaging Market

North America Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of FMCG Industry to Propel the Market; Cosmetic and Personal Care Sector Witnesses Soaring Demand for Rigid Plastic Packaging

- 3.3. Market Restrains

- 3.3.1. Flexible Plastic Packaging Drive Shift Benefits Over Rigid Plastic Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyethylene (PE)

- 5.1.1.1. Low-Dens

- 5.1.1.2. High Density Polyethylene (HDPE)

- 5.1.2. Polyethylene terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.1.5. Polyvinyl chloride (PVC)

- 5.1.6. Other Resin Types

- 5.1.1. Polyethylene (PE)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Jars

- 5.2.2. Trays and Containers

- 5.2.3. Caps and Closures

- 5.2.4. Intermediate Bulk Containers (IBCs)

- 5.2.5. Drums

- 5.2.6. Pallets

- 5.2.7. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-use Industries

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Others Foodservice Sectors

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other End User Industries

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Albea Grou

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Graham Packaging Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berry Global Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Silgan Holdings Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Plastipak Holding Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealed Air Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alpla Werke Alwin Lehner GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huhtamaki Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: North America Rigid Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Rigid Plastic Packaging Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 2: North America Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: North America Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 4: North America Rigid Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Rigid Plastic Packaging Market Revenue million Forecast, by Resin Type 2020 & 2033

- Table 6: North America Rigid Plastic Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: North America Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industries 2020 & 2033

- Table 8: North America Rigid Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Rigid Plastic Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Rigid Plastic Packaging Market?

The projected CAGR is approximately 2.13%.

2. Which companies are prominent players in the North America Rigid Plastic Packaging Market?

Key companies in the market include Sonoco Products Company, Amcor Group GmbH, Albea Grou, Graham Packaging Company, Berry Global Inc, Silgan Holdings Inc, Plastipak Holding Inc, Sealed Air Corporation, Alpla Werke Alwin Lehner GmbH & Co KG, Huhtamaki Inc.

3. What are the main segments of the North America Rigid Plastic Packaging Market?

The market segments include Resin Type, Product Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.51 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of FMCG Industry to Propel the Market; Cosmetic and Personal Care Sector Witnesses Soaring Demand for Rigid Plastic Packaging.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Flexible Plastic Packaging Drive Shift Benefits Over Rigid Plastic Packaging.

8. Can you provide examples of recent developments in the market?

April 2023: Tesco and Faerch collaborated to create a totally new way to package ready meals - by recycling used plastic trays and turning them into food-grade trays. This is the first of its kind in the industry and will involve collecting PET trays from customers and recycling them back into trays. Tesco's trays already have a minimum recycled tray content of up to 75%, but now the company is getting better - with the help of Faerch, Tesco will use bottles of flake plastic to recycle up to 30% of their tray content.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the North America Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence