Key Insights

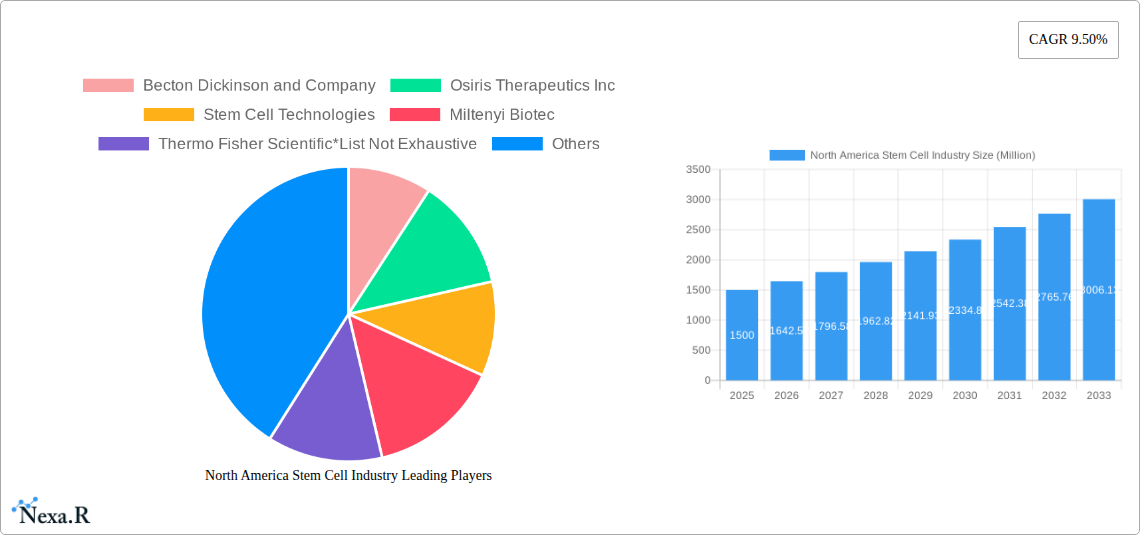

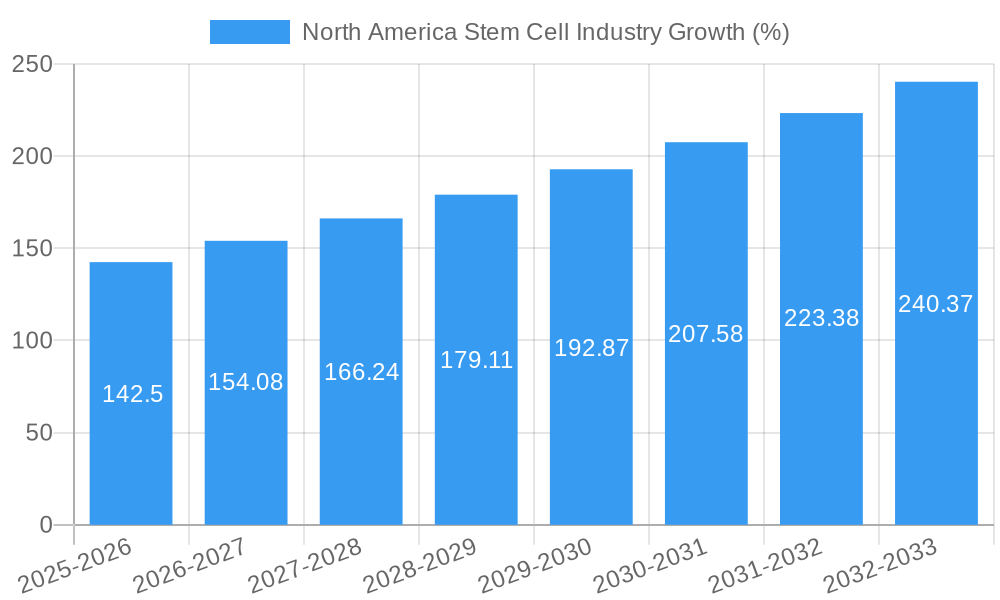

The North American stem cell therapy market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a 9.5% CAGR from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases such as neurological disorders, cardiovascular diseases, and various types of cancer is creating a significant demand for effective treatment options. Stem cell therapy offers a promising avenue for treating these conditions, leading to heightened investment in research and development and increased adoption of these therapies. Secondly, advancements in stem cell research and technology are continually improving the safety and efficacy of stem cell-based treatments, resulting in a wider range of applications and a greater acceptance among both healthcare professionals and patients. Regulatory approvals for novel stem cell therapies further contribute to market growth. Finally, rising government funding for stem cell research and the increased efforts of key players in this domain are bolstering the overall market expansion.

However, several challenges hinder the market's complete potential. The high cost associated with stem cell therapies, including research, manufacturing, and administration, poses a significant barrier to widespread accessibility. Furthermore, the stringent regulatory landscape surrounding the development and approval of these therapies can create lengthy timelines and potentially impede market penetration. The ethical considerations surrounding the use of embryonic stem cells also remain a considerable factor influencing market dynamics. Despite these constraints, the continued advancements in stem cell research and technological innovations, along with growing acceptance of these treatments, are expected to significantly mitigate these challenges, leading to continued and substantial market growth throughout the forecast period. The segments witnessing the most rapid growth include allogeneic stem cell therapies due to their ease of use and reduced ethical concerns, as well as treatments focused on neurological disorders, which are prevalent and have limited treatment options.

This comprehensive report provides an in-depth analysis of the North America stem cell industry, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and researchers. The report leverages extensive data analysis to provide precise market sizing and segmentation across various product types, therapeutic applications, and treatment types. The market is expected to reach xx Million by 2033.

North America Stem Cell Industry Market Dynamics & Structure

The North American stem cell industry is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is moderate, with several key players holding significant market share, while numerous smaller companies contribute to innovation. Technological innovation is a major driver, spurred by advancements in cell processing, delivery systems, and genetic engineering. Regulatory frameworks, particularly those governing clinical trials and product approvals, play a crucial role in shaping market access and growth. Competitive pressures arise from both established pharmaceutical companies and emerging biotech firms.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Advancements in gene editing (CRISPR), induced pluripotent stem cells (iPSCs), and cell manufacturing technologies are accelerating growth.

- Regulatory Landscape: Stringent FDA regulations influence clinical trial timelines and product approvals, presenting both challenges and opportunities.

- Competitive Substitutes: Traditional treatments and emerging therapies pose competitive challenges to stem cell therapies.

- End-User Demographics: Aging population and rising prevalence of chronic diseases drive demand for stem cell-based treatments.

- M&A Activity: The number of M&A deals in the stem cell industry is expected to be xx in 2025, driven by strategic acquisitions and collaborations.

North America Stem Cell Industry Growth Trends & Insights

The North American stem cell industry is experiencing robust growth, fueled by the rising prevalence of chronic diseases, technological advancements, and increasing investments in research and development. The market is segmented by product type (adult stem cells, embryonic stem cells, pluripotent stem cells, other product types), therapeutic application (neurological disorders, orthopedic treatments, oncology disorders, injuries and wounds, cardiovascular disorders, other applications), and treatment type (allogeneic, autologous, syngeneic). The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Adoption rates are gradually increasing with clinical success and improved safety profiles of therapies. Technological disruptions, such as advancements in cell processing and delivery methods, enhance efficacy and market penetration. Consumer behavior is shifting towards personalized and regenerative medicine approaches, further supporting market expansion.

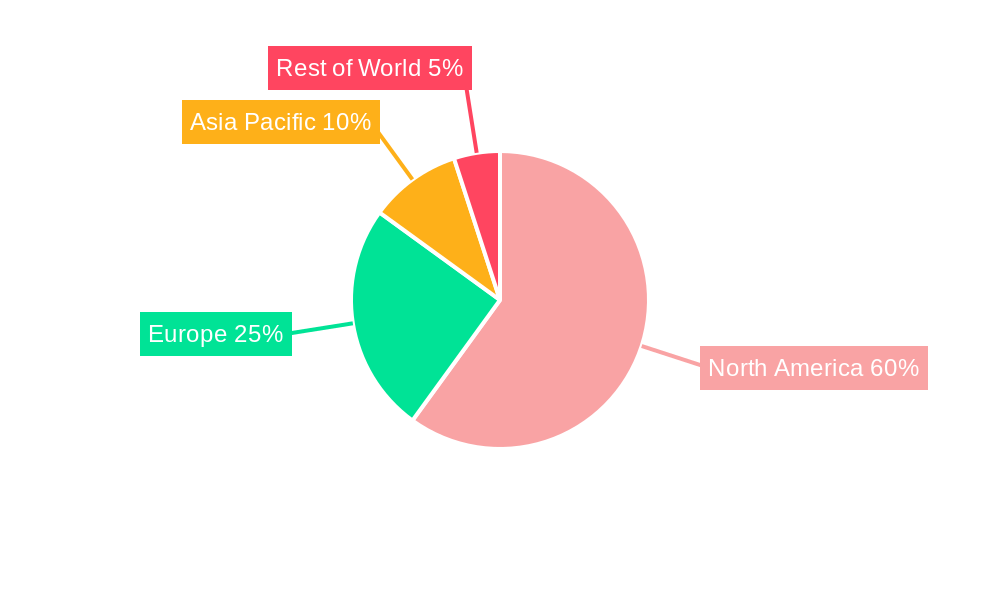

Dominant Regions, Countries, or Segments in North America Stem Cell Industry

Within North America, the [Specify leading region/state, e.g., California] region exhibits the strongest growth in the stem cell industry driven by a high concentration of research institutions, biotech companies, and favorable regulatory environments. The leading segments are expected to be:

- By Product Type: Adult stem cells dominate due to their accessibility and established safety profiles, comprising xx% of the market in 2025.

- By Therapeutic Application: Oncology and neurological disorders represent substantial market segments due to high unmet clinical needs and extensive research activity, together capturing xx% of the market in 2025.

- By Treatment Type: Allogeneic stem cell therapy is projected to hold the largest market share in 2025 due to potential for scalability and off-the-shelf availability, reaching xx Million.

Key drivers include supportive government policies, a robust healthcare infrastructure, and considerable private investment fueling research and development.

North America Stem Cell Industry Product Landscape

The stem cell product landscape is characterized by continuous innovation, with advancements in cell processing, delivery systems, and combination therapies. Companies are developing novel products with improved efficacy, safety, and scalability. Unique selling propositions include personalized treatment approaches, targeted cell delivery, and combination therapies that address multiple disease mechanisms. Technological advancements, including gene editing and cell reprogramming techniques, are revolutionizing the industry's capabilities, promising more effective and accessible treatments.

Key Drivers, Barriers & Challenges in North America Stem Cell Industry

Key Drivers:

- Growing prevalence of chronic diseases.

- Rising investments in R&D and clinical trials.

- Technological advancements in cell manipulation and delivery.

- Favorable regulatory policies in certain regions.

Key Barriers & Challenges:

- High cost of development and manufacturing.

- Stringent regulatory approvals leading to long timelines for product launches.

- Potential safety concerns and ethical considerations related to stem cell use.

- Competition from established pharmaceutical companies and alternative therapies.

Emerging Opportunities in North America Stem Cell Industry

- Untapped therapeutic areas such as regenerative medicine and personalized cancer therapy.

- Increasing adoption of cell-based therapies in combination with other treatments (e.g., immunotherapies).

- Growing demand for stem cell-based treatments in veterinary medicine.

- Expansion into international markets.

Growth Accelerators in the North America Stem Cell Industry Industry

Long-term growth is fueled by ongoing technological advancements, strategic partnerships between biotech and pharmaceutical companies, and a growing understanding of stem cell biology and its therapeutic potential. Successful clinical trials, regulatory approvals of new therapies, and increasing government support will further accelerate market expansion in the coming years.

Key Players Shaping the North America Stem Cell Industry Market

- Becton Dickinson and Company

- Osiris Therapeutics Inc

- Stem Cell Technologies

- Miltenyi Biotec

- Thermo Fisher Scientific

- Brainstorm Cell Therapeutics

- Lineage Cell Therapeutics Inc

- International Stem Cell Corp

- Sigma Aldrich (Merck KGaA)

- Bristol-Myers Squibb Company

Notable Milestones in North America Stem Cell Industry Sector

- July 2022: CORESTEM (South Korea) continued enrolling participants for the Phase 3 clinical trial of NeuroNata-R, a stem cell therapy conditionally approved to treat amyotrophic lateral sclerosis (ALS) in South Korea.

- September 2021: Stemedica Cell Technologies received investigational new drug (IND) approval from the U.S. FDA for intravenous allogeneic mesenchymal stem cells (MSCs) to treat moderate to severe COVID-19.

In-Depth North America Stem Cell Industry Market Outlook

The future of the North American stem cell industry is bright, with significant growth potential driven by continuous innovation, expanding clinical applications, and supportive regulatory environments. Strategic partnerships, acquisitions, and investments in research will further propel market expansion. The industry is poised to deliver transformative therapies across a range of diseases, leading to improved patient outcomes and significant market growth in the coming decade.

North America Stem Cell Industry Segmentation

-

1. Product Type

- 1.1. Adult Stem Cell

- 1.2. Human Embryonic Cell

- 1.3. Pluripotent Stem Cell

- 1.4. Other Product Types

-

2. Therapeutic Application

- 2.1. Neurological Disorders

- 2.2. Orthopedic Treatments

- 2.3. Oncology Disorders

- 2.4. Injuries and Wounds

- 2.5. Cardiovascular Disorders

- 2.6. Other Therapeutic Applications

-

3. Treatment Type

- 3.1. Allogeneic Stem Cell Therapy

- 3.2. Auto logic Stem Cell Therapy

- 3.3. Syngeneic Stem Cell Therapy

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Stem Cell Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Stem Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Approval for Clinical Trials in Stem Cell Research; Growing Demand for Regenerative Treatment Option; Rising R&D Initiatives to Develop Therapeutic Options for Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Regulatory Complications

- 3.4. Market Trends

- 3.4.1. The Oncology Segment is Expected to Show Lucrative Growth in the Therapeutic Application Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Adult Stem Cell

- 5.1.2. Human Embryonic Cell

- 5.1.3. Pluripotent Stem Cell

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 5.2.1. Neurological Disorders

- 5.2.2. Orthopedic Treatments

- 5.2.3. Oncology Disorders

- 5.2.4. Injuries and Wounds

- 5.2.5. Cardiovascular Disorders

- 5.2.6. Other Therapeutic Applications

- 5.3. Market Analysis, Insights and Forecast - by Treatment Type

- 5.3.1. Allogeneic Stem Cell Therapy

- 5.3.2. Auto logic Stem Cell Therapy

- 5.3.3. Syngeneic Stem Cell Therapy

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Adult Stem Cell

- 6.1.2. Human Embryonic Cell

- 6.1.3. Pluripotent Stem Cell

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 6.2.1. Neurological Disorders

- 6.2.2. Orthopedic Treatments

- 6.2.3. Oncology Disorders

- 6.2.4. Injuries and Wounds

- 6.2.5. Cardiovascular Disorders

- 6.2.6. Other Therapeutic Applications

- 6.3. Market Analysis, Insights and Forecast - by Treatment Type

- 6.3.1. Allogeneic Stem Cell Therapy

- 6.3.2. Auto logic Stem Cell Therapy

- 6.3.3. Syngeneic Stem Cell Therapy

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Adult Stem Cell

- 7.1.2. Human Embryonic Cell

- 7.1.3. Pluripotent Stem Cell

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 7.2.1. Neurological Disorders

- 7.2.2. Orthopedic Treatments

- 7.2.3. Oncology Disorders

- 7.2.4. Injuries and Wounds

- 7.2.5. Cardiovascular Disorders

- 7.2.6. Other Therapeutic Applications

- 7.3. Market Analysis, Insights and Forecast - by Treatment Type

- 7.3.1. Allogeneic Stem Cell Therapy

- 7.3.2. Auto logic Stem Cell Therapy

- 7.3.3. Syngeneic Stem Cell Therapy

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Adult Stem Cell

- 8.1.2. Human Embryonic Cell

- 8.1.3. Pluripotent Stem Cell

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Therapeutic Application

- 8.2.1. Neurological Disorders

- 8.2.2. Orthopedic Treatments

- 8.2.3. Oncology Disorders

- 8.2.4. Injuries and Wounds

- 8.2.5. Cardiovascular Disorders

- 8.2.6. Other Therapeutic Applications

- 8.3. Market Analysis, Insights and Forecast - by Treatment Type

- 8.3.1. Allogeneic Stem Cell Therapy

- 8.3.2. Auto logic Stem Cell Therapy

- 8.3.3. Syngeneic Stem Cell Therapy

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. United States North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Stem Cell Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Becton Dickinson and Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Osiris Therapeutics Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Stem Cell Technologies

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Miltenyi Biotec

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Thermo Fisher Scientific*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Brainstorm Cell Therapeutics

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Lineage Cell Therapeutics Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 International Stem Cell Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Sigma Aldrich (Merck KGaA)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bristol-Myers Squibb Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Stem Cell Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Stem Cell Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Stem Cell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 4: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 5: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Stem Cell Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America Stem Cell Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 14: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 15: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 19: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 20: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America Stem Cell Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: North America Stem Cell Industry Revenue Million Forecast, by Therapeutic Application 2019 & 2032

- Table 24: North America Stem Cell Industry Revenue Million Forecast, by Treatment Type 2019 & 2032

- Table 25: North America Stem Cell Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Stem Cell Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Stem Cell Industry?

The projected CAGR is approximately 9.50%.

2. Which companies are prominent players in the North America Stem Cell Industry?

Key companies in the market include Becton Dickinson and Company, Osiris Therapeutics Inc, Stem Cell Technologies, Miltenyi Biotec, Thermo Fisher Scientific*List Not Exhaustive, Brainstorm Cell Therapeutics, Lineage Cell Therapeutics Inc, International Stem Cell Corp, Sigma Aldrich (Merck KGaA), Bristol-Myers Squibb Company.

3. What are the main segments of the North America Stem Cell Industry?

The market segments include Product Type, Therapeutic Application, Treatment Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Approval for Clinical Trials in Stem Cell Research; Growing Demand for Regenerative Treatment Option; Rising R&D Initiatives to Develop Therapeutic Options for Chronic Diseases.

6. What are the notable trends driving market growth?

The Oncology Segment is Expected to Show Lucrative Growth in the Therapeutic Application Type.

7. Are there any restraints impacting market growth?

Expensive Procedures; Regulatory Complications.

8. Can you provide examples of recent developments in the market?

In July 2022, CORESTEM (South Korea) continued enrolling participants for the Phase 3 clinical trial of NeuroNata-R, a stem cell therapy that is conditionally approved to treat amyotrophic lateral sclerosis (ALS) in South Korea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Stem Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Stem Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Stem Cell Industry?

To stay informed about further developments, trends, and reports in the North America Stem Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence