Key Insights

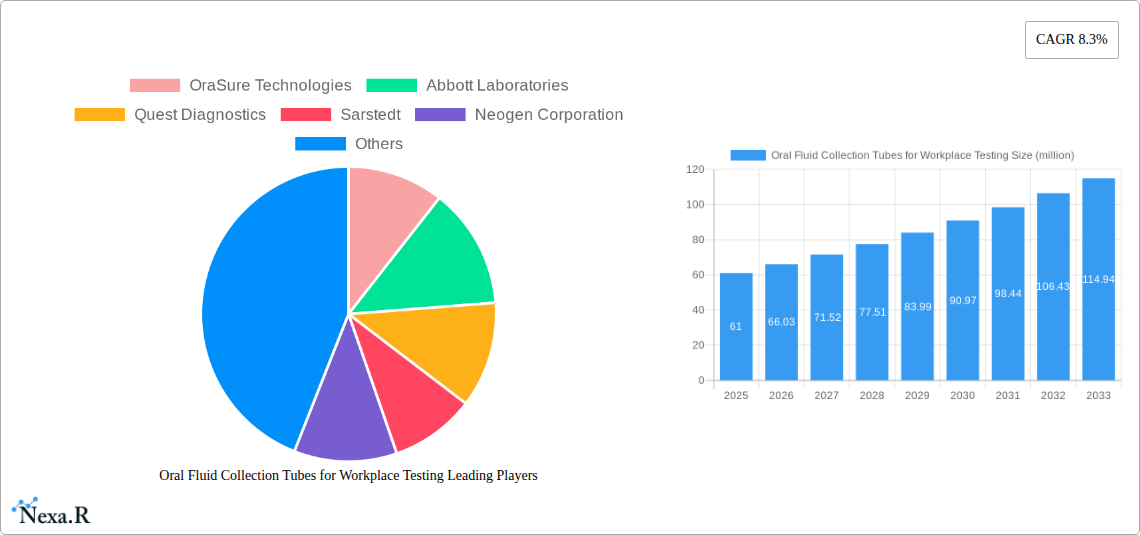

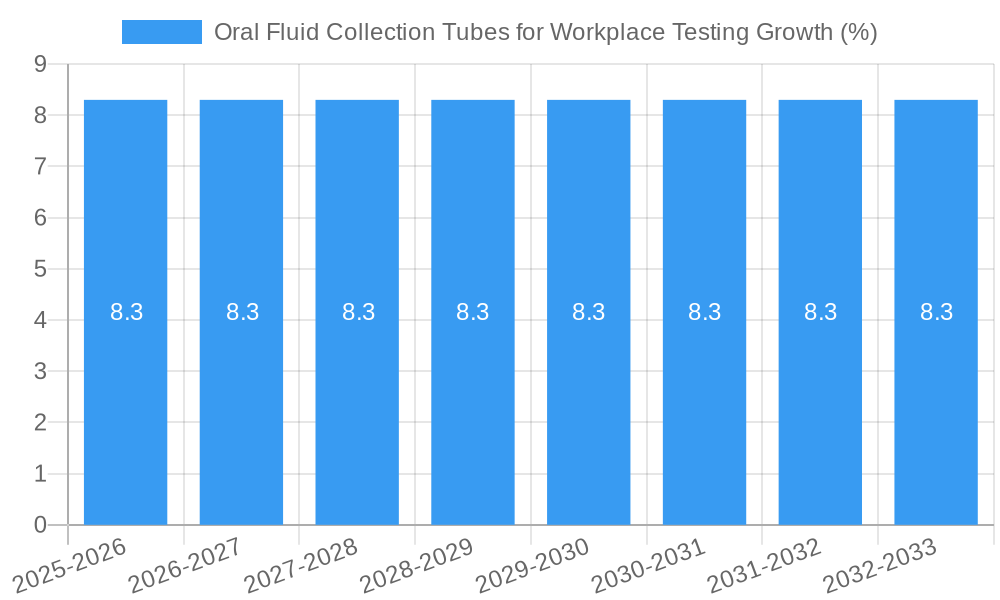

The global market for Oral Fluid Collection Tubes for Workplace Testing is experiencing robust growth, projected to reach USD 61 million by 2025. This expansion is driven by an increasing emphasis on maintaining safe and productive work environments, coupled with the inherent advantages of saliva-based drug screening. Oral fluid collection offers a non-invasive, convenient, and cost-effective alternative to traditional urine testing, facilitating more frequent and on-site testing protocols. The market is expected to maintain a Compound Annual Growth Rate (CAGR) of 8.3% throughout the forecast period of 2025-2033, underscoring its dynamic trajectory. Key applications are segmented into General Analysis and Genomic Analysis, with Saliva Tubes and Oral Sponges representing the primary product types. Companies such as OraSure Technologies, Abbott Laboratories, and Quest Diagnostics are prominent players, actively innovating and expanding their offerings to cater to the growing demand for reliable and user-friendly oral fluid collection solutions.

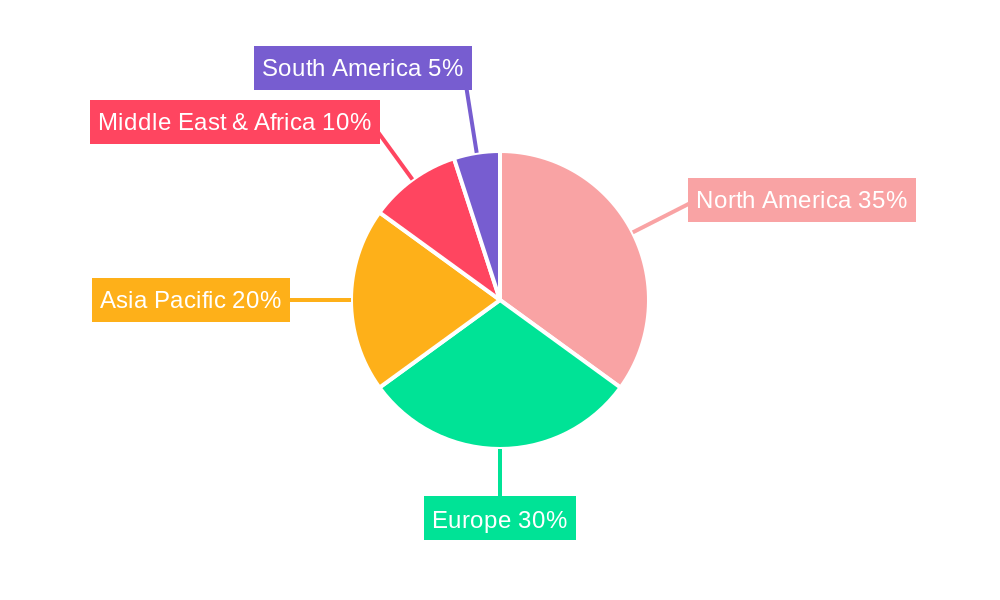

Further analysis reveals that the market's upward momentum is propelled by several key trends, including the rising prevalence of drug and alcohol abuse in workplaces, stringent regulatory mandates for employee drug testing, and advancements in diagnostic technologies that enhance the accuracy and speed of saliva analysis. The growing adoption of rapid on-site testing kits, particularly in sectors like transportation, healthcare, and construction, is a significant contributor to market expansion. While the market is generally favorable, potential restraints such as the sensitivity of certain tests to recent ingestion and the need for robust chain-of-custody protocols necessitate careful consideration by stakeholders. Geographically, North America and Europe are anticipated to lead the market, owing to established workplace safety regulations and a high adoption rate of advanced testing methodologies. The Asia Pacific region, with its rapidly industrializing economies and increasing awareness of occupational health, presents substantial growth opportunities.

This in-depth report provides a definitive analysis of the global Oral Fluid Collection Tubes for Workplace Testing market. Delving into market dynamics, growth trends, regional dominance, product landscapes, key players, and future outlook, this research is an indispensable resource for stakeholders seeking to navigate this evolving sector. With a study period spanning 2019–2033, including a historical overview (2019–2024), base year analysis (2025), and a comprehensive forecast (2025–2033), this report offers unparalleled foresight into market trajectory. We meticulously analyze the parent market and child market segments, providing a holistic view of their interplay and impact.

Oral Fluid Collection Tubes for Workplace Testing Market Dynamics & Structure

The oral fluid collection tubes market for workplace testing exhibits a moderately consolidated structure, characterized by the strategic presence of key manufacturers and a growing number of specialized niche players. Technological innovation is a significant driver, with continuous advancements in sample stabilization, ease of use, and multiplexing capabilities. Regulatory frameworks, particularly those governing drug testing and infectious disease screening in occupational health settings, play a crucial role in shaping market demand and product specifications. While direct competitive product substitutes are limited, the broader landscape includes traditional urine-based testing and other biological sample collection methods, creating an indirect competitive pressure. End-user demographics are shifting, with an increasing demand from diverse industries including transportation, healthcare, construction, and manufacturing, driven by a greater emphasis on employee safety and health compliance. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, an estimated 10-15 M&A deals have been recorded in the broader diagnostic sample collection sector over the past five years, indicating strategic consolidation. Innovation barriers include the high cost of research and development for advanced stabilization technologies and the lengthy regulatory approval processes for new product types.

Oral Fluid Collection Tubes for Workplace Testing Growth Trends & Insights

The global oral fluid collection tubes for workplace testing market is poised for robust expansion, driven by escalating demand for non-invasive, convenient, and reliable biological sample collection methods. The market size is projected to grow from approximately $650 million in 2025 to an estimated $1.2 billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This growth trajectory is underpinned by several key trends. Firstly, the increasing prevalence of workplace drug and alcohol abuse, coupled with stringent regulatory mandates for employee safety and impairment testing, is a primary growth accelerator. Secondly, the inherent advantages of oral fluid collection, such as ease of administration, reduced sample adulteration risks compared to urine, and immediate on-site testing capabilities, are significantly boosting adoption rates. Technological disruptions are also playing a pivotal role, with the development of advanced collection devices featuring enhanced saliva stimulation, sample stabilization, and integrated detection mechanisms. Consumer behavior shifts are evident, with a growing preference for less intrusive testing methods among both employees and employers. Market penetration is expanding beyond traditional sectors, with emerging applications in remote workforce monitoring and pre-employment screening. The estimated market penetration for oral fluid testing in certain high-risk industries is expected to rise from 25% in 2025 to over 40% by 2033. Furthermore, the expanding use of oral fluid for infectious disease screening, particularly in the wake of global health events, is contributing significantly to market growth. The development of point-of-care diagnostics utilizing oral fluid is also creating new avenues for market expansion.

Dominant Regions, Countries, or Segments in Oral Fluid Collection Tubes for Workplace Testing

North America currently dominates the oral fluid collection tubes for workplace testing market, largely driven by the United States. The region's leadership is attributed to a strong regulatory framework for workplace safety, particularly in industries like transportation (e.g., Department of Transportation mandates for drug testing), and a high adoption rate of advanced diagnostic technologies. The US market alone is estimated to represent over 60% of the North American market share.

Within the Types segment, Saliva Tubes represent the dominant category, accounting for an estimated 70% of the market. Their widespread use in drug testing, hormone analysis, and infectious disease screening makes them the preferred choice for many workplace applications. The Oral Sponge segment, while smaller, is experiencing significant growth due to its ease of use and effectiveness in stimulating saliva production, particularly for individuals who may have difficulty producing sufficient saliva.

In terms of Application, For General Analysis holds a substantial market share, encompassing a wide range of workplace testing needs, including pre-employment screening, random drug testing, and post-accident investigations. The For Genomic Analysis segment, while nascent in the workplace testing context, shows strong potential for growth with advancements in DNA testing for identification and other specialized occupational health applications. This segment is projected to witness a CAGR of over 10% during the forecast period.

Key drivers contributing to North America's dominance include proactive government policies promoting occupational health, substantial investment in R&D by leading companies like OraSure Technologies and Abbott Laboratories, and a well-established healthcare and diagnostic infrastructure. The high disposable income and corporate awareness of the benefits of regular health monitoring also contribute to market expansion. The presence of major diagnostic service providers like Quest Diagnostics further bolsters the region's market strength.

Oral Fluid Collection Tubes for Workplace Testing Product Landscape

The product landscape for oral fluid collection tubes is characterized by continuous innovation focused on enhancing user experience and sample integrity. Manufacturers are introducing advanced devices with built-in saliva stimulants, collection indicators, and tamper-evident features. Innovations include improved buffer solutions for DNA preservation, rapid stabilization of biomarkers for drug metabolites, and integrated temperature indicators. Performance metrics such as collection volume accuracy, stability of analytes over time (up to 7 days at room temperature), and ease of use are key differentiating factors. Unique selling propositions often revolve around rapid results, reduced contamination risk, and compatibility with various laboratory analysis platforms. Technological advancements are also leading to the development of more sensitive and specific detection capabilities for a wider range of analytes within a single collection device.

Key Drivers, Barriers & Challenges in Oral Fluid Collection Tubes for Workplace Testing

Key Drivers:

- Increasing prevalence of drug and alcohol abuse in the workplace: Driving demand for effective and non-invasive testing solutions.

- Stringent regulatory requirements for workplace safety: Mandating regular testing in high-risk industries.

- Technological advancements in sample stabilization and analysis: Improving accuracy, speed, and breadth of testing.

- Growing preference for non-invasive collection methods: Enhancing employee compliance and comfort.

- Expanding applications beyond drug testing: Including infectious disease screening and health monitoring.

Barriers & Challenges:

- Cost of advanced collection devices: Can be a deterrent for smaller organizations.

- Regulatory hurdles and standardization issues: Varying guidelines across regions can impact market adoption.

- Limited awareness and education: Particularly in emerging markets regarding the benefits of oral fluid testing.

- Competition from established urine testing methods: Requiring significant effort to displace traditional practices.

- Supply chain vulnerabilities: Ensuring consistent availability of raw materials and finished products globally. For instance, the estimated impact of supply chain disruptions on market growth could be in the range of 2-3% annually if not mitigated.

Emerging Opportunities in Oral Fluid Collection Tubes for Workplace Testing

Emerging opportunities in the oral fluid collection tubes market for workplace testing are diverse and promising. The expansion of rapid point-of-care testing for infectious diseases within occupational settings, such as COVID-19 and influenza, presents a significant growth avenue. The development of integrated smart collection devices that can wirelessly transmit data to laboratory information systems offers enhanced efficiency and data management. Untapped markets in developing economies, with increasing industrialization and a growing focus on employee well-being, represent considerable potential. Furthermore, the application of oral fluid testing for monitoring chronic diseases and wellness programs in the workplace, beyond just drug and alcohol screening, is an evolving consumer preference that can drive innovation and market penetration. The use of oral fluid for genomic screening in occupational health and safety is also an emerging niche with substantial future potential.

Growth Accelerators in the Oral Fluid Collection Tubes for Workplace Testing Industry

Growth accelerators in the oral fluid collection tubes industry are multifaceted. Technological breakthroughs in microfluidics and biosensor technology are enabling more sensitive and rapid detection of analytes, expanding the scope of workplace testing. Strategic partnerships between collection device manufacturers and diagnostic assay developers are crucial for creating integrated testing solutions. Market expansion strategies, including aggressive penetration into underserved industrial sectors and geographical regions, are vital. Furthermore, the increasing emphasis on preventive healthcare and proactive employee wellness programs by corporations globally is a significant catalyst for sustained growth. The development of cost-effective and user-friendly solutions will also accelerate adoption rates across a wider spectrum of businesses.

Key Players Shaping the Oral Fluid Collection Tubes for Workplace Testing Market

- OraSure Technologies

- Abbott Laboratories

- Quest Diagnostics

- Sarstedt

- Neogen Corporation

- Salimetrics

- Oasis Diagnostics

- Immunodiagnostic

- Lin-Zhi International

- Cell Projects

Notable Milestones in Oral Fluid Collection Tubes for Workplace Testing Sector

- 2019: Launch of enhanced stabilization buffers for DNA preservation in oral fluid samples by Salimetrics.

- 2020: Increased demand and development of rapid oral fluid COVID-19 testing kits by various manufacturers.

- 2021: OraSure Technologies receives FDA emergency use authorization for an oral fluid COVID-19 test.

- 2022: Sarstedt introduces a new generation of saliva collection tubes with improved flow control.

- 2023: Neogen Corporation expands its drug detection portfolio with new oral fluid test kits for workplace screening.

- 2024: Oasis Diagnostics pioneers a new oral sponge technology for enhanced saliva collection in challenging environments.

In-Depth Oral Fluid Collection Tubes for Workplace Testing Market Outlook

- 2019: Launch of enhanced stabilization buffers for DNA preservation in oral fluid samples by Salimetrics.

- 2020: Increased demand and development of rapid oral fluid COVID-19 testing kits by various manufacturers.

- 2021: OraSure Technologies receives FDA emergency use authorization for an oral fluid COVID-19 test.

- 2022: Sarstedt introduces a new generation of saliva collection tubes with improved flow control.

- 2023: Neogen Corporation expands its drug detection portfolio with new oral fluid test kits for workplace screening.

- 2024: Oasis Diagnostics pioneers a new oral sponge technology for enhanced saliva collection in challenging environments.

In-Depth Oral Fluid Collection Tubes for Workplace Testing Market Outlook

The future outlook for the oral fluid collection tubes for workplace testing market is exceptionally positive, driven by a convergence of technological advancements, evolving regulatory landscapes, and a heightened global focus on occupational health and safety. Growth accelerators, including the development of multiplexed detection assays and the integration of artificial intelligence for data analysis, will further enhance the value proposition of oral fluid testing. Strategic collaborations among key players, coupled with the exploration of new applications such as chronic disease management and personalized health monitoring in the workplace, will unlock new revenue streams. The market is poised for sustained growth, with an anticipated expansion in global reach and penetration into emerging industrial sectors, solidifying its position as a critical component of modern workplace health and safety protocols.

Oral Fluid Collection Tubes for Workplace Testing Segmentation

-

1. Application

- 1.1. For General Analysis

- 1.2. For Genomic Analysis

-

2. Types

- 2.1. Saliva Tube

- 2.2. Oral Sponge

Oral Fluid Collection Tubes for Workplace Testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oral Fluid Collection Tubes for Workplace Testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oral Fluid Collection Tubes for Workplace Testing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. For General Analysis

- 5.1.2. For Genomic Analysis

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Saliva Tube

- 5.2.2. Oral Sponge

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Oral Fluid Collection Tubes for Workplace Testing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. For General Analysis

- 6.1.2. For Genomic Analysis

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Saliva Tube

- 6.2.2. Oral Sponge

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Oral Fluid Collection Tubes for Workplace Testing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. For General Analysis

- 7.1.2. For Genomic Analysis

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Saliva Tube

- 7.2.2. Oral Sponge

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Oral Fluid Collection Tubes for Workplace Testing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. For General Analysis

- 8.1.2. For Genomic Analysis

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Saliva Tube

- 8.2.2. Oral Sponge

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. For General Analysis

- 9.1.2. For Genomic Analysis

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Saliva Tube

- 9.2.2. Oral Sponge

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. For General Analysis

- 10.1.2. For Genomic Analysis

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Saliva Tube

- 10.2.2. Oral Sponge

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 OraSure Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Abbott Laboratories

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quest Diagnostics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sarstedt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Neogen Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Salimetrics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oasis Diagnostics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Immunodiagnostic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lin-Zhi International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cell Projects

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 OraSure Technologies

List of Figures

- Figure 1: Global Oral Fluid Collection Tubes for Workplace Testing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Application 2024 & 2032

- Figure 3: North America Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Types 2024 & 2032

- Figure 5: North America Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Country 2024 & 2032

- Figure 7: North America Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Application 2024 & 2032

- Figure 9: South America Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Types 2024 & 2032

- Figure 11: South America Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Country 2024 & 2032

- Figure 13: South America Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Oral Fluid Collection Tubes for Workplace Testing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Oral Fluid Collection Tubes for Workplace Testing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oral Fluid Collection Tubes for Workplace Testing?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Oral Fluid Collection Tubes for Workplace Testing?

Key companies in the market include OraSure Technologies, Abbott Laboratories, Quest Diagnostics, Sarstedt, Neogen Corporation, Salimetrics, Oasis Diagnostics, Immunodiagnostic, Lin-Zhi International, Cell Projects.

3. What are the main segments of the Oral Fluid Collection Tubes for Workplace Testing?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 61 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oral Fluid Collection Tubes for Workplace Testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oral Fluid Collection Tubes for Workplace Testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oral Fluid Collection Tubes for Workplace Testing?

To stay informed about further developments, trends, and reports in the Oral Fluid Collection Tubes for Workplace Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence