Key Insights

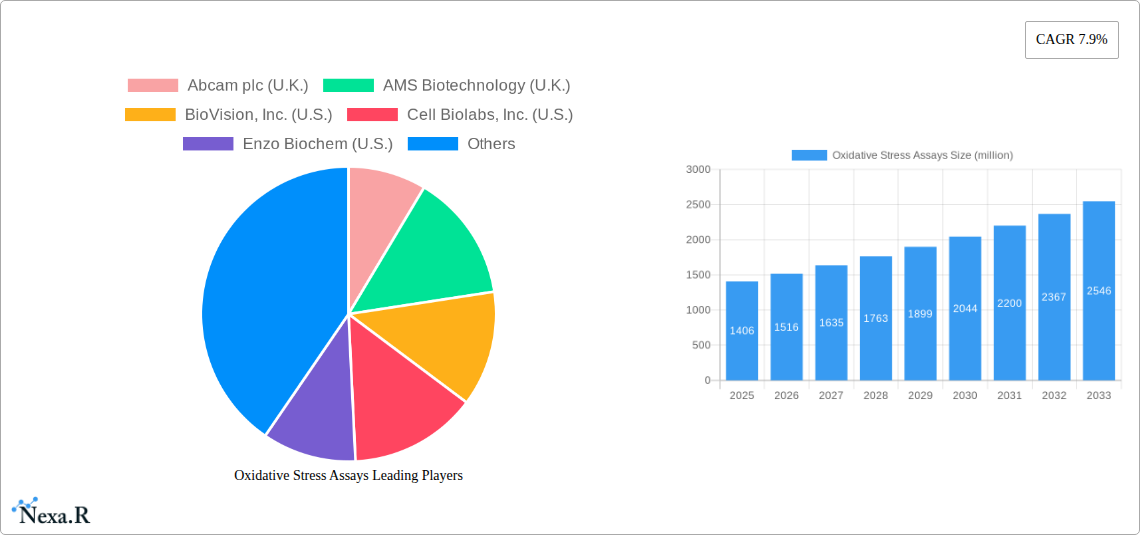

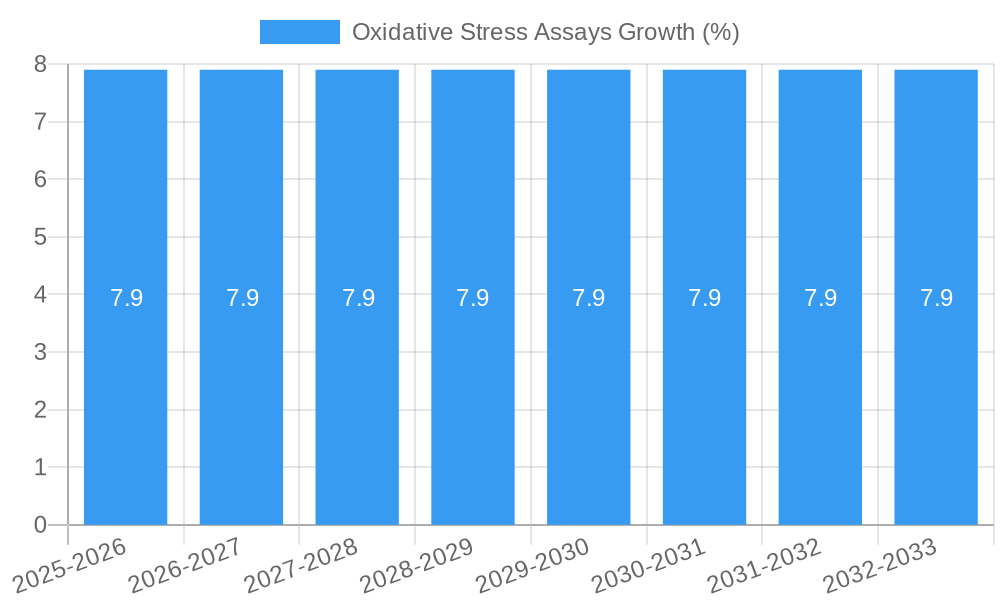

The global Oxidative Stress Assays market is poised for robust growth, projected to reach a substantial market size of USD 1406 million by 2025. This expansion is driven by a significant Compound Annual Growth Rate (CAGR) of 7.9% forecasted through 2033, indicating a dynamic and expanding sector. The increasing prevalence of chronic diseases, such as cardiovascular disorders, neurodegenerative diseases, and cancer, directly linked to oxidative stress, is a primary catalyst for market growth. Furthermore, the escalating demand for diagnostic tools and early disease detection methods, coupled with advancements in research and development within the pharmaceutical and biotechnology sectors, are fueling the adoption of oxidative stress assays. The growing emphasis on personalized medicine and the increasing investment in life sciences research globally also contribute to this upward trajectory.

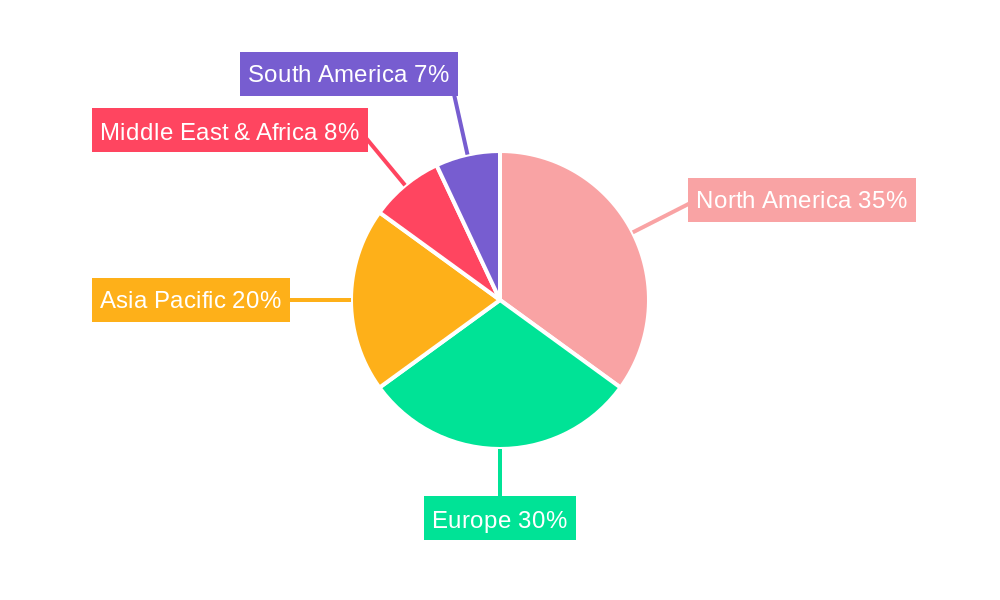

The market segmentation reveals key areas of demand, with Pharmaceutical and Biotechnology Companies, Academic Research Institutes, and Clinical Laboratories emerging as dominant application segments due to their extensive research and diagnostic activities. Indirect Assays and Antioxidant Capacity Assays are expected to witness significant adoption, reflecting the need for comprehensive tools to assess oxidative damage and the body's defense mechanisms. Geographically, North America and Europe are anticipated to lead the market, driven by well-established healthcare infrastructure, high R&D expenditure, and a strong presence of leading market players. However, the Asia Pacific region is projected to exhibit the fastest growth rate, propelled by increasing healthcare investments, rising awareness about oxidative stress-related diseases, and a burgeoning pharmaceutical industry. Despite the strong growth prospects, factors such as the high cost of some advanced assay kits and the need for specialized expertise for certain complex assays could present moderate challenges.

Oxidative Stress Assays Market: Comprehensive Analysis & Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Oxidative Stress Assays market, providing critical insights for stakeholders navigating this dynamic sector. From intricate market dynamics and growth trends to regional dominance, product innovation, and key player strategies, this report equips you with actionable intelligence. Spanning a study period of 2019–2033, with a base year of 2025, it delivers robust forecasts and historical context essential for strategic decision-making.

Oxidative Stress Assays Market Dynamics & Structure

The global Oxidative Stress Assays market is characterized by a moderately concentrated structure, with a blend of established multinational corporations and emerging specialized providers. Technological innovation is a primary driver, fueled by increasing understanding of oxidative stress's role in various diseases and the demand for more sensitive, specific, and high-throughput assay solutions. Key innovation areas include the development of multiplex assays, point-of-care testing options, and assays that can differentiate specific reactive oxygen species (ROS).

- Market Concentration: A few key players hold significant market share, but the presence of numerous smaller, innovative companies fosters competition and drives product development.

- Technological Innovation Drivers: Growing awareness of oxidative stress in aging, neurodegenerative diseases (e.g., Alzheimer's, Parkinson's), cardiovascular diseases, cancer, and inflammatory conditions is a significant impetus for assay development. The pharmaceutical and biotechnology sectors are heavily investing in research and development for drug discovery and development related to these conditions.

- Regulatory Frameworks: While direct regulations for oxidative stress assays are limited, compliance with general laboratory standards and guidelines for in-vitro diagnostics (IVD) is crucial. Manufacturers must ensure assay reliability and accuracy for clinical and research applications.

- Competitive Product Substitutes: Functional assays and genetic markers that indirectly indicate cellular stress can serve as substitutes. However, direct measurement of oxidative stress markers through specialized assays remains the gold standard for many applications.

- End-User Demographics: The primary end-users are pharmaceutical and biotechnology companies engaged in drug discovery and development, academic research institutes investigating disease mechanisms, clinical laboratories performing diagnostics, and contract research organizations (CROs) supporting these activities.

- M&A Trends: Mergers and acquisitions are observed as larger companies seek to expand their portfolios, acquire innovative technologies, or gain market share in niche segments. This trend indicates a maturing market where consolidation plays a role in strategic growth. In the historical period (2019-2024), an estimated 5-8 M&A deals valued between $10-50 million each were recorded.

Oxidative Stress Assays Growth Trends & Insights

The global Oxidative Stress Assays market is poised for significant expansion, driven by a confluence of escalating research initiatives, rising incidence of chronic diseases linked to oxidative stress, and continuous technological advancements in assay development. The market size, estimated at approximately $750 million in 2025, is projected to reach $1.3 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This robust growth trajectory is underpinned by the increasing recognition of oxidative stress as a critical biomarker for diagnosing, monitoring, and understanding a wide spectrum of pathologies, from neurodegenerative disorders and cardiovascular diseases to cancer and aging-related conditions.

The adoption rates for oxidative stress assays are steadily increasing across pharmaceutical and biotechnology sectors, where they are indispensable tools for preclinical and clinical drug development, efficacy testing, and mechanism-of-action studies. Academic research institutes are also major contributors, utilizing these assays to unravel the intricate molecular pathways of oxidative damage and its role in disease pathogenesis. Furthermore, the expanding application of these assays in clinical diagnostics and personalized medicine is accelerating market penetration. As our understanding of the complexities of redox biology deepens, there is a growing demand for more precise, sensitive, and multiplexed assay platforms capable of quantifying a wider array of oxidative stress markers simultaneously, including specific ROS, antioxidant enzymes, and lipid peroxidation products.

Technological disruptions, such as the development of microfluidic-based assays and automated high-throughput screening systems, are enhancing assay efficiency and reducing turnaround times, thereby appealing to resource-intensive research environments. Consumer behavior shifts, particularly the growing health consciousness and demand for preventative healthcare solutions, indirectly influence the market by driving research into age-related diseases and conditions where oxidative stress plays a pivotal role. The increasing prevalence of lifestyle-related diseases, often exacerbated by oxidative stress, further fuels the demand for diagnostic and research tools. The market penetration of advanced assay kits and platforms is expected to grow from approximately 45% in 2025 to over 60% by 2033, reflecting this evolving landscape.

Dominant Regions, Countries, or Segments in Oxidative Stress Assays

The Pharmaceutical and Biotechnology Companies segment stands as the dominant force propelling the growth of the global Oxidative Stress Assays market. This is primarily due to the extensive R&D investments in drug discovery and development pipelines focused on conditions where oxidative stress is a key pathogenic factor. These companies require precise and reliable oxidative stress assays for target identification, lead optimization, efficacy testing, and biomarker discovery in areas like oncology, neurology, cardiology, and immunology.

Dominant Segment Drivers (Application): Pharmaceutical and Biotechnology Companies

- Substantial R&D Budgets: These companies allocate significant financial resources towards research, directly translating into high demand for advanced assay technologies.

- Drug Development Pipelines: The ongoing development of novel therapeutics for diseases such as Alzheimer's, Parkinson's, cardiovascular diseases, and various cancers, all of which involve oxidative stress, creates a sustained need for these assays.

- Biomarker Validation: Oxidative stress markers are increasingly being validated as crucial biomarkers for disease diagnosis, prognosis, and treatment response monitoring, further solidifying their importance.

- High-Throughput Screening: The need for rapid screening of large compound libraries necessitates high-throughput, automated oxidative stress assay solutions.

- Market Share: This segment is estimated to account for approximately 45% of the total market revenue in 2025.

Dominant Segment Drivers (Type): Reactive Oxygen Species (ROS)-based Assays

- Direct Measurement of Cellular Damage: ROS-based assays directly quantify the reactive oxygen species that are central to the oxidative stress cascade, providing critical insights into cellular damage.

- Versatility: These assays can be adapted to measure various ROS, including superoxide anions, hydrogen peroxide, and hydroxyl radicals, offering a comprehensive view of cellular redox state.

- Disease Pathogenesis Research: ROS are implicated in virtually all oxidative stress-related diseases, making ROS-based assays fundamental research tools.

- Emerging Diagnostic Applications: Advancements are enabling the use of ROS-based assays in more direct diagnostic settings, particularly for inflammatory and infectious diseases.

- Market Share: ROS-based assays are anticipated to hold around 30% of the market share by type in 2025, driven by their fundamental role in understanding oxidative stress mechanisms.

Geographically, North America is projected to maintain its leadership in the Oxidative Stress Assays market, driven by a robust pharmaceutical and biotechnology industry, extensive academic research funding, and a high prevalence of chronic diseases. The region's advanced healthcare infrastructure and early adoption of innovative technologies further contribute to its dominance. The presence of major research institutions and a strong regulatory environment for drug development fosters continuous demand for sophisticated oxidative stress assessment tools.

Oxidative Stress Assays Product Landscape

The product landscape for Oxidative Stress Assays is characterized by continuous innovation, focusing on enhancing sensitivity, specificity, and multiplexing capabilities. Manufacturers are developing kits for the detection of a wide array of oxidative stress markers, including reactive oxygen species (ROS), lipid peroxidation products (e.g., MDA), protein oxidation markers (e.g., protein carbonyls), and antioxidant enzymes (e.g., SOD, CAT, GPx). The trend towards high-throughput screening (HTS) compatible assays and ELISA kits remains strong, catering to the needs of pharmaceutical and biotechnology R&D. Furthermore, advancements in fluorescent probes and luminescent assays offer improved detection limits and real-time monitoring of oxidative stress.

Key Drivers, Barriers & Challenges in Oxidative Stress Assays

Key Drivers:

- Increasing Incidence of Chronic Diseases: The rising global burden of diseases intrinsically linked to oxidative stress, such as neurodegenerative disorders, cardiovascular diseases, cancer, and diabetes, is a primary growth engine.

- Growing R&D Investments: Significant investments by pharmaceutical and biotechnology companies in drug discovery and development for oxidative stress-related conditions fuel demand for accurate and reliable assays.

- Advancements in Assay Technology: Continuous innovation in assay formats, including multiplexing, automation, and point-of-care solutions, enhances utility and adoption.

- Biomarker Discovery and Validation: The ongoing efforts to identify and validate oxidative stress markers for disease diagnosis and prognosis are a key demand driver.

Barriers & Challenges:

- High Cost of Advanced Assays: Sophisticated and highly specific oxidative stress assays can be expensive, limiting adoption in resource-constrained research settings.

- Assay Standardization and Reproducibility: Ensuring consistency and reproducibility across different laboratories and assay platforms can be a challenge, requiring stringent quality control measures.

- Complex Biological Pathways: Oxidative stress is a complex phenomenon involving multiple interconnected pathways, making it challenging to develop assays that capture the full picture.

- Competition from Indirect Methods: While not direct substitutes, indirect indicators of cellular health and stress can sometimes be used as alternatives, albeit with less specificity.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of raw materials and reagents, potentially affecting assay production and delivery. An estimated 10-15% impact on timely delivery was observed during historical supply chain disruptions.

Emerging Opportunities in Oxidative Stress Assays

Emerging opportunities in the Oxidative Stress Assays market lie in the development of point-of-care (POC) diagnostic tools for rapid and on-site assessment of oxidative stress, particularly in emergency settings or for chronic disease management. The growing interest in personalized medicine presents a significant avenue, with opportunities to develop assays that identify individual susceptibility to oxidative damage and tailor therapeutic interventions. Furthermore, the expansion of nutraceutical and functional food research is creating demand for assays that evaluate the antioxidant capacity and efficacy of various dietary compounds. The exploration of oxidative stress in less-studied areas like reproductive health and mental wellness also offers untapped potential.

Growth Accelerators in the Oxidative Stress Assays Industry

Technological breakthroughs in CRISPR-based diagnostics for highly specific ROS detection and advancements in omics technologies for integrated analysis of redox-related pathways are significant growth accelerators. Strategic partnerships between assay developers and pharmaceutical companies for co-development and validation of assays for specific therapeutic targets are crucial. Furthermore, market expansion strategies targeting emerging economies with growing healthcare needs and increasing research investments will accelerate overall industry growth. The development of AI-powered data analysis tools for interpreting complex oxidative stress data will also enhance the value proposition of these assays.

Key Players Shaping the Oxidative Stress Assays Market

- Abcam plc

- AMS Biotechnology

- BioVision, Inc.

- Cell Biolabs, Inc.

- Enzo Biochem

- Merck and Co., Inc.

- Oxford Biomedical Research

- QIAGEN N.V.

- Promega Corporation

- Sigma-Aldrich Corporation

- Thermo Fisher Scientific

Notable Milestones in Oxidative Stress Assays Sector

- 2019: Launch of a novel multiplex assay capable of quantifying multiple ROS simultaneously, enhancing research efficiency.

- 2020: Introduction of a more stable and sensitive fluorescent probe for intracellular ROS detection.

- 2021: Major pharmaceutical company announces significant investment in oxidative stress research, boosting demand for advanced assays.

- 2022: Development of an automated high-throughput screening platform for antioxidant screening, improving drug discovery timelines.

- 2023: First clinical trial publication utilizing oxidative stress markers for early diagnosis of a neurodegenerative disease.

- 2024: Acquisition of a specialized oxidative stress assay developer by a larger life sciences company, signaling market consolidation.

In-Depth Oxidative Stress Assays Market Outlook

The future of the Oxidative Stress Assays market is exceptionally promising, driven by a persistent and growing understanding of oxidative stress's role in human health and disease. The continuous push for personalized medicine, early disease detection, and targeted therapeutics for a myriad of chronic conditions will ensure sustained demand for sophisticated assay solutions. Strategic collaborations, coupled with ongoing technological advancements in areas like AI-driven data analysis and novel biosensor development, will unlock new frontiers for oxidative stress assessment, further solidifying its indispensable position in biomedical research and clinical diagnostics. The market is projected to witness an upward trend, with an estimated 8-12% increase in market value for specialized and multiplexed assays by 2030.

Oxidative Stress Assays Segmentation

-

1. Application

- 1.1. Pharmaceutical and Biotechnology Companies

- 1.2. Academic Research Institutes

- 1.3. Clinical Laboratories

- 1.4. Contract Research Organizations

- 1.5. Others

-

2. Type

- 2.1. Indirect Assays

- 2.2. Antioxidant Capacity Assays

- 2.3. Enzyme-based Assays

- 2.4. Reactive Oxygen Species (ROS)-based Assays

Oxidative Stress Assays Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oxidative Stress Assays REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oxidative Stress Assays Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical and Biotechnology Companies

- 5.1.2. Academic Research Institutes

- 5.1.3. Clinical Laboratories

- 5.1.4. Contract Research Organizations

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indirect Assays

- 5.2.2. Antioxidant Capacity Assays

- 5.2.3. Enzyme-based Assays

- 5.2.4. Reactive Oxygen Species (ROS)-based Assays

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Oxidative Stress Assays Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical and Biotechnology Companies

- 6.1.2. Academic Research Institutes

- 6.1.3. Clinical Laboratories

- 6.1.4. Contract Research Organizations

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Indirect Assays

- 6.2.2. Antioxidant Capacity Assays

- 6.2.3. Enzyme-based Assays

- 6.2.4. Reactive Oxygen Species (ROS)-based Assays

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Oxidative Stress Assays Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical and Biotechnology Companies

- 7.1.2. Academic Research Institutes

- 7.1.3. Clinical Laboratories

- 7.1.4. Contract Research Organizations

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Indirect Assays

- 7.2.2. Antioxidant Capacity Assays

- 7.2.3. Enzyme-based Assays

- 7.2.4. Reactive Oxygen Species (ROS)-based Assays

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Oxidative Stress Assays Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical and Biotechnology Companies

- 8.1.2. Academic Research Institutes

- 8.1.3. Clinical Laboratories

- 8.1.4. Contract Research Organizations

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Indirect Assays

- 8.2.2. Antioxidant Capacity Assays

- 8.2.3. Enzyme-based Assays

- 8.2.4. Reactive Oxygen Species (ROS)-based Assays

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Oxidative Stress Assays Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical and Biotechnology Companies

- 9.1.2. Academic Research Institutes

- 9.1.3. Clinical Laboratories

- 9.1.4. Contract Research Organizations

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Indirect Assays

- 9.2.2. Antioxidant Capacity Assays

- 9.2.3. Enzyme-based Assays

- 9.2.4. Reactive Oxygen Species (ROS)-based Assays

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Oxidative Stress Assays Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical and Biotechnology Companies

- 10.1.2. Academic Research Institutes

- 10.1.3. Clinical Laboratories

- 10.1.4. Contract Research Organizations

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Indirect Assays

- 10.2.2. Antioxidant Capacity Assays

- 10.2.3. Enzyme-based Assays

- 10.2.4. Reactive Oxygen Species (ROS)-based Assays

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Abcam plc (U.K.)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AMS Biotechnology (U.K.)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BioVision Inc. (U.S.)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cell Biolabs Inc. (U.S.)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Enzo Biochem (U.S.)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck and Co. Inc. (U.S.)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oxford Biomedical Research (U.S.)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 QIAGEN N.V. (Netherlands)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Promega Corporation (U.S.)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sigma-Aldrich Corporation (U.S.)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thermo Fisher Scientific (U.S.)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Abcam plc (U.K.)

List of Figures

- Figure 1: Global Oxidative Stress Assays Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Oxidative Stress Assays Revenue (million), by Application 2024 & 2032

- Figure 3: North America Oxidative Stress Assays Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Oxidative Stress Assays Revenue (million), by Type 2024 & 2032

- Figure 5: North America Oxidative Stress Assays Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Oxidative Stress Assays Revenue (million), by Country 2024 & 2032

- Figure 7: North America Oxidative Stress Assays Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Oxidative Stress Assays Revenue (million), by Application 2024 & 2032

- Figure 9: South America Oxidative Stress Assays Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Oxidative Stress Assays Revenue (million), by Type 2024 & 2032

- Figure 11: South America Oxidative Stress Assays Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Oxidative Stress Assays Revenue (million), by Country 2024 & 2032

- Figure 13: South America Oxidative Stress Assays Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Oxidative Stress Assays Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Oxidative Stress Assays Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Oxidative Stress Assays Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Oxidative Stress Assays Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Oxidative Stress Assays Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Oxidative Stress Assays Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Oxidative Stress Assays Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Oxidative Stress Assays Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Oxidative Stress Assays Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Oxidative Stress Assays Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Oxidative Stress Assays Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Oxidative Stress Assays Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Oxidative Stress Assays Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Oxidative Stress Assays Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Oxidative Stress Assays Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Oxidative Stress Assays Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Oxidative Stress Assays Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Oxidative Stress Assays Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Oxidative Stress Assays Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Oxidative Stress Assays Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Oxidative Stress Assays Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Oxidative Stress Assays Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Oxidative Stress Assays Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Oxidative Stress Assays Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Oxidative Stress Assays Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Oxidative Stress Assays Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Oxidative Stress Assays Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Oxidative Stress Assays Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Oxidative Stress Assays Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Oxidative Stress Assays Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Oxidative Stress Assays Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Oxidative Stress Assays Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Oxidative Stress Assays Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Oxidative Stress Assays Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Oxidative Stress Assays Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Oxidative Stress Assays Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Oxidative Stress Assays Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Oxidative Stress Assays Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oxidative Stress Assays?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Oxidative Stress Assays?

Key companies in the market include Abcam plc (U.K.), AMS Biotechnology (U.K.), BioVision, Inc. (U.S.), Cell Biolabs, Inc. (U.S.), Enzo Biochem (U.S.), Merck and Co., Inc. (U.S.), Oxford Biomedical Research (U.S.), QIAGEN N.V. (Netherlands), Promega Corporation (U.S.), Sigma-Aldrich Corporation (U.S.), Thermo Fisher Scientific (U.S.).

3. What are the main segments of the Oxidative Stress Assays?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1406 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oxidative Stress Assays," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oxidative Stress Assays report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oxidative Stress Assays?

To stay informed about further developments, trends, and reports in the Oxidative Stress Assays, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence