Key Insights

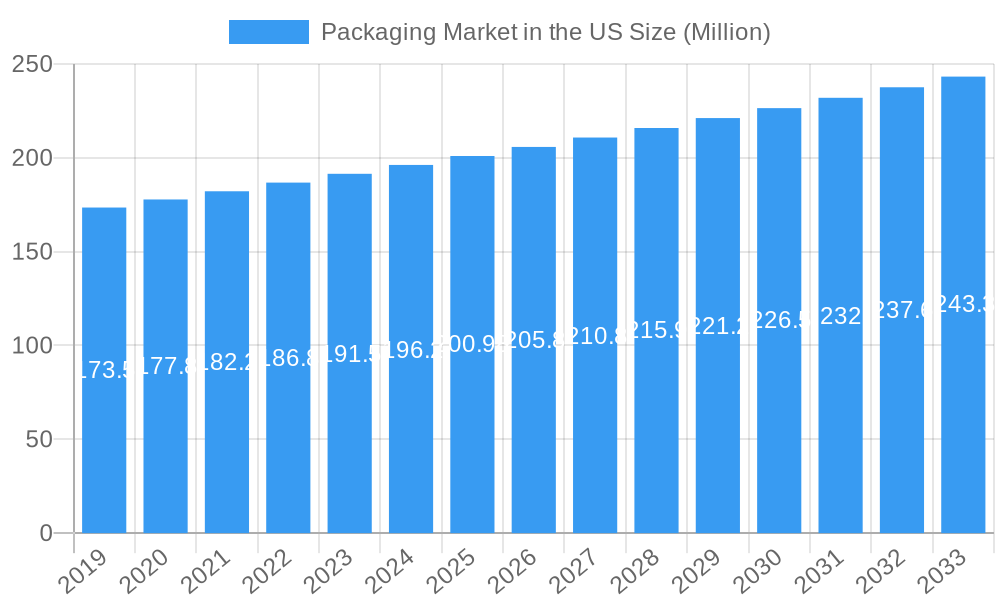

The US Packaging Market is poised for steady expansion, projected to reach $200.98 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.97% expected to sustain this momentum through 2033. This growth is underpinned by a robust demand across diverse end-user industries, prominently featuring the beverage, food, pharmaceutical, and household and personal care sectors. The inherent need for product protection, preservation, and consumer appeal drives this sustained market activity. Innovations in material science and sustainable packaging solutions are emerging as significant drivers, addressing increasing environmental consciousness and regulatory pressures. For instance, the shift towards flexible and recyclable plastic packaging, alongside advancements in paper-based solutions, reflects a conscious effort to reduce environmental impact while maintaining functional integrity and aesthetic appeal. The market also benefits from the increasing complexity of supply chains and the growing e-commerce landscape, which necessitate efficient, durable, and often customized packaging solutions.

Packaging Market in the US Market Size (In Million)

The market's trajectory will be shaped by evolving consumer preferences and technological advancements. While traditional materials like glass and metal will retain their relevance, particularly in specific applications requiring high barrier properties or premium perception, the ascendancy of paper and plastic is notable. Rigid and flexible plastics, especially those designed for recyclability and reduced material usage, are seeing increased adoption due to their versatility and cost-effectiveness. Restraints, such as fluctuating raw material costs and the ongoing challenge of developing truly circular packaging systems, will require strategic innovation from industry players. Companies like Proampac LLC, Sonoco Products Company, and Berry Global Inc. are at the forefront, investing in R&D to develop more sustainable and high-performance packaging materials and designs, anticipating a future where environmental stewardship and economic viability are intrinsically linked. The dynamic nature of these trends suggests a market ripe for innovation and strategic partnerships to navigate its future growth.

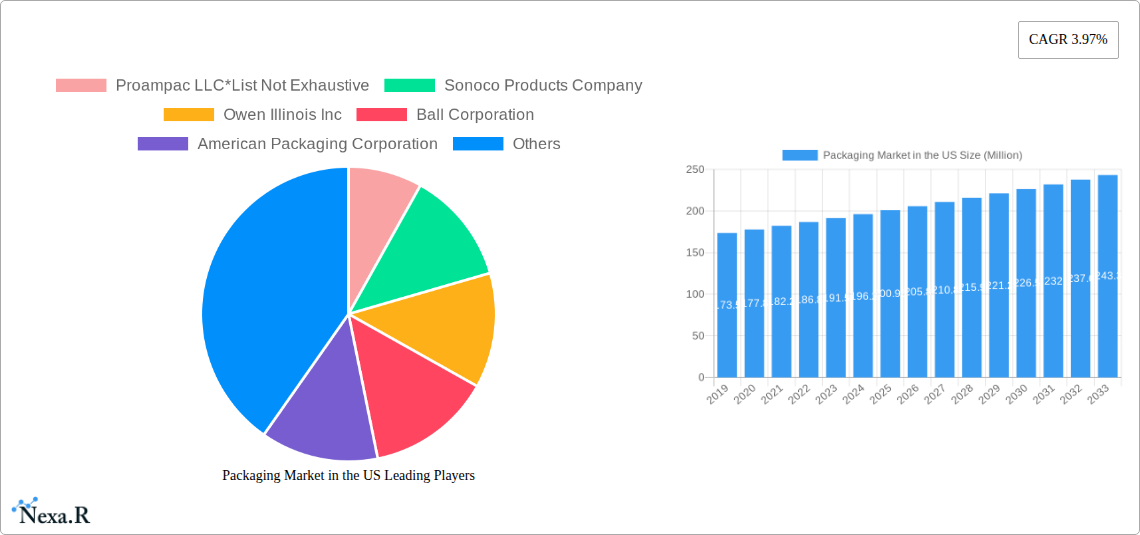

Packaging Market in the US Company Market Share

This in-depth report provides a panoramic view of the US Packaging Market, meticulously analyzing its current state and projecting its trajectory through 2033. Delve into the intricate dynamics of this multi-billion dollar industry, from material innovations to end-user demands, and uncover the strategies employed by leading players. With a focus on sustainable packaging solutions, flexible packaging trends, and the burgeoning e-commerce packaging sector, this report is an indispensable resource for manufacturers, suppliers, investors, and stakeholders seeking to navigate and capitalize on the evolving landscape of US packaging.

Gain unparalleled insights into market segmentation, including a granular breakdown of paper packaging, plastic packaging (rigid and flexible), metal packaging, and glass packaging (bottles and containers). Understand the growth drivers and challenges within key end-user industries such as beverage packaging, food packaging, pharmaceutical packaging, and household and personal care packaging. This report offers precise quantitative data, with all values presented in million units, and forecasts critical metrics for informed decision-making.

Packaging Market in the US Market Dynamics & Structure

The US packaging market is characterized by a moderately concentrated structure, with a few large corporations holding significant market share, yet a robust presence of specialized niche players. Technological innovation is a primary driver, fueled by the demand for enhanced functionality, sustainability, and aesthetic appeal. Regulatory frameworks, particularly concerning environmental impact and food safety, play a crucial role in shaping product development and material choices. Competitive product substitutes are constantly emerging, pushing companies to innovate and differentiate their offerings. End-user demographics are shifting, with an increasing preference for convenient, sustainable, and visually appealing packaging solutions. Mergers and acquisitions (M&A) continue to be a significant trend, as companies seek to consolidate market presence, expand their product portfolios, and achieve economies of scale.

- Market Concentration: Dominated by key players like Sonoco Products Company and Berry Global Inc., but with opportunities for specialized manufacturers.

- Technological Innovation: Focus on advanced barrier properties, smart packaging features, and eco-friendly materials.

- Regulatory Frameworks: Stringent regulations driving adoption of recyclable and compostable packaging materials.

- Competitive Substitutes: Development of bio-based plastics and novel paper-based solutions challenging traditional materials.

- End-User Demographics: Growing demand for lightweight, easy-to-open, and portion-controlled packaging.

- M&A Trends: Active consolidation to enhance supply chain integration and broaden technological capabilities.

Packaging Market in the US Growth Trends & Insights

The US packaging market is poised for robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and increasing demand across key end-user sectors. The historical period from 2019 to 2024 has witnessed steady expansion, with the base year of 2025 estimated to mark a significant milestone in market valuation. The forecast period, spanning from 2025 to 2033, anticipates a sustained upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.8%. This growth is underpinned by several key trends: the escalating adoption of sustainable packaging materials, such as recycled content and biodegradable alternatives, in response to heightened environmental consciousness and regulatory pressures; the proliferation of e-commerce, which necessitates specialized and durable shipping and fulfillment packaging solutions; and the continuous innovation in flexible packaging, offering superior product protection, extended shelf life, and cost-effectiveness for a wide array of goods.

Technological disruptions, including advancements in digital printing for customization and shorter run lengths, the integration of smart packaging for enhanced traceability and consumer engagement, and the development of high-performance barrier materials, are further accelerating market penetration. Consumer behavior shifts towards convenience, health-consciousness, and premiumization are directly influencing packaging design and functionality. For instance, single-serve portions for food and beverages, tamper-evident seals for pharmaceuticals, and resealable features for household products are becoming increasingly prevalent. The beverage sector, particularly in its flexible and rigid plastic segments, continues to be a primary volume driver, closely followed by the food industry, which demands diverse packaging solutions for fresh, processed, and frozen goods. The pharmaceutical industry’s stringent requirements for product integrity and child-resistance also contribute significantly to market value, while the household and personal care segment benefits from innovative designs and branding opportunities.

The market's growth is also bolstered by advancements in material science, leading to lighter yet stronger packaging that reduces transportation costs and environmental footprint. The push for a circular economy is reshaping material flows, with increased investment in recycling infrastructure and the development of closed-loop systems for packaging materials. This integrated approach to sustainability, coupled with the relentless pursuit of operational efficiency by manufacturers, is expected to maintain a healthy growth trajectory for the US packaging market throughout the forecast period. The total market size is projected to reach an estimated value of over $250 billion units by 2033, reflecting the indispensable role of packaging in the US economy.

Dominant Regions, Countries, or Segments in Packaging Market in the US

The Plastic (Rigid and Flexible) segment is projected to be the dominant force in the US packaging market, exhibiting unparalleled growth potential and market share. This dominance is fueled by the inherent versatility, cost-effectiveness, and superior barrier properties of plastic materials, making them indispensable across a vast spectrum of end-user industries. Within the broader plastic category, flexible packaging is expected to outpace its rigid counterpart due to its lightweight nature, reduced material usage, enhanced product protection, and growing appeal in the burgeoning e-commerce sector. The ability of flexible packaging to conform to various product shapes and sizes, coupled with advancements in printing and barrier technologies, positions it for sustained expansion.

The Food and Beverage end-user industries are the primary consumers of plastic packaging, driving significant demand for both rigid containers and flexible pouches, films, and wraps. The convenience-oriented nature of modern food consumption, the demand for extended shelf life, and the increasing popularity of ready-to-eat meals and on-the-go beverages directly translate into substantial volume requirements for plastic packaging solutions. Economic policies favoring domestic manufacturing and the availability of raw materials further bolster the US plastic packaging industry.

- Dominant Segment: Plastic (Rigid and Flexible)

- Flexible Packaging Growth: Driven by e-commerce, snack foods, and individual portioning.

- Rigid Packaging Demand: Sustained by beverage bottles, food trays, and personal care containers.

- Material Innovations: Development of thinner, stronger, and more sustainable plastic films and containers.

- Key End-User Industries:

- Food: Dominates demand due to diverse product categories and shelf-life requirements.

- Drivers: Growth in convenience foods, frozen foods, and fresh produce packaging.

- Market Share Impact: Accounts for an estimated 35-40% of total packaging consumption.

- Beverage: Significant volume driver, especially for carbonated soft drinks, water, and juices.

- Drivers: Shift towards smaller, portable formats and sustainable bottle options.

- Market Share Impact: Represents approximately 25-30% of the packaging market.

- Food: Dominates demand due to diverse product categories and shelf-life requirements.

- Regional Influence: While the entire US market is substantial, regions with high population density and strong manufacturing bases, such as the Midwest and the Southeast, are key contributors to overall demand.

- Drivers: Proximity to agricultural production, major food processing hubs, and extensive distribution networks.

- Growth Potential: Emerging markets in the South and West are showing accelerated growth due to population shifts and industrial expansion.

The Paper segment also holds a significant position, particularly in the Food and Household and Personal Care sectors, for applications like corrugated boxes, paperboard cartons, and flexible paper packaging. Its recyclability and biodegradable nature make it a strong contender in the sustainability race. However, its barrier properties are often inferior to plastics, limiting its application in certain product categories. The Glass segment, primarily for Beverage and Food applications, retains its appeal for premium products and its perceived inertness, though its weight and fragility present challenges. Metal packaging, predominantly aluminum and steel, remains crucial for beverages and certain food products, valued for its recyclability and protective qualities, but faces competition from lighter plastic alternatives. The continuous pursuit of innovative solutions, such as enhanced recyclability for all material types and the integration of bio-based alternatives, will continue to shape the dominance landscape within the US packaging market.

Packaging Market in the US Product Landscape

The US packaging market is dynamic, characterized by a constant influx of innovative products designed to meet evolving consumer demands and environmental concerns. Key product innovations include advanced barrier films for extended shelf life in food packaging, lightweight yet durable rigid containers for beverages, and smart packaging solutions integrated with QR codes for traceability and consumer engagement. Applications span across all end-user industries, from tamper-evident seals for pharmaceuticals to customizable designs for household and personal care products. Performance metrics such as improved puncture resistance, enhanced printability, and reduced material weight are crucial selling propositions. Technological advancements in digital printing, particularly Sealed Air's prismiq system, enable full-color, high-speed printing on flexible materials, offering unprecedented customization and visual appeal for brands.

Key Drivers, Barriers & Challenges in Packaging Market in the US

Key Drivers: The US packaging market is propelled by several powerful forces. The escalating demand for sustainable packaging solutions, driven by consumer awareness and regulatory mandates, is a primary accelerator. Innovations in material science, leading to lighter, stronger, and more functional packaging, also play a critical role. The burgeoning e-commerce sector necessitates specialized shipping and fulfillment packaging, creating new avenues for growth. Furthermore, evolving consumer lifestyles, emphasizing convenience and on-the-go consumption, directly influence packaging design and demand. Technological advancements, such as digital printing and smart packaging, offer differentiated product offerings and enhanced consumer engagement.

Key Barriers & Challenges: Despite robust growth, the market faces significant barriers and challenges. Fluctuations in raw material prices, particularly for plastics and paper, can impact profitability and pricing strategies. Stringent regulatory frameworks, while driving sustainability, can also increase compliance costs and necessitate significant investment in new technologies. Supply chain disruptions, exacerbated by global events, pose a continuous threat to timely production and delivery. Intense competition among established players and emerging disruptors can lead to price wars and pressure on margins. The capital-intensive nature of advanced packaging technologies can also be a barrier to entry for smaller manufacturers. The public perception and actual performance of recycled materials in food-grade applications remain a challenge that the industry is actively working to overcome.

Emerging Opportunities in Packaging Market in the US

Emerging opportunities in the US packaging market are predominantly centered around sustainability and technological integration. The development and widespread adoption of truly compostable and biodegradable packaging materials, especially for single-use applications, represent a significant untapped market. Innovative applications of smart packaging, including interactive elements and enhanced traceability beyond current capabilities, offer a pathway for premiumization and consumer connection. The growing demand for personalized and customizable packaging, facilitated by advancements in digital printing, presents opportunities for niche manufacturers and brands. Furthermore, the expansion of circular economy initiatives and the development of advanced recycling technologies to handle complex multi-layer flexible packaging open new avenues for material recovery and reuse. The increasing focus on reducing food waste through improved packaging designs also presents a substantial opportunity for innovation.

Growth Accelerators in the Packaging Market in the US Industry

Several catalysts are accelerating long-term growth in the US packaging industry. Technological breakthroughs in material science are enabling the creation of packaging with superior barrier properties, extended shelf life, and reduced environmental impact. Strategic partnerships between packaging manufacturers, material suppliers, and end-user brands are crucial for co-creating innovative and sustainable solutions. For instance, collaborations focused on advanced recycling technologies, like the one involving Sealed Air, ExxonMobil, and Ahold Delhaize USA, are pivotal. Market expansion strategies, driven by the growing middle class and increasing consumer spending, particularly in the food and beverage sectors, are also significant growth enablers. The continuous drive for operational efficiency and automation within manufacturing facilities helps to mitigate costs and improve throughput, further fueling growth.

Key Players Shaping the Packaging Market in the US Market

- Proampac LLC

- Sonoco Products Company

- Owens-Illinois Inc

- Ball Corporation

- American Packaging Corporation

- Sealed Air Corp

- International Paper Company

- Crown Holdings

- Berry Global Inc

- CCL Container (Hermitage) Inc

Notable Milestones in Packaging Market in the US Sector

- June 2022: American Packaging Corporation (APC) announced the opening of a new 275,000-square-foot Center of Excellence manufacturing facility in Cedar City, Utah.

- May 2022: Berry Global Group and Taco Bell partnered to advance a circular approach to sustainable packaging with the launch of a new clear, all-plastic cup containing mechanically recycled post-consumer resin (PCR).

- April 2022: Sealed Air introduced prismiq, a digital packaging brand offering design services, digital printing, and smart packaging solutions for flexible and shrinkable materials.

- April 2022: Sealed Air, ExxonMobil, and Ahold Delhaize USA collaborated on an advanced recycling initiative to recycle flexible plastics from the food supply chain into new, certified circular food-grade packaging.

In-Depth Packaging Market in the US Market Outlook

The future outlook for the US packaging market remains exceptionally bright, with sustained growth projected through 2033. Key growth accelerators will continue to be the unwavering demand for sustainable packaging, driven by both consumer preference and stringent regulations, pushing innovation in recyclable, compostable, and bio-based materials. The expansion of e-commerce will continue to fuel the need for efficient, protective, and brand-enhancing shipping solutions. Technological advancements in digital printing and smart packaging will offer greater customization, traceability, and consumer engagement opportunities. Strategic collaborations and investments in advanced recycling infrastructure will be crucial in developing a more circular economy for packaging materials. The market is expected to witness further consolidation and specialization, with companies focusing on niche segments and high-value solutions. Overall, the US packaging market is poised for continued expansion, driven by innovation, sustainability, and evolving consumer demands.

Packaging Market in the US Segmentation

-

1. Material Type

- 1.1. Paper an

- 1.2. Plastic (Rigid and Flexible)

- 1.3. Metal (C

- 1.4. Glass (Bottle and Containers)

-

2. End-user Industry

- 2.1. Beverage

- 2.2. Food

- 2.3. Pharmaceutical

- 2.4. Household and Personal Care

- 2.5. Other End-user Industries

Packaging Market in the US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

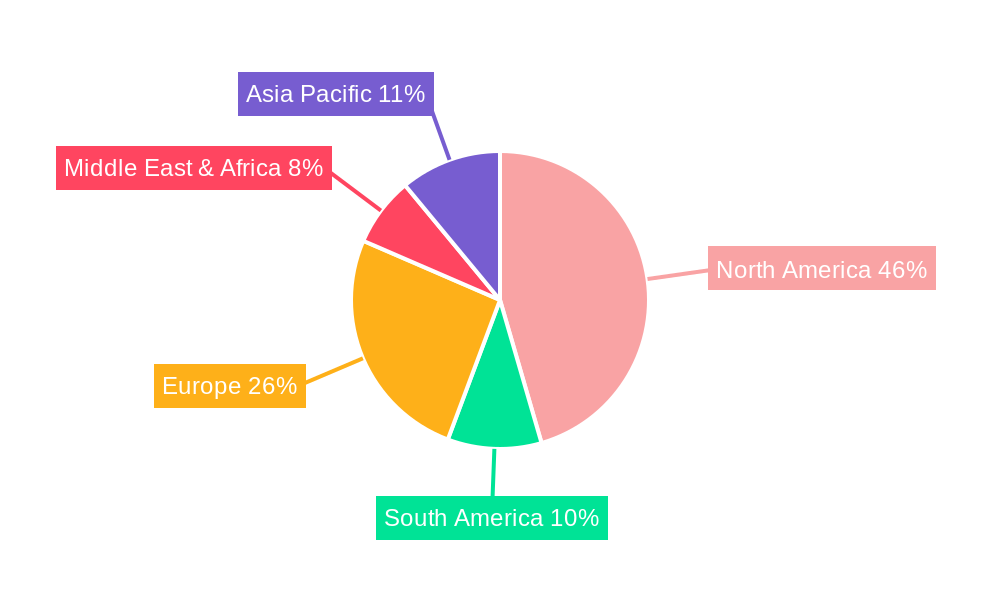

Packaging Market in the US Regional Market Share

Geographic Coverage of Packaging Market in the US

Packaging Market in the US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Convenient Packaging; Move Toward Sustainable Alternatives to Spur Demand for Paper-Based and Bio -Plastic Based Products; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations from Government Bodies over Single-use Plastic Packaging; High Dependence on Raw Material Availability and Pricing

- 3.4. Market Trends

- 3.4.1. Paper and Paperboard Vertical to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaging Market in the US Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper an

- 5.1.2. Plastic (Rigid and Flexible)

- 5.1.3. Metal (C

- 5.1.4. Glass (Bottle and Containers)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Beverage

- 5.2.2. Food

- 5.2.3. Pharmaceutical

- 5.2.4. Household and Personal Care

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Packaging Market in the US Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Paper an

- 6.1.2. Plastic (Rigid and Flexible)

- 6.1.3. Metal (C

- 6.1.4. Glass (Bottle and Containers)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Beverage

- 6.2.2. Food

- 6.2.3. Pharmaceutical

- 6.2.4. Household and Personal Care

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America Packaging Market in the US Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Paper an

- 7.1.2. Plastic (Rigid and Flexible)

- 7.1.3. Metal (C

- 7.1.4. Glass (Bottle and Containers)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Beverage

- 7.2.2. Food

- 7.2.3. Pharmaceutical

- 7.2.4. Household and Personal Care

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe Packaging Market in the US Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Paper an

- 8.1.2. Plastic (Rigid and Flexible)

- 8.1.3. Metal (C

- 8.1.4. Glass (Bottle and Containers)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Beverage

- 8.2.2. Food

- 8.2.3. Pharmaceutical

- 8.2.4. Household and Personal Care

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa Packaging Market in the US Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Paper an

- 9.1.2. Plastic (Rigid and Flexible)

- 9.1.3. Metal (C

- 9.1.4. Glass (Bottle and Containers)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Beverage

- 9.2.2. Food

- 9.2.3. Pharmaceutical

- 9.2.4. Household and Personal Care

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific Packaging Market in the US Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Paper an

- 10.1.2. Plastic (Rigid and Flexible)

- 10.1.3. Metal (C

- 10.1.4. Glass (Bottle and Containers)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Beverage

- 10.2.2. Food

- 10.2.3. Pharmaceutical

- 10.2.4. Household and Personal Care

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Proampac LLC*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Owen Illinois Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ball Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Packaging Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sealed Air Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 International Paper Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crown Holdings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berry Global Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CCL Container (Hermitage) Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Proampac LLC*List Not Exhaustive

List of Figures

- Figure 1: Global Packaging Market in the US Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Packaging Market in the US Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Packaging Market in the US Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Packaging Market in the US Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Packaging Market in the US Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Packaging Market in the US Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Packaging Market in the US Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Packaging Market in the US Revenue (Million), by Material Type 2025 & 2033

- Figure 9: South America Packaging Market in the US Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: South America Packaging Market in the US Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: South America Packaging Market in the US Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: South America Packaging Market in the US Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Packaging Market in the US Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Packaging Market in the US Revenue (Million), by Material Type 2025 & 2033

- Figure 15: Europe Packaging Market in the US Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Europe Packaging Market in the US Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Packaging Market in the US Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Packaging Market in the US Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Packaging Market in the US Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Packaging Market in the US Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Middle East & Africa Packaging Market in the US Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Middle East & Africa Packaging Market in the US Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Middle East & Africa Packaging Market in the US Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Middle East & Africa Packaging Market in the US Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Packaging Market in the US Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Packaging Market in the US Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Asia Pacific Packaging Market in the US Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Asia Pacific Packaging Market in the US Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Packaging Market in the US Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Packaging Market in the US Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Packaging Market in the US Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaging Market in the US Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Packaging Market in the US Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Packaging Market in the US Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Packaging Market in the US Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global Packaging Market in the US Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Packaging Market in the US Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Packaging Market in the US Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global Packaging Market in the US Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Packaging Market in the US Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Packaging Market in the US Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global Packaging Market in the US Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Packaging Market in the US Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Packaging Market in the US Revenue Million Forecast, by Material Type 2020 & 2033

- Table 29: Global Packaging Market in the US Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Packaging Market in the US Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Packaging Market in the US Revenue Million Forecast, by Material Type 2020 & 2033

- Table 38: Global Packaging Market in the US Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Packaging Market in the US Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Packaging Market in the US Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging Market in the US?

The projected CAGR is approximately 3.97%.

2. Which companies are prominent players in the Packaging Market in the US?

Key companies in the market include Proampac LLC*List Not Exhaustive, Sonoco Products Company, Owen Illinois Inc, Ball Corporation, American Packaging Corporation, Sealed Air Corp, International Paper Company, Crown Holdings, Berry Global Inc, CCL Container (Hermitage) Inc.

3. What are the main segments of the Packaging Market in the US?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 200.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Convenient Packaging; Move Toward Sustainable Alternatives to Spur Demand for Paper-Based and Bio -Plastic Based Products; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Paper and Paperboard Vertical to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Environmental Regulations from Government Bodies over Single-use Plastic Packaging; High Dependence on Raw Material Availability and Pricing.

8. Can you provide examples of recent developments in the market?

June 2022 - American Packaging Corporation (APC) announced that it would open a new 275,000-square-foot Center of Excellence manufacturing facility in Cedar City, Utah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaging Market in the US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaging Market in the US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaging Market in the US?

To stay informed about further developments, trends, and reports in the Packaging Market in the US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence