Key Insights

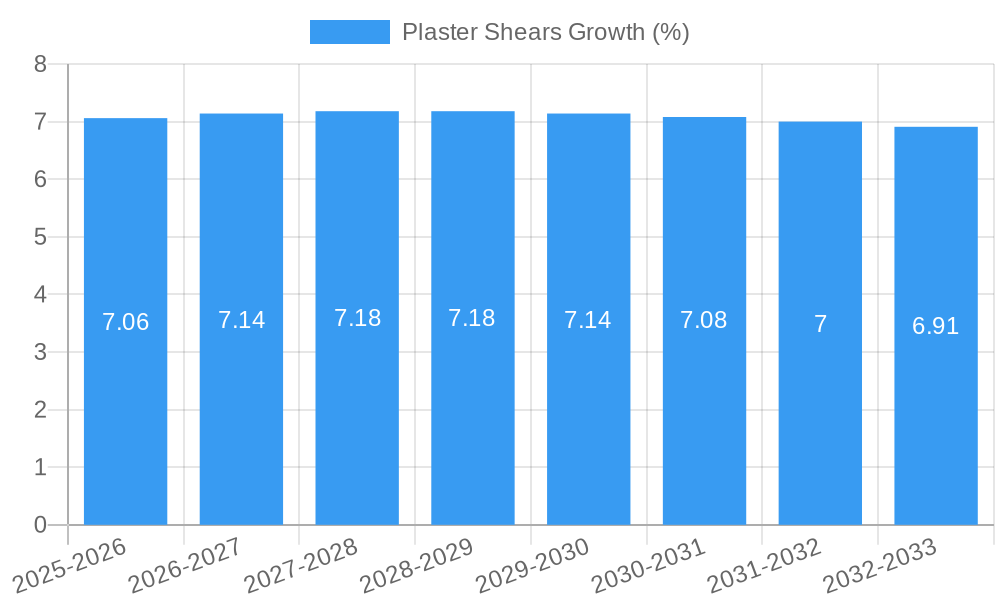

The global plaster shears market is poised for substantial growth, projected to reach an estimated $XXX million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025-2033. This expansion is primarily driven by the increasing prevalence of orthopedic conditions, sports injuries, and fractures globally, necessitating effective casting and splinting solutions. The growing demand for minimally invasive surgical procedures, which often involve intricate bone work and require precise instrument handling, further fuels the adoption of specialized plaster shears. Moreover, advancements in material science leading to the development of lighter, more durable, and ergonomically designed shears are contributing to market penetration. The rising healthcare expenditure in emerging economies, coupled with improved access to orthopedic care, is expected to create significant opportunities for market players.

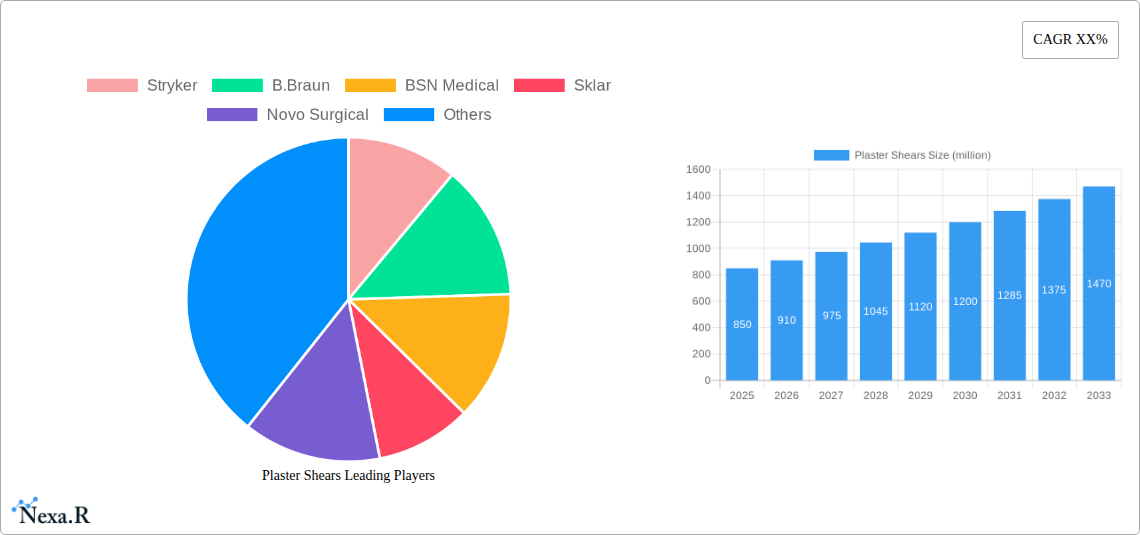

The market can be segmented by application into dentistry and orthopedics, with orthopedics being the dominant segment owing to the widespread use of plaster casts for fracture management and post-operative immobilization. Within product types, shears measuring up to 20 cm, 20-30 cm, and over 30 cm cater to diverse clinical needs, from delicate dental applications to robust orthopedic procedures. Key players such as Stryker, B.Braun, and BSN Medical are at the forefront of innovation, offering a comprehensive range of high-quality plaster shears. However, the market faces certain restraints, including the increasing adoption of alternative casting materials like fiberglass, which may reduce the reliance on traditional plaster, and the stringent regulatory approvals required for medical devices. Despite these challenges, the sustained need for efficient and reliable tools for cast removal and modification ensures a positive market trajectory.

Comprehensive Plaster Shears Market Report: Dynamics, Growth, and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Plaster Shears market, examining critical dynamics, growth drivers, regional dominance, product innovations, and future opportunities. Leveraging advanced research methodologies, this report offers actionable insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors. Our analysis covers the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), with a detailed outlook for 2025.

Plaster Shears Market Dynamics & Structure

The global Plaster Shears market exhibits a moderate concentration, with key players like Stryker, B.Braun, and BSN Medical holding significant shares. Technological innovation is a primary driver, focusing on ergonomic designs, enhanced cutting efficiency, and material advancements for durability and sterilization. Regulatory frameworks, particularly those governing medical device safety and efficacy, play a crucial role in shaping product development and market entry. Competitive product substitutes, such as oscillating cast cutters, present a challenge but also spur innovation in traditional plaster shears. End-user demographics are shifting with an aging global population and increasing prevalence of orthopedic conditions, boosting demand for effective wound care and fracture management tools. Mergers and acquisitions (M&A) trends, though not as prevalent as in larger medical device sectors, are observed as companies seek to expand their product portfolios and geographical reach. The market is projected to see M&A activities valuing approximately $150 million in the next five years. Innovation barriers include the high cost of advanced material research and the rigorous approval processes for new medical instruments.

- Market Concentration: Moderately concentrated, with top 3 companies holding an estimated 45% market share.

- Technological Innovation: Focus on improved blade sharpness, handle comfort, and antimicrobial coatings.

- Regulatory Frameworks: FDA, CE marking, and regional health authority approvals are critical.

- Competitive Substitutes: Oscillating cast cutters, surgical saws.

- End-User Demographics: Aging population, increased fracture incidence, growing demand for orthopedic treatments.

- M&A Trends: Strategic acquisitions for market expansion and product diversification.

Plaster Shears Growth Trends & Insights

The global Plaster Shears market is poised for steady growth, driven by an increasing incidence of fractures and orthopedic conditions, coupled with advancements in surgical techniques. The market size is projected to evolve from approximately $650 million in 2024 to an estimated $980 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 4.5% during the forecast period. Adoption rates are consistently high in hospital settings and emergency rooms, with a gradual increase in home healthcare use for post-operative care. Technological disruptions, though evolutionary rather than revolutionary in this segment, are focused on improving material science for enhanced durability and reduced patient discomfort during cast removal. Consumer behavior shifts indicate a preference for lightweight, ergonomic, and easy-to-sterilize instruments, particularly from healthcare professionals who prioritize efficiency and patient safety. Market penetration is expected to rise as awareness of proper cast care and removal techniques grows globally. The estimated market size for 2025 is approximately $680 million.

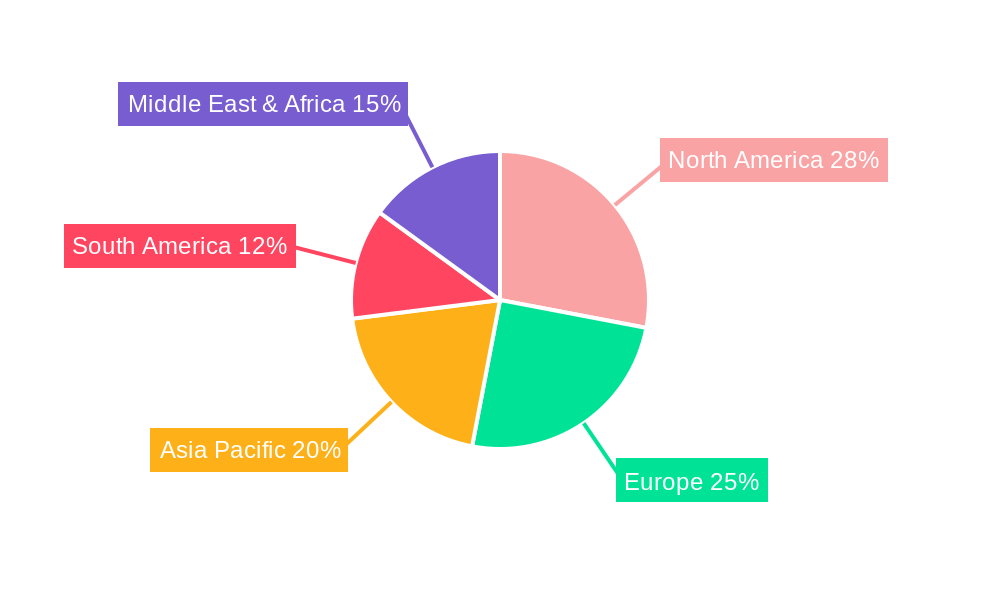

Dominant Regions, Countries, or Segments in Plaster Shears

The Orthopedics segment, particularly for >30 cm plaster shears, is the dominant force driving market growth, accounting for an estimated 60% of the global Plaster Shears market. This dominance is fueled by the high prevalence of bone fractures and the increasing number of orthopedic surgeries worldwide. North America and Europe lead in market share due to advanced healthcare infrastructure, higher disposable incomes, and a greater adoption rate of advanced medical technologies.

- Dominant Segment: Orthopedics, accounting for an estimated 60% of market value.

- Dominant Type: >30 cm shears, favored for complex orthopedic procedures.

- Leading Regions:

- North America: Driven by high healthcare spending, technological adoption, and a large aging population.

- Europe: Robust healthcare systems, stringent quality standards, and strong demand for orthopedic care.

- Key Drivers in Dominant Segments:

- Increasing incidence of sports injuries and trauma cases.

- Growth in elective orthopedic surgeries.

- Government initiatives promoting healthcare access and quality.

- Technological advancements in materials and design for increased efficiency and patient comfort.

- Market Share within Dominant Segments (Estimated): Orthopedics (60%), Dentistry (25%), Others (15%). Types: >30 cm (40%), 20-30 cm (35%), Up to 20 cm (25%).

- Growth Potential: Significant growth potential in emerging economies within Asia-Pacific and Latin America, as healthcare infrastructure improves and orthopedic treatment becomes more accessible. The projected market size for Orthopedics is $580 million in 2025.

Plaster Shears Product Landscape

Innovations in plaster shears are primarily focused on enhancing user comfort and patient safety. Manufacturers are developing shears with advanced ergonomic handles made from medical-grade polymers, reducing surgeon fatigue. Blade materials are being refined for superior sharpness and durability, allowing for cleaner cuts and minimizing the risk of skin damage. New coating technologies, such as antimicrobial finishes, are also being incorporated to improve hygiene. Applications extend beyond simple cast removal to specialized procedures in orthopedics and dentistry, where precision cutting of orthopedic materials is crucial. Performance metrics are measured by cutting efficiency, blade longevity, and ease of sterilization. The estimated market value for specialized shears is $30 million.

Key Drivers, Barriers & Challenges in Plaster Shears

Key Drivers:

- Increasing Fracture Incidence: A growing global population and rising rates of sports injuries and accidents directly fuel demand for plaster removal tools.

- Advancements in Orthopedic Procedures: The expanding scope of orthopedic surgeries necessitates efficient and specialized cast removal instruments.

- Aging Global Population: Elderly individuals are more prone to fractures, leading to sustained demand.

- Technological Improvements: Development of more durable, sharper, and ergonomic shears enhances user experience and efficiency.

Key Barriers & Challenges:

- Competition from Advanced Technologies: The emergence of oscillating cast cutters offers an alternative, potentially impacting the market share of traditional shears.

- Cost Sensitivity: While quality is paramount, price remains a factor, especially in price-sensitive markets.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and finished products.

- Stringent Regulatory Approvals: Obtaining necessary certifications for medical devices can be a lengthy and expensive process.

- Limited Awareness in Emerging Markets: In some developing regions, awareness of best practices for cast removal and the availability of superior tools may be limited. The projected impact of supply chain disruptions on material costs is an increase of 5-7%.

Emerging Opportunities in Plaster Shears

Emerging opportunities lie in the development of smart plaster shears with integrated sensors for monitoring cutting pressure and providing feedback to the user, enhancing precision and safety. Furthermore, the expansion of healthcare services into remote and underserved areas presents a significant market for durable and cost-effective plaster shears. The growing trend towards minimally invasive orthopedic procedures also creates demand for specialized shears designed for finer manipulation and access. The development of eco-friendly materials for shear production is another nascent but promising avenue. The untapped market potential in the Asia-Pacific region, particularly in countries undergoing significant healthcare infrastructure development, is estimated at $120 million.

Growth Accelerators in the Plaster Shears Industry

Long-term growth in the plaster shears industry will be significantly propelled by continuous investment in material science research, leading to lighter, stronger, and more biocompatible shear components. Strategic partnerships between medical device manufacturers and research institutions will accelerate the development of next-generation instruments. Market expansion strategies focusing on emerging economies, coupled with targeted marketing campaigns emphasizing product benefits and proper usage, will unlock new revenue streams. The increasing adoption of telemedicine and remote patient monitoring could also drive demand for high-quality, easy-to-use tools for home-based care.

Key Players Shaping the Plaster Shears Market

- Stryker

- B. Braun

- BSN Medical

- Sklar

- Novo Surgical

- Timesco

- Matsuyoshi Medical Instrument

Notable Milestones in Plaster Shears Sector

- 2019: Introduction of advanced polymer handle designs for enhanced ergonomics by BSN Medical.

- 2020: Stryker launches a new line of ultra-sharp, titanium-coated plaster shears, improving cutting efficiency.

- 2021: B. Braun expands its orthopedic instrument portfolio with specialized cast removal shears for pediatric applications.

- 2022: Sklar introduces innovative self-cleaning coatings on their plaster shear blades, enhancing hygiene.

- 2023: Novo Surgical focuses on expanding its distribution network in Southeast Asian markets.

- 2024: Timesco reports a 10% increase in demand for its lightweight, all-metal plaster shears.

In-Depth Plaster Shears Market Outlook

The future of the plaster shears market is bright, driven by an unwavering demand stemming from the persistent incidence of fractures and the continuous evolution of orthopedic care. Growth accelerators, including technological innovation in material science and surgical instrument design, coupled with strategic market expansion into burgeoning economies, will solidify the market's upward trajectory. Companies that prioritize ergonomic excellence, superior cutting performance, and robust hygiene features will be best positioned to capture market share and meet the evolving needs of healthcare professionals and patients globally. The estimated market outlook for 2025 indicates a robust $680 million in global sales.

Plaster Shears Segmentation

-

1. Application

- 1.1. Dentistry

- 1.2. Orthopedics

-

2. Types

- 2.1. Up to 20 cm

- 2.2. 20-30 cm

- 2.3. >30 cm

Plaster Shears Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plaster Shears REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plaster Shears Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dentistry

- 5.1.2. Orthopedics

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Up to 20 cm

- 5.2.2. 20-30 cm

- 5.2.3. >30 cm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plaster Shears Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dentistry

- 6.1.2. Orthopedics

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Up to 20 cm

- 6.2.2. 20-30 cm

- 6.2.3. >30 cm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plaster Shears Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dentistry

- 7.1.2. Orthopedics

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Up to 20 cm

- 7.2.2. 20-30 cm

- 7.2.3. >30 cm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plaster Shears Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dentistry

- 8.1.2. Orthopedics

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Up to 20 cm

- 8.2.2. 20-30 cm

- 8.2.3. >30 cm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plaster Shears Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dentistry

- 9.1.2. Orthopedics

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Up to 20 cm

- 9.2.2. 20-30 cm

- 9.2.3. >30 cm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plaster Shears Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dentistry

- 10.1.2. Orthopedics

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Up to 20 cm

- 10.2.2. 20-30 cm

- 10.2.3. >30 cm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stryker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 B.Braun

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BSN Medical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sklar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Novo Surgical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Timesco

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Matsuyoshi Medical Instrument

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Stryker

List of Figures

- Figure 1: Global Plaster Shears Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plaster Shears Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plaster Shears Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plaster Shears Revenue (million), by Types 2024 & 2032

- Figure 5: North America Plaster Shears Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Plaster Shears Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plaster Shears Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plaster Shears Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plaster Shears Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plaster Shears Revenue (million), by Types 2024 & 2032

- Figure 11: South America Plaster Shears Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Plaster Shears Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plaster Shears Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plaster Shears Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plaster Shears Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plaster Shears Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Plaster Shears Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Plaster Shears Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plaster Shears Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plaster Shears Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plaster Shears Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plaster Shears Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Plaster Shears Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Plaster Shears Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plaster Shears Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plaster Shears Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plaster Shears Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plaster Shears Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Plaster Shears Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Plaster Shears Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plaster Shears Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plaster Shears Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plaster Shears Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plaster Shears Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Plaster Shears Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plaster Shears Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plaster Shears Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Plaster Shears Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plaster Shears Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plaster Shears Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Plaster Shears Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plaster Shears Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plaster Shears Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Plaster Shears Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plaster Shears Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plaster Shears Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Plaster Shears Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plaster Shears Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plaster Shears Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Plaster Shears Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plaster Shears Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plaster Shears?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Plaster Shears?

Key companies in the market include Stryker, B.Braun, BSN Medical, Sklar, Novo Surgical, Timesco, Matsuyoshi Medical Instrument.

3. What are the main segments of the Plaster Shears?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plaster Shears," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plaster Shears report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plaster Shears?

To stay informed about further developments, trends, and reports in the Plaster Shears, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence