Key Insights

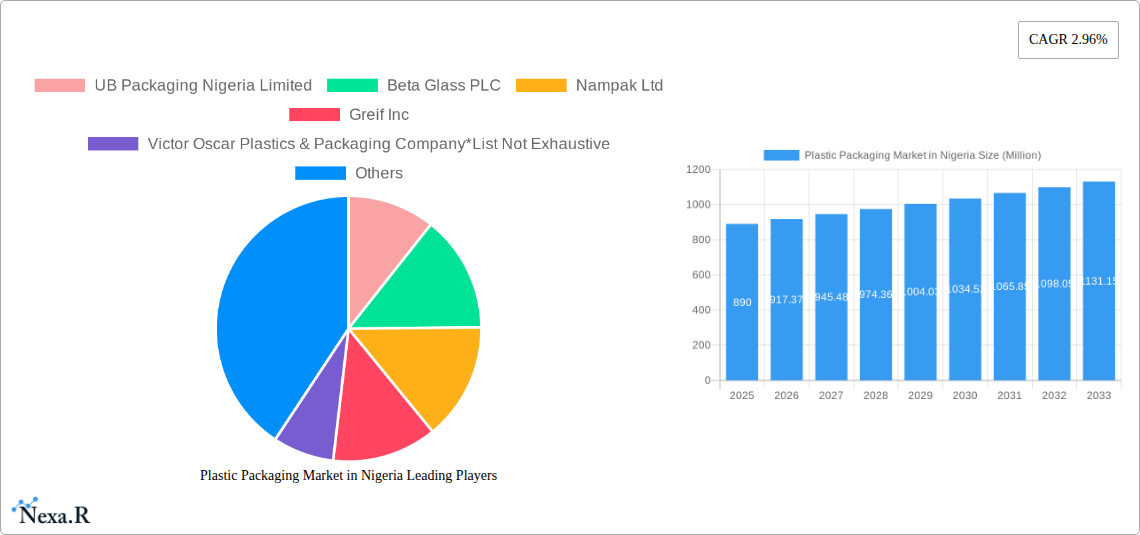

The Nigerian plastic packaging market, valued at $0.89 billion in 2025, is projected to experience steady growth, driven by a burgeoning population, rising consumer spending, and a shift towards packaged goods across various sectors. The increasing demand for convenience and longer shelf life for food and beverages fuels this expansion. While the country's robust agricultural sector contributes significantly to the demand for packaging solutions, particularly for agricultural produce, the pharmaceutical and healthcare sectors also contribute notably due to the growing need for hygienic and safe packaging of medication and medical supplies. Growth is expected across various product types including bottles, bags, pouches, and corrugated boxes. Plastic’s affordability and versatility contribute to its dominance in the market, despite growing environmental concerns. However, this dominance is likely to face pressure in the coming years as regulations aimed at curbing plastic pollution become more stringent. The government's increasing focus on sustainable alternatives and growing consumer awareness of environmental issues could lead to a gradual shift towards eco-friendly materials like paper and paperboard in the longer term. This presents both opportunities and challenges for market players, requiring investment in sustainable packaging solutions and innovation to maintain competitiveness. Competition is largely dominated by local players alongside a few international companies, creating a dynamic market landscape.

Plastic Packaging Market in Nigeria Market Size (In Million)

The projected Compound Annual Growth Rate (CAGR) of 2.96% from 2025 to 2033 suggests a gradual but consistent expansion. This growth trajectory will likely be influenced by factors including economic fluctuations, infrastructural developments, and policy changes within the country. The market segmentation by material (plastic, paper and paperboard, glass, metal), product type (bottles, bags, pouches, corrugated boxes, metal cans), and end-user industry (beverage, food, pharmaceutical and healthcare, cosmetics and toiletries, household chemicals) provides a detailed understanding of the market’s composition and helps identify areas of significant growth and potential investment. Specific attention to emerging trends, such as the rising adoption of flexible packaging and the growing need for customized packaging solutions, will be crucial for businesses seeking to thrive in this market.

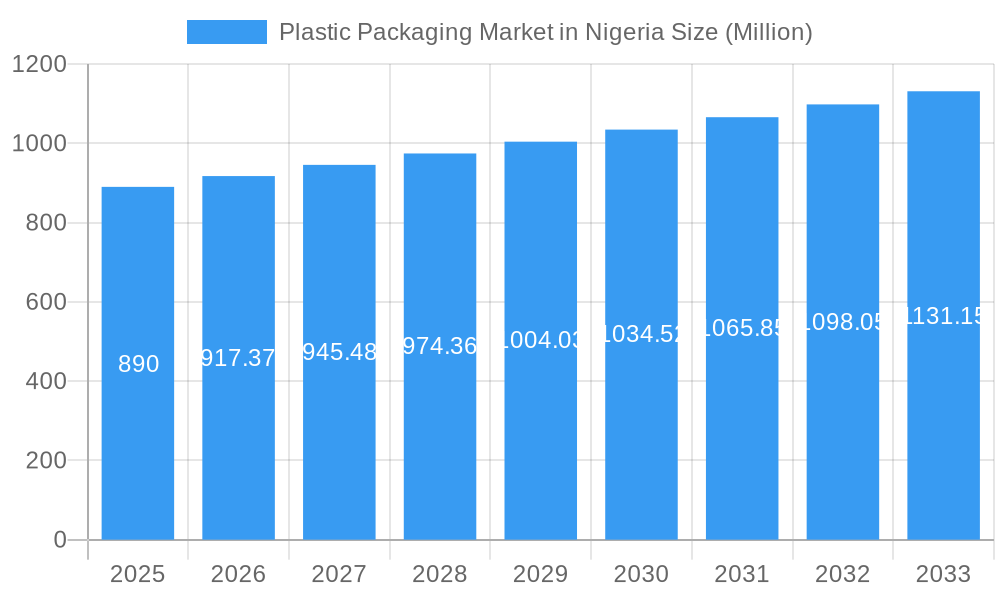

Plastic Packaging Market in Nigeria Company Market Share

Plastic Packaging Market in Nigeria: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Plastic Packaging Market in Nigeria, covering market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for businesses operating in or looking to enter the vibrant Nigerian packaging industry, encompassing the parent market of Packaging Materials and the child market of Plastic Packaging. The report leverages extensive primary and secondary research to provide actionable insights for informed decision-making. Market values are presented in million units.

Plastic Packaging Market in Nigeria Market Dynamics & Structure

The Nigerian plastic packaging market is characterized by a moderately fragmented structure, featuring a competitive landscape with several established large players and a significant number of smaller, agile companies vying for market share. This relatively low market concentration fosters a dynamic environment, offering fertile ground for both established enterprises looking to expand and emerging businesses seeking to carve out a niche. A primary catalyst for market evolution is technological innovation, predominantly steered towards the development and adoption of sustainable and eco-friendly packaging solutions. However, the path to widespread innovation is not without its hurdles, with substantial initial investment costs and constrained access to cutting-edge technologies acting as significant impediments.

The regulatory landscape is undergoing a noticeable transformation, with an increasing emphasis on environmental stewardship and waste reduction. This evolving framework is actively promoting the integration of recycled materials and advocating for a decrease in overall plastic waste. This regulatory shift presents a dual-edged sword: it drives companies towards adopting more sustainable operational practices, thereby fostering a greener industry, while simultaneously introducing the challenge of managing compliance costs. Furthermore, the market contends with the presence of competitive product substitutes, such as paper-based and glass packaging, which exert continuous pressure on the plastic packaging segment to enhance its value proposition.

The demographic profile of end-users, marked by a burgeoning population and a steadily expanding middle class, directly fuels the demand for packaged goods. This sustained demand is a critical engine for market growth. While Mergers and Acquisitions (M&A) are not an everyday occurrence, they represent a crucial strategic avenue for larger entities to broaden their market penetration and diversify their product portfolios. Historically (2019-2024), the market has witnessed approximately xx M&A deals, with projections indicating a notable uptick to xx deals during the forecast period (2025-2033), underscoring a trend towards consolidation and strategic expansion.

- Market Concentration: Exhibits a low to moderate level, indicating a competitive but not overly saturated environment.

- Technological Innovation: Primarily driven by sustainability imperatives, yet significantly hindered by the high upfront capital required for implementation.

- Regulatory Framework: Demonstrates a growing commitment to environmental protection and proactive measures for waste reduction and management.

- Competitive Substitutes: Includes viable alternatives such as paper, glass, and metal packaging, influencing market dynamics.

- M&A Activity: Recorded xx deals in the historical period (2019-2024), with a projected increase to xx deals in the forecast period (2025-2033), signaling strategic consolidations.

- Innovation Barriers: Key challenges include substantial capital expenditure requirements, limited access to advanced technologies, and a shortage of a skilled labor force capable of operating and maintaining sophisticated equipment.

Plastic Packaging Market in Nigeria Growth Trends & Insights

The Nigerian plastic packaging market is poised for robust growth, propelled by a confluence of influential factors. The market's scale has witnessed substantial expansion, growing from approximately xx million units in 2019 to xx million units in 2024, demonstrating a Compound Annual Growth Rate (CAGR) of xx%. This upward trajectory is expected to persist through the forecast period (2025-2033), with an anticipated CAGR of xx%, projecting the market to reach an impressive xx million units by 2033. A significant opportunity for market penetration remains, particularly in underserved rural areas, highlighting ample room for further expansion.

Technological advancements are playing a transformative role, with innovations in packaging materials, streamlined manufacturing processes, and increased automation contributing to enhanced efficiency and improved sustainability metrics. Consumer preferences are also undergoing a significant shift, with a discernible inclination towards packaging that is convenient, ensures product safety, and aligns with eco-friendly principles. The market's trajectory is further influenced by the volatility of raw material prices, prevailing economic conditions, and the impact of government policies. A comprehensive and detailed analysis of these critical factors and their specific influence on market growth is thoroughly elaborated within the report.

Dominant Regions, Countries, or Segments in Plastic Packaging Market in Nigeria

The Lagos region stands as the undisputed leader in the Nigerian plastic packaging market. This dominance is attributed to its superior infrastructure, the highest population density in the country, and a significant concentration of manufacturing hubs and retail activities. Among product categories, bottles, bags, and pouches command the largest market share. This is primarily driven by the immense and consistent demand for packaged beverages and a wide array of food products. In terms of end-user industries, the food and beverage sector emerges as the most substantial consumer of plastic packaging solutions, reflecting its critical role in the Nigerian economy.

- Key Drivers of Dominance:

- Lagos Region: Characterized by its robust infrastructure, high population concentration, and a thriving ecosystem of manufacturing and retail enterprises.

- Bottles, Bags, & Pouches: Driven by substantial consumer demand for conveniently packaged food and beverage products.

- Food & Beverage Sector: Represents the most significant segment in terms of plastic packaging consumption, a testament to its widespread product offerings.

- Economic Growth: A growing middle class with increasing disposable incomes translates into higher consumer spending and a greater demand for packaged goods.

- Government Policies: Favorable policies aimed at supporting local manufacturing and fostering industrial development contribute to market expansion.

Plastic Packaging Market in Nigeria Product Landscape

The Nigerian plastic packaging market offers a comprehensive and varied array of products, encompassing essential items such as bottles, bags, pouches, films, and containers. These products are meticulously crafted from a spectrum of versatile plastics, including polyethylene terephthalate (PET), high-density polyethylene (HDPE), and polypropylene (PP), catering to diverse application needs. A key focus for innovation within the market is on developing solutions that offer reduced weight (lightweighting), enhanced barrier properties to improve product preservation, and the strategic incorporation of recycled content to meet stringent environmental standards. Many companies are prioritizing product customization and optimizing delivery logistics to secure and maintain a competitive edge. The specific performance metrics of these products, such as their tensile strength and barrier characteristics, are carefully engineered and vary significantly depending on the chosen material and its intended application.

Key Drivers, Barriers & Challenges in Plastic Packaging Market in Nigeria

Key Drivers:

- Growing Population & Urbanization: Increased demand for packaged goods.

- Rising Disposable Incomes: Higher purchasing power fuels consumption of packaged products.

- Government Support for Manufacturing: Incentives to enhance local production.

Challenges & Restraints:

- Raw Material Price Volatility: Fluctuating costs impacting production profitability.

- Environmental Regulations: Stricter norms pushing for sustainable practices, potentially increasing production costs.

- Infrastructure Gaps: Limited access to reliable power and transportation networks in certain regions.

- Competition: Presence of both domestic and international players creates a competitive landscape.

Emerging Opportunities in Plastic Packaging Market in Nigeria

- Sustainable Packaging: Growing demand for eco-friendly and recyclable options presents a significant opportunity.

- E-commerce Growth: Increased online shopping necessitates packaging solutions tailored to e-commerce needs.

- Specialized Packaging: Demand for packaging solutions tailored to specific products (e.g., pharmaceuticals).

Growth Accelerators in the Plastic Packaging Market in Nigeria Industry

The long-term growth trajectory of the Nigerian plastic packaging market is set to be significantly propelled by several key accelerators. The widespread adoption of advanced manufacturing technologies, including automation and robotics, will enhance production efficiency and scalability. Strategic partnerships between packaging manufacturers and brand owners will be crucial for co-developing innovative, market-responsive solutions. Furthermore, the expansion into currently untapped markets, particularly in rural areas, through improved accessibility and robust supply chain development, will unlock substantial growth potential. The active promotion and integration of circular economy principles throughout the value chain are also expected to act as a powerful catalyst, driving sustainable growth and fostering a more environmentally responsible industry.

Key Players Shaping the Plastic Packaging Market in Nigeria Market

- UB Packaging Nigeria Limited

- Beta Glass PLC

- Nampak Ltd

- Greif Inc

- Victor Oscar Plastics & Packaging Company

- Avon Crowncaps & Containers Nigeria Limited

- Sonnex Packaging And Plastic Industries Limited

- PrimePak Industries Nigeria Ltd

- Quantum Packaging Nigeria Limited

- Twinstar Industries Ltd

Notable Milestones in Plastic Packaging Market in Nigeria Sector

- December 2023: Nestle Nigeria launched new water bottles made with 50% recycled PET, showcasing a commitment to circular economy principles.

- September 2023: SIPA Solutions expanded its operations in Lagos, indicating increased investment in the Nigerian market.

In-Depth Plastic Packaging Market in Nigeria Market Outlook

The Nigerian plastic packaging market is poised for continued growth, driven by a robust consumer base, increasing urbanization, and supportive government policies. Strategic partnerships and the integration of sustainable practices will define future success. Opportunities exist in the development of innovative packaging solutions tailored to specific needs, further reinforcing the sector’s upward trajectory. The market’s growth potential is significant, emphasizing the importance of adapting to evolving consumer preferences and environmental concerns.

Plastic Packaging Market in Nigeria Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Glass

- 1.4. Metal

-

2. Product Type

- 2.1. Bottles

- 2.2. Bags and Pouches

- 2.3. Corrugated Boxes

- 2.4. Metal Cans

-

3. End-user Industry

- 3.1. Beverage

- 3.2. Food

- 3.3. Pharmaceutical and Healthcare

- 3.4. Cosmetics and Toiletries and Household Chemicals

Plastic Packaging Market in Nigeria Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plastic Packaging Market in Nigeria Regional Market Share

Geographic Coverage of Plastic Packaging Market in Nigeria

Plastic Packaging Market in Nigeria REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Beverage Industry; Rising Adoption of Online Shopping

- 3.3. Market Restrains

- 3.3.1. Increasing Environment Concerns and Recycling

- 3.4. Market Trends

- 3.4.1. The E-commerce Industry is Growing Rapidly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plastic Packaging Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Glass

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Bags and Pouches

- 5.2.3. Corrugated Boxes

- 5.2.4. Metal Cans

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Beverage

- 5.3.2. Food

- 5.3.3. Pharmaceutical and Healthcare

- 5.3.4. Cosmetics and Toiletries and Household Chemicals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Plastic Packaging Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paper and Paperboard

- 6.1.3. Glass

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles

- 6.2.2. Bags and Pouches

- 6.2.3. Corrugated Boxes

- 6.2.4. Metal Cans

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Beverage

- 6.3.2. Food

- 6.3.3. Pharmaceutical and Healthcare

- 6.3.4. Cosmetics and Toiletries and Household Chemicals

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America Plastic Packaging Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paper and Paperboard

- 7.1.3. Glass

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles

- 7.2.2. Bags and Pouches

- 7.2.3. Corrugated Boxes

- 7.2.4. Metal Cans

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Beverage

- 7.3.2. Food

- 7.3.3. Pharmaceutical and Healthcare

- 7.3.4. Cosmetics and Toiletries and Household Chemicals

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Plastic Packaging Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paper and Paperboard

- 8.1.3. Glass

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles

- 8.2.2. Bags and Pouches

- 8.2.3. Corrugated Boxes

- 8.2.4. Metal Cans

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Beverage

- 8.3.2. Food

- 8.3.3. Pharmaceutical and Healthcare

- 8.3.4. Cosmetics and Toiletries and Household Chemicals

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa Plastic Packaging Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paper and Paperboard

- 9.1.3. Glass

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles

- 9.2.2. Bags and Pouches

- 9.2.3. Corrugated Boxes

- 9.2.4. Metal Cans

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Beverage

- 9.3.2. Food

- 9.3.3. Pharmaceutical and Healthcare

- 9.3.4. Cosmetics and Toiletries and Household Chemicals

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific Plastic Packaging Market in Nigeria Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paper and Paperboard

- 10.1.3. Glass

- 10.1.4. Metal

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles

- 10.2.2. Bags and Pouches

- 10.2.3. Corrugated Boxes

- 10.2.4. Metal Cans

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Beverage

- 10.3.2. Food

- 10.3.3. Pharmaceutical and Healthcare

- 10.3.4. Cosmetics and Toiletries and Household Chemicals

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UB Packaging Nigeria Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beta Glass PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nampak Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Greif Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Victor Oscar Plastics & Packaging Company*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Avon Crowncaps & Containers Nigeria Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sonnex Packaging And Plastic Industries Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PrimePak Industries Nigeria Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Quantum Packaging Nigeria Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Twinstar Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 UB Packaging Nigeria Limited

List of Figures

- Figure 1: Global Plastic Packaging Market in Nigeria Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Plastic Packaging Market in Nigeria Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Plastic Packaging Market in Nigeria Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Plastic Packaging Market in Nigeria Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Plastic Packaging Market in Nigeria Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Plastic Packaging Market in Nigeria Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Plastic Packaging Market in Nigeria Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Plastic Packaging Market in Nigeria Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Plastic Packaging Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Plastic Packaging Market in Nigeria Revenue (Million), by Material 2025 & 2033

- Figure 11: South America Plastic Packaging Market in Nigeria Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America Plastic Packaging Market in Nigeria Revenue (Million), by Product Type 2025 & 2033

- Figure 13: South America Plastic Packaging Market in Nigeria Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America Plastic Packaging Market in Nigeria Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Plastic Packaging Market in Nigeria Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Plastic Packaging Market in Nigeria Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Plastic Packaging Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Plastic Packaging Market in Nigeria Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe Plastic Packaging Market in Nigeria Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Plastic Packaging Market in Nigeria Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Europe Plastic Packaging Market in Nigeria Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Plastic Packaging Market in Nigeria Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Plastic Packaging Market in Nigeria Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Plastic Packaging Market in Nigeria Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Plastic Packaging Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Plastic Packaging Market in Nigeria Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa Plastic Packaging Market in Nigeria Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa Plastic Packaging Market in Nigeria Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa Plastic Packaging Market in Nigeria Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa Plastic Packaging Market in Nigeria Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa Plastic Packaging Market in Nigeria Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa Plastic Packaging Market in Nigeria Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Plastic Packaging Market in Nigeria Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Plastic Packaging Market in Nigeria Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific Plastic Packaging Market in Nigeria Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific Plastic Packaging Market in Nigeria Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Plastic Packaging Market in Nigeria Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Plastic Packaging Market in Nigeria Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific Plastic Packaging Market in Nigeria Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific Plastic Packaging Market in Nigeria Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Plastic Packaging Market in Nigeria Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Plastic Packaging Market in Nigeria Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Plastic Packaging Market in Nigeria Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Packaging Market in Nigeria?

The projected CAGR is approximately 2.96%.

2. Which companies are prominent players in the Plastic Packaging Market in Nigeria?

Key companies in the market include UB Packaging Nigeria Limited, Beta Glass PLC, Nampak Ltd, Greif Inc, Victor Oscar Plastics & Packaging Company*List Not Exhaustive, Avon Crowncaps & Containers Nigeria Limited, Sonnex Packaging And Plastic Industries Limited, PrimePak Industries Nigeria Ltd, Quantum Packaging Nigeria Limited, Twinstar Industries Ltd.

3. What are the main segments of the Plastic Packaging Market in Nigeria?

The market segments include Material, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Beverage Industry; Rising Adoption of Online Shopping.

6. What are the notable trends driving market growth?

The E-commerce Industry is Growing Rapidly.

7. Are there any restraints impacting market growth?

Increasing Environment Concerns and Recycling.

8. Can you provide examples of recent developments in the market?

December 2023: Nestle Nigeria introduced new water bottles that are made with 50% recycled Polyethylene Terephthalate (PET). The goal of the company is to promote circular economy and minimize the impact of its production process on the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plastic Packaging Market in Nigeria," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plastic Packaging Market in Nigeria report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plastic Packaging Market in Nigeria?

To stay informed about further developments, trends, and reports in the Plastic Packaging Market in Nigeria, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence