Key Insights

The Saudi Arabian pharmaceutical glass packaging market is poised for significant expansion, propelled by a burgeoning pharmaceutical sector and escalating demand for sterile packaging for injectables and other medications. The market is projected to reach 96.5 million units by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.24%. This growth is underpinned by increased healthcare expenditure, supportive government initiatives to bolster healthcare infrastructure, and the rising incidence of chronic diseases necessitating sustained medication. Type I glass, recognized for its superior chemical resistance, is anticipated to lead segment growth, particularly for sensitive pharmaceutical formulations. Bottles and containers are expected to dominate product types, followed by vials and ampoules, reflecting the substantial volume of liquid and injectable medicines. The branded segment is projected to maintain its leading position in application types, driven by brand loyalty and premium pricing. Key industry contributors, including DWK Life Sciences GmbH, Becton Dickinson and Company, and Corning Incorporated, are instrumental in market development through their technological prowess and extensive distribution networks. Key growth hubs are likely to include Riyadh and Jeddah, owing to their concentration of pharmaceutical firms and healthcare facilities. Future market dynamics will be shaped by advancements in glass manufacturing, the adoption of eco-friendly packaging, and evolving regulatory landscapes within the pharmaceutical industry.

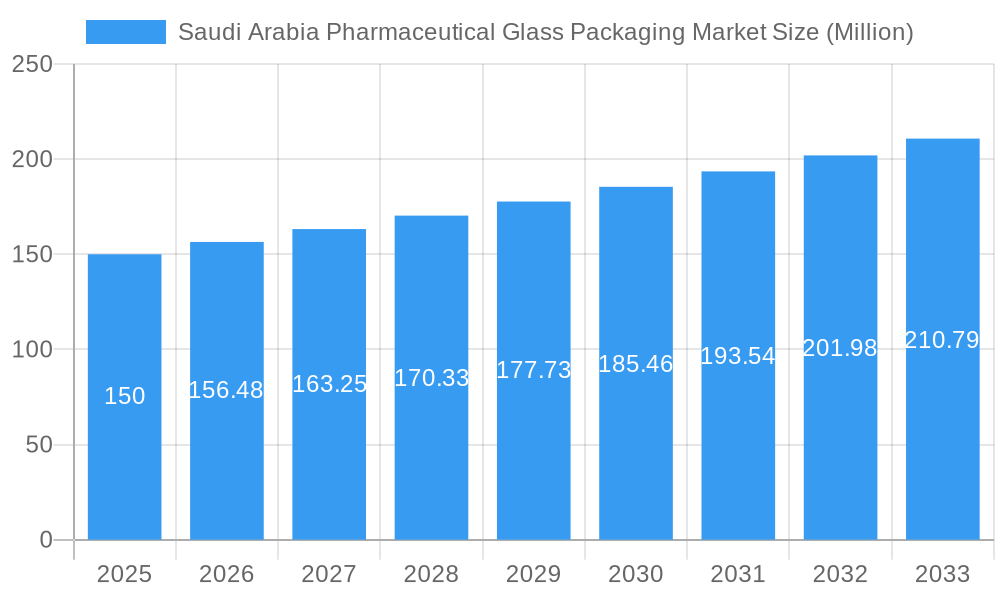

Saudi Arabia Pharmaceutical Glass Packaging Market Market Size (In Million)

The Saudi Arabian pharmaceutical glass packaging market is forecasted to maintain its positive trajectory through 2033, with potential moderation influenced by economic factors such as oil price volatility, evolving healthcare policies, and global supply chain resilience. However, the long-term outlook remains robust, fueled by continuous healthcare sector growth and the persistent need for secure and efficacious pharmaceutical products. Ongoing investments in domestic manufacturing and the emergence of specialized packaging for temperature-sensitive biologics will foster sustained market development. Increased competition from established and new entrants is expected to stimulate innovation and broaden product offerings to meet diverse client requirements.

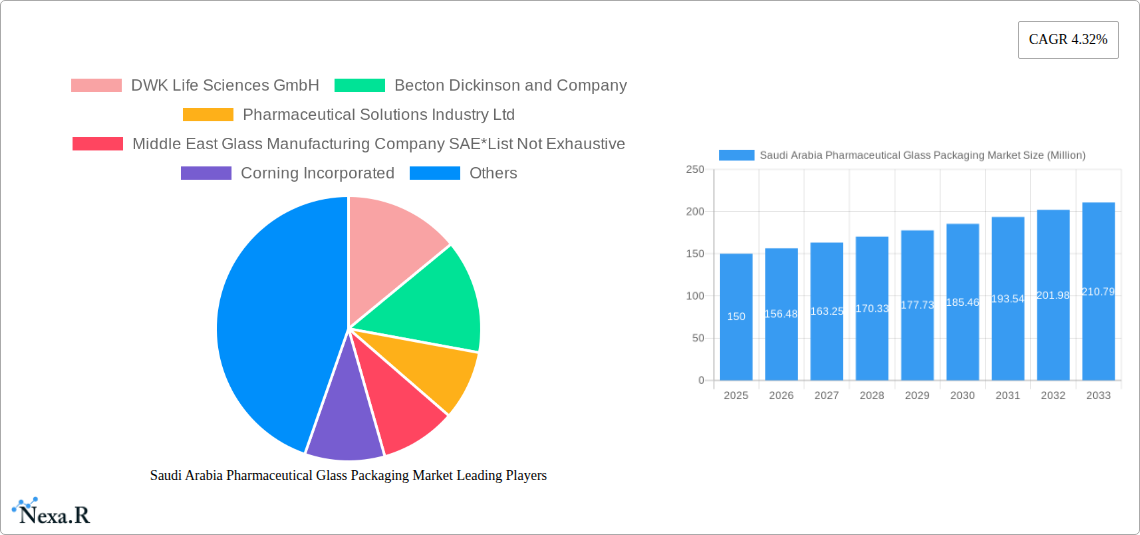

Saudi Arabia Pharmaceutical Glass Packaging Market Company Market Share

Saudi Arabia Pharmaceutical Glass Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia pharmaceutical glass packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by glass type (Type I, Type II, Type III), product type (bottles & containers, vials, ampoules, cartridges & syringes, other), and application type (branded, biological, generic). Key players include DWK Life Sciences GmbH, Becton Dickinson and Company, Pharmaceutical Solutions Industry Ltd, Middle East Glass Manufacturing Company SAE, Corning Incorporated, and GlaxoSmithKline PLC.

Saudi Arabia Pharmaceutical Glass Packaging Market Dynamics & Structure

This section analyzes the Saudi Arabia pharmaceutical glass packaging market's structure, encompassing market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A trends. The market exhibits a moderately concentrated structure, with a few large players holding significant market share. Technological advancements in glass manufacturing processes, such as improved barrier properties and enhanced sterilization techniques, are key drivers. Stringent regulatory frameworks ensure product quality and safety, impacting market dynamics. Competition from alternative packaging materials, such as plastics, exists but is limited due to glass's inherent advantages for pharmaceutical applications.

- Market Concentration: xx% held by top 5 players (2024).

- M&A Activity: xx deals recorded between 2019-2024, primarily focused on expanding production capacity and geographical reach.

- Technological Innovation: Focus on sustainable and recyclable glass packaging, along with improved barrier properties to extend shelf life.

- Regulatory Landscape: Strict adherence to Saudi Food and Drug Authority (SFDA) guidelines.

Saudi Arabia Pharmaceutical Glass Packaging Market Growth Trends & Insights

The Saudi Arabian pharmaceutical glass packaging market is experiencing robust growth, driven by factors such as rising healthcare expenditure, a growing pharmaceutical industry, and increasing demand for pharmaceutical products. The market size is projected to reach xx million units by 2025 and xx million units by 2033, registering a CAGR of xx% during the forecast period. This growth is fueled by increasing adoption of advanced packaging solutions, technological disruptions leading to enhanced product quality, and a shift towards branded and biological pharmaceuticals. The market penetration of Type I glass is expected to increase significantly due to its superior barrier properties. Consumer behavior is influenced by factors like product safety and efficacy, leading to increased preference for high-quality glass packaging.

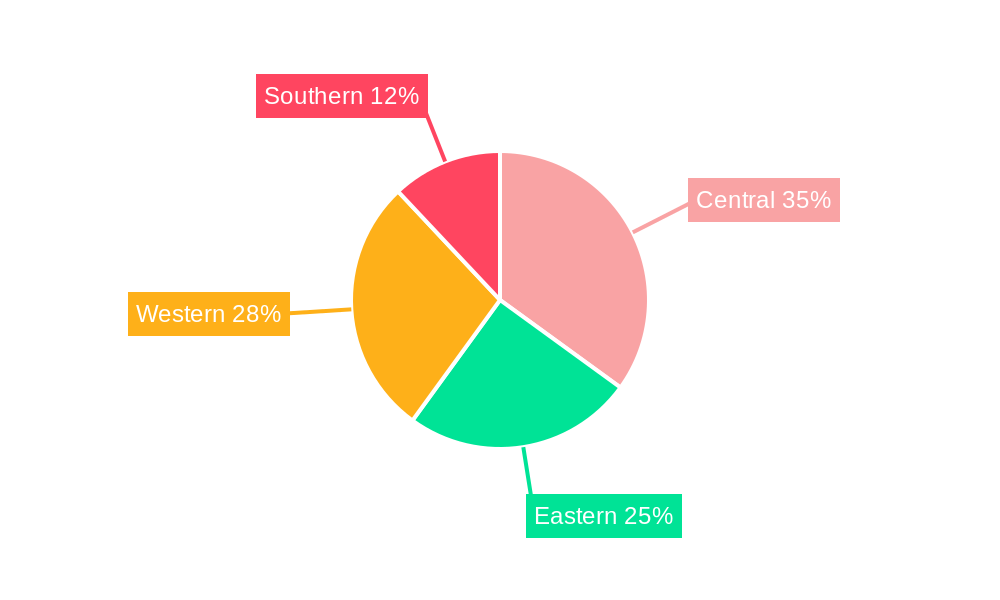

Dominant Regions, Countries, or Segments in Saudi Arabia Pharmaceutical Glass Packaging Market

The market is predominantly driven by the urban areas of Saudi Arabia, with Riyadh, Jeddah, and Dammam exhibiting the highest demand. The Type I glass segment holds the largest market share due to its superior chemical resistance and suitability for sensitive pharmaceuticals. Similarly, the Vials and Bottles & Containers segments dominate the product type landscape due to their widespread use in various pharmaceutical applications. The Branded segment is the largest within application types, due to the increased demand for branded pharmaceutical products.

- Key Growth Drivers: Rising healthcare infrastructure investments, government initiatives to boost the pharmaceutical sector, and increasing demand for injectables.

- Dominant Segment: Type I glass, holding xx% market share in 2024.

- Regional Dominance: Urban centers like Riyadh and Jeddah drive market growth.

Saudi Arabia Pharmaceutical Glass Packaging Market Product Landscape

The Saudi Arabian pharmaceutical glass packaging market features a diverse range of products, from standard vials and bottles to specialized containers designed for specific pharmaceutical applications. Continuous innovation focuses on improving barrier properties, enhancing product sterility, and developing sustainable packaging solutions. Key trends include the adoption of lightweight glass to reduce transportation costs and the development of tamper-evident closures to enhance product security. Unique selling propositions include customized designs, superior barrier properties, and improved sustainability features.

Key Drivers, Barriers & Challenges in Saudi Arabia Pharmaceutical Glass Packaging Market

Key Drivers:

- Increasing demand for pharmaceutical products.

- Growth in the healthcare sector.

- Stringent regulatory compliance requirements.

- Growing preference for sterile packaging solutions.

Key Barriers & Challenges:

- Competition from alternative packaging materials.

- Fluctuations in raw material prices (e.g., silica sand).

- Supply chain disruptions and logistics challenges.

- Potential for environmental concerns related to glass production and disposal.

Emerging Opportunities in Saudi Arabia Pharmaceutical Glass Packaging Market

Emerging opportunities include the growing demand for customized packaging solutions, increasing adoption of smart packaging technologies (e.g., RFID tagging for product traceability), and a rising focus on sustainable and eco-friendly glass packaging. Untapped markets lie in the expansion of services to smaller pharmaceutical companies and exploration of niche applications within the pharmaceutical sector.

Growth Accelerators in the Saudi Arabia Pharmaceutical Glass Packaging Market Industry

Long-term growth is accelerated by strategic partnerships between glass packaging manufacturers and pharmaceutical companies, coupled with technological advancements driving greater efficiency and product innovation. Expansion into new geographical regions within the Kingdom and the development of innovative packaging designs tailored to specific pharmaceutical products will contribute to market expansion.

Key Players Shaping the Saudi Arabia Pharmaceutical Glass Packaging Market Market

- DWK Life Sciences GmbH

- Becton Dickinson and Company

- Pharmaceutical Solutions Industry Ltd

- Middle East Glass Manufacturing Company SAE

- Corning Incorporated

- GlaxoSmithKline PLC

Notable Milestones in Saudi Arabia Pharmaceutical Glass Packaging Market Sector

- November 2022: SAR 272 million (USD 73 million) investment in a new Spimaco factory in the Qassim region, supported by AstraZeneca, creating opportunities for glass packaging companies.

In-Depth Saudi Arabia Pharmaceutical Glass Packaging Market Outlook

The Saudi Arabia pharmaceutical glass packaging market is poised for continued strong growth, driven by favorable government policies, rising healthcare expenditure, and a burgeoning pharmaceutical industry. Strategic partnerships, technological innovation, and expansion into new market segments present significant opportunities for market players. The long-term outlook remains positive, with substantial growth potential in the coming years.

Saudi Arabia Pharmaceutical Glass Packaging Market Segmentation

-

1. Glass Type

- 1.1. Type I

- 1.2. Type II

- 1.3. Type III

-

2. Product Type

- 2.1. Bottles and Containers

- 2.2. Vials

- 2.3. Ampoules

- 2.4. Cartridges and Syringes

- 2.5. Other Product Types

-

3. Application Type

- 3.1. Branded

- 3.2. Biological

- 3.3. Generic

Saudi Arabia Pharmaceutical Glass Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Pharmaceutical Glass Packaging Market Regional Market Share

Geographic Coverage of Saudi Arabia Pharmaceutical Glass Packaging Market

Saudi Arabia Pharmaceutical Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Pharmaceutical Sector in the Country; Recyclability Increasing the Commodity Value of Glass

- 3.3. Market Restrains

- 3.3.1. Presence of Relevant Alternate Material Sources; Concerns Regarding Glass Surface may Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Growth of the Pharmaceutical Sector in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Pharmaceutical Glass Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Glass Type

- 5.1.1. Type I

- 5.1.2. Type II

- 5.1.3. Type III

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Containers

- 5.2.2. Vials

- 5.2.3. Ampoules

- 5.2.4. Cartridges and Syringes

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Branded

- 5.3.2. Biological

- 5.3.3. Generic

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Glass Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DWK Life Sciences GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Becton Dickinson and Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pharmaceutical Solutions Industry Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Middle East Glass Manufacturing Company SAE*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corning Incorporated

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GlaxoSmithKline PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 DWK Life Sciences GmbH

List of Figures

- Figure 1: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Pharmaceutical Glass Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Glass Type 2020 & 2033

- Table 2: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Glass Type 2020 & 2033

- Table 6: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Saudi Arabia Pharmaceutical Glass Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Pharmaceutical Glass Packaging Market?

The projected CAGR is approximately 5.24%.

2. Which companies are prominent players in the Saudi Arabia Pharmaceutical Glass Packaging Market?

Key companies in the market include DWK Life Sciences GmbH, Becton Dickinson and Company, Pharmaceutical Solutions Industry Ltd, Middle East Glass Manufacturing Company SAE*List Not Exhaustive, Corning Incorporated, GlaxoSmithKline PLC.

3. What are the main segments of the Saudi Arabia Pharmaceutical Glass Packaging Market?

The market segments include Glass Type, Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.5 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Pharmaceutical Sector in the Country; Recyclability Increasing the Commodity Value of Glass.

6. What are the notable trends driving market growth?

Growth of the Pharmaceutical Sector in the Country.

7. Are there any restraints impacting market growth?

Presence of Relevant Alternate Material Sources; Concerns Regarding Glass Surface may Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: A total of SAR 272 million (USD 73 million) was invested in the construction of the new factory in the Qassim region by Saudi Pharmaceutical Industries & Medical Appliances Corporation (Spimaco), a market player in the Kingdom's pharmaceutical industries sector. AstraZeneca, a prominent worldwide pharmaceutical company, helped establish the new 2,800 square meter plant, producing many hazardous medications. The investment would provide opportunities to various glass packaging companies in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Pharmaceutical Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Pharmaceutical Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Pharmaceutical Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Pharmaceutical Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence