Key Insights

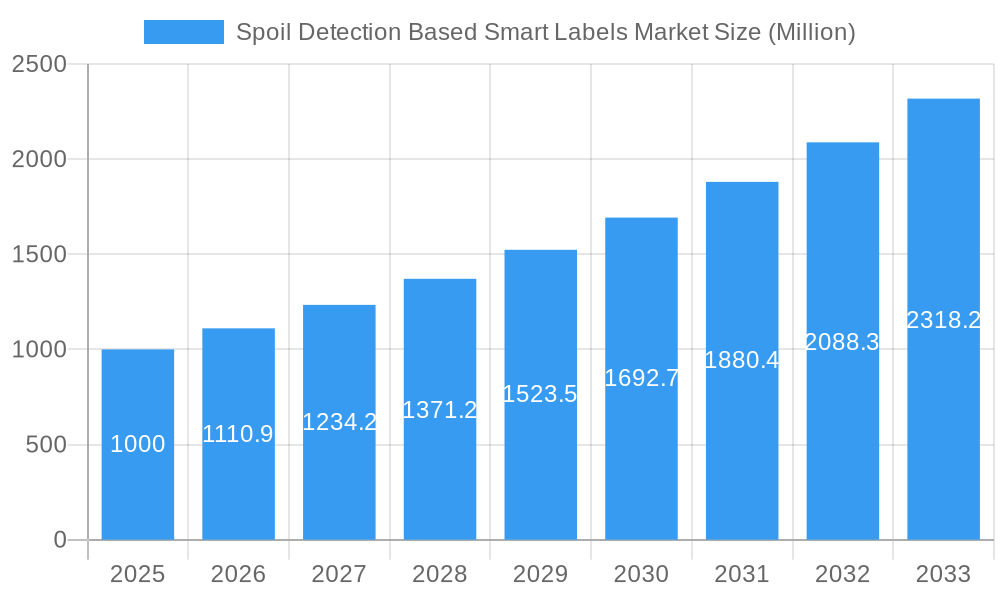

The Spoil Detection Based Smart Labels market is experiencing robust growth, projected to reach \$1.00 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 11.09% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing consumer demand for food safety and quality assurance is pushing adoption across the food and beverage sector. The need to minimize food waste due to spoilage, coupled with stricter regulatory compliance requirements, is further accelerating market growth. Technological advancements in sensing technologies like RFID, NFC, and sensing labels, offering enhanced accuracy and reliability in detecting spoilage, are also major contributors. Furthermore, the pharmaceutical industry's increasing focus on maintaining the integrity and efficacy of temperature-sensitive drugs fuels demand for these smart labels. Logistics companies are also leveraging these technologies to improve supply chain visibility and reduce losses due to product deterioration. The market is segmented by technology (RFID, Sensing Labels, NFC) and end-user industry (Pharmaceutical, Food and Beverage, Logistics, Cosmetics, and Others), with the food and beverage sector currently dominating. Geographic expansion is anticipated across North America (particularly the US and Canada), Europe (Germany, UK, France leading the way), and Asia Pacific (driven by China, Japan, and India), reflecting increasing global awareness of food safety and supply chain optimization.

Spoil Detection Based Smart Labels Market Market Size (In Billion)

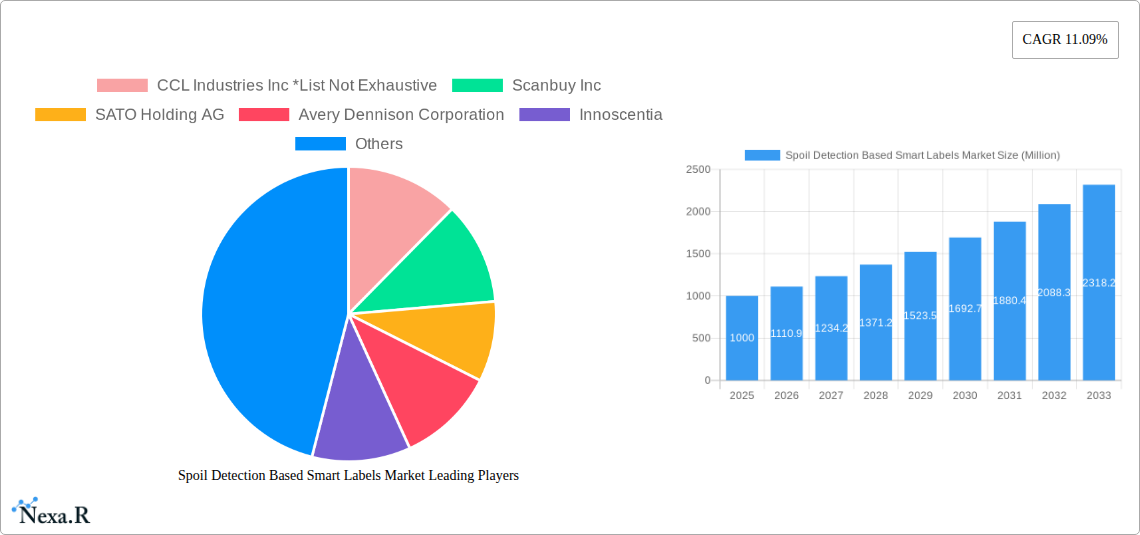

The market's sustained growth trajectory is expected to continue throughout the forecast period (2025-2033). Competitive intensity is moderate, with key players like CCL Industries, Scanbuy, SATO Holding, Avery Dennison, and Zebra Technologies actively innovating and expanding their product portfolios. Future growth hinges on continued technological advancements to improve label affordability and functionality, alongside increased consumer and regulatory acceptance of these solutions. The development of integrated systems that combine smart labels with data analytics platforms for proactive spoilage management will further enhance market prospects. Challenges remain, including the initial investment costs associated with adopting smart label technology, and ensuring the reliability and scalability of these systems across diverse supply chains. However, the significant benefits in terms of reduced waste, improved safety, and enhanced efficiency are poised to outweigh these challenges, supporting the market's continued expansion.

Spoil Detection Based Smart Labels Market Company Market Share

Spoil Detection Based Smart Labels Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Spoil Detection Based Smart Labels Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The parent market is the smart label market, and the child market is specifically spoil detection based smart labels. This detailed analysis is crucial for businesses and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market size is predicted to reach xx Million by 2033.

Spoil Detection Based Smart Labels Market Dynamics & Structure

The Spoil Detection Based Smart Labels market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, driven by advancements in RFID, NFC, and sensing label technologies, is a primary growth driver. Stringent regulatory frameworks, particularly within the pharmaceutical and food & beverage sectors, are influencing adoption rates and product development. Competitive pressures from substitute technologies and alternative preservation methods are also observed. The end-user demographics are diverse, spanning various industries with varying adoption levels based on product sensitivity and regulatory requirements. M&A activity has been relatively moderate, with strategic acquisitions focused on enhancing technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Significant advancements in RFID, NFC, and sensing technologies are driving market growth.

- Regulatory Frameworks: Stringent regulations in food & beverage and pharmaceutical sectors are catalysts for adoption.

- Competitive Substitutes: Traditional labeling methods and alternative preservation techniques present competitive pressure.

- End-User Demographics: Pharmaceutical, Food & Beverage, Logistics, and Cosmetics are key end-user industries.

- M&A Trends: Strategic acquisitions focusing on technology and market expansion; xx M&A deals recorded between 2019-2024.

Spoil Detection Based Smart Labels Market Growth Trends & Insights

The Spoil Detection Based Smart Labels market is experiencing robust growth, driven by increasing demand for enhanced food safety, improved supply chain visibility, and reduced product waste. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Adoption rates are particularly high in developed regions with stringent quality control standards. Technological disruptions, such as the integration of IoT capabilities and advanced sensing technologies, are further accelerating market expansion. Consumer preferences for transparency and traceability are also contributing to increased market penetration. Market size is expected to be xx Million in 2025 and xx Million by 2033.

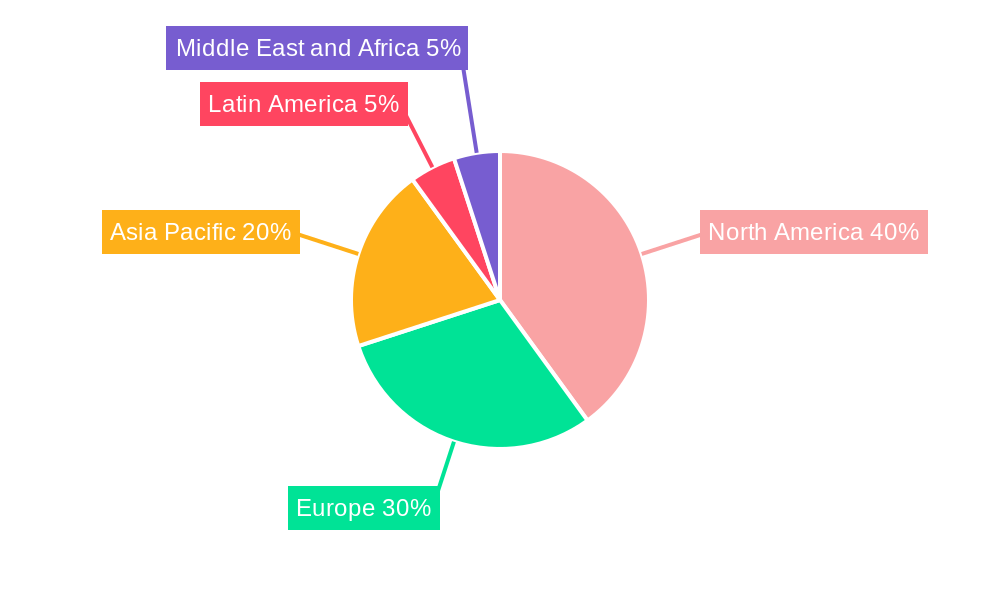

Dominant Regions, Countries, or Segments in Spoil Detection Based Smart Labels Market

North America currently holds the largest market share in the Spoil Detection Based Smart Labels market, driven by strong regulatory frameworks, high consumer awareness, and significant investments in supply chain technologies. Europe follows closely, exhibiting considerable growth potential due to increasing demand for sustainable packaging solutions and stricter food safety regulations. Within technology segments, RFID holds the largest market share, owing to its robust data handling capabilities and long-range read capabilities, followed by sensing labels and NFC. The Pharmaceutical sector dominates end-user industries due to stringent quality control requirements and high sensitivity to product spoilage.

- North America: High adoption due to stringent regulations, consumer awareness, and technological advancements.

- Europe: Strong growth potential driven by demand for sustainable packaging and stricter food safety standards.

- Asia-Pacific: Emerging market with significant growth potential, driven by rising disposable income and increasing food safety concerns.

- Technology Segments: RFID dominates, followed by sensing labels and NFC.

- End-User Industries: Pharmaceutical leads, followed by Food & Beverage, Logistics, and Cosmetics.

Spoil Detection Based Smart Labels Market Product Landscape

Spoil detection based smart labels encompass a range of technologies, including RFID, NFC, and various sensing labels that monitor temperature, humidity, and other environmental factors affecting product integrity. These labels offer real-time data capture, enabling enhanced traceability and allowing for proactive intervention to prevent spoilage. Key performance metrics include accuracy, reliability, and ease of integration into existing supply chains. Unique selling propositions often include cost-effectiveness, ease of use, and superior data visibility. Continuous innovation focuses on miniaturization, enhanced sensitivity, and integration with IoT platforms.

Key Drivers, Barriers & Challenges in Spoil Detection Based Smart Labels Market

Key Drivers:

- Increasing consumer demand for food safety and product traceability.

- Stringent regulatory requirements in various industries (e.g., pharmaceutical, food & beverage).

- Advancements in sensing and communication technologies.

- Growing adoption of IoT and data analytics in supply chain management.

Challenges and Restraints:

- High initial investment costs for some technologies (e.g., RFID).

- Concerns about data security and privacy.

- Interoperability issues between different label technologies.

- Potential for increased complexity in supply chain management. This complexity has slowed adoption by approximately xx% in the past year.

Emerging Opportunities in Spoil Detection Based Smart Labels Market

- Expansion into developing markets with growing demand for improved food safety and supply chain transparency.

- Development of multi-sensor labels capable of monitoring multiple parameters simultaneously.

- Integration with blockchain technology to enhance data security and traceability.

- Growing demand for sustainable and eco-friendly smart label materials.

Growth Accelerators in the Spoil Detection Based Smart Labels Market Industry

Technological advancements, strategic partnerships between technology providers and end-user industries, and the expansion into new markets are pivotal growth catalysts. The integration of artificial intelligence (AI) and machine learning (ML) into data analysis is poised to significantly enhance predictive capabilities and optimize supply chain efficiency. Collaborative efforts to standardize label technologies and data formats are also crucial for wider adoption.

Key Players Shaping the Spoil Detection Based Smart Labels Market Market

- CCL Industries Inc

- Scanbuy Inc

- SATO Holding AG

- Avery Dennison Corporation

- Innoscentia

- SpotSee

- Insignia Technologies

- Zebra Technologies Corporation

- Evigence Sensors

- Ensurge Micropower ASA

Notable Milestones in Spoil Detection Based Smart Labels Market Sector

- September 2021: Timestrip UK Limited launched the VFM -7C vaccine temperature indicator.

- December 2021: SpotSee launched the Vaccine Vial Indicator.

- April 2022: SpotSee launched FreezeSafe temperature indicator.

- April 2022: Avery Dennison opened a new manufacturing facility in Greater Noida, India.

In-Depth Spoil Detection Based Smart Labels Market Market Outlook

The Spoil Detection Based Smart Labels market is poised for substantial growth, driven by ongoing technological innovation, increasing regulatory pressure, and rising consumer demand for product traceability and safety. Strategic partnerships, market expansion into untapped regions, and the development of innovative applications will be key to realizing the market's full potential. The integration of AI and blockchain technologies presents significant opportunities for enhancing data security and supply chain efficiency. The market anticipates substantial growth in the coming years, presenting lucrative opportunities for businesses operating in this dynamic sector.

Spoil Detection Based Smart Labels Market Segmentation

-

1. Technology (Qualitative Trend Analysis)

- 1.1. RFID

- 1.2. Sensing Label

- 1.3. NFC

-

2. End-user Industry

- 2.1. Pharmaceutical

- 2.2. Food and Beverage

- 2.3. Logistics

- 2.4. Cosmetics

- 2.5. Other End-user Industries

Spoil Detection Based Smart Labels Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Spoil Detection Based Smart Labels Market Regional Market Share

Geographic Coverage of Spoil Detection Based Smart Labels Market

Spoil Detection Based Smart Labels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Determine the Freshness of Products; Rising Consumer Preference for Hygienic Food Materials; Increasing Demand for Security and Tracking Solutions

- 3.3. Market Restrains

- 3.3.1 Competition from Substitutes

- 3.3.2 such as Glass and Plastic Packaging

- 3.4. Market Trends

- 3.4.1. The RFID Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Spoil Detection Based Smart Labels Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 5.1.1. RFID

- 5.1.2. Sensing Label

- 5.1.3. NFC

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Pharmaceutical

- 5.2.2. Food and Beverage

- 5.2.3. Logistics

- 5.2.4. Cosmetics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 6. North America Spoil Detection Based Smart Labels Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 6.1.1. RFID

- 6.1.2. Sensing Label

- 6.1.3. NFC

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Pharmaceutical

- 6.2.2. Food and Beverage

- 6.2.3. Logistics

- 6.2.4. Cosmetics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 7. Europe Spoil Detection Based Smart Labels Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 7.1.1. RFID

- 7.1.2. Sensing Label

- 7.1.3. NFC

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Pharmaceutical

- 7.2.2. Food and Beverage

- 7.2.3. Logistics

- 7.2.4. Cosmetics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 8. Asia Pacific Spoil Detection Based Smart Labels Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 8.1.1. RFID

- 8.1.2. Sensing Label

- 8.1.3. NFC

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Pharmaceutical

- 8.2.2. Food and Beverage

- 8.2.3. Logistics

- 8.2.4. Cosmetics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 9. Latin America Spoil Detection Based Smart Labels Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 9.1.1. RFID

- 9.1.2. Sensing Label

- 9.1.3. NFC

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Pharmaceutical

- 9.2.2. Food and Beverage

- 9.2.3. Logistics

- 9.2.4. Cosmetics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 10. Middle East and Africa Spoil Detection Based Smart Labels Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 10.1.1. RFID

- 10.1.2. Sensing Label

- 10.1.3. NFC

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Pharmaceutical

- 10.2.2. Food and Beverage

- 10.2.3. Logistics

- 10.2.4. Cosmetics

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology (Qualitative Trend Analysis)

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CCL Industries Inc *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Scanbuy Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SATO Holding AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Avery Dennison Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Innoscentia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SpotSee

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Insignia Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zebra Technologies Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evigence Sensors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ensurge Micropower ASA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CCL Industries Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Spoil Detection Based Smart Labels Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Spoil Detection Based Smart Labels Market Revenue (Million), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 3: North America Spoil Detection Based Smart Labels Market Revenue Share (%), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 4: North America Spoil Detection Based Smart Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Spoil Detection Based Smart Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Spoil Detection Based Smart Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Spoil Detection Based Smart Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Spoil Detection Based Smart Labels Market Revenue (Million), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 9: Europe Spoil Detection Based Smart Labels Market Revenue Share (%), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 10: Europe Spoil Detection Based Smart Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Spoil Detection Based Smart Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Spoil Detection Based Smart Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Spoil Detection Based Smart Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Spoil Detection Based Smart Labels Market Revenue (Million), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 15: Asia Pacific Spoil Detection Based Smart Labels Market Revenue Share (%), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 16: Asia Pacific Spoil Detection Based Smart Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Spoil Detection Based Smart Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Spoil Detection Based Smart Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Spoil Detection Based Smart Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Spoil Detection Based Smart Labels Market Revenue (Million), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 21: Latin America Spoil Detection Based Smart Labels Market Revenue Share (%), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 22: Latin America Spoil Detection Based Smart Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Spoil Detection Based Smart Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Spoil Detection Based Smart Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Spoil Detection Based Smart Labels Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Spoil Detection Based Smart Labels Market Revenue (Million), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 27: Middle East and Africa Spoil Detection Based Smart Labels Market Revenue Share (%), by Technology (Qualitative Trend Analysis) 2025 & 2033

- Figure 28: Middle East and Africa Spoil Detection Based Smart Labels Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Spoil Detection Based Smart Labels Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Spoil Detection Based Smart Labels Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Spoil Detection Based Smart Labels Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2020 & 2033

- Table 2: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2020 & 2033

- Table 5: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2020 & 2033

- Table 10: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2020 & 2033

- Table 17: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Spoil Detection Based Smart Labels Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2020 & 2033

- Table 24: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Technology (Qualitative Trend Analysis) 2020 & 2033

- Table 27: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Spoil Detection Based Smart Labels Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spoil Detection Based Smart Labels Market?

The projected CAGR is approximately 11.09%.

2. Which companies are prominent players in the Spoil Detection Based Smart Labels Market?

Key companies in the market include CCL Industries Inc *List Not Exhaustive, Scanbuy Inc, SATO Holding AG, Avery Dennison Corporation, Innoscentia, SpotSee, Insignia Technologies, Zebra Technologies Corporation, Evigence Sensors, Ensurge Micropower ASA.

3. What are the main segments of the Spoil Detection Based Smart Labels Market?

The market segments include Technology (Qualitative Trend Analysis), End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Determine the Freshness of Products; Rising Consumer Preference for Hygienic Food Materials; Increasing Demand for Security and Tracking Solutions.

6. What are the notable trends driving market growth?

The RFID Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Competition from Substitutes. such as Glass and Plastic Packaging.

8. Can you provide examples of recent developments in the market?

April 2022 - Avery Dennison, one of the leaders in global materials science and manufacturing, to commence operations in its new state-of-the-art manufacturing facility in Greater Noida. Through this new facility, the company will consolidate its manufacturing operations to serve customer demands better while optimizing the latest technology and leveraging improved efficiencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spoil Detection Based Smart Labels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spoil Detection Based Smart Labels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spoil Detection Based Smart Labels Market?

To stay informed about further developments, trends, and reports in the Spoil Detection Based Smart Labels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence