Key Insights

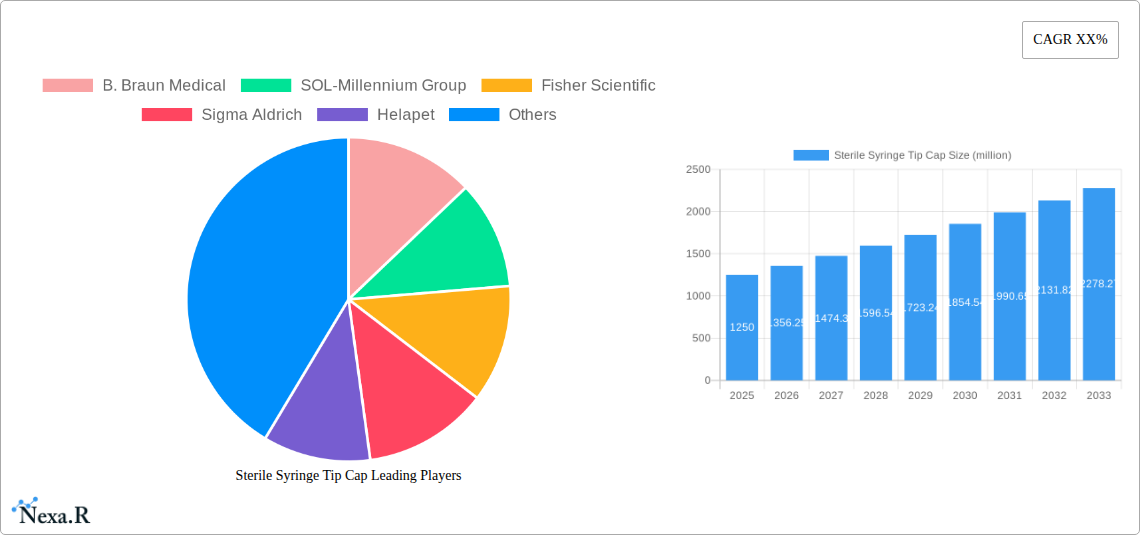

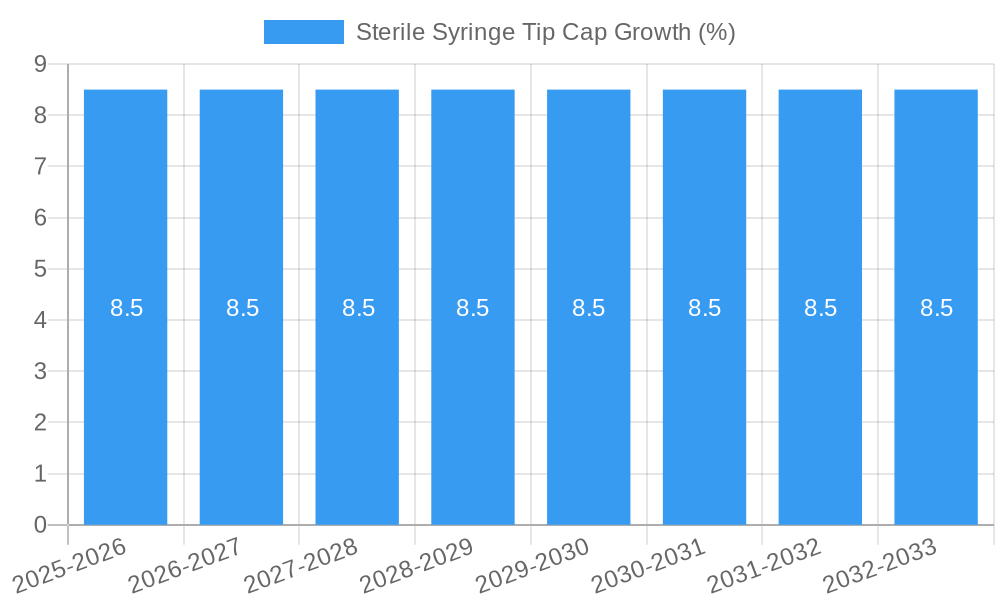

The global Sterile Syringe Tip Cap market is poised for significant expansion, projected to reach an estimated \$1,250 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This substantial growth is primarily propelled by the escalating demand for sterile medical supplies, driven by the increasing prevalence of chronic diseases and the expanding healthcare infrastructure worldwide. The rising number of surgical procedures, coupled with the growing adoption of advanced injection and infusion therapies, further fuels the need for reliable sterile syringe tip caps to prevent contamination and ensure patient safety. Furthermore, stringent regulatory standards governing pharmaceutical and medical device manufacturing necessitate the use of high-quality, sterile components, creating a sustained demand for these products. The market is witnessing a notable shift towards advanced materials and innovative designs that offer enhanced sterility assurance and ease of use, catering to the evolving needs of healthcare professionals.

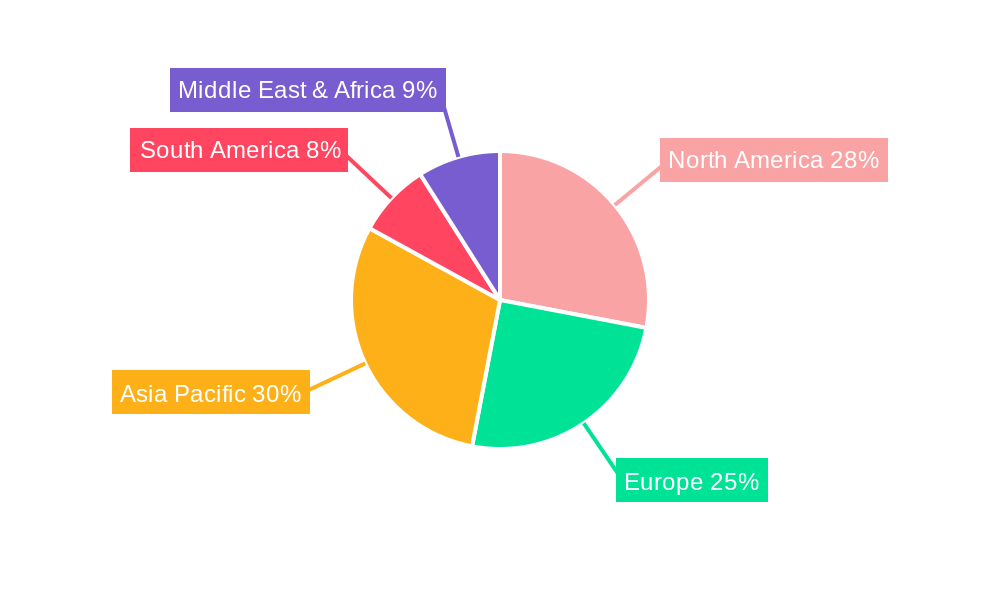

The market dynamics for sterile syringe tip caps are shaped by a confluence of factors, including technological advancements in manufacturing processes and material science, alongside a growing emphasis on infection control protocols within healthcare settings. Key drivers include the increasing global healthcare expenditure, particularly in emerging economies, which is leading to improved access to medical devices and supplies. The burgeoning pharmaceutical industry, with its continuous development of new drug formulations and delivery systems, also contributes significantly to market growth. However, certain restraints, such as fluctuating raw material prices and the high cost of advanced manufacturing technologies, could pose challenges. The market is segmented into 'Fit Luer-Lock Tip' and 'Fit Luer-Slip Tip' segments, with the Luer-Lock configuration anticipated to hold a dominant share due to its superior secure connection capabilities, minimizing the risk of accidental detachment. Geographically, the Asia Pacific region is expected to emerge as a significant growth engine, fueled by its large patient population, rapid healthcare development, and increasing domestic manufacturing capabilities.

Sterile Syringe Tip Cap Market Dynamics & Structure

The sterile syringe tip cap market exhibits moderate concentration, with key players like B. Braun Medical, SOL-Millennium Group, Fisher Scientific, and Sigma Aldrich holding significant shares. Technological innovation is driven by the demand for enhanced sterility, user safety, and compatibility with advanced drug delivery systems. Regulatory frameworks, particularly stringent requirements from bodies like the FDA and EMA concerning medical device manufacturing and material safety, play a crucial role in shaping product development and market entry. Competitive product substitutes, though limited in direct functionality, include alternative sterile sealing methods or integrated syringe designs that aim to minimize handling. End-user demographics are predominantly healthcare professionals in hospitals and clinics, with an increasing focus on home healthcare settings. Mergers and acquisitions (M&A) trends, while not overly aggressive, focus on consolidating market presence and expanding product portfolios. For instance, recent M&A activity has seen larger medical device manufacturers acquiring smaller, specialized cap producers to gain immediate access to niche technologies or customer bases. The market share of the top 5 players is estimated at 55-60%, with M&A deal volumes averaging 2-3 significant transactions annually in the historical period. Barriers to innovation include the high cost of regulatory approvals and the need for extensive clinical validation for novel materials or designs.

Market Concentration:

- Moderate concentration with a few dominant global players.

- Top 5 players account for approximately 55-60% of the global market share.

Technological Innovation Drivers:

- Enhanced sterility assurance technologies.

- Development of caps with improved tamper-evident features.

- Materials offering superior chemical resistance and biocompatibility.

- Integration with advanced syringe designs for automated dispensing.

Regulatory Frameworks:

- Strict adherence to FDA, EMA, and other regional medical device regulations.

- Emphasis on ISO 13485 certification for quality management systems.

- Requirements for biocompatibility testing and material traceability.

Competitive Product Substitutes:

- Integrated syringe designs minimizing the need for separate caps.

- Alternative sterile barrier solutions in specific clinical scenarios.

End-User Demographics:

- Primary users: Healthcare professionals (nurses, physicians, pharmacists) in hospitals and clinics.

- Growing segment: Home healthcare providers and patients managing chronic conditions.

M&A Trends:

- Strategic acquisitions to gain market share and technological capabilities.

- Consolidation of smaller manufacturers by larger entities.

- Average of 2-3 significant M&A deals annually during 2019-2024.

Sterile Syringe Tip Cap Growth Trends & Insights

The global sterile syringe tip cap market has witnessed a robust growth trajectory, driven by an escalating demand for safe and reliable drug administration solutions. The market size, valued at approximately $650 million in 2023, is projected to reach $950 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2025–2033. This expansion is fueled by the increasing prevalence of chronic diseases, the growing number of minimally invasive surgical procedures, and the expanding pharmaceutical industry's reliance on sterile packaging for parenteral drugs. Adoption rates for advanced sterile syringe tip caps are steadily increasing, particularly in developed economies where healthcare infrastructure is well-established and patient safety is paramount. Technological disruptions are contributing significantly, with innovations focusing on materials science, such as the development of antimicrobial coatings and advanced polymers that offer enhanced chemical inertness and flexibility. These advancements not only ensure superior sterility but also improve the ease of use for healthcare professionals and reduce the risk of needle-stick injuries. Consumer behavior shifts are also playing a vital role; patients and healthcare providers are increasingly aware of the importance of sterile consumables, demanding products that minimize contamination risks and guarantee drug integrity throughout the supply chain. The shift towards single-use medical devices, further propelled by concerns over cross-contamination, especially post-pandemic, has amplified the demand for sterile syringe tip caps. Market penetration is high in established healthcare systems, but significant growth potential exists in emerging economies as their healthcare expenditures rise and access to advanced medical supplies improves. The forecast period anticipates sustained demand, with key growth drivers including advancements in syringe technology, personalized medicine requiring precise drug delivery, and the continuous expansion of the biologics and vaccine markets.

Dominant Regions, Countries, or Segments in Sterile Syringe Tip Cap

The Hospital segment emerges as the dominant force in the sterile syringe tip cap market, driven by its substantial and continuous demand for parenteral drug administration. Hospitals are at the forefront of medical treatment, performing a vast number of procedures that require sterile syringes daily. This high volume of injections, infusions, and sample collections directly translates into a consistent need for sterile syringe tip caps to maintain aseptic conditions and prevent contamination of the needle and syringe. The market share for the Hospital segment is estimated to be around 70% of the total market in 2025, with a projected CAGR of 7.0% during the forecast period.

Key Drivers for Hospital Segment Dominance:

- High Volume of Procedures: Hospitals perform millions of injections, IV administrations, and diagnostic procedures annually, creating a constant demand.

- Strict Sterility Protocols: Healthcare regulations and infection control policies in hospitals mandate the use of sterile consumables to prevent healthcare-associated infections (HAIs).

- Diverse Applications: From routine medication delivery to critical care and surgical interventions, syringes and their protective caps are indispensable.

- Adoption of Advanced Syringes: The integration of sterile tip caps with advanced Luer-Lock and Luer-Slip syringes used in critical care and for complex drug formulations further boosts demand.

Within the Types segment, the Fit Luer-Lock Tip category holds a commanding position, accounting for an estimated 65% of the market share in 2025, with a CAGR of 6.8% for the forecast period. Luer-Lock connectors are favored in many clinical settings due to their secure attachment mechanism, which prevents accidental disconnection of the needle or tubing from the syringe. This is particularly crucial in applications involving higher pressures or where tubing needs to remain securely attached for extended periods.

Key Drivers for Fit Luer-Lock Tip Dominance:

- Secure Connection: The threaded lock mechanism significantly reduces the risk of leakage and accidental separation, ensuring a safer and more reliable injection or infusion.

- Versatility in Applications: Widely used in intravenous therapies, epidural anesthesia, chemotherapy delivery, and other critical procedures where a secure connection is paramount.

- Compatibility with Medical Devices: Luer-Lock syringes are compatible with a wide range of medical devices, including IV sets, extension tubing, and infusion pumps.

- Preference in High-Risk Settings: Hospitals and specialized clinics often prefer Luer-Lock for its reliability in critical care and high-risk procedures.

North America is the dominant region, contributing an estimated 38% of the global sterile syringe tip cap market revenue in 2025, with a CAGR of 6.0%. This dominance is attributed to a robust healthcare infrastructure, high healthcare expenditure, a large aging population, and the widespread adoption of advanced medical technologies. The presence of major pharmaceutical companies and stringent regulatory standards further support market growth.

Key Drivers for North America's Dominance:

- High Healthcare Spending: Significant investment in healthcare infrastructure and advanced medical supplies.

- Prevalence of Chronic Diseases: A large patient pool requiring regular medication and treatment necessitates a continuous supply of sterile consumables.

- Technological Advancements: Early adoption and integration of new medical devices and drug delivery systems.

- Stringent Quality and Safety Standards: Regulatory bodies like the FDA enforce high standards, driving demand for quality sterile tip caps.

Sterile Syringe Tip Cap Product Landscape

The sterile syringe tip cap market is characterized by continuous product innovation focused on enhancing safety, sterility assurance, and user convenience. Manufacturers are increasingly developing caps from advanced medical-grade polymers that offer superior chemical resistance and biocompatibility, ensuring no adverse reactions with various medications. Key innovations include tamper-evident designs that provide visual confirmation of seal integrity, thereby preventing unauthorized access or contamination before use. Products designed for specific syringe types, such as Fit Luer-Lock Tip and Fit Luer-Slip Tip caps, are tailored for optimal performance and secure fitting, minimizing leakage and disconnection risks. Antimicrobial coatings are also being integrated into certain tip caps to further reduce the risk of microbial contamination. The performance metrics revolve around achieving and maintaining ISO 7/8 sterility standards, leak-proof capabilities, and ease of application and removal by healthcare professionals.

Key Drivers, Barriers & Challenges in Sterile Syringe Tip Cap

Key Drivers:

- Increasing Demand for Parenteral Drugs: The growing pharmaceutical industry, particularly in biologics and vaccines, fuels the demand for sterile syringe tip caps.

- Rising Healthcare Expenditure: Increased investment in healthcare infrastructure globally, especially in emerging economies, expands the market for medical consumables.

- Focus on Patient Safety and Infection Control: Stringent regulations and growing awareness of healthcare-associated infections drive the adoption of high-quality sterile products.

- Technological Advancements in Syringe Design: Innovations in syringes, such as pre-filled syringes and advanced drug delivery systems, necessitate compatible sterile tip caps.

Barriers & Challenges:

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished goods, leading to potential shortages and price volatility.

- Regulatory Hurdles: Obtaining approvals from various regulatory bodies across different regions can be time-consuming and costly, particularly for novel materials or designs.

- Price Sensitivity in Certain Markets: In some developing regions, cost remains a significant factor, creating a barrier to the adoption of premium sterile tip caps.

- Intense Competition: A fragmented market with numerous manufacturers can lead to price pressure and challenges in market differentiation.

- Waste Management Concerns: The increasing use of single-use medical devices, including sterile syringe tip caps, raises environmental concerns regarding medical waste disposal. The global annual waste generated by single-use medical supplies is estimated to be over 3 million tons, with tip caps contributing a portion of this volume.

Emerging Opportunities in Sterile Syringe Tip Cap

Emerging opportunities in the sterile syringe tip cap market lie in the development of smart tip caps integrated with RFID technology for enhanced inventory management and traceability within healthcare facilities. The growing trend of home healthcare and self-administration of medications presents a significant avenue for user-friendly, easy-to-handle, and ergonomically designed tip caps. Furthermore, the expanding market for personalized medicine and complex biologics necessitates the development of highly specialized tip caps that can maintain sterility and prevent degradation of sensitive formulations. Expanding into underserved emerging markets with tailored product offerings and competitive pricing models also represents a substantial growth opportunity.

Growth Accelerators in the Sterile Syringe Tip Cap Industry

Long-term growth in the sterile syringe tip cap industry will be significantly accelerated by breakthroughs in material science, leading to caps with enhanced antimicrobial properties and improved biocompatibility. Strategic partnerships between syringe manufacturers and tip cap producers can streamline product development and offer integrated solutions to healthcare providers. The increasing global focus on preventative healthcare and the vaccination drives, especially in response to public health crises, will provide sustained demand. Market expansion into emerging economies, driven by rising disposable incomes and improving healthcare access, will also act as a major growth catalyst.

Key Players Shaping the Sterile Syringe Tip Cap Market

B. Braun Medical SOL-Millennium Group Fisher Scientific Sigma Aldrich Helapet Medicina Henry Schein Cardinal Health International Medical Industries Vesco Medical SAI Infusion Technologies Stevanato Group

Notable Milestones in Sterile Syringe Tip Cap Sector

- 2020: Increased focus on antimicrobial-coated tip caps due to heightened infection control awareness.

- 2021: Introduction of advanced tamper-evident features in tip caps for enhanced drug security.

- 2022: Development of bio-based and recyclable materials for tip cap manufacturing explored by some R&D divisions.

- 2023: Growth in demand for sterile tip caps compatible with pre-filled syringes for biologics and biosimilars.

- 2024: Exploration of smart tip cap technologies with IoT integration for enhanced tracking and inventory.

In-Depth Sterile Syringe Tip Cap Market Outlook

The future outlook for the sterile syringe tip cap market is exceptionally positive, driven by sustained demand from the global healthcare sector. Growth accelerators, including continuous technological innovation in materials and design, coupled with strategic market expansion into emerging economies, will propel the market forward. The increasing adoption of advanced drug delivery systems and pre-filled syringes for complex therapies like biologics will create opportunities for specialized and high-performance sterile tip caps. Furthermore, the persistent emphasis on patient safety and infection prevention will ensure a stable and growing market for reliable sterile consumables. Strategic partnerships and a focus on sustainable manufacturing practices will be key to capturing future market share.

Sterile Syringe Tip Cap Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Types

- 2.1. Fit Luer-Lock Tip

- 2.2. Fit Luer-Slip Tip

Sterile Syringe Tip Cap Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sterile Syringe Tip Cap REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sterile Syringe Tip Cap Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fit Luer-Lock Tip

- 5.2.2. Fit Luer-Slip Tip

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sterile Syringe Tip Cap Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fit Luer-Lock Tip

- 6.2.2. Fit Luer-Slip Tip

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sterile Syringe Tip Cap Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fit Luer-Lock Tip

- 7.2.2. Fit Luer-Slip Tip

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sterile Syringe Tip Cap Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fit Luer-Lock Tip

- 8.2.2. Fit Luer-Slip Tip

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sterile Syringe Tip Cap Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fit Luer-Lock Tip

- 9.2.2. Fit Luer-Slip Tip

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sterile Syringe Tip Cap Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fit Luer-Lock Tip

- 10.2.2. Fit Luer-Slip Tip

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 B. Braun Medical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SOL-Millennium Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fisher Scientific

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sigma Aldrich

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Helapet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medicina

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Henry Schein

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cardinal Health

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 International Medical Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vesco Medical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SAI Infusion Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Stevanato Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 B. Braun Medical

List of Figures

- Figure 1: Global Sterile Syringe Tip Cap Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Sterile Syringe Tip Cap Revenue (million), by Application 2024 & 2032

- Figure 3: North America Sterile Syringe Tip Cap Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Sterile Syringe Tip Cap Revenue (million), by Types 2024 & 2032

- Figure 5: North America Sterile Syringe Tip Cap Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Sterile Syringe Tip Cap Revenue (million), by Country 2024 & 2032

- Figure 7: North America Sterile Syringe Tip Cap Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Sterile Syringe Tip Cap Revenue (million), by Application 2024 & 2032

- Figure 9: South America Sterile Syringe Tip Cap Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Sterile Syringe Tip Cap Revenue (million), by Types 2024 & 2032

- Figure 11: South America Sterile Syringe Tip Cap Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Sterile Syringe Tip Cap Revenue (million), by Country 2024 & 2032

- Figure 13: South America Sterile Syringe Tip Cap Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Sterile Syringe Tip Cap Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Sterile Syringe Tip Cap Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Sterile Syringe Tip Cap Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Sterile Syringe Tip Cap Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Sterile Syringe Tip Cap Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Sterile Syringe Tip Cap Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Sterile Syringe Tip Cap Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Sterile Syringe Tip Cap Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Sterile Syringe Tip Cap Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Sterile Syringe Tip Cap Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Sterile Syringe Tip Cap Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Sterile Syringe Tip Cap Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Sterile Syringe Tip Cap Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Sterile Syringe Tip Cap Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Sterile Syringe Tip Cap Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Sterile Syringe Tip Cap Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Sterile Syringe Tip Cap Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Sterile Syringe Tip Cap Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sterile Syringe Tip Cap Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sterile Syringe Tip Cap Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Sterile Syringe Tip Cap Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Sterile Syringe Tip Cap Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Sterile Syringe Tip Cap Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Sterile Syringe Tip Cap Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Sterile Syringe Tip Cap Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Sterile Syringe Tip Cap Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Sterile Syringe Tip Cap Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Sterile Syringe Tip Cap Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Sterile Syringe Tip Cap Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Sterile Syringe Tip Cap Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Sterile Syringe Tip Cap Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Sterile Syringe Tip Cap Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Sterile Syringe Tip Cap Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Sterile Syringe Tip Cap Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Sterile Syringe Tip Cap Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Sterile Syringe Tip Cap Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Sterile Syringe Tip Cap Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Sterile Syringe Tip Cap Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sterile Syringe Tip Cap?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Sterile Syringe Tip Cap?

Key companies in the market include B. Braun Medical, SOL-Millennium Group, Fisher Scientific, Sigma Aldrich, Helapet, Medicina, Henry Schein, Cardinal Health, International Medical Industries, Vesco Medical, SAI Infusion Technologies, Stevanato Group.

3. What are the main segments of the Sterile Syringe Tip Cap?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sterile Syringe Tip Cap," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sterile Syringe Tip Cap report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sterile Syringe Tip Cap?

To stay informed about further developments, trends, and reports in the Sterile Syringe Tip Cap, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence