Key Insights

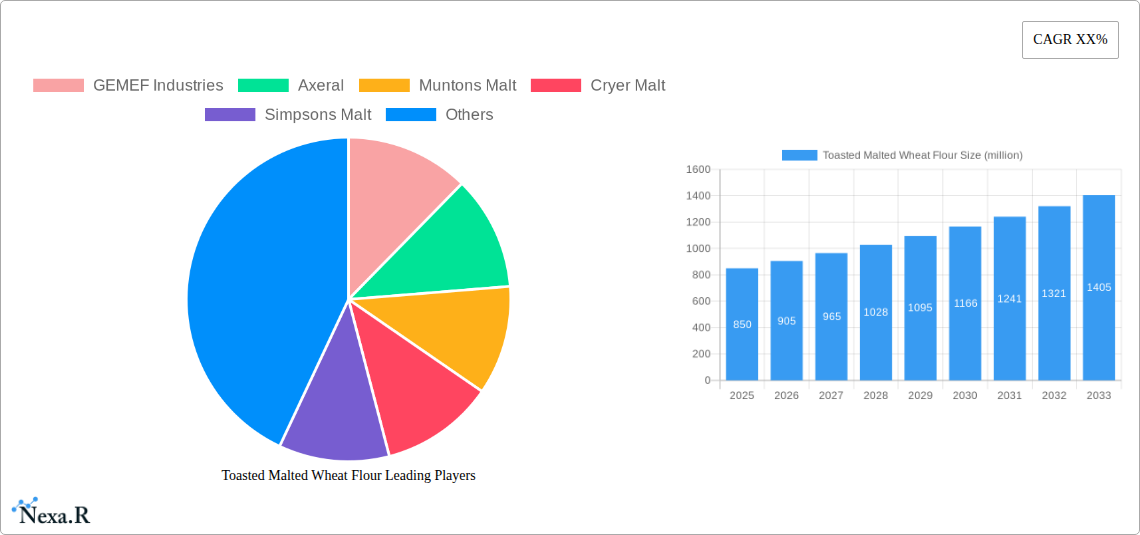

The global Toasted Malted Wheat Flour market is poised for substantial growth, projected to reach an estimated USD 850 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033. This expansion is primarily fueled by the increasing consumer demand for premium bakery products and ready-to-eat meals, where toasted malted wheat flour imparts desirable flavor, texture, and browning characteristics. The versatility of this ingredient, ranging from its application in artisan breads and pastries to savory snacks, underpins its expanding market presence. Furthermore, a growing awareness of the nutritional benefits associated with malted grains, including enhanced digestibility and a richer flavor profile, is driving adoption across various food industries. Key market drivers include innovation in food processing technologies, the rise of health-conscious consumers seeking natural ingredients, and the ongoing globalization of food trends, which expose diverse markets to the unique qualities of toasted malted wheat flour.

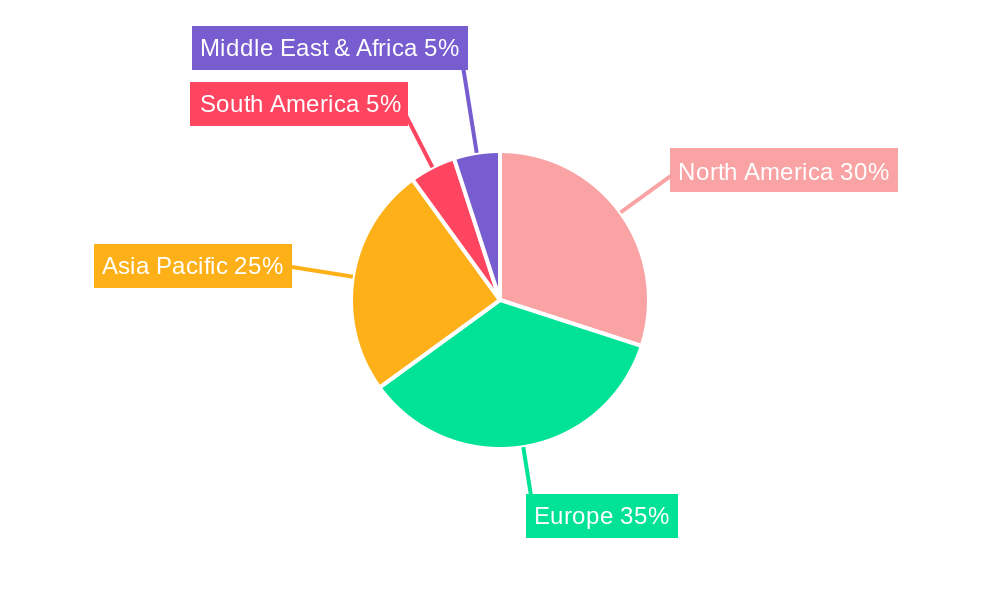

Despite this positive outlook, the market faces certain restraints, including the fluctuating prices of raw materials, particularly wheat, and the potential for increased competition from alternative flours and flavor enhancers. Supply chain disruptions and evolving regulatory landscapes also present challenges. Nevertheless, the market is segmented into Diastatic and Non-Diastatic Toasted Malted Wheat Flour types, catering to specific product requirements. Applications are broad, encompassing bakery products, ready-to-eat items, and a variety of other food preparations. Geographically, North America and Europe currently lead the market due to established food industries and high consumer spending, but the Asia Pacific region is anticipated to witness the most significant growth, driven by rapid urbanization, rising disposable incomes, and a burgeoning food processing sector. Key players like GEMEF Industries, Axeral, and Muntons Malt are actively investing in research and development and expanding their production capacities to capitalize on these emerging opportunities.

Here is a compelling, SEO-optimized report description for Toasted Malted Wheat Flour, designed for maximum visibility and industry engagement, with all values presented in millions of units and structured as requested:

Toasted Malted Wheat Flour Market Dynamics & Structure

The global toasted malted wheat flour market is characterized by moderate concentration, with key players like GEMEF Industries, Axeral, Muntons Malt, Cryer Malt, Simpsons Malt, Imperial Malts, MUNARI, and Barley Agro Foods strategically positioning themselves. Technological innovation is a significant driver, with ongoing research into enhancing flavor profiles, shelf-life, and functional properties, particularly for applications in bakery products and ready to eat products. Regulatory frameworks, primarily focusing on food safety and labeling standards, are generally supportive of market growth. Competitive product substitutes, such as conventional wheat flour and other specialty flours, pose a challenge, but the unique sensory and nutritional benefits of toasted malted wheat flour offer differentiation. End-user demographics are shifting towards health-conscious consumers seeking natural ingredients and improved taste experiences. Mergers and acquisitions (M&A) activity, though not at peak levels, are strategically employed to expand product portfolios and market reach. For instance, approximately 5 M&A deals were observed in the historical period (2019-2024), indicating a trend towards consolidation. Innovation barriers include the cost of specialized processing and the need for consumer education on the benefits of toasted malted wheat flour.

- Market Concentration: Moderate, with established global and regional players.

- Technological Innovation: Focus on flavor enhancement, extended shelf-life, and functional properties.

- Regulatory Frameworks: Primarily focused on food safety and clear labeling.

- Competitive Substitutes: Conventional wheat flour, other specialty flours.

- End-User Demographics: Growing demand from health-conscious consumers.

- M&A Trends: Strategic acquisitions for portfolio expansion and market access.

- Innovation Barriers: Processing costs, consumer awareness.

Toasted Malted Wheat Flour Growth Trends & Insights

The toasted malted wheat flour market is poised for substantial growth, projected to reach an estimated USD 4,850 million in 2025. This expansion is fueled by a compelling CAGR of 6.8% anticipated from 2025 to 2033, propelling the market to an estimated USD 8,200 million by the end of the forecast period. Historical data from 2019 to 2024 indicates a robust foundation, with the market valued at approximately USD 3,400 million in the base year of 2025. Adoption rates are steadily increasing across both developed and emerging economies, driven by rising consumer preferences for enhanced taste, texture, and nutritional value in their food products. Technological disruptions are playing a pivotal role, with advancements in malting and toasting processes leading to the development of specialized flour types such as diastatic toasted malted wheat flour and non-diastatic toasted malted wheat flour, each offering unique functional benefits for diverse applications.

Consumer behavior shifts are a significant accelerator, with a growing demand for artisanal baked goods, premium ready-to-eat meals, and clean-label ingredients. This trend directly benefits toasted malted wheat flour due to its natural origin and distinct flavor profile. Market penetration is expanding as manufacturers integrate this ingredient into a wider array of products, moving beyond traditional bakery items into snacks and convenience foods. The increasing awareness of the digestive benefits and complex carbohydrate content of malted grains also contributes to higher adoption rates. The market's evolution is further shaped by evolving dietary trends, with consumers actively seeking ingredients that offer both sensory appeal and perceived health advantages. The overall trajectory suggests a market ripe for innovation and expansion, catering to a discerning consumer base.

Dominant Regions, Countries, or Segments in Toasted Malted Wheat Flour

The global toasted malted wheat flour market is witnessing significant growth drivers across various regions and segments, with Bakery Products emerging as the dominant application segment. This segment is projected to account for approximately 45% of the total market revenue by 2025, driven by the increasing popularity of artisan breads, pastries, and confectioneries that leverage the unique flavor and texture imparted by toasted malted wheat flour. North America currently holds the largest market share, estimated at around 30% in 2025, due to a well-established food manufacturing industry and high consumer spending on premium food items. The United States, in particular, is a key market, driven by a strong demand for naturally sourced ingredients and innovative food products.

Europe follows closely, with an estimated 25% market share in 2025, characterized by a rich culinary heritage and a growing consumer appreciation for traditional baking techniques enhanced by specialty flours. Countries like Germany and the United Kingdom are leading this growth. The Asia-Pacific region is expected to exhibit the fastest growth rate, with a projected CAGR of 7.5% from 2025 to 2033. This surge is attributed to a rapidly expanding middle class, increasing urbanization, and a growing adoption of Western dietary habits, leading to higher demand for bakery products and ready-to-eat options. Economic policies supporting food processing industries and infrastructure development for ingredient distribution are key drivers in these regions.

Within the types of toasted malted wheat flour, Non-Diastatic Toasted Malted Wheat Flour currently dominates the market, holding an estimated 60% share in 2025, primarily due to its versatile application in a wide range of baked goods where precise enzymatic activity is not required. However, Diastatic Toasted Malted Wheat Flour is witnessing a higher growth rate, driven by its specialized use in bread making for improved crumb structure and crust development. The "Others" application segment, encompassing snacks, breakfast cereals, and animal feed, is also showing promising growth, indicating diversification of end-use.

- Dominant Application Segment: Bakery Products, estimated 45% market share in 2025.

- Leading Region: North America, estimated 30% market share in 2025.

- Key Countries: United States, Germany, United Kingdom.

- Fastest Growing Region: Asia-Pacific, projected CAGR of 7.5% (2025-2033).

- Dominant Type: Non-Diastatic Toasted Malted Wheat Flour, estimated 60% market share in 2025.

- Key Drivers: Economic policies, infrastructure development, evolving dietary habits, consumer preference for premium food.

Toasted Malted Wheat Flour Product Landscape

The toasted malted wheat flour product landscape is evolving with continuous innovation focused on enhancing sensory appeal and functional benefits. Manufacturers are developing specialized variants, such as diastatic and non-diastatic toasted malted wheat flour, to cater to specific application needs in bakery products and ready-to-eat items. Product innovations are centered on optimizing toasting processes to achieve nuanced flavor profiles, from light caramel notes to deeper roasted undertones. Performance metrics are improving, with enhanced dough handling properties, improved crust coloration, and extended shelf-life being key selling points. Unique selling propositions often revolve around natural ingredient sourcing, gluten-free options (where applicable through specific processing), and contributions to perceived health benefits like better digestion. Technological advancements in malting and drying techniques are crucial in this segment.

Key Drivers, Barriers & Challenges in Toasted Malted Wheat Flour

Key Drivers:

- Rising consumer demand for natural and artisanal food products: Toasted malted wheat flour's inherent natural origin and unique flavor profile align perfectly with this trend.

- Growth in the global bakery industry: The expanding bakery sector, particularly artisan and specialty breads, directly fuels demand.

- Increasing preference for enhanced taste and texture in food: Consumers are actively seeking ingredients that elevate their culinary experiences.

- Technological advancements in processing: Improved malting and toasting techniques lead to higher quality and more versatile products.

- Growing awareness of health benefits: Perceived benefits related to digestion and complex carbohydrates contribute to adoption.

Key Barriers & Challenges:

- Price volatility of raw materials (wheat): Fluctuations in wheat prices can impact production costs and final product pricing, estimated impact of 5-10% on cost.

- Competition from conventional flours and other specialty ingredients: Existing market saturation and lower-cost alternatives present a significant challenge.

- Consumer education on benefits and applications: Lack of widespread understanding about toasted malted wheat flour's unique properties can hinder adoption.

- Supply chain disruptions and logistics: Ensuring consistent availability and efficient distribution across global markets can be complex, with potential delays of up to 15% in historical periods.

- Regulatory hurdles for new product formulations: Navigating food safety and labeling regulations for novel applications can be time-consuming and costly.

Emerging Opportunities in Toasted Malted Wheat Flour

Emerging opportunities for toasted malted wheat flour lie in the burgeoning demand for innovative and clean-label ingredients in functional foods and beverages. The expanding "free-from" market presents a chance for specialized toasted malted wheat flour variants, particularly those that can be certified gluten-free or allergen-friendly. Untapped markets in developing economies with growing middle classes and a rising appetite for premium food products offer significant growth potential. Furthermore, the development of novel applications beyond traditional bakery, such as in savory snacks, pet food formulations, and even in brewing, presents exciting avenues for market expansion. Evolving consumer preferences towards plant-based diets also create opportunities for toasted malted wheat flour as a valuable ingredient in vegan and vegetarian product development.

Growth Accelerators in the Toasted Malted Wheat Flour Industry

Several catalysts are driving long-term growth in the toasted malted wheat flour industry. Technological breakthroughs in enzymatic modification and controlled toasting are enabling the creation of flours with highly specific functional properties, leading to enhanced product performance and consumer satisfaction. Strategic partnerships between flour producers and food manufacturers are crucial for co-creating innovative products and expanding market reach. Market expansion strategies focused on emerging economies, where consumer awareness and demand for premium ingredients are on the rise, will be pivotal. Investments in research and development to unlock new health benefits and applications of toasted malted wheat flour will further accelerate adoption and market penetration. The trend towards sustainable sourcing and production will also act as a growth accelerator, appealing to environmentally conscious consumers and businesses.

Key Players Shaping the Toasted Malted Wheat Flour Market

- GEMEF Industries

- Axeral

- Muntons Malt

- Cryer Malt

- Simpsons Malt

- Imperial Malts

- MUNARI

- Barley Agro Foods

Notable Milestones in Toasted Malted Wheat Flour Sector

- 2019: Introduction of low-ash toasted malted wheat flour for premium bakery applications by Simpsons Malt.

- 2020: GEMEF Industries expands its product line with a focus on diastatic toasted malted wheat flour for enhanced bread volume.

- 2021: Cryer Malt launches a new range of toasted malted wheat flours with distinct caramel notes for confectionery.

- 2022: Muntons Malt announces significant investment in R&D for allergen-free malting processes.

- 2023: Imperial Malts develops specialized toasted malted wheat flours for gluten-free baking formulations.

- 2024: Barley Agro Foods explores novel applications of toasted malted wheat flour in ready-to-eat cereal products.

In-Depth Toasted Malted Wheat Flour Market Outlook

The future outlook for the toasted malted wheat flour market is exceptionally promising, driven by a confluence of strong growth accelerators. The increasing consumer desire for natural, flavorful, and functional food ingredients will continue to be a primary impetus. Innovations in processing technologies are expected to unlock new product possibilities and enhance existing applications, thereby broadening the market's scope. Strategic collaborations between industry leaders and burgeoning food startups will foster product diversification and market penetration. As global economies continue to develop and consumer purchasing power rises, particularly in emerging markets, the demand for premium food ingredients like toasted malted wheat flour is set to surge. The industry is well-positioned to capitalize on evolving dietary trends and the persistent quest for enhanced culinary experiences, solidifying its growth trajectory for years to come.

Toasted Malted Wheat Flour Segmentation

-

1. Application

- 1.1. Bakery Products

- 1.2. Ready to Eat Products

- 1.3. Others

-

2. Types

- 2.1. Diastatic Toasted Malted Wheat Flour

- 2.2. Non-Diastatic Toasted Malted Wheat Flour

Toasted Malted Wheat Flour Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Toasted Malted Wheat Flour REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Toasted Malted Wheat Flour Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bakery Products

- 5.1.2. Ready to Eat Products

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Diastatic Toasted Malted Wheat Flour

- 5.2.2. Non-Diastatic Toasted Malted Wheat Flour

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Toasted Malted Wheat Flour Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bakery Products

- 6.1.2. Ready to Eat Products

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Diastatic Toasted Malted Wheat Flour

- 6.2.2. Non-Diastatic Toasted Malted Wheat Flour

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Toasted Malted Wheat Flour Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bakery Products

- 7.1.2. Ready to Eat Products

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Diastatic Toasted Malted Wheat Flour

- 7.2.2. Non-Diastatic Toasted Malted Wheat Flour

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Toasted Malted Wheat Flour Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bakery Products

- 8.1.2. Ready to Eat Products

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Diastatic Toasted Malted Wheat Flour

- 8.2.2. Non-Diastatic Toasted Malted Wheat Flour

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Toasted Malted Wheat Flour Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bakery Products

- 9.1.2. Ready to Eat Products

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Diastatic Toasted Malted Wheat Flour

- 9.2.2. Non-Diastatic Toasted Malted Wheat Flour

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Toasted Malted Wheat Flour Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bakery Products

- 10.1.2. Ready to Eat Products

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Diastatic Toasted Malted Wheat Flour

- 10.2.2. Non-Diastatic Toasted Malted Wheat Flour

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GEMEF Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Axeral

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Muntons Malt

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cryer Malt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Simpsons Malt

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Imperial Malts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MUNARI

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Barley Agro Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 GEMEF Industries

List of Figures

- Figure 1: Global Toasted Malted Wheat Flour Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Toasted Malted Wheat Flour Revenue (million), by Application 2024 & 2032

- Figure 3: North America Toasted Malted Wheat Flour Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Toasted Malted Wheat Flour Revenue (million), by Types 2024 & 2032

- Figure 5: North America Toasted Malted Wheat Flour Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Toasted Malted Wheat Flour Revenue (million), by Country 2024 & 2032

- Figure 7: North America Toasted Malted Wheat Flour Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Toasted Malted Wheat Flour Revenue (million), by Application 2024 & 2032

- Figure 9: South America Toasted Malted Wheat Flour Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Toasted Malted Wheat Flour Revenue (million), by Types 2024 & 2032

- Figure 11: South America Toasted Malted Wheat Flour Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Toasted Malted Wheat Flour Revenue (million), by Country 2024 & 2032

- Figure 13: South America Toasted Malted Wheat Flour Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Toasted Malted Wheat Flour Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Toasted Malted Wheat Flour Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Toasted Malted Wheat Flour Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Toasted Malted Wheat Flour Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Toasted Malted Wheat Flour Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Toasted Malted Wheat Flour Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Toasted Malted Wheat Flour Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Toasted Malted Wheat Flour Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Toasted Malted Wheat Flour Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Toasted Malted Wheat Flour Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Toasted Malted Wheat Flour Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Toasted Malted Wheat Flour Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Toasted Malted Wheat Flour Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Toasted Malted Wheat Flour Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Toasted Malted Wheat Flour Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Toasted Malted Wheat Flour Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Toasted Malted Wheat Flour Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Toasted Malted Wheat Flour Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Toasted Malted Wheat Flour Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Toasted Malted Wheat Flour Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Toasted Malted Wheat Flour Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Toasted Malted Wheat Flour Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Toasted Malted Wheat Flour Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Toasted Malted Wheat Flour Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Toasted Malted Wheat Flour Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Toasted Malted Wheat Flour Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Toasted Malted Wheat Flour Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Toasted Malted Wheat Flour Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Toasted Malted Wheat Flour Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Toasted Malted Wheat Flour Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Toasted Malted Wheat Flour Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Toasted Malted Wheat Flour Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Toasted Malted Wheat Flour Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Toasted Malted Wheat Flour Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Toasted Malted Wheat Flour Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Toasted Malted Wheat Flour Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Toasted Malted Wheat Flour Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Toasted Malted Wheat Flour Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Toasted Malted Wheat Flour?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Toasted Malted Wheat Flour?

Key companies in the market include GEMEF Industries, Axeral, Muntons Malt, Cryer Malt, Simpsons Malt, Imperial Malts, MUNARI, Barley Agro Foods.

3. What are the main segments of the Toasted Malted Wheat Flour?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Toasted Malted Wheat Flour," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Toasted Malted Wheat Flour report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Toasted Malted Wheat Flour?

To stay informed about further developments, trends, and reports in the Toasted Malted Wheat Flour, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence