Key Insights

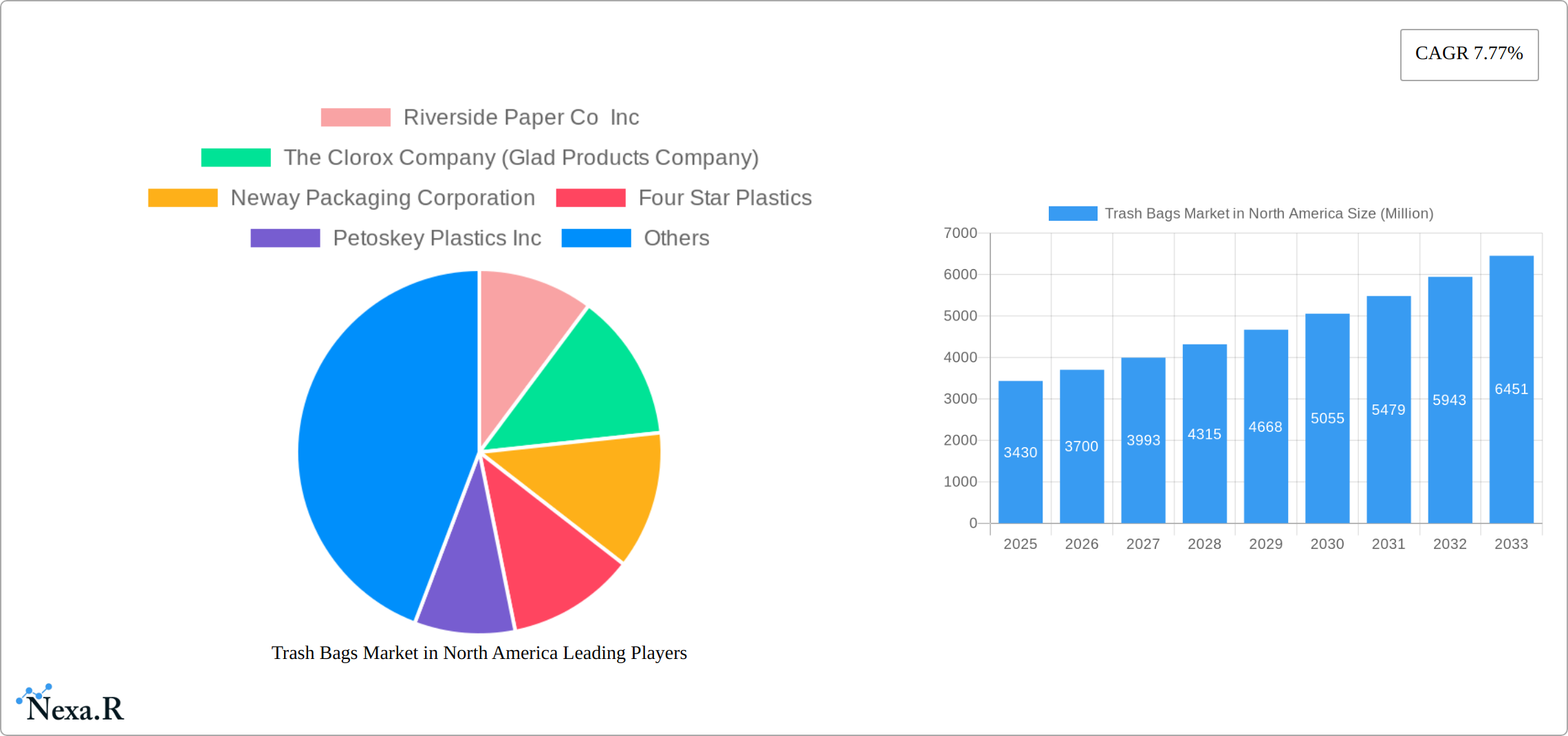

The North American trash bag market, valued at $3.43 billion in 2025, is projected to experience robust growth, driven by factors such as increasing waste generation due to rising population and consumption levels, and a growing preference for convenient and hygienic waste disposal solutions. The market's Compound Annual Growth Rate (CAGR) of 7.77% from 2019 to 2024 suggests a strong upward trajectory, which is expected to continue throughout the forecast period (2025-2033). Key market segments include residential, commercial, and industrial applications, with the residential sector likely dominating due to high household penetration. Within North America, the United States represents the largest market share, given its higher population density and consumption patterns compared to Canada. The market's growth is also influenced by environmental concerns, leading to increased demand for biodegradable and compostable trash bags. Furthermore, innovative product designs focusing on strength, durability, and leak-proof features are further boosting market expansion. Competition within the market is significant, with major players like Berry Global Inc, Novolex Holdings LLC, and Reynolds Consumer Products (Hefty) vying for market share through product innovation, strategic partnerships, and efficient distribution networks.

Trash Bags Market in North America Market Size (In Billion)

The forecast for the North American trash bag market from 2025 to 2033 is positive, anticipating sustained growth driven by several factors. The rising adoption of single-stream recycling programs, while potentially reducing overall waste volume in the long-term, is concurrently driving demand for specialized trash bags designed for efficient separation and waste management. Additionally, the growth of e-commerce and the associated packaging waste is contributing to increased demand. While regulatory changes regarding plastic waste and increasing raw material costs may pose challenges, the market's positive growth outlook remains robust due to the fundamental demand for waste disposal solutions and ongoing innovation within the industry. The continued focus on sustainable and eco-friendly options, such as biodegradable and compostable trash bags, will further shape the market landscape in the coming years.

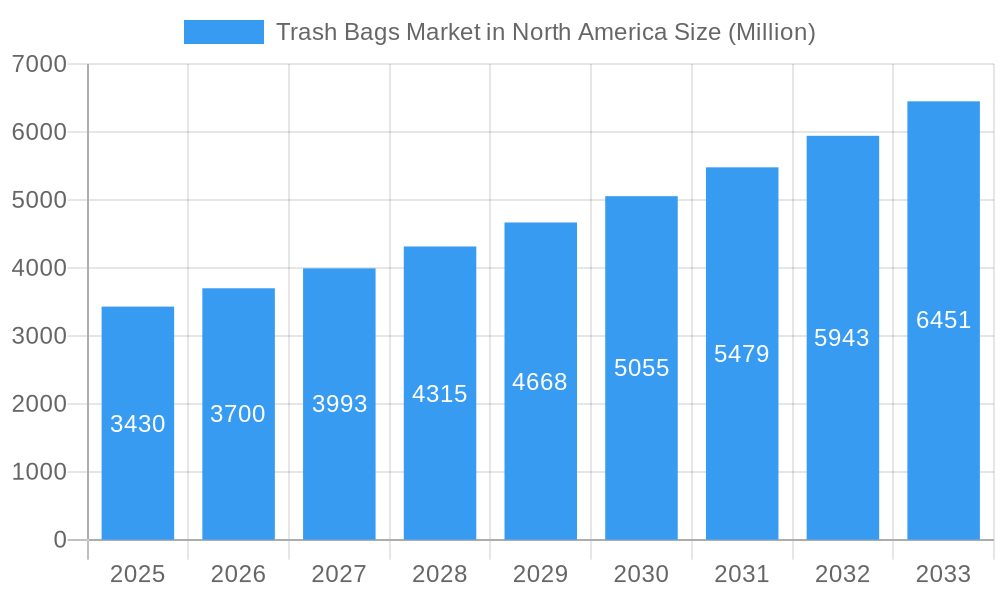

Trash Bags Market in North America Company Market Share

This in-depth report provides a comprehensive analysis of the North American trash bags market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. Market values are presented in million units.

Trash Bags Market in North America Market Dynamics & Structure

The North American trash bag market is characterized by a dynamic and evolving landscape. While still moderately concentrated with prominent players, the industry is witnessing a significant shift driven by technological innovation, particularly in the development of sustainable materials like biodegradable polymers and recycled plastics. Enhanced product features, such as improved leak-proof designs, odor control, and convenient dispensing mechanisms, are increasingly becoming key differentiators. The market is also heavily influenced by a robust regulatory framework that emphasizes waste reduction and recycling initiatives, compelling manufacturers to prioritize eco-friendly options. Despite the dominance of disposable bags, competition from reusable alternatives and evolving waste management practices presents an ongoing challenge, shaping consumer preferences and product demand. End-user demographics, including household size, income levels, and regional waste generation habits, are critical factors in market segmentation and targeted product development. Mergers and acquisitions (M&A) activity remains a strategic tool for larger players to consolidate their market positions, expand their product portfolios, and enhance their operational efficiencies.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 60-70% market share (2024).

- Technological Innovation: Focus on advanced biodegradable and recycled materials, enhanced durability, superior leak and tear resistance, odor-neutralizing technologies, and user-friendly dispensing solutions.

- Regulatory Framework: Increasing global and regional emphasis on circular economy principles, extended producer responsibility, and plastic waste reduction is a significant influence on material choices, manufacturing processes, and product lifecycle considerations.

- Competitive Substitutes: Ongoing competition from reusable bags, specialized composting solutions, and evolving municipal waste management programs requires continuous product differentiation and value proposition enhancement.

- End-User Demographics: The residential segment continues to be the largest, driven by urbanization and changing lifestyle patterns. The commercial sector, encompassing offices, hospitality, and retail, presents substantial growth opportunities due to rising business activity and stricter waste management protocols. The industrial segment is also experiencing steady demand linked to manufacturing output.

- M&A Trends: Moderate M&A activity is observed, with strategic acquisitions aimed at gaining access to new technologies, expanding geographical reach, and achieving economies of scale. Approximately 8-12 significant M&A deals have been recorded between 2019 and 2024.

Trash Bags Market in North America Growth Trends & Insights

The North American trash bags market experienced steady growth during the historical period (2019-2024), driven by increasing waste generation, rising consumer awareness of hygiene, and the convenience of disposable bags. The market is expected to maintain a moderate CAGR of xx% during the forecast period (2025-2033). This growth is fueled by sustained residential demand, increasing commercial and industrial activity, and ongoing product innovation. Technological advancements, including the adoption of biodegradable and compostable materials, are expected to further shape market dynamics. Shifts in consumer behavior, such as increased focus on sustainability, are influencing demand for eco-friendly options. Market penetration of biodegradable bags is projected to reach xx% by 2033. The market size was valued at xx million units in 2024 and is projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Trash Bags Market in North America

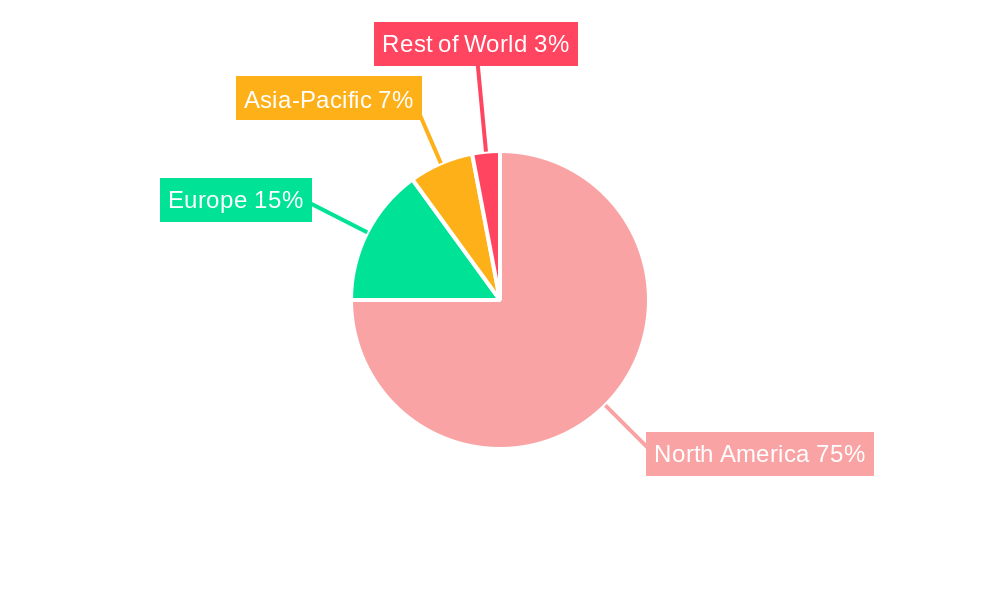

The United States unequivocally dominates the North American trash bag market, propelled by its substantial population, high per capita waste generation rates, and a well-established, sophisticated distribution network. The residential segment remains the bedrock of this market, characterized by widespread household penetration and consistent, high-volume demand. Concurrently, the commercial sector is exhibiting robust growth, fueled by the proliferation of businesses, institutions, and evolving waste management mandates across various industries.

- United States: Holds the largest market share due to its immense population density, advanced economic infrastructure, high consumer spending power, and the widespread adoption of convenient waste disposal solutions.

- Canada: Demonstrates steady and consistent growth, driven by expanding urban centers, ongoing industrial development, and a growing awareness of sustainable waste management practices.

- Residential Segment: Remains the most dominant segment, supported by the fundamental necessity in every household and consistent replacement cycles.

- Commercial Segment: Presents significant growth potential, propelled by an increasing number of businesses, stricter waste management regulations in commercial spaces, and a growing demand for specialized waste solutions in sectors like healthcare and food service.

- Industrial Segment: Expected to experience steady growth, mirroring the expansion and output of various manufacturing and industrial sectors that require robust and reliable waste containment.

Trash Bags Market in North America Product Landscape

The trash bag market offers a diverse range of products, catering to various end-user needs. Innovations focus on improving durability, leak resistance, and convenience features like easy-tie closures and enhanced strength. The use of recycled and biodegradable materials is gaining traction, reflecting growing environmental awareness. Unique selling propositions include thicker gauge bags for heavier waste, scented bags for odor control, and specialized bags for specific waste types. Technological advancements are focused on enhancing biodegradability, reducing environmental impact, and increasing convenience for consumers.

Key Drivers, Barriers & Challenges in Trash Bags Market in North America

Key Drivers:

- Increasing Waste Generation: Continued population growth, urbanization, and expanding economic activities globally are leading to a sustained rise in overall waste generation, directly boosting demand for trash bags.

- Heightened Hygiene and Sanitation Awareness: Growing consumer consciousness regarding personal hygiene and public sanitation, particularly amplified by recent global health events, fuels the demand for single-use, disposable waste management solutions.

- Demand for Convenience and Efficiency: Consumers and businesses alike value the convenience and efficiency offered by disposable trash bags for managing household and commercial waste, making them an indispensable part of daily life.

- Technological Advancements in Material Science: Continuous innovation in polymers and manufacturing processes is leading to the development of more durable, leak-proof, odor-controlling, and aesthetically appealing trash bags, enhancing their value proposition.

- Growth of E-commerce and Food Delivery Services: The proliferation of e-commerce and the food delivery industry contributes to increased packaging waste, thereby driving the demand for associated waste disposal products.

Challenges & Restraints:

- Competition from Sustainable Alternatives: The rising environmental consciousness is fostering a growing market for reusable bags and alternative waste management systems, posing a significant competitive challenge to traditional trash bags.

- Volatility in Raw Material Prices: Fluctuations in the prices of key raw materials, such as polyethylene, directly impact production costs, leading to potential price instability and affecting profit margins for manufacturers.

- Stringent Environmental Regulations and Compliance Costs: Evolving and increasingly stringent environmental regulations regarding plastic usage, disposal, and recyclability necessitate higher compliance costs for manufacturers, impacting production strategies and product design.

- Supply Chain Disruptions: Global and regional supply chain vulnerabilities, including logistics issues, geopolitical events, and raw material shortages, can significantly influence the availability, lead times, and pricing of trash bags. Approximately 20-25% of manufacturers reported significant supply chain disruptions in 2024, impacting their production and distribution capabilities.

- Consumer Perception and Greenwashing Concerns: Negative consumer perceptions regarding the environmental impact of plastic bags and skepticism around "greenwashing" claims can influence purchasing decisions and create a demand for truly sustainable and transparently marketed products.

Emerging Opportunities in Trash Bags Market in North America

- Growing demand for eco-friendly and biodegradable options.

- Expansion into niche segments, such as specialized waste bags for medical or hazardous materials.

- Development of innovative features, such as smart sensors for waste level detection in bins.

- Increasing focus on online retail channels for direct-to-consumer sales.

Growth Accelerators in the Trash Bags Market in North America Industry

The long-term growth trajectory of the North American trash bags market is poised for acceleration through a multi-pronged strategy. Continued and intensified innovations in sustainable materials, such as advanced bioplastics and highly efficient recycled content integration, will be pivotal. Strategic partnerships and collaborations aimed at expanding distribution networks, especially into emerging markets and specialized commercial sectors, will unlock new avenues for revenue. Targeted marketing campaigns that effectively communicate the convenience, hygiene benefits, and increasingly, the environmental credentials of products will resonate with a broader consumer base. Furthermore, government initiatives and policies that actively support waste reduction, promote recycling infrastructure, and incentivize the use of eco-friendly waste management solutions will create a more favorable market environment for sustainable trash bag products.

Key Players Shaping the Trash Bags Market in North America Market

- Riverside Paper Co Inc

- The Clorox Company (Glad Products Company)

- Neway Packaging Corporation

- Four Star Plastics

- Petoskey Plastics Inc

- Inteplast Group

- Hefty (Reynolds Consumer Products Inc )

- Aluf Plastics

- International Plastics Inc

- Cosmoplast Industrial Company LLC

- Poly-America LP

- Berry Global Inc

- Novolex Holdings LLC

- All American Poly

Notable Milestones in Trash Bags Market in North America Sector

- June 2022: Tossits launched a newly designed trash bag with improved vehicle placement and leak-proof features, made from post-industrial recycled material. This signals increased consumer demand for sustainable and durable options.

- April 2022: The Barry Callebaut Group's expansion in Ontario, Canada, is projected to increase waste generation, positively impacting demand for trash bags in the region.

In-Depth Trash Bags Market in North America Market Outlook

The North American trash bags market is on a trajectory of sustained and robust growth. This expansion will be primarily fueled by the confluence of rapid technological advancements in material science and manufacturing, the persistent trend of urbanization leading to increased population density and waste generation, and a burgeoning societal and regulatory emphasis on environmental sustainability and responsible waste management. To successfully capture and expand market share in this competitive environment, companies will need to prioritize strategic partnerships, foster continuous innovation in product development, and implement highly effective marketing and branding strategies that highlight not just convenience and hygiene but also demonstrable environmental benefits. The market presents compelling and attractive opportunities for agile and forward-thinking companies that can consistently deliver high-quality, cost-effective, environmentally responsible, and user-centric trash bag solutions that align with evolving consumer demands and regulatory expectations.

Trash Bags Market in North America Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

Trash Bags Market in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Trash Bags Market in North America Regional Market Share

Geographic Coverage of Trash Bags Market in North America

Trash Bags Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. United States Continues to Lead the Market in Terms of Demand and Considering the Various Initiatives Undertaken to Promote Waste Disposal; Growing Demand for Compostable and Oxo-biodegradable Bags

- 3.3. Market Restrains

- 3.3.1. Contamination Due to Poor Packaging or Mishandling

- 3.4. Market Trends

- 3.4.1. Residential Sector Holds Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. South America Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Europe Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Middle East & Africa Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Asia Pacific Trash Bags Market in North America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Riverside Paper Co Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Clorox Company (Glad Products Company)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Neway Packaging Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Four Star Plastics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Petoskey Plastics Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inteplast Group*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hefty (Reynolds Consumer Products Inc )

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aluf Plastics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 International Plastics Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cosmoplast Industrial Company LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Poly-America LP

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Global Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Novolex Holdings LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 All American Poly

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Riverside Paper Co Inc

List of Figures

- Figure 1: Global Trash Bags Market in North America Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 3: North America Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 7: South America Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 8: South America Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 15: Middle East & Africa Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 16: Middle East & Africa Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Trash Bags Market in North America Revenue (Million), by End User 2025 & 2033

- Figure 19: Asia Pacific Trash Bags Market in North America Revenue Share (%), by End User 2025 & 2033

- Figure 20: Asia Pacific Trash Bags Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Trash Bags Market in North America Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Trash Bags Market in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Trash Bags Market in North America Revenue Million Forecast, by End User 2020 & 2033

- Table 33: Global Trash Bags Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Trash Bags Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Trash Bags Market in North America?

The projected CAGR is approximately 7.77%.

2. Which companies are prominent players in the Trash Bags Market in North America?

Key companies in the market include Riverside Paper Co Inc, The Clorox Company (Glad Products Company), Neway Packaging Corporation, Four Star Plastics, Petoskey Plastics Inc, Inteplast Group*List Not Exhaustive, Hefty (Reynolds Consumer Products Inc ), Aluf Plastics, International Plastics Inc, Cosmoplast Industrial Company LLC, Poly-America LP, Berry Global Inc, Novolex Holdings LLC, All American Poly.

3. What are the main segments of the Trash Bags Market in North America?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.43 Million as of 2022.

5. What are some drivers contributing to market growth?

United States Continues to Lead the Market in Terms of Demand and Considering the Various Initiatives Undertaken to Promote Waste Disposal; Growing Demand for Compostable and Oxo-biodegradable Bags.

6. What are the notable trends driving market growth?

Residential Sector Holds Major Market Share.

7. Are there any restraints impacting market growth?

Contamination Due to Poor Packaging or Mishandling.

8. Can you provide examples of recent developments in the market?

June 2022: Tossits introduced a newly designed trash bag with more vehicle placement options owing to the longer bungee cord feature. Each of these thick bags is made from post-industrial recycled material. These bags are leak-proof and have an adhesive strip that seals off bad odors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Trash Bags Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Trash Bags Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Trash Bags Market in North America?

To stay informed about further developments, trends, and reports in the Trash Bags Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence