Key Insights

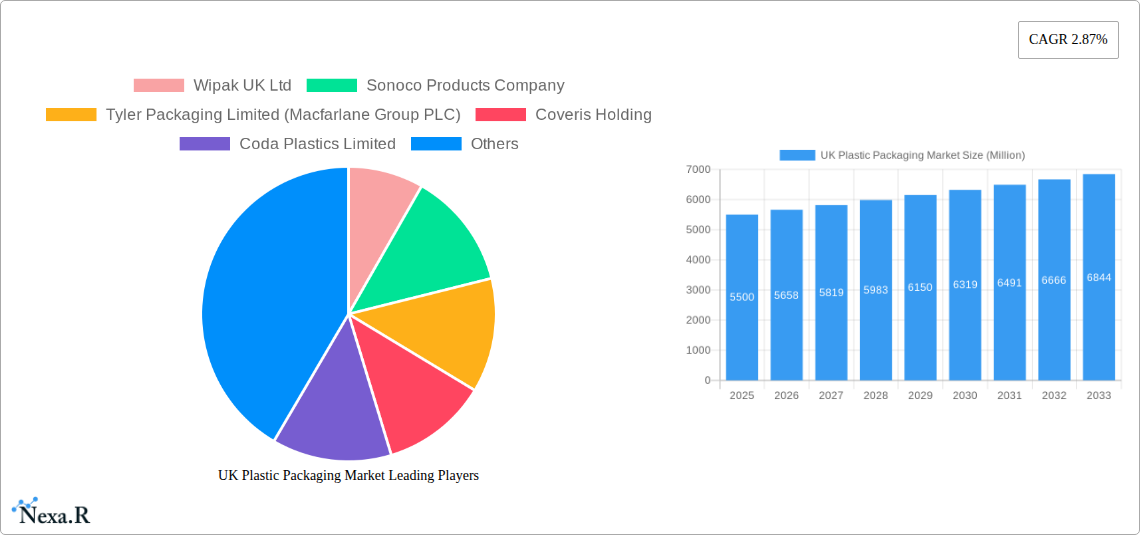

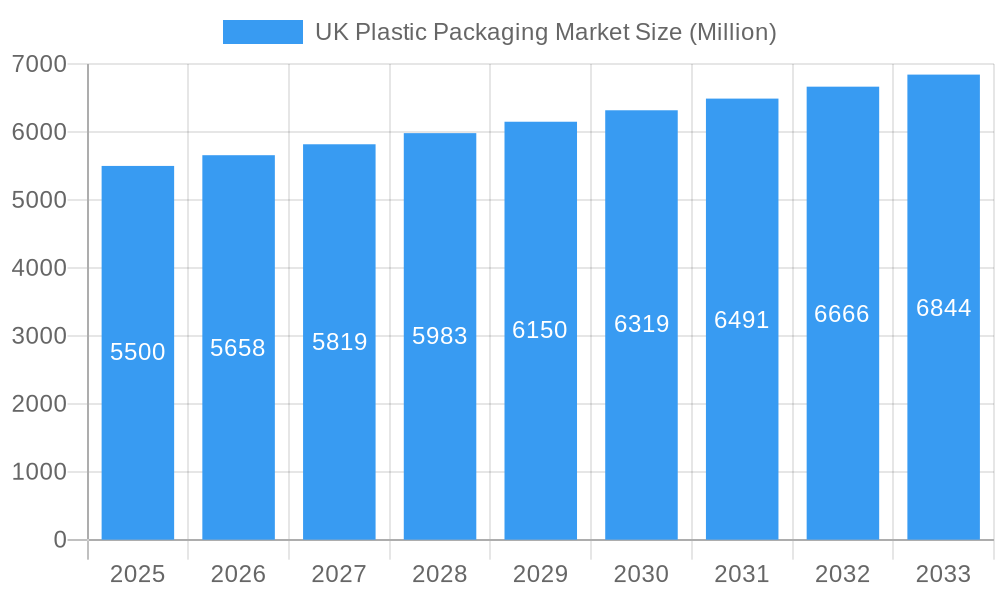

The UK plastic packaging market is poised for steady, albeit moderate, growth, with an estimated market size of approximately £5,500 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 2.87% through 2033. This expansion is primarily fueled by the persistent demand across key end-user industries such as food, beverage, and healthcare. The inherent versatility, cost-effectiveness, and protective qualities of plastic packaging continue to make it an indispensable choice for manufacturers and consumers alike. Within the packaging types, flexible plastic packaging, particularly pouches and films, is likely to witness significant traction due to its lightweight nature and suitability for a wide range of applications, from single-serve food items to medical supplies. Rigid plastic packaging, especially bottles, jars, and trays, will remain crucial for sectors requiring robust containment and product integrity. The sector's growth will also be influenced by ongoing innovation in sustainable plastic solutions and advancements in recycling technologies, addressing increasing environmental concerns.

UK Plastic Packaging Market Market Size (In Billion)

Despite the positive growth trajectory, the market faces certain restraints, most notably the growing regulatory pressure and public scrutiny surrounding plastic waste and its environmental impact. The push for a circular economy, coupled with stringent legislation on single-use plastics and Extended Producer Responsibility (EPR) schemes, will necessitate substantial investment in alternative materials and enhanced recycling infrastructure. Furthermore, the volatile cost of raw materials, often linked to petrochemical prices, can impact profit margins and pose a challenge to market stability. However, these challenges also present opportunities for companies to differentiate themselves through sustainable practices, the development of biodegradable and compostable alternatives, and the implementation of advanced recycling technologies. Key players like Amcor PLC, Berry Global, and Sealed Air Corporation are expected to lead the market through strategic expansions, mergers, and a focus on R&D for eco-friendly packaging solutions. The UK's commitment to net-zero targets will further drive the adoption of sustainable packaging, shaping the market's future landscape.

UK Plastic Packaging Market Company Market Share

UK Plastic Packaging Market Report: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report delivers a detailed examination of the UK plastic packaging market, offering critical insights into its dynamics, growth trajectory, and future potential. Covering the historical period from 2019 to 2024 and projecting through 2033 with a base year of 2025, this report is an indispensable resource for industry professionals, investors, and policymakers seeking to navigate the evolving landscape of flexible and rigid plastic packaging solutions across the United Kingdom. With a focus on high-traffic keywords, including "UK plastic packaging," "flexible plastic packaging," "rigid plastic packaging," "food packaging," "beverage packaging," "healthcare packaging," and "sustainable packaging," this report maximizes search engine visibility and engagement.

UK Plastic Packaging Market Market Dynamics & Structure

The UK plastic packaging market is characterized by a moderate level of concentration, with key players like Amcor PLC, Berry Global, and Coveris Holding exhibiting significant market share. Technological innovation is a primary driver, particularly in areas such as advanced material science for enhanced barrier properties and the development of lightweighting solutions to reduce material consumption. The regulatory framework, driven by government initiatives and EU directives transposed into UK law, plays a pivotal role in shaping market trends, with a strong emphasis on recyclability, recycled content mandates, and extended producer responsibility schemes. Competitive product substitutes, including paper, glass, and metal packaging, exert pressure, though plastic's versatility, cost-effectiveness, and performance often give it an edge, especially in demanding applications. End-user demographics, influenced by evolving consumer preferences for convenience, sustainability, and product safety, are also critical. Mergers and acquisitions (M&A) remain a key strategy for market consolidation and portfolio expansion, with deal volumes fluctuating based on economic conditions and strategic imperatives.

- Market Concentration: Dominated by a mix of global conglomerates and specialized regional players.

- Technological Innovation: Focus on lightweighting, barrier enhancement, and recyclability advancements.

- Regulatory Framework: Increasingly stringent environmental legislation impacting material use and end-of-life management.

- Competitive Landscape: Balancing plastic's advantages against growing demand for alternative materials.

- M&A Trends: Strategic acquisitions to broaden product offerings and market reach.

UK Plastic Packaging Market Growth Trends & Insights

The UK plastic packaging market is poised for sustained growth, driven by an increasing demand for versatile and cost-effective packaging solutions across various end-user industries. The market size is expected to witness a compound annual growth rate (CAGR) of approximately 3.5% over the forecast period. Adoption rates for advanced plastic packaging technologies are on the rise, particularly those that enhance product shelf-life, improve food safety, and contribute to waste reduction. Technological disruptions, such as the integration of smart packaging features for traceability and enhanced consumer engagement, are gaining traction. Consumer behavior shifts towards convenience, single-serving portions, and online grocery shopping further fuel the demand for specific plastic packaging formats like pouches and trays. The growing awareness of sustainability, however, is creating a dual trend: increased demand for recyclable and recycled-content plastics, alongside a cautious exploration of bio-based and compostable alternatives where feasible. The market penetration of flexible plastic packaging, particularly for food and personal care products, is projected to remain high due to its lightweight nature and adaptability. Conversely, the rigid plastic packaging segment, especially for beverages and household goods, continues to adapt through design innovations aimed at improving recyclability and incorporating higher percentages of post-consumer recycled (PCR) material. The push for a circular economy is a significant underlying theme, influencing material choices and processing technologies.

Dominant Regions, Countries, or Segments in UK Plastic Packaging Market

Within the UK plastic packaging market, flexible plastic packaging stands out as the dominant segment, driven by its extensive application across the Food and Personal Care and Household end-user industries. This dominance is underpinned by the inherent versatility of flexible formats, including pouches, bags, and films and wraps, which offer superior product protection, extended shelf-life, and significant lightweighting advantages compared to their rigid counterparts. The Food industry alone accounts for a substantial portion of flexible plastic packaging consumption, driven by the ever-growing demand for convenience foods, ready-to-eat meals, and packaged snacks, all of which rely heavily on the barrier properties and resealability offered by flexible plastic solutions.

- Key Drivers for Flexible Plastic Packaging Dominance:

- Superior Barrier Properties: Essential for preserving freshness, flavor, and extending the shelf-life of a wide range of food products.

- Lightweighting Benefits: Significantly reduces transportation costs and associated carbon emissions.

- Product Versatility: Adaptable to various shapes and sizes, catering to diverse product needs.

- Cost-Effectiveness: Often a more economical packaging solution compared to rigid alternatives.

- Consumer Convenience: Resealable pouches and easy-open bags enhance user experience.

The Food end-user industry's strong preference for flexible packaging is further amplified by evolving consumer lifestyles, the rise of e-commerce for grocery delivery, and the necessity for robust packaging to prevent spoilage and contamination. Similarly, the Personal Care and Household segment leverages flexible packaging for its hygiene, portability, and aesthetic appeal, particularly for products like detergents, cleaning supplies, and toiletries. The economic policies that support the growth of these consumer-facing sectors indirectly bolster the demand for their packaging requirements. Infrastructure advancements in the UK, including improved logistics networks, facilitate the efficient distribution of packaged goods, further solidifying the position of flexible plastic packaging. While rigid plastic packaging, particularly Bottles and Jars, also holds significant market share, especially within the Beverage and Personal Care and Household sectors, flexible packaging's broader application spectrum and ongoing innovation in materials and design ensure its leading role in driving market growth. The market share of flexible plastic packaging is estimated to be approximately 65% of the total UK plastic packaging market.

UK Plastic Packaging Market Product Landscape

The UK plastic packaging product landscape is a dynamic arena of innovation, focused on enhancing performance, sustainability, and consumer appeal. Key product developments include advanced barrier films that significantly extend product shelf-life, reducing food waste and offering greater logistical flexibility. Lightweighting initiatives have led to the creation of thinner yet stronger films and containers, reducing material usage without compromising protection. The rise of recyclable mono-material structures for flexible packaging, moving away from complex multi-layer constructions, is a significant trend. In rigid packaging, design innovations for easier recyclability, such as the development of PET bottles with integrated shrink sleeves that separate efficiently during recycling, are crucial. Applications span across all major end-user industries, with a particular emphasis on food safety, product integrity for pharmaceuticals, and aesthetic appeal for personal care items. Unique selling propositions increasingly revolve around circularity, with a focus on incorporating higher percentages of post-consumer recycled (PCR) content and developing packaging designed for infinite recyclability.

Key Drivers, Barriers & Challenges in UK Plastic Packaging Market

Key Drivers:

- Growing Demand from End-User Industries: Sustained demand from the food, beverage, healthcare, and personal care sectors fuels market expansion.

- Technological Advancements: Innovations in material science, processing, and design are enhancing packaging functionality and sustainability.

- Consumer Preference for Convenience: The rise of on-the-go consumption and ready-to-eat meals drives the need for flexible and easy-to-use packaging.

- Cost-Effectiveness of Plastics: Compared to many alternatives, plastic offers a favorable balance of performance and price.

- Government Initiatives for Recycling: Policies aimed at increasing recycling rates and promoting circular economy principles are indirectly driving demand for recyclable plastic packaging.

Barriers & Challenges:

- Negative Public Perception and Environmental Concerns: Growing societal concern regarding plastic waste and its environmental impact.

- Stringent Regulatory Landscape: Evolving legislation on plastic use, single-use plastics, and recycled content mandates can increase compliance costs.

- Supply Chain Disruptions: Volatility in raw material prices and availability, coupled with geopolitical factors, can impact production and costs.

- Competition from Alternative Materials: Increasing adoption of paper, glass, and metal packaging in certain applications.

- Infrastructure for Recycling: Limited or inconsistent infrastructure for collecting, sorting, and recycling certain types of plastic packaging.

Emerging Opportunities in UK Plastic Packaging Market

Emerging opportunities in the UK plastic packaging market are largely centered around sustainability and innovative applications. The drive towards a circular economy presents a significant opportunity for manufacturers to develop and supply packaging made from high-quality recycled plastics, including advanced chemical recycling technologies. The expansion of e-commerce logistics necessitates robust and lightweight packaging solutions, creating demand for specialized films and containers. Furthermore, the development of bio-based and compostable plastics, where their end-of-life management is clearly defined and achievable, offers niche growth avenues, particularly for specific consumer applications. The integration of smart technologies, such as QR codes for traceability and interactive consumer information, also presents untapped potential, especially within the food and healthcare sectors.

Growth Accelerators in the UK Plastic Packaging Market Industry

The UK plastic packaging market is propelled by several significant growth accelerators. Technological breakthroughs in polymer science, leading to enhanced recyclability and the development of high-performance, sustainable materials, are crucial. Strategic partnerships between packaging manufacturers, material suppliers, and waste management companies are fostering innovation and improving collection and recycling infrastructure. Market expansion strategies, including the development of new product lines tailored to evolving consumer demands for convenience and sustainability, are also key. Furthermore, investments in advanced manufacturing processes that improve efficiency and reduce environmental impact contribute to the industry's growth trajectory.

Key Players Shaping the UK Plastic Packaging Market Market

- Wipak UK Ltd

- Sonoco Products Company

- Tyler Packaging Limited (Macfarlane Group PLC)

- Coveris Holding

- Coda Plastics Limited

- Polystar Plastics Ltd

- Amcor PLC

- Clifton Packaging Group Limited

- National Flexible

- Constantia Flexibles

- Charpak Ltd

- Berry Global

- Sealed Air Corporation

Notable Milestones in UK Plastic Packaging Market Sector

- September 2022: Coca-Cola Great Britain (CCGB) expanded the use of its attached caps to 500 ml bottles to increase recycling rates and reduce waste, simplifying the recycling process.

- May 2022: FlexCollect, a major UK collaborative project for flexible plastic packaging collection and recycling, was launched with UK Research and Innovation (UKRI) backing to boost recovery and recycling rates through residential pickups.

In-Depth UK Plastic Packaging Market Market Outlook

The future outlook for the UK plastic packaging market remains robust, driven by a commitment to innovation and sustainability. Growth accelerators will continue to shape the industry, with a strong emphasis on the development and adoption of circular economy principles. Strategic opportunities lie in expanding the use of recycled content, investing in advanced recycling technologies, and collaborating across the value chain to enhance collection and processing capabilities. The market is expected to witness continued demand from essential sectors like food and healthcare, with a growing consumer appetite for packaging that is both functional and environmentally responsible. This strategic shift towards greater sustainability will define the market's trajectory, presenting opportunities for companies that can effectively integrate eco-friendly solutions into their portfolios.

UK Plastic Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Flexible Plastic Packaging

- 1.2. Rigid Plastic Packaging

-

2. Product Type

-

2.1. Rigid Plastic Packaging

- 2.1.1. Bottles and Jars

- 2.1.2. Trays and containers

- 2.1.3. Other Product Types (Caps and Closures, etc.)

-

2.2. Flexible Plastic Packaging

- 2.2.1. Pouches

- 2.2.2. Bags

- 2.2.3. Films and Wraps

-

2.1. Rigid Plastic Packaging

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Personal Care and Household

- 3.5. Other End-user Industries

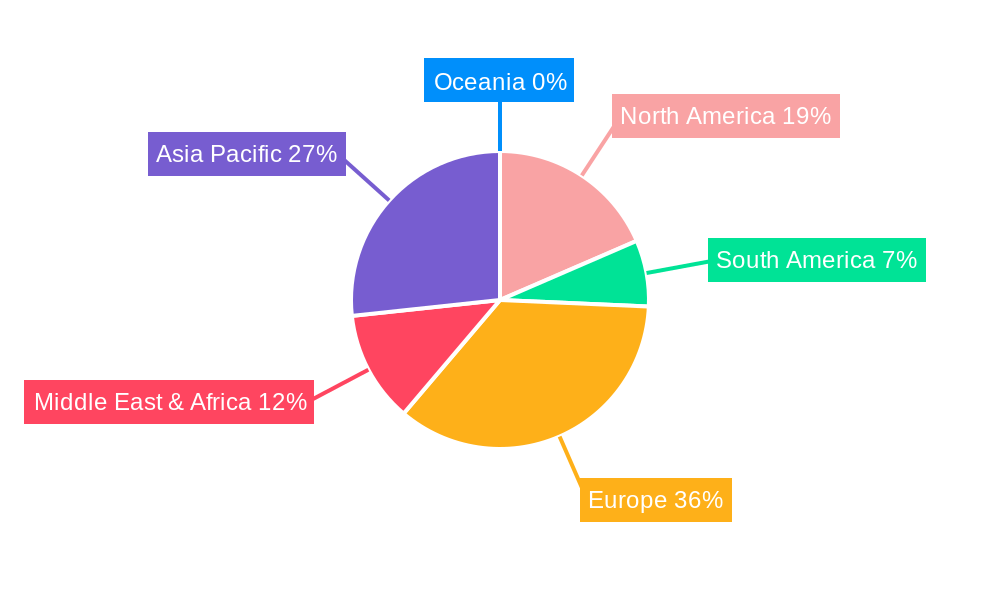

UK Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Plastic Packaging Market Regional Market Share

Geographic Coverage of UK Plastic Packaging Market

UK Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight-packaging Methods; Increased Eco-friendly Packaging and Recycled Plastics

- 3.3. Market Restrains

- 3.3.1. High Price of Raw Material (Plastic Resin); Government Regulations and Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Food Industry Driving Prominent Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Flexible Plastic Packaging

- 5.1.2. Rigid Plastic Packaging

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Rigid Plastic Packaging

- 5.2.1.1. Bottles and Jars

- 5.2.1.2. Trays and containers

- 5.2.1.3. Other Product Types (Caps and Closures, etc.)

- 5.2.2. Flexible Plastic Packaging

- 5.2.2.1. Pouches

- 5.2.2.2. Bags

- 5.2.2.3. Films and Wraps

- 5.2.1. Rigid Plastic Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Personal Care and Household

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. North America UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. Flexible Plastic Packaging

- 6.1.2. Rigid Plastic Packaging

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Rigid Plastic Packaging

- 6.2.1.1. Bottles and Jars

- 6.2.1.2. Trays and containers

- 6.2.1.3. Other Product Types (Caps and Closures, etc.)

- 6.2.2. Flexible Plastic Packaging

- 6.2.2.1. Pouches

- 6.2.2.2. Bags

- 6.2.2.3. Films and Wraps

- 6.2.1. Rigid Plastic Packaging

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare

- 6.3.4. Personal Care and Household

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. South America UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. Flexible Plastic Packaging

- 7.1.2. Rigid Plastic Packaging

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Rigid Plastic Packaging

- 7.2.1.1. Bottles and Jars

- 7.2.1.2. Trays and containers

- 7.2.1.3. Other Product Types (Caps and Closures, etc.)

- 7.2.2. Flexible Plastic Packaging

- 7.2.2.1. Pouches

- 7.2.2.2. Bags

- 7.2.2.3. Films and Wraps

- 7.2.1. Rigid Plastic Packaging

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare

- 7.3.4. Personal Care and Household

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. Europe UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. Flexible Plastic Packaging

- 8.1.2. Rigid Plastic Packaging

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Rigid Plastic Packaging

- 8.2.1.1. Bottles and Jars

- 8.2.1.2. Trays and containers

- 8.2.1.3. Other Product Types (Caps and Closures, etc.)

- 8.2.2. Flexible Plastic Packaging

- 8.2.2.1. Pouches

- 8.2.2.2. Bags

- 8.2.2.3. Films and Wraps

- 8.2.1. Rigid Plastic Packaging

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare

- 8.3.4. Personal Care and Household

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Middle East & Africa UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9.1.1. Flexible Plastic Packaging

- 9.1.2. Rigid Plastic Packaging

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Rigid Plastic Packaging

- 9.2.1.1. Bottles and Jars

- 9.2.1.2. Trays and containers

- 9.2.1.3. Other Product Types (Caps and Closures, etc.)

- 9.2.2. Flexible Plastic Packaging

- 9.2.2.1. Pouches

- 9.2.2.2. Bags

- 9.2.2.3. Films and Wraps

- 9.2.1. Rigid Plastic Packaging

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare

- 9.3.4. Personal Care and Household

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10. Asia Pacific UK Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10.1.1. Flexible Plastic Packaging

- 10.1.2. Rigid Plastic Packaging

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Rigid Plastic Packaging

- 10.2.1.1. Bottles and Jars

- 10.2.1.2. Trays and containers

- 10.2.1.3. Other Product Types (Caps and Closures, etc.)

- 10.2.2. Flexible Plastic Packaging

- 10.2.2.1. Pouches

- 10.2.2.2. Bags

- 10.2.2.3. Films and Wraps

- 10.2.1. Rigid Plastic Packaging

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare

- 10.3.4. Personal Care and Household

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Packaging Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wipak UK Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonoco Products Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tyler Packaging Limited (Macfarlane Group PLC)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Coveris Holding

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coda Plastics Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Polystar Plastics Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clifton Packaging Group Limited*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 National Flexible

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Constantia Flexibles

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Charpak Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berry Global

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sealed Air Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Wipak UK Ltd

List of Figures

- Figure 1: Global UK Plastic Packaging Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 3: North America UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 4: North America UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 5: North America UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 11: South America UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 12: South America UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: South America UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: South America UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 19: Europe UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 20: Europe UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Europe UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Europe UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 27: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 28: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 35: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 36: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 37: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific UK Plastic Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific UK Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 2: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global UK Plastic Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 6: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 13: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 20: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 21: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 33: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 35: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global UK Plastic Packaging Market Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 43: Global UK Plastic Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global UK Plastic Packaging Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 45: Global UK Plastic Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UK Plastic Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Plastic Packaging Market?

The projected CAGR is approximately 7.56%.

2. Which companies are prominent players in the UK Plastic Packaging Market?

Key companies in the market include Wipak UK Ltd, Sonoco Products Company, Tyler Packaging Limited (Macfarlane Group PLC), Coveris Holding, Coda Plastics Limited, Polystar Plastics Ltd, Amcor PLC, Clifton Packaging Group Limited*List Not Exhaustive, National Flexible, Constantia Flexibles, Charpak Ltd, Berry Global, Sealed Air Corporation.

3. What are the main segments of the UK Plastic Packaging Market?

The market segments include Packaging Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight-packaging Methods; Increased Eco-friendly Packaging and Recycled Plastics.

6. What are the notable trends driving market growth?

Food Industry Driving Prominent Growth.

7. Are there any restraints impacting market growth?

High Price of Raw Material (Plastic Resin); Government Regulations and Environmental Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: In an effort to increase recycling rates and reduce waste, Coca-Cola Great Britain (CCGB) expanded the use of its attached caps to 500 ml bottles. This move was a part of a packaging evolution across the company's complete portfolio. The bottle cap can now remain attached to the bottle even after it has been opened, making it simpler to recycle the complete package and guaranteeing that no cap is ever left behind, even when traveling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the UK Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence