Key Insights

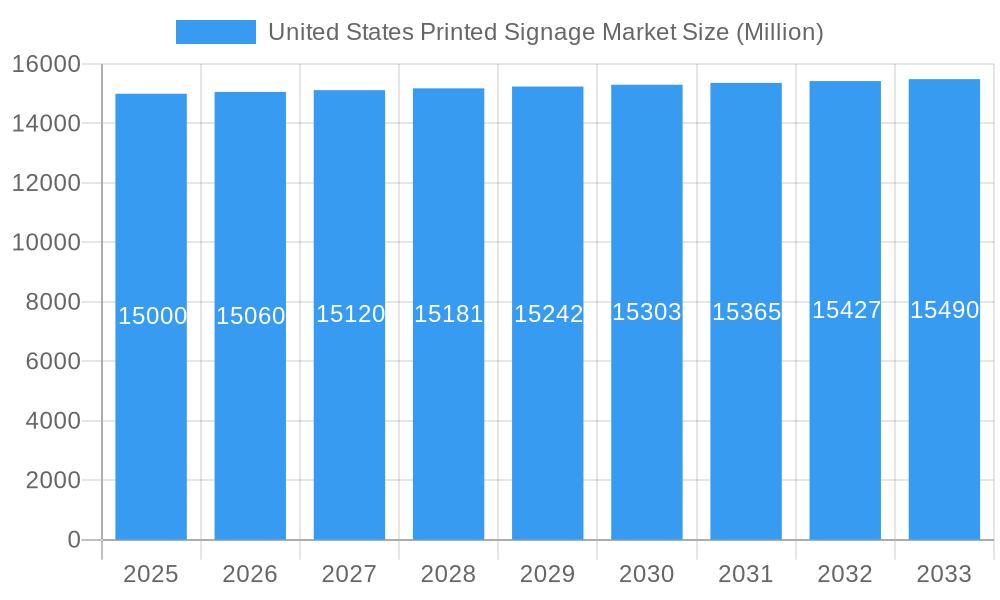

The United States printed signage market, while exhibiting a modest Compound Annual Growth Rate (CAGR) of 0.40%, presents a robust and dynamic landscape. Driven by the increasing need for impactful brand communication across diverse sectors, the market is projected to experience steady growth throughout the forecast period (2025-2033). Key drivers include the rising popularity of outdoor advertising, particularly billboards and backlit displays, a surge in retail marketing initiatives employing pop displays and banners, and the continued demand for corporate branding solutions in exhibitions and trade shows. The BFSI (Banking, Financial Services, and Insurance) and retail sectors represent significant end-user verticals, fueling market expansion. While the market faces certain restraints, such as the growing preference for digital advertising and fluctuating raw material prices, these challenges are being offset by the ongoing innovation in signage materials and printing technologies, including more sustainable and eco-friendly options. The market segmentation reveals a strong preference for outdoor printed signage, reflecting the sustained power of traditional outdoor advertising to reach broad audiences. Companies like Avery Dennison, Vistaprint, and others are well-positioned to capitalize on this market's steady growth through product diversification, strategic partnerships, and targeted marketing efforts. The competitive landscape is characterized by both large multinational corporations and smaller regional players, resulting in a diverse range of offerings and price points.

United States Printed Signage Market Market Size (In Billion)

The market's relatively low CAGR indicates a mature market characterized by incremental growth rather than explosive expansion. However, this stability suggests a reliable and predictable investment opportunity for businesses operating within this sector. Future growth will likely depend on successful adaptation to emerging trends, such as the integration of digital technologies into printed signage, personalization efforts catering to specific consumer segments, and a stronger focus on sustainability. The increasing emphasis on experiential marketing is another factor that will shape the market, driving demand for more creative and engaging signage solutions. Regional variations within the US market are expected, with certain areas exhibiting stronger growth than others, driven by factors such as population density, economic activity, and local regulations. Continuous monitoring of these regional dynamics will be crucial for effective market penetration and strategic resource allocation.

United States Printed Signage Market Company Market Share

United States Printed Signage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Printed Signage Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by product (Billboards, Backlit Displays, Pop Displays, Banners, Flags & Backdrops, Corporate Graphics, Exhibition & Trade Show Materials, Others), type (Indoor, Outdoor), and end-user vertical (BFSI, Retail, Sports & Leisure, Entertainment, Transportation & Logistics, Healthcare, Others). The market size is expressed in million units.

Keywords: United States Printed Signage Market, Billboard Advertising, Backlit Displays, Pop-up Displays, Banner Printing, Flag Printing, Trade Show Displays, Indoor Signage, Outdoor Signage, BFSI Signage, Retail Signage, Signage Market Size, Signage Market Growth, Signage Market Trends, Signage Industry, Signage Companies

United States Printed Signage Market Dynamics & Structure

The US Printed Signage market is characterized by moderate concentration, with several large players and numerous smaller, regional businesses. Technological innovation, particularly in digital printing and material science, is a key driver. Regulatory frameworks concerning advertising and outdoor signage vary by state and locality, influencing market dynamics. Competitive substitutes include digital advertising and other forms of visual communication. The end-user demographics are broad, reflecting the diverse needs of various industries. M&A activity has been moderate, with larger companies seeking to expand their product portfolios and geographic reach.

- Market Concentration: Moderately fragmented, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Digital printing, LED lighting in backlit displays, and sustainable materials are key innovations.

- Regulatory Framework: Varies by state and locality, impacting outdoor signage installations.

- Competitive Substitutes: Digital advertising, video screens, and online marketing pose competition.

- End-User Demographics: Diverse, spanning across various industries and consumer segments.

- M&A Trends: Moderate activity, with larger players focusing on acquisitions for expansion. xx M&A deals were recorded between 2019 and 2024.

United States Printed Signage Market Growth Trends & Insights

The US Printed Signage market experienced steady growth during the historical period (2019-2024), driven by factors such as increasing advertising expenditure, expansion of retail and entertainment sectors, and growing adoption of digital printing technologies. The market is expected to continue its growth trajectory during the forecast period (2025-2033), albeit at a slightly moderated pace. Technological disruptions, such as the rise of AR/VR in advertising, are presenting new opportunities and challenges. Consumer behavior shifts towards experiential marketing are impacting signage design and placement. The market is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. Market penetration of digital printing technologies is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in United States Printed Signage Market

The largest segment is Outdoor Printed Signage, driven by high demand from billboards and other outdoor advertising formats. California, Texas, and New York are leading states due to high population density and robust economic activity. Within product segments, Billboards maintain significant market share, followed by Backlit Displays and Pop Displays. The Retail end-user vertical is the largest contributor due to the extensive use of point-of-sale (POS) signage.

- Key Drivers:

- High advertising spending in major metropolitan areas.

- Growth of retail and entertainment sectors.

- Development of new shopping malls and entertainment complexes.

- Dominant Segments: Outdoor Printed Signage (xx% market share), Retail end-user vertical (xx% market share), Billboards (xx% within product segment).

- Growth Potential: Significant growth is anticipated in the digital printing segment and in sectors like healthcare and transportation.

United States Printed Signage Market Product Landscape

The market features a wide array of printed signage products, ranging from traditional billboards to sophisticated backlit displays and interactive pop-up displays. Significant advancements have occurred in material science, with the introduction of durable, lightweight, and eco-friendly materials. Digital printing technologies enable high-resolution graphics, personalization, and cost-effective production. Unique selling propositions focus on innovative designs, sustainable materials, and efficient installation methods.

Key Drivers, Barriers & Challenges in United States Printed Signage Market

Key Drivers: Growing advertising budgets, expansion of retail spaces, technological advancements in digital printing and materials. Government initiatives promoting infrastructure development also contribute positively.

Challenges: Intense competition, fluctuating raw material prices, economic downturns impacting advertising spending, and environmental regulations related to waste disposal. Supply chain disruptions could lead to xx% reduction in production capacity during peak seasons.

Emerging Opportunities in United States Printed Signage Market

Emerging opportunities lie in the integration of digital technologies, such as interactive displays and augmented reality experiences. Sustainable and eco-friendly signage materials are gaining traction. Untapped markets include smaller towns and rural areas with potential for customized signage solutions.

Growth Accelerators in the United States Printed Signage Market Industry

Technological breakthroughs in printing and material science, along with strategic partnerships between signage companies and advertising agencies, are accelerating market growth. Expansion into new markets, such as smart cities and experiential retail spaces, is also a key growth catalyst.

Key Players Shaping the United States Printed Signage Market Market

- Kelly Signs Inc

- Midwest Sign & Screen Printing Supply Co

- Neenah Inc

- Chandler Inc

- James Printing & Signs

- Sabre Digital Marketing

- Vistaprint (Cimpress plc)

- AJ Printing & Graphics Inc

- Avery Dennison Corporation

- RJ Courtney LLC

- Southwest Printing Co

- 3A Composites USA Inc

Notable Milestones in United States Printed Signage Market Sector

- 2021-Q3: Introduction of recyclable billboard materials by Avery Dennison Corporation.

- 2022-Q1: Merger between two regional signage companies, resulting in increased market share.

- 2023-Q4: Launch of a new interactive pop-up display technology by a major signage manufacturer.

- 2024-Q2: Increased adoption of sustainable signage materials.

In-Depth United States Printed Signage Market Market Outlook

The US Printed Signage market is poised for continued growth, driven by technological innovation, increasing advertising budgets, and the evolving needs of various industries. Strategic opportunities lie in developing sustainable and technologically advanced signage solutions, targeting emerging markets, and fostering partnerships to enhance market penetration. The market's long-term outlook remains positive, with significant potential for expansion and innovation.

United States Printed Signage Market Segmentation

-

1. Product

- 1.1. Billboards

- 1.2. Backlit Displays

- 1.3. Pop Displays

- 1.4. Banners, Flags, and Backdrops

- 1.5. Corporat

- 1.6. Others Products

-

2. Type

- 2.1. Indoor Printed Signage

- 2.2. Outdoor Printed Signage

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Retail

- 3.3. Sports & Leisure

- 3.4. Entertainment

- 3.5. Transportation & Logistics

- 3.6. Healthcare

- 3.7. Other end-user verticals

United States Printed Signage Market Segmentation By Geography

- 1. United States

United States Printed Signage Market Regional Market Share

Geographic Coverage of United States Printed Signage Market

United States Printed Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Cost Effectiveness of Printed Signage

- 3.3. Market Restrains

- 3.3.1 Lack of Ubiquitous Standards

- 3.3.2 Safety Concerns

- 3.3.3 and Inability to withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Printed Billboards are Expected to Witness Downfall

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Billboards

- 5.1.2. Backlit Displays

- 5.1.3. Pop Displays

- 5.1.4. Banners, Flags, and Backdrops

- 5.1.5. Corporat

- 5.1.6. Others Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indoor Printed Signage

- 5.2.2. Outdoor Printed Signage

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Sports & Leisure

- 5.3.4. Entertainment

- 5.3.5. Transportation & Logistics

- 5.3.6. Healthcare

- 5.3.7. Other end-user verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kelly Signs Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midwest Sign & Screen Printing Supply Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neenah Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chandler Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Printing & Signs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sabre Digital Marketing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistaprint ( Cimpress plc)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AJ Printing & Graphics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avery Dennison Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RJ Courtney LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Southwest Printing Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3A Composites USA Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kelly Signs Inc

List of Figures

- Figure 1: United States Printed Signage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Printed Signage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: United States Printed Signage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: United States Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Printed Signage Market?

The projected CAGR is approximately 0.40%.

2. Which companies are prominent players in the United States Printed Signage Market?

Key companies in the market include Kelly Signs Inc, Midwest Sign & Screen Printing Supply Co, Neenah Inc *List Not Exhaustive, Chandler Inc, James Printing & Signs, Sabre Digital Marketing, Vistaprint ( Cimpress plc), AJ Printing & Graphics Inc, Avery Dennison Corporation, RJ Courtney LLC, Southwest Printing Co, 3A Composites USA Inc.

3. What are the main segments of the United States Printed Signage Market?

The market segments include Product, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Cost Effectiveness of Printed Signage.

6. What are the notable trends driving market growth?

Printed Billboards are Expected to Witness Downfall.

7. Are there any restraints impacting market growth?

Lack of Ubiquitous Standards. Safety Concerns. and Inability to withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Printed Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Printed Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Printed Signage Market?

To stay informed about further developments, trends, and reports in the United States Printed Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence