Key Insights

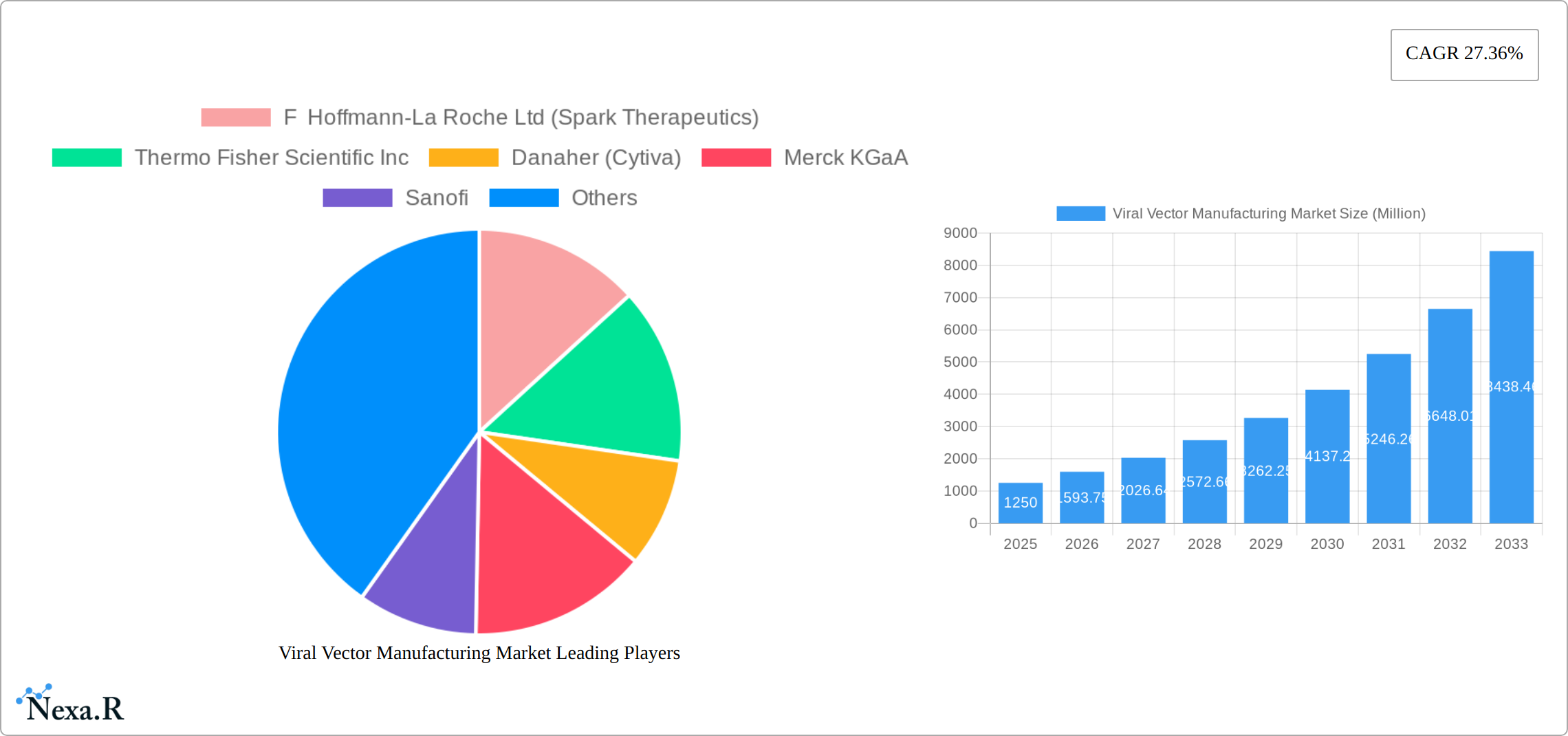

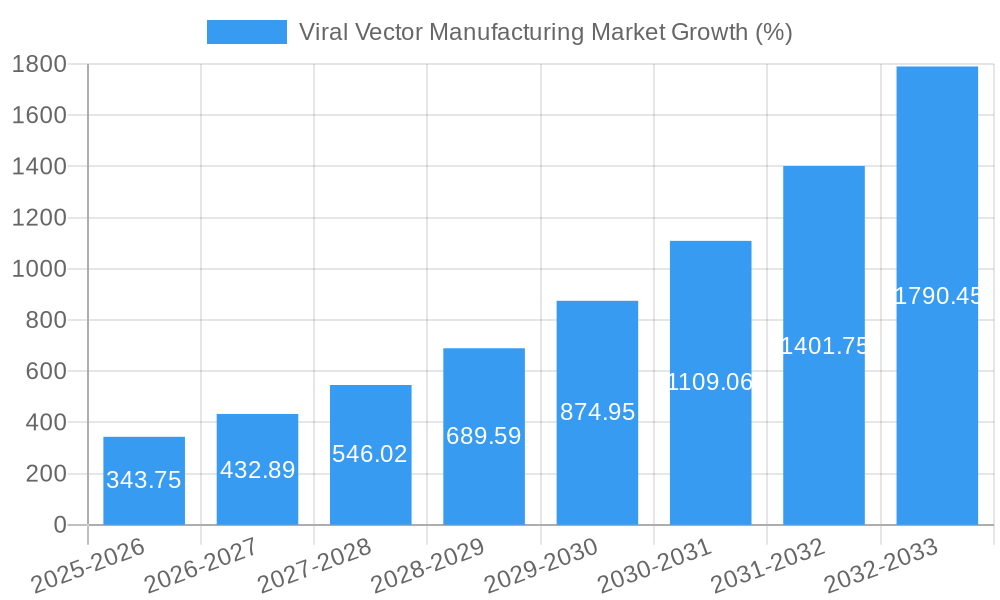

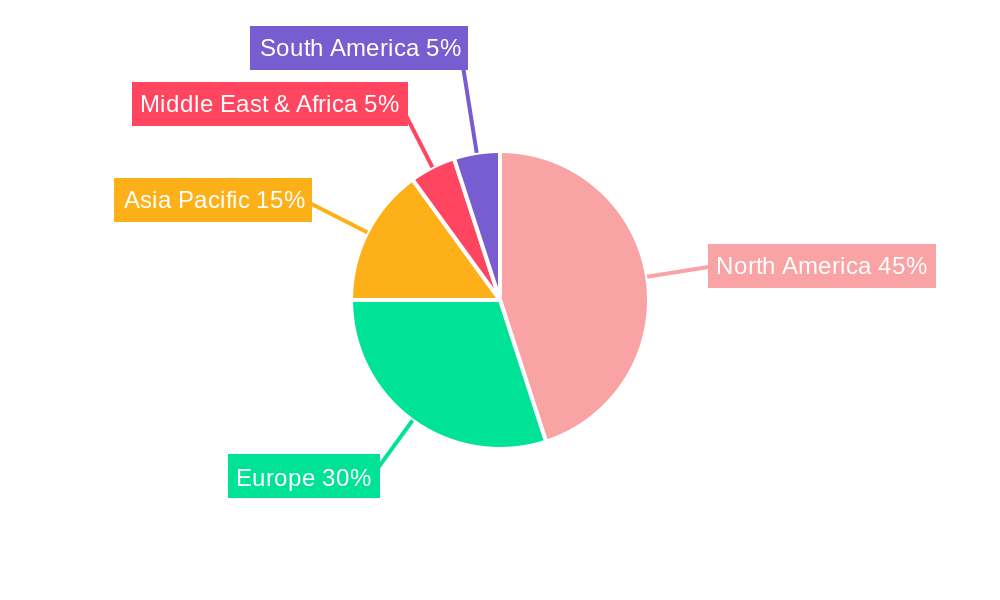

The viral vector manufacturing market is experiencing robust growth, projected to reach $1.25 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 27.36% from 2025 to 2033. This expansion is fueled by the increasing demand for gene therapy and advanced vaccine development. Key drivers include the rising prevalence of genetic disorders and cancers, coupled with significant advancements in viral vector technology leading to safer and more effective treatments. The market is segmented by vector type (adenoviral, adeno-associated, lentiviral, retroviral, and others), disease indication (cancer, genetic disorders, infectious diseases, and others), and application (gene therapy and vaccinology). North America currently holds a substantial market share due to the presence of major pharmaceutical companies, well-established research infrastructure, and regulatory approvals. However, the Asia-Pacific region is anticipated to witness significant growth in the coming years, driven by increasing investments in biotechnology and a growing awareness of advanced therapies. The competitive landscape is characterized by a mix of large multinational pharmaceutical companies and specialized biotech firms, each contributing to the innovation and expansion of this rapidly evolving market. The continued development of novel viral vectors with enhanced safety profiles and targeted delivery capabilities will be crucial to further market growth.

The substantial CAGR indicates a rapidly expanding market with significant investment opportunities. Challenges include the inherent complexities and costs associated with viral vector manufacturing, regulatory hurdles in gaining approvals for new therapies, and the potential for manufacturing scalability issues. Nevertheless, ongoing research and development efforts, alongside increasing collaborations between pharmaceutical companies and research institutions, are addressing these challenges and paving the way for more widespread adoption of viral vector-based therapies. The market's diverse application across gene therapy and vaccinology, coupled with the growing number of clinical trials and product approvals, points toward a sustained period of high growth and substantial market value in the coming years. The competitive landscape is expected to remain dynamic, with ongoing innovation and mergers and acquisitions playing a key role in shaping market dynamics.

Viral Vector Manufacturing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Viral Vector Manufacturing Market, encompassing its current state, future projections, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report delves into various segments, including vector type (Adenoviral Vectors, Adeno-associated Viral Vectors, Lentiviral Vectors, Retroviral Vectors, Other Types), disease application (Cancer, Genetic Disorders, Infectious Diseases, Other Diseases), and application areas (Gene Therapy, Vaccinology). The market size is presented in million units.

Viral Vector Manufacturing Market Dynamics & Structure

The viral vector manufacturing market is characterized by a moderately concentrated landscape, with several large players holding significant market share. However, the market shows promise for smaller companies due to ongoing technological innovations and increasing demand for advanced therapies. Regulatory frameworks, while crucial for safety, also pose challenges to market entry and expansion. The competitive landscape includes existing players and emerging companies, some leveraging partnerships and acquisitions to expand capabilities and market reach.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Continuous advancements in vector design, production processes, and purification techniques are driving market growth. Challenges include scalability and cost-effectiveness of production.

- Regulatory Landscape: Stringent regulatory approvals impact time-to-market and necessitate significant investment in compliance.

- Competitive Substitutes: Alternative gene delivery methods and therapeutic approaches pose some competitive pressure.

- M&A Activity: The market has witnessed xx M&A deals in the past 5 years, reflecting consolidation and expansion strategies. These deals often center on acquiring specialized technologies or expanding manufacturing capacity.

- End-User Demographics: Primarily driven by pharmaceutical and biotechnology companies, academic research institutions, and contract development and manufacturing organizations (CDMOs).

Viral Vector Manufacturing Market Growth Trends & Insights

The viral vector manufacturing market is experiencing robust growth, driven by the increasing adoption of gene therapy and advanced vaccine technologies. The market's expansion is fueled by a rising prevalence of genetic disorders and cancers, coupled with substantial investments in research and development. Technological advancements, such as improved vector design and high-throughput manufacturing processes, are further contributing to market expansion. The CAGR for the forecast period (2025-2033) is estimated to be xx%. Market penetration is expected to reach xx% by 2033.

(Note: This section requires XXX data to fulfill its 600-word requirement. Specific metrics such as CAGR, market penetration rates, and detailed adoption trends will be inserted here in the final report.)

Dominant Regions, Countries, or Segments in Viral Vector Manufacturing Market

North America continues to assert its dominance in the viral vector manufacturing market. This leadership is underpinned by substantial investments in cutting-edge research and development initiatives, the established presence of leading global biotechnology and pharmaceutical companies specializing in gene and cell therapies, and a robust and supportive regulatory framework that facilitates innovation and commercialization. The region benefits from a well-developed healthcare infrastructure and a significant patient population seeking advanced treatment modalities.

However, the Asia-Pacific region is rapidly emerging as a significant growth engine. This surge is propelled by escalating healthcare expenditures, a growing emphasis on public health awareness regarding advanced therapies like gene therapy, and increasing government initiatives aimed at fostering domestic biopharmaceutical manufacturing capabilities. Countries like China and India, with their large populations and growing economies, are poised to become key players in the viral vector manufacturing landscape.

Examining the market breakdown reveals distinct leadership within specific segments:

- By Type: Adeno-associated viral vectors (AAVs) indisputably command the largest market share. This is attributed to their favorable safety profile, excellent biocompatibility, and their demonstrated efficacy in delivering therapeutic genes to a wide range of target cells and tissues. The versatility and established track record of AAVs in preclinical and clinical studies solidify their leading position. Lentiviral vectors are also experiencing a robust growth trajectory. Their ability to transduce both dividing and non-dividing cells makes them highly suitable for a broad spectrum of gene therapy applications, including ex vivo gene modification of hematopoietic stem cells and in vivo delivery for chronic diseases.

- By Disease: Cancer continues to be the most prominent application area for viral vector manufacturing. The development of oncolytic viruses, CAR T-cell therapies, and other gene-based cancer immunotherapies has fueled substantial demand. Genetic disorders represent the second largest segment, with gene therapies offering potential cures for monogenic diseases like cystic fibrosis, spinal muscular atrophy, and hemophilia. The expanding pipeline of gene therapies targeting rare genetic conditions and the growing success of approved treatments are key drivers. Furthermore, the escalating research into gene-based interventions for infectious diseases, particularly in the wake of recent global health challenges, is contributing significantly to market expansion.

- By Application: Gene therapy stands as the preeminent application, accounting for a substantial portion of the market revenue derived from the successful commercialization of groundbreaking gene therapies. The transformative potential of gene therapy to address previously untreatable diseases drives innovation and investment. The burgeoning demand for novel vaccine technologies, especially for prophylactic and therapeutic purposes against infectious diseases and cancer, is invigorating the vaccinology application segment. Viral vectors are proving to be highly effective platforms for developing next-generation vaccines with enhanced immunogenicity and durability.

(Note: This section is designed to be expanded upon with detailed market share data for regions, countries, and individual segments in the final report. The analysis of factors contributing to the dominance of specific regions and segments will be further elaborated to meet the required word count.)

Viral Vector Manufacturing Market Product Landscape

The viral vector manufacturing market showcases a diverse range of products, including various vector types and accompanying services. Recent innovations focus on improving vector design for increased efficacy and reduced immunogenicity. Advanced manufacturing technologies are being implemented to enhance production efficiency, scalability, and cost-effectiveness. Unique selling propositions often center around enhanced vector performance, customized manufacturing solutions, and accelerated timelines for product development and commercialization.

Key Drivers, Barriers & Challenges in Viral Vector Manufacturing Market

Key Drivers:

- Increasing prevalence of genetic disorders and cancers.

- Growing adoption of gene therapy and advanced vaccine technologies.

- Technological advancements in vector design and manufacturing processes.

- Favorable regulatory landscape and supportive government initiatives.

Challenges & Restraints:

- High production costs and complexities associated with viral vector manufacturing.

- Stringent regulatory requirements and lengthy approval processes.

- Potential immunogenicity and safety concerns related to viral vectors.

- Competition from alternative gene delivery methods.

- Supply chain issues relating to raw materials and specialized equipment ( xx% disruption in 2024 estimated)

Emerging Opportunities in Viral Vector Manufacturing Market

- Geographic Expansion: Tapping into untapped markets within developing countries, where the burden of disease is high and access to advanced therapies is growing, presents a significant opportunity. Establishing manufacturing capabilities and distribution networks in these regions can unlock substantial market potential.

- Novel Applications: Pioneering innovative applications for viral vectors beyond traditional gene therapy and vaccination holds immense promise. This includes their use in targeted drug delivery systems, enhancing the efficacy and specificity of cancer immunotherapies, and developing sophisticated gene editing tools.

- Technological Advancements: Embracing and integrating cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) can revolutionize viral vector manufacturing. These technologies can be leveraged for optimizing production processes, predicting and mitigating manufacturing challenges, improving batch consistency, and enhancing overall quality control, leading to increased efficiency and reduced costs.

- Platform Innovation: The development and validation of novel viral vector platforms with inherently improved safety profiles, enhanced gene delivery efficiencies, reduced immunogenicity, and expanded tropism will open new therapeutic avenues and address limitations of existing vectors.

- Contract Development and Manufacturing Organization (CDMO) Growth: The increasing complexity and capital-intensive nature of viral vector manufacturing are driving demand for specialized CDMOs. Companies that can offer end-to-end services, from process development to large-scale CGMP manufacturing, are well-positioned for growth.

Growth Accelerators in the Viral Vector Manufacturing Market Industry

Technological breakthroughs in viral vector engineering and production processes are key growth catalysts. Strategic partnerships and collaborations between pharmaceutical companies, biotechnology firms, and CDMOs are driving innovation and market expansion. Expanding into new therapeutic areas and geographical markets, along with increasing investments in research and development, further accelerate market growth.

Key Players Shaping the Viral Vector Manufacturing Market Market

- F Hoffmann-La Roche Ltd (Spark Therapeutics)

- Thermo Fisher Scientific Inc

- Danaher (Cytiva)

- Merck KGaA

- Sanofi

- Finvector

- Charles River Laboratories (Cobra Biologics)

- AstraZeneca

- Vibalogics

- Fujifilm Holdings Corporation (Fujifilm Diosynth Biotechnologies)

- uniQure NV

- Lonza

- Oxford Biomedica PLC

- Kaneka Eurogentec SA

- Johnson & Johnson (Janssen Global Services LLC)

Notable Milestones in Viral Vector Manufacturing Market Sector

- June 2022: Avid Bioservices, Inc. announced a significant expansion of its viral vector manufacturing capabilities with the inauguration of new analytical and process development suites. The company projected full CGMP (Current Good Manufacturing Practice) compliance for these advanced facilities by mid-2023, bolstering its capacity to support the growing demand for gene therapy manufacturing.

- May 2022: AGC Biologics, a leading global CDMO, declared a substantial expansion of its viral vector manufacturing capacity at its Longmont, Colorado facility. This strategic investment aimed to meet the escalating needs of its clients in the rapidly growing gene and cell therapy sector.

- October 2023: Thermo Fisher Scientific announced the acquisition of Viralgen, a leading contract development and manufacturing organization (CDMO) specializing in AAV viral vectors, further solidifying its position in the gene therapy manufacturing space.

- February 2024: Catalent announced the expansion of its gene therapy manufacturing capabilities at its flagship facility in Rockville, Maryland, adding new clinical and commercial manufacturing suites for viral vectors.

In-Depth Viral Vector Manufacturing Market Market Outlook

The outlook for the viral vector manufacturing market is exceptionally robust and poised for sustained, significant expansion. This optimism is fueled by the relentless pace of innovation in gene therapy, with an ever-increasing number of promising drug candidates progressing through clinical trials and towards regulatory approval. Ongoing research into novel viral vector platforms is continually expanding the therapeutic potential and addressing the limitations of existing technologies. Strategic partnerships between academic institutions, biopharmaceutical companies, and CDMOs are proving instrumental in accelerating the development and commercialization of gene-based therapies. Mergers and acquisitions are reshaping the market landscape, with larger players consolidating capabilities and expanding their portfolios.

Furthermore, substantial investments in enhancing manufacturing capacity and technological infrastructure are crucial to meet the anticipated surge in demand. The global expansion into new therapeutic areas, targeting a wider array of diseases beyond rare genetic disorders and cancer, will unlock vast untapped markets. Similarly, geographical expansion into emerging economies with growing healthcare needs presents significant opportunities for market players. The market is exceptionally well-positioned for substantial growth in the coming years, driven by the unmet medical needs that gene therapies promise to address and the continuous evolution of technological advancements in manufacturing and delivery.

Viral Vector Manufacturing Market Segmentation

-

1. Type

- 1.1. Adenoviral Vectors

- 1.2. Adeno-associated Viral Vectors

- 1.3. Lentiviral Vectors

- 1.4. Retroviral Vectors

- 1.5. Other Types

-

2. Disease

- 2.1. Cancer

- 2.2. Genetic Disorders

- 2.3. Infectious Diseases

- 2.4. Other Diseases

-

3. Application

- 3.1. Gene Therapy

- 3.2. Vaccinology

Viral Vector Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Viral Vector Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 27.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Prevalence of Genetic Disorders

- 3.2.2 Cancer

- 3.2.3 and Infectious Diseases; Increasing Number of Clinical Studies and Availability of Funding for Gene Therapy Development; Potential Applications in Novel Drug Delivery Approaches

- 3.3. Market Restrains

- 3.3.1. High Cost of Gene Therapies; Challenges in Viral Vector Manufacturing Capacity

- 3.4. Market Trends

- 3.4.1. Cancer Sub-segment is Expected to Grow Faster in the Disease Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Adenoviral Vectors

- 5.1.2. Adeno-associated Viral Vectors

- 5.1.3. Lentiviral Vectors

- 5.1.4. Retroviral Vectors

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Disease

- 5.2.1. Cancer

- 5.2.2. Genetic Disorders

- 5.2.3. Infectious Diseases

- 5.2.4. Other Diseases

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Gene Therapy

- 5.3.2. Vaccinology

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. GCC

- 5.4.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Adenoviral Vectors

- 6.1.2. Adeno-associated Viral Vectors

- 6.1.3. Lentiviral Vectors

- 6.1.4. Retroviral Vectors

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Disease

- 6.2.1. Cancer

- 6.2.2. Genetic Disorders

- 6.2.3. Infectious Diseases

- 6.2.4. Other Diseases

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Gene Therapy

- 6.3.2. Vaccinology

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Adenoviral Vectors

- 7.1.2. Adeno-associated Viral Vectors

- 7.1.3. Lentiviral Vectors

- 7.1.4. Retroviral Vectors

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Disease

- 7.2.1. Cancer

- 7.2.2. Genetic Disorders

- 7.2.3. Infectious Diseases

- 7.2.4. Other Diseases

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Gene Therapy

- 7.3.2. Vaccinology

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Adenoviral Vectors

- 8.1.2. Adeno-associated Viral Vectors

- 8.1.3. Lentiviral Vectors

- 8.1.4. Retroviral Vectors

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Disease

- 8.2.1. Cancer

- 8.2.2. Genetic Disorders

- 8.2.3. Infectious Diseases

- 8.2.4. Other Diseases

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Gene Therapy

- 8.3.2. Vaccinology

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Adenoviral Vectors

- 9.1.2. Adeno-associated Viral Vectors

- 9.1.3. Lentiviral Vectors

- 9.1.4. Retroviral Vectors

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Disease

- 9.2.1. Cancer

- 9.2.2. Genetic Disorders

- 9.2.3. Infectious Diseases

- 9.2.4. Other Diseases

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Gene Therapy

- 9.3.2. Vaccinology

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. GCC Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Adenoviral Vectors

- 10.1.2. Adeno-associated Viral Vectors

- 10.1.3. Lentiviral Vectors

- 10.1.4. Retroviral Vectors

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Disease

- 10.2.1. Cancer

- 10.2.2. Genetic Disorders

- 10.2.3. Infectious Diseases

- 10.2.4. Other Diseases

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Gene Therapy

- 10.3.2. Vaccinology

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South America Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Adenoviral Vectors

- 11.1.2. Adeno-associated Viral Vectors

- 11.1.3. Lentiviral Vectors

- 11.1.4. Retroviral Vectors

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Disease

- 11.2.1. Cancer

- 11.2.2. Genetic Disorders

- 11.2.3. Infectious Diseases

- 11.2.4. Other Diseases

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Gene Therapy

- 11.3.2. Vaccinology

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Rest of Europe

- 14. Asia Pacific Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 Australia

- 14.1.5 South Korea

- 14.1.6 Rest of Asia Pacific

- 15. Middle East Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Qatar

- 15.1.4 Israel

- 15.1.5 Egypt

- 15.1.6 Oman

- 15.1.7 Rest of Middle East

- 16. GCC Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 South Africa

- 16.1.2 Rest of Middle East

- 17. South America Viral Vector Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Brazil

- 17.1.2 Argentina

- 17.1.3 Rest of South America

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 F Hoffmann-La Roche Ltd (Spark Therapeutics)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Thermo Fisher Scientific Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Danaher (Cytiva)

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Merck KGaA

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Sanofi

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Finvector

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Charles River Laboratories (Cobra Biologics)

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 AstraZeneca

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Vibalogics

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Fujifilm Holdings Corporation (Fujifilm Diosynth Biotechnologies)

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 uniQure NV

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Lonza

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Oxford Biomedica PLC

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Kaneka Eurogentec SA

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Johnson & Johnson (Janssen Global Services LLC)

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.1 F Hoffmann-La Roche Ltd (Spark Therapeutics)

List of Figures

- Figure 1: Global Viral Vector Manufacturing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: GCC Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: GCC Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Viral Vector Manufacturing Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Viral Vector Manufacturing Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Viral Vector Manufacturing Market Revenue (Million), by Disease 2024 & 2032

- Figure 17: North America Viral Vector Manufacturing Market Revenue Share (%), by Disease 2024 & 2032

- Figure 18: North America Viral Vector Manufacturing Market Revenue (Million), by Application 2024 & 2032

- Figure 19: North America Viral Vector Manufacturing Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: North America Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Viral Vector Manufacturing Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Viral Vector Manufacturing Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Viral Vector Manufacturing Market Revenue (Million), by Disease 2024 & 2032

- Figure 25: Europe Viral Vector Manufacturing Market Revenue Share (%), by Disease 2024 & 2032

- Figure 26: Europe Viral Vector Manufacturing Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Europe Viral Vector Manufacturing Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Viral Vector Manufacturing Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Viral Vector Manufacturing Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Viral Vector Manufacturing Market Revenue (Million), by Disease 2024 & 2032

- Figure 33: Asia Pacific Viral Vector Manufacturing Market Revenue Share (%), by Disease 2024 & 2032

- Figure 34: Asia Pacific Viral Vector Manufacturing Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Asia Pacific Viral Vector Manufacturing Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Asia Pacific Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Asia Pacific Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East Viral Vector Manufacturing Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East Viral Vector Manufacturing Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East Viral Vector Manufacturing Market Revenue (Million), by Disease 2024 & 2032

- Figure 41: Middle East Viral Vector Manufacturing Market Revenue Share (%), by Disease 2024 & 2032

- Figure 42: Middle East Viral Vector Manufacturing Market Revenue (Million), by Application 2024 & 2032

- Figure 43: Middle East Viral Vector Manufacturing Market Revenue Share (%), by Application 2024 & 2032

- Figure 44: Middle East Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Middle East Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: GCC Viral Vector Manufacturing Market Revenue (Million), by Type 2024 & 2032

- Figure 47: GCC Viral Vector Manufacturing Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: GCC Viral Vector Manufacturing Market Revenue (Million), by Disease 2024 & 2032

- Figure 49: GCC Viral Vector Manufacturing Market Revenue Share (%), by Disease 2024 & 2032

- Figure 50: GCC Viral Vector Manufacturing Market Revenue (Million), by Application 2024 & 2032

- Figure 51: GCC Viral Vector Manufacturing Market Revenue Share (%), by Application 2024 & 2032

- Figure 52: GCC Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 53: GCC Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: South America Viral Vector Manufacturing Market Revenue (Million), by Type 2024 & 2032

- Figure 55: South America Viral Vector Manufacturing Market Revenue Share (%), by Type 2024 & 2032

- Figure 56: South America Viral Vector Manufacturing Market Revenue (Million), by Disease 2024 & 2032

- Figure 57: South America Viral Vector Manufacturing Market Revenue Share (%), by Disease 2024 & 2032

- Figure 58: South America Viral Vector Manufacturing Market Revenue (Million), by Application 2024 & 2032

- Figure 59: South America Viral Vector Manufacturing Market Revenue Share (%), by Application 2024 & 2032

- Figure 60: South America Viral Vector Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 61: South America Viral Vector Manufacturing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Disease 2019 & 2032

- Table 4: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Arab Emirates Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Saudi Arabia Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Qatar Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Egypt Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Oman Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: South Africa Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Middle East Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Brazil Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Argentina Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of South America Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Disease 2019 & 2032

- Table 41: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Disease 2019 & 2032

- Table 48: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 49: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Germany Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: United Kingdom Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Spain Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Disease 2019 & 2032

- Table 58: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: China Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Japan Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: India Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Australia Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Korea Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Asia Pacific Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 67: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Disease 2019 & 2032

- Table 68: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 69: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 71: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Disease 2019 & 2032

- Table 72: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 73: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 74: South Africa Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Rest of Middle East Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 77: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Disease 2019 & 2032

- Table 78: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Application 2019 & 2032

- Table 79: Global Viral Vector Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 80: Brazil Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 81: Argentina Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Rest of South America Viral Vector Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Viral Vector Manufacturing Market?

The projected CAGR is approximately 27.36%.

2. Which companies are prominent players in the Viral Vector Manufacturing Market?

Key companies in the market include F Hoffmann-La Roche Ltd (Spark Therapeutics), Thermo Fisher Scientific Inc, Danaher (Cytiva), Merck KGaA, Sanofi, Finvector, Charles River Laboratories (Cobra Biologics), AstraZeneca, Vibalogics, Fujifilm Holdings Corporation (Fujifilm Diosynth Biotechnologies), uniQure NV, Lonza, Oxford Biomedica PLC, Kaneka Eurogentec SA, Johnson & Johnson (Janssen Global Services LLC).

3. What are the main segments of the Viral Vector Manufacturing Market?

The market segments include Type, Disease, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Genetic Disorders. Cancer. and Infectious Diseases; Increasing Number of Clinical Studies and Availability of Funding for Gene Therapy Development; Potential Applications in Novel Drug Delivery Approaches.

6. What are the notable trends driving market growth?

Cancer Sub-segment is Expected to Grow Faster in the Disease Segment.

7. Are there any restraints impacting market growth?

High Cost of Gene Therapies; Challenges in Viral Vector Manufacturing Capacity.

8. Can you provide examples of recent developments in the market?

In June 2022, Avid Bioservices, Inc. opened the analytical and process development (AD/PD) suites within the company's new, world-class viral vector development and Current Good manufacturing Plant (CGMP) manufacturing facility. Build-out of the viral vector facility's CGMP manufacturing suites is ongoing, with those capabilities expected to come online in mid-calendar 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Viral Vector Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Viral Vector Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Viral Vector Manufacturing Market?

To stay informed about further developments, trends, and reports in the Viral Vector Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence