Key Insights

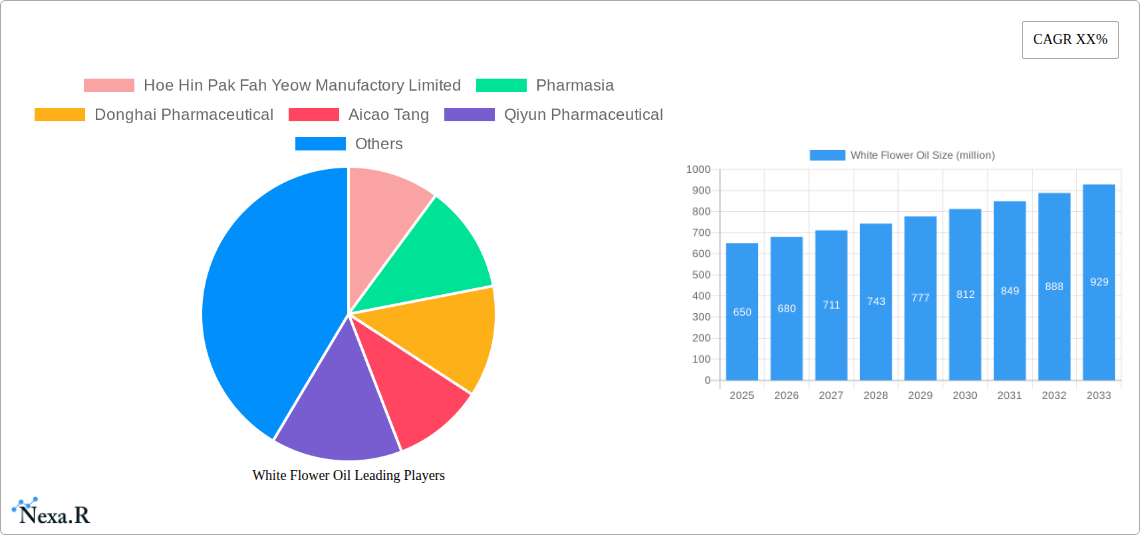

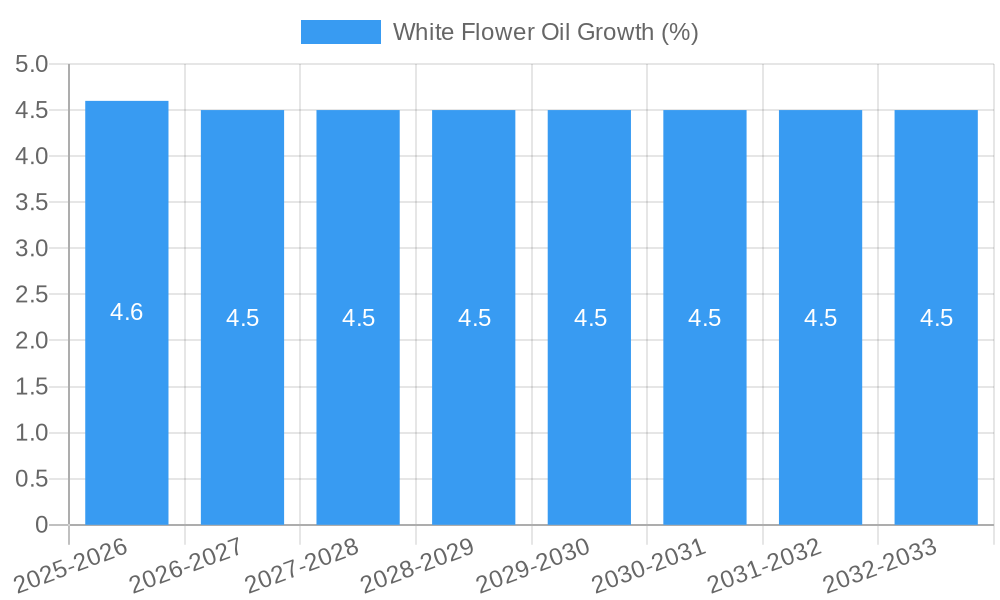

The global White Flower Oil market is projected for robust expansion, anticipating a market size of approximately $650 million with a Compound Annual Growth Rate (CAGR) of roughly 4.5% between 2025 and 2033. This growth is fueled by an increasing consumer preference for natural and herbal remedies for common ailments, a trend amplified by growing health consciousness and a desire for alternatives to conventional pharmaceuticals. The oil's established efficacy in providing relief from headaches, muscle aches, and minor discomforts, coupled with its widespread availability and relatively low cost, positions it as a staple in many households. Furthermore, an aging global population susceptible to chronic pain and discomfort will contribute significantly to sustained demand. The market is also benefiting from expanding distribution channels, including online retail, which enhances accessibility for consumers worldwide.

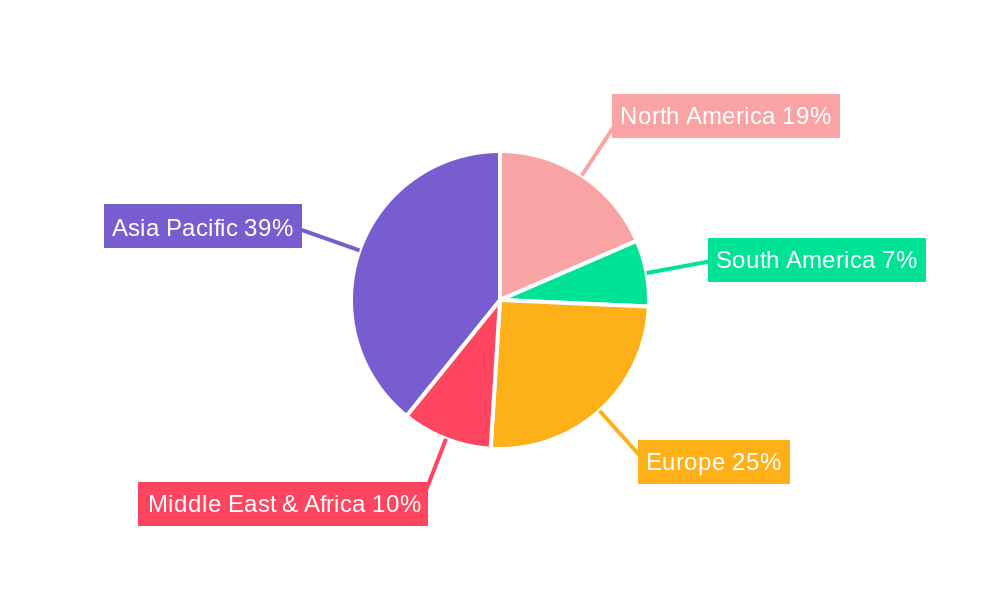

Key growth drivers for the White Flower Oil market include its multi-purpose therapeutic applications, the rising prevalence of lifestyle-related ailments such as stress-induced headaches and joint pain, and the increasing adoption of aromatherapy and traditional medicine practices. The market is segmented by application into hospitals, clinics, and others, with the "others" category, encompassing household use and retail sales, currently dominating. In terms of types, the 5ml per bottle and 10ml per bottle segments are expected to see the highest demand due to their convenient size and affordability for regular use. Geographically, the Asia Pacific region, particularly China and India, is anticipated to lead the market, owing to the deep-rooted tradition of using herbal remedies and a large consumer base. However, North America and Europe are also showing steady growth as consumers become more receptive to natural health solutions. Restraints include the increasing competition from synthetic pain relief products and potential regulatory hurdles in certain regions, though the natural product appeal largely offsets these concerns.

White Flower Oil Market Dynamics & Structure

The global White Flower Oil market is characterized by a moderate level of concentration, with key players like Hoe Hin Pak Fah Yeow Manufactory Limited and Pharmasia holding significant, yet not entirely dominant, market shares. Technological innovation is primarily driven by advancements in extraction methods, formulation refinement to enhance efficacy and reduce side effects, and the development of novel delivery systems. Regulatory frameworks, though varied by region, generally focus on product safety, efficacy claims, and ingredient transparency, acting as both a driver for quality improvement and a barrier to entry for new formulations. Competitive product substitutes include other topical analgesics, liniments, and essential oil-based remedies, each vying for consumer preference based on perceived effectiveness, cost, and natural origin. End-user demographics are broad, encompassing individuals seeking relief from minor aches and pains, athletes, elderly populations, and consumers interested in traditional remedies. Mergers and acquisitions (M&A) are infrequent but strategically significant, often aimed at consolidating market presence, acquiring new technologies, or expanding distribution networks. For instance, a hypothetical acquisition of a smaller regional player by a larger entity could increase combined market share by 5%. Innovation barriers are primarily associated with the stringent approval processes for new drug formulations and the high cost of clinical trials to substantiate efficacy claims.

- Market Concentration: Moderate, with top players holding an estimated combined market share of 45% in 2025.

- Technological Innovation Drivers: Enhanced extraction techniques, improved formulation stability, and novel packaging.

- Regulatory Frameworks: Focus on safety, efficacy, and ingredient disclosure across major markets.

- Competitive Substitutes: Topical analgesics, menthol-based products, and other herbal liniments.

- End-User Demographics: Diverse, including individuals with musculoskeletal discomfort, athletes, and users of traditional medicine.

- M&A Trends: Infrequent but strategic, aimed at market consolidation and technology acquisition.

- Innovation Barriers: High cost of R&D, clinical trials, and navigating complex regulatory pathways.

White Flower Oil Growth Trends & Insights

The White Flower Oil market is poised for robust growth, propelled by a confluence of factors that are reshaping consumer preferences and healthcare access. The global market size for White Flower Oil is projected to expand significantly, from an estimated $1.2 billion in 2019 to $2.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. This upward trajectory is underpinned by increasing consumer awareness regarding the therapeutic benefits of natural and traditional remedies for pain management and muscle relief. Adoption rates are steadily rising, particularly in emerging economies where access to advanced pain management solutions may be limited or prohibitively expensive. Technological disruptions, while not revolutionary, are subtly influencing the market. Advancements in formulation science are leading to improved absorption rates and longer-lasting effects, enhancing product efficacy. Furthermore, the integration of digital channels for marketing and sales is broadening reach and accessibility, allowing manufacturers to connect directly with a wider consumer base.

Consumer behavior is undergoing a notable shift towards holistic health and wellness, with a growing appreciation for ingredients perceived as natural and gentle. White Flower Oil, with its roots in traditional medicine, resonates strongly with this trend. Consumers are actively seeking alternatives to synthetic pharmaceuticals, driven by concerns about side effects and a desire for more natural approaches to managing everyday discomforts like headaches, muscle aches, and minor sprains. The penetration of White Flower Oil is expanding beyond its traditional user base, attracting younger demographics who are increasingly open to exploring traditional remedies as part of their self-care routines. This expanding consumer base, coupled with consistent demand from established users, is a primary driver of market growth. Moreover, the increasing incidence of sedentary lifestyles and physically demanding occupations contributes to a sustained need for effective topical pain relief solutions. The market's ability to adapt to evolving consumer demands for efficacy, safety, and natural ingredients will be critical in capitalizing on these growth trends. The market penetration is expected to reach 18% globally by 2030.

Dominant Regions, Countries, or Segments in White Flower Oil

The White Flower Oil market’s dominance is most pronounced in the Asia Pacific region, driven by a rich history of traditional medicine, robust manufacturing capabilities, and a vast consumer base with established preferences for herbal remedies. Within this region, countries like China and Southeast Asian nations are pivotal, contributing a substantial share to global consumption and production. The “Others” segment within Applications, encompassing over-the-counter (OTC) sales in pharmacies, traditional medicine stores, and online retail, significantly fuels market growth. This segment’s dominance is attributed to the widespread accessibility and self-medication practices prevalent in these regions, where consumers readily turn to White Flower Oil for immediate relief from common ailments.

The 2.5ml Per Bottle and 5ml Per Bottle types of White Flower Oil are experiencing the highest demand, particularly in the "Others" application segment. These smaller, portable sizes are ideal for individual use, carrying in personal bags, and for trial purchases, making them highly attractive to a broad consumer base. Their lower price point also enhances accessibility, further contributing to their widespread adoption. Economic policies in the Asia Pacific region, often supportive of traditional medicine industries, coupled with significant investments in local production and distribution infrastructure, create a fertile ground for market expansion. The increasing disposable income in these countries allows for greater consumer spending on health and wellness products, including White Flower Oil. Furthermore, cultural acceptance and deep-rooted trust in the efficacy of traditional formulations in Asia Pacific provide a powerful market advantage. The market share of the Asia Pacific region is estimated to be 55% of the global market in 2025, with a projected CAGR of 7.0% over the forecast period.

- Dominant Region: Asia Pacific.

- Key Contributing Countries: China, Thailand, Vietnam, Malaysia.

- Dominant Application Segment: Others (OTC sales in pharmacies, traditional stores, online retail).

- Dominant Type Segments: 2.5ml Per Bottle and 5ml Per Bottle.

- Key Drivers in Asia Pacific: Cultural acceptance of traditional medicine, strong manufacturing base, increasing disposable income, supportive government policies.

- Growth Potential: High, due to expanding consumer base and sustained demand for accessible pain relief.

White Flower Oil Product Landscape

The White Flower Oil product landscape is characterized by a focus on enhancing efficacy and expanding applications while maintaining its traditional appeal. Manufacturers are investing in refining extraction processes to ensure higher purity and potency of active ingredients, leading to improved pain relief and anti-inflammatory properties. Innovations include the development of more stable formulations that offer a longer shelf-life and consistent performance. Unique selling propositions often revolve around the natural origin of ingredients, traditional formulations passed down through generations, and demonstrable relief from a variety of minor aches, pains, and discomforts. Some advanced products are exploring enhanced absorption technologies and incorporating synergistic blends of essential oils to target specific conditions more effectively.

Key Drivers, Barriers & Challenges in White Flower Oil

Key Drivers:

- Growing Demand for Natural Remedies: Increasing consumer preference for natural and herbal pain relief solutions.

- Effectiveness in Pain Management: Proven efficacy in alleviating minor aches, pains, headaches, and muscle soreness.

- Affordability and Accessibility: Generally cost-effective and widely available in various retail channels.

- Cultural Acceptance: Deep-rooted tradition and trust in herbal remedies, particularly in Asian markets.

- Rising Healthcare Costs: Consumers seeking more affordable alternatives to prescription pain medications.

Key Barriers & Challenges:

- Regulatory Hurdles: Stringent and varied regulations for product approval and labeling across different countries.

- Competition from Synthetic Alternatives: Intense competition from a wide range of over-the-counter synthetic pain relievers.

- Lack of Extensive Clinical Trials: Limited large-scale, placebo-controlled clinical studies to substantiate all efficacy claims to Western pharmaceutical standards.

- Supply Chain Volatility: Potential for disruptions in the sourcing of raw materials due to agricultural factors or geopolitical issues.

- Perception as a "Traditional" Remedy: Some consumers may perceive it as less sophisticated or effective compared to modern pharmaceutical options.

- Counterfeit Products: The presence of counterfeit or substandard products can damage brand reputation and consumer trust.

- Adverse Event Reporting: While generally safe, rare instances of skin irritation or allergic reactions can occur, requiring careful monitoring and communication. The cost associated with rigorous testing and documentation for regulatory compliance can be a significant barrier, estimated at $1-3 million for new product registrations in developed markets.

Emerging Opportunities in White Flower Oil

Emerging opportunities for White Flower Oil lie in expanding its global reach beyond traditional markets, particularly in North America and Europe, where the demand for natural health products is steadily growing. The development of specialized formulations targeting specific pain conditions, such as arthritis or sports-related injuries, presents a significant avenue for growth. Moreover, leveraging e-commerce platforms to reach a wider, digitally-connected consumer base, especially millennials and Gen Z interested in wellness and self-care, offers untapped potential. The integration of White Flower Oil into broader wellness routines, such as aromatherapy or massage therapy, can also open new market segments.

Growth Accelerators in the White Flower Oil Industry

Growth accelerators for the White Flower Oil industry include strategic partnerships with global distributors to enhance market penetration in untapped regions, and investments in research and development to scientifically validate traditional claims and explore new applications. Technological breakthroughs in encapsulation and delivery systems could improve product efficacy and consumer experience. Furthermore, targeted marketing campaigns that highlight the natural origins and effectiveness of White Flower Oil, coupled with endorsements from credible wellness influencers and healthcare professionals, can significantly boost adoption rates and drive long-term market expansion.

Key Players Shaping the White Flower Oil Market

- Hoe Hin Pak Fah Yeow Manufactory Limited

- Pharmasia

- Donghai Pharmaceutical

- Aicao Tang

- Qiyun Pharmaceutical

- Green Flower Pharmaceutical

- Health Pharma

- Huakang Pharmaceutical

- Limin Pharmaceutical

- Xianghe Pharmaceutical

Notable Milestones in White Flower Oil Sector

- 2019: Increased global export of White Flower Oil from key Asian manufacturing hubs.

- 2020: Rise in online sales and direct-to-consumer (DTC) models due to the pandemic.

- 2021: Introduction of enhanced formulations with improved topical absorption.

- 2022: Growing consumer interest in natural pain relief driving market growth.

- 2023: Expansion of product lines to include larger, family-sized bottles.

- 2024: Increased regulatory scrutiny and focus on ingredient transparency in major markets.

In-Depth White Flower Oil Market Outlook

The future outlook for the White Flower Oil market is highly promising, fueled by enduring consumer demand for natural health solutions and a growing appreciation for traditional remedies. Growth accelerators, including strategic international market expansion and innovative product development focusing on enhanced efficacy and new applications, will significantly shape the market's trajectory. The industry is expected to witness sustained growth, driven by increasing disposable incomes in emerging economies and a global shift towards holistic wellness. Strategic collaborations and continued investment in product quality and consumer education will be crucial for capitalizing on the substantial opportunities that lie ahead.

White Flower Oil Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Others

-

2. Types

- 2.1. 2.5ml Per Bottle

- 2.2. 5ml Per Bottle

- 2.3. 10ml Per Bottle

- 2.4. 20ml Per Bottle

White Flower Oil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

White Flower Oil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global White Flower Oil Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 2.5ml Per Bottle

- 5.2.2. 5ml Per Bottle

- 5.2.3. 10ml Per Bottle

- 5.2.4. 20ml Per Bottle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America White Flower Oil Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 2.5ml Per Bottle

- 6.2.2. 5ml Per Bottle

- 6.2.3. 10ml Per Bottle

- 6.2.4. 20ml Per Bottle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America White Flower Oil Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 2.5ml Per Bottle

- 7.2.2. 5ml Per Bottle

- 7.2.3. 10ml Per Bottle

- 7.2.4. 20ml Per Bottle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe White Flower Oil Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 2.5ml Per Bottle

- 8.2.2. 5ml Per Bottle

- 8.2.3. 10ml Per Bottle

- 8.2.4. 20ml Per Bottle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa White Flower Oil Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 2.5ml Per Bottle

- 9.2.2. 5ml Per Bottle

- 9.2.3. 10ml Per Bottle

- 9.2.4. 20ml Per Bottle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific White Flower Oil Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 2.5ml Per Bottle

- 10.2.2. 5ml Per Bottle

- 10.2.3. 10ml Per Bottle

- 10.2.4. 20ml Per Bottle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hoe Hin Pak Fah Yeow Manufactory Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pharmasia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Donghai Pharmaceutical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aicao Tang

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Qiyun Pharmaceutical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Green Flower Pharmaceutical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Health Pharma

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Huakang Pharmaceutical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Limin Pharmaceutical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Xianghe Pharmaceutical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hoe Hin Pak Fah Yeow Manufactory Limited

List of Figures

- Figure 1: Global White Flower Oil Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America White Flower Oil Revenue (million), by Application 2024 & 2032

- Figure 3: North America White Flower Oil Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America White Flower Oil Revenue (million), by Types 2024 & 2032

- Figure 5: North America White Flower Oil Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America White Flower Oil Revenue (million), by Country 2024 & 2032

- Figure 7: North America White Flower Oil Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America White Flower Oil Revenue (million), by Application 2024 & 2032

- Figure 9: South America White Flower Oil Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America White Flower Oil Revenue (million), by Types 2024 & 2032

- Figure 11: South America White Flower Oil Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America White Flower Oil Revenue (million), by Country 2024 & 2032

- Figure 13: South America White Flower Oil Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe White Flower Oil Revenue (million), by Application 2024 & 2032

- Figure 15: Europe White Flower Oil Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe White Flower Oil Revenue (million), by Types 2024 & 2032

- Figure 17: Europe White Flower Oil Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe White Flower Oil Revenue (million), by Country 2024 & 2032

- Figure 19: Europe White Flower Oil Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa White Flower Oil Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa White Flower Oil Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa White Flower Oil Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa White Flower Oil Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa White Flower Oil Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa White Flower Oil Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific White Flower Oil Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific White Flower Oil Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific White Flower Oil Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific White Flower Oil Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific White Flower Oil Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific White Flower Oil Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global White Flower Oil Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global White Flower Oil Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global White Flower Oil Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global White Flower Oil Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global White Flower Oil Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global White Flower Oil Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global White Flower Oil Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global White Flower Oil Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global White Flower Oil Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global White Flower Oil Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global White Flower Oil Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global White Flower Oil Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global White Flower Oil Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global White Flower Oil Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global White Flower Oil Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global White Flower Oil Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global White Flower Oil Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global White Flower Oil Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global White Flower Oil Revenue million Forecast, by Country 2019 & 2032

- Table 41: China White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific White Flower Oil Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the White Flower Oil?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the White Flower Oil?

Key companies in the market include Hoe Hin Pak Fah Yeow Manufactory Limited, Pharmasia, Donghai Pharmaceutical, Aicao Tang, Qiyun Pharmaceutical, Green Flower Pharmaceutical, Health Pharma, Huakang Pharmaceutical, Limin Pharmaceutical, Xianghe Pharmaceutical.

3. What are the main segments of the White Flower Oil?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "White Flower Oil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the White Flower Oil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the White Flower Oil?

To stay informed about further developments, trends, and reports in the White Flower Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence