Key Insights

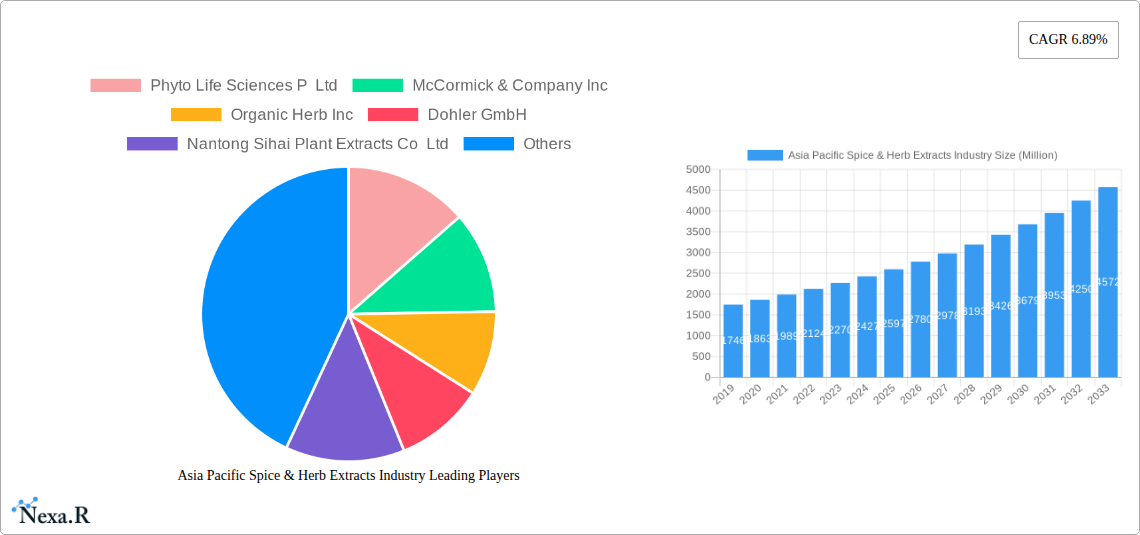

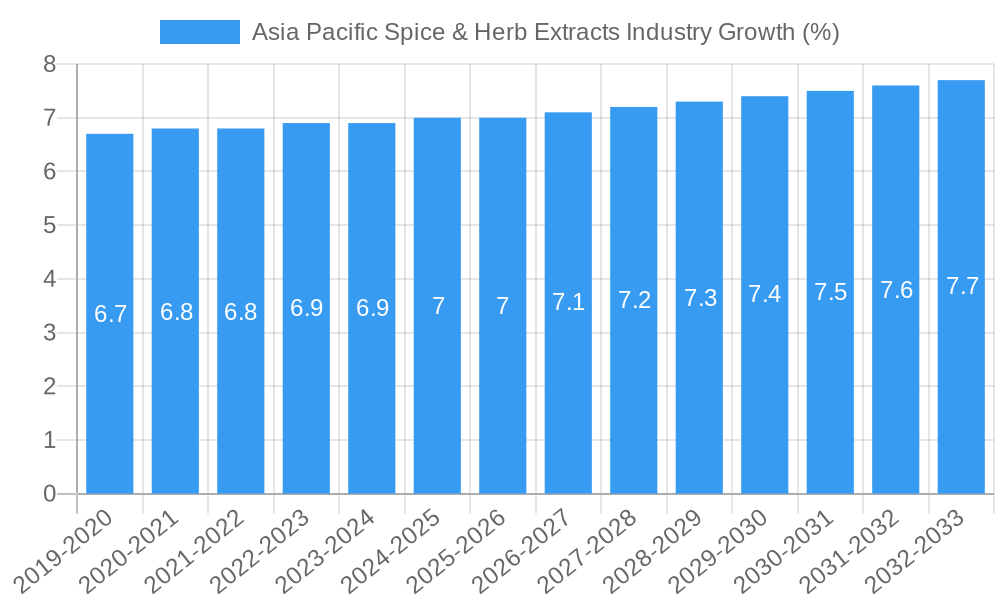

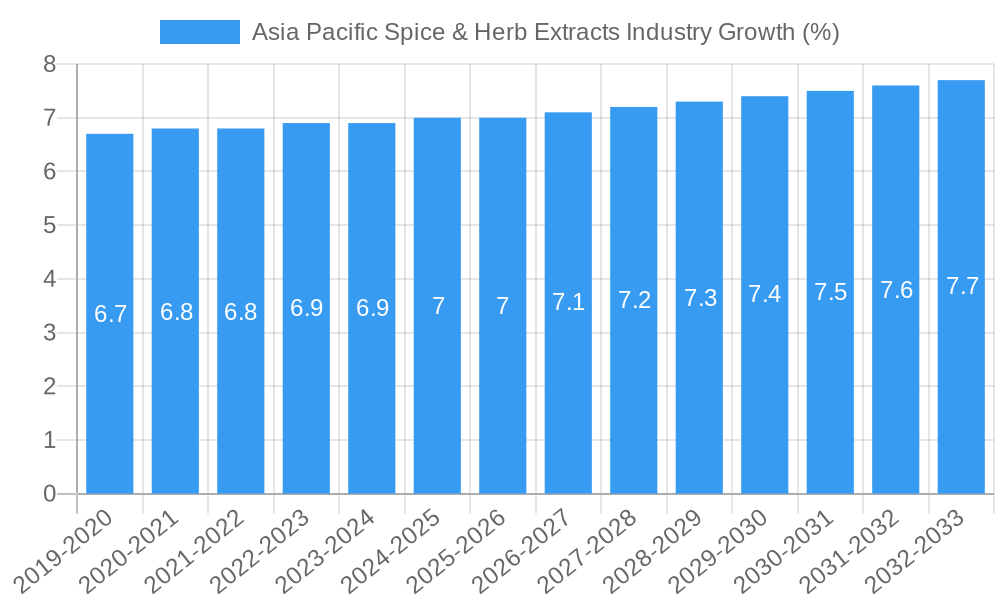

The Asia Pacific Spice & Herb Extracts market is poised for robust expansion, projected to reach an estimated value of USD 2,500 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 6.89% extending through 2033. This growth is primarily fueled by escalating consumer demand for natural and clean-label ingredients across diverse applications, particularly in the food and beverage sectors. The increasing awareness of the health benefits associated with spice and herb extracts, such as antioxidant and anti-inflammatory properties, is further bolstering market penetration. Key drivers include the burgeoning processed food industry, the growing popularity of functional foods and beverages, and the rising disposable incomes in emerging economies within the region, which translate to higher spending on premium and health-conscious products. Furthermore, advancements in extraction technologies are enabling the production of higher-purity and more potent extracts, meeting stringent quality standards and expanding their use in pharmaceuticals and nutraceuticals.

While the market exhibits strong upward momentum, certain restraints warrant attention. These include the volatility in raw material prices due to climatic factors and supply chain disruptions, which can impact the cost-effectiveness of spice and herb extracts. Stringent regulatory frameworks governing food additives and natural ingredients in different countries across Asia Pacific can also pose challenges for market players. However, the dominant market segments are expected to be Food Applications, driven by the demand for natural flavoring and preservation, and Beverage Applications, reflecting the trend towards healthier and more sophisticated drink options. Geographically, China and India are anticipated to lead the market, owing to their large consumer bases, expanding food processing industries, and growing preference for natural ingredients. Opportunities lie in innovating new extract formulations, exploring novel applications in personal care and cosmetics, and establishing sustainable sourcing practices to mitigate price fluctuations and ensure consistent supply.

Asia Pacific Spice & Herb Extracts Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific Spice & Herb Extracts Industry, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and a forward-looking market outlook. Leveraging high-traffic keywords like "Asia Pacific spice extracts," "herb extract market," "natural food ingredients," "pharmaceutical botanical extracts," and "APAC beverage ingredients," this report is optimized for maximum search engine visibility and designed to engage industry professionals, including manufacturers, ingredient suppliers, R&D specialists, procurement managers, and market strategists.

The study encompasses a detailed examination of the market from 2019 to 2033, with a base year of 2025, and a comprehensive forecast period of 2025–2033, alongside a historical review from 2019–2024. All quantitative data is presented in Million units.

Asia Pacific Spice & Herb Extracts Industry Market Dynamics & Structure

The Asia Pacific spice and herb extracts market is characterized by a moderate to high degree of fragmentation, with a blend of large multinational corporations and numerous regional and local players vying for market share. Technological innovation is a significant driver, fueled by advancements in extraction technologies such as supercritical fluid extraction and microwave-assisted extraction, enabling higher yields and purer extracts with enhanced bioavailability. Regulatory frameworks are evolving, with increasing emphasis on food safety, purity standards, and labeling transparency, particularly in major markets like China and India. Competitive product substitutes primarily include whole spices and herbs, but the concentrated flavor and extended shelf-life of extracts offer a distinct advantage. End-user demographics are shifting towards health-conscious consumers and a growing demand for natural and clean-label products across food, beverage, and pharmaceutical applications. Mergers and acquisitions (M&A) activity is moderate, with companies seeking to expand their product portfolios, geographic reach, and technological capabilities.

- Market Concentration: Moderate to High fragmentation with key players holding significant shares in specific product categories or geographies.

- Technological Innovation Drivers: Advancements in extraction efficiency, sustainability, and preservation techniques.

- Regulatory Frameworks: Increasing stringency in food safety (e.g., GFSI standards), organic certifications, and labeling requirements.

- Competitive Product Substitutes: Whole spices and herbs, synthetic flavorings.

- End-User Demographics: Growing demand for natural, functional, and health-benefiting ingredients.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

Asia Pacific Spice & Herb Extracts Industry Growth Trends & Insights

The Asia Pacific spice and herb extracts market is poised for robust growth, driven by a confluence of factors including rising consumer awareness of health and wellness, an increasing preference for natural and clean-label products, and the expanding food and beverage industry across the region. The market size is projected to witness a significant expansion from an estimated $4,500 Million in 2025 to a projected $8,200 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This growth is further propelled by technological advancements in extraction processes, leading to more efficient, sustainable, and cost-effective production of high-quality extracts. The adoption rate of spice and herb extracts in the food and beverage sector is accelerating, as manufacturers seek to enhance flavor profiles, extend shelf-life, and incorporate functional benefits into their products. For instance, the demand for ginger extracts for their anti-inflammatory properties and cinnamon extracts for their antioxidant benefits is on the rise.

Consumer behavior shifts are playing a pivotal role, with a growing segment of consumers actively seeking natural ingredients and shunning artificial additives. This trend is particularly evident in the booming ready-to-eat meal, functional beverage, and dietary supplement markets within Asia Pacific. Pharmaceutical applications are also a key growth area, as the region leverages traditional medicinal knowledge and the efficacy of botanical extracts for various therapeutic purposes, including stress relief, immune support, and digestive health. The penetration of specialized spice and herb extracts in nascent markets is expected to increase as awareness and accessibility grow. Emerging economies within the Asia Pacific, such as Vietnam, Indonesia, and the Philippines, present substantial untapped potential due to their growing middle class and increasing disposable incomes. The integration of these extracts into diverse culinary traditions across the region further solidifies their market presence.

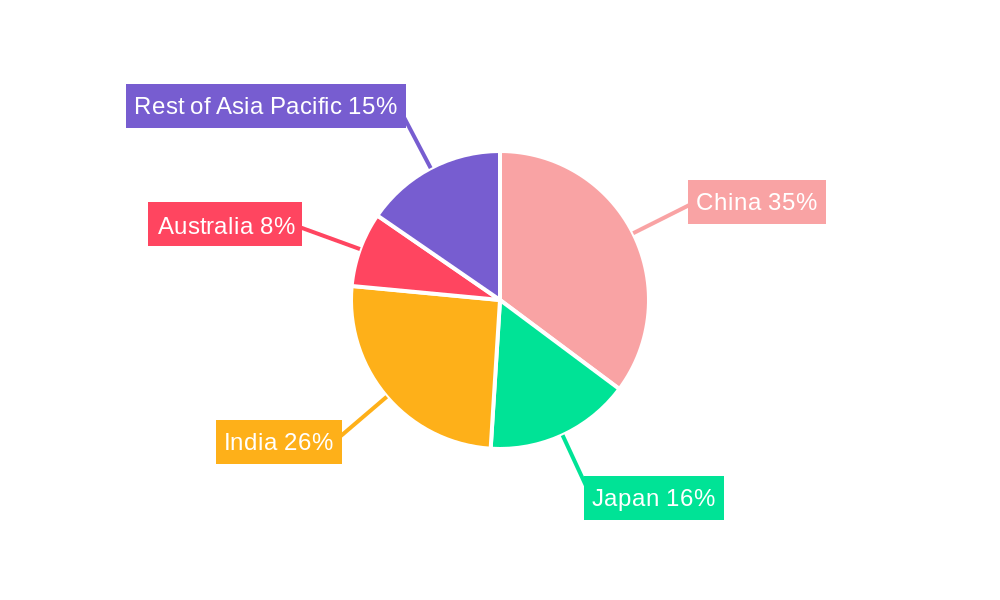

Dominant Regions, Countries, or Segments in Asia Pacific Spice & Herb Extracts Industry

China stands out as the dominant region in the Asia Pacific spice and herb extracts industry, driven by its vast manufacturing capabilities, significant domestic consumption, and its role as a major global supplier of botanical ingredients. The country's robust food processing sector, coupled with an increasing demand for natural flavors and functional ingredients, fuels the consumption of extracts like chili, ginger, and cinnamon. China’s established infrastructure for agricultural production of key spice and herb crops also contributes to its leadership. The market size for spice and herb extracts in China is estimated to reach $2,500 Million by 2025.

India, with its rich heritage of spices and herbs and a rapidly expanding food and beverage industry, is a close second and a significant growth driver. The demand for extracts of cumin, coriander, turmeric, and cardamom is substantial, catering to both traditional culinary uses and emerging health and wellness trends. India’s pharmaceutical sector also contributes significantly to the demand for botanical extracts.

The Food Applications segment is the largest and most influential, accounting for an estimated 65% of the total market revenue. This dominance is attributed to the widespread use of spice and herb extracts as natural flavor enhancers, colorants, and preservatives in a vast array of food products, including snacks, sauces, marinades, baked goods, and processed meats.

Within Product Type, Chili and Ginger extracts are experiencing particularly strong growth due to their widespread culinary applications and perceived health benefits. Cinnamon and Coriander also hold significant market share. The Beverage Applications segment is another crucial growth area, with a rising demand for natural flavorings in juices, teas, and functional beverages. The Pharmaceuticals segment, though smaller, is characterized by high-value applications, particularly for extracts with proven medicinal properties.

Key drivers for the dominance of these segments and regions include:

- China: Government initiatives promoting the food processing industry, large-scale agricultural production of raw materials, and a burgeoning middle-class consumer base.

- India: Extensive spice cultivation, strong traditional medicine practices, and rapid growth in the processed food and beverage sectors.

- Food Applications: Rising consumer preference for natural ingredients, demand for convenience foods, and the need for extended shelf-life.

- Chili and Ginger Extracts: Versatile flavor profiles and documented health benefits such as antioxidant and anti-inflammatory properties.

- Beverage Applications: Growing demand for natural flavors in health drinks and functional beverages.

Asia Pacific Spice & Herb Extracts Industry Product Landscape

The Asia Pacific spice and herb extracts product landscape is characterized by a growing portfolio of natural, high-purity ingredients catering to diverse industrial needs. Innovations are focused on advanced extraction techniques that preserve the natural volatile compounds and bioactives, leading to superior aroma, flavor, and functional properties. These extracts are increasingly offered in standardized forms, ensuring consistent quality and efficacy for manufacturers. Applications span across vibrant food flavorings, aromatic beverage enhancers, and potent pharmaceutical ingredients. Unique selling propositions often revolve around organic sourcing, specific cultivar origins, and scientifically validated health benefits, differentiating products in a competitive market. Technological advancements are enabling the development of specialized extracts with tailored functionalities, such as enhanced solubility or targeted release mechanisms.

Key Drivers, Barriers & Challenges in Asia Pacific Spice & Herb Extracts Industry

Key Drivers:

- Growing Demand for Natural and Clean-Label Products: Consumers are increasingly scrutinizing ingredient lists, favoring natural flavors and preservatives over artificial alternatives.

- Health and Wellness Trends: The perceived health benefits associated with various spices and herbs, such as antioxidant, anti-inflammatory, and digestive properties, are driving demand for their extracts.

- Expansion of the Food & Beverage Industry: The booming processed food, ready-to-eat meals, and functional beverage sectors across Asia Pacific are significant end-users.

- Technological Advancements in Extraction: Improved extraction techniques lead to higher yields, purity, and cost-effectiveness.

- Rising Disposable Incomes: Increased purchasing power in emerging economies fuels demand for premium and health-conscious food and beverage options.

Barriers & Challenges:

- Supply Chain Volatility and Raw Material Availability: Climate change, geopolitical factors, and agricultural yields can impact the consistent supply and price of raw spices and herbs. For example, a $500 Million impact on raw material costs due to unpredictable weather patterns.

- Regulatory Compliance and Standardization: Navigating diverse and evolving regulatory landscapes across different Asia Pacific countries can be complex and costly.

- Competition from Generic and Low-Cost Suppliers: The market faces pressure from suppliers offering less refined or lower-quality extracts.

- Consumer Education and Perception: Overcoming skepticism and educating consumers about the benefits and safety of botanical extracts is an ongoing challenge.

- Shelf-Life and Stability Issues: Maintaining the integrity and potency of certain extracts over extended periods can require advanced formulation and packaging solutions.

Emerging Opportunities in Asia Pacific Spice & Herb Extracts Industry

Emerging opportunities lie in the development of novel functional extracts with scientifically proven health benefits, catering to the growing nutraceutical and cosmeceutical markets. The expansion of plant-based diets presents a significant avenue for spice and herb extracts to enhance the flavor profiles of meat alternatives and vegan products. Untapped markets within Southeast Asia and Oceania offer substantial growth potential due to increasing urbanization and evolving consumer preferences. Furthermore, the trend towards sustainable and ethically sourced ingredients is creating opportunities for companies demonstrating robust environmental and social responsibility. The development of customized extract blends for specific health outcomes, such as stress management or cognitive enhancement, is also gaining traction.

Growth Accelerators in the Asia Pacific Spice & Herb Extracts Industry Industry

Long-term growth in the Asia Pacific spice and herb extracts industry will be significantly accelerated by continuous investment in research and development to identify and isolate novel bioactive compounds with therapeutic and functional applications. Strategic partnerships between extract manufacturers and food, beverage, and pharmaceutical companies will foster innovation and market penetration. The adoption of advanced processing technologies, including enzyme-assisted extraction and molecular encapsulation, will enhance product quality and broaden application possibilities. Furthermore, market expansion strategies focusing on educating consumers and B2B clients about the benefits and versatility of these natural ingredients will be crucial for sustained growth. The increasing focus on sustainable sourcing and production practices will also serve as a key accelerator, aligning with global consumer demand.

Key Players Shaping the Asia Pacific Spice & Herb Extracts Industry Market

- Phyto Life Sciences P Ltd

- McCormick & Company Inc

- Organic Herb Inc

- Dohler GmbH

- Nantong Sihai Plant Extracts Co Ltd

- Kalsec Inc

- Langdon Ingredients

- Kerry Group plc

Notable Milestones in Asia Pacific Spice & Herb Extracts Industry Sector

- 2021: Increased investment in R&D for novel anti-viral and immune-boosting botanical extracts.

- 2022: Growing adoption of supercritical CO2 extraction technology for higher purity and solvent-free extracts.

- 2022: Launch of new ranges of organic and sustainably sourced spice and herb extracts by several key players.

- 2023: Expansion of production capacities in China and India to meet growing global demand.

- 2023: Increased focus on the pharmaceutical applications of turmeric and ginger extracts for inflammatory conditions.

- 2024: Strategic collaborations between ingredient suppliers and major food & beverage manufacturers for product innovation.

In-Depth Asia Pacific Spice & Herb Extracts Industry Market Outlook

The outlook for the Asia Pacific spice and herb extracts industry is exceptionally positive, driven by the enduring global shift towards natural, healthy, and sustainable ingredients. Growth accelerators, including technological innovation, strategic market expansion, and evolving consumer preferences for clean-label products, will continue to propel market expansion. The burgeoning pharmaceutical and nutraceutical sectors in the region present significant untapped potential for high-value botanical extracts. Strategic partnerships and a commitment to ethical sourcing will further solidify market leadership. Overall, the industry is poised for sustained and robust growth in the coming years, presenting lucrative opportunities for stakeholders.

Asia Pacific Spice & Herb Extracts Industry Segmentation

-

1. Product Type

- 1.1. Cinnamon

- 1.2. Cumin

- 1.3. Chili

- 1.4. Coriander

- 1.5. Cardamom

- 1.6. Oregano

- 1.7. Pepper

- 1.8. Ginger

- 1.9. Other product Types

-

2. Application

- 2.1. Food Applications

- 2.2. Beverage Applications

- 2.3. Pharmaceuticals

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia Pacific Spice & Herb Extracts Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Spice & Herb Extracts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus On Health and Wellness; Surge in Product Innovation

- 3.3. Market Restrains

- 3.3.1. Presence of Substitutes

- 3.4. Market Trends

- 3.4.1. Rising Demand due to Popularity of Western Cuisine

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cinnamon

- 5.1.2. Cumin

- 5.1.3. Chili

- 5.1.4. Coriander

- 5.1.5. Cardamom

- 5.1.6. Oregano

- 5.1.7. Pepper

- 5.1.8. Ginger

- 5.1.9. Other product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food Applications

- 5.2.2. Beverage Applications

- 5.2.3. Pharmaceuticals

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cinnamon

- 6.1.2. Cumin

- 6.1.3. Chili

- 6.1.4. Coriander

- 6.1.5. Cardamom

- 6.1.6. Oregano

- 6.1.7. Pepper

- 6.1.8. Ginger

- 6.1.9. Other product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food Applications

- 6.2.2. Beverage Applications

- 6.2.3. Pharmaceuticals

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cinnamon

- 7.1.2. Cumin

- 7.1.3. Chili

- 7.1.4. Coriander

- 7.1.5. Cardamom

- 7.1.6. Oregano

- 7.1.7. Pepper

- 7.1.8. Ginger

- 7.1.9. Other product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food Applications

- 7.2.2. Beverage Applications

- 7.2.3. Pharmaceuticals

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cinnamon

- 8.1.2. Cumin

- 8.1.3. Chili

- 8.1.4. Coriander

- 8.1.5. Cardamom

- 8.1.6. Oregano

- 8.1.7. Pepper

- 8.1.8. Ginger

- 8.1.9. Other product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food Applications

- 8.2.2. Beverage Applications

- 8.2.3. Pharmaceuticals

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cinnamon

- 9.1.2. Cumin

- 9.1.3. Chili

- 9.1.4. Coriander

- 9.1.5. Cardamom

- 9.1.6. Oregano

- 9.1.7. Pepper

- 9.1.8. Ginger

- 9.1.9. Other product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food Applications

- 9.2.2. Beverage Applications

- 9.2.3. Pharmaceuticals

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cinnamon

- 10.1.2. Cumin

- 10.1.3. Chili

- 10.1.4. Coriander

- 10.1.5. Cardamom

- 10.1.6. Oregano

- 10.1.7. Pepper

- 10.1.8. Ginger

- 10.1.9. Other product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food Applications

- 10.2.2. Beverage Applications

- 10.2.3. Pharmaceuticals

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. China Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 13. India Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia Pacific Spice & Herb Extracts Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Phyto Life Sciences P Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 McCormick & Company Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Organic Herb Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Dohler GmbH

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Nantong Sihai Plant Extracts Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Kalsec Inc *List Not Exhaustive

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Langdon Ingredients

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Kerry Group plc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.1 Phyto Life Sciences P Ltd

List of Figures

- Figure 1: Asia Pacific Spice & Herb Extracts Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Spice & Herb Extracts Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia Pacific Spice & Herb Extracts Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia Pacific Spice & Herb Extracts Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia Pacific Spice & Herb Extracts Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia Pacific Spice & Herb Extracts Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia Pacific Spice & Herb Extracts Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia Pacific Spice & Herb Extracts Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia Pacific Spice & Herb Extracts Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia Pacific Spice & Herb Extracts Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Spice & Herb Extracts Industry?

The projected CAGR is approximately 6.89%.

2. Which companies are prominent players in the Asia Pacific Spice & Herb Extracts Industry?

Key companies in the market include Phyto Life Sciences P Ltd, McCormick & Company Inc, Organic Herb Inc, Dohler GmbH, Nantong Sihai Plant Extracts Co Ltd, Kalsec Inc *List Not Exhaustive, Langdon Ingredients, Kerry Group plc.

3. What are the main segments of the Asia Pacific Spice & Herb Extracts Industry?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus On Health and Wellness; Surge in Product Innovation.

6. What are the notable trends driving market growth?

Rising Demand due to Popularity of Western Cuisine.

7. Are there any restraints impacting market growth?

Presence of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Spice & Herb Extracts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Spice & Herb Extracts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Spice & Herb Extracts Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Spice & Herb Extracts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence