Key Insights

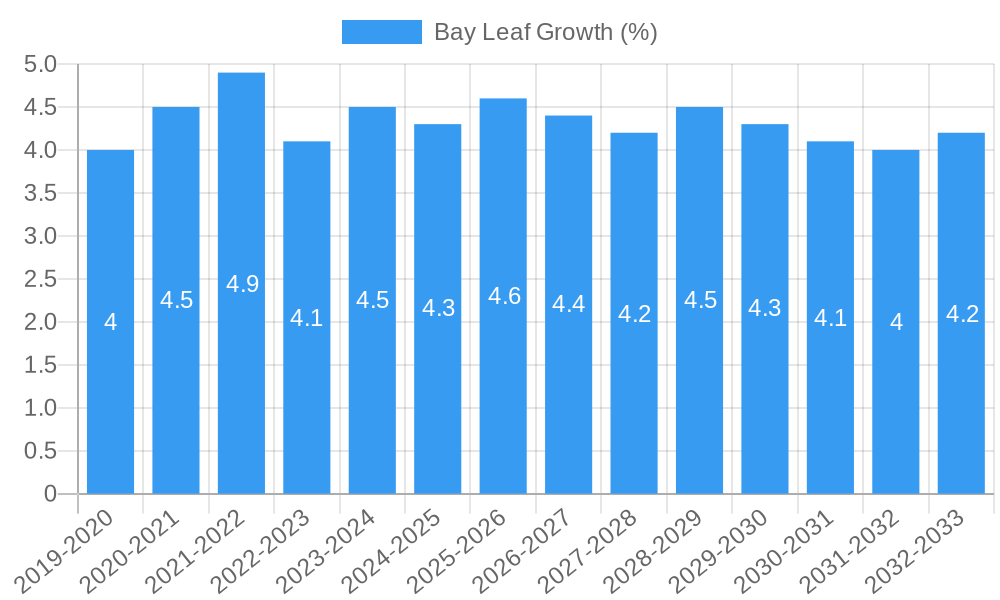

The global bay leaf market is experiencing robust growth, projected to reach a significant valuation by 2033, driven by its increasing demand across diverse industries. The market's expansion is largely attributed to the rising consumer preference for natural flavoring agents and the expanding use of bay leaves in culinary applications, particularly within the food and beverage sector, which represents a substantial segment. The pharmaceutical industry also contributes to market growth, leveraging bay leaf's medicinal properties and its incorporation into traditional remedies and health supplements. Furthermore, the cosmetics and personal care industry is increasingly utilizing bay leaf extracts for their antioxidant and anti-inflammatory benefits in skincare and haircare products. Key growth drivers include the growing awareness of health benefits associated with bay leaves, the increasing popularity of gourmet cooking and ethnic cuisines that frequently utilize bay leaves, and the ongoing innovation in product formulations across various end-use industries. The market is witnessing a compound annual growth rate (CAGR) of approximately 5-7%, reflecting sustained consumer interest and industry adoption.

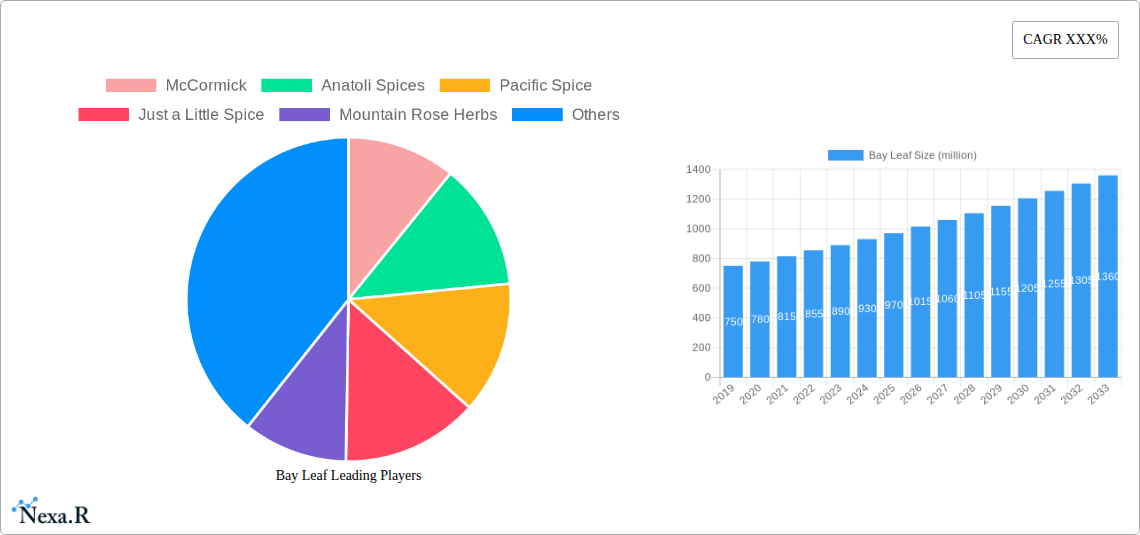

The market's trajectory is further shaped by several emerging trends and strategic initiatives by key players. The increasing demand for organic and sustainably sourced bay leaves is a prominent trend, aligning with consumer preferences for eco-friendly and ethically produced products. Innovations in processing and packaging, such as the development of specialized bay leaf powders and extracts, are enhancing convenience and broadening application possibilities. For instance, the shift towards value-added products like dried and powdered bay leaves is catering to the evolving needs of consumers and industrial users alike. While the market exhibits strong growth potential, certain restraints such as price volatility of raw materials due to agricultural factors and potential supply chain disruptions can impact market dynamics. However, the broad spectrum of applications, combined with consistent demand from established industries like food and beverage and pharmaceuticals, positions the bay leaf market for continued expansion and profitability in the coming years. The market is characterized by the presence of established companies like McCormick, Anatoli Spices, and Pacific Spice, who are actively involved in expanding their product portfolios and geographical reach to capitalize on global demand.

This in-depth report provides a comprehensive analysis of the global Bay Leaf market, offering critical insights into market dynamics, growth trends, regional dominance, product innovations, and the competitive landscape. Covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033, this report is an essential resource for industry stakeholders seeking to understand and capitalize on the evolving Bay Leaf industry. We delve into key segments such as applications in the Food and Beverage Industry, Pharmaceutical Industry, Cosmetics and Personal Care Industry, and Others, as well as product types including Flake and Powder.

Bay Leaf Market Dynamics & Structure

The global Bay Leaf market exhibits a moderately concentrated structure, characterized by the presence of both established multinational corporations and emerging regional players. Technological innovation plays a pivotal role, with advancements in cultivation techniques, processing methods, and extraction technologies driving product differentiation and efficiency. Regulatory frameworks, particularly concerning food safety, organic certification, and import/export regulations, significantly influence market entry and product development. Competitive product substitutes, such as other culinary herbs and synthetic flavorings, present a constant challenge, necessitating continuous product quality improvement and marketing efforts. End-user demographics are increasingly influenced by growing health consciousness and a demand for natural and organic products. Mergers and acquisitions (M&A) activity, while not at an aggressive pace, indicates strategic consolidation among key players aiming to expand market reach and product portfolios.

- Market Concentration: Dominated by a few key players, with significant contributions from specialized spice and herb producers.

- Technological Innovation: Focus on sustainable farming practices, advanced drying and grinding technologies, and novel extraction methods for essential oils.

- Regulatory Frameworks: Strict adherence to food safety standards (e.g., FDA, EFSA) and evolving organic and sustainability certifications.

- Competitive Substitutes: Competition from other herbs, spices, and artificial flavor enhancers.

- End-User Demographics: Growing demand from health-conscious consumers and the culinary sector emphasizing natural ingredients.

- M&A Trends: Strategic acquisitions to broaden product offerings and enhance supply chain integration.

Bay Leaf Growth Trends & Insights

The Bay Leaf market is poised for robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) through the forecast period. This expansion is fueled by a confluence of factors, including an escalating global demand for natural ingredients in culinary applications, a rising awareness of the health benefits associated with bay leaves, and their increasing integration into pharmaceutical and cosmetic formulations. The Food and Beverage Industry remains the primary revenue generator, driven by the universal appeal of bay leaves in flavoring soups, stews, sauces, and various meat and vegetarian dishes. Adoption rates for bay leaf products are steadily increasing across both developed and emerging economies, propelled by their perceived naturalness and health-promoting properties. Technological disruptions, such as precision agriculture and advanced processing techniques, are contributing to improved product quality, yield, and cost-effectiveness, thereby accelerating market penetration. Consumer behavior shifts towards healthier lifestyles and a preference for authentic culinary experiences are further cementing the importance of bay leaves in their diets. The market penetration of bay leaf products is expected to deepen as its versatility in both savory and sweet applications, as well as its medicinal properties, become more widely recognized. Market size evolution will be characterized by steady, organic growth, with pockets of accelerated expansion in regions with burgeoning food processing industries and a strong culinary heritage.

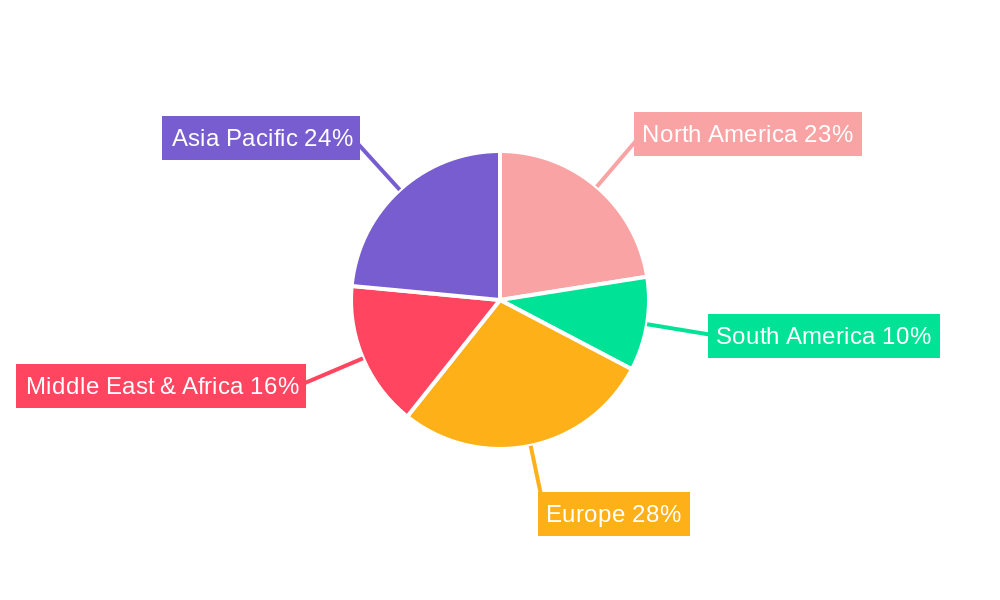

Dominant Regions, Countries, or Segments in Bay Leaf

The Food and Beverage Industry segment stands out as the dominant force driving global Bay Leaf market growth. This dominance is attributable to the ubiquitous use of bay leaves as a fundamental aromatic ingredient in a vast array of cuisines worldwide. From traditional European stews and Mediterranean dishes to contemporary fusion cooking, bay leaves impart a distinctive, subtle flavor that is indispensable for many culinary preparations. The sheer volume of consumption within this sector, coupled with the expanding processed food market, contributes significantly to market share. Economic policies in key food-producing nations that support agricultural development and export, alongside robust infrastructure for the processing and distribution of spices, further bolster this segment’s leadership.

The Application: Food and Beverage Industry segment is projected to account for a substantial market share, estimated at over 70% of the total market value by 2025. Within this segment, the growth is further propelled by trends in convenience foods, ready-to-eat meals, and ethnic food products, all of which frequently incorporate bay leaves. The increasing consumer preference for natural and minimally processed ingredients further strengthens the position of bay leaves over artificial flavor enhancers.

The Type: Powder segment is also experiencing significant growth due to its ease of use and extended shelf life, making it a preferred choice for many food manufacturers. However, the Type: Flake segment maintains a strong presence, particularly in traditional cooking and for specific culinary applications where the leaf's texture is desired.

Key drivers for the dominance of these segments include:

- Global Culinary Demand: Bay leaves are an integral part of traditional recipes across continents.

- Health and Wellness Trends: Perceived health benefits and the demand for natural ingredients.

- Expanding Processed Food Market: Increased use in ready-to-eat meals and convenience foods.

- Versatility: Applicability in a wide range of dishes and food products.

- Economic Policies: Government support for agriculture and spice exports in major producing countries.

- Infrastructure Development: Improved supply chain and logistics networks for efficient distribution.

The growth potential within these dominant segments remains considerable, driven by ongoing innovation in food product development and the persistent consumer demand for authentic and natural flavors.

Bay Leaf Product Landscape

The Bay Leaf product landscape is characterized by innovation focused on enhancing quality, shelf-life, and application convenience. Products range from whole dried bay leaves, prized for their traditional use and visual appeal, to finely ground powder, offering ease of integration into spice blends and instant food products. Innovations include advanced drying techniques that preserve flavor and aroma, as well as specialized grinding processes that ensure consistent particle size. Extracting bay leaf essential oils for use in flavorings and aromatherapy represents another significant product avenue. Unique selling propositions often revolve around organic certification, single-origin sourcing, and sustainable farming practices, catering to a growing segment of environmentally conscious consumers and premium food manufacturers. Technological advancements are also being made in packaging to maintain freshness and prevent contamination, further extending the product's appeal and utility.

Key Drivers, Barriers & Challenges in Bay Leaf

Key Drivers: The Bay Leaf market is propelled by several key drivers. The increasing global demand for natural and organic food ingredients is a primary catalyst, as consumers seek healthier and more authentic culinary experiences. The well-documented health benefits of bay leaves, including their antioxidant and anti-inflammatory properties, are also driving their incorporation into functional foods and dietary supplements. Furthermore, the expanding pharmaceutical and cosmetic industries' interest in bay leaf extracts for their therapeutic and aromatic qualities presents a significant growth avenue. Technological advancements in cultivation and processing are improving yields and product quality, making bay leaves more accessible and cost-effective.

Barriers & Challenges: Despite its growth potential, the Bay Leaf market faces several challenges. Supply chain disruptions, including unpredictable weather patterns and agricultural diseases, can impact availability and price volatility. Stringent import regulations and varying food safety standards across different countries can create trade barriers. Intense competition from other herbs and spices, as well as the availability of artificial flavorings, necessitates continuous market differentiation. Furthermore, the labor-intensive nature of harvesting and initial processing can affect production costs.

Emerging Opportunities in Bay Leaf

Emerging opportunities in the Bay Leaf sector lie in the expanding market for health and wellness products. The increasing consumer interest in natural remedies and supplements presents a significant avenue for bay leaf extracts and tinctures, leveraging their purported digestive, anti-inflammatory, and antimicrobial properties. Furthermore, the growing trend of plant-based diets and the demand for clean-label ingredients create a space for bay leaves as a flavor enhancer in meat alternatives and vegan products. Untapped markets in developing economies with rising disposable incomes and an increasing exposure to global cuisines also offer considerable potential for market penetration. Innovative applications in the beverage industry, such as artisanal teas and flavored waters, are also emerging as promising growth areas.

Growth Accelerators in the Bay Leaf Industry

Growth in the Bay Leaf industry is being accelerated by several critical factors. The ongoing research into the phytochemical composition of bay leaves and its associated health benefits is unlocking new applications in the nutraceutical and pharmaceutical sectors, thereby broadening its market reach beyond traditional culinary uses. Strategic partnerships between bay leaf producers and large food manufacturers, as well as cosmetic and pharmaceutical companies, are enabling wider distribution and product development. The adoption of sustainable and organic farming practices is not only meeting consumer demand but also improving crop resilience and yields, acting as a significant growth accelerator. Investments in advanced processing technologies, such as supercritical fluid extraction for high-purity essential oils, are creating premium product lines and increasing market value.

Key Players Shaping the Bay Leaf Market

- McCormick

- Anatoli Spices

- Pacific Spice

- Just a Little Spice

- Mountain Rose Herbs

- Hoby Agriculture and Forest Product

- Sultar

Notable Milestones in Bay Leaf Sector

- 2019: Increased consumer demand for organic and sustainably sourced herbs.

- 2020: Growing awareness of bay leaf's health benefits amidst global health concerns.

- 2021: Innovations in vacuum drying technology to preserve aroma and flavor.

- 2022: Expansion of bay leaf cultivation in new geographical regions to meet rising demand.

- 2023: Increased research into bay leaf extracts for cosmetic and pharmaceutical applications.

- 2024: Major spice companies focus on diversifying their supply chains for key ingredients like bay leaves.

In-Depth Bay Leaf Market Outlook

The future outlook for the Bay Leaf market is exceptionally promising, driven by sustained growth in key application sectors and emerging opportunities. The ongoing consumer trend towards natural, healthy, and ethically sourced ingredients will continue to underpin demand in the food and beverage industry, while also opening doors in the burgeoning nutraceutical and cosmetic markets. Investments in sustainable agricultural practices and advanced processing technologies will not only enhance product quality and availability but also contribute to a more resilient and efficient supply chain. Strategic collaborations and a focus on product innovation will be crucial for players to capitalize on evolving consumer preferences and maintain a competitive edge. The market is expected to witness steady expansion, with significant potential for value-added products and geographical market penetration.

Bay Leaf Segmentation

-

1. Application

- 1.1. Food and Beverage Industry

- 1.2. Pharmaceutical Industry

- 1.3. Cosmetics and Personal Care Industry

- 1.4. Others

-

2. Type

- 2.1. Flake

- 2.2. Powder

Bay Leaf Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bay Leaf REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bay Leaf Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverage Industry

- 5.1.2. Pharmaceutical Industry

- 5.1.3. Cosmetics and Personal Care Industry

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Flake

- 5.2.2. Powder

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bay Leaf Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverage Industry

- 6.1.2. Pharmaceutical Industry

- 6.1.3. Cosmetics and Personal Care Industry

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Flake

- 6.2.2. Powder

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bay Leaf Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverage Industry

- 7.1.2. Pharmaceutical Industry

- 7.1.3. Cosmetics and Personal Care Industry

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Flake

- 7.2.2. Powder

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bay Leaf Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverage Industry

- 8.1.2. Pharmaceutical Industry

- 8.1.3. Cosmetics and Personal Care Industry

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Flake

- 8.2.2. Powder

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bay Leaf Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverage Industry

- 9.1.2. Pharmaceutical Industry

- 9.1.3. Cosmetics and Personal Care Industry

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Flake

- 9.2.2. Powder

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bay Leaf Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food and Beverage Industry

- 10.1.2. Pharmaceutical Industry

- 10.1.3. Cosmetics and Personal Care Industry

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Flake

- 10.2.2. Powder

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 McCormick

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Anatoli Spices

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pacific Spice

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Just a Little Spice

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mountain Rose Herbs

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hoby Agriculture and Forest Product

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sultar

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 McCormick

List of Figures

- Figure 1: Global Bay Leaf Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Bay Leaf Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Bay Leaf Revenue (million), by Application 2024 & 2032

- Figure 4: North America Bay Leaf Volume (K), by Application 2024 & 2032

- Figure 5: North America Bay Leaf Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Bay Leaf Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Bay Leaf Revenue (million), by Type 2024 & 2032

- Figure 8: North America Bay Leaf Volume (K), by Type 2024 & 2032

- Figure 9: North America Bay Leaf Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Bay Leaf Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Bay Leaf Revenue (million), by Country 2024 & 2032

- Figure 12: North America Bay Leaf Volume (K), by Country 2024 & 2032

- Figure 13: North America Bay Leaf Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Bay Leaf Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Bay Leaf Revenue (million), by Application 2024 & 2032

- Figure 16: South America Bay Leaf Volume (K), by Application 2024 & 2032

- Figure 17: South America Bay Leaf Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Bay Leaf Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Bay Leaf Revenue (million), by Type 2024 & 2032

- Figure 20: South America Bay Leaf Volume (K), by Type 2024 & 2032

- Figure 21: South America Bay Leaf Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Bay Leaf Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Bay Leaf Revenue (million), by Country 2024 & 2032

- Figure 24: South America Bay Leaf Volume (K), by Country 2024 & 2032

- Figure 25: South America Bay Leaf Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Bay Leaf Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Bay Leaf Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Bay Leaf Volume (K), by Application 2024 & 2032

- Figure 29: Europe Bay Leaf Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Bay Leaf Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Bay Leaf Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Bay Leaf Volume (K), by Type 2024 & 2032

- Figure 33: Europe Bay Leaf Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Bay Leaf Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Bay Leaf Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Bay Leaf Volume (K), by Country 2024 & 2032

- Figure 37: Europe Bay Leaf Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Bay Leaf Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Bay Leaf Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Bay Leaf Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Bay Leaf Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Bay Leaf Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Bay Leaf Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Bay Leaf Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Bay Leaf Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Bay Leaf Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Bay Leaf Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Bay Leaf Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Bay Leaf Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Bay Leaf Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Bay Leaf Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Bay Leaf Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Bay Leaf Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Bay Leaf Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Bay Leaf Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Bay Leaf Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Bay Leaf Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Bay Leaf Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Bay Leaf Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Bay Leaf Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Bay Leaf Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Bay Leaf Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bay Leaf Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Bay Leaf Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Bay Leaf Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Bay Leaf Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Bay Leaf Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Bay Leaf Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Bay Leaf Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Bay Leaf Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Bay Leaf Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Bay Leaf Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Bay Leaf Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Bay Leaf Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Bay Leaf Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Bay Leaf Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Bay Leaf Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Bay Leaf Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Bay Leaf Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Bay Leaf Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Bay Leaf Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Bay Leaf Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Bay Leaf Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Bay Leaf Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Bay Leaf Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Bay Leaf Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Bay Leaf Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Bay Leaf Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Bay Leaf Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Bay Leaf Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Bay Leaf Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Bay Leaf Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Bay Leaf Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Bay Leaf Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Bay Leaf Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Bay Leaf Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Bay Leaf Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Bay Leaf Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Bay Leaf Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Bay Leaf Volume K Forecast, by Country 2019 & 2032

- Table 81: China Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Bay Leaf Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Bay Leaf Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bay Leaf?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Bay Leaf?

Key companies in the market include McCormick, Anatoli Spices, Pacific Spice, Just a Little Spice, Mountain Rose Herbs, Hoby Agriculture and Forest Product, Sultar.

3. What are the main segments of the Bay Leaf?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bay Leaf," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bay Leaf report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bay Leaf?

To stay informed about further developments, trends, and reports in the Bay Leaf, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence