Key Insights

The global automotive automatic transmission (AT) market is projected for significant expansion, estimated at $5.91 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 16.7%. This growth is primarily fueled by increasing consumer demand for enhanced driving comfort, particularly in urban settings, and rising global disposable incomes driving vehicle purchases. Stringent government regulations focused on fuel efficiency and emission reduction further support market expansion. Manufacturers are actively investing in advanced AT technologies such as Continuously Variable Transmissions (CVTs) and Dual-Clutch Transmissions (DCTs) to meet these mandates and evolving consumer preferences, marking a shift from traditional torque converter automatics to more efficient solutions.

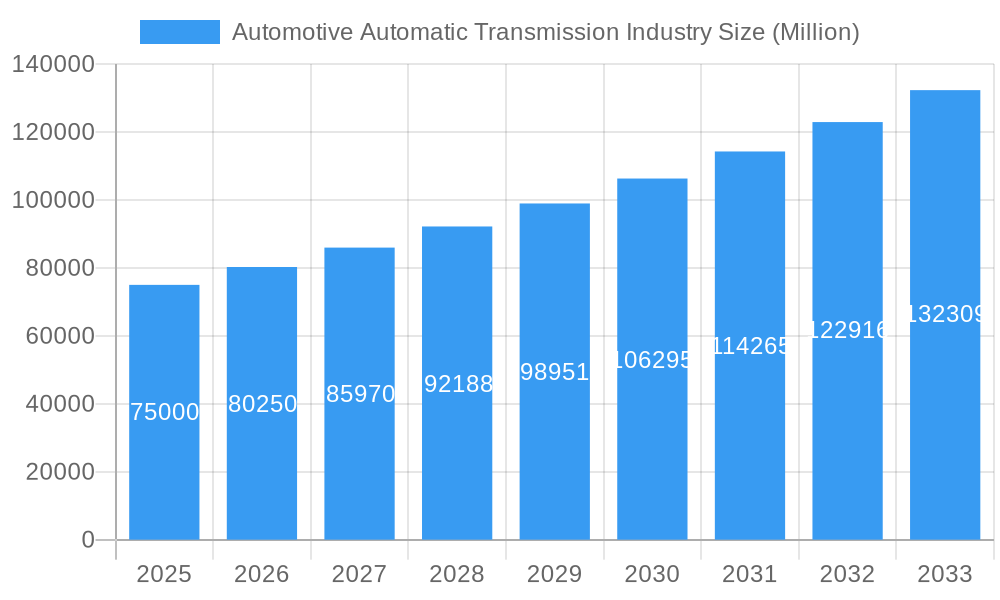

Automotive Automatic Transmission Industry Market Size (In Billion)

Key trends shaping the automotive AT industry include the growing integration of ATs into hybrid and electric vehicles (EVs) as the sector transitions to sustainable mobility. Emerging economies, especially in the Asia Pacific region, present substantial growth opportunities driven by rapid automotive market expansion and an increasing middle class. Despite strong growth drivers, potential restraints include the higher initial cost of ATs compared to manual transmissions in price-sensitive markets and the complexity of their repair and maintenance. However, continuous technological advancements and economies of scale are expected to address these challenges, solidifying the dominance of automatic transmissions.

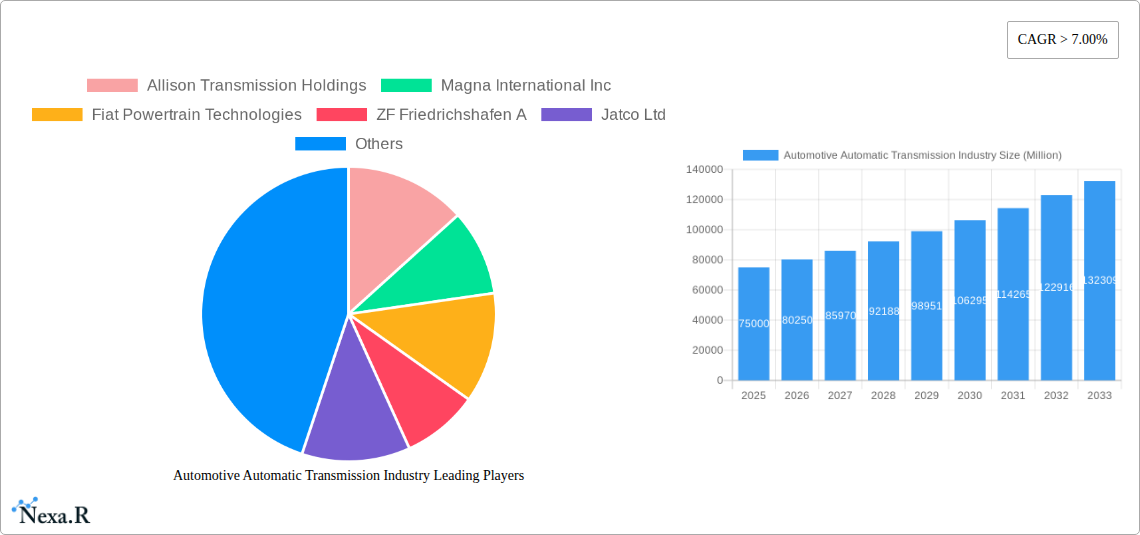

Automotive Automatic Transmission Industry Company Market Share

Automotive Automatic Transmission Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the intricate landscape of the global Automotive Automatic Transmission (AT) Industry, providing an in-depth analysis of market dynamics, growth trajectories, regional dominance, and future opportunities. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this report leverages advanced analytical methodologies to deliver actionable insights for stakeholders. It meticulously dissects the parent and child markets, offering a granular view of how different transmission types, fuel categories, and vehicle segments are shaping this critical automotive sector. With a focus on high-traffic keywords, this report aims to be the definitive resource for industry professionals, investors, and market researchers seeking to understand and capitalize on the evolving automotive automatic transmission market.

Automotive Automatic Transmission Industry Market Dynamics & Structure

The Automotive Automatic Transmission (AT) industry exhibits a moderately concentrated market structure, characterized by the presence of both large, established global players and specialized component manufacturers. Technological innovation, particularly in areas like electrification, software integration, and efficiency improvements, serves as a primary driver of market evolution. Regulatory frameworks, increasingly focused on emissions reduction and fuel economy standards, are significantly influencing the adoption of advanced AT technologies. Competitive product substitutes, such as advanced manual transmissions and hybrid powertrains, pose a challenge, yet the demand for enhanced driving comfort and performance continues to propel the AT segment. End-user demographics, with a growing preference for SUVs and a rising middle class in emerging economies, further shape demand patterns. Mergers and acquisitions (M&A) activity remains a key strategy for market consolidation, technological acquisition, and expanding global reach.

- Market Concentration: Dominated by a few key global suppliers, but with significant contributions from regional specialists.

- Technological Innovation Drivers: Electrification (EV/HEV transmissions), improved fuel efficiency (e.g., more gears, advanced control systems), enhanced driving performance, and integration with autonomous driving systems.

- Regulatory Frameworks: Stringent emissions standards (e.g., Euro 7, CAFE), fuel economy mandates, and government incentives for electrified vehicles directly influence AT development and adoption.

- Competitive Product Substitutes: While traditional manual transmissions are declining, advanced automatics face competition from highly efficient CVTs, quick-shifting DCTs, and increasingly sophisticated hybrid transaxles.

- End-User Demographics: Rising consumer demand for comfort, ease of driving, and performance, particularly in SUV and premium segments, favors AT adoption.

- M&A Trends: Strategic acquisitions to gain access to new technologies, expand production capacity, and enter new geographic markets. Key M&A activities in the historical period (2019-2024) suggest ongoing consolidation and strategic realignment.

Automotive Automatic Transmission Industry Growth Trends & Insights

The global Automotive Automatic Transmission (AT) industry is poised for robust growth, driven by a confluence of technological advancements, shifting consumer preferences, and stringent environmental regulations. The market size is projected to expand significantly, fueled by the increasing penetration of automatic transmissions across various vehicle types, from passenger cars to heavy commercial vehicles. Adoption rates for advanced AT technologies, such as Dual Clutch Transmissions (DCTs) and Continuously Variable Transmissions (CVTs), are escalating due to their inherent fuel efficiency benefits and improved driving dynamics. Technological disruptions, including the integration of electric and hybrid powertrains, are reshaping the AT landscape, leading to the development of specialized transmissions for electrified vehicles. Consumer behavior shifts towards greater convenience and enhanced driving experiences are further accelerating the demand for automatic gearboxes. The overall Compound Annual Growth Rate (CAGR) is anticipated to be strong, reflecting these dynamic market forces.

- Market Size Evolution: The global AT market is projected to grow from approximately 78,500 million units in the historical period to an estimated 115,000 million units by 2033, indicating a substantial expansion.

- Adoption Rates: Automatic transmissions are increasingly becoming the default choice in passenger cars and light commercial vehicles, with penetration rates expected to surpass 90% in many developed markets.

- Technological Disruptions: The rise of hybrid and electric vehicles is spurring innovation in multi-speed EV transmissions and dedicated hybrid transaxles, offering new growth avenues.

- Consumer Behavior Shifts: The demand for a seamless and effortless driving experience, coupled with the proliferation of advanced driver-assistance systems (ADAS), is a significant driver for AT adoption.

- Market Penetration: Across all vehicle types, the market penetration of automatic transmissions is set to increase, driven by both consumer preference and regulatory push for cleaner technologies.

- Key Growth Metrics: The market is anticipated to witness a CAGR of approximately 4.5% from 2025 to 2033.

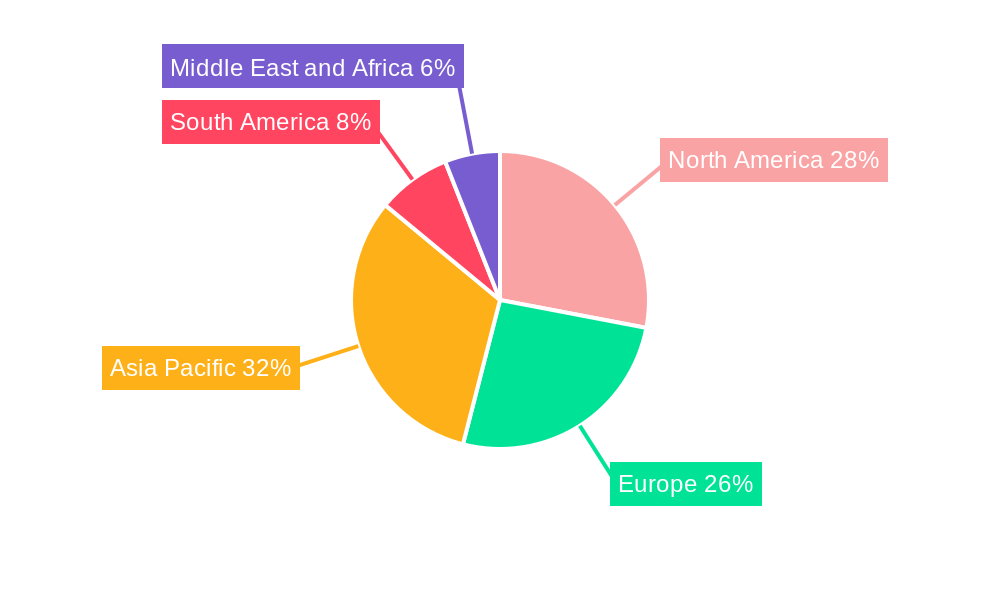

Dominant Regions, Countries, or Segments in Automotive Automatic Transmission Industry

North America and Europe are currently dominant regions in the Automotive Automatic Transmission (AT) industry, driven by a mature automotive market, stringent emission regulations, and a high consumer preference for comfort and performance, leading to widespread AT adoption in passenger cars and light commercial vehicles. The United States, in particular, stands out due to its large vehicle parc and a strong inclination towards automatic gearboxes across all vehicle segments. Within segments, the Automatic Transmission (AT)/Torque Converter (TC) type remains the largest and most dominant, owing to its long-established reliability, smooth operation, and versatility. However, the Dual Clutch Transmission (DCT) segment is exhibiting remarkable growth, particularly in performance-oriented passenger cars and increasingly in light commercial vehicles, due to its efficiency and rapid shifting capabilities. The Hybrid Fuel Type segment is a critical growth accelerator, with hybrid vehicles increasingly equipped with specialized automatic transmissions designed to optimize power delivery from both internal combustion engines and electric motors.

- Dominant Vehicle Type: Passenger Cars represent the largest segment, accounting for over 65% of the total market demand.

- Dominant Transmission Type: Automatic Transmission (AT)/Torque Converter (TC) continues to lead, with an estimated market share of over 55% in 2025.

- Fastest Growing Transmission Type: Dual Clutch Transmission (DCT) is projected to witness a CAGR of over 6.5% during the forecast period.

- Key Fuel Type Driver: Hybrid fuel type is experiencing significant growth, propelled by environmental regulations and consumer demand for fuel efficiency, estimated to grow from 15% in 2025 to over 30% by 2033.

- Regional Dominance Factors:

- North America: High disposable income, preference for larger vehicles, and established infrastructure for automatic transmissions.

- Europe: Stringent emission standards driving adoption of fuel-efficient ATs and hybrids, coupled with a growing preference for DCTs in premium segments.

- Country-Specific Insights:

- United States: Largest single market for ATs, with high penetration across all vehicle classes.

- Germany: Strong demand for advanced ATs and DCTs in passenger cars, with significant innovation from local manufacturers.

- China: Rapidly growing market for ATs, especially in passenger cars and LCVs, driven by increasing urbanization and consumer spending.

- Market Share: The AT/TC segment is estimated to be valued at approximately 50,000 million units in 2025. DCTs are projected to reach over 18,000 million units by 2033.

Automotive Automatic Transmission Industry Product Landscape

The automotive automatic transmission industry is characterized by a dynamic product landscape driven by a continuous quest for enhanced efficiency, performance, and drivability. Innovations are focused on reducing weight, friction, and complexity while increasing the number of gears or continuously optimizing gear ratios. Torque converter automatic transmissions are evolving with more clutch packs and advanced lock-up strategies to improve fuel economy. Continuously Variable Transmissions (CVTs) are becoming more robust and responsive, offering a seamless power delivery. Dual Clutch Transmissions (DCTs) are being refined for smoother shifts and wider application across vehicle segments. The integration of electric motors within hybrid transmissions is a key development, enabling sophisticated power management. These advancements ensure smoother shifts, improved acceleration, and significant fuel savings, offering unique selling propositions for automakers.

- Technological Advancements: Focus on 8-speed, 9-speed, and 10-speed ATs, advanced DCT designs with faster shift times, and more efficient CVT pulley systems.

- Electrification Integration: Development of multi-speed transmissions for electric vehicles and integrated starter-generator transmissions for mild-hybrid systems.

- Performance Metrics: Improved shift times, reduced NVH (Noise, Vibration, and Harshness), enhanced fuel efficiency (up to 5% improvement in some cases), and increased torque handling capacity.

- Unique Selling Propositions: Superior driving comfort, enhanced fuel economy, and improved acceleration capabilities are key differentiators.

Key Drivers, Barriers & Challenges in Automotive Automatic Transmission Industry

Key Drivers: The primary forces propelling the Automotive Automatic Transmission (AT) industry include the relentless pursuit of improved fuel efficiency mandated by global regulations, the growing consumer demand for driving comfort and convenience, and the increasing integration of ATs into electrified and hybrid powertrains. Technological advancements in DCTs and CVTs offer compelling alternatives to traditional automatics, further stimulating growth. The expanding global automotive market, particularly in emerging economies, also presents a significant growth opportunity.

Barriers & Challenges: Despite the positive outlook, the industry faces several challenges. The high cost of development and manufacturing for advanced ATs, especially those for electrified vehicles, can be a barrier. Supply chain complexities and disruptions, as witnessed in recent years, pose a significant risk. Regulatory uncertainty and the pace of EV adoption can create strategic dilemmas for component suppliers. Furthermore, intense competition from in-house AT development by OEMs and the need for continuous innovation to stay ahead of evolving automotive technologies present ongoing pressures.

Emerging Opportunities in Automotive Automatic Transmission Industry

Emerging opportunities in the Automotive Automatic Transmission industry are primarily centered around the burgeoning electrification trend. The development of multi-speed transmissions for electric vehicles (EVs) is a significant area of growth, addressing limitations of single-speed transmissions in achieving optimal performance and efficiency across a wider speed range. The increasing demand for advanced driver-assistance systems (ADAS) and autonomous driving capabilities presents opportunities for highly integrated and intelligent transmission control units. Furthermore, the expansion of the light commercial vehicle (LCV) segment, particularly for last-mile delivery and logistics, is creating demand for robust and efficient AT solutions. Untapped markets in developing economies, where the transition from manual to automatic transmissions is accelerating, also represent substantial growth potential.

Growth Accelerators in the Automotive Automatic Transmission Industry Industry

Several catalysts are accelerating long-term growth in the Automotive Automatic Transmission (AT) industry. The unstoppable momentum of vehicle electrification is a primary accelerator, pushing for innovative transmission solutions that can handle higher torque and optimize power delivery from electric motors. Strategic partnerships and collaborations between transmission manufacturers, OEMs, and battery suppliers are fostering co-development and faster market entry of new technologies. Government incentives and regulatory support for hybrid and electric vehicles indirectly boost the demand for advanced automatic transmissions. Market expansion strategies by key players into emerging automotive markets are also critical growth accelerators, capitalizing on the increasing consumer preference for automatic gearboxes as disposable incomes rise.

Key Players Shaping the Automotive Automatic Transmission Industry Market

- Allison Transmission Holdings

- Magna International Inc.

- Fiat Powertrain Technologies

- ZF Friedrichshafen AG

- Jatco Ltd.

- NSK Ltd.

- Daimler AG

- Aisin Seiki Co., Ltd.

- Delphi Technologies (now part of BorgWarner)

- Eaton Corporation PLC

- Continental AG

- BorgWarner Inc.

- Valeo

Notable Milestones in Automotive Automatic Transmission Industry Sector

- 2019: Introduction of new 10-speed automatic transmissions by several OEMs, enhancing fuel efficiency and performance.

- 2020: Increased focus and investment in multi-speed transmissions for electric vehicles by major Tier 1 suppliers.

- 2021: Significant advancements in DCT technology, leading to smoother shifts and wider application in performance vehicles.

- 2022: Growing trend of hybrid transmissions integrating sophisticated electric motor control for improved energy recuperation.

- 2023: Major acquisitions and partnerships aimed at strengthening capabilities in electrified powertrain components.

- 2024: Continued development of highly efficient torque converter automatics with advanced lock-up strategies to meet evolving fuel economy standards.

In-Depth Automotive Automatic Transmission Industry Market Outlook

The future of the Automotive Automatic Transmission (AT) industry is exceptionally promising, characterized by a sustained growth trajectory driven by technological innovation and evolving market demands. Growth accelerators, including the rapid adoption of electrified powertrains and the continuous refinement of transmission efficiency, will be paramount. Strategic opportunities lie in developing specialized transmissions for new energy vehicles and catering to the expanding LCV market. The industry is set to witness further consolidation and a heightened focus on intelligent, software-driven transmission control systems that enhance vehicle performance and safety. The forecast period to 2033 indicates a robust and dynamic market, ripe for investment and strategic development, with a strong emphasis on sustainability and advanced driver experience.

Automotive Automatic Transmission Industry Segmentation

-

1. Type

- 1.1. Automatic Transmission (AT)/Torque Converter (TC)

- 1.2. Automatic Manual Transmission (AMT)

- 1.3. Continuous Variable Transmission (CVT)

- 1.4. Dual Clutch Transmission (DCT)

-

2. Fuel Type

- 2.1. Gasoline (Petrol)

- 2.2. Diesel

- 2.3. Hybrid

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Light Commercial Vehicles (LCVs)

- 3.3. Heavy Commercial Vehicles (HCVs)

Automotive Automatic Transmission Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of the Middle East and Africa

Automotive Automatic Transmission Industry Regional Market Share

Geographic Coverage of Automotive Automatic Transmission Industry

Automotive Automatic Transmission Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns

- 3.3. Market Restrains

- 3.3.1. Shift towards Disposable Filters

- 3.4. Market Trends

- 3.4.1. OEMs Focusing on Developing Advanced Automatic Transmission

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Automatic Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Automatic Transmission (AT)/Torque Converter (TC)

- 5.1.2. Automatic Manual Transmission (AMT)

- 5.1.3. Continuous Variable Transmission (CVT)

- 5.1.4. Dual Clutch Transmission (DCT)

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline (Petrol)

- 5.2.2. Diesel

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Light Commercial Vehicles (LCVs)

- 5.3.3. Heavy Commercial Vehicles (HCVs)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Automatic Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Automatic Transmission (AT)/Torque Converter (TC)

- 6.1.2. Automatic Manual Transmission (AMT)

- 6.1.3. Continuous Variable Transmission (CVT)

- 6.1.4. Dual Clutch Transmission (DCT)

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gasoline (Petrol)

- 6.2.2. Diesel

- 6.2.3. Hybrid

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Light Commercial Vehicles (LCVs)

- 6.3.3. Heavy Commercial Vehicles (HCVs)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Automatic Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Automatic Transmission (AT)/Torque Converter (TC)

- 7.1.2. Automatic Manual Transmission (AMT)

- 7.1.3. Continuous Variable Transmission (CVT)

- 7.1.4. Dual Clutch Transmission (DCT)

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gasoline (Petrol)

- 7.2.2. Diesel

- 7.2.3. Hybrid

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Light Commercial Vehicles (LCVs)

- 7.3.3. Heavy Commercial Vehicles (HCVs)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Automatic Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Automatic Transmission (AT)/Torque Converter (TC)

- 8.1.2. Automatic Manual Transmission (AMT)

- 8.1.3. Continuous Variable Transmission (CVT)

- 8.1.4. Dual Clutch Transmission (DCT)

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gasoline (Petrol)

- 8.2.2. Diesel

- 8.2.3. Hybrid

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Light Commercial Vehicles (LCVs)

- 8.3.3. Heavy Commercial Vehicles (HCVs)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Automotive Automatic Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Automatic Transmission (AT)/Torque Converter (TC)

- 9.1.2. Automatic Manual Transmission (AMT)

- 9.1.3. Continuous Variable Transmission (CVT)

- 9.1.4. Dual Clutch Transmission (DCT)

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Gasoline (Petrol)

- 9.2.2. Diesel

- 9.2.3. Hybrid

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Light Commercial Vehicles (LCVs)

- 9.3.3. Heavy Commercial Vehicles (HCVs)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automotive Automatic Transmission Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Automatic Transmission (AT)/Torque Converter (TC)

- 10.1.2. Automatic Manual Transmission (AMT)

- 10.1.3. Continuous Variable Transmission (CVT)

- 10.1.4. Dual Clutch Transmission (DCT)

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Gasoline (Petrol)

- 10.2.2. Diesel

- 10.2.3. Hybrid

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Cars

- 10.3.2. Light Commercial Vehicles (LCVs)

- 10.3.3. Heavy Commercial Vehicles (HCVs)

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allison Transmission Holdings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Magna International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fiat Powertrain Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ZF Friedrichshafen A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jatco Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NSK Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Daimler AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aisin Seiki Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delphi Automotive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eaton Corporation PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Continental AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BorgWarner Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Valeo

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Allison Transmission Holdings

List of Figures

- Figure 1: Global Automotive Automatic Transmission Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Automatic Transmission Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Automotive Automatic Transmission Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Automatic Transmission Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 5: North America Automotive Automatic Transmission Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 6: North America Automotive Automatic Transmission Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Automatic Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Automatic Transmission Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive Automatic Transmission Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Automatic Transmission Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Automotive Automatic Transmission Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Automotive Automatic Transmission Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 13: Europe Automotive Automatic Transmission Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 14: Europe Automotive Automatic Transmission Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Automatic Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Automatic Transmission Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Automatic Transmission Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Automatic Transmission Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Automatic Transmission Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Automatic Transmission Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Automatic Transmission Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Automatic Transmission Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Automatic Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Automatic Transmission Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Automatic Transmission Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Automatic Transmission Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: South America Automotive Automatic Transmission Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Automotive Automatic Transmission Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 29: South America Automotive Automatic Transmission Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 30: South America Automotive Automatic Transmission Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 31: South America Automotive Automatic Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: South America Automotive Automatic Transmission Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Automotive Automatic Transmission Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Automatic Transmission Industry Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East and Africa Automotive Automatic Transmission Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Automotive Automatic Transmission Industry Revenue (billion), by Fuel Type 2025 & 2033

- Figure 37: Middle East and Africa Automotive Automatic Transmission Industry Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 38: Middle East and Africa Automotive Automatic Transmission Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 39: Middle East and Africa Automotive Automatic Transmission Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Middle East and Africa Automotive Automatic Transmission Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Automatic Transmission Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 7: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 14: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 23: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: China Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: India Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 31: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 32: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Brazil Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Argentina Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 39: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 40: Global Automotive Automatic Transmission Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: United Arab Emirates Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Saudi Arabia Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of the Middle East and Africa Automotive Automatic Transmission Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Automatic Transmission Industry?

The projected CAGR is approximately 16.7%.

2. Which companies are prominent players in the Automotive Automatic Transmission Industry?

Key companies in the market include Allison Transmission Holdings, Magna International Inc, Fiat Powertrain Technologies, ZF Friedrichshafen A, Jatco Ltd, NSK Ltd, Daimler AG, Aisin Seiki Co Ltd, Delphi Automotive, Eaton Corporation PLC, Continental AG, BorgWarner Inc, Valeo.

3. What are the main segments of the Automotive Automatic Transmission Industry?

The market segments include Type, Fuel Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns.

6. What are the notable trends driving market growth?

OEMs Focusing on Developing Advanced Automatic Transmission.

7. Are there any restraints impacting market growth?

Shift towards Disposable Filters.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Automatic Transmission Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Automatic Transmission Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Automatic Transmission Industry?

To stay informed about further developments, trends, and reports in the Automotive Automatic Transmission Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence