Key Insights

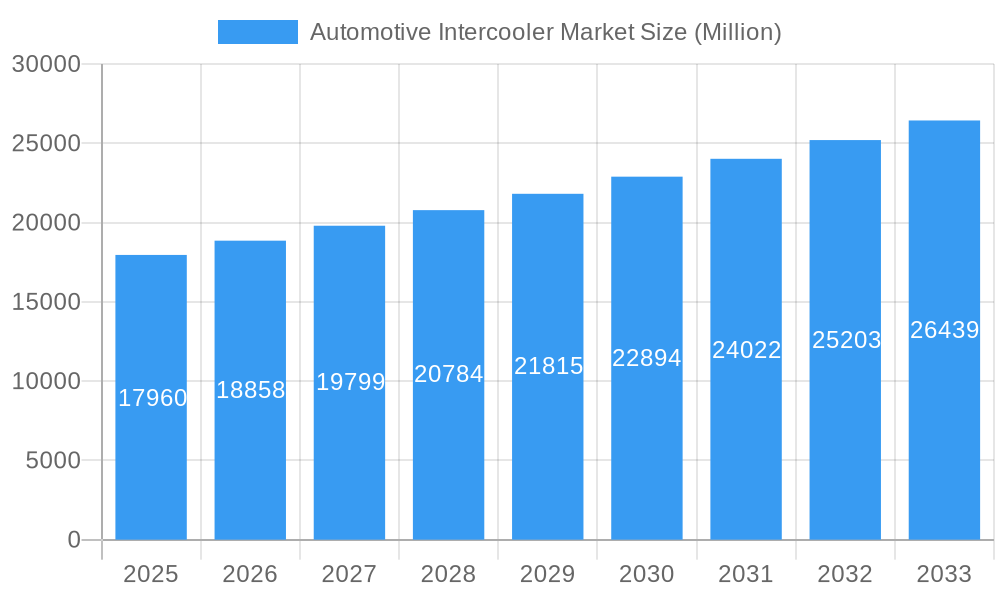

The global Automotive Intercooler Market is poised for robust growth, with a projected market size of $17.96 billion in 2025. Driven by an estimated Compound Annual Growth Rate (CAGR) of 5.00% through 2033, the market is set to expand significantly, reflecting the increasing adoption of turbocharged and supercharged engines across various vehicle segments. The primary drivers fueling this expansion include the persistent demand for enhanced fuel efficiency and improved engine performance in the face of stringent emission regulations. As manufacturers strive to meet these evolving standards, intercoolers play a crucial role in optimizing engine combustion and reducing harmful emissions. The market is segmented into Air to Air and Air to Water intercoolers, with both types witnessing steady demand. Air to Air intercoolers are prevalent in a wide range of applications due to their cost-effectiveness and efficiency, while Air to Water intercoolers are gaining traction in high-performance vehicles and specialized applications where superior cooling is paramount. The Passenger Cars segment, in particular, is a major contributor, driven by consumer preferences for more powerful and fuel-efficient vehicles. Commercial vehicles are also increasingly incorporating intercooler technology to boost power output and improve operational efficiency.

Automotive Intercooler Market Market Size (In Billion)

The market's trajectory is further shaped by evolving technological trends and emerging opportunities. Innovations in materials science, such as the use of lightweight composites and advanced heat transfer technologies, are leading to more efficient and compact intercooler designs. The growing popularity of performance tuning and aftermarket modifications also presents a significant avenue for market growth, as enthusiasts seek to optimize their vehicle's performance. While the market exhibits strong growth potential, certain restraints could influence its pace. The increasing complexity of vehicle electronics and the integration of advanced cooling systems might pose manufacturing challenges. However, the overarching trend towards electrification, while seemingly a threat, also presents an indirect opportunity. Electric vehicles often utilize complex thermal management systems, and the principles of efficient heat exchange employed in intercoolers can be applied to battery cooling and other thermal management components, paving the way for future innovations in related cooling technologies. The competitive landscape is characterized by the presence of established global players who are continuously investing in research and development to introduce advanced intercooler solutions.

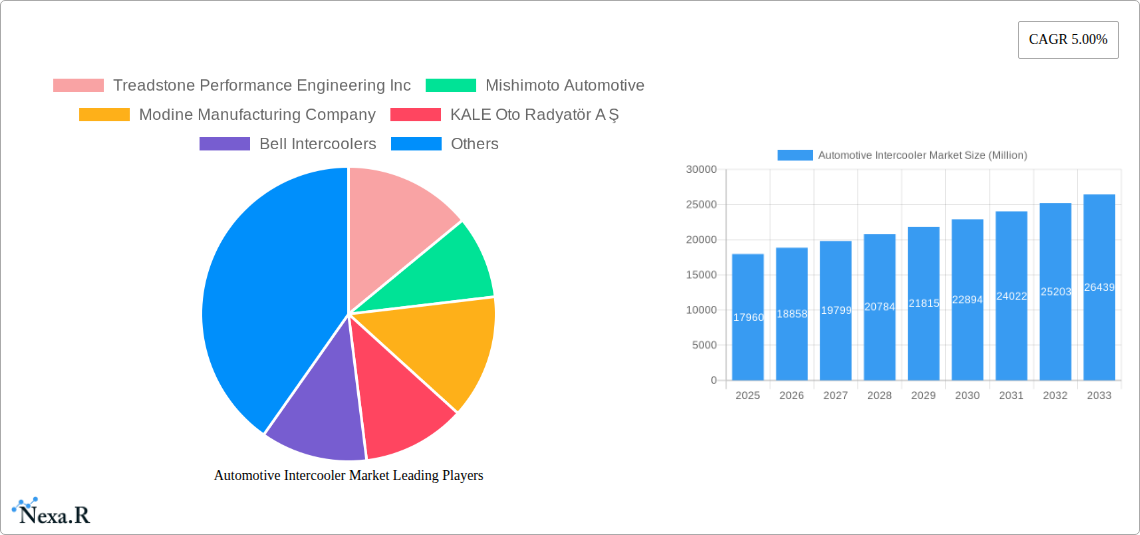

Automotive Intercooler Market Company Market Share

Automotive Intercooler Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Automotive Intercooler market, forecasting significant growth from 2019 to 2033, with a base year of 2025 and a robust forecast period of 2025-2033. We delve into the intricate dynamics, evolving trends, dominant segments, and the competitive landscape of this crucial automotive component market. Covering Air to Air Intercooler Market and Air to Water Intercooler Market segments, and analyzing their impact on Passenger Cars and Commercial Vehicles with Supercharged Engine and Turbocharged Engine technologies, this report offers unparalleled insights for industry stakeholders. All values are presented in Million Units.

Automotive Intercooler Market Market Dynamics & Structure

The Automotive Intercooler market is characterized by a moderate to high level of concentration, with key players like MAHLE GmbH, Garrett Motion Inc (Honeywell), and Valeo Group holding significant shares. Technological innovation is a primary driver, spurred by the increasing demand for fuel efficiency and enhanced engine performance in internal combustion engines and the burgeoning hybrid and electric vehicle sectors, which indirectly influence intercooler technology development for range extension and power management. Stringent emission regulations globally are compelling automakers to adopt more advanced engine technologies, directly boosting intercooler demand. Competitive product substitutes are limited, with mechanical intercoolers being the dominant technology, though advancements in thermal management systems for EVs present a nascent form of indirect competition. End-user demographics are shifting towards a preference for performance-oriented vehicles and a growing awareness of the role intercoolers play in optimizing power output and fuel economy. Mergers and acquisitions (M&A) are moderately active, as larger players seek to consolidate their market position, acquire niche technologies, and expand their geographical reach. For instance, the integration of advanced thermal management solutions in hybrid powertrains presents an innovation barrier for traditional intercooler manufacturers to adapt.

- Market Concentration: Moderate to High, dominated by established Tier-1 suppliers.

- Technological Innovation Drivers: Fuel efficiency mandates, performance enhancement, EV thermal management.

- Regulatory Frameworks: Emission standards (e.g., Euro 7, EPA standards) are key influencers.

- Competitive Product Substitutes: Limited, with focus on optimizing mechanical intercooler designs.

- End-User Demographics: Growing demand for performance, efficiency, and emissions compliance.

- M&A Trends: Strategic acquisitions to broaden product portfolios and market access.

Automotive Intercooler Market Growth Trends & Insights

The Automotive Intercooler market is poised for substantial growth, driven by the global automotive industry's continuous pursuit of enhanced engine performance and stricter emission norms. The market size is projected to expand significantly over the forecast period, fueled by the increasing adoption of turbocharged and supercharged engines across various vehicle types. The Turbocharged Engine segment, particularly in passenger cars and light commercial vehicles, is a primary growth engine, as manufacturers leverage turbocharging for downsizing engines without compromising power, thereby improving fuel economy. The CAGR for the Automotive Intercooler market is estimated at approximately 5.5% from 2025-2033. Adoption rates of advanced intercooler technologies, such as highly efficient air-to-water intercoolers for performance applications and lighter, more robust air-to-air intercoolers for mass-market vehicles, are steadily increasing. Technological disruptions are less about fundamental shifts and more about incremental improvements in materials, design, and manufacturing processes, leading to lighter, more efficient, and cost-effective intercoolers. Consumer behavior is increasingly influenced by performance metrics and fuel efficiency figures, directly correlating with the demand for vehicles equipped with optimized intercooler systems. The integration of intercoolers in hybrid vehicle powertrains, managing the thermal load of both internal combustion engines and electric components, represents a significant market penetration opportunity.

- Market Size Evolution: Projected to grow from an estimated 150 Million units in 2025 to over 230 Million units by 2033.

- Adoption Rates: Increasing for advanced and lightweight intercooler designs.

- Technological Disruptions: Focus on material science, multi-stage cooling, and integrated thermal management.

- Consumer Behavior Shifts: Growing emphasis on performance, fuel economy, and reduced emissions.

- Market Penetration: Significant opportunities in hybrid and performance vehicle segments.

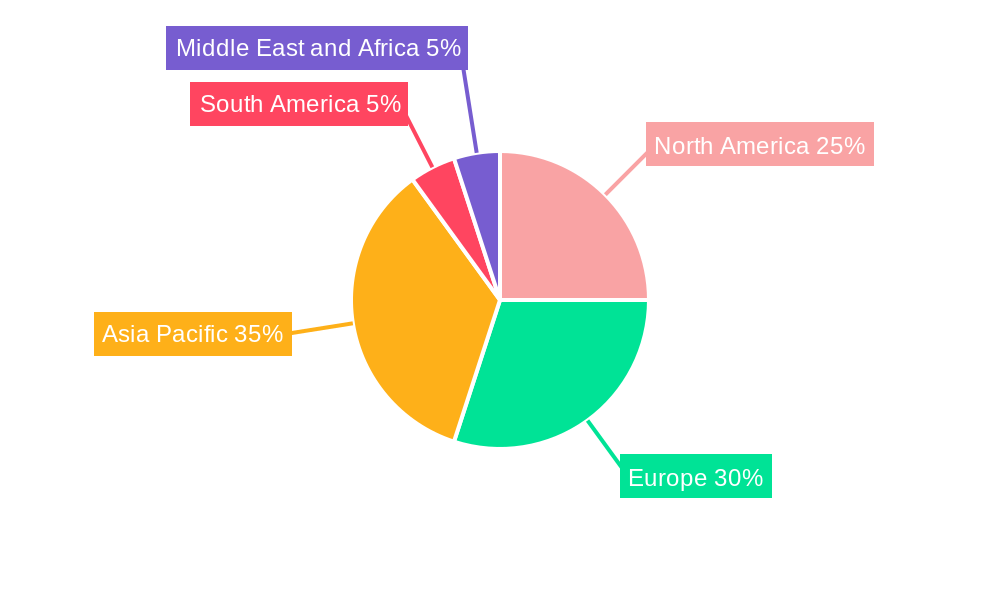

Dominant Regions, Countries, or Segments in Automotive Intercooler Market

The Air to Air Intercooler Market segment currently dominates the global Automotive Intercooler market, driven by its widespread application in a vast majority of turbocharged and supercharged internal combustion engine vehicles, especially Passenger Cars. This dominance is further amplified by the sheer volume of passenger car production worldwide, particularly in Asia-Pacific. Within this region, China stands out as a leading country due to its massive automotive manufacturing base and increasing adoption of performance-enhancing technologies in its domestic vehicle brands. Key drivers for this dominance include favorable economic policies supporting automotive manufacturing, significant investments in R&D by local and international players, and a rapidly growing middle class with a penchant for feature-rich vehicles. The market share of Air to Air Intercoolers is estimated to be around 75% of the total intercooler market.

The Turbocharged Engine segment is another major growth driver, as turbocharging has become a ubiquitous technology for improving power output and fuel efficiency in gasoline and diesel engines. The increasing stringency of emission regulations worldwide necessitates the use of turbochargers to enable engine downsizing, thereby reducing CO2 emissions. Countries with robust automotive manufacturing industries and significant export activities, such as Germany, Japan, and South Korea, also represent strong markets for automotive intercoolers. The development of advanced intercooler designs, including larger surface area and more efficient fin structures, continues to enhance the performance of Air to Air Intercoolers, further solidifying their market position. While Air to Water Intercoolers are gaining traction in high-performance and motorsport applications due to their superior cooling efficiency and compact size, their adoption in mass-market vehicles is still limited by cost and system complexity.

- Dominant Segment (Type): Air to Air Intercooler Market (approx. 75% market share in 2025).

- Dominant Segment (Vehicle Type): Passenger Cars (contributing over 70% of demand).

- Dominant Segment (Engine Type): Turbocharged Engine (ubiquitous across modern ICE vehicles).

- Leading Region: Asia-Pacific, driven by China's manufacturing prowess.

- Leading Country: China, followed by the United States and European nations.

- Key Drivers: Emission regulations, fuel efficiency mandates, rising disposable incomes, and growing demand for performance vehicles.

Automotive Intercooler Market Product Landscape

The product landscape of the Automotive Intercooler market is characterized by continuous innovation aimed at enhancing cooling efficiency, reducing weight, and improving packaging within increasingly space-constrained engine bays. Manufacturers are focusing on advanced materials like lightweight aluminum alloys and composite materials to improve thermal conductivity and reduce overall vehicle weight, contributing to better fuel economy. Product innovations include the development of bar-and-plate intercoolers for high-boost applications requiring maximum cooling capacity, and tube-and-fin designs for more compact and cost-effective solutions. Air-to-water intercoolers, with their superior efficiency and quicker heat dissipation capabilities, are finding increasing applications in performance vehicles and hybrid powertrains where rapid temperature management is critical. Specific advancements include multi-stage intercooling systems for extreme performance applications and integrated intercooler designs that combine with other engine components for optimized thermal management.

Key Drivers, Barriers & Challenges in Automotive Intercooler Market

Key Drivers: The primary forces propelling the Automotive Intercooler market are the escalating global demand for fuel-efficient vehicles, driven by stringent emission regulations and rising fuel prices. The widespread adoption of turbocharged and supercharged engines across passenger cars and commercial vehicles to achieve power density and economic operation is a significant catalyst. Furthermore, the growing automotive performance and tuning aftermarket segment contributes to sustained demand for upgraded intercooler solutions.

- Technological: Increasing prevalence of turbocharging and supercharging.

- Economic: Rising fuel prices and consumer demand for fuel efficiency.

- Policy-Driven: Strict emission standards (e.g., Euro 7, CAFE standards) mandating engine optimization.

Key Challenges & Restraints: Despite robust growth, the market faces challenges. The transition towards electric vehicles (EVs), while not directly eliminating intercoolers, could reduce the overall volume of traditional internal combustion engine (ICE) intercooler demand in the long term. Supply chain disruptions, particularly for raw materials like aluminum, can impact production costs and lead times. Intense competition among established players and emerging manufacturers can lead to price pressures. Regulatory hurdles related to material sourcing and manufacturing processes also pose a challenge.

- Supply Chain Issues: Volatility in raw material prices and availability (e.g., aluminum).

- Regulatory Hurdles: Evolving environmental and material compliance standards.

- Competitive Pressures: Price wars and market saturation in certain segments.

- EV Transition: Long-term potential reduction in ICE vehicle volumes.

Emerging Opportunities in Automotive Intercooler Market

Emerging opportunities lie in the development of highly efficient and compact intercoolers for hybrid and plug-in hybrid electric vehicles (PHEVs), where they play a crucial role in managing the thermal loads of both the internal combustion engine and electric powertrain components. The increasing demand for performance and tuning aftermarket solutions presents a consistent opportunity for specialized and high-performance intercooler designs. Furthermore, the growing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies necessitates sophisticated thermal management solutions for the electronic components, potentially opening avenues for integrated cooling systems that could incorporate intercooler principles. Untapped markets in developing economies with rapidly expanding automotive sectors also offer significant growth potential.

Growth Accelerators in the Automotive Intercooler Market Industry

The long-term growth of the Automotive Intercooler market is significantly accelerated by ongoing technological breakthroughs in materials science, enabling the creation of lighter, more durable, and highly conductive intercooler components. Strategic partnerships between intercooler manufacturers and original equipment manufacturers (OEMs) are crucial for integrating advanced intercooler solutions into new vehicle platforms from the design stage. Market expansion strategies, including geographical diversification into emerging automotive hubs and the development of specialized intercooler solutions for niche applications such as motorsports and heavy-duty commercial vehicles, are key growth accelerators. The continued investment in R&D by leading companies to optimize intercooler designs for maximum performance and efficiency under various operating conditions will also fuel sustained expansion.

Key Players Shaping the Automotive Intercooler Market Market

- Treadstone Performance Engineering Inc

- Mishimoto Automotive

- Modine Manufacturing Company

- KALE Oto Radyatör A Ş

- Bell Intercoolers

- Nissens Automotive A/S

- PWR Performance Products Pty Ltd

- Garrett Motion Inc (Honeywell)

- Valeo Group

- NRF Global

- MAHLE GmbH

- Pro Alloy Motorsport Ltd

- MANN+HUMMEL Group

Notable Milestones in Automotive Intercooler Market Sector

- April 2022: Garrett Motion, a global differentiated technology leader, released an external wastegate product line to complement its extensive turbocharger and intercooler portfolio. External Wastegates regulate turbocharger shaft speed by venting exhaust gas around the turbine stage of the turbocharger. This product expansion reinforces Garrett's commitment to providing comprehensive engine performance solutions.

- March 2022: Toyota Motor Corporation held the world premiere of the all-new GR Corolla (North America specifications, prototype), a sports car, in Long Beach, California, USA. The GR Corolla boasts a strengthened version of the 1.6 l in-line three-cylinder intercooler turbo engine found in the GR Yaris, resulting in a maximum output of 224 kW (304 PS). A valve-equipped triple-exhaust muffler reduces both exhaust pressure and noise, highlighting the importance of optimized intercooler turbo systems in performance vehicles.

In-Depth Automotive Intercooler Market Market Outlook

The outlook for the Automotive Intercooler market remains exceptionally positive, driven by the persistent need for enhanced engine performance and fuel efficiency in internal combustion engines, even as the automotive landscape evolves. Growth accelerators such as advancements in lightweight materials and sophisticated thermal management integration for hybrid powertrains will continue to shape the market. Strategic opportunities lie in expanding offerings for the performance tuning aftermarket and developing specialized intercoolers for emerging applications. The increasing complexity of vehicle powertrains and the drive for cleaner emissions ensure a sustained demand for optimized intercooling solutions, positioning the market for robust expansion through 2033.

Automotive Intercooler Market Segmentation

-

1. Type

- 1.1. Air to Air Intercooler Market

- 1.2. Air to Water Intercooler Market

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Engine Type

- 3.1. Supercharged Engine

- 3.2. Turbocharged Engine

Automotive Intercooler Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Intercooler Market Regional Market Share

Geographic Coverage of Automotive Intercooler Market

Automotive Intercooler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Turbochargers is likely to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Intercooler Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Air to Air Intercooler Market

- 5.1.2. Air to Water Intercooler Market

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Engine Type

- 5.3.1. Supercharged Engine

- 5.3.2. Turbocharged Engine

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Intercooler Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Air to Air Intercooler Market

- 6.1.2. Air to Water Intercooler Market

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Engine Type

- 6.3.1. Supercharged Engine

- 6.3.2. Turbocharged Engine

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Intercooler Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Air to Air Intercooler Market

- 7.1.2. Air to Water Intercooler Market

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Engine Type

- 7.3.1. Supercharged Engine

- 7.3.2. Turbocharged Engine

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Intercooler Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Air to Air Intercooler Market

- 8.1.2. Air to Water Intercooler Market

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Engine Type

- 8.3.1. Supercharged Engine

- 8.3.2. Turbocharged Engine

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Automotive Intercooler Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Air to Air Intercooler Market

- 9.1.2. Air to Water Intercooler Market

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Engine Type

- 9.3.1. Supercharged Engine

- 9.3.2. Turbocharged Engine

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Automotive Intercooler Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Air to Air Intercooler Market

- 10.1.2. Air to Water Intercooler Market

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Engine Type

- 10.3.1. Supercharged Engine

- 10.3.2. Turbocharged Engine

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Treadstone Performance Engineering Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mishimoto Automotive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Modine Manufacturing Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KALE Oto Radyatör A Ş

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bell Intercoolers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nissens Automotive A/S

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PWR Performance Products Pty Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Garrett Motion Inc (Honeywell)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Valeo Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NRF Global

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MAHLE GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pro Alloy Motorsport Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MANN+HUMMEL Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Treadstone Performance Engineering Inc

List of Figures

- Figure 1: Global Automotive Intercooler Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Intercooler Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Automotive Intercooler Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Intercooler Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Intercooler Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Intercooler Market Revenue (Million), by Engine Type 2025 & 2033

- Figure 7: North America Automotive Intercooler Market Revenue Share (%), by Engine Type 2025 & 2033

- Figure 8: North America Automotive Intercooler Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Intercooler Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Intercooler Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Automotive Intercooler Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Automotive Intercooler Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Intercooler Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Intercooler Market Revenue (Million), by Engine Type 2025 & 2033

- Figure 15: Europe Automotive Intercooler Market Revenue Share (%), by Engine Type 2025 & 2033

- Figure 16: Europe Automotive Intercooler Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Intercooler Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Intercooler Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Intercooler Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Intercooler Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Intercooler Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Intercooler Market Revenue (Million), by Engine Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Intercooler Market Revenue Share (%), by Engine Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Intercooler Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Intercooler Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Intercooler Market Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Automotive Intercooler Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Automotive Intercooler Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: South America Automotive Intercooler Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: South America Automotive Intercooler Market Revenue (Million), by Engine Type 2025 & 2033

- Figure 31: South America Automotive Intercooler Market Revenue Share (%), by Engine Type 2025 & 2033

- Figure 32: South America Automotive Intercooler Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Automotive Intercooler Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Intercooler Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Automotive Intercooler Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Automotive Intercooler Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 37: Middle East and Africa Automotive Intercooler Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 38: Middle East and Africa Automotive Intercooler Market Revenue (Million), by Engine Type 2025 & 2033

- Figure 39: Middle East and Africa Automotive Intercooler Market Revenue Share (%), by Engine Type 2025 & 2033

- Figure 40: Middle East and Africa Automotive Intercooler Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Intercooler Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Intercooler Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Intercooler Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Intercooler Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 4: Global Automotive Intercooler Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Intercooler Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Intercooler Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Intercooler Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 8: Global Automotive Intercooler Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Intercooler Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Automotive Intercooler Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Intercooler Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 15: Global Automotive Intercooler Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Intercooler Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Automotive Intercooler Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Automotive Intercooler Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 24: Global Automotive Intercooler Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: India Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Intercooler Market Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Automotive Intercooler Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Automotive Intercooler Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 33: Global Automotive Intercooler Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Automotive Intercooler Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Automotive Intercooler Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 39: Global Automotive Intercooler Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 40: Global Automotive Intercooler Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: United Arab Emirates Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Saudi Arabia Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Automotive Intercooler Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Intercooler Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Automotive Intercooler Market?

Key companies in the market include Treadstone Performance Engineering Inc, Mishimoto Automotive, Modine Manufacturing Company, KALE Oto Radyatör A Ş, Bell Intercoolers, Nissens Automotive A/S, PWR Performance Products Pty Ltd, Garrett Motion Inc (Honeywell), Valeo Group, NRF Global, MAHLE GmbH, Pro Alloy Motorsport Ltd, MANN+HUMMEL Group.

3. What are the main segments of the Automotive Intercooler Market?

The market segments include Type, Vehicle Type, Engine Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.96 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

Increasing Adoption of Turbochargers is likely to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

April 2022: Garrett Motion, a global differentiated technology leader, released an external wastegate product line to complement its extensive turbocharger and intercooler portfolio. External Wastegates regulate turbocharger shaft speed by venting exhaust gas around the turbine stage of the turbocharger.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Intercooler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Intercooler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Intercooler Market?

To stay informed about further developments, trends, and reports in the Automotive Intercooler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence